#united states treasury

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

63 notes

·

View notes

Text

🇺🇲 🏦 🚨 U.S. NATIONAL DEBT RISES ABOVE $34 TRILLION FOR FIRST TIME

The United States Federal Government's total public debt has risen above $34 trillion for the first time.

According to a U.S. Treasury statement from Friday, the Federal Government's total public debt topped $34 trillion on Thursday.

Maya MacGuineas, President of the Committee for a Responsible Federal Budget, said in a statement that "the U.S. gross national debt hit $34 trillion dollars Friday, which is barely three months after it hit $33 trillion, and this truly a depressing achievement."

"There is not a single economic reason to add to the debt at the rate we are, but sadly our political leaders are unwilling to make the changes we need to turn the fiscal situation around," MacGuineas added.

#source

@WorkerSolidarityNews

#us debt#us spending#us economy#us news#us treasury#debt spending#united states#united states treasury#politics#news#geopolitics#world news#global news#international news#war news#breaking news#current events

18 notes

·

View notes

Text

TAX DAY tomorrow!

Posted here are a couple recent drawings I created reflecting on TAX DAY -the annual (and usually depressing) payment to a host of various taxes… Chin up!

#taxes#tax day#tariffis#IRS#United States Treasury#Taxes Due#Tax Payements#Tax Returns#illustration#Steven Salerno#stevensalerno.com

3 notes

·

View notes

Text

United States Five Dollar Silver Certificate - series 1896.

#united states currency#u.s. currency#5 dollar bill#five dollar bill#silver certificate#vintage currency#U.S. treasury#bureau of engraving & printing#money#paper currency#1896#series 1896#educational series#allegorical motifs#engraving#vintage illustration#neoclassical design#neoclassical#$5 notes#$5#currency#paper money#allegory#bank notes#currency design

11 notes

·

View notes

Text

Why America is Losing the World to China: A Deeper Understanding

Welcome to our blog post, where we delve into the intriguing topic of why America is losing the world to China. In this thought-provoking piece, we aim to provide you with a deeper understanding of the dynamics at play, exploring various factors that have contributed to China’s rise and America’s decline in global influence. Through examining the economic, political, and cultural aspects, we hope…

View On WordPress

#brics#brics vs g7#china#china brics#china saudi arabia#china us dollar#china us treasuries#china vs united states#china vs usa#de-dollarization#dollar#economic news#economic war#fed rate hikes#gold#investing news#macroeconomics#petrodollar#petroyuan#recession 2023#sean foo#us china#us china economic war#us china relations#US China trade war#us dollar#us dollar hegemony#us treasury dump#why america is losing to china#why china is winning against america

2 notes

·

View notes

Text

Stock futures fall to start week with key inflation data, earnings ahead

Stock futures fall to start week with key inflation data, earnings ahead

Stock futures were lower Monday morning as the markets come out of a tumultuous week and traders look ahead to key reports coming in the next week that can offer insights into the health of the economy.

Futures connected to the Dow Jones Industrial Average slid 28 points. S&P 500 futures were lower by 0.18%, while Nasdaq 100 futures fell 0.30%.

Market observers generally consider the week ahead…

View On WordPress

#Breaking News: Markets#business news#Citigroup Inc#Delta Air Lines Inc#Domino&x27;s Pizza Inc#Dow Jones Industrial Average#Economic events#JPMorgan Chase & Co#Levi Strauss & Co#Markets#Morgan Stanley#Nasdaq Inc#PepsiCo Inc.#S&P 500 Index#S&P Global Inc#Stock markets#U.S. 2 Year Treasury#United States#Wells Fargo & Co

2 notes

·

View notes

Quote

In a 2018 report titled "The Rise of Digital Authoritarianism," China was identified as the "worst abuser" of internet freedom by Freedom House, a bipartisan nonprofit focused on promoting democracy. "One of the things that makes [China] distinct is that tech there is designed to meet the standards of government needs," said Samantha Hoffman, a senior analyst with the Australian Strategic Policy Institute (ASPI), an independent research group. "There is a type of cooperation between companies that is on the face normal but abnormal in a political context," Hoffman told ESPN. In 2019, Hoffman's group issued a series of reports that linked Megvii, SenseTime and other tech firms to the abuses in Xinjiang. Citing Chinese documents and government reports, the research group said Megvii worked in cooperation with security services, including one instance in which its facial recognition software was used to trigger a "Uyghur alarm" that could be sent to police. SenseTime, the group concluded, relies on the "largesse of the party-state, particularly its investment in two government projects linked to public security surveillance as well as the surveillance state in Xinjiang that have benefited from an estimated $7.2 billion worth of investment in the past two years." Also in 2019, The New York Times and Human Rights Watch both reported that Megvii and SenseTime were among companies that built algorithms enabling the government to track the Uyghur population. Last December, the U.S. Treasury Department added Megvii, SenseTime and six other Chinese companies to a separate blacklist that prohibits Americans from holding stock in those firms. A department spokesman accused the companies of "actively cooperating with the government's efforts to repress members of ethnic and religious minority groups."

‘Brooklyn Nets owner Joe Tsai is the face of NBA's uneasy China relationship’, ESPN

#ESPN#Brooklyn Nets#NBA#United States#China#Digital Authoritarianism#Freedom House#Samantha Hoffman#Australian Strategic Policy Institute#Megvii#SenseTime#Xinjiang#Uyghur alarm#New York Times#Human Rights Watch#Uyghurs#US Treasury Department

5 notes

·

View notes

Text

Liz Truss broke UK rules with book revealing queen’s advice

While Truss submitted her book to civil servants in the Cabinet Office for review, a final sign-off was not sought before publication.

Truss wrote that Queen Elizabeth II told her to “pace yourself” in a meeting with the monarch. She said the queen told her being PM is “incredibly aging” during their 20 minute conversation, which became the monarch’s last official engagement before her death days…

View On WordPress

#British politics#Liz Truss#Queen Elizabeth II#UK Treasury#United Kingdom#United States#Westminster bubble

1 note

·

View note

Text

Chinese firms helping Russia face “significant consequences”, US Treasury Department says

US Treasury Secretary Janet Yellen has warned China’s banks of “significant consequences” if they provide material support to Russia to bolster its military capabilities, Bloomberg reports.

Yellen said on Monday in prepared remarks for a press conference at the US ambassador’s residence in Beijing, using an abbreviation for the People’s Republic of China:

“I stressed that companies, including those in the PRC, must not provide material support for Russia’s war, and that they will face significant consequences if they do. Any banks that facilitate significant transactions that channel military or dual-use goods to Russia’s defense industrial base expose themselves to the risk of US sanctions.”

Yellen’s threats came as Russian Foreign Minister Sergey Lavrov arrived in Beijing to discuss issues including Ukraine.

Read more HERE

#world news#world politics#news#usa#us politics#us news#usa news#usa politics#usa today#united states#geopolitics#united states of america#us treasury#janet yellen#china#china news#chinese politics#russia#russia news#russian news#russian politics#russia politics

0 notes

Text

Improv comedians: Marriage is a bit. Ready to commit?

Criminals: Marriage is a crime. Join me in doing some time?

Financiers: Marriage is a bond. Make ours out for the treasury?

#this is a joke about the maturity rates for treasure bills/notes/bonds#finance#united states#united states treasury#wordplay#bad jokes#phoenix talks

173 notes

·

View notes

Text

New York Institute of Finance Course Spotlight: Corporate Treasury Management With Valisha Graves

New York Institute of Finance Course Spotlight: Corporate Treasury Management With Valisha Graves

Learn how to manage treasury activities more effectively using new approaches and technologies with a special focus on the U.S. financial environment. CPE Credits: 21

In this course, you will learn how to:

Develop an action plan and utilize better practices in treasury management strategy

Develop an action plan for evaluating and improving their treasury operations

Apply general principles to…

View On WordPress

#A Moment Of Your Time...#Corporate Treasury Management#New York Institute of Finance#NYIF#United States#Valisha Graves

0 notes

Text

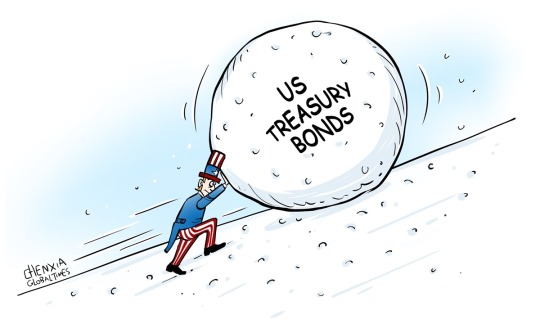

US Treasury Bonds Have Increasingly Become a Perilous, Risky Investment

— Wen Sheng | December 24, 2023

Illustration: Chen Xia/Global Times

China has been paring its holdings of US government bonds for months, as the country's total stockpile of US Treasury debt narrowed to less than $770 billion in October.

Overseas media pundits speculated that the motive behind China's reduction is to "retaliate" against the economic coercion and technology suppression by the US of recent times. But they are too evasive, by not telling the world the more obvious reason - that the US national debt is now reportedly approaching $34 trillion, which may trigger another financial system crisis soon.

Not only is China downscaling its US Treasury holdings, many other countries are dumping these bonds too, because purchasing US debt is no longer considered to be investing in a "safe haven" asset.

According to the Treasury International Capital data released by the US Department of the Treasury on December 19, as of the end of October, China held a net $769.6 billion of US government bonds, down $8.5 billion from one month earlier. October also marked the seventh consecutive month that China's purchases fell.

The public chorus for reducing the country's holdings of US Treasury debt has been getting louder since Washington moved to cut off crucial supplies to a group of Chinese technology companies - both private-sector and state-owned ones. When Fitch Ratings lowered the US government's credit rating from AAA to AA+ in August, more countries were agitated and jumped on the bandwagon of cutting their US assets.

It is a precautionary and also prudent decision for China and other countries to trim their US Treasury holdings, given the deteriorating fiscal crunch faced by the Biden administration, as well as the rising possibility that the US Federal Reserve's reckless monetary policy tightening and high interest rates may cause an economic downturn or even a recession next year. For instance, the US Congress has just approved a staggering defense budget of $886 billion for 2024, which is set to aggravate and worsen the US debt woes.

US Treasury bonds used to be the prime choice of China and other emerging economies like Brazil to park their foreign exchange reserves. But what made these countries run away from the traditional "safe haven" asset to store their hard-earned trade surplus?

There are two culprits: Uncle Sam's accelerating fiscal deterioration and the weaponization of the US dollar by Washington politicians.

US government debt has kept exploding, especially when the country decided to spend relentlessly out of a nightmarish financial system meltdown in 2008. To support a broken economy at that time, the US Federal Reserve adopted record loose monetary policy. It is senseless and outlandish for the Biden administration to keep splurging like his two predecessors in government spending since Day One in the White House, causing the US national debt to surpass $33 trillion, in addition to creating runaway inflation.

Foreign investors are increasingly unnerved with the trajectory of the US debt and the country's fraught fiscal governance. Washington's overspending is projected to keep pushing up its debt to unsustainable levels, with some economists warning of some form of a fiscal default in the near future.

Massive US budget deficits are a growing risk to the country's and world's financial stability. In the first half of this year, three US banks - Silicon Valley Bank, Signature Bank and First Republic Bank - collapsed when bank runs were triggered after they were forced to sell their Treasury bond portfolios at large losses, because the bonds had lost significant value as market interest rates rose.

To prevent the contagion from affecting more banks and spreading to the world, the US Fed and several other central banks intervened to provide extraordinary liquidity.

A rising number of governments have warned against the weaponization of the US dollar, particularly after media reports said Western countries, including the US, are exploring ways to justify seizing Russian central bank assets that are frozen in the financial system. More countries have chosen to diversify their foreign reserves by purchasing more gold and non-US assets.

With regard to China, there is another reason for the country to cash in from selling US Treasury debt - to stem capital flight in 2023 caused by the US central bank's steep interest rate hikes to the current yearly 5.25-5.5 percent. A slight depreciation of the yuan is normal, as a widening interest rate gap between the two countries drove foreign investors to pull money out of China. To prop up the yuan, it was necessary for the country's central bank to shed US Treasury holdings.

Chinese economists also worry about the security of China's overseas assets, the country's US Treasury holdings in particular, because Washington's "decoupling" or "de-risking" maneuvers haven't really stopped. Gold, a global safe-haven asset, will provide China with a more resilient means to navigate market headwinds. As of the end of October, China had had gold reserves of 71.20 million ounces, increasing for the 12th straight month, data from the State Administration of Foreign Exchange (SAFE) showed in November.

Security is always a major goal highlighted by the SAFE, which oversees the country's foreign exchange reserves. The US government has tilted toward brandishing its sanctions club in conducting state-to-state relations, so it is warranted and imperative for other governments to shed risky and perilous assets.

0 notes

Text

United States Ten Dollar Note (obverse) - series 1914.

#united states currency#u.s. currency#10 dollar bill#ten dollar bill#vintage currency#U.S. treasury#bureau of engraving & printing#money#paper currency#1914#series 1914#allegorical motifs#engraving#vintage illustration#neoclassical design#neoclassical#$10 notes#$10#currency#paper money#allegory#bank notes#currency design

7 notes

·

View notes

Text

Treasury: America is on the path to default on the first of June

US Treasury Secretary Janet Yellen confirmed Monday that it is unlikely that the department will meet all US government debt obligations by early June, leading the United States to default for the first time in its history.In her second message to Congress in two weeks, she added that the debt ceiling could become binding by June 1.

The new date reflects more data on revenue and payments since…

View On WordPress

#Arab book#Arab world#news agency#political news#The UAE#United State#US Treasury#US Treasury Secretary Janet Yellen#World News

0 notes

Text

China’s Middle East Victory Has Doomed The Dollar

China has got a major victory in the Middle East and the U.S dollar is Officially in trouble the Chinese have Broken a deal between Saudi Arabia and Iran two historic Rivals that have now Agreed to restore diplomatic ties we are Both the Saudis and Iranians reopening Embassies in their respective capitals And on track towards peace I think we Can see the different approaches being Made on the…

View On WordPress

#brics#brics vs g7#changing world order#china brokers iran saudi deal#china brokers peace deal#china de-dollarization#china dumping us dolar#china dumping us treasuries#china middle east#china vs united states#de-dollarization#economic news#gold#investing news#oil trade in yuan#petrodollar#petroyuan#saudi arabia china#saudi arabia iran china#saudi arabia iran deal#sean foo#us dollar#us sanctions#why gold why now#world reserve currency#yuan vs dollar

0 notes