#at the 1.5 year mark and its gotten to THIS

Text

...

#no brain tumor#no cancer#not sure about lyme yet but i doubt it#its just an escalation of the sleep stuff#at the 1.5 year mark and its gotten to THIS#i cant do it anymore. but i have to. so i will. and thats really all there is to it#....i cant color anymore.#i used to be especially good with color blends#patterns and such#the thing i made last night... was like something i wouldve made in grade school#its been so long since i tried but i didnt think id lose the ability to... color. of all things#now im too afraid to pick up one of my instruments again. even if id only have the energy for one song...#what if i cant play anymore?#hell i already had to quit playing minecraft because id just. get lost running in circles around the map. not remembering what i was doing#same thing happened with tears of the kingdom after the hyperfixation wore off#back to not being able to tell dreams from reality and that is really fucking bad when all your dreams are nightmares#for a bit i was able to whittle charms to hang over the bed. but if im not safe to drive i definityl shouldnt be handling a knife#not even to sharpen the colored pencils i cant use...#at least in this hellsite i can talk to myself as much as you#next up is the neurology department. and some harassing of other sleep labs#wish me luck#id say delete later but i wont

3 notes

·

View notes

Text

A. I do not like this new dashboard layout

2. There is definitely something wrong with me.

I went from being absolutely exhausted - cried myself to sleep last night, woke up crying this morning and the crying continued on and off until noon. I made a To-Do list earlier this week; vacuum, make my room tolerable (which means able to walk from one end to the other without feeling like I'm being buried alive by things). I got home around 830pm and got a burst of energy/motivation or maybe something else. But as soon as I walked in the door I took out the garbage which turned into vacuuming which turned into decluttering the desk, which turned into dusting (I have not dusted in about 1 to 1.5 years) which turned into washing the cat food bowl, which turned into washing my monitor. I still have more on my List because while I did some of it I also went and did other things I didn't plan on. (Because of my depression I don't ever deep clean so things get dusty and stuff so IDK how dusting became something I did.)

Also - TMI period stuff below the cut

It (in the TMI) honestly would explain my moods so I'm hoping that's all it is. Really fucked up bad PMS and stuff. Because I literally feel so insane I considered walking into a psych facility. I don't feel like I'm gonna hurt myself or anyone, I just feel like I am literally loosing my mind and need help calming down and thinking clearly - like I need to be rebooted.

However - my BF and I had a light lunch and a healthy dinner and between them we went for a 20-25 minute walk. I haven't gotten actual exercise in a year. Ever since I got sick back in October of last year I have spent all my time laying down. If I'm not at work or working on something that NEEDS the computer then I am literally laying in bed. So maybe the walk, despite being 9-10 hours ago, kinda helped?

IDK someone help lol

I had my period end on August 3rd and I have been spotting for like three days but today the spotting was like more than normal so I think it's actually my period but it wasn't due until my birthday (the 24th) so its like 6-8 days early if you count from the first spotting and assume it was actually not spotting. My DR says the copper "bug zapper" as my BF calls it causes spotting between periods and I've had the thing for 2 years now so I know it happens. And I have gotten a period only 21 days into my cycle before (avg is 26 for me atm) but still.

I'm wondering WHY and if its all tied together. The intense mood swings/intense depression. The spotting/early period. Maybe my hormones got confused this month and I had like a huge spike in something which triggered the liable moods and period. If it doesnt stop tomorrow I'm marking it as a period and not spotting. And it BETTER end normally and NOT last from now until when it's supposed to start and end and therefore last for two fucking weeks.

0 notes

Text

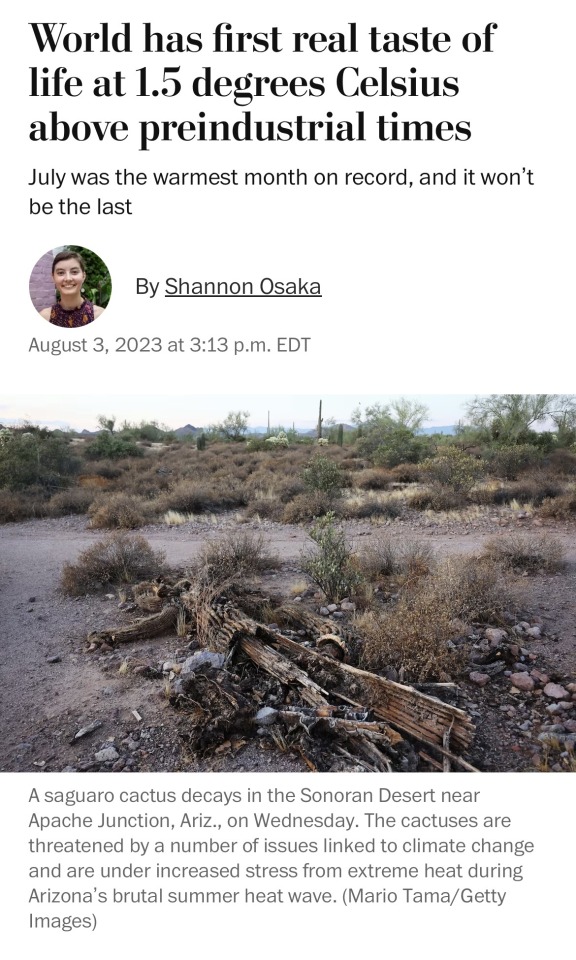

“The world has just gotten its first real taste of a planet that is 1.5 degrees Celsius — or 2.7 degrees Fahrenheit — hotter than preindustrial times.

According to data from the Copernicus Climate Change Service, July of this year was the most scorching July on record, clocking in at somewhere between 1.5 and 1.6 Celsius hotter than the average before the widespread use of fossil fuels.

(…)

Before this July, the world had briefly passed over 1.5 degrees for a few times before — but it was during winter months for the Northern Hemisphere, thus blunting the impacts on the largest population centers. This was the first month where temperatures were that far above preindustrial levels and most of the world’s population was under hot, summer conditions.

This doesn’t mean that the world has missed its climate goal of preventing a temperature rise over 1.5 degrees. That would require temperatures to be over that, on average, for multiple years in a row — not just a single month. Currently, scientists estimate that without dramatic emissions reductions, that 1.5 mark will be passed sometime around 2030.

(…)

It hasn’t been pleasant. In Phoenix, temperatures were above 110 degrees Fahrenheit for 31 days straight — sometimes reaching 118 or 119 degrees. The local medical examiner’s office was forced to bring in coolers to handle excess bodies, for the first time since the height of the coronavirus pandemic.

In Europe, Rome recorded a record temperature of 107 degrees Fahrenheit, while in Beijing residents ordered full-face masks called “facekinis” to protect themselves from the sun. In Iran’s Persian Gulf, the heat index reached 152 degrees — near the limit of human survival.

At some level, this is not a surprise. Scientists say July’s scorching temperatures are pretty much in line with expectations for a climate-changed world. “This is in the range of our models,” said Andrew Dessler, a climate scientist at Texas A&M University.

Some workings of the climate system currently — the record-low Antarctic sea ice, for example — are true anomalies that scientists can’t yet currently explain. But most are just what we would expect from a world that has continued to burn fossil fuels. While some developed countries have cut back on the use of coal, oil, and gas, global emissions have only plateaued. And unless global emissions reach zero, the planet will continue to warm.

(…)

But while some aspects of warming temperatures may come to feel commonplace, others will not. In parts of the Middle East and Africa, temperatures are reaching the limits of what human bodies can take. At the same time, electric grids, roads, bridges, and other infrastructure are under pressure as temperatures rise above what they were built and planned for. “What we’re seeing is that our world is very sensitively designed for a small range of temperatures,” Dessler said. “When the temperatures get out of that range, the whole system implodes.””

1 note

·

View note

Text

By Jill Cowan

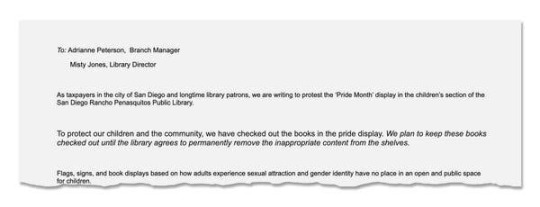

Adrianne Peterson, the manager of the Rancho Peñasquitos branch of the San Diego Public Library, was actually a little embarrassed by the modest size of her Pride Month display in June. Between staff vacations and organizing workshops for graduating high school students, it had fallen through the cracks and fell short of what she had hoped to offer.

Yet the kiosk across from the checkout counter, marked by a Progress Pride rainbow flag, was enough to thrust the suburban library onto the front lines of the nation’s culture wars.

Ms. Peterson, who has run the library branch since 2012 and highlighted books for Pride Month for the better part of a decade, was taken aback when she read an email last month from two neighborhood residents. They informed her that they had gotten nearly all of the books in the Pride display checked out and would not return them unless the library permanently removed what they considered “inappropriate content.”

“It was just kind of like, ‘Whoa, curveball,’” Ms. Peterson said. “I began to wonder, ‘Oh, have I been misunderstanding our community?’”

Soon, she would get her answer: Stacks of Amazon boxes containing new copies of the books the protesters checked out started to arrive at the library after The San Diego Union-Tribune reported on the protest. Roughly 180 people, mostly San Diegans, gave more than $15,000 to the library system, which after a city match will provide over $30,000 toward more L.G.B.T.Q.-themed materials and programming, including an expansion of the system’s already popular drag queen story hours.

In an ever divided nation, Americans are waging battles in big ways and small, right down to turning their library cards into protest weapons.

Right-wing activists have challenged the recognition of June as Pride Month and have sought to remove textbooks from schools and L.G.B.T.Q.-affirming picture books from libraries. In Republican-led states, those in office have used their power to change policy and ban materials contested by conservatives.

Adrianne Peterson, the branch director of the Rancho Peñasquitos branch of the San Diego Public Library.Credit...John Francis Peters for The New York Times

But even in California and other states led by Democrats, demonstrations against Pride events and L.G.B.T.Q.-themed books have broken out in recent weeks.

In North Hollywood, a neighborhood within the liberal stronghold of Los Angeles, a Pride flag was burned at an elementary school and dueling protests days later over a Pride assembly devolved into scuffles outside the campus. In Temecula, not far from San Diego, the conservative majority of the school board twice rejected elementary school materials that discuss Harvey Milk, the slain gay rights leader, and L.G.B.T.Q. history before agreeing to acquire them after Gov. Gavin Newsom threatened to fine the school district $1.5 million for not complying with state standards.

And in Chino, the state’s superintendent of public instruction, Tony Thurmond, was kicked out of a school board meeting on Thursday after criticizing a proposal by conservatives that would notify parents if a student asks to use a name or pronoun that does not align with their birth certificate.

In San Diego, supporters of L.G.B.T.Q. rights were quick to counter opponents. The city council member who represents Rancho Peñasquitos, Marni von Wilpert, condemned the library protest against Pride books and asked the community to help restore the display.

Like many Southern California suburbs, Rancho Peñasquitos, in the northeastern part of San Diego, was once solidly Republican territory. But the community has become more liberal over the years, attracting a diverse range of residents with its highly rated schools and glimpses of the Pacific Ocean. Ms. von Wilpert is the first Democrat to represent District 5, which now includes Rancho Peñasquitos. The neighborhood did have a Democratic council member when it was part of a more liberal district.

The political shift reflects changes in San Diego at large. Long known as a military town with religious roots that date back to the first Spanish mission in California, the city had favored Republicans for most of its history. But like other parts of the state, San Diego has grown more diverse after decades of immigration and the establishment of a booming biotech sector. After victories in 2022, Democrats held all nine seats on the City Council for the first time.

The city also has embraced the L.G.B.T.Q. community; in 2020, voters elected Todd Gloria as San Diego’s first openly gay mayor, and have sent Toni Atkins to the State Legislature, where she has become the first lesbian to serve as the leader of each house. Both are Democrats.

The San Diego Public Library’s parade contingent marching in the San Diego Pride Parade earlier this month.Credit...John Francis Peters for The New York Times

Ms. von Wilpert grew up in Rancho Peñasquitos and in 2020 won a closely fought race to represent her home district, where Democrats now have a plurality of registered voters and there are almost as many independents as Republicans. Ms. von Wilpert, who is a member of the L.G.B.T.Q. community, said she appreciated how quickly her neighbors rallied to support the library.

“Suburban, formerly conservative communities are still not buying into this culture war idea that we can’t have love and tolerance and acceptance,” she said. “That has been amazing.”

Conservative groups nationwide have pushed to ban books that discuss L.G.B.T.Q. issues from libraries and schools, saying that parents should be able to control what their children are being taught.

The San Diego residents who sent the email to the Rancho Peñasquitos Library, Amy M. Vance and Martha Martin, did not respond to requests for comment. City officials said they have not heard since from the library patrons.

The text of their email was identical to a template posted online by a right-wing group called CatholicVote, which has an office in Indiana and is not affiliated with the Catholic church. The group has promoted a “Hide the Pride” campaign that encourages supporters to check out or move books that depict L.G.B.T.Q. characters and families. Organizers have described such material as pornographic and obscene and said it should not be available to young library patrons.

“The library needs to use its discretion in how it will make certain content available to people who have very different beliefs about whether this is appropriate for kids,” said Brian Burch, the president of CatholicVote.

Among the books on the group’s target list are “Julián Is a Mermaid,” a picture book about a little boy whose grandmother takes him to a mermaid parade at Coney Island, and “Morris Micklewhite and the Tangerine Dress,” another picture book about a boy who loves using his imagination and wearing an orange dress to school. Both were checked out by the protesters in San Diego.

Mr. Burch said that his group does not encourage supporters to break the law. But, he said, if one decides to keep a book indefinitely, “that’s perfectly fine.”

The mission of public libraries is to provide access to any kind of information, even if it is offensive to some, said Misty Jones, the director of the San Diego Public Library. The San Diego library system also does not restrict children from materials that have adult content, according to its library card form.

The Pride-themed 2023 library cards for San Diego Public Library members.Credit...John Francis Peters for The New York Times

Marni von Wilpert, a San Diego councilwoman, helped draw attention to the situation at the library.Credit...John Francis Peters for The New York Times

Librarians say that it has become more difficult to retain open access as book challenges have exploded in the past two years.

Last year, 2,571 unique titles faced censorship attempts — a 38 percent increase over 2021 and a record high, according to the American Library Association. The A.L.A. also documented 1,269 demands to censor library books or materials, the highest number since the association started collecting data more than two decades ago.

In Greenville, S.C., library board members sought to ban two dozen titles this year, though they ultimately dropped that effort in favor of rules that restrict books on gender identity to adult sections. Last year, a Michigan town defunded its library after librarians refused to remove L.G.B.T.Q.-themed books.

Deborah Caldwell-Stone, who serves as director of the association’s office of intellectual freedom, said that the protesters in San Diego and elsewhere have taken advantage of relaxed policies intended to make books more accessible to patrons who cannot afford hefty fines.

In the San Diego Public Library system, card holders get five renewals for materials as long as no one else has requested them. Then, once a book is overdue, library patrons have two more months to return it before it is considered lost, and then they will be billed for it.

“Things intended to broaden access have been weaponized to engage in censorship,” Ms. Caldwell-Stone said.

At the Rancho Peñasquitos Library, the Pride display has since been replenished. As for the books checked out last month?

They were recently returned.

0 notes

Text

By Jill Cowan

Adrianne Peterson, the manager of the Rancho Peñasquitos branch of the San Diego Public Library, was actually a little embarrassed by the modest size of her Pride Month display in June. Between staff vacations and organizing workshops for graduating high school students, it had fallen through the cracks and fell short of what she had hoped to offer.

Yet the kiosk across from the checkout counter, marked by a Progress Pride rainbow flag, was enough to thrust the suburban library onto the front lines of the nation’s culture wars.

Ms. Peterson, who has run the library branch since 2012 and highlighted books for Pride Month for the better part of a decade, was taken aback when she read an email last month from two neighborhood residents. They informed her that they had gotten nearly all of the books in the Pride display checked out and would not return them unless the library permanently removed what they considered “inappropriate content.”

“It was just kind of like, ‘Whoa, curveball,’” Ms. Peterson said. “I began to wonder, ‘Oh, have I been misunderstanding our community?’”

Soon, she would get her answer: Stacks of Amazon boxes containing new copies of the books the protesters checked out started to arrive at the library after The San Diego Union-Tribune reported on the protest. Roughly 180 people, mostly San Diegans, gave more than $15,000 to the library system, which after a city match will provide over $30,000 toward more L.G.B.T.Q.-themed materials and programming, including an expansion of the system’s already popular drag queen story hours.

In an ever divided nation, Americans are waging battles in big ways and small, right down to turning their library cards into protest weapons.

Right-wing activists have challenged the recognition of June as Pride Month and have sought to remove textbooks from schools and L.G.B.T.Q.-affirming picture books from libraries. In Republican-led states, those in office have used their power to change policy and ban materials contested by conservatives.

Adrianne Peterson, the branch director of the Rancho Peñasquitos branch of the San Diego Public Library.Credit...John Francis Peters for The New York Times

But even in California and other states led by Democrats, demonstrations against Pride events and L.G.B.T.Q.-themed books have broken out in recent weeks.

In North Hollywood, a neighborhood within the liberal stronghold of Los Angeles, a Pride flag was burned at an elementary school and dueling protests days later over a Pride assembly devolved into scuffles outside the campus. In Temecula, not far from San Diego, the conservative majority of the school board twice rejected elementary school materials that discuss Harvey Milk, the slain gay rights leader, and L.G.B.T.Q. history before agreeing to acquire them after Gov. Gavin Newsom threatened to fine the school district $1.5 million for not complying with state standards.

And in Chino, the state’s superintendent of public instruction, Tony Thurmond, was kicked out of a school board meeting on Thursday after criticizing a proposal by conservatives that would notify parents if a student asks to use a name or pronoun that does not align with their birth certificate.

In San Diego, supporters of L.G.B.T.Q. rights were quick to counter opponents. The city council member who represents Rancho Peñasquitos, Marni von Wilpert, condemned the library protest against Pride books and asked the community to help restore the display.

Like many Southern California suburbs, Rancho Peñasquitos, in the northeastern part of San Diego, was once solidly Republican territory. But the community has become more liberal over the years, attracting a diverse range of residents with its highly rated schools and glimpses of the Pacific Ocean. Ms. von Wilpert is the first Democrat to represent District 5, which now includes Rancho Peñasquitos. The neighborhood did have a Democratic council member when it was part of a more liberal district.

The political shift reflects changes in San Diego at large. Long known as a military town with religious roots that date back to the first Spanish mission in California, the city had favored Republicans for most of its history. But like other parts of the state, San Diego has grown more diverse after decades of immigration and the establishment of a booming biotech sector. After victories in 2022, Democrats held all nine seats on the City Council for the first time.

The city also has embraced the L.G.B.T.Q. community; in 2020, voters elected Todd Gloria as San Diego’s first openly gay mayor, and have sent Toni Atkins to the State Legislature, where she has become the first lesbian to serve as the leader of each house. Both are Democrats.

The San Diego Public Library’s parade contingent marching in the San Diego Pride Parade earlier this month.Credit...John Francis Peters for The New York Times

Ms. von Wilpert grew up in Rancho Peñasquitos and in 2020 won a closely fought race to represent her home district, where Democrats now have a plurality of registered voters and there are almost as many independents as Republicans. Ms. von Wilpert, who is a member of the L.G.B.T.Q. community, said she appreciated how quickly her neighbors rallied to support the library.

“Suburban, formerly conservative communities are still not buying into this culture war idea that we can’t have love and tolerance and acceptance,” she said. “That has been amazing.”

Conservative groups nationwide have pushed to ban books that discuss L.G.B.T.Q. issues from libraries and schools, saying that parents should be able to control what their children are being taught.

The San Diego residents who sent the email to the Rancho Peñasquitos Library, Amy M. Vance and Martha Martin, did not respond to requests for comment. City officials said they have not heard since from the library patrons.

The text of their email was identical to a template posted online by a right-wing group called CatholicVote, which has an office in Indiana and is not affiliated with the Catholic church. The group has promoted a “Hide the Pride” campaign that encourages supporters to check out or move books that depict L.G.B.T.Q. characters and families. Organizers have described such material as pornographic and obscene and said it should not be available to young library patrons.

“The library needs to use its discretion in how it will make certain content available to people who have very different beliefs about whether this is appropriate for kids,” said Brian Burch, the president of CatholicVote.

Among the books on the group’s target list are “Julián Is a Mermaid,” a picture book about a little boy whose grandmother takes him to a mermaid parade at Coney Island, and “Morris Micklewhite and the Tangerine Dress,” another picture book about a boy who loves using his imagination and wearing an orange dress to school. Both were checked out by the protesters in San Diego.

Mr. Burch said that his group does not encourage supporters to break the law. But, he said, if one decides to keep a book indefinitely, “that’s perfectly fine.”

The mission of public libraries is to provide access to any kind of information, even if it is offensive to some, said Misty Jones, the director of the San Diego Public Library. The San Diego library system also does not restrict children from materials that have adult content, according to its library card form.

The Pride-themed 2023 library cards for San Diego Public Library members.Credit...John Francis Peters for The New York Times

Marni von Wilpert, a San Diego councilwoman, helped draw attention to the situation at the library.Credit...John Francis Peters for The New York Times

Librarians say that it has become more difficult to retain open access as book challenges have exploded in the past two years.

Last year, 2,571 unique titles faced censorship attempts — a 38 percent increase over 2021 and a record high, according to the American Library Association. The A.L.A. also documented 1,269 demands to censor library books or materials, the highest number since the association started collecting data more than two decades ago.

In Greenville, S.C., library board members sought to ban two dozen titles this year, though they ultimately dropped that effort in favor of rules that restrict books on gender identity to adult sections. Last year, a Michigan town defunded its library after librarians refused to remove L.G.B.T.Q.-themed books.

Deborah Caldwell-Stone, who serves as director of the association’s office of intellectual freedom, said that the protesters in San Diego and elsewhere have taken advantage of relaxed policies intended to make books more accessible to patrons who cannot afford hefty fines.

In the San Diego Public Library system, card holders get five renewals for materials as long as no one else has requested them. Then, once a book is overdue, library patrons have two more months to return it before it is considered lost, and then they will be billed for it.

“Things intended to broaden access have been weaponized to engage in censorship,” Ms. Caldwell-Stone said.

At the Rancho Peñasquitos Library, the Pride display has since been replenished. As for the books checked out last month?

They were recently returned.

0 notes

Text

Newest info on the price of residing disaster because it impacts households and people throughout the UK

Might 5: Rocketing Restore Prices Including To Value Of Cowl

The typical value of a used automobile reached £17,843 in April, in response to the Auto Dealer Retail Value Index, with an inevitable knock-on impact on insurance premiums, writes Mark Hooson.

The rise in automobile costs equates to a close to 3% leap in a yr, however common costs shot up by 1.5% from March.

April marked the thirty seventh consecutive month of year-on-year value rises, however not all car varieties are going up in worth.

Common costs of used electrical autos (EVs) in April this yr had been 18.1% decrease than in April 2022, at £31,517. Final month additionally marked the fourth consecutive month wherein common EV costs fell.

Auto Dealer’s Richard Walker, mentioned: “The used automobile market has had a powerful yr thus far. Rising used automobile values have completed little to dampen demand and, based mostly on what we’re monitoring throughout the market, there’s no indication of it slowing considerably anytime quickly.”

With automobile insurance premiums dictated, partly, by the worth of a car and the price of components and repairs, the rising common value of a used automobile is having a knock-on impact.

Knowledge from the Affiliation of British Insurers (ABI) in February confirmed common premiums had been up 8% to £470 within the fourth quarter of 2022.

As a part of its analysis, the ABI mentioned its members – over 90% of the UK insurance business – blamed greater paint and materials prices, up by almost 16%.

It says 40% of all restore work is affected by components delays, and that the common value of second-hand vehicles elevated by 19% within the yr ending July 2022.

Jonathan Fong on the ABI mentioned: “Each motorist needs one of the best insurance deal, particularly when dealing with price of residing pressures, and insurers proceed to do all they will to maintain motor insurance as competitively priced as doable.

“But, like many different sectors, insurers proceed to face greater prices, similar to costlier uncooked supplies, which have gotten more and more difficult to soak up.”

Evaluate Automobile Insurance coverage Quotes

Select from a spread of coverage choices for inexpensive cowl, that fits you and your automobile.

4 Might: Tariff Change Casts Shadow Over EV Manufacturing In UK

Uptake of electrical autos (EVs) continues to collect tempo because the UK approaches a ‘cliff edge’ for tariffs on autos offered into Europe.

The most recent information from the Society of Motor Producers and Merchants (SMMT) represents the ninth consecutive month of progress within the new automobile market, with EVs now making up roughly one in six (15%) new registrations.

New car gross sales had been up 11.6% in April at round 132,000 registrations. That is one of the best April since 2021 however a lot decrease than registration ranges pre-pandemic. By comparability, April 2019 registrations had been round 17% greater.

Battery electrical autos (BEV) registrations had been up by greater than half (59.1%) in April, at 20,522 items. Plug-in hybrid autos (PHEVs) had been up 33.3% at 8,595 registrations. Hybrid electrical autos (HEVs) had been up 7.7% to fifteen,026 registrations.

The SMMT has revised its predictions upward for the quarter, anticipating higher-than-expected registrations on account of decrease stress on provide chains. That is the primary time it has completed so since 2021.

‘Nation of origin’ modifications

In the meantime, a forthcoming change within the UK’s buying and selling relationship with Europe might have an effect on EV registrations except a brand new settlement is reached.

Because it stands beneath the UK-EU Commerce and Cooperation Settlement (TCA), the UK can promote EVs into Europe with out having

to pay tariffs so long as not more than 70% of an electrical battery’s elements come from outdoors the UK. From the start of 2024, nonetheless, the edge will drop to 40%.

At that time, any car with a battery comprised of greater than 40% imported elements will appeal to a ten% levy when offered into Europe. This might deter producers from establishing or remaining within the UK.

Whereas the change is eight months away, fulfilling orders in time on the market within the EU subsequent yr will begin properly forward of that point, creating uncertainty for producers about whether or not the settlement might be amended within the meantime.

In February the Division for Enterprise and Commerce mentioned: “We're conscious that some members of UK and EU business are involved in regards to the 2024 guidelines and we proceed to work carefully with business to know and mitigate the affect of exterior elements, such because the Covid-19 pandemic and the worldwide semiconductor chip scarcity on the manufacturing of electrical autos and batteries.”

Hugo Griffiths, spokesperson at Carwow, mentioned: “There are points round sourcing EV battery elements, certain, and each the EU and UK are method behind different nations’ battery-production capabilities, and this wants addressing.

“However insisting that from subsequent yr solely 40%, fairly than 70%, of an EV’s battery elements can come from outdoors the UK or EU earlier than further commerce tariffs kick in is a purely artificial, legislative drawback: it has been concocted by policymakers, so it have to be solved by them on behalf of the populations they signify.”

4 Might: £1.6bn Added To Family Debt

Customers borrowed £1.6 billion in March, up from £1.3 billion 12 months in the past, in response to recent information from the Financial institution of England, writes Jo Thornhill.

The determine can be up on the £1.5 billion reported in February, making it the six month-to-month improve in a row.

Borrowing in March was break up between £700 million on bank cards and £900 million on different types of shopper credit score, similar to automobile dealership finance and private loans.

The price of bank card borrowing edged greater, rising by 0.18 share factors to its highest ever stage at 20.29%.

Rates of interest on financial institution overdraft borrowing fell by 0.27 share factors, in response to the report, to face at 21.07%. The speed on new private loans fell by 0.36 share factors to 7.79%.

Mortgage approvals for home buy rose considerably in March, in response to the Financial institution information, reaching 52,000, up from 44,100 in February. Nonetheless, the figures stay subdued in comparison with the degrees seen in March 2022, when mortgage approvals had been recorded at 70,700.

Jeremy Leaf, north London property agent and a former RICS residential chairman, mentioned: ‘We regard mortgage approvals as a really helpful indicator of future course of journey for the housing market.

“Lending was within the doldrums, reflecting the quiet interval between the mini-Price range and the top of final yr, whereas the approvals figures illustrate that stabilising mortgage charges and inflation is prompting a rise in exercise.”

The Financial institution says households withdrew £4.8 billion from banks and constructing societies in March. Web deposits into interest-bearing quick access accounts fell considerably, however £6.5 billion was paid into discover accounts.

As well as, throughout March, households deposited £3.5 billion into Nationwide Financial savings and Funding (NS&I) accounts. That is the best internet stream into NS&I since September 2022, when the determine was £5 billion.

Evaluate Automobile Insurance coverage Quotes

Select from a spread of coverage choices for inexpensive cowl, that fits you and your automobile.

3 Might: Customers Informed To Assume Any Contact Is A Rip-off

The federal government introduced at this time that every one chilly calls providing monetary merchandise will probably be banned to guard customers from scams, writes Bethany Garner.

Whereas chilly calls referring to pensions have been banned since 2019, the brand new guidelines will apply to all monetary merchandise – together with investments, insurance and cryptocurrency.

In response to authorities estimates, fraud accounts for 40% of crime within the UK and prices people round £7 billion annually.

As soon as the brand new guidelines come into impact, customers can routinely assume that any unsolicited calls about monetary merchandise are scams.

The brand new guidelines will even ban ‘Sim farms’ – the place fraudsters ship rip-off textual content messages to 1000's of people without delay – and stop scammers from impersonating the telephone numbers of legit banks and different companies.

On the identical time, a brand new Nationwide Fraud Squad is to be created, led by the Nationwide Crime Company and Metropolis of London Police. The squad’s 500 members will work with the worldwide intelligence neighborhood to establish and disrupt potential scams, the federal government says.

Funding to the tune of £30 million will even be funnelled into a brand new fraud reporting centre, which will probably be working “inside a yr” and which is able to work with tech companies to make reporting on-line fraud simpler.

Tom Selby, head of retirement coverage at AJ Bell, mentioned: “Monetary scams are a scourge on society and smash lives, so any transfer to guard extra customers from several types of fraud is extraordinarily welcome.”

“For this cold-calling crackdown to work we'd like two issues: tightly worded laws, to make sure nefarious contacts are particularly focused, and a legit risk of enforcement the place somebody breaks the brand new guidelines.

“The plans additionally must go hand-in-hand with higher accountability being taken by web giants like Google for paid-for rip-off adverts, one thing which the On-line Security Invoice can hopefully carry into UK laws.”

Whereas these plans are broadly welcomed, the federal government has confronted criticism for not performing sooner.

Rocio Concha at shopper group Which? mentioned: “The struggle towards fraud has progressed far too slowly lately and particularly extra motion is required to ensure that massive tech platforms take severe motion towards fraud.”

Mr Selby additionally warns customers to stay vigilant: “It's vital, no matter what the federal government does, that Brits hold their wits about them and are cautious when they're contacted out of the blue by somebody they don’t find out about their funds.”

Evaluate Automobile Insurance coverage Quotes

Select from a spread of coverage choices for inexpensive cowl, that fits you and your automobile.

2 Might: Spring Reductions Barely Dent Annual Value Will increase

The hovering price of store costs seems to have peaked however meals is continuous to get costlier, in response to figures out at this time from the British Retail Consortium (BRC), writes Laura Howard.

It says annual store value inflation slowed to eight.8% in April, edging down from 8.9% in March. However shop-bought meals prices continued to climb in April, with annual inflation for this class rising to fifteen.7% from 15% in March.

The price of recent meals and ambient meals, which might be saved at room temperature, continued to speed up within the 12 months to April by 17.8% and 12.9% respectively (17% and 12.5% in March).

The BRC mentioned price pressures all through the provision chain, costlier prepared meals on account of greater packaging prices and the excessive value of espresso beans had been main drivers behind the meals costs rise.

Specialists say the general store value plateau is because of heavy ‘Spring reductions’ within the clothes, footwear and furnishings sectors.

Non-food inflation fell to five.5% in April, down from 5.9% in March. Whereas the determine stays elevated, it's under the three-month common price of 5.6%, mentioned the BRC. Inflation for different meals classes is above the three-month common.

Helen Dickinson, chief government of the BRC, mentioned: “We must always begin to see meals costs come down within the coming months because the cuts to wholesale costs and different price pressures filter by means of.”

The official UK inflation determine, as measured by the Workplace for Nationwide Statistics’ Client Value Index (CPI), eased from 10.4% to 10.1% within the yr to March 2023, however continues to be greater than 5 instances the Financial institution of England’s goal of two%.

14 April: Drivers Obliged To Focus As If Driving Usually

Ford has grow to be the primary automobile producer to supply hands-free driving in Europe with the introduction of ‘BlueCruise’ technology in its 2023 Ford Mustang Mach-E electrical autos (EVs), writes Candiece Cyrus.

With the overwhelming majority of street visitors accidents deemed to be the results of human error, it's hoped the introduction of more and more refined autonomous autos will enhance security statistics, which in flip might lead to a common discount in automobile insurance premiums.

Drivers of the Ford Mustang Mach-E mannequin, which prices from £50,830, can use what the producer calls ‘hands-off, eyes-on’ technology. It has been government-approved for driving on 2,300 miles (3,700km) of motorways in England, Scotland and Wales, which have been designated as ‘Blue Zones’.

The primary 90 days’ use of BlueCruise is included with the acquisition of the car. After this, drivers can subscribe to make use of it for £17.99 a month.

The ‘Stage 2 hands-free superior driver help system’ builds on Stage 1 cruise management technology, which is offered as customary in an rising variety of vehicles and units a car’s accelerator at a selected velocity, permitting the motive force to take their foot off the pedal.

There are six ranges of driving autonomy in complete. Stage 0 gives no automation, whereas Stage 3, the step past this Ford initiative, gives conditional automation, which incorporates options similar to a visitors jam chauffeur.

Stage 4, excessive automation, consists of autos the place a wheel and pedals should not put in, similar to a driverless taxi, whereas Stage 5, full automation, affords the identical options as Stage 4, however in every single place and in all situations. Each 4 and 5 don't require any type of guide driving.

BlueCruise makes use of cameras and radars to watch the atmosphere, together with visitors, street markings, velocity indicators and the place and velocity of different autos, to permit drivers to take their palms off the steering wheel.

An infrared driver-facing digital camera can be used to verify the motive force’s attentiveness, by monitoring their gaze, even when sporting sun shades, in addition to the place of their head.

If the system detects a lapse within the driver’s consideration, it would show warning messages. That is adopted by audible alerts, activation of the brakes and eventually slowing the car down whereas controlling steering. Comparable actions will happen if the motive force doesn't place their palms on the steering wheel on leaving a Blue Zone.

Ford has already launched the technology in its personal–branded and luxurious Lincoln-branded autos, within the US and Canada, the place it has been used throughout 64 million miles (102 million km), throughout an 18-month interval. Throughout this time, there have been no reported linked incidents or accidents, in response to Ford.

The agency intends to roll out the technology throughout different European international locations and different Ford autos.

Jesse Norman, transport minister, mentioned: “The most recent superior driver help programs make driving smoother and simpler, however they will additionally assist make roads safer by decreasing scope for driver error.

”

The introduction of hands-free technology in driving is a part of the bigger purpose of in the end producing totally autonomous autos. It's thought that such technology might cut back the variety of accidents on the roads and in flip automobile insurance prices, with the potential to avoid wasting as much as 1,500 lives a yr. At the moment, 9 out of 10 accidents on the street are a results of human error.

Nonetheless, automobile insurance continues to be a necessity even when driving a automobile that makes use of automated driving technology. It may possibly cowl theft of the car, in addition to accidents the place the motive force or the automated system is at fault.

Drivers will want to have the ability to take management of the car if obligatory. Falling asleep and crashing the automobile, for instance, would put them at fault.

If somebody is injured or their property broken on account of an accident with a driverless automobile, they might declare within the traditional method towards the insurer of the car. The insurer then might select to pursue its personal declare towards the car producer if it believes the autonomous driving technology is in charge.Drivers can discover a map of the Blue Zones on the Ford web site.

5 April: Electrical Car Registrations Hit Document Month-to-month Excessive

The variety of battery electrical autos (BEVs) registered within the UK in March reached a file month-to-month excessive of over 46,600 – up 18.6% from round 39,300 in March final yr, in response to the Society of Motor Producers and Merchants (SMMT), writes Candiece Cyrus.

Nonetheless, the general BEV market share remained virtually the identical as final yr at slightly over 16%.

General, new automobile registrations rose year-on-year by 18.2% final month – the best stage recorded by the SMMT in a ‘new plate month’ since earlier than the pandemic. 12 months-related registration plates are launched in March and September.

As provide chain points eased popping out of the pandemic, March marked the eighth consecutive month of progress within the automobile market, with virtually 288,000 items delivered in comparison with round 243,400 final yr. The primary three months of 2023 had been the strongest for the market since 2019, with just below 500,000 new vehicles registered.

Plug-in hybrid (PHEV) registrations rose by 11.8%, from simply over 16,000 registrations final yr to virtually 18,000 this yr. Plug-in registrations general – the whole of BEV and PHEV registrations – comprised 22.4% of the market – a slight fall on final yr.

This follows the closure of the federal government’s plug-in automobile grant scheme in June final yr.

Hybrid (HEV) registrations fared higher, rising by 34.3% from round 27,700 final yr to round 37,200 this yr – its largest year-on-year progress – serving to electrical autos account for greater than 33.3% of automobile registrations final month.

Hybrids use each battery and inside combustion engine powertrains.

Supply: SMMT

12 months-to-date in 2023, BEVs accounted for over 76,000 gross sales in comparison with over 64,100 within the interval between January and March 2022, exhibiting progress of 18.8%. PHEVs accounted for over 31,700 gross sales, and HEVs over 65,800 gross sales, seeing progress of 6.7% and 36.9% respectively in comparison with January and March final yr.

The Tesla Mannequin Y – a BEV – was the most well-liked automobile mannequin in March, with 8,123 offered, adopted by the Nissan Juke (7,532) and the Nissan Qashqai (6,755).

With the publication of the federal government’s session on a Zero Emission Car Mandate final week, the SMMT mentioned: “The market must transfer extra quickly to battery electrical and different zero tailpipe emission vehicles and vans.

“Fashions are coming to market in higher numbers, however customers will solely make the change if they've the boldness they will cost at any time when and wherever they want.

“Success of the mandate, subsequently, will probably be dependent not simply on product availability however on infrastructure suppliers investing within the public charging community throughout the UK.”

Mike Hawes, the SMMT’s chief government, mentioned: “March’s new plate month often units the tone for the yr so this efficiency will give the business and customers higher confidence.

“With eight consecutive months of progress, the automotive business is recovering, bucking wider tendencies and supporting financial progress. The perfect month ever for zero emission autos is reflective of elevated shopper selection and improved availability but when EV market ambitions – and regulation – are to be met, infrastructure funding should catch up.

Evaluate Automobile Insurance coverage Quotes

Select from a spread of coverage choices for inexpensive cowl, that fits you and your automobile.

28 March: Fruit And Greens Drive Hovering Meals Prices

Rocketing foods and drinks costs have pushed store value inflation to a file excessive, in response to figures from the British Retail Consortium (BRC), writes Jo Thornhill.

Annual meals inflation was recorded at 15% in March – up from 14.5% in February. It's the highest stage seen for the reason that BRC began gathering the info for its Store Value Index in 2005.

The index is a measure of the price of 500 of probably the most generally purchased objects – together with meals, drink and non meals items, similar to clothes and electrical home equipment.

Non-food value inflation rose from 5.3% to five.7% for a similar interval and general store value inflation rose to eight.9% – up from 8.4% in February and marking a file excessive.

The steepest value rises had been seen in recent meals, similar to fruit and greens, pushed by shortages and provide points. Inflation for costs of recent meals rose 0.7 share factors in March to 17%.

Helen Dickinson OBE, chief government on the British Retail Consortium, mentioned: “Store value inflation has but to peak. As Easter approaches, the rising price of sugar coupled with excessive manufacturing prices left some prospects with a bitter style, as value rises for chocolate, sweets and fizzy drinks elevated in March.

“Fruit and vegetable costs additionally rose as poor harvests in Europe and North Africa worsened availability, and imports turned costlier as a result of weakening pound. Some sweeter offers had been accessible in non-food, as retailers supplied reductions on house leisure items and electrical home equipment.

“Meals value rises will doubtless ease within the coming months, notably as we enter the UK rising season, however wider inflation is predicted to stay excessive.”

It follows the shock rise in inflation recorded by the Workplace for Nationwide Statistics (ONS) earlier this month. Specialists had been anticipating the speed to start out easing downwards. However the Client Value Index (CPI) rose to 10.4% within the 12 months February – up from 10.1% within the earlier month.

The ONS mentioned the worth of meals and non-alcoholic drinks rose at their quickest price in 45 years over this era, with the most important contributor to the will increase being recent greens.

Laura Suter, head of non-public finance at AJ Bell, mentioned: “Meals prices hold going up and up, a lot to the dismay of the British public, who had hoped the invoice on the checkout would have dropped by now.

“We’re nonetheless seeing the affect of excessive power costs and the struggle in Ukraine coming by means of into meals costs, in addition to extra particular provide points, just like the scarcity of salad objects or eggs not too long ago. All of those are pushing up prices, notably for lots of staple objects. It now seems to be like we’re going to have a costlier Easter, as sugar costs have pushed up the price of Easter treats.”

Ms Suter added that these hit hardest are low revenue households, who spend extra of their general revenue on meals.

Evaluate Automobile Insurance coverage Quotes

Select from a spread of coverage choices for inexpensive cowl, that fits you and your automobile.

27 March: 95% See Actual-Phrases Pay Lower Over 12 Months

Nearly half of households (47%) say they're involved about paying their mortgage or hire within the coming yr, in response to new information from monetary companies supplier Authorized & Basic, writes Jo Thornhill.

The findings, from its Rebuilding Britain Index survey of 20,000 households, additionally present that 95% have skilled a real-terms pay minimize over the past 12 months on account of hovering inflation.

The bottom revenue teams – these with a family annual revenue of lower than £20,000 – are almost definitely to really feel that their high quality of life is declining at 29%, in comparison with 13% within the highest revenue households.

Greater than half of respondents to the survey mentioned they'd lowered day-to-day expenditure in response to rising inflation and prices. And 51% mentioned they count on their spending to should lower even additional over the subsequent 12 months.

Inflation, which was recorded at 10.4% final week (a rise from 10.1% in January), is widening the hole between the wealthiest and poorest households, in response to L&G’s survey. It discovered that one in 5 households have skilled a decline in revenue, with decrease revenue communities hit the toughest.

As a part of the survey L&G requested respondents what long-term options may finest sort out the price of residing disaster, with funding in energy-efficient houses and workplaces (59%) and the creation of upper wage employment (52%) proving the most well-liked.

24 March: 4-In-10 Use Playing cards To Bridge Hole To Payday

New analysis from Nationwide Constructing Society has revealed that just about four-in-10 (38%) customers have used bank cards within the final six months to tide them over till payday or advantages fee, writes Laura Howard.

The ballot of greater than 2,000 people throughout the nation additionally revealed that just about two thirds (63%) are frightened in regards to the state of their private funds and their skill to cowl important prices. Nonetheless, the determine is down from the 70% reported final month.

Grocery store groceries (29%), consuming and consuming out (14%), gasoline/electrical automobile charging (13%), utilities (12%) and holidays and journey (11%) had been the primary spending areas being plugged by bank cards.

Nationwide’s Spending Report, printed alongside the analysis which collects information from 208 million debit card, bank card and direct debit transactions, confirmed that important spending was 12% greater in February than 12 months earlier than, at £3.97 billion.

Nationwide defines important spending as utility payments, supermarkets, bank card repayments and childcare prices.

Non-essential spending, which incorporates holidays, consuming out and subscriptions, was up by 9% year-on-year at a complete of £2.75 billion.

TV subscriptions are the primary price to be culled, with almost 1 / 4 (23%) of people reporting they've already lowered or cancelled TV subscriptions, with an additional 14% contemplating doing so.

Mark Nalder at Nationwide mentioned: “Regardless of rising prices, households are clearly trying to strike the stability between being fiscally accountable and nonetheless having the ability to spend cash on themselves.

“Nonetheless, our analysis reveals that, whereas the variety of people frightened about their funds has fallen barely, there are people counting on credit score as a method of bridging the hole for important payments.”

Rising residing prices are exhibiting no indicators of abating, with the newest annual inflation price within the yr to February at 10.4% – up from 10.1% in January and better than the 9.9% many analysts had been predicting.

Yesterday the Financial institution of England additionally raised rates of interest from 4% to 4.

25%, doubtlessly affecting the price of mortgages and different shopper borrowing.

15 March: Chancellor Says Inflation To Be 2.9% By 12 months-Finish

At present’s Price range supplied a buoyant evaluation of the UK financial system’s prospects whereas acknowledging the monetary misery being suffered by hundreds of thousands of households in the price of residing disaster.

The Chancellor, Jeremy Hunt MP, says UK inflation will fall from its current stage of 10.1% to 2.9% by the top of the yr. He additionally mentioned that the UK will keep away from falling right into a technical recession in 2023.

He mentioned the federal government has spent £94 billion in offering cost-of-living help – the equal of £3,300 for each family.

He introduced sweeping reforms to pensions and prolonged the supply of subsidised and government-funded childcare for folks trying to enter the office or improve their employment hours.

The Vitality Value Assure, which was on account of rise from £2,500 to £3,000 on 1 April, will stay at its present stage till the top of June, and the worth differential which makes prepayment meters costlier than credit score meters will probably be eliminated.

This may save common consumption prepayment prospects round £45 a yr when it comes into impact later this yr.

The UK’s nuclear business will probably be expanded, with the purpose of reaching 25% of electrical energy manufacturing being nuclear by 2050.

There was no announcement of elevated help for business power customers past the Vitality Payments Low cost Scheme, which runs from

Mr Hunt introduced a collection of company tax reliefs to reward companies that put money into their operations, and unveiled proposals for 12 funding zones throughout the UK. There will even be important funding within the artificial intelligence sector.

Right here’s a have a look at the details from the Price range.

Vitality payments

The Vitality Value Assure (EPG) will probably be stored at a mean of £2,500 till the top of June. It was scheduled to rise to £3,000 on 1 April.

Mr Hunt additionally mentioned that the so-called prepayment premium is to be eradicated, which means prepayment prospects will successfully be charged on the identical phrases as these with credit score meters. At current they pay extra due to the upper price of working prepayment infrastructure.

The EPG will stay in operation whereas it stays decrease than the worth cap operated by Ofgem, the market regulator. The cap, which is reviewed quarterly, rose to £4,279 in Janaury and will probably be set at £3,280 on 1 April.

Nonetheless, the cap is forecast to fall to £2,013 in July, at which level suppliers will probably be required to supply tariffs that conform with the cap, fairly than the EPG.

If wholesale costs proceed to fall, we might even see the re-emergence of competitors between suppliers, with keenly priced tariffs getting used to encourage prospects to change between companies – a market phenomenon that hasn’t functioned for 18 months.

The EPG will stay in place till the top of March 2024, rising to £3,000 on 1 July. It's going to come into play as soon as extra if the Ofgem cap rises above this determine on account of will increase in wholesale costs.

Business analyst Cornwall Perception predicts it would attain £2,002 within the fourth quarter of 2023.

Childcare

A scheme providing 30 hours of free childcare for working households with three and 4 year-olds is being expanded to cowl these with youngsters aged 9 months and older.

The Chancellor hopes to spice up the financial system with the growth of the scheme in England by encouraging extra mother and father and caregivers into work. Equal growth in Wales, Scotland and Northern Eire is predicted to observe.

The 30 hours’ free childcare scheme was launched in September 2017, protecting registered nurseries, childminders and nannies, registered after-school golf equipment and play schemes and residential care employees from a registered house care company.

Each mother and father (or a baby’s sole dad or mum) should work at the very least a mean of 16 hours per week on the Nationwide Dwelling Wage to qualify for the help, leaving some low-income households (for instance, the place one dad or mum is in full-time schooling) ineligible.

To help households struggling to entry the provide due to the preliminary outlay, the federal government pays upfront childcare prices of as much as £951 for one little one and £1,630 for 2.

Critics say the funding received’t totally cowl suppliers’ prices, that there already aren’t sufficient nursery locations accessible to fulfill demand, and that growth might create issues of safety by forcing suppliers to loosen up the ratio of carers per little one.

In his speech, Mr Hunt mentioned suppliers can be permitted to extend the ratio of carers to youngsters from 1:4 to 1:5.

The expanded free childcare provide will probably be rolled out progressively from April 2024, beginning with 15 hours’ free childcare for two-year-olds, adopted by 15 hours for youngsters aged 9 months to a few years in September 2024.

All beneath 5’s will probably be eligible for 30 hours’ free childcare by September 2025.

Welfare

Common Credit score (UC) claimants must work extra hours every week in an effort to keep away from having to fulfill with Division of Work and Pensions (DWP) ‘Work Coaches’.

The Administrative Earnings Threshold (AET), which displays the minimal a claimant is predicted to earn from work in an effort to hold receiving UC, is being elevated.

Beforehand, the edge for people was set at £617 for people and at £988 for couples. These thresholds had been the equal of a single individual working 15 hours per week at Nationwide Dwelling Wage (NLW) or 24 hours for a pair.

The brand new thresholds are equal to 18 hours at NLW for a single individual. Claimants who fail to make up the hours will threat having their UC funds minimize.

Elsewhere, the Chancellor additionally introduced reforms to incapacity advantages with Common Help – a voluntary scheme in England and Wales to assist people with disabilities discover work value £4,000 per individual.

Gas responsibility

Drivers will probably be happy to listen to that the 5p-per-litre gasoline responsibility low cost, launched in March 2022, will stay in place for an additional 12 months.

This low cost will save motorists round £100 a yr, the Chancellor mentioned.

An extra £200 million will even be made accessible for pot-hole repairs in 2024, along with the present price range of £500 million.

Kevin Pratt, Forbes Advisor UK editor, mentioned: “Motorists will probably be relieved that the federal government is freezing gasoline responsibility and sustaining the 5p-per-litre gasoline responsibility minimize, which was on account of finish subsequent month, for one more yr. However they’ll even be completely satisfied to see an official acknowledgement of the surprising state of Britain’s roads, with an addition £200 million of funding to sort out the scourge of potholes.

“That is nowhere close to sufficient – billions is required to repair the nation’s potholes sufficiently properly they they don’t merely reappear in just a few weeks – however it's higher than nothing.

“In lots of areas, driving is the equal of slaloming down the street attempting to remain out of the worst divots, with costly restore payments mendacity in wait for many who fall sufferer. Extra must be completed to assist beleaguered drivers.”

Hugo Griffiths at Carwow mentioned: “Within the grand scheme of issues the Authorities is clearly missing concepts in numerous key strategic areas [regarding driving].

“To call however just a few: we're nonetheless being stored at midnight with regard to how gasoline responsibility will probably be changed as soon as electrical vehicles are mandated. There may be additionally little readability on how EVs will probably be made inexpensive for personal consumers as we edge ever nearer to 2030.

“The £200 million pothole fund is prone to be yet one more sticking plaster for the nation’s street community, which wants complete, basic consideration.

“All issues thought of, Jeremy Hunt’s Price range is skinny gruel that can maintain motorists for some time, however drivers want substance and readability which are sorely missing.”

Jeremy Hunt delivered his first full Price range, calling it an agenda for “prosperity with objective”

Pensions

The Chancellor shocked the pensions business by considerably altering the whole sum of money employees can put into their pensions earlier than being hit with a hefty tax invoice.

Mr Hunt is abolishing the pensions ‘lifetime allowance’ (LTA), which at present stands at £1,073,100, from April subsequent yr. He's elevating the cap on tax-free annual pension contributions – the ‘annual allowance’ – from £40,000 to £60,000.

The Chancellor additionally elevated the cash buy annual allowance, or MPAA, from £4,000 to £10,000. The MPAA is a particular restriction on the quantity you possibly can pay right into a pension and nonetheless obtain tax aid.

There is no such thing as a restrict on the worth of pension financial savings that may be constructed up by a person, but when the LTA is exceeded, the stability is topic to a cost generally known as the ‘lifetime allowance cost’.

Employees who've accrued pension pots in extra of the allowance face an additional 25% levy – on high of revenue tax – after they take the cash above that stage as revenue, or are responsible for a 55% tax cost in the event that they withdraw cash as a lump sum.

A part of the pondering behind at this time’s bulletins is to discourage employees – together with well-paid hospital consultants – from decreasing the hours they work or retiring early to swerve punitive taxation ranges in relation to their pension preparations.

Lily Megson of My Pension Knowledgeable, mentioned: “Abolishing the lifetime allowance is eye-catching – but it surely solely impacts probably the most prosperous earners. Certainly, within the yr main as much as April 2020, solely 42,350 breached the allowance.”

Commenting on the rise to the annual allowance, Dean Butler at Customary Life mentioned: “Solely a small variety of earners will ever attain the present annual allowance of £40,000, however the advantages of at this time’s improve will probably be a selected assist to those that need to meet up with their financial savings later of their careers.”

With regard to the hike within the cash buy annual allowance, Mr Butler mentioned: “This is without doubt one of the few areas of the pension system the place there was close to common settlement on the necessity for change.

“At a time when the federal government is hoping to encourage retirees again to work, that is arguably the largest lever they might have pulled from a pensions perspective. Upping the allowance to £10,000 will present some incentive to return.”

Alcohol and tobacco

In a bid to help bars and pubs, the Chancellor introduced that draught beer and cider will proceed to be taxed at a decrease price than grocery store equivalents.

The Draught Reduction Scheme, launched in 2021, minimize duties on draught beer and cider by 5%. From August, the low cost will improve to 9.2%.

Dubbed the “Brexit Pubs Assure” by the Chancellor, this measure means the alcohol responsibility charged on draught pints will probably be as much as 11p decrease than duties charged on grocery store beer.

From August, the responsibility price for alcohol offered in supermarkets and different outlets will rise 10.1%, according to inflation.

People who smoke additionally face a tax hike. Tobacco responsibility will rise by 14.7% from this night, the Chancellor introduced.

Following the rise, the worth of a packet of 20 cigarettes might rise from round £15.35 to £17.65.

Crypto

From 2024/25, self evaluation tax types – which have to be accomplished by

the self-employed, excessive earners and people with funding revenue, amongst others – could have a separate part for capital positive factors made by crypto merchants.

Company tax

The Chancellor confirmed the rise to company tax from 19% to 25% from April 2023, though he mentioned solely 10% of companies, sometimes the most important, pays the complete price.

Whereas it was confirmed that the company tax super-deduction, which permits companies to chop their tax invoice by 25p in each £1 they make investments, will finish on 31 March, the Chancellor introduced a brand new tax deduction scheme – full expensing (FE).

The FE coverage will probably be launched from 1 April 2023 and can run for 3 years till 31 March 2026. Below the brand new scheme companies can instantly deduct 100% of the price of sure capital spending from their pre-tax income, together with spending on IT gear, plant equipment, hearth alarms, autos and workplace furnishings. This equates to a 25p tax saving for each £1 invested.

The primary-year allowance (FYA), which was on account of finish on 31 March, has been prolonged for an additional three years till March 2026 with a view to creating it everlasting. This allowance permits companies to deduct 50% of the price of plant gear and equipment (generally known as particular price belongings) from pre-tax income within the yr of buy.

The mixed financial savings to companies of FE and the FYA are calculated at £9 billion a yr.

However Martin McTague, nationwide chair of the Federation of Small Companies (FSB), was left unimpressed: “The distinct lack of recent help in core areas proves that small companies are ignored and undervalued. With billions being allotted to massive companies and to households, 5.5 million small companies and the 16 million people who work for them will probably be questioning why the selection has been made to miss them.

“The Chancellor careworn that the UK is without doubt one of the finest locations to do enterprise – however small companies want extra ambition and extra focus. Motion is what counts if we're to reverse the five hundred,000 small companies misplaced over the past two years.”

Funding zones

The federal government introduced the creation of 12 funding zones outdoors London, together with within the West Midlands, East Midlands, Larger Manchester, Liverpool, the North East, South Yorkshire, Teeside, West Midlands and West Yorkshire, plus at the very least one every in Scotland, Wales and Northern Eire. The Chancellor mentioned the purpose of the zones was to ‘drive enterprise funding and stage up’.

The transfer is backed with £80 million in funding for every location over the subsequent 5 years. This will probably be within the type of tax breaks for companies and grant funding.

It follows the introduction of 10 freeports, created in 2021 round seaports and airports within the UK, the place companies in these areas already make the most of tax breaks and customs incentives.

The 12 funding zones will probably be targeted round universities and analysis establishments with the hope this can increase the technology sector, together with artificial intelligence. Every area must establish an acceptable location.

There was additionally the announcement of £400 million for levelling-up initiatives in 20 areas throughout England together with Bassetlaw, Blackburn, Oldham, Redcar and Rochdale, and an additional £8.8 billion over the subsequent 5 years for funding in sustainable transport schemes within the areas.

14 March: Financial institution Of England Figures Word Lower by Third

New mortgage lending plummeted by a 3rd on the finish of 2022, in response to the Financial institution of England’s newest quarterly statistics, suggesting rising rates of interest and the persevering with cost-of-living disaster took a toll on the housing market, writes Jo Thornhill.

Between October and December, new mortgage commitments (lending agreed for the approaching months) was £58.

4 billion – 33.5% lower than within the earlier quarter when it stood at £87.8 billion, and 24.5% lower than a yr earlier when it was £77.3 billion.

Excluding the time across the begin of the Covid-19 pandemic in 2020, that is the bottom stage of recent lending since 2015.

The worth of mortgage balances in arrears elevated by 4.6% within the ultimate quarter of final yr from £13 billion to £13.6 billion. The quantity was up 1.3% over 12 months when it was recorded at £13.5 billion (This autumn 2021).

That is the primary time there was an increase since Q1 in 2021 – a mirrored image of elevated monetary stress amongst debtors.

However arrears account for simply 0.81% of complete excellent mortgage balances and stay near the historic low of 0.78%, recorded in Q3 of 2022.

On Friday final week (10 March) the regulator, the Monetary Conduct Authority, printed steering for lenders on dealing sympathetically with mortgage debtors who're struggling.

Complete excellent mortgage debt on residential house loans was £1.67 billion on the finish of This autumn 2022, 3.9% greater than in the identical interval in 2021. The worth of gross mortgage advances was £81.6 billion, which was £4.3 billion decrease than the earlier quarter, however 16.3% greater than in the identical quarter in 2021.

Charlotte Nixon, mortgage professional at wealth administration agency Quilter, mentioned: “The interval resulting in as much as Christmas 2022 was rife with uncertainty, and whereas the nation continues to be not out of the woods, and continues to be struggling with the affect of upper rates of interest and excessive inflation, the course of journey does at the very least look much less unpredictable.

“After the troubling days following the mini price range [in September last year, while Liz Truss was prime minister and Kwasi Kwarteng was Chancellor], mortgage charges have dropped quicker than initially anticipated and subsequently there's a probability that this can assist encourage extra people to the market and extra people will probably be searching for a mortgage.

“As lenders participate in a race to encourage debtors, we're seeing charges stabilise as banks compete for patrons.”

7 March: Choice To Enhance State Pension Entitlement

The federal government is giving UK people three further months to plug the gaps of their Nationwide Insurance coverage (NI) contribution data, Andrew Michael writes.

It's going to lengthen the deadline from 5 April 2023 to 31 July 2023 for people desirous to top-up lacking NI years between 2006 and 2016. This was a transitional interval coinciding with the transfer from a former state pension association to the current one.

To be eligible, you will need to have certified or will qualify for the brand new state pension on or after 6 April 2016.

You'll be able to verify your nationwide insurance file on the federal government web site.

NI contributions are a way of taxing earnings and self-employed income. Paying is a authorized obligation, and people who accomplish that additionally earn the suitable to obtain sure social safety advantages.

Not everybody manages to maintain up with a full set of NI funds, maybe due to a profession break, doubtlessly decreasing the quantity in advantages to which they're entitled. This consists of the quantity obtained in state pension, at present value £185.15 per week.

To treatment this, the federal government permits people to fill the gaps of their NI historical past by topping-up missed contributions. Making voluntary contributions could make people considerably higher off in retirement than not doing so.

After revenue tax, NICs are the UK’s second largest tax, elevating almost £150 billion within the tax yr 2021/22 – a few fifth of all of the nation’s annual tax income.

The choice to increase the deadline comes after many people reported being unable to entry very important authorities helplines, run by the Division for

Work and Pensions and HM Income & Customs, to obtain important recommendation earlier than the unique 5 April deadline.

Charges differ for various lessons of NIC, payable in response to employment/self-employment standing, however at present stand at £3.15 per week for Class 2 and £15.85 per week for Class 3.

Victoria Atkins, monetary secretary to the Treasury, mentioned: “We’ve listened to involved members of the general public and have acted. We recognise how necessary state pensions are for retired people, which is why we're giving people extra time to fill any gaps of their NI file to assist bolster their entitlement.”

Alice Haine, private finance analyst at Bestinvest, mentioned: “Shopping for again missed years is a good way to bolster retirement revenue.

“Britons sometimes want at the very least 10 years of NI contributions to obtain something in any respect and at the very least 35 years to obtain the utmost quantity, which at present stands at £9,600 a yr for these retiring after 6 April 2016 and which is able to rise to £10,600 a yr from this April.”

6 March: Hybrids Lead Cost For Electrical Automobiles

The variety of new autos registered in February was 26% greater year-on-year, in response to the newest figures from the Society of Motor Producers and Merchants (SMMT), writes Jo Groves.

There have been over 74,000 new registrations, marking the seventh consecutive month of progress as provide chain points from the pandemic proceed to ease. This was considerably decrease than the 132,000 new vehicles registered in January, as is usually the case forward of the discharge of the brand new registration plates on 1 March.

Progress was seen throughout the market, with massive fleets main the cost with a 46% year-on-year improve, in comparison with a extra modest 6% improve in non-public automobile registrations.

Trying by class, super-minis accounted for a 3rd of all deliveries, with multi-purpose autos additionally rising in recognition. On the different finish, registrations of government and luxurious saloon vehicles fell by 15% and 6% respectively.

The transition to electrical autos continued, with the best progress of 40% posted by hybrid electrical autos, whereas battery electrical autos now account for one in six new vehicles registered by UK households.

The SMMT expects the addition of almost half one million hybrid and fully-electric autos to Britain’s roads in 2023. Nonetheless, it warns of potential issues if charging infrastructure fails to maintain tempo with elevated demand.

Mike Hawes, chief government of SMMT, mentioned: “After seven months of progress, it's no shock that the UK automotive sector is dealing with the longer term with rising confidence.

“As we transfer into ‘new plate month’ in March, with extra of the newest high-tech vehicles accessible, the upcoming Price range should ship measures that drive this [net-zero] transition, rising affordability and ease of charging for all.”

Hugo Griffiths, shopper editor of carwow, mentioned: “The strategy of spring actually does appear to mark a time of renewal and regeneration the place the UK automobile market is anxious, with February’s registration figures being a mere 6.5% down on pre-pandemic 2020.

“Given the maelstroms confronted by the UK automobile business and the financial system as a complete over the previous couple of years, we ought to be shouting this success from the rooftops – whereas protecting each accessible appendage crossed that this upswing continues.”

Evaluate Automobile Insurance coverage Quotes

Select from a spread of coverage choices for inexpensive cowl, that fits you and your automobile.

14 February: Regulation Of BNPL Sector Anticipated 2024

The federal government is consulting on regulation of the controversial buy-now-pay-later (BNPL) credit score sector, which is utilized by an estimated 10 million people within the UK.

The proposed guidelines would see BNPL companies regulated by the Monetary Conduct Authority (FCA), the watchdog that governs banks, insurance firms and different monetary companies companies.

Two years in the past, the FCA mentioned regulation was wanted to guard customers, whereas final summer season it warned companies about using deceptive promoting and promotions, particularly on social media.

Below the brand new proposals, BNPL prospects would additionally, for the primary time, be capable of take complaints to the Monetary Ombudsman Service (FOS).