#investment

Text

Why Diamonds are a Girl's Best Friend

Women and their jewellery have a very intricate relationship. The tale of the nagging wife troubling her husband for new jewellery is as old as time. It is a reflection on a woman's vanity. Folk tales mock her ignorance of worldly ways and her frivolous obsession with being adorned. She is redundant to a mere crow that admires shiny things. However, this begs the question, is a woman's desire to collect jewellery as absurd as men paint it to be?

The world has forgotten that until very recently, women were forbidden from owning any form of capital. Be it property, money or even small inanimate objects, they belonged first to her father then her husband. The roof above her could be taken away on a whim with a clock's tick. In these trying times, jewellery emerged as a beacon of financial security for most women of the globe.

Mother of pearls, diamond earrings, gold necklaces etc. were-- although not in print-- under a woman's reign of control. They had an impressive resale value and could last several generations under proper care. More so, they could be secretly sold usually without paperwork to acquire a woman some monetary freedom. If her husband gambled all their assets away, atleast she'll have enough money to put some food on the table for her children.

Jewellery has often times saved people from calamities. Unlike land, jewellery is easier to sell. In case of an emergency, a large sum of money could be obtained without much trouble. Jewellery are an excellent heirloom. The wisdom of grandmothers is passed down to granddaughters to come, allowing them some command over their own life.

Jewellery is a form of investment just like land and shares. Its value is diminished solely due to its association with women. It is not a woman's vice but a survival tactic against the suffocating patriarchy. Jewellery is something she can have under her own name--no matter how small or how futile-- it is her sole capital, her best friend.

#radblr#radical feminism#radical feminists do interact#radical feminists do touch#radical feminist theory#terfsafe#trans exclusionary radical feminist#radical feminist safe#female seperatism#women are the superior sex#terfblr#radical feminist#radical feminist community#radical feminists please touch#rad fem#gender abolition#gender critical#jewellery#jewelry#jewerly#diamond#diamonds are a girls best friend#marilyn monroe#investment

98 notes

·

View notes

Text

Who wants my pants will be selling it out

#sissy caged#beta sissy#humiliated sissy#faggot sissy#sissi slave#barbie#investment#humiliation sissy#sissy domination#sissy tasks#sissi femboi#panty sissy#dominated slave#foot domination#female dominance

23 notes

·

View notes

Text

Inej: You know, I really like crime documentaries

Kaz, trying to impress her: I have been a prime suspect in over 50 murder cases

#kanej#why do I see this happening#kaz brekker#inej ghafa#inej my beloved#kazzle dazzle#incorrect six of crows#six of crows#crooked kingdom#investment#bastard of the barrel#captain ghafa#the wraith#kaz dirtyhands brekker#grishaverse

1K notes

·

View notes

Text

Wealth Building: What Rich People Do Differently

Wealthy people prioritize learning about personal finance, investing, and wealth building strategies. They always strive to gain more knowledge in these areas.

They maintain a long term perspective when setting financial goals and are patient in their pursuits.

Wealthy people diversify their investments across various asset classes to manage their risk.

Many of them are entrepreneurs who create and manage businesses as a means to build wealth.

They build and nurture professional networks opens doors to opportunities for investments, partnerships, and business growth.

They set clear, specific financial goals and regularly review and adjust their strategies to stay on track.

Wealthy individuals exercise discipline in their spending habits, avoiding impulse purchases and consistently saving and investing.

They assess and manage investment risks carefully, often with the guidance of financial advisors.

Many engage in philanthropy and charitable giving, recognizing the importance of supporting their communities and causes they care about.

Wealthy people invest in their personal development, acquiring new skills and knowledge to increase their earning potential or make better investment decisions.

They use legal tax strategies to minimize tax liabilities, such as tax advantaged accounts and tax efficient investments.

Legal structures like trusts and estate planning are employed to safeguard assets and facilitate smooth wealth transfer.

Wealthy people can adapt to changing economic conditions and market trends by diversifying income sources and investments.

Building wealth often involves overcoming setbacks and failures, and the wealthy demonstrates the result of persistence in their pursuit of financial success.

They have a positive and growth oriented mindset drives their belief in their ability to succeed and willingness to take calculated risks.

They prioritize acquiring and growing assets, emphasizing that assets generate income and wealth over time.

They are cautious about spending in liabilities (Things that do not make you money) and maximize their assets (add value) and those that detract from wealth (liabilities).

Instead of working solely for money, they make money work for them.

When they indulge in luxury purchases, they do so using returns on their investments rather than the money they earn or have saved.

#finance#investment#financial planning#investing#entrepreneur#girl math#generationalwealth#rich#success mindset#wealth

841 notes

·

View notes

Text

#effort#interest#actions#love#care#relationship#commitment#attention#qualitytime#communication#reciprocation#investment

458 notes

·

View notes

Text

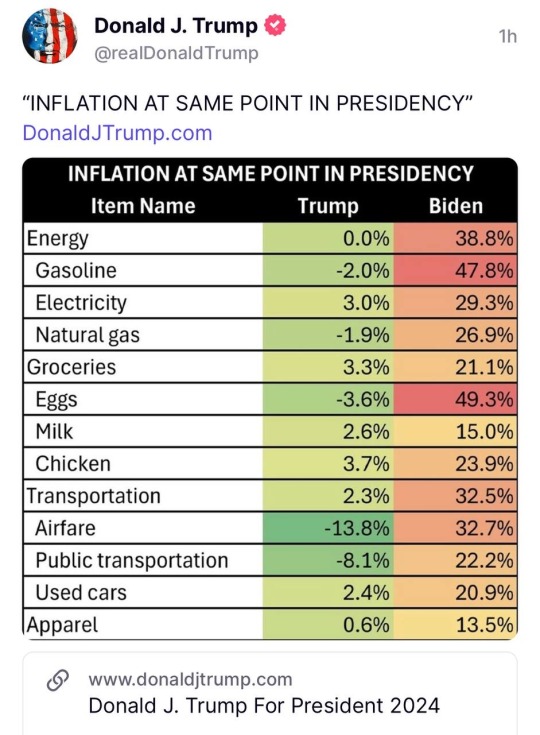

“INFLATION AT SAME POINT IN PRESIDENCY”

CHECK THE LINK IN OUR PINNED POST TO HELP YOU THROUGH THIS THOUGH TIMES‼️ ‼️‼️

#donald trump#republicans#trump#ultra maga#politics#news#patriots#trump 2024#biden#joe biden#conservatives#investment#investing#bidenflation

267 notes

·

View notes

Text

https://kristie-619.mxtkh.fun/w/EuoDkHK

https://kristie-619.mxtkh.fun/w/EuoDkHK

#jennette mccurdy#studyinspo#house#monster high#the princess bride#red vs blue#investment#高中生#healthcare#bd/sm brat#nails#rilakkuma#[yellowjackets]

127 notes

·

View notes

Text

SOCIAL MEDIA CAN AND WILL FUCK YOU UP

We have established that what we think about manifests in the physical.

We also know that our emotional vibration, translates to the 3D.

Before social media, our mindset was engineered by our immediate environment, books and TV.

Now, we consume so much content that it is ALTERING OUR THOUGHTS.

SOCIAL MEDIA CAN ALTER YOUR MINDSET NEGATIVELY OR POSITIVELY.

Perception becomes reality.

If you consume content of women who have multiple plastic surgeries your brain, after 1 month/year/decade will think of it as the "norm". "It's okay to get plastic surgery, let's change up our nose!"

Watching videos of people talking about their loneliness will evoke that feeling within you. You will start empathising with them and before you know it you will feel lonely too.

ONLY follow and interact with content that makes you feel good. Inspirational people and accounts that help you cultivate the mindset which aligns with your goals and dream reality.

Don't let them take away your power.

#level up journey#soulmate#high value mindset#law of manifestation#manifesting#lawofattraction#law of assumption#astrology#high value woman#business#entreprenuership#wealth mindset#mindset#mindfulness#sacred feminine#inspiration#intuitive messages#intuitive#investment#personal improvement#personal growth#self development#personal development#discipline#advice#philosophy#boss quotes#tarot reading#ethics#social media

174 notes

·

View notes

Text

324 notes

·

View notes

Text

BEST HACKER CONTACT; CAPTAIN WEBGENESIS.

Good day, everyone. I'm Jordan Hoad from Oregon, USA, and I'm going to tell you about Captain WebGenesis and how the Bitcoin Expert assisted me in recovering the $278,000 in Bitcoins that were stolen from me. Just when I was becoming interested in Crypto Investments, I was duped by a phony cryptocurrency investment organization that claimed to assist people quadruple their investments. I was told that once you lose Bitcoin, it is hard to recover it, however after reading about Captain WebGenesis, a certified Bitcoin recovery Expert. I quickly contacted Captain WebGenesis and was able to retrieve everything I had lost. To anyone scouting for a recovery Expert, I implore you to contact Captain WebGenesis.

BEST HACKER CONTACT; CAPTAIN WEBGENESIS.

Good day, everyone. I'm Jordan Hoad from Oregon, USA, and I'm going to tell you about Captain WebGenesis and how the Bitcoin Expert assisted me in recovering the $278,000 in Bitcoins that were stolen from me. Just when I was becoming interested in Crypto Investments, I was duped by a phony cryptocurrency investment organization that claimed to assist people quadruple their investments. I was told that once you lose Bitcoin, it is hard to recover it, however after reading about Captain WebGenesis, a certified Bitcoin recovery Expert. I quickly contacted Captain WebGenesis and was able to retrieve everything I had lost. To anyone scouting for a recovery Expert, I implore you to contact Captain WebGenesis.

BEST HACKER CONTACT; CAPTAIN WEBGENESIS.

Good day, everyone. I'm Jordan Hoad from Oregon, USA, and I'm going to tell you about Captain WebGenesis and how the Bitcoin Expert assisted me in recovering the $278,000 in Bitcoins that were stolen from me. Just when I was becoming interested in Crypto Investments, I was duped by a phony cryptocurrency investment organization that claimed to assist people quadruple their investments. I was told that once you lose Bitcoin, it is hard to recover it, however after reading about Captain WebGenesis, a certified Bitcoin recovery Expert. I quickly contacted Captain WebGenesis and was able to retrieve everything I had lost. To anyone scouting for a recovery Expert, I implore you to contact Captain WebGenesis.

172 notes

·

View notes

Text

https://nancy-456.mjcyd.asia/um/nYZgqwF

#studyinspo#tw edd#charlotte flair#martin freeman#lee min ho#totoro#will and grace#maddie ziegler#investment#rachel weisz#bd/sm brat#nails#[yellowjackets]#Sasuke Uchiha

140 notes

·

View notes

Text

#studyinspo#nietzsche#lokius#charlotte flair#medusa#monster high#statue#totoro#monsterfucker#persephanii#maddie ziegler#emmys#investment

126 notes

·

View notes

Text

#bd/sm daddy#keith kogane#andy murray#ateez x reader#grace van dien#jennette mccurdy#sapphic nsft#tw edd#charlotte flair#monster high#totoro#will and grace#maddie ziegler#emmys#investment

124 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

63 notes

·

View notes

Text

It's never too early to start thinking about your future. As long as your future is having a Good Morning every day.

#good#morning#good morning#good morning message#good morning image#good morning images#good morning man#the good morning man#the entire morning#gif#good morning messages#goblin#green goblin#business person#business man#business goblin#investing#investment#office#business#good vibes

306 notes

·

View notes