#financialgoals

Text

#success#entrepreneurlife#mindsetiseverything#wealthcreation#businesstips#entrepreneurmindset#growthmindset#financialfreedom#businessgrowth#entreprenuerjourney#millionairemindset#financialgoals

2 notes

·

View notes

Text

How to Save Money with a Tight Budget!!!

Wallet feeling lighter than a feather? Don't worry, fam! We're all about saving smart, not living like a broke student (again). Share your budgeting hacks, score deals like a pro, and ditch sneaky spending habits in the comments! Let's turn #SquadGoals into #SavingsGoals!

Saving Money Responsibly

Pay yourself first

Avoid accumulating new debt

Set reasonable savings goals

Establish a time frame for your goals

Keep a budget

Record your expenses

Double-check all payment amounts

Start saving as early as possible

Consider contributing to a retirement account

Make stock market investments cautiously

Don't get discouraged

Chopping Your Expenses

Remove luxuries from your budget

Find cheaper housing

Eat for cheap.

Reduce your energy usage.

Use cheaper forms of transportation

Have fun for cheap (or free)

Avoid expensive addictions.

Spending Money Brilliantly

Spend money on absolute essentials first

Save for an emergency fund

Pay off your debt

Put away money next

Spend on smart non-essentials

Spend on luxuries last

#finance#money#investing#business#economy#budgeting#debtfree#financialliteracy#financialfreedom#personalfinance#sidehustle#passiveincome#fintwit#financialgoals#millennialmoney

2 notes

·

View notes

Text

For Vietnamese and Chinese versions, please check out:

https://ngocnga.net/positive-thinking/?utm_source=tumblr&utm_medium=social&utm_campaign=quote

💰💸🤞

If life is going to hit a wall, I hope it's a wall of money.

//

Rúguǒ rénshēng yào pèngbì, wǒ xīwàng shì rénmínbì.

#MoneyMatters#FinancialGoals#PositiveThinking#1quotein3languages#chineselanguage#learnchinese#learnmandarin#studychinese#chinesewords#putonghua#weibo#chinese#mandarin#pinyin#quotes#quote

2 notes

·

View notes

Text

Tax-Smart Strategies: Goviin Bookkeeping's Commitment to Your Financial Goals

Step into the dynamic realm of Goviin Bookkeeping, where financial expertise meets innovation in the heart of the UAE! Thrilled to be your financial ally, we're dedicated to offering a spectrum of cutting-edge financial services, placing a spotlight on the unparalleled Bookkeeping Services in Dubai.

We take immense pride in transcending the role of mere number crunchers. Consider us your devoted partners in navigating the intricate world of finances. Whether you're a blossoming start-up seeking establishment or a seasoned business refining its processes, rest assured, we've got your back!

Our services extend far beyond the conventional. From Specialized Bookkeeping Services in Dubai to FTA Services, Tax Preparation, and assistance with UAE Free Zone Company Formation – think of us as your comprehensive one-stop-shop for all things finance. We're not just here to balance the books; we're here to harmonize your business for unparalleled success.

In the fast-paced landscape of business, we comprehend the daily challenges you encounter. Hence, Goviin Bookkeeping is here to assist you in establishing, implementing, and tracking your financial goals. With us by your side, you can unlock your business's full potential, turning obstacles into stepping stones toward triumph.

We're not just financial experts; we're your tax-smart partners. Our mission is to tailor solutions that not only meet but surpass your expectations. Envision us as your financial strategists, skilfully minimizing tax burdens, optimizing the advantages of accessible Pro Services, and pinpointing opportunities that propel your business towards growth.

Trust is the cornerstone of our client relationships. Opting for Goviin Bookkeeping means choosing reliability and excellence. Propel your business towards greater success with our team of qualified financial experts. Your financial journey is on the verge of becoming remarkably smoother.

In the dynamic landscape of business, selecting the right financial partner is paramount. Choose Goviin Bookkeeping for the Pinnacle Bookkeeping Services in Dubai – where financial triumph takes its first step!

#GoviinBookkeeping#DubaiFinance#BusinessSuccess#BookkeepingServices#FinancialExcellence#TaxSmartPartners#UAEFreeZone#ProServices#FinancialGoals#BusinessTriumph#InnovationInFinance

5 notes

·

View notes

Text

10 Essential Tips for Effective Financial Management

Introduction

Effective financial management is the cornerstone of a stable and prosperous life. Whether you're an individual or a business owner, mastering the art of managing your finances can lead to greater financial security and opportunities. In this article, we will delve into the 10 essential tips for effective financial management, providing you with actionable advice to help you make informed financial decisions.

1. Create a Detailed Budget

Managing your finances starts with creating a detailed budget. A budget helps you track your income, expenses, and savings goals. By understanding where your money goes, you can make necessary adjustments to achieve your financial objectives.

2. Set Clear Financial Goals

To effectively manage your finances, set clear and achievable financial goals. These goals will serve as a roadmap for your financial journey, helping you stay motivated and focused.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

4. Reduce Debt

High-interest debts can hinder your financial progress. Create a plan to reduce and eventually eliminate your debts. Start by paying off high-interest debts first.

5. Invest Wisely

Make your money work for you by investing wisely. Diversify your investments, consider long-term strategies, and seek advice from financial experts if needed.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life. Regularly monitor it and take steps to improve it if necessary. A good credit score can lead to better borrowing terms and financial opportunities.

7. Save for Retirement

Don't wait until retirement is around the corner to start saving. The earlier you begin, the more you can accumulate. Explore retirement account options and contribute regularly.

8. Review and Adjust

Financial management is not a one-time task. Periodically review your budget, goals, and investments. Make adjustments as your financial situation changes.

9. Seek Professional Advice

If you find financial management overwhelming, consider seeking advice from a financial advisor. They can provide personalized guidance and strategies to optimize your finances.

10. Stay Informed

Stay updated on financial news, trends, and opportunities. Knowledge is power, and being informed will help you make better financial decisions.

10 Essential Tips for Effective Financial Management

In this section, we will briefly recap the ten essential tips for effective financial management:

Create a Detailed Budget

Set Clear Financial Goals

Build an Emergency Fund

Reduce Debt

Invest Wisely

Monitor Your Credit Score

Save for Retirement

Review and Adjust

Seek Professional Advice

Stay Informed

FAQs

Q: How do I start creating a budget?

A: Begin by listing all your sources of income and your monthly expenses. Categorize your expenses and identify areas where you can cut back.

Q: What's the ideal emergency fund size?

A: Aim for three to six months' worth of living expenses, but adjust based on your personal circumstances and risk tolerance.

Q: Can I manage my investments on my own?

A: While it's possible to manage your investments independently, seeking advice from a financial advisor can help you make more informed decisions.

Q: How often should I review my financial goals?

A: Regularly review your financial goals, at least once a year, and adjust them as needed to reflect changes in your life or financial situation.

Q: What's the best way to improve my credit score?

A: To boost your credit score, pay bills on time, reduce outstanding debts, and avoid opening too many new credit accounts.

Q: When should I start saving for retirement?

A: Start saving for retirement as early as possible to maximize your savings. The earlier you begin, the more you can accumulate over time.

Conclusion

Effective financial management is a skill that anyone can master with dedication and commitment. By following these 10 essential tips for effective financial management, you can take control of your finances, secure your future, and achieve your financial dreams. Remember that financial management is an ongoing process, so stay informed, adapt to changes, and always strive for financial excellence.

#FinancialManagement#MoneyManagement#PersonalFinance#FinancialGoals#Budgeting#InvestingTips#CreditScore#RetirementPlanning#DebtManagement#FinancialFreedom#Savings#FinanceTips#SmartInvesting#BudgetingTips#FinancialPlanning#WealthManagement#FinancialEducation#Finance101#FinancialAdvisor#MoneyMatters#MoneySmarts

4 notes

·

View notes

Text

#529Plan#AssetAllocation#CryptoInvesting#Diversification#DividendInvesting#FinancialAdvice#FinancialAdvisor#FinancialEducation#FinancialGoals#FinancialPlanning#HighYieldSavings#InvestmentOptions#InvestmentPortfolio#PassiveIncome#PeerToPeerLending#RealEstateInvesting#RetirementPlanning#RoboAdvisors#RothIRA#SavingsStrategies#SideBusiness#StockMarket#StocksAndBonds#WealthManagement#Investing#SHARE.#Facebook#Twitter#Pinterest#LinkedIn

2 notes

·

View notes

Text

"Mastering Finances: Unlocking Wealth with Our Money-Making Tutorials"

------------------------------------------------------------------------

DM ME (instagram: z3tko) SAME MONEY ONLY FOR 20$ 💳💸

#FinanceTips#MoneyTutorials#FinancialSuccess#WealthBuilding#IncomeBoost#MoneyManagement#FinancialFreedom#InvestingAdvice#BudgetingTips#FinancialEducation#PersonalFinance#MoneyMatters#FinancialEmpowerment#FinancialGoals#MoneySkills#FinancialWisdom#MoneySavvy#MoneyTalks#EconomicEmpowerment#FinancialResources#FinancialJourney

2 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes

Text

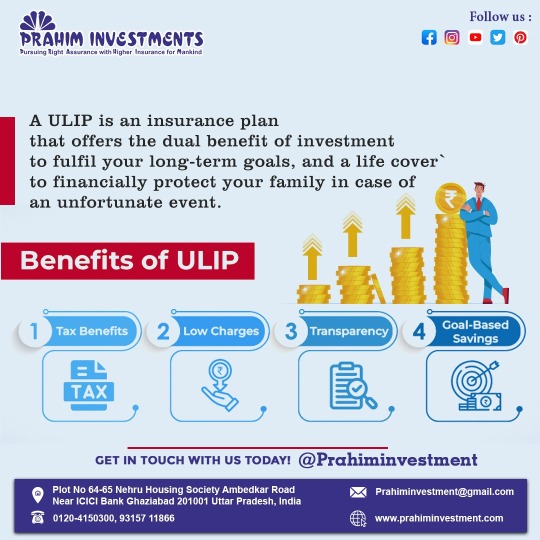

"Unlock the power of ULIPs and embrace financial growth with tax advantages, minimal fees, transparent operations and focused savings to achieve your aspirations."

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahiminvestments#Ulip#financialgrowth#taxadvantages#aspirations#investments#wealthcreation#financialplanning#longterminvesting#lifeinsurance#taxsavings#financialfreedom#investmentstrategy#securefuture#moneymanagement#SmartInvesting#wealthbuilding#FinancialGoals#retirementplanning

2 notes

·

View notes

Text

Traders reaction on tiktok #shorts

🔔Subscribe to the channel for tips & strategies for managing money & achieving financial independence: https://www.youtube.com/@your_finance_account/

✅ Stay Connected with Us.

👉Twitter: https://mobile.twitter.com/your_finance_?t=rr4nnhz-e3j1KAtHHwWc-w&s=09

✅ For Business Inquiries: [email protected]

=============================

✅ Recommended Playlists

👉 Motivational Videos

https://www.youtube.com/watch?v=RcFJAHHVBMw&list=PLYxqx3-R5Rlg6uJu6hzoH1RmzhFl1lRJB

👉Videos about finance

https://www.youtube.com/watch?v=NfDTd6CpFyk&list=PLYxqx3-R5Rlh2BGPUCJoij3xX1MiSxRNJ

✅ Other Videos You Might Be Interested In Watching:

👉Expert tips for saving a massive down payment and Achieving Your homeownership dreams

https://www.youtube.com/watch?v=D_Xjr5q6M_0

👉How to become a Billionaire like Jeff Bezos in 2023

https://www.youtube.com/watch?v=0495kUXBGkE

👉BEST WARREN BUFFET SPEECH THAT WILL CHANGE YOUR FUTURE IN 2023

https://www.youtube.com/watch?v=aSsFFed9tdo

👉Unlock the Secrets to Billionaire Success: 6 Expert Tips to Achieve Billionaire Status!

https://www.youtube.com/watch?v=c5iRreERdHE

👉The ultimate top 10 money-earning apps without investment in 2023

https://www.youtube.com/watch?v=mi0qULllG8A

=============================

✅ About Your Finance.

Welcome to Your Finance channel, where we empower you to achieve financial freedom. Our mission is to bridge the gap in financial education and equip you with the knowledge and tools needed to take control of your finances. From saving and investing strategies to budgeting and debt management, our team of experts will guide you every step of the way.

Join us on this journey to financial stability and independence. Subscribe now and hit the notification bell to stay updated on all things finance. Your financial success starts here!

For Collaboration and Business inquiries, please use the contact information below:

📩 Email: [email protected]

🔔 Subscribe to the channel for tips & strategies for managing money & achieving financial independence: https://www.youtube.com/@your_finance_account/

=================================

#budgetingtips #personalfinance #moneymanagement #financialplanning #savingsplan #financialfreedom

Disclaimer: We do not accept any liability for any loss or damage incurred from you acting or not acting as a result of watching any of my publications. You acknowledge that you use the information I provide at your own risk. Do your own research.

Copyright Notice: This video and my YouTube channel contain dialog, music, and images that are the property of Your Finance. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to my Youtube Channel is provided.

© Your Finance

https://ifttt.com/images/no_image_card.png

https://www.youtube.com/watch?v=bq0bSBudHn0

#wealthbuilding#financialfreedom#investing#personalfinance#financialplanning#multipleincomestreams#debtfree#savemoney#financialgoals

2 notes

·

View notes

Text

Happy Saturday! Follow Your Day News COFFEE TIME on Medium.⚡

Read with Us!

Take your business professional skills to another level. Join on Medium. Share your enthusiasm. 💬

https://www.medium.com/your-day-news-coffee-time/

Soon, Your Day News Cofffee Time will analyze the tone of your emails to help you make the right kind of impact.

Want full access? 👀

Now, apply on our newsletter list.

4 notes

·

View notes

Text

The Truth About Money: How Rich Dad's Teachings Can Help You Avoid the Rat Race - Day 3 Reflection

📚🌟 Can reading really change your life? 🌟📚 According to research, reading books can reduce stress, improve comprehension and imagination, alleviate depression, and even help prevent Alzheimer's! 🧠💭 Day 3 of Bookish Buzz's test features "Rich Dad Poor Dad," which shares valuable lessons on financial literacy. 🤑 Why not pick up a book today and start changing your life for the better? #ReadMore #ChangeYourLife #RichDadPoorDad

My learning- Rich Dad's teachings focus on changing one's perspective on money and wealth to become successful. The lesson he teaches is that the poor and middle class work for money, while the rich have money work for them. Instead of operating out of fear, people should learn how money works and have it work for them. Learning to work smarter, not harder, and using their minds to create wealth is the key to success. While it may be tempting to focus on immediate rewards, it is important to look at the bigger picture and avoid the trap of the rat race. The first step to finding another way is to tell the truth. By implementing Rich Dad's teachings, one can change their perspective on wealth and success, and ultimately become successful in life.

#FinancialFreedom#MoneyMindset#PersonalFinance#Investing#Wealth#Success#PassiveIncome#FinancialEducation#FinancialLiteracy#MoneyManagement#Entrepreneurship#Motivation#Inspiration#Goals#Mindset#WealthCreation#FinancialGoals#FinancialSuccess#FinancialPlanning#DebtFree#Budgeting#Savings#MoneyTips#FinancialAdvice#MoneyTalks#MoneyMatters

2 notes

·

View notes

Photo

Want to improve your trading discipline and achieve long-term success in the markets? Follow these tips to develop a strong trading plan, manage risk effectively, control your emotions, and cultivate a disciplined mindset. Remember, discipline is a skill that can be developed with practice and perseverance. Let's start building your path to financial freedom! 💪📈 #tradingdiscipline #tradingmindset #riskmanagement #tradingplan #riskmanagement #emotioncontrol #financialgoals #personalfinance #investing #tradingtips #tradingeducation (at San Francisco, California) https://www.instagram.com/p/CqG2UxiOiaH/?igshid=NGJjMDIxMWI=

#tradingdiscipline#tradingmindset#riskmanagement#tradingplan#emotioncontrol#financialgoals#personalfinance#investing#tradingtips#tradingeducation

5 notes

·

View notes

Text

Haven't you reached your financial goal yet? Contact us, and we will guide you in the correct direction: 9910133556

#financialgoals#financialgoals2023#financialfreedom#financialliteracy#financialindependence#financialeducation#financialservices#financialsecurity#financialsuccess#financialsolutions#financialstatements#financialsupport#financialmanagement#financialwellness#financialwellbeing#financialwealth#financialwisdom#financialempowerment#financialeducationservices#financialeducator#financialeducationmatters#financialreporting#financialtips#financialtechnology#financialtimes#financialplanning#budget2023#financialyear#financialinvestment#finance

2 notes

·

View notes

Text

youtube

#FinanceTips#AccountingSkills#EntrepreneurLife#SmallBizSuccess#FinancialGuidance#MoneyManagement#QuickBooksTips#FinancialFreedom#BusinessSuccess#FinancialEmpowerment#EntrepreneurshipJourney#SuccessMindset#EfficiencyHacks#FinancialPlanning#MoneyMatters#StartupLife#FinancialGoals#SavingsGoals#youtube#small youtuber#online business#ecommerce#branding#marketing#entrepreneur#accounting#bookkeeping#digitalmarketing#Youtube

0 notes

Text

Loan Truths: Responsible Borrowing Leads to Financial Growth.

0 notes