#Financialwellness

Text

🌟 Discover the Power of an RRSP in British Columbia! 🌟

Are you looking to secure your financial future? An RRSP (Registered Retirement Savings Plan) is a fantastic way to save for retirement while enjoying some amazing tax benefits. Here’s what you need to know:

💡 What is an RRSP?

An RRSP is a retirement savings account that offers tax-deferred growth on your investments. Contributions you make are tax-deductible, which means you can reduce your taxable income and potentially get a bigger refund! 🎉

📈 Benefits of an RRSP:

Tax Savings: Contributions lower your taxable income.

Tax-Deferred Growth: Your investments grow without being taxed until withdrawal.

Retirement Security: Provides a steady income during retirement.

🔍 How Does It Work?

Contribute Regularly: Make regular contributions to maximize your savings.

Invest Wisely: Choose from a variety of investment options like Mutual Funds, Bonds, and GIC.

Withdraw Smartly: Plan your withdrawals strategically to manage your tax impact.

🏦 Why Choose Brace Financial Services?

At Brace Financial, we’re here to guide you every step of the way. Our experts will help you create a personalized RRSP strategy that fits your financial goals. Let's secure your future together! 💪

#bracefinancialservices#finance#financialadvisor#financialfreedom#canada#financial services#financialplanning#life insurance#surrey#financialwellness#RRSP#RetirementPlanning#TaxBenefits#FinancialFreedom#BraceFinancialServices#InvestSmart#RetirementSavings#SecureFuture#WealthManagement#TaxDeferredGrowth#FinancialAdvisor#PlanForTomorrow#SavingsGoals#BritishColumbia#CanadaFinance

2 notes

·

View notes

Text

Ready to transform lives through financial wellness? Join forces with Prasio, where innovation meets impact. Reach millions, optimize your solutions, and thrive with our AI Assistant. Let's empower individuals to master their financial journeys together.

#prasio#financialwellness#PrasioPartner#empowerment#reach#optimize#ai#assistant#financial#journeys#wellness

2 notes

·

View notes

Text

#100 days of productivity#my writing#BusinessTips#Entrepreneurship#SmallBusiness#StartupAdvice#MarketingStrategies#DigitalMarketing#SuccessStories#BizCareFirst#BusinessBlog#LeadershipInsights#EconomicTrends#FinancialWellness#CareerDevelopment#ProductivityHacks#TechInnovation

2 notes

·

View notes

Text

Retirement Planning: Securing Your Golden Years

Introduction

Retirement planning is a critical aspect of financial stability and ensuring a comfortable life during your golden years. While it may seem distant, the earlier you start planning, the better prepared you'll be. In this guide, we'll delve into the intricate details of retirement planning, covering everything from setting financial goals to investment strategies. Get ready to embark on a journey towards a secure retirement.

Retirement Planning Essentials

Setting Clear Financial Goals

Retirement planning begins with setting clear financial goals. Ask yourself how much you'll need to maintain your desired lifestyle post-retirement. This includes housing, healthcare, and leisure activities. Create a detailed budget to estimate your future expenses accurately.

Creating a Retirement Timeline

Establishing a retirement timeline is crucial. Determine when you'd like to retire and consider factors such as your current age, life expectancy, and any unexpected early retirements. A well-defined timeline helps shape your savings and investment strategies.

Assessing Your Current Financial Situation

Take stock of your current financial situation. Calculate your assets, liabilities, and net worth. This assessment forms the foundation for developing a personalized retirement plan.

Investment Strategies for Retirement

Diversifying Your Portfolio

Diversification is key to managing risk in your retirement investments. Spread your investments across different asset classes, including stocks, bonds, and real estate. This minimizes the impact of market fluctuations.

Tax-Efficient Investments

Explore tax-efficient investment options, such as IRAs and 401(k)s. These accounts offer tax advantages, allowing your retirement savings to grow more effectively.

Seeking Professional Advice

Consider consulting a financial advisor who specializes in retirement planning. Their expertise can help you make informed decisions and optimize your investment strategy.

FAQs on Retirement Planning

What is the ideal age to start retirement planning?

Begin retirement planning as early as possible. Ideally, start in your 20s or 30s to take advantage of compounding interest.

Can I rely solely on Social Security for retirement income?

While Social Security provides some income, it's advisable to have additional savings and investments to ensure financial security during retirement.

How do I calculate my retirement savings goal?

Calculate your retirement savings goal by estimating your future expenses and factoring in inflation. Online retirement calculators can assist in this process.

Should I pay off all debts before retiring?

It's generally wise to minimize high-interest debts before retiring. However, low-interest debts may be manageable during retirement.

What if I haven't started saving for retirement yet?

Start now, regardless of your age. Even small contributions can accumulate over time and make a significant difference.

How can I adjust my retirement plan if unforeseen circumstances arise?

Regularly review and adjust your retirement plan as needed. Life changes, such as health issues or job changes, may require modifications.

Conclusion

Retirement planning is a journey that requires careful consideration, diligent saving, and informed decision-making. By setting clear goals, assessing your financial situation, and adopting the right investment strategies, you can pave the way for a secure and enjoyable retirement. Remember, it's never too early or too late to start planning for your golden years.

#RetirementPlanning#FinancialSecurity#RetirementGoals#InvestmentStrategies#FinancialFreedom#RetirementSavings#EstatePlanning#WealthManagement#TaxEfficiency#FinancialAdvisors#RetirementIncome#EarlyRetirement#SecureFuture#FinancialWellness#RetirementJourney#Toronto#Canada

2 notes

·

View notes

Text

Life Update 1/14/23

Hey guys! So sorry it’s been so long, my pc needed parts and I had a bunch of other stuff going on as well, and then I proceeded to procrastinate on posting here, of course. All is well now though, so I would love to continue with daily updates again.

Since we last spoke I have been able to start a nice chunk of my savings, and I’ve been looking into either getting a better job, or even moving up in my current job. I’ve been trying to brainstorm on what I would like to do as a long term career, and honestly, I’ve been struggling quite a lot. I know one thing I’ve loved about all my jobs so far, has been the human interaction, and helping customers, the things I dislike specifically about my current place of work, is my management. I cannot stand who my upper management is, both my store manager and sales manager have made their way onto my shit list. The way that both of them talk to people is so demeaning and condescending, and it really grinds my gears. Another thing I dislike about my current position is how temporary it feels, I feel like this is just the filler chapter of my life, which I guess it kind of is, but I would love to still feel like my life has some meaning, ya know?

I’ve been working really hard to try and focus on my goals, and make sure I don’t over spend. I have a few things I need to spend on this month that are necessary but unbudgeted for, such as new sneakers to work in (my old ones were worn out and my feet have been killing me), and I also need an oil change and tire rotation for my car. Both of these are just parts of life, however I had not budgeted them in necessarily, since I barely started budgeting to begin with.

I am going to try to start putting away at least $50 from each paycheck, now that I get payed weekly, that will be $200 a month, which hopefully will be achievable. That will end up being a little over 2K saved this year just from that. I would also love to start Door-Dashing again to bump up how much I can afford to stash away each month. Even if that doesn’t happen though, I hope I will at least be able to keep up with the minimum of $200 a month.

I also think I am going to start doing a weekly spending log at the bottom here, instead of doing it as daily, so I will update it every time to adjust the amount per week, including bills and everything. But I will start that this week, since I have also fallen back on not tracking my spending as I was previously.

Finance Tracker:

Savings: $500

#personalfinance#PersonalGrowth#personal blog#personal financing#financial makeover#financialwellness#moneymakeover#money#MysStella#growthmindset#self improvement

15 notes

·

View notes

Photo

Had to go into the New Year with GREEN on my hands (and gold) 🤑. Happy New Year! More Yoga, more love (all forms) and more abundance. Had the collard greens and black eyed peas yesterday so how can I not win in 2023? Wishing you all the same. 🏆💵❇️🏆 * * * #lawofattraction #abundance #positiveaffirmations #abundancemindset #dailyaffirmations #abundantlife #prosperity #💅🏾 #financialwellness #nailinspo #sistersofyoga #crystalhealing #blackyogateacher #chicagoyoga #chicagoyogateacher #chicagowellness #positivequotes #sage #smudging #healingcrystals #metaphysics #blackwallstreet #newyear2023 #yogachicago #selfcare #meditation #raiseyourvibration #girlbosslife #browngirlbloggers #carefreeblackgirl (at Chicago, Illinois) https://www.instagram.com/p/Cm7EXCkv618/?igshid=NGJjMDIxMWI=

#lawofattraction#abundance#positiveaffirmations#abundancemindset#dailyaffirmations#abundantlife#prosperity#💅🏾#financialwellness#nailinspo#sistersofyoga#crystalhealing#blackyogateacher#chicagoyoga#chicagoyogateacher#chicagowellness#positivequotes#sage#smudging#healingcrystals#metaphysics#blackwallstreet#newyear2023#yogachicago#selfcare#meditation#raiseyourvibration#girlbosslife#browngirlbloggers#carefreeblackgirl

3 notes

·

View notes

Text

Haven't you reached your financial goal yet? Contact us, and we will guide you in the correct direction: 9910133556

#financialgoals#financialgoals2023#financialfreedom#financialliteracy#financialindependence#financialeducation#financialservices#financialsecurity#financialsuccess#financialsolutions#financialstatements#financialsupport#financialmanagement#financialwellness#financialwellbeing#financialwealth#financialwisdom#financialempowerment#financialeducationservices#financialeducator#financialeducationmatters#financialreporting#financialtips#financialtechnology#financialtimes#financialplanning#budget2023#financialyear#financialinvestment#finance

2 notes

·

View notes

Text

youtube

#FreelancerLife#Entrepreneurship#SmallBizTips#FinancialFreedom#OnlineBusiness#DigitalNomadLife#MoneyManagement#WorkFromAnywhere#SideHustleIdeas#FinancialPlanning#BusinessSuccess#SavingsGoals#BudgetingTips#FinancialWellness#RemoteWorkLife#EntrepreneurLife#IncomeStreams#DigitalMarketingTips#HomeBusinessIdeas#BusinessInsights#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing

0 notes

Text

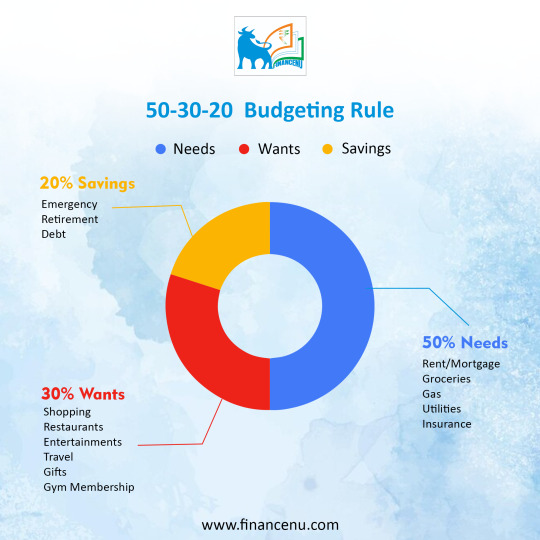

Smart Budgeting Rule: Allocate 50% for needs, 30% for wants, and 20% for savings and debt.

Balance your finances effectively!

#budgetingtips#financialmanagement#savingsuccess#budgetplanning#moneysavingtips#financialfreedom#budgeting101#smartspending#financialgoals#savingstrategies#budgetingmadeeasy#financialplanning#savingsolutions#budgetinghacks#financialwellness#savingmoney#budgetingtools#financialadvice

0 notes

Text

Unlocking the Potential of Systematic Investment Plans (SIPs) for Long-Term Growth

In the realm of investment strategies, consistency is often the key to unlocking long-term financial success. One such strategy that embodies this principle is Systematic Investment Plans (SIPs). SIPs have gained popularity among investors for their ability to harness the power of consistent investing, providing a pathway to wealth accumulation and financial security over time. In this article, we delve into the essence of SIPs and explore how they offer a potent tool for achieving your financial goals.

Understanding Systematic Investment Plans (SIPs)

At its core, a Systematic Investment Plan (SIP) is a disciplined approach to investing in mutual funds. Unlike lump-sum investments, where a large amount is invested at once, SIPs involve investing a fixed amount at regular intervals, typically monthly or quarterly. This systematic approach eliminates the need for market timing, as investors contribute regardless of market fluctuations.

The Power of Consistency:

Consistency is the cornerstone of SIPs and is what sets them apart from other investment strategies. By committing to invest a fixed sum regularly, investors benefit from the power of compounding. Compounding is the snowball effect where the returns generated on investments are reinvested to generate further returns. Over time, this compounding effect can significantly boost the growth of your investment portfolio.

Mitigating Market Volatility:

One of the primary advantages of SIPs is their ability to mitigate the impact of market volatility. Since investments are spread out over time, SIP investors benefit from rupee-cost averaging. In essence, this means that when markets are down, your fixed investment amount buys more units of the mutual fund, and when markets are up, it buys fewer units. Over the long term, this helps smooth out the impact of market fluctuations and reduces the risk associated with timing the market.

Achieving Financial Goals:

SIPs are highly versatile and can be tailored to meet a wide range of financial goals. Whether you're saving for retirement, education expenses, a down payment on a house, or any other long-term objective, SIPs provide a structured approach to achieving your goals. By consistently investing over time, investors can accumulate the wealth needed to fulfill their aspirations.

Flexibility and Convenience:

Another attractive feature of SIPs is their flexibility and convenience. Investors can start with a relatively small investment amount and gradually increase it over time as their financial situation improves. Additionally, most mutual fund companies offer the convenience of automating SIP payments, allowing investors to set up a standing instruction with their bank for hassle-free investing.

Conclusion:

In today's dynamic and uncertain financial landscape, a disciplined and consistent approach to investing is more crucial than ever. Systematic Investment Plans (SIPs) offer investors a powerful tool to navigate market volatility, harness the benefits of compounding, and achieve their long-term financial goals. By committing to regular investments and staying the course, investors can unlock the full potential of SIPs and pave the way for a brighter financial future. In essence, while SIPs offer a powerful tool for consistent investing and long-term growth, the guidance of financial advisors or experts serves as a catalyst for achieving financial freedom and security. Together, with the right blend of discipline, patience, and expert guidance, investors can embark on a journey towards realizing their financial aspirations and unlocking a future of prosperity and freedom.

Empower your financial journey with a FREE consultation today. Your future starts now. 💯

🔗 To know more, visit - www.fintlivest.com

📞 Contact us – 8951741819 / 9637778041

👉 Follow for daily financial tips and strategies: @fintlivest

#InvestingForTheFuture #FinancialFreedom #SIPInvesting #LongTermGrowth #WealthBuilding #FinancialPlanning #SmartInvesting #WealthManagement #InvestmentStrategies #SIPforSuccess #SecureYourFuture #InvestmentGoals #SIPBenefits #SteadyReturns #FinancialWellness #InvestmentOpportunity

Get FREE financial advice from our experts to plan your investment with Fintlivest!

To know more, visit - www.fintlivest.com

Contact us – 8951741819 / 9637778041

https://www.instagram.com/fintlivest

https://www.facebook.com/Fintlivest

https://www.youtube.com/@Fintlivest

https://in.pinterest.com/fintlivestservices/

#investment#insurance#personalfinance#finance#wealthmanagement#InvestingForTheFuture#FinancialFreedom#SIPInvesting#LongTermGrowth#wealthbuilding#FinancialPlanning#SmartInvesting#financialwellness#SIPBenefits

0 notes

Text

Importance Of Estate Planning For Doctors

#financialplanner#DoctorEstatePlanning#FinancialWellness#EstatePlanningIndia#HealthcareFinance#DoctorFinanceTips#DoctorWealth#IndianDoctorFinance#DoctorFinancialSecurity#EstatePlanningForIndianDoctors

0 notes

Text

🌟 Why You Need a Financial Advisor in Beautiful British Columbia! 🌟

🏞️ Living in BC is a dream come true with its stunning landscapes and vibrant communities. But whether you're enjoying the bustling city life of Vancouver or the serene beauty of the Okanagan, having a solid financial plan is crucial to truly make the most of it! Here’s why:

💼 Expert Guidance: Navigating the complex world of investments, savings, and retirement can be overwhelming. A financial advisor provides expert advice tailored to your unique goals and lifestyle.

🏡 Home: Planning to buy a house in BC's competitive real estate market? A financial advisor helps you prepare and make informed decisions.

📈 Investment Opportunities: From tech startups in Vancouver to wineries in the Okanagan, BC offers diverse investment opportunities. A financial advisor helps you identify and seize these opportunities.

👨👩👧👦 Family Future: Whether it’s saving for your children's education or ensuring a comfortable retirement, a financial advisor helps you secure your family’s future.

💰 Debt Management: Struggling with debt? A financial advisor can create a personalized strategy to help you manage and reduce it.

🌿 Peace of Mind: With a financial advisor, you gain peace of mind knowing your finances are in expert hands, allowing you to focus on what truly matters in your life.

🌟 Achieve Your Dreams: Whether it's starting your own business, traveling the world, or simply enjoying a worry-free retirement, a financial advisor helps turn your dreams into reality.

🔒 Financial Security: Protecting your assets and planning for the unexpected is essential. A financial advisor ensures you and your loved ones are secure no matter what life throws your way.

Ready to take control of your financial future in BC? Contact Brace Financial Services today! 📞✨

#bracefinancialservices#finance#financialadvisor#financialfreedom#financial services#financialwellness#surrey#canada#financialplanning#life insurance#FinancialFreedom#VancouverFinance#InvestmentPlanning#Canada#BritishColumbia#FamilyFinance#SecureFuture#FinancialGoals#BC#Surrey#FinancialAdvisor#RetirementPlanning#CanadianFinance

1 note

·

View note

Text

Navigating the Pursuit of Prosperity: A Comprehensive Review of the Wealth Manifestation DNA Code

In today’s fast-paced world, the desire for wealth and financial abundance is a common aspiration. The concept of manifesting abundance has gained tremendous popularity recently, with various programs and courses claiming to unlock the secrets to prosperity. One such program that has garnered widespread attention is the “Wealth Manifestation DNA Code.” In this detailed review, we will delve into the intricacies of this program, exploring its principles, techniques, and effectiveness.

#WealthManifestation#Abundance#ManifestationProgram#FinancialAbundance#PositiveMindset#VisualizationTechniques#FinancialSuccess#Testimonials#PersonalDevelopment#ManifestationJourney#HolisticApproach#Empowerment#InnerPotential#PositiveChange#SEO#AbundanceManifestation#FinancialWellness#MindsetShifts#UserTestimonials#SuccessStories#RealWorldImpact#ManifestationSystem

0 notes

Text

Optimizing Your Finances

Conducting a thorough financial checkup using these four steps can significantly improve your financial well-being. By staying proactive and informed, you can optimize your money's potential and build a secure financial future for yourself.

Learn more at https://reps.modernwoodmen.org/slong

#FinancialCheckup#PersonalFinance#MoneyManagement#Budgeting#DebtManagement#AssetManagement#FinancialGoals#FinancialWellness#Savings#Investing#MoneyTips

0 notes

Text

Day Five- Dec. 18, 22

Hey guys! I haven’t been up to too much today, but I do have a work dinner tomorrow so that’s cool I guess. In all honesty, its pretty late right now and my brain is kind of giving up on me, so it may be another short update for today, sorry.

I did have to spend a little more than I would’ve liked on lunch today because the other place was way too busy, and any other day I would’ve just skipped lunch but I worked a later shift than usual today as it is so I was already pretty much starving. I think Sundays I will do an end of the week recap, as in showing what I spent for the week. Also, I didn’t notice until a little while ago but my phone bill snuck in yesterday on autopay, so I should've included that as well for yesterdays update, but it was $50 for those wondering.

One of my more personal goals for this upcoming week is to get at least something put into my savings. Another goal is to try and get my sleep schedule back on track. As some of you may know, I had a week off last week, and my sleep schedule has been all sorts of out of line.

One thing I would love to do to wrap up the end of the year is tidy up my space, and try to just really finish the year off strong, and therefore starting the new year off fresh. I definitely need to super deep clean my room and declutter a ton of stuff, maybe I’ll actually sell some of it and put that money into my savings as well, but if I don't get to it I plan on at least donating what I can.

Alright, I think that’s all for today. definitely feel free to DM me suggestions or hit the “Ask me anything” button on my profile if you have questions or feedback! I’d love to hear from you!

Finance Tracker:

Savings: $0

Spent Today: $14.88

#personalgrowth#personalfinance#personal financing#financial makeover#financialwellness#moneymakeover#money#MysStella#growthmindset#self improvement

2 notes

·

View notes

Text

आज ही फाइल करें अपनी Income Tax Return और पाएं TDS रिफंड का लाभ!

Maximize your tax savings! Don't miss out on the opportunity to file your Income Tax Return today and unlock the potential of receiving a TDS refund. Act now to secure your financial future and enjoy the benefits of timely tax planning. Let's make every rupee count!

#IncomeTax#TaxSeason#TaxRefund#TDSRefund#TaxFiling#DeadlineAlert#FinancialPlanning#TaxSavings#ITR#TaxBenefits#FilingDeadline#FinancialFreedom#MoneyMatters#TaxPreparation#FinancialWellness

0 notes