#financialplanning

Text

What to do to grow a food business?

1. To expand a food business, one must engage in strategic planning, marketing, product development, and customer interaction. Below are steps to help grow your food business:

- Define your niche: Identify what makes your food business unique compared to competitors. Whether it's a special product, a particular cuisine, or a commitment to organic and sustainable ingredients, find your niche and capitalize on it.

- Maintain quality and consistency: Consistently offer top-notch products to establish trust and loyalty with customers. Consistency in flavor, presentation, and service is crucial for retaining current customers and attracting new ones.

- Diversify your product range: Think about expanding your product line to meet various customer preferences and demands. This may involve introducing new menu items, different versions of existing products, or venturing into related food categories.

- Promote your brand: Develop a strong brand identity and marketing plan to boost visibility and draw in customers. Utilize social media, email marketing, and partnerships with influencers or local businesses to reach your target market.

- Interact with customers: Cultivate a devoted customer base by engaging with them online and offline. Respond to feedback, offer promotions or loyalty programs, and create opportunities for customers to connect with your brand.

- Explore new sales avenues: Seek out opportunities to sell your products through different channels like online platforms, grocery stores, food events, or catering services. Diversifying your sales channels can help expand your customer base and revenue.

- Embrace technology: Use technology to streamline operations, enhance efficiency, and improve the customer experience. This could involve implementing online ordering systems, mobile payment options, or investing in kitchen automation.

- Prioritize customer service: Deliver exceptional customer service to ensure a positive experience for your customers. Train your staff to be knowledgeable, friendly, and attentive to customer needs.

#entrepreneurship#startup#smallbusiness#businessdevelopment#businessstrategy#marketresearch#marketanalysis#financialplanning#investment#e-commerce#retail#sales#marketing#digitalmarketing#socialmediamarketing#contentmarketing#branding#customerservice#productdevelopment#supplychain#facebookbusiness#facebookbusinessgrow#growyourbusiness

2 notes

·

View notes

Text

10 Essential Tips for Effective Financial Management

Introduction

Effective financial management is the cornerstone of a stable and prosperous life. Whether you're an individual or a business owner, mastering the art of managing your finances can lead to greater financial security and opportunities. In this article, we will delve into the 10 essential tips for effective financial management, providing you with actionable advice to help you make informed financial decisions.

1. Create a Detailed Budget

Managing your finances starts with creating a detailed budget. A budget helps you track your income, expenses, and savings goals. By understanding where your money goes, you can make necessary adjustments to achieve your financial objectives.

2. Set Clear Financial Goals

To effectively manage your finances, set clear and achievable financial goals. These goals will serve as a roadmap for your financial journey, helping you stay motivated and focused.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

4. Reduce Debt

High-interest debts can hinder your financial progress. Create a plan to reduce and eventually eliminate your debts. Start by paying off high-interest debts first.

5. Invest Wisely

Make your money work for you by investing wisely. Diversify your investments, consider long-term strategies, and seek advice from financial experts if needed.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life. Regularly monitor it and take steps to improve it if necessary. A good credit score can lead to better borrowing terms and financial opportunities.

7. Save for Retirement

Don't wait until retirement is around the corner to start saving. The earlier you begin, the more you can accumulate. Explore retirement account options and contribute regularly.

8. Review and Adjust

Financial management is not a one-time task. Periodically review your budget, goals, and investments. Make adjustments as your financial situation changes.

9. Seek Professional Advice

If you find financial management overwhelming, consider seeking advice from a financial advisor. They can provide personalized guidance and strategies to optimize your finances.

10. Stay Informed

Stay updated on financial news, trends, and opportunities. Knowledge is power, and being informed will help you make better financial decisions.

10 Essential Tips for Effective Financial Management

In this section, we will briefly recap the ten essential tips for effective financial management:

Create a Detailed Budget

Set Clear Financial Goals

Build an Emergency Fund

Reduce Debt

Invest Wisely

Monitor Your Credit Score

Save for Retirement

Review and Adjust

Seek Professional Advice

Stay Informed

FAQs

Q: How do I start creating a budget?

A: Begin by listing all your sources of income and your monthly expenses. Categorize your expenses and identify areas where you can cut back.

Q: What's the ideal emergency fund size?

A: Aim for three to six months' worth of living expenses, but adjust based on your personal circumstances and risk tolerance.

Q: Can I manage my investments on my own?

A: While it's possible to manage your investments independently, seeking advice from a financial advisor can help you make more informed decisions.

Q: How often should I review my financial goals?

A: Regularly review your financial goals, at least once a year, and adjust them as needed to reflect changes in your life or financial situation.

Q: What's the best way to improve my credit score?

A: To boost your credit score, pay bills on time, reduce outstanding debts, and avoid opening too many new credit accounts.

Q: When should I start saving for retirement?

A: Start saving for retirement as early as possible to maximize your savings. The earlier you begin, the more you can accumulate over time.

Conclusion

Effective financial management is a skill that anyone can master with dedication and commitment. By following these 10 essential tips for effective financial management, you can take control of your finances, secure your future, and achieve your financial dreams. Remember that financial management is an ongoing process, so stay informed, adapt to changes, and always strive for financial excellence.

#FinancialManagement#MoneyManagement#PersonalFinance#FinancialGoals#Budgeting#InvestingTips#CreditScore#RetirementPlanning#DebtManagement#FinancialFreedom#Savings#FinanceTips#SmartInvesting#BudgetingTips#FinancialPlanning#WealthManagement#FinancialEducation#Finance101#FinancialAdvisor#MoneyMatters#MoneySmarts

4 notes

·

View notes

Text

2 notes

·

View notes

Photo

"Secure the future of your loved ones with a smart financial plan that includes life insurance. 💰💛 It's an important consideration that offers a measure of security and peace of mind. Let's chat about your options and find the perfect fit for your family's needs. 🤝 #LifeInsurance #FinancialPlanning #FamilySecurity #PeaceOfMind" (at Pinnacle Financial Group, Inc.) https://www.instagram.com/p/Cp_uD1hOeEY/?igshid=NGJjMDIxMWI=

7 notes

·

View notes

Text

#529Plan#AssetAllocation#CryptoInvesting#Diversification#DividendInvesting#FinancialAdvice#FinancialAdvisor#FinancialEducation#FinancialGoals#FinancialPlanning#HighYieldSavings#InvestmentOptions#InvestmentPortfolio#PassiveIncome#PeerToPeerLending#RealEstateInvesting#RetirementPlanning#RoboAdvisors#RothIRA#SavingsStrategies#SideBusiness#StockMarket#StocksAndBonds#WealthManagement#Investing#SHARE.#Facebook#Twitter#Pinterest#LinkedIn

2 notes

·

View notes

Text

15 Essential Tips for Managing Finances for Small Businesses

Introduction

“The key to managing finances is to spend less than you earn.” – Warren Buffett

Managing finances is a crucial aspect of running a successful small business. Your company will stay on course, make wise judgments, and maintain financial stability if you practice sound financial management.

In this blog post, we will explore 15 essential tips for managing finances for small…

View On WordPress

#BudgetingAdvice#BusinessTips#Entrepreneurship#FinancialManagement#FinancialPlanning#SmallBusinessFinances

5 notes

·

View notes

Text

Unlock the Power of Generational Wealth with My Wealth Locker!

Secure your family's future with our comprehensive wealth management solution. My Wealth Locker empowers you to build a strong financial legacy that spans generations. 🏦✨

🔒 Robust Security: Rest easy knowing your valuable assets and documents are protected with advanced security measures.

🌈 Plan Ahead: Create customized financial strategies to secure your family's prosperity for years to come.

Start building generational wealth today with My Wealth Locker! 💪🏼💼👉 https://bit.ly/3LvMJfo

#GenerationalWealth#FinancialLegacy#WealthManagement#SecureFuture#FinancialPlanning#FamilyLegacy#InvestSmart#MyWealthLocker

3 notes

·

View notes

Text

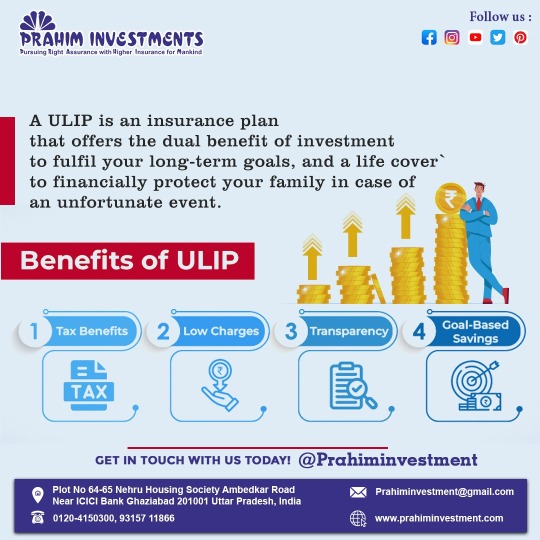

"Unlock the power of ULIPs and embrace financial growth with tax advantages, minimal fees, transparent operations and focused savings to achieve your aspirations."

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahiminvestments#Ulip#financialgrowth#taxadvantages#aspirations#investments#wealthcreation#financialplanning#longterminvesting#lifeinsurance#taxsavings#financialfreedom#investmentstrategy#securefuture#moneymanagement#SmartInvesting#wealthbuilding#FinancialGoals#retirementplanning

2 notes

·

View notes

Text

How to save money if you're living hand to mouth

Let's address the elephant in the room. A middle-class person's nightmare. Bills and more bills. Salary credited? Money debited. What are you left with? The Bare minimum to get you through the month, sometimes just weeks. Thanks to credit cards for saving us on rainy days. So, how can we make our financial situation work for us despite the odds? Let's explore.

Make a budget: You just cannot go on spending money if you don't have a budget made well in advance before the salary hits your account. You will always be in a dilemma that you have enough. The truth is - you always have lesser than what you think you can afford. Make your budget at the end of every month, a week before your salary gets credited. It will save you the decision-making exhaustion when you go shopping or plan that trip. Use Excel and let it do the math for you.

Cut all your expenses first from your budget list, and see if you can manage without them: Thought you can't go without a new pair of jeans? Well, imagine you had no money in your bank a/c. Does your life drastically change if you don't have those jeans? You'll thank yourself at the end of the month. Want to travel for a break every 3 months? Well, have you made a budget for your trip 3 months prior? No? Cut it off. I'm not saying don't take that trip, but you need to plan it better so that you know what you're getting into money-wise. By doing this exercise, you will exactly know what your most important expenses are like groceries to make food at home and not eat outside. Mixing and matching old clothes and not buying that new pair of jeans.

Freeze 10% - 20% of your money every month: Make an FD and just put your money out of your reach. You have to be strict with yourself. You may have to struggle initially but that will become a way of life pretty soon. You will feel more secure financially in hindsight. Rainy days - oh they come unannounced!

Keep looking for avenues to earn more: don't settle for average. Keep looking for a better job or a second source of income. You deserve the best! At the same time, don't get flustered, keep a positive outlook and continue to grind.

Gratitude: Thank the universe for everything you have. Pray for more and pray in the present tense. EG: I am Rich! I have all the luxuries in life! Thank you universe for all the abundance!! It's important to align your reality mentally and emotionally. What you think, feel, and say about yourself actually manifests.

Try these tips and if they don't work for you, try something else. You will learn more about how you function.

All the best,

xoxo

#budget#money#saving#lifehacks#savemoney#financialfreedom#investing#finance#income#personalfinance#financialplanning#success#middleclass#life#tips and tricks#guide#how to#helpful#self help

2 notes

·

View notes

Text

Why Do You Need A Financial Planner?

A financial planner can provide expertise and knowledge, objective advice, a customized financial plan, accountability and discipline, and time savings. To get more tips you can contact us now.

#lifeinsurance#kdcreation#healthinsurance#insurance#financialconsultant#financialsecurity#financialadvisor#financialplanning

3 notes

·

View notes

Text

How will you ensure a positive and consistent customer experience?

1. It is essential for the success and reputation of a fitness business to ensure a positive and consistent customer experience. Below are strategies to achieve this goal:

- Ensure clear communication by providing information about services, class schedules, and any changes through various channels like the website, social media, and email.

- Hire friendly and knowledgeable staff with excellent customer service skills and a deep understanding of fitness and wellness.

- Offer personalized services by tailoring fitness programs to meet individual needs and goals through initial assessments and regular check-ins.

- Maintain a clean and welcoming environment in the fitness facility with appropriate lighting, music, and amenities.

- Provide a thorough onboarding process for new clients, including an orientation to the facility and guidance on equipment usage.

- Collect regular client feedback to understand satisfaction levels and areas for improvement.

- Consistently deliver high-quality fitness classes and services by evaluating and updating workout plans regularly.

- Clearly communicate pricing, membership options, and policies related to cancellations, refunds, or changes in services.

- Address client concerns promptly and professionally, training staff to handle complaints with empathy.

- Foster a sense of community among clients through events, challenges, or social activities.

- Keep clients informed about new updates and provide ongoing education in the fitness industry.

#entrepreneurship#startup#smallbusiness#businessdevelopment#businessstrategy#marketresearch#marketanalysis#financialplanning#investment#e-commerce#retail#sales#marketing#digitalmarketing#socialmediamarketing#contentmarketing#branding#customerservice#productdevelopment#supplychain#facebookbusiness#facebookbusinessgrow#growyourbusiness

2 notes

·

View notes

Text

Traders reaction on tiktok #shorts

🔔Subscribe to the channel for tips & strategies for managing money & achieving financial independence: https://www.youtube.com/@your_finance_account/

✅ Stay Connected with Us.

👉Twitter: https://mobile.twitter.com/your_finance_?t=rr4nnhz-e3j1KAtHHwWc-w&s=09

✅ For Business Inquiries: [email protected]

=============================

✅ Recommended Playlists

👉 Motivational Videos

https://www.youtube.com/watch?v=RcFJAHHVBMw&list=PLYxqx3-R5Rlg6uJu6hzoH1RmzhFl1lRJB

👉Videos about finance

https://www.youtube.com/watch?v=NfDTd6CpFyk&list=PLYxqx3-R5Rlh2BGPUCJoij3xX1MiSxRNJ

✅ Other Videos You Might Be Interested In Watching:

👉Expert tips for saving a massive down payment and Achieving Your homeownership dreams

https://www.youtube.com/watch?v=D_Xjr5q6M_0

👉How to become a Billionaire like Jeff Bezos in 2023

https://www.youtube.com/watch?v=0495kUXBGkE

👉BEST WARREN BUFFET SPEECH THAT WILL CHANGE YOUR FUTURE IN 2023

https://www.youtube.com/watch?v=aSsFFed9tdo

👉Unlock the Secrets to Billionaire Success: 6 Expert Tips to Achieve Billionaire Status!

https://www.youtube.com/watch?v=c5iRreERdHE

👉The ultimate top 10 money-earning apps without investment in 2023

https://www.youtube.com/watch?v=mi0qULllG8A

=============================

✅ About Your Finance.

Welcome to Your Finance channel, where we empower you to achieve financial freedom. Our mission is to bridge the gap in financial education and equip you with the knowledge and tools needed to take control of your finances. From saving and investing strategies to budgeting and debt management, our team of experts will guide you every step of the way.

Join us on this journey to financial stability and independence. Subscribe now and hit the notification bell to stay updated on all things finance. Your financial success starts here!

For Collaboration and Business inquiries, please use the contact information below:

📩 Email: [email protected]

🔔 Subscribe to the channel for tips & strategies for managing money & achieving financial independence: https://www.youtube.com/@your_finance_account/

=================================

#budgetingtips #personalfinance #moneymanagement #financialplanning #savingsplan #financialfreedom

Disclaimer: We do not accept any liability for any loss or damage incurred from you acting or not acting as a result of watching any of my publications. You acknowledge that you use the information I provide at your own risk. Do your own research.

Copyright Notice: This video and my YouTube channel contain dialog, music, and images that are the property of Your Finance. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to my Youtube Channel is provided.

© Your Finance

https://ifttt.com/images/no_image_card.png

https://www.youtube.com/watch?v=bq0bSBudHn0

#wealthbuilding#financialfreedom#investing#personalfinance#financialplanning#multipleincomestreams#debtfree#savemoney#financialgoals

2 notes

·

View notes

Text

The Truth About Money: How Rich Dad's Teachings Can Help You Avoid the Rat Race - Day 3 Reflection

📚🌟 Can reading really change your life? 🌟📚 According to research, reading books can reduce stress, improve comprehension and imagination, alleviate depression, and even help prevent Alzheimer's! 🧠💭 Day 3 of Bookish Buzz's test features "Rich Dad Poor Dad," which shares valuable lessons on financial literacy. 🤑 Why not pick up a book today and start changing your life for the better? #ReadMore #ChangeYourLife #RichDadPoorDad

My learning- Rich Dad's teachings focus on changing one's perspective on money and wealth to become successful. The lesson he teaches is that the poor and middle class work for money, while the rich have money work for them. Instead of operating out of fear, people should learn how money works and have it work for them. Learning to work smarter, not harder, and using their minds to create wealth is the key to success. While it may be tempting to focus on immediate rewards, it is important to look at the bigger picture and avoid the trap of the rat race. The first step to finding another way is to tell the truth. By implementing Rich Dad's teachings, one can change their perspective on wealth and success, and ultimately become successful in life.

#FinancialFreedom#MoneyMindset#PersonalFinance#Investing#Wealth#Success#PassiveIncome#FinancialEducation#FinancialLiteracy#MoneyManagement#Entrepreneurship#Motivation#Inspiration#Goals#Mindset#WealthCreation#FinancialGoals#FinancialSuccess#FinancialPlanning#DebtFree#Budgeting#Savings#MoneyTips#FinancialAdvice#MoneyTalks#MoneyMatters

2 notes

·

View notes

Photo

Top Leading Mutual Fund Distributor

Are you looking for financial freedom? VSRK CAPITAL is the mutual fund distributor you can trust! We offer exclusive services and sound investment solutions to help you make informed decisions and grow wealth. With our easy-to-use online platform, you can monitor your investments securely. Plus, get access to the latest trends and insights on the Indian equity markets. Start your journey with us today and achieve financial freedom through smart investments!

Check here more: https://t.ly/-HJq

#mutualfunddistributor#financialfreedom#financialplanning#mutualfundonline#buymutualfunds#investmentservices#growwealth#financialservices#mutualfundinvesting#mutualfundadvisor#stocksmarket#wealthadvisor

2 notes

·

View notes

Text

Google Trends: An Introduction to Understanding Search Trends

When it comes to creating content for your website, it’s important to stay on top of current trends and topics that your audience is interested in. One tool that can help you with this is Google Trends. This free online tool allows you to explore what people are searching for on Google and can help you make informed decisions when it comes to your content and keyword strategy. In this article, we…

View On WordPress

#affiliatemarketing#bloggingtips#budgeting#coaching#ContentCreation#contentmarketing#digitalmarketing#digitalnomad#dropshipping#earnmoneyfromhome#eCommerce#emailmarketing#entrepreneurmindset#financialfreedom#financialindependence#financialplanning#freelancer#frugalliving#homebusiness#hustlefromhome#influencermarketing#inspirationalquotes.#investingtips#leadgeneration#makemoneyonline#marketingautomation#mentoring#mindsetcoach#moneylover#moneymindset

3 notes

·

View notes

Text

The Importance Of Research Methodology In Your Thesis

Call us: 6268991983

Mail us: [email protected]

Visit: https://thescrc.org/

https://thescrc.org/the-importance-of-research-methodology-in-your-thesis/

#PhD #phdlife #phdjourney #phdjobs #phdresearch

#research #researchstudy #ResearchMatters #ResearchChallenge

#researcher #dissertation #financialplanning #analysis #management #scholarship #thesis #Synopsis

#PhD#phdlife#phdjourney#phdjobs#phdresearch#research#researchstudy#ResearchMatters#ResearchChallenge#researcher#dissertation#financialplanning#analysis#management#scholarship#thesis#Synopsis

2 notes

·

View notes