#wealth mindset

Text

Basic Financial Rules To Live By 💰✨

Create a plan that shows how much money you get and how much you spend. This helps you see where your money goes.

Set aside a part of your money as savings. Try to save at least 10-20% of what you earn.

Be careful with borrowing money, especially if you have to pay back a lot of extra money (interest).

Save some money for unexpected things like medical bills or losing your job. Aim to have enough to cover your living costs for a few months.

Put your saved money into different things that can make it grow, like stocks or real estate. Be patient, as it takes time.

Don't spend more money than you make. Stick to buying what you really need, not just what you want.

Decide what you want to do with your money, both in the short term (like a vacation) and long term (like retirement).

Set up automatic transfers to your savings and bills so you don't forget to save or pay your bills on time.

Make saving money a top priority before spending on other things.

Regularly look at your money situation, adjust your plan as needed, and see how your investments are doing.

Pay your bills on time and use credit wisely (like credit cards) to keep a good credit score, which can help you get better deals on loans.

Save money for when you're older and don't work anymore. Use retirement accounts to help with this.

Think before you buy things. Don't buy something just because you want it; think if it's necessary.

Keep learning about how money works and how to make smart money choices.

Only use your emergency fund for real unexpected problems, not for things you just want to buy.

#financial planning#finance#investing#money#girl math#wealth#level up journey#it girl#dream girl#dream girl guide#dream girl tips#dream girl journey#that girl#becoming that girl#educate yourself#wealth mindset#growth mindset#success mindset

3K notes

·

View notes

Text

Wealth comes from a wealthy mindset.

Be rich in spirit and money will follow.

#wealth mindset#wealth#high value mindset#high value woman#mindset#self education#success#self care#self love#self development#self improvement#personal growth#personal development#money#business#girl boss aesthetic#high maintenance

848 notes

·

View notes

Text

I love spending money cause I know it always comes back to me multiplied 🪄

#money#wealth#abundance#money mindset#wealth mindset#law of abundance#loa#money magnet#affirmations#affirm#higher self#new earth#mindfulness#universe#posted#mine

19 notes

·

View notes

Text

#law of attraction#lawofattraction#manifestyourlife#law of abundance#abundance mindset#wealth consciousness#money magnet#manifestation#manifest#spirituality#affirmations#manifest money#wealth mindset#black wealth#black spirituality#tiktok

337 notes

·

View notes

Text

( 𝙲𝚛𝚎𝚍𝚜 𝚏𝚛𝚘𝚖 𝚙𝚒𝚗𝚝𝚎𝚛𝚎𝚜𝚝)

#maroon aesthetic#red aesthetic#dark feminine energy#dark femininity#wealth mindset#luxury aesthetic

14 notes

·

View notes

Text

Basic Financial Rules To Live By

💰💰💰💰💰💰💰💰💰💰

Create a plan that shows how much money you get and how much you spend. This helps you see where your money goes.

Set aside a part of your money as savings. Try to save at least 10-20% of what you earn.

Be careful with borrowing money, especially if you have to pay back a lot of extra money (interest).

Save some money for unexpected things like medical bills or losing your job. Aim to have enough to cover your living costs for a few months.

Put your saved money into different things that can make it grow, like stocks or real estate. Be patient, as it takes time.

Don’t spend more money than you make. Stick to buying what you really need, not just what you want.

Decide what you want to do with your money, both in the short term (like a vacation) and long term (like retirement).

Set up automatic transfers to your savings and bills so you don’t forget to save or pay your bills on time.

Make saving money a top priority before spending on other things.

Regularly look at your money situation, adjust your plan as needed, and see how your investments are doing.

Pay your bills on time and use credit wisely (like credit cards) to keep a good credit score, which can help you get better deals on loans.

Save money for when you’re older and don’t work anymore. Use retirement accounts to help with this.

Think before you buy things. Don’t buy something just because you want it; think if it’s necessary.

Keep learning about how money works and how to make smart money choices.

Only use your emergency fund for real unexpected problems, not for things you just want to buy.

#financial planning#finance investing#wealth#levelup#wealth mindset#growth mindset#growth strategies#educate yourself#success mindset

9 notes

·

View notes

Text

Living Below Your Means: A Millionaire's Financial Secret

Unlock the financial secrets of millionaires! 💰 Learn how to live below your means and adopt millionaire habits. Read the full blog - Link-in-bio #FinancialSuccess #MillionaireMindset #SmartGoals #MillionaireThinking #Wealthy #Save #LiveBelowYourMeans

Have you ever wondered how some people manage to become millionaires without having a high-paying job, winning the lottery, inheriting a fortune, or starting a successful business? How do they accumulate wealth and achieve financial freedom while others struggle to make ends meet? The answer is simple: they live below their means.

Living below your means is a financial strategy that involves…

View On WordPress

#Embracing failure#Financial Freedom#Financial success#Gratitude mindset#Growth Mindset#Income tracking#Investment Strategies#Lifelong learning#Millionaire#Millionaire Habits#Money Management#Networking#Positive thinking#Self-improvement#SMART goals#Success#Wealth building#Wealth creation#Wealth Mindset

2 notes

·

View notes

Text

Darknightluxe Blue.

#fashion#aestheitcs#classy#art#luxury#luxurious#poolboychagi#ivy league#Victorian#night luxe#oldmoney#wealthy#wealth mindset#richmindset#rich#millionairelifestyle#billionarelifestyle

1 note

·

View note

Text

#abundance#affirmdaily#affirmation#affirmations#affirm and manifest 🫧 🎀✨ ִִֶָ ٠˟#wealth mindset#wealth manifestation#affirmyourreality

0 notes

Text

youtube

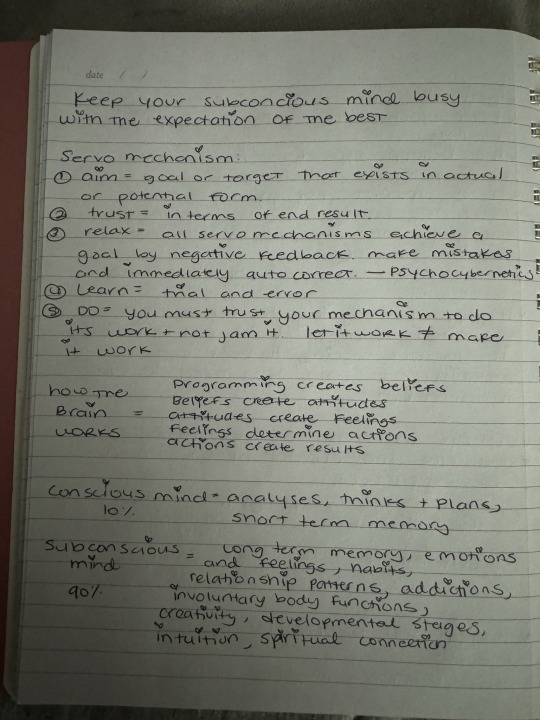

Unlocking financial abundance starts with understanding and transforming your subconscious beliefs about money. In this enlightening video, we delve into the six core subconscious beliefs that influence our ability to make money. 👉 Subscribe to my channel to stay tuned: / @drchriswalton8743

In today's exploration, we unravel the powerful connection between our subconscious beliefs and financial reality. From childhood experiences to societal conditioning, we uncover the roots of our money mindset and how it shapes our relationship with wealth.

The power of subconscious beliefs in shaping our reality highlights the importance of coherence between conscious and subconscious minds. By integrating these fundamental beliefs, viewers can alleviate stress, enhance clarity of thought, and open themselves up to opportunities for financial prosperity.

This video serves as a guide to identify and address any internal conflicts that may hinder financial abundance. We'll offer insights into how aligning subconscious beliefs can foster a mindset conducive to wealth creation.

Through a simple test, viewers are invited to assess their alignment with these beliefs, gauging their readiness for financial success. Discover how to reprogram your subconscious mind for abundance and manifest the financial success you deserve.

#unveiling subconscious beliefs for making money#unlock financial abundance#subconscious beliefs change#fundamental core beliefs about making money#subconscious beliefs for money#unlocking the power of your subconscious#subconscious beliefs#money mindset#Dr Chris Walton#personal development#manifestation wealth#wealth mindset#Youtube

0 notes

Text

Notes from my study journal ⋆˙⟡♡

#law of vibration#law of the universe#law of abundance#laws of attraction#law of assumption#law of manifestation#manifesation#manifestation#how to manifest#high value mindset#wealth mindset#positive mindset#success mindset#growth mindset

251 notes

·

View notes

Text

SOCIAL MEDIA CAN AND WILL FUCK YOU UP

We have established that what we think about manifests in the physical.

We also know that our emotional vibration, translates to the 3D.

Before social media, our mindset was engineered by our immediate environment, books and TV.

Now, we consume so much content that it is ALTERING OUR THOUGHTS.

SOCIAL MEDIA CAN ALTER YOUR MINDSET NEGATIVELY OR POSITIVELY.

Perception becomes reality.

If you consume content of women who have multiple plastic surgeries your brain, after 1 month/year/decade will think of it as the "norm". "It's okay to get plastic surgery, let's change up our nose!"

Watching videos of people talking about their loneliness will evoke that feeling within you. You will start empathising with them and before you know it you will feel lonely too.

ONLY follow and interact with content that makes you feel good. Inspirational people and accounts that help you cultivate the mindset which aligns with your goals and dream reality.

Don't let them take away your power.

#level up journey#soulmate#high value mindset#law of manifestation#manifesting#lawofattraction#law of assumption#astrology#high value woman#business#entreprenuership#wealth mindset#mindset#mindfulness#sacred feminine#inspiration#intuitive messages#intuitive#investment#personal improvement#personal growth#self development#personal development#discipline#advice#philosophy#boss quotes#tarot reading#ethics#social media

174 notes

·

View notes

Text

Creating Wealth with Social Media

youtube

0 notes

Text

The Deceptive Reality of Network Marketing

The biggest illusion trap that many people fall into is network marketing. It’s one of the best ways to fool people and promise them that they can become rich by doing it. I’ve seen people lose their lives and their possessions because of network marketing. In this blog, we will explore what network marketing is and how it falsely promises riches.

Network marketing, also known as MLM…

View On WordPress

0 notes

Text

Mastering Time Management: How Millionaires Maximize Productivity

Unlock the secrets of productivity! 💼 Learn how millionaires master their time to achieve extraordinary results. Read our latest blog post on Time Management. Link-In-Bio #TimeManagement #ProductivityHacks #MillionaireMindset #TheMillionaireThinking

Introduction

Time management lies at the core of success, especially for those striving to achieve millionaire status. It’s not merely about staying busy but rather about optimizing productivity and focusing efforts on tasks that drive significant results. In this comprehensive guide, we’ll delve deep into the time management strategies employed by millionaires, uncovering the secrets behind…

View On WordPress

#continuous learning#delegation#effective scheduling#Financial Freedom#Financial success#Goal setting#Growth Mindset#Millionaire#Millionaire Mindset#Mindfulness#Positive thinking#Prioritization#Productivity#self-care#Self-improvement#Success#technology tools#time blocking#time management#two-minute rule#Wealth building#Wealth creation#Wealth Mindset#Work-Life Balance

0 notes

Text

youtube

0 notes