#we buy ugly houses

Text

'We buy ugly houses' is code for 'we steal vulnerable peoples' homes'

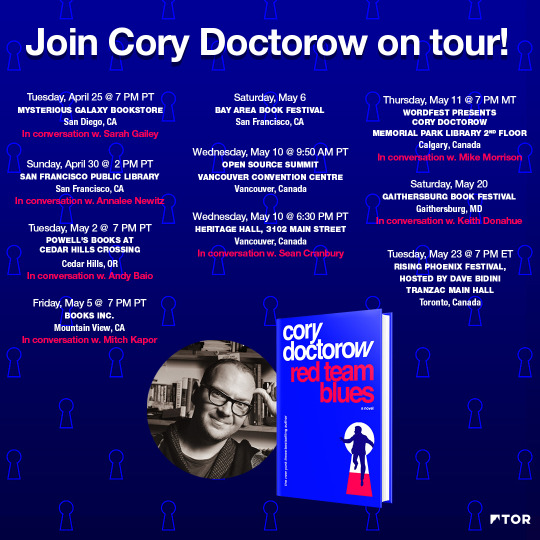

Tonight (May 11) at 7PM, I’m in CALGARY for Wordfest, with my novel Red Team Blues; I’ll be hosted by Peter Hemminger at the Memorial Park Library, 2nd Floor.

Home ownership is the American dream: not only do you get a place to live, free from the high-handed dictates of a landlord, but you also get an asset that appreciates, building intergenerational wealth while you sleep — literally.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

Of course, you can’t have it both ways. If your house is an asset you use to cover falling wages, rising health care costs, spiraling college tuition and paper-thin support for eldercare, then it can’t be a place you live. It’s gonna be an asset you sell — or at the very least, borrow so heavily against that you are in constant risk of losing it.

This is the contradiction at the heart of the American dream: when America turned its back on organized labor as an engine for creating prosperity and embraced property speculation, it set itself on the road to serfdom — a world where the roof over your head is also your piggy bank, destined to be smashed open to cover the rising costs that an organized labor movement would have fought:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Today, we’re hit the end of the road for the post-war (unevenly, racially segregated) shared prosperity that made it seem, briefly, that everyone could get rich by owning a house, living in it, then selling it to everybody else. Now that the game is ending, the winners are cashing in their chips:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

The big con of home ownership is proceeding smartly on schedulee. First, you let the mark win a little, so they go all in on the scam. Then you take it all back. Obama’s tolerance of bank sleze after the Great Financial Crisis kicked off the modern era of corporations and grifters stealing Americans’ out from under them, forging deeds in robosigning mills:

https://www.marketwatch.com/story/us-breaks-down-93-bln-robo-signing-settlement-2013-02-28

The thefts never stopped. Today on Propublica, by Anjeanette Damon, Byard Duncan and Mollie Simon bring a horrifying, brilliantly reported account of the rampant, bottomless scams of Homevestors, AKA We Buy Ugly Houses, AKA “the #1 homebuyer in the USA”:

https://www.propublica.org/article/ugly-truth-behind-we-buy-ugly-houses

Homevestors — an army of the hedge fund Bayview Asset Management — claims a public mission: to bail out homeowners sitting on unsellable houses with all-cash deals. The company’s franchisees — 1,150 of them in 48 states — then sprinkle pixie dust and secret sauce on these “ugly houses” and sell them at a profit.

But Propublica’s investigation — which relied on whistleblowers, company veterans, court records and interviews with victims — tells a very different story. The Homevestor they discovered is a predator that steals houses out from under elderly people, disabled people, people struggling with mental illness and other vulnerable people. It’s a company whose agents have a powerful, well-polished playbook that stops family members from halting the transfers the company’s high-pressure salespeople set in motion.

Propublica reveals homeowners with advanced dementia who signed their shaky signatures to transfers that same their homes sold out from under them for a fraction of their market value. They show how Homevestor targets neighborhoods struck by hurricanes, or whose owners are recently divorced, or sick. One whistleblower tells of how the company uses the surveillance advertising industry to locate elderly people who’ve broken a hip: “a 60-day countdown to death — and, possibly, a deal.” The company’s mobile ads are geofenced to target people near hospitals and rehab hospitals, in hopes of finding desperate sellers who need to liquidate homes so that Medicaid will cover their medical expenses.

The sales pitches are relentless. One of Homevestor’s targets was a Texas woman whose father had recently been murdered. As she grieved, they blanketed her in pitches to sell her father’s house until “checking her mail became a traumatic experience.”

Real-estate brokers are bound by strict regulations, but not house flippers like Homevestors. Likewise, salespeople who pitch other high-ticket items, from securities to plane tickets — are required to offer buyers a cooling-off period during which they can reconsider their purchases. By contrast, Homevestors’ franchisees are well-versed in “muddying the title” to houses after the contract is signed, filing paperwork that makes it all but impossible for sellers to withdraw from the sale.

This produces a litany of ghastly horror-stories: homeowners who end up living in their trucks after they were pressured into a lowball sales; sellers who end up dying in hospital beds haunted by the trick that cost them their homes. One woman who struggled with hoarding was tricked into selling her house by false claims that the city would evict her because of her hoarding. A widow was tricked into signing away the deed to her late husband’s house by the lie that she could do so despite not being on the deed. One seller was tricked into signing a document he believed to be a home equity loan application, only to discover he had sold his house at a huge discount on its market value. An Arizona woman was tricked into selling her dead mother’s house through the lie that the house would have to be torn down and the lot redeveloped; the Homevestor franchisee then flipped the house for 5,500% of the sale-price.

The company vigorously denies these claims. They say that most people who do business with Homevestors are happy with the outcome; in support of this claim, they cite internal surveys of their own customers that produce a 96% approval rating.

When confronted with the specifics, the company blamed rogue franchisees. But Propublica obtained training materials and other internal documents that show that the problem is widespread and endemic to Homevestors’ business. Propublica discovered that at least eight franchisees who engaged in conduct the company said it “didn’t tolerate” had been awarded prizes by the company for their business acumen.

Franchisees are on the hook for massive recurring fees and face constant pressure from corporate auditors to close sales. To make those sales, franchisees turn to Homevana’s training materials, which are rife with predatory tactics. One document counsels franchisees that “pain is always a form of motivation.” What kind of pain? Lost jobs, looming foreclosure or a child in need of surgery.

A former franchisee explained how this is put into practice in the field: he encountered a seller who needed to sell quickly so he could join his dying mother who had just entered a hospice 1,400 miles away. The seller didn’t want to sell the house; they wanted to “get to Colorado to see their dying mother.”

These same training materials warn franchisees that they must not deal with sellers who are “subject to a guardianship or has a mental capacity that is diminished to the point that the person does not understand the value of the property,” but Propublica’s investigation discovered “a pattern of disregard” for this rule. For example, there was the 2020 incident in which a 78-year-old Atlanta man sold his house to a Homevestors franchisee for half its sale price. The seller was later shown to be “unable to write a sentence or name the year, season, date or month.”

The company tried to pin the blame for all this on bad eggs among its franchisees. But Propublica found that some of the company’s most egregious offenders were celebrated and tolerated before and after they were convicted of felonies related to their conduct on behalf of the company. For example, Hi-Land Properties is a five-time winner of Homevestors’ National Franchise of the Year prize. The owner was praised by the CEO as “loyal, hardworking franchisee who has well represented our national brand, best practices and values.”

This same franchisee had “filed two dozen breach of contract lawsuits since 2016 and clouded titles on more than 300 properties by recording notices of a sales contract.” Hi-Land “sued an elderly man so incapacitated by illness he couldn’t leave his house.”

Another franchisee, Patriot Holdings, uses the courts aggressively to stop families of vulnerable people from canceling deals their relatives signed. Patriot Holdings’ co-owner, Cory Evans, eventually pleaded guilty to to two felonies, attempted grand theft of real property. He had to drop his lawsuits against buyers, and make restitution.

According to Homevestors’ internal policies, Patriot’s franchise should have been canceled. But Homevestors allowed Patriot to stay in business after Cory Evans took his name off the business, leaving his brothers and other partners to run it. Nominally, Cory Evans was out of the picture, but well after that date, internal Homevestors included Evans in an award it gave to Patriot, commemorating its sales (Homevestors claims this was an error).

Propublica’s reporters sought comment from Homevestors and its franchisees about this story. The company hired “a former FBI spokesperson who specializes in ‘crisis and special situations’ and ‘reputation management’ and funnelled future questions through him.”

Internally, company leadership scrambled to control the news. The company convened a webinar in April with all 1,150 franchisees to lay out its strategy. Company CEO David Hicks explained the company’s plan to “bury” the Propublica article with “‘strategic ad buys on social and web pages’ and ‘SEO content to minimize visibility.’”

https://www.propublica.org/article/homevestors-aims-to-bury-propublica-reporting

Franchisees were warned not to click links to the story because they “might improve its internet search ranking.”

Even as the company sought to “bury” the story and stonewalled Propublica, they cleaned house, instituting new procedures and taking action against franchisees identified in Propublica’s article. “Clouding titles” is now prohibited. Suing sellers for breach of contract is “discouraged.” Deals with seniors “should always involve family, attorneys or other guardians.”

During the webinar, franchisees “pushed back on the changes, claiming they could hurt business.”

If you’ve had experience with hard-sell house-flippers, Propublica wants to know: “If you’ve had experience with a company or buyer promising fast cash for homes, our reporting team wants to hear about it.”

Catch me on tour with Red Team Blues in Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A Depression-era photo of a dour widow standing in front of a dilapidated cabin. Next to her is Ug, the caveman mascot for Homevestors, smiling and pointing at her. Behind her is a 'We buy ugly houses' sign.

Image:

Homevestors

https://www.homevestors.com/

Fair use:

https://www.eff.org/issues/intellectual-property

#pluralistic#the rents too damned high#house flipping#llc brain#scams#elder abuse#ripoffs#weaponized shelter#predators#homevestors#we buy ugly houses#ugly houses#real estate#propublica

2K notes

·

View notes

Text

228 notes

·

View notes

Text

Get cash now!!!

We pay cash for owner finance mortgage notes

Highest Price Paid, GET A FREE QUOTE!!!

sellthisnote.com

#i need money#we buy and sell mortgage notes#we buy homes#creativefinancing#carry a note#private money lender#private money#we buy ugly houses#we buy private funding#we buy private mortgages#we buy real estate loans#business loan#cash buyers#buy my note#we buy notes#we buy private financing#christmas money#christmas shopping#startup funding#invest in yourself#ineedmoney

2 notes

·

View notes

Text

“We Buy Ugly Houses” Company Overhauls Policies Following ProPublica Investigation — ProPublica

0 notes

Text

What is it Called When Companies Buy Houses?

The real estate industry is vast, with various sectors and categories catering to different needs. One emerging trend in the realm of property sales is the business model where companies quickly purchase homes from homeowners. But what exactly is this trend called? Let's dive deeper into understanding this concept.

Understanding the Trend

When companies, rather than individual buyers, step in to purchase homes directly from homeowners, it's generally referred to as an "iBuyer" model. iBuyers, or "instant buyers," are companies that utilize technology to make instant offers on homes. The primary appeal for homeowners is the convenience and speed at which they can sell their homes.

Benefits of Selling to iBuyers

Quick Sale: Homeowners can receive an offer within days, sometimes even within 24 hours.

No Need for Home Repairs: Many iBuyers purchase homes "as-is," eliminating the need for costly and time-consuming repairs.

Flexible Closing Dates: Sellers often have the flexibility to choose their closing date, which can be beneficial if they are in a hurry or need more time to move.

iBuyer Vs. Traditional Home Sale

While selling to an iBuyer might seem attractive due to its speed and convenience, it's essential to weigh the benefits against potential drawbacks. Traditional home sales might offer more room for price negotiation, and homes might fetch a higher sale price in competitive markets. Additionally, iBuyers generally charge service fees that can sometimes be higher than traditional realtor commissions.

Is the iBuyer Model for Everyone?

Not necessarily. While many find the iBuyer model appealing, especially those who value speed and convenience, it may not be the best choice for everyone. Homeowners should consider factors like their home's condition, the current market scenario, and their financial situation before deciding.

Where to Turn If You're Considering an iBuyer Sale

For homeowners in the Las Vegas area who are thinking, "I want a company to buy my house fast," a reliable option to consider is "Cash for Vegas Homes." With a credible online presence, their business site offers insight into their process and services, providing a quick solution for homeowners eager to make a fast sale.

Conclusion

The emergence of the iBuyer model in the real estate industry has provided homeowners with an alternative to traditional home sales. By understanding the benefits and drawbacks of this approach, homeowners can make an informed decision about the best way to sell their property. Whether opting for an iBuyer or a conventional sale, it's crucial to choose a trusted partner in your home selling journey.

Cash for Vegas Homes

8690 S Maryland Pkwy Suite 130, Las Vegas, NV 89123, United States

+1 702-508-7113

Website: https://cashforvegashomes.com/

Map URL: https://goo.gl/maps/XS7msFvbetLRzpzNA

0 notes

Text

We buy homes in Los Angeles with fairness, respect, and education because we take seriously each opportunity to serve you. 20+ years. Read about us here: https://www.fairsalehomes.com

1 note

·

View note

Text

Learn More About Sell My House for Cash Wentzville MO

We Buy Houses Wentzville MO:

https://www.blogger.com/profile/03040234056677161302

Despite the potential for stress, selling your home is simple and profitable with our help! Every step of the way, our committed team will be by your side, offering essential advice so you may get the most return on your investment with the least amount of work.

https://www.zillow.com/profile/wentzvillecashbuyer

Sell My House Fast Wentzville MO:

https://www.flickr.com/people/198700787@N03/

Put an end to your home-buying concerns by joining Raad Buys Houses! To make sure you understand all of the benefits of the treatment and that you can quickly recoup your investment, our professional staff will carefully walk you through it.

https://sites.google.com/view/sellmyhousefastwentzvillemo

Sell My House Fast For Cash Wentzville MO:

https://sellmyhousefastwentzvillemo.mystrikingly.com/blog/sell-my-house-fast-wentzville-mo

Take action today! Make a prudent decision and pick us to safeguard the future of your family. If necessary, we'll make sure the payment process is free of unwanted surprises.

https://www.instapaper.com/p/wentzvillebuyer

Sell House Fast Wentzville MO:

https://sellmyhousefastwentzvillemo.bigcartel.com/sell-my-house-fast-wentzville-mo

Your trustworthy advisor as you navigate the challenging and complex divorce process is Raad Buys Houses. Our dedicated team will handle all the practicalities, including the paperwork and the money, so you may prioritize yourself and look forward to the future with anticipation.

http://64a90ea80b8cc.site123.me/

0 notes

Text

Selling a house can be a complex and sometimes challenging process. As a homeowner, you might find yourself wondering, "What is stopping my house from selling?" Whether you're located in Hamilton, Columbus, or any other city, there are common factors that can impede the sale of your property. In this blog post, we'll delve into some of the reasons why your house might not be selling and explore the potential solution offered by cash home buyers in Hamilton.

Pricing: One of the primary reasons a house may struggle to sell is an inaccurate listing price. Setting the right price is crucial for attracting potential buyers. If your house is overpriced, it may deter interested parties, resulting in a prolonged time on the market. Consider consulting with a reputable real estate agent or appraiser to determine a fair and competitive price for your property.

Condition and Repairs: The condition of your house plays a significant role in its marketability. If your property requires extensive repairs or renovations, it may discourage traditional buyers who are looking for move-in ready homes. Cash home buyers, on the other hand, are often willing to purchase houses in as-is condition. They can provide a solution for homeowners who don't want to invest time and money into repairs before selling.

Curb Appeal: First impressions matter, and the exterior appearance of your house can greatly impact its saleability. Poor curb appeal, such as an unkempt yard, peeling paint, or an outdated facade, can turn off potential buyers. Enhancing your home's curb appeal can be a worthwhile investment, but if time or resources are limited, cash home buyers can offer an alternative solution by purchasing your property regardless of its curb appeal.

Limited Market Interest: In certain circumstances, the local housing market may be experiencing a slowdown or have limited buyer interest. Factors such as economic conditions, job market fluctuations, or an oversupply of properties can contribute to this. In such cases, traditional buyers might be scarce, leading to an extended time on the market. Cash home buyers can provide a quicker and more certain sale, as they are often investors looking to add properties to their portfolios.

Unique Situations: Sometimes, homeowners face unique situations that make it challenging to sell their houses through traditional means. These situations can include divorce, inheritance, foreclosure, relocation, or the need for quick cash. Cash home buyers in Columbus specialize in these scenarios and can provide a streamlined and hassle-free selling process, allowing homeowners to move on from their property swiftly.

Conclusion: If you find yourself asking, "What is stopping my house from selling?" and traditional selling methods have proved unsuccessful, cash home buyers may offer a viable solution. Whether you're located in Hamilton, Columbus, or any other area, cash home buyers are experienced investors who can purchase your property quickly, often within a matter of days, and without the need for repairs or staging. They provide an alternative route for homeowners facing challenges in the traditional real estate market.

Remember, it's important to research and choose reputable cash home buyers who have a track record of fair and transparent transactions. Consult with local real estate professionals or explore reputable cash home buyers in Hamilton companies in your area to understand the options available to you. By considering this alternative route, you can overcome the obstacles preventing your house from selling and move forward with your real estate goals.

0 notes

Text

"The process of selling a house may be one thing, but the process of selling during the winter may be quite another. By using a real estate agent, you might find a buyer who is ready to buy right away and has quick financing access. But what if you need to sell your property fast for cash, what should you do? What steps should you take?"

#32homeshomies#webuyhouses#webuyhousescash#we buy ugly houses#savannah real estate#savannahga#bloomingdale georgia#port wentworth georgia#gardencityga#richmond hill georgia#we buy houses

0 notes

Text

Stop or Avoid Foreclosure In Today’s Market

If you are facing foreclosure problem then you can contact us today. We are Stop foreclosure or avoid it. To Protect your credit during the foreclosure process our team have many different types of steps to protect your foreclosure situation with minimal long-term damage. Please follow these steps and rules and save your Credit. For more details, you can call us at 720-263-4447.

#Stop foreclosure#Sell your house fast in Denver#We buy ugly houses#Buy my House in Broomfield#Buy my House in Aurora

1 note

·

View note

Text

We Buy Homes Fast Bradenton

Do you need cash quickly? We can help!

We buy your house and give you cash in advance of closing. We buy houses immediately without wasting any time, our procedure is hassle free and transparent. If you want to sell your house in Florida, just contact us, we will make a great deal for you with quick cash.

#we buy homes#we sell homes fast cash#we buy ugly houses#Sell house fast cash Bradenton#Sell house cash offer Bradenton

0 notes

Text

Like I know we all love making ADHD seem cool but like, don't forget it's actually a disability? My ADHD is bad enough I've nearly been evicted for forgetting to mail the rent check to the property manager, I've forgotten to pay the utility bills and had my water or power get turned off or had to pay fines bcs I missed a credit card payment. Once I was supposed to cat sit for a friend and I lost the house key she gave me but didn't realize until she was already out of town, and she had to call the apartment office to get someone to give me the spare so her cats would have food for the week. When I'm unmedicated I can't even get myself to shower half the time, forget eating or cleaning. Before I started living with my fiance I'd just like, not eat for days because I didn't have anyone to remind me to eat or go buy me food. I've forgotten to turn the stove off so many times and ruined kettles and tbh been DAMN fucking lucky the house didn't burn down. I've done stupid, impulsive shit that's nearly gotten me KILLED. I can't remember to close the shower curtain reliably even through my fiance points out every single time I forget, and he's almost out of soap rn bcs for the last MONTH neither of us have been able to remember to order more once we get out of the shower.

I've had such bad memory my entire life that to this day someone suggesting I forgot something because I simply didn't care enough is a legitimate trigger that, in the worst cases, makes me have a breakdown.

I get that for some of you this is just something that makes studying hard or you forget to take a pee break when you're playing Minecraft or whatever, that's still a valid struggle and you do deserve help and understanding, but like, ADHD is a disability. It's disabling. It's not impossible to improve and learn coping skills, meds help a lot, there are great accommodations out there(LIKE CLEANING SERVICES), but not every case of ADHD is the same, and a lot of them are pretty ugly ngl, and just because you managed to do something doesn't mean someone else is gonna be able to manage it too, or that they're being lazy for struggling. And that obviously doesn't mean ADHD people have a free pass to never work on themselves and make everyone cater to their every need or whatever, but we do deserve some understanding when we explain that our disability is actually disabling in ways that aren't palatable to you. So like, idk, maybe don't immediately recoil in horror when you find out that someone with ADHD can't keep their house clean. And for fucks sake don't ridicule them for it.

9K notes

·

View notes

Text

Is Selling Your House For Cash A Good Idea?

The real estate market has always been a dynamic space, with various methods and models emerging as the industry evolves. One trend that has been gaining traction over the years is the idea of selling houses for cash. But is this method truly beneficial for homeowners? Let's delve deeper into the subject.

The Concept Behind Cash Sales

Before we delve into the pros and cons, it's crucial to understand what selling your house for cash means. This model refers to a direct transaction between the buyer and the seller without the need for traditional bank financing. Typically, investors or specialized companies make these offers, intending to renovate and resell or rent out the property.

Advantages of Selling Your House for Cash

Quick Closings: Traditional sales can sometimes drag on for months due to various reasons such as appraisals, inspections, and financing approvals. With cash sales, these time-consuming processes are eliminated, allowing for faster transactions.

No Repair Costs: Cash buyers often purchase properties "as-is." This means homeowners won't need to invest in any repairs or renovations before selling, saving both time and money.

Simplified Process: Cash sales often involve fewer contingencies and paperwork. There's no need to worry about a buyer's loan falling through at the last minute.

Potential Downsides of Cash Sales

Lower Sale Price: Since many cash buyers are investors looking for a return on their investment, they might offer a price below market value. It's essential to weigh the quicker sale against the potential for a reduced sale price.

Fewer Bids: Putting your home exclusively in the cash-sale market can limit the number of offers you receive. Broadening to traditional buyers can increase competition and potentially drive up the sale price.

Scams and Unreliable Buyers: As with any industry, there are potential scammers in the cash-for-homes market. Sellers should be wary and do their research before accepting an offer.

Considering Your Options

For homeowners in urgent need of funds or those looking to sell a property quickly without the hassle of repairs and long wait times, cash sales can be a boon. However, if maximizing profit is your primary concern, it might be worth considering traditional selling methods.

For those based in the Vegas area and interested in a quick, hassle-free sale, cash for house offers an attractive option. It provides the convenience of a direct sale without the stresses commonly associated with traditional sales. Check their location on this map to find out more.

Conclusion

Selling your house for cash is an option that comes with both its advantages and potential pitfalls. As with any significant financial decision, it's essential to do thorough research and understand your priorities. Whether you choose the cash route or the traditional selling method, being informed will ensure you make the best decision for your unique circumstances.

Cash for Vegas Homes

8690 S Maryland Pkwy Suite 130, Las Vegas, NV 89123, United States

Map URL: https://goo.gl/maps/XS7msFvbetLRzpzNA

0 notes

Text

We Buy Houses Tulsa - 918HomeBuyers.com

Sell Your House Fast in Tulsa. We Buy Ugly Houses in Tulsa Fast As-Is No Repairs Needed No Cleaning Required. Visit: https://918homebuyer.com/wp-content/uploads/2023/07/we-buy-houses-Tulsa-300x214-1.png

1 note

·

View note

Text

Sell My Home Fast - TulsaPropertyBuyers.com

Sell My House Fast Tulsa, We Buy Houses Tulsa, We Buy Ugly Houses Tulsa, Ugly Houses Tulsa, We Buy Homes Tulsa. Visit: https://tulsapropertybuyers.com/wp-content/uploads/2023/07/WE-BUY-UGLY-HOUSES-tULSA.png

#Sell My Home Fast Tulsa#We Buy Houses in Tulsa#Sell My House Fast Tulsa#We Buy Ugly houses Tulsa#We Buy Homes Tulsa

1 note

·

View note

Text

32Homes is here to help you sell your home as quickly and easily as possible. The process we offer is for frustrated homeowners who are ready to stop investing time and money in a property they don't want. Let us take care of your property sale at your convenience.

0 notes