#SecureFuture

Text

Unveiling the Power of Health Insurance Leads with TheLiveLead

Understanding the Essence of Health Insurance Leads

Health insurance leads serve as the bridge between insurance providers and individuals seeking coverage. These leads represent prospective clients who are interested in purchasing health insurance policies. Whether it’s individuals looking for personal coverage or businesses seeking group plans for their employees, health insurance leads play a pivotal role in connecting insurers with their target audience.

TheLiveLead: Redefining Lead Generation in the Health Insurance Industry

At TheLiveLead, we recognize the significance of efficient lead generation in the health insurance sector. Our innovative approach leverages advanced technology and data analytics to deliver high-quality leads to insurance companies. Here’s how we differentiate ourselves in the market:

Cutting-edge Technology: We harness the power of cutting-edge technology to identify and qualify potential health insurance leads effectively. Through advanced algorithms and data analytics, we ensure that our leads match the specific criteria and preferences of our clients.

Targeted Marketing Strategies: Our team employs targeted marketing strategies to reach individuals who are actively seeking health insurance solutions. Whether through digital advertising, email campaigns, or social media outreach, we engage with potential clients in a meaningful way, driving higher conversion rates for our clients.

Real-time Lead Delivery: Time is of the essence in the insurance industry, and we understand the importance of prompt action. With our real-time lead delivery system, insurance companies receive fresh leads instantly, enabling them to follow up quickly and capitalize on valuable opportunities.

Customized Solutions: We believe in offering tailored solutions that cater to the unique needs of each client. Whether it’s a large insurance corporation or a small agency, we work closely with our clients to understand their goals and objectives, delivering customized lead generation strategies that yield optimal results.

Unlocking Opportunities with TheLiveLead

Partnering with TheLiveLead opens up a world of opportunities for insurance companies looking to expand their client base and increase revenue. Here are some key benefits of choosing TheLiveLead as your lead generation partner:

Increased Conversion Rates: Our high-quality leads are pre-qualified and primed for conversion, resulting in higher conversion rates and improved sales performance for our clients.

Cost-effective Solutions: By outsourcing lead generation to TheLiveLead, insurance companies can save valuable time and resources that would otherwise be spent on traditional marketing efforts. Our cost-effective solutions deliver maximum ROI for our clients.

Enhanced Efficiency: With our streamlined lead generation process, insurance companies can focus their time and energy on serving clients and growing their business, rather than chasing leads.

Continuous Support: Our dedicated team is committed to providing ongoing support and assistance to our clients. Whether it’s refining targeting strategies or optimizing lead quality, we are always here to help our clients succeed.

Embracing the Future of Health Insurance Leads

As the healthcare landscape continues to evolve, the demand for reliable health insurance coverage will only continue to grow. By harnessing the power of innovative lead generation solutions, insurance companies can stay ahead of the curve and meet the needs of today’s health-conscious consumers.

With TheLiveLead as your trusted partner, you can unlock the full potential of health insurance leads and take your business to new heights of success. Contact us today to learn more about our services and start generating quality leads for your insurance business. Together, let’s build a healthier and more secure future for all.

In conclusion, TheLiveLead is not just a company it’s a catalyst for transformation in the Health Insurance Leads, empowering insurers to thrive in an ever-changing market landscape. Join us in our mission to redefine lead generation and shape the future of health insurance coverage for generations to come.

#HealthInsuranceLeads#InsuranceRevolution#TheLiveLead#LeadGeneration#HealthcareCoverage#FutureofInsurance#InnovativeSolutions#InsuranceIndustry#ClientConversion#SecureFuture

2 notes

·

View notes

Text

Retirement Planning: Securing Your Golden Years

Introduction

Retirement planning is a critical aspect of financial stability and ensuring a comfortable life during your golden years. While it may seem distant, the earlier you start planning, the better prepared you'll be. In this guide, we'll delve into the intricate details of retirement planning, covering everything from setting financial goals to investment strategies. Get ready to embark on a journey towards a secure retirement.

Retirement Planning Essentials

Setting Clear Financial Goals

Retirement planning begins with setting clear financial goals. Ask yourself how much you'll need to maintain your desired lifestyle post-retirement. This includes housing, healthcare, and leisure activities. Create a detailed budget to estimate your future expenses accurately.

Creating a Retirement Timeline

Establishing a retirement timeline is crucial. Determine when you'd like to retire and consider factors such as your current age, life expectancy, and any unexpected early retirements. A well-defined timeline helps shape your savings and investment strategies.

Assessing Your Current Financial Situation

Take stock of your current financial situation. Calculate your assets, liabilities, and net worth. This assessment forms the foundation for developing a personalized retirement plan.

Investment Strategies for Retirement

Diversifying Your Portfolio

Diversification is key to managing risk in your retirement investments. Spread your investments across different asset classes, including stocks, bonds, and real estate. This minimizes the impact of market fluctuations.

Tax-Efficient Investments

Explore tax-efficient investment options, such as IRAs and 401(k)s. These accounts offer tax advantages, allowing your retirement savings to grow more effectively.

Seeking Professional Advice

Consider consulting a financial advisor who specializes in retirement planning. Their expertise can help you make informed decisions and optimize your investment strategy.

FAQs on Retirement Planning

What is the ideal age to start retirement planning?

Begin retirement planning as early as possible. Ideally, start in your 20s or 30s to take advantage of compounding interest.

Can I rely solely on Social Security for retirement income?

While Social Security provides some income, it's advisable to have additional savings and investments to ensure financial security during retirement.

How do I calculate my retirement savings goal?

Calculate your retirement savings goal by estimating your future expenses and factoring in inflation. Online retirement calculators can assist in this process.

Should I pay off all debts before retiring?

It's generally wise to minimize high-interest debts before retiring. However, low-interest debts may be manageable during retirement.

What if I haven't started saving for retirement yet?

Start now, regardless of your age. Even small contributions can accumulate over time and make a significant difference.

How can I adjust my retirement plan if unforeseen circumstances arise?

Regularly review and adjust your retirement plan as needed. Life changes, such as health issues or job changes, may require modifications.

Conclusion

Retirement planning is a journey that requires careful consideration, diligent saving, and informed decision-making. By setting clear goals, assessing your financial situation, and adopting the right investment strategies, you can pave the way for a secure and enjoyable retirement. Remember, it's never too early or too late to start planning for your golden years.

#RetirementPlanning#FinancialSecurity#RetirementGoals#InvestmentStrategies#FinancialFreedom#RetirementSavings#EstatePlanning#WealthManagement#TaxEfficiency#FinancialAdvisors#RetirementIncome#EarlyRetirement#SecureFuture#FinancialWellness#RetirementJourney#Toronto#Canada

2 notes

·

View notes

Text

Unlock the Power of Generational Wealth with My Wealth Locker!

Secure your family's future with our comprehensive wealth management solution. My Wealth Locker empowers you to build a strong financial legacy that spans generations. 🏦✨

🔒 Robust Security: Rest easy knowing your valuable assets and documents are protected with advanced security measures.

🌈 Plan Ahead: Create customized financial strategies to secure your family's prosperity for years to come.

Start building generational wealth today with My Wealth Locker! 💪🏼💼👉 https://bit.ly/3LvMJfo

#GenerationalWealth#FinancialLegacy#WealthManagement#SecureFuture#FinancialPlanning#FamilyLegacy#InvestSmart#MyWealthLocker

3 notes

·

View notes

Text

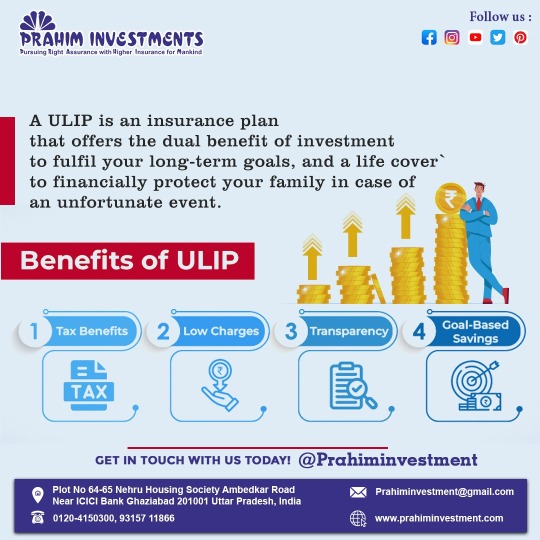

"Unlock the power of ULIPs and embrace financial growth with tax advantages, minimal fees, transparent operations and focused savings to achieve your aspirations."

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahiminvestments#Ulip#financialgrowth#taxadvantages#aspirations#investments#wealthcreation#financialplanning#longterminvesting#lifeinsurance#taxsavings#financialfreedom#investmentstrategy#securefuture#moneymanagement#SmartInvesting#wealthbuilding#FinancialGoals#retirementplanning

2 notes

·

View notes

Text

Financial Growth

Financial growth is within your reach, and we're here to show you the way.

Explore valuable resources and actionable advice to build a secure future for yourself.

Let's embark on this journey towards financial independence together.

Start now - https://www.samratfinancialbanking.com/personal-savings

#FinancialInclusion #crypto #nfts

#FinancialGrowth#SecureFuture#WealthCreation#financial planning#samrat investments#financial freedom#make money#investing#wealth#growth

5 notes

·

View notes

Text

#legal services#propertylawyer#sunil shelke#LandMatters#LegalExpertise#PeaceOfMind#LegalServices#LegalProtection#legaladvice#PropertyRights#SecureFuture#LegalSolutions#LegalAdvocate#legalrights#landdocument#landsolution#landservice#LegalExperts#abhitalandsolutions#pune#kharghar#navimumbai

0 notes

Text

Utilize SIP Crorepati Calculator from Ajmera Xchange to unleash the power of systematic investing

With the use of systematic SIP investments, you may plan and visualize your journey toward attaining the coveted crorepati title with the aid of this user-friendly application. At Ajmera X-change their SIP Crorepati Calculator provides useful insights into how monthly investments might develop over time to meet your financial milestones by allowing you to enter important factors like investment amount, estimated rate of return, and investment length. Regardless of your level of experience, our calculator enables you to make wise choices and clear the path to a stable financial future. To know more about their services, have a look at their website - https://www.ajmeraxchange.co.in/tools-and-calculators/crorepati-calculator

#AjmeraXChange#CrorepatiCalculator#InvestmentPlanning#FinancialCalculator#WealthBuilding#InvestmentTools#FinancialPlanning#SecureFuture#BuildWealth#FinancialFreedom#SmartInvesting#PlanYourFuture#InvestmentGoals#FinancialWellbeing#CalculateYourWealth

0 notes

Text

Discover peace of mind and financial stability with our bespoke retirement planning services in Kingston. Our seasoned advisors specialize in tailoring retirement strategies to suit your unique goals and aspirations. for more information visit :

#RetirementPlanning#KingstonRetirement#FinancialAdvisor#SecureFuture#WealthManagement#RetirementGoals#InvestmentAdvice#PlanYourFuture

0 notes

Text

Understanding Social Security Benefits Maximize your retirement potential with strategic saving and optimized Social Security benefits. Let's craft a plan together to secure your financial future with confidence! 💼💰

0 notes

Text

Your money will work relentlessly for you thanks to YOJ Investment's High Return Investment Plan in Nepal, which offers exceptional returns. Watch as your money grows rapidly thanks to our track record of success. Your secret to a bright future filled with growing wealth is this. To learn more, visit https://yojinvest.com.

#YOJInvestment#HighReturn#InvestmentPlan#InvestNepal#ExtraordinaryReturns#ROI#InvestmentStrategy#FinancialGrowth#SecureFuture#Profits#FinancialSuccess#InvestingInNepal#WealthManagement#MulyiplyingProfits#RiskManagement#InvestmentPortfolio

1 note

·

View note

Text

Passive Income: What It Is and Ideas for 2024

In today's dynamic economic landscape, the concept of earning passive income has become increasingly appealing. While the traditional nine-to-five job remains a cornerstone of financial stability for many, the allure of generating income passively, where money works for you instead of the other way around, has captured the imagination of millions.

In this blog post, we delve into the essence of passive income, explore its significance in 2024, and provide innovative ideas to help you embark on your journey toward financial freedom.

What is Passive Income and Explain its importance in 2024?

Passive income refers to earnings derived from sources requiring minimal to no effort to maintain. Unlike active income, which demands ongoing participation (such as a regular job), passive income streams can continue to generate revenue even when you're not actively involved.

This type of income offers flexibility, scalability, and the potential for long-term wealth accumulation. The year 2024 presents a unique landscape for passive income seekers. With advancements in technology, changes in consumer behavior, and evolving market trends, new opportunities emerge for individuals to create diverse streams of passive income.

Moreover, the aftermath of global events like the COVID-19 pandemic has underscored the importance of financial resilience, making passive income more relevant than ever.

Passive income can come from various sources, including:

1. Investments: Income generated from investments such as stocks, bonds, mutual funds, and real estate properties.

2. Royalties: Income earned from intellectual property rights, such as royalties from books, music, patents, or trademarks.

3. Business Ownership: Income generated from owning and operating a business like Truly Passive that does not require active involvement in day-to-day operations, such as rental properties or a profitable online business.

4. Affiliate Marketing: Income earned by promoting and selling products or services for other companies or individuals, usually through affiliate programs.

5. Digital Products: Income generated from selling digital products such as e-books, online courses, software, or digital downloads.

Importance of Generating Passive Income in 2024:

1. Financial Stability:

In an increasingly volatile economic environment, having multiple streams of passive income can provide a buffer against financial uncertainties. Diversifying income sources reduces reliance on a single source of income, making individuals more resilient to economic downturns, job loss, or unexpected expenses.

2. Flexibility and Freedom:

Passive income allows individuals to break free from the constraints of traditional employment and achieve greater flexibility and freedom in how they earn a living. By generating income passively, individuals can have more control over their time, allowing them to pursue other interests, spend time with family, or travel without sacrificing their financial security.

3. Wealth Accumulation:

Passive income streams have the potential to accumulate wealth over time, thanks to the power of compounding and the ability to reinvest earnings. By consistently reinvesting passive income into income-generating assets, individuals can accelerate wealth accumulation and achieve long-term financial goals, such as retirement or financial independence.

4. Adaptability to Technological Advancements:

Technological advancements continue to reshape industries and create new opportunities for passive income generation. From the rise of digital platforms and e-commerce to advancements in automation and artificial intelligence, individuals can leverage technology to create innovative passive income streams that capitalize on emerging trends and consumer behaviors.

5. Rising Cost of Living:

With the cost of living steadily increasing in many parts of the world, passive income can help individuals supplement their primary income and maintain their standard of living. Whether it's to cover essential expenses, save for the future, or enjoy a higher quality of life, passive income provides a valuable source of additional income to meet financial needs.

Passive income will play a crucial role in 2024 as individuals seek financial stability, flexibility, and long-term wealth accumulation. By diversifying income sources, embracing technological advancements, and harnessing the power of passive income, individuals can achieve greater financial security and independence in the years to come.

Ideas for Generating Passive Income in 2024:

1. Investing in Dividend Stocks:

Dividend-paying stocks can be a lucrative avenue for passive income. By investing in reputable companies with a history of consistent dividend payments, you can enjoy regular income without actively managing your investments.

2. Real Estate Crowdfunding:

Participating in real estate crowdfunding platforms allows you to invest in properties without the hassle of property management. Platforms like Fundrise and RealtyMogul enable you to pool resources with other investors to access lucrative real estate opportunities.

3. Creating Digital Products:

In the digital age, creating and selling digital products such as e-books, online courses, or software can be an excellent way to generate passive income. Once you've developed the product, you can continue to earn revenue through sales without additional effort.

4. Peer-to-Peer Lending:

Peer-to-peer lending platforms connect borrowers with individual investors, providing an opportunity to earn interest on funds lent out. While it carries some risk, diversifying your investments across multiple loans can mitigate potential losses.

5. Building a YouTube Channel or Blog:

Monetizing content creation through platforms like YouTube or blogging can yield passive income through ad revenue, affiliate marketing, or sponsored content. Consistently producing high-quality content in a niche market can attract a loyal audience and steady income over time.

6. Robo-Advisors and Automated Investing:

Robo-advisors offer automated investment management services, making it easy for individuals to invest in diversified portfolios tailored to their risk tolerance and financial goals. With minimal effort, you can passively grow your wealth over time.

7. Renting Out Assets:

Whether it's renting out a spare room on Airbnb, leasing out equipment, or even renting out your car through platforms like Turo, leveraging idle assets can provide a steady stream of passive income.

8. Affiliate Marketing:

Partnering with companies to promote their products or services through affiliate marketing can be a lucrative source of passive income. By earning a commission for every sale or lead generated through your unique affiliate link, you can monetize your online presence effectively.

The Final Wrap-Up:

As we navigate the complexities of the modern economy, harnessing the power of passive income has become an increasingly vital aspect of financial planning. Whether you're looking to supplement your existing income, achieve financial independence, or simply diversify your revenue streams, the possibilities for generating passive income in 2024 are abundant.

Take charge of your retirement planning advice journey with expert guidance from Trulypassive.com. Our platform offers tailored financial planning for retirement, ensuring you're equipped with the strategies and insights needed to achieve your long-term goals. Start planning for a secure future now!

By exploring innovative ideas, embracing technological advancements, and adopting a proactive mindset, you can embark on a journey toward financial freedom and unlock the full potential of passive income in your life. Discover the secrets to unlocking true passive income potential with Truly Passive– where financial freedom meets innovative opportunities.

#RetirementPlanning#FinancialFreedom#SecureFuture#PlanAhead#RetirementGoals#FinancialIndependence#RetirementSavings#WealthManagement#FuturePlanning#SecureRetirement#InvestForRetirement#FinancialPlanning

1 note

·

View note

Text

Unlock Financial Stability With HDFC Life Smart Protect Plan

In the ever-changing landscape of life, discover true tranquility with the HDFC Life Smart Protect Plan. More than just safeguarding your aspirations, it stands as a beacon of assurance for your family's tomorrow. Rooted in a steadfast dedication to securing your financial future, it remains a faithful companion through every twist and turn. Whether you're ensuring your children's education or preparing for retirement, this tailored plan lays the groundwork for a resilient future.

#arrowcapitalinvestments#hdfclife#securefuture#financialsecurity#lifeinsurance#insurance#financialprotection#investing#planahead#pensionplans

0 notes

Text

DHS Ventures Provides Clarity on Common Questions and Concerns

youtube

Are you considering partnering with DHS Ventures for your investment needs? Before you take the plunge, make sure to watch this video where we share five essential tips to verify the legitimacy of DHS Ventures. From checking regulatory compliance to reviewing customer feedback, these tips will help you make an informed decision about working with DHS Ventures. Don't miss out on this important information to protect your investments!

#DHSVentures#LegitInvestment#SecureInvestment#TrustworthyInvestment#LegitFinancialServices#InvestmentSecurity#VerifiedInvestment#LegitimateInvestment#FinancialTrust#SecureFuture#Youtube

0 notes

Text

Secure Your Golden Years: Top Strategies for Building Reliable Retirement Income Sources

Ah, retirement. A time to finally relax, travel the world, and pursue your passions. But this idyllic picture requires careful planning, particularly when it comes to securing a reliable stream of income to support your desired lifestyle. Social Security alone might not be enough to cover all your expenses. So, how do you build robust retirement income sources?

This blog dives deep into various retirement income sources, helping you explore options and craft a personalized strategy for a secure and fulfilling retirement.

Understanding Your Retirement Needs

The first step is to understand your retirement needs. Consider your desired lifestyle – will you travel extensively, downsize your living situation, or pursue hobbies that require significant financial investment? Estimate your monthly expenses and factor in potential healthcare costs, which tend to rise with age. Once you have a clear picture of your needs, you can start exploring different income sources to bridge the gap between your expenses and Social Security benefits.

Traditional Retirement Income Sources

1. Social Security

Social Security provides a foundation for most retirees. The exact benefit amount depends on your lifetime earnings and retirement age. You can estimate your benefits using the Social Security Administration’s online tool (https://www.ssa.gov/OACT/quickcalc/).

2. Pensions

While less common nowadays, traditional pensions provide a guaranteed monthly income for life after retirement. If you’re fortunate enough to have a pension plan through your employer, factor this into your retirement income calculations.

Building Your Nest Egg: Savings and Investments

A key strategy for a secure retirement is building a nest egg through savings and investments. Here are some popular options:

1. Employer-sponsored retirement plans:

Many employers offer 401(k) plans, where you contribute pre-tax dollars, and some may even match your contributions. Take full advantage of these plans to maximize your retirement savings and benefit from employer matching programs.

2. Individual Retirement Accounts (IRAs)

IRAs offer tax advantages for retirement savings. Traditional IRAs allow pre-tax contributions with tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement if you meet eligibility requirements.

3. Investment accounts

Consider investing in a diversified portfolio of stocks, bonds, and mutual funds to grow your retirement savings. The ideal asset allocation depends on your risk tolerance, time horizon, and investment goals.

Additional Retirement Income Sources

Beyond traditional sources, explore these options for generating additional income in retirement:

1. Part-time work

Consider working part-time in retirement to supplement your income and stay engaged. This could be a flexible job you enjoy or a way to leverage your skills and experience.

2. Annuities

These insurance products provide a guaranteed stream of income in retirement in exchange for a lump sum investment or premium payments. There are different types of annuities, so carefully research and choose one that aligns with your needs.

3. Rental income

Owning rental properties can be a source of passive income in retirement. However, it also comes with responsibilities like managing property upkeep and finding tenants.

4. Reverse mortgages

These allow homeowners 62 and older to access a portion of their home equity as a stream of income or a lump sum while continuing to live in the home. Carefully consider the implications of reverse mortgages as they can impact your heirs’ inheritance.

Planning for a Secure Retirement

Here are some additional tips to secure your golden years:

1. Start saving early

The power of compound interest is significant. The earlier you start saving, the more time your money has to grow.

2. Develop a budget

Create a realistic retirement budget and track your spending habits to identify areas to adjust if necessary.

3. Review your plan regularly

Your retirement needs and financial situation might change over time. Regularly review your plan and adjust your strategies as needed.

4. Seek professional financial guidance

A financial advisor can help you create a personalized retirement plan based on your goals and risk tolerance.

Conclusion

Building secure retirement income sources takes planning and proactive management. By exploring different income sources, diversifying your investments, and starting early, you can create a financial foundation that allows you to enjoy your golden years without financial worries. Remember, retirement should be a time of relaxation and fulfillment. By taking charge of your financial future now, you can ensure a secure and happy retirement.

#retirementplanning#financialfreedom#securefuture#retirementincome#financialplanning#SecureRetirement#planforthefuture#RetirementGoals#financialsecurity

0 notes

Text

Why Life Insurance is the Unsung Hero of Our Stories

Hey friends,

As I navigate the early morning streets of Warren Ohio, delivering the day’s news to your doorstep, I can’t help but reflect on the stories hidden within those pages. Some tales are of triumph, others of loss, but each carries a message, a lesson about the unpredictability of life.

In my journey as a newspaper carrier, I've come to see the world through the lens of daybreak—where every morning brings a new story, a fresh start. But this job, much like the tales within those pages, speaks to the unexpected turns life can throw our way. It’s got me thinking about the importance of being prepared, of writing our own stories with a bit of foresight. That's why I've delved into the world of life insurance with PHP Agency, not just as a broker but as someone who genuinely believes in its value.

Life insurance, in many ways, is like the unsung hero of our personal narratives. It's there, in the background, providing a safety net for the chapters yet to be written. Here's why I think it deserves a spotlight in our lives:

1. It’s About Love, Not Loss: The heart of life insurance isn't in the event of loss; it's in the act of love. It’s about ensuring that those you love most will have financial stability, even if life throws a curveball their way.

2. A Legacy of Care: Just as every story seeks to leave a message, life insurance allows us to leave a legacy. Whether it’s ensuring your kids can go to college, your partner can pay off the mortgage, or simply that your family won’t be burdened by final expenses, it’s your way of saying, “I’ve got you covered.”

3. More Than Just a Policy: Life insurance can be more versatile than you might think. From term policies that offer a safety net for a specific period to whole life policies that build cash value over time, there’s an option that fits your chapter of life.

4. An Act of Empowerment: Deciding to get life insurance is like choosing to own your story. It’s an empowering step that says you’re proactive about protecting your loved ones and securing their future.

I share this with you not just as a broker looking to sell a policy but as a friend who delivers your news, who understands the value of stories and the importance of being prepared for all of life’s twists and turns. Life insurance is a tool that helps us write a more secure story for ourselves and our loved ones.

As we continue to share moments, laughs, and debates, I’m here not just to deliver your paper but to talk about how we can secure our stories’ future chapters. Let’s chat about it—whether it's over a morning coffee after I drop off your paper, or a quick message here on Facebook. Your story matters, and I’m here to help you protect it.

#LifeInsurance#familyprotection#financial planning#securefuture#InsuranceTips#moneymatters#wealthbuilding#newspaper#life

0 notes

Text

🔒 Keep your business running smoothly with ISO 22301 certification! B2BCert ensures your operations stay resilient and ready for any challenge. Get certified today for peace of mind and continued success! 💼✨

#ISO22301#BusinessContinuity#B2BCertResilience#DisasterRecovery#ISOStandards#CertifyWithConfidence#BusinessResilience#RiskManagement#SecureFuture#PrepareForSuccess#ISOCompliance#BusinessContinuityPlanning#B2BPreparedness#SafeguardOperations#BuildTrust

0 notes