#the rents too damned high

Text

The tax sharks are back and they’re coming for your home

I'm touring my new, nationally bestselling novel The Bezzle! Catch me TODAY (Apr 27) in MARIN COUNTY, then Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

One of my weirder and more rewarding hobbies is collecting definitions of "conservativism," and one of the jewels of that collection comes from Corey Robin's must-read book The Reactionary Mind:

https://en.wikipedia.org/wiki/The_Reactionary_Mind

Robin's definition of conservativism has enormous explanatory power and I'm always finding fresh ways in which it clarifies my understand of events in the world: a conservative is someone who believes that a minority of people were born to rule, and that everyone else was born to follow their rules, and that the world is in harmony when the born rulers are in charge.

This definition unifies the otherwise very odd grab-bag of ideologies that we identify with conservativism: a Christian Dominionist believes in the rule of Christians over others; a "men's rights advocate" thinks men should rule over women; a US imperialist thinks America should rule over the world; a white nationalist thinks white people should rule over racialized people; a libertarian believes in bosses dominating workers and a Hindu nationalist believes in Hindu domination over Muslims.

These people all disagree about who should be in charge, but they all agree that some people are ordained to rule, and that any "artificial" attempt to overturn the "natural" order throws society into chaos. This is the entire basis of the panic over DEI, and the brainless reflex to blame the Francis Scott Key bridge disaster on the possibility that someone had been unjustly promoted to ship's captain due to their membership in a disfavored racial group or gender.

This definition is also useful because it cleanly cleaves progressives from conservatives. If conservatives think there's a natural order in which the few dominate the many, progressivism is a belief in pluralism and inclusion, the idea that disparate perspectives and experiences all have something to contribute to society. Progressives see a world in which only a small number of people rise to public life, rarified professions, and cultural prominence and assume that this is terrible waste of the talents and contributions of people whose accidents of birth keep them from participating in the same way.

This is why progressives are committed to class mobility, broad access to education, and active programs to bring traditionally underrepresented groups into arenas that once excluded them. The "some are born to rule, and most to be ruled over" conservative credo rejects this as not just wrong, but dangerous, the kind of thing that leads to bridges being demolished by cargo ships.

The progressive reforms from the New Deal until the Reagan revolution were a series of efforts to broaden participation in every part of society by successively broader groups of people. A movement that started with inclusive housing and education for white men and votes for white women grew to encompass universal suffrage, racial struggles for equality, workplace protections for a widening group of people, rights for people with disabilities, truth and reconciliation with indigenous people and so on.

The conservative project of the past 40 years has been to reverse this: to return the great majority of us to the status of desperate, forelock-tugging plebs who know our places. Hence the return of child labor, the tradwife movement, and of course the attacks on labor unions and voting rights:

https://pluralistic.net/2022/11/06/the-end-of-the-road-to-serfdom/

Arguably the most potent symbol of this struggle is the fight over homes. The New Deal offered (some) working people a twofold path to prosperity: subsidized home-ownership and strong labor protections. This insulated (mostly white) workers from the two most potent threats to working peoples' lives and wellbeing: the cruel boss and the greedy landlord.

But the neoliberal era dispensed with labor rights, leaving the descendants of those lucky workers with just one tool for securing their American dream: home-ownership. As wages stagnated, your home – so essential to your ability to simply live – became your most important asset first, and a home second. So long as property values rose – and property taxes didn't – your home could be the backstop for debt-fueled consumption that filled the gap left by stagnating wages. Liquidating your family home might someday provide for your retirement, your kids' college loans and your emergency medical bills.

For conservatives who want to restore Gilded Age class rule, this was a very canny move. It pitted lucky workers with homes against their unlucky brethren – the more housing supply there was, the less your house was worth. The more protections tenants had, the less your house was worth. The more equitably municipal services (like schools) were distributed, the less your house was worth:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

And now that the long game is over, they're coming for your house. It started with the foreclosure epidemic after the 2008 financial crisis, first under GW Bush, but then in earnest under Obama, who accepted the advice of his Treasury Secretary Timothy Geithner, who insisted that homeowners should be liquidated to "foam the runways" for the crashing banks:

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

Then there are scams like "We Buy Ugly Houses," a nationwide mass-fraud outfit that steals houses out from under elderly, vulnerable and desperate people:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The more we lose our houses, the more single-family homes Wall Street gets to snap up and convert into slum properties, aslosh with a toxic stew of black mold, junk fees and eviction threats:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

Now there's a new way for finance barons the steal our houses out from under us – or rather, a very old way that had lain dormant since the last time child labor was legal – "tax lien investing."

Across the country, counties and cities have programs that allow investment funds to buy up overdue tax-bills from homeowners in financial hardship. These "investors" are entitled to be paid the missing property taxes, and if the homeowner can't afford to make that payment, the "investor" gets to kick them out of their homes and take possession of them, for a tiny fraction of their value.

As Andrew Kahrl writes for The American Prospect, tax lien investing was common in the 19th century, until the fundamental ugliness of the business made it unattractive even to the robber barons of the day:

https://prospect.org/economy/2024-04-26-investing-in-distress-tax-liens/

The "tax sharks" of Chicago and New York were deemed "too merciless" by their peers. One exec who got out of the business compared it to "picking pennies off a dead man’s eyes." The very idea of outsourcing municipal tax collection to merciless debt-hounds fell aroused public ire.

Today – as the conservative project to restore the "natural" order of the ruled and the ruled-over builds momentum – tax lien investing is attracting some of America's most rapacious investors – and they're making a killing. In Chicago, Alden Capital just spent a measly $1.75m to acquire the tax liens on 600 family homes in Cook County. They now get to charge escalating fees and penalties and usurious interest to those unlucky homeowners. Any homeowner that can't pay loses their home.

The first targets for tax-lien investing are the people who were the last people to benefit from the New Deal and its successors: Black and Latino families, elderly and disabled people and others who got the smallest share of America's experiment in shared prosperity are the first to lose the small slice of the American dream that they were grudgingly given.

This is the very definition of "structural racism." Redlining meant that families of color were shut out of the federal loan guarantees that benefited white workers. Rather than building intergenerational wealth, these families were forced to rent (building some other family's intergenerational wealth), and had a harder time saving for downpayments. That meant that they went into homeownership with "nontraditional" or "nonconforming" mortgages with higher interest rates and penalties, which made them more vulnerable to economic volatility, and thus more likely to fall behind on their taxes. Now that they're delinquent on their property taxes, they're in hock to a private equity fund that's charging them even more to live in their family home, and the second they fail to pay, they'll be evicted, rendered homeless and dispossessed of all the equity they built in their (former) home.

It's very on-brand for Alden Capital to be destroying the lives of Chicagoans. Alden is most notorious for buying up and destroying America's most beloved newspapers. It was Alden who bought up the Chicago Tribune, gutted its workforce, sold off its iconic downtown tower, and moved its few remaining reporters to an outer suburban, windowless brick building "the size of a Chipotle":

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Before the ghastly hotel baroness Leona Helmsley went to prison for tax evasion, she famously said, "We don't pay taxes; only the little people pay taxes." Helmsley wasn't wrong – she was just a little ahead of schedule. As Propublica's IRS Files taught us, America's 400 richest people pay less tax than you do:

https://pluralistic.net/2022/04/13/for-the-little-people/#leona-helmsley-2022

When billionaires don't pay their taxes, they get to buy sports franchises. When poor people don't pay their taxes, billionaires get to steal their houses after paying the local government an insultingly small amount of money.

It's all going according to plan. We weren't meant to have houses, or job security, or retirement funds. We weren't meant to go to university, or even high school, and our kids were always supposed to be in harness at a local meat-packer or fast food kitchen, not wasting time with their high school chess club or sports team. They don't need high school: that's for the people who were born to rule. They – we – were meant to be ruled over.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/26/taxes-are-for-the-little-people/#alden-capital

#pluralistic#chicago#illinois#alden capital#the rents too damned high#debt#immiseration#chicago tribune#private equity#vulture capital#cook county#liens#tax evasion#taxes are for the little people#tax lien certificates#tax sharks#race#racial capitalism#predatory lending

351 notes

·

View notes

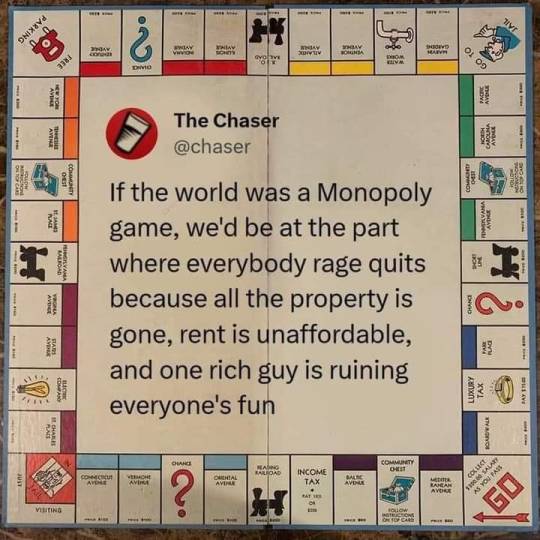

Text

If you want to know why people have lost faith in capitalism, this might help

#capitalism#rent is theft#landlords are parasites#poverty#class war#fyi#psa#rent is too damn high#homeless#eat the rich#eat the fucking rich#classwar#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#ausgov#politas#auspol#tasgov#taspol#australia#neoliberal capitalism#fuck neoliberals#anthony albanese#albanese government#fuck the gop#fuck the police#fuck the supreme court#fuck the patriarchy

43K notes

·

View notes

Text

The rent is too damn high!

#politics#housing#affordable housing#living wages#rent#the rent is too damn high#wages vs rents#economics

680 notes

·

View notes

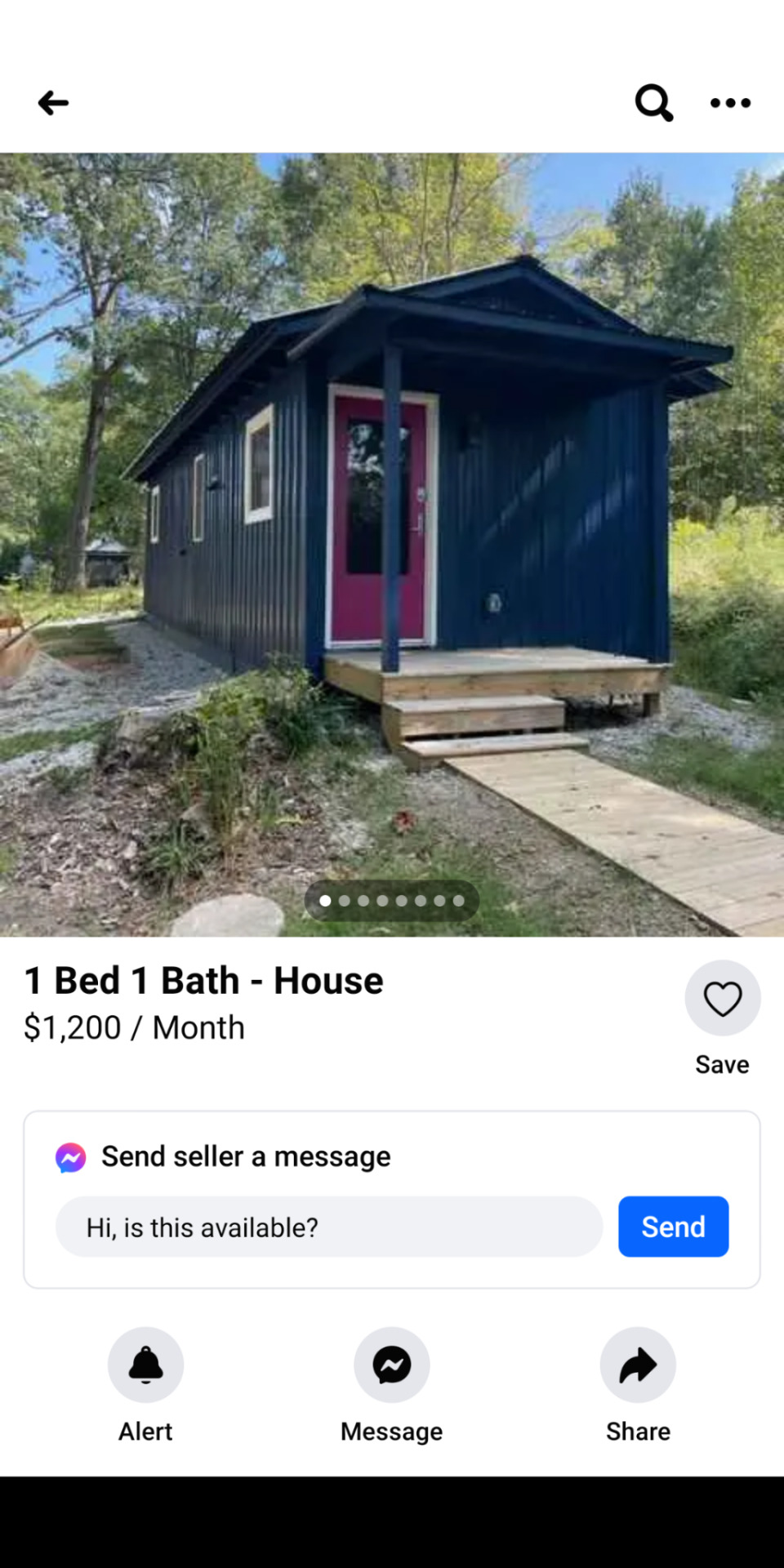

Text

327 notes

·

View notes

Text

Scrolling fb marketplace & came across - is that...? Yeah, that is a shed that somebody "finished" & now they're renting it out like it's a real house. Smh.

#converting a shed for yourself to live in is one thing#a fun moneysaving diy thing!#renting it to others for TWELVE HUNDRED AMERICAN DOLLARS?!??#that is another eviller thing#real estate#the rent is too damn high

70 notes

·

View notes

Photo

Did this Landlords Are Leeches design, for fun.

You can get it here if you’re interested:

https://society6.com/art/landlords-are-leeches8284119

https://www.teepublic.com/t-shirt/44995877-landlords-are-leeches?store_id=2389831

#leeches#landlords are leeches#landlords#rent#rent is too damn high#socialism#socialist#fuck capitalism#but I still need to pay my bills

170 notes

·

View notes

Text

Looking up the numbers on how much it takes to live alone in my area is very disheartening. I mean $53 an hour or over $60,000 annually to afford a 1 bedroom apartment? So everyone has to settle for toxic or awkward living situations just to exist down here wow okay makes a lot more sense now.

#shitpost#cost of living#housing cost#california#california housing#renting#rent is too damn high#meme#lol#funny#lmao#mental health#relatable memes#life stuff#roommates#renting a room#thoughts

12 notes

·

View notes

Photo

Just going to leave this here.

#amusing tweets#universal basic income#universal healthcare#rents are too damn high#I'm Irish fuck the British Royalty

267 notes

·

View notes

Text

The Rent Is Too Damn High: The Affordable Housing Crisis, Explained

Keep reading.

If you liked this article, join our Patreon!

74 notes

·

View notes

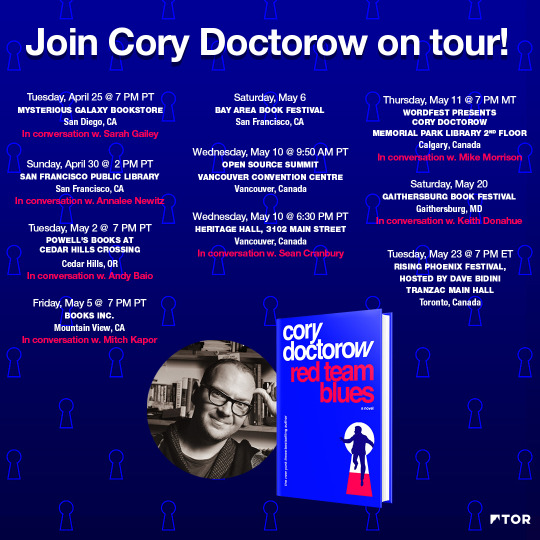

Text

'We buy ugly houses' is code for 'we steal vulnerable peoples' homes'

Tonight (May 11) at 7PM, I’m in CALGARY for Wordfest, with my novel Red Team Blues; I’ll be hosted by Peter Hemminger at the Memorial Park Library, 2nd Floor.

Home ownership is the American dream: not only do you get a place to live, free from the high-handed dictates of a landlord, but you also get an asset that appreciates, building intergenerational wealth while you sleep — literally.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

Of course, you can’t have it both ways. If your house is an asset you use to cover falling wages, rising health care costs, spiraling college tuition and paper-thin support for eldercare, then it can’t be a place you live. It’s gonna be an asset you sell — or at the very least, borrow so heavily against that you are in constant risk of losing it.

This is the contradiction at the heart of the American dream: when America turned its back on organized labor as an engine for creating prosperity and embraced property speculation, it set itself on the road to serfdom — a world where the roof over your head is also your piggy bank, destined to be smashed open to cover the rising costs that an organized labor movement would have fought:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Today, we’re hit the end of the road for the post-war (unevenly, racially segregated) shared prosperity that made it seem, briefly, that everyone could get rich by owning a house, living in it, then selling it to everybody else. Now that the game is ending, the winners are cashing in their chips:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

The big con of home ownership is proceeding smartly on schedulee. First, you let the mark win a little, so they go all in on the scam. Then you take it all back. Obama’s tolerance of bank sleze after the Great Financial Crisis kicked off the modern era of corporations and grifters stealing Americans’ out from under them, forging deeds in robosigning mills:

https://www.marketwatch.com/story/us-breaks-down-93-bln-robo-signing-settlement-2013-02-28

The thefts never stopped. Today on Propublica, by Anjeanette Damon, Byard Duncan and Mollie Simon bring a horrifying, brilliantly reported account of the rampant, bottomless scams of Homevestors, AKA We Buy Ugly Houses, AKA “the #1 homebuyer in the USA”:

https://www.propublica.org/article/ugly-truth-behind-we-buy-ugly-houses

Homevestors — an army of the hedge fund Bayview Asset Management — claims a public mission: to bail out homeowners sitting on unsellable houses with all-cash deals. The company’s franchisees — 1,150 of them in 48 states — then sprinkle pixie dust and secret sauce on these “ugly houses” and sell them at a profit.

But Propublica’s investigation — which relied on whistleblowers, company veterans, court records and interviews with victims — tells a very different story. The Homevestor they discovered is a predator that steals houses out from under elderly people, disabled people, people struggling with mental illness and other vulnerable people. It’s a company whose agents have a powerful, well-polished playbook that stops family members from halting the transfers the company’s high-pressure salespeople set in motion.

Propublica reveals homeowners with advanced dementia who signed their shaky signatures to transfers that same their homes sold out from under them for a fraction of their market value. They show how Homevestor targets neighborhoods struck by hurricanes, or whose owners are recently divorced, or sick. One whistleblower tells of how the company uses the surveillance advertising industry to locate elderly people who’ve broken a hip: “a 60-day countdown to death — and, possibly, a deal.” The company’s mobile ads are geofenced to target people near hospitals and rehab hospitals, in hopes of finding desperate sellers who need to liquidate homes so that Medicaid will cover their medical expenses.

The sales pitches are relentless. One of Homevestor’s targets was a Texas woman whose father had recently been murdered. As she grieved, they blanketed her in pitches to sell her father’s house until “checking her mail became a traumatic experience.”

Real-estate brokers are bound by strict regulations, but not house flippers like Homevestors. Likewise, salespeople who pitch other high-ticket items, from securities to plane tickets — are required to offer buyers a cooling-off period during which they can reconsider their purchases. By contrast, Homevestors’ franchisees are well-versed in “muddying the title” to houses after the contract is signed, filing paperwork that makes it all but impossible for sellers to withdraw from the sale.

This produces a litany of ghastly horror-stories: homeowners who end up living in their trucks after they were pressured into a lowball sales; sellers who end up dying in hospital beds haunted by the trick that cost them their homes. One woman who struggled with hoarding was tricked into selling her house by false claims that the city would evict her because of her hoarding. A widow was tricked into signing away the deed to her late husband’s house by the lie that she could do so despite not being on the deed. One seller was tricked into signing a document he believed to be a home equity loan application, only to discover he had sold his house at a huge discount on its market value. An Arizona woman was tricked into selling her dead mother’s house through the lie that the house would have to be torn down and the lot redeveloped; the Homevestor franchisee then flipped the house for 5,500% of the sale-price.

The company vigorously denies these claims. They say that most people who do business with Homevestors are happy with the outcome; in support of this claim, they cite internal surveys of their own customers that produce a 96% approval rating.

When confronted with the specifics, the company blamed rogue franchisees. But Propublica obtained training materials and other internal documents that show that the problem is widespread and endemic to Homevestors’ business. Propublica discovered that at least eight franchisees who engaged in conduct the company said it “didn’t tolerate” had been awarded prizes by the company for their business acumen.

Franchisees are on the hook for massive recurring fees and face constant pressure from corporate auditors to close sales. To make those sales, franchisees turn to Homevana’s training materials, which are rife with predatory tactics. One document counsels franchisees that “pain is always a form of motivation.” What kind of pain? Lost jobs, looming foreclosure or a child in need of surgery.

A former franchisee explained how this is put into practice in the field: he encountered a seller who needed to sell quickly so he could join his dying mother who had just entered a hospice 1,400 miles away. The seller didn’t want to sell the house; they wanted to “get to Colorado to see their dying mother.”

These same training materials warn franchisees that they must not deal with sellers who are “subject to a guardianship or has a mental capacity that is diminished to the point that the person does not understand the value of the property,” but Propublica’s investigation discovered “a pattern of disregard” for this rule. For example, there was the 2020 incident in which a 78-year-old Atlanta man sold his house to a Homevestors franchisee for half its sale price. The seller was later shown to be “unable to write a sentence or name the year, season, date or month.”

The company tried to pin the blame for all this on bad eggs among its franchisees. But Propublica found that some of the company’s most egregious offenders were celebrated and tolerated before and after they were convicted of felonies related to their conduct on behalf of the company. For example, Hi-Land Properties is a five-time winner of Homevestors’ National Franchise of the Year prize. The owner was praised by the CEO as “loyal, hardworking franchisee who has well represented our national brand, best practices and values.”

This same franchisee had “filed two dozen breach of contract lawsuits since 2016 and clouded titles on more than 300 properties by recording notices of a sales contract.” Hi-Land “sued an elderly man so incapacitated by illness he couldn’t leave his house.”

Another franchisee, Patriot Holdings, uses the courts aggressively to stop families of vulnerable people from canceling deals their relatives signed. Patriot Holdings’ co-owner, Cory Evans, eventually pleaded guilty to to two felonies, attempted grand theft of real property. He had to drop his lawsuits against buyers, and make restitution.

According to Homevestors’ internal policies, Patriot’s franchise should have been canceled. But Homevestors allowed Patriot to stay in business after Cory Evans took his name off the business, leaving his brothers and other partners to run it. Nominally, Cory Evans was out of the picture, but well after that date, internal Homevestors included Evans in an award it gave to Patriot, commemorating its sales (Homevestors claims this was an error).

Propublica’s reporters sought comment from Homevestors and its franchisees about this story. The company hired “a former FBI spokesperson who specializes in ‘crisis and special situations’ and ‘reputation management’ and funnelled future questions through him.”

Internally, company leadership scrambled to control the news. The company convened a webinar in April with all 1,150 franchisees to lay out its strategy. Company CEO David Hicks explained the company’s plan to “bury” the Propublica article with “‘strategic ad buys on social and web pages’ and ‘SEO content to minimize visibility.’”

https://www.propublica.org/article/homevestors-aims-to-bury-propublica-reporting

Franchisees were warned not to click links to the story because they “might improve its internet search ranking.”

Even as the company sought to “bury” the story and stonewalled Propublica, they cleaned house, instituting new procedures and taking action against franchisees identified in Propublica’s article. “Clouding titles” is now prohibited. Suing sellers for breach of contract is “discouraged.” Deals with seniors “should always involve family, attorneys or other guardians.”

During the webinar, franchisees “pushed back on the changes, claiming they could hurt business.”

If you’ve had experience with hard-sell house-flippers, Propublica wants to know: “If you’ve had experience with a company or buyer promising fast cash for homes, our reporting team wants to hear about it.”

Catch me on tour with Red Team Blues in Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A Depression-era photo of a dour widow standing in front of a dilapidated cabin. Next to her is Ug, the caveman mascot for Homevestors, smiling and pointing at her. Behind her is a 'We buy ugly houses' sign.

Image:

Homevestors

https://www.homevestors.com/

Fair use:

https://www.eff.org/issues/intellectual-property

#pluralistic#the rents too damned high#house flipping#llc brain#scams#elder abuse#ripoffs#weaponized shelter#predators#homevestors#we buy ugly houses#ugly houses#real estate#propublica

2K notes

·

View notes

Text

#homeless#homeless people in edinburgh offered beds 250 miles away weeks after city declares housing emergency#homeless people#rent is theft#rent is too damn high#landlords are parasites#fuck landlords#landlords are scum#landlords are leeches#landlords are bastards#i’m a housing lawyer – landlords use new loophole to push out tenants in ‘bad faith’ evictions#landlords#i took my landlord to court over common rental problem that made my life hell and won $14#court dismisses assault on landlord and son who threw student out in his ‘jocks’ after no rent paid#we had to flee our home as it was invaded by mice & bedbugs – inspectors said it’s ‘deplorable’ but landlord won’t act#landlord#rental#rent#auspol#politas#ausgov#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich

861 notes

·

View notes

Text

My landlord just upped my rent by the most he ever has because of “inflation” wtf inflation doesn’t change the cost of your mortgage.

Water rate hasn’t gone up.

Since I’ve been renting here he’s gone from working a very busy full time job and driving an old little Mazda and living in house down the street to early retirement, moved to one of the richer parts of town in a huge house and driving an Audi. Fucking “inflation” my ass

Mind you I don’t have a functioning sink in my bathroom and haven’t in over a decade. My fridge that he was totally going to replace after I moved in is still sitting in my kitchen with busted shelves and either being too cold or too warm no middle ground. Windows that don’t close all the way that he was totally going to replace ? Yep still not done just like the fridge over a decade later

I could go on and on. He’s literally fixed one thing the entire time I lived here. Replaced a toilet that had been leaking for I think 3-4 years possibly longer. I kept mentioning it but he kept saying oh ok he’ll get to it but didn’t bother until it became a serious issue

But yeah I can’t really afford to move so…..

But what an asshole move to raise the rent at the start of heating season because I can really afford more rent and the outrageous costs for heating that have gone up like mad

And of course I was just finally feeling like life had become somewhat stable for me heading towards better. Every fucking time I feel ok there’s something that ruins it

#fuck landlords#landlords#rent is theft#the rent is too damn high#eat the rich#guess I’m freezing to death this winter#seriously I could barely afford to keep it 60F inside last winter I don’t know what I’m going to do#so depressing#it’s 54F inside right now because I can’t afford the heat this early#whining#i’m so miserable

19 notes

·

View notes

Text

Friend need help:

In just 60 days we will be forced to leave our home. Rent prices in California has made it very very hard to find a new place despite our efforts. Owning this house is out of reach which is very depressing since my parents have worked countless years to keep this roof over our heads just for it to be taken away.

$1,495 USD raised of $5,600 goal

Finding a home that truly fits our needs has been a struggle, and planning for the future has caused us stress. But we're staying positive.

We're working hard to save money and protect my nephews from this situation. Recently, our landlord offered to sell us the house we're currently in. It's tough right now, as we're barely making ends meet,

but we're exploring options like seller financing or rent-to-own deals. House hunting has become monotonous, with unresponsive listings and deceptive schemes.

It's not easy, especially with little kids, to find an apartment where noise isn't an issue. However, we believe things will work out. The support from our community has been incredible, and we're grateful for every dollar we receive.

Though we know there's still a long road ahead, we will remain hopeful.

#california#rent#home#community#help#family in need#fundraser#lake forest#It's depressing#California housing#Housing crisis#Rent is too damn high

8 notes

·

View notes

Text

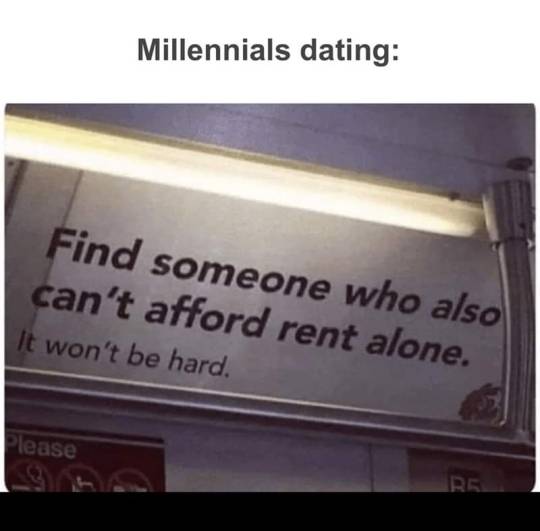

#memes#meme#throwback#lol#funny#lol memes#funny memes#funny meme haha#funny stuff#millenials#broke girl#dating#haha#single forever#rent is too damn high#eat the rich#millennials#gen y

7 notes

·

View notes

Text

"idolish7 depicts realistic problems within the entertainment industry and the harsh toll it takes on the people desperately trying to make a living in the business" yeah okay i see that

"in idolish7 three young adults move in together as roommates because they cannot afford to rent individually" HOLY SHIT THEY JUST LIKE ME FR????

#i feel like i never see rent as a legitimate problem in anime unless the show is specifically about people living in poverty#and this! is really fucking refreshing to see! the cost of living IS too damn high!#idolish7#i7 trigger

12 notes

·

View notes

Text

🚨Please stop scrolling — Mutual Aid Request 🚨

I started a new job this week! Yay!!!!!

However I need some help. You see between now & when I get paid, I don’t have any source of income for things like bills and food that can’t be put off.

I need $300 this month for help with expenses that I can’t postpone until after I get paid.

(Originally it was higher, but Twitter helped me get a little over halfway there. I forgot to post here too for a bit. I’m putting off everything that I can afford to until my first paycheck, which should be at the end of the month.)

CashApp - secretladyspider

venmo - secretladyspider

PayPal

Please reblog!

If more people see it, there’s a better chance someone who can help even a smidge will see it too. That’s why shares matter. So if nothing else, please reblog! It makes a difference, I promise.

Thank you for your help as I get back on my feet. 💛

#mutual funds#mutual aid#mutual aid request#capitalism#rent is too damn high#cost of living#food#text#fundrasier#gofundme#please help#please boost#crowd funding

130 notes

·

View notes