#SmartInvesting

Text

These days, I’m learning to actually spend money on things that’d benefit my life. So growing up being the first child, it has been instilled in me to save money. I’d rather save my money because “the bird in hand is better than the 2 in the forest.” (African proverb)

This year I’m taking a new turn, I’m going to spend my money on things that’d give me an ROI, not being foolish with my spending but smart.

I’d be taking a writing course to polish my writing and also gain a side income as a student. #Godissointentionalaboutme

I’m super excited. Been scared for so long but there’s no better time than now.

I wonder what the future has in store for me.

Ladies, this is your reminder that scared money makes no money

#money#study motivation#girly blog#luxurious black women#studycommunity#it girl#study aesthetic#studyblr#black girl luxury#study blog#studying#smart girl#smartinvesting#make money online#make money from home

9 notes

·

View notes

Text

Passive Income Paradise How to Make Money Easily from Anywhere in the World

Welcome to the gateway of financial liberation — welcome to “Passive Income Paradise: How to Make Money Easily from Anywhere in the World.” In an era where autonomy and flexibility reign supreme, the pursuit of passive income has become a journey towards unrestricted financial prosperity. This blog delves into the multifaceted realm of passive income, offering you insights into diverse avenues that enable earnings without the shackles of constant effort. Join us as we explore traditional investments, online ventures, real estate, and intellectual property, guiding you on a path to financial freedom that transcends geographical boundaries. Embrace the art of making money effortlessly, and let’s start on a journey to the paradise of passive income together.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Types of Passive Income

Passive income refers to earnings derived from a business, investment, or other sources with little to no effort on the part of the recipient. While it often requires upfront work or investment, the goal is to generate income with minimal ongoing effort.

Here are some common types of passive income:

Dividend Stocks: Investing in stocks that pay regular dividends allows you to earn a portion of the company’s profits.

Rental Income: Owning real estate and renting out properties can provide a steady stream of passive income.

Real Estate Crowdfunding: Participating in crowdfunding platforms allows you to invest in real estate projects and receive a share of the profits.

Peer-to-Peer Lending: Platforms that facilitate peer-to-peer lending allow you to lend money to individuals or small businesses in exchange for interest payments.

Create and Sell Intellectual Property: This could include writing books, creating music, designing software, or developing other forms of intellectual property that can be sold or licensed.

Create an Online Course or e-Book: Sharing your expertise on a particular subject through an online course or e-book can generate passive income.

Affiliate Marketing: Promoting other people’s products and earning a commission for each sale made through your unique affiliate link.

Automated Online Businesses: Building and automating online businesses, such as dropshipping or affiliate marketing websites, can generate passive income.

Royalties from Intellectual Property: If you own patents, trademarks, or copyrights, you can earn royalties from others using or licensing your intellectual property.

Stock Photography: If you are a photographer, selling your photos to stock photography websites can provide ongoing royalties.

Create and Monetize a Blog or YouTube Channel: Building a blog or YouTube channel and monetizing it through ads, sponsorships, or affiliate marketing can generate passive income.

Dividend-Generating Funds: Investing in mutual funds or exchange-traded funds (ETFs) that focus on dividend-paying stocks.

Automated Investing Apps: Robo-advisors and automated investment platforms can help you invest in a diversified portfolio with minimal effort.

License Your Art or Designs: If you’re an artist or designer, licensing your work for use in various products can generate passive income.

Create a Mobile App: Developing a useful or entertaining mobile app and earning money through ads or in-app purchases.

The Pros and Cons of Passive Income

Venturing into the world of passive income brings both promises and challenges. Enjoy financial freedom, flexibility, and diversification, but be prepared for the initial effort required and potential market volatility. Navigate the landscape wisely to unlock the true potential of passive income.

A. Advantages

Financial Freedom: Attain the freedom to live life on your terms.

Flexibility: Enjoy a flexible lifestyle with more time for personal pursuits.

Diversification: Spread your income sources, reducing dependency on a single channel.

B. Challenges

Initial Effort: Many passive income streams require substantial effort upfront.

Market Volatility: External factors may impact income, especially in investments and online ventures.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Getting Started with Passive Income

The route to passive income begins with self-reflection. Determine your hobbies, investigate prospective revenue sources, and develop a strategic strategy. This first step is critical for building the groundwork for future financial success by aligning with your abilities.

Traditional Investments

Traditional investments offer a stable route to passive income. Dive into the dynamic world of the stock market, bonds, and mutual funds. Learn the art of strategic investment to secure steady returns and create a robust financial foundation for the future.

Online Ventures

Online ventures offer a dynamic path to passive income. Engage in affiliate marketing, promoting products for commission. Transform passions into profit with blogging, leveraging ads and sponsorships. Explore YouTube for ad revenue and e-commerce for a digital storefront that generates income while you sleep.

Start your journey of online entrepreneurship.

Affiliate Marketing: Identify products that resonate with your audience. Build a dedicated following for sustainable earnings.

Blogging: Choose a niche you’re passionate about. Monetize through various channels, gradually turning your blog into a passive income powerhouse.

YouTube: Craft engaging content, optimize for search engines, and let ad revenue and sponsorships contribute to your passive income.

E-commerce: Select the right platform, products, and marketing strategies. Build a brand that continues to generate income with minimal oversight.

Real Estate

If you want a safe way to make money while you sleep, get into real estate. If you want to make a steady income from rentals, you should buy rental homes. Check out real estate crowdfunding. When people pool their money and time to work on bigger projects, you can get a piece of the income without having to do any work yourself.

Explore the realm of bricks and mortar for long-term, reliable passive income.

Rental Properties: Invest in properties that attract tenants. Enjoy a steady rental income.

Real Estate Crowdfunding: Pool resources with others to invest in larger real estate projects, sharing the profits.

Intellectual Property

Unlock the potential of intellectual property as a passive income source. Write and publish, earning royalties from books and articles. Create online courses to share expertise globally. License innovative ideas, turning creativity into a continuous stream of income in the dynamic world of intellectual property.

Monetize your creativity and knowledge.

Writing and Publishing: Write books or articles and earn royalties. Leverage digital platforms for wider reach.

Creating Online Courses: Share your expertise through online courses, reaching a global audience.

Licensing Ideas: Turn your innovative ideas into passive income by licensing them to businesses.

Overcoming Challenges

Journey through the inevitable challenges of passive income. Embrace failures as invaluable lessons, adapting and growing stronger. Navigate market changes by staying vigilant and flexible. Overcoming these hurdles is integral to carving a resilient path to financial freedom through passive income.

Acknowledge and overcome the hurdles in your passive income journey.

Learning from Failures: Treat setbacks as learning experiences. Adapt and grow from your failures.

Adapting to Market Changes: Stay vigilant and adapt your strategies to navigate through market fluctuations.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Scaling Up Your Passive Income

Improve your passive income game by intelligently scaling up. Profits should be reinvested properly, compounding earnings for exponential development. Automate procedures to lessen your hands-on engagement, enabling your revenue to grow with less work. Investigate new enterprises to diversify and improve your financial situation.

Move beyond the basics and elevate your passive income game.

Reinvesting Profits: Compound your earnings by reinvesting in your existing ventures or exploring new ones.

Automating Processes: Streamline operations to minimize hands-on involvement, allowing your income to grow with reduced effort.

Exploring New Ventures: Stay dynamic by exploring new opportunities and expanding your passive income portfolio.

Case Studies

Set off on an inspirational adventure via real-life case studies. Dive into success stories to learn about the techniques and tactics people used to attain financial independence via different passive income sources. Take away key lessons from these situations to help you on your journey to success.

Learn from those who have successfully mastered the art of passive income.

Success Stories: Explore real-life examples of individuals who have achieved financial freedom through passive income.

Lessons Learned: Understand the challenges faced by others and gain insights into overcoming obstacles.

The Future of Passive Income

Peering into the future of passive income unveils exciting possibilities. Stay ahead by embracing emerging trends and leveraging technological influences. Constantly adapt and innovate to navigate the evolving landscape, ensuring sustained success in the dynamic realm of passive income.

Stay ahead of the curve by anticipating future trends.

Emerging Trends: Stay informed about new opportunities and technological advancements in the passive income landscape.

Technological Influences: Embrace technology to enhance and diversify your passive income streams.

Conclusion

As we conclude our exploration of Passive Income Paradise, reflect on the diverse avenues unveiled. Align your passions with profitable ventures, overcome challenges, and witness the evolution of your financial strategies. This journey isn’t just about earning; it’s about creating a lifestyle that affords freedom and fulfillment. Stay committed, learn from experiences, and watch your passive income flourish, providing the key to unlocking financial independence and making money easily from anywhere in the world. The possibilities are limitless, and your path to prosperity begins now.

FAQs

Q1. How much initial investment is needed for passive income?

The initial investment varies based on the chosen income stream. Some require minimal investment, while others may demand a more significant upfront commitment.

Q2. Can passive income replace a full-time job?

In many cases, yes. However, the transition depends on your financial goals, chosen income streams, and the effort you invest initially.

Q3. What are common mistakes to avoid in passive income ventures?

Avoid the mistake of expecting instant results. Patience is key. Additionally, thorough research and ongoing learning are crucial to success.

Q4. Is passive income suitable for everyone?

While passive income is a viable option for many, it’s essential to assess your skills, interests, and commitment level before diving in.

Q5. How long does it take to see significant returns from passive income?

The timeline varies, but it’s common for significant returns to take time. Be prepared for an initial period of effort and learning before experiencing substantial results.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Affiliate Disclaimer :

This article Contain may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

Source : Passive Income Paradise How to Make Money Easily from Anywhere in the World

Thanks for reading my article on “Passive Income Paradise How to Make Money Easily from Anywhere in the World“, hope it will help!

#FinancialFreedom#OnlineBusiness#LocationIndependent#EarnAnywhere#DigitalNomadLife#FinancialIndependence#SmartInvesting#howtomakemoneyonline#makemoneyonline#makemoneyonline2023#makemoneyonlinefromhome#makemoneyfast#affiliatemarketing#cpamarketing#blogging#dropshipping#ecommerce#passiveincome#makemoneytutorials#methodsandtutorials#internetmarketing#digitalmarketing#clickbankaffiliatemarketing#affiliatemarketingtraining#cpamarketingtraining#cpa#blog#makemoney#makemoneyonlineguide#freelancingtraining

3 notes

·

View notes

Text

🌟 Navigating the DeFi Universe in 2024 🚀✨

The world of Decentralized Finance is ever-evolving and full of potential, but it's not without its risks. Stay ahead of the game with crucial insights on how to avoid pitfalls and embrace opportunities in DeFi this coming year. 🛡️📈

🔗 Risks of DeFi: Avoiding Pitfalls and Embracing Opportunity in 2024

#DeFi #BlockchainTechnology #CryptoInvesting #FinancialFreedom #DeFi2024 #SmartInvesting #CryptoFuture

2 notes

·

View notes

Text

10 Essential Tips for Effective Financial Management

Introduction

Effective financial management is the cornerstone of a stable and prosperous life. Whether you're an individual or a business owner, mastering the art of managing your finances can lead to greater financial security and opportunities. In this article, we will delve into the 10 essential tips for effective financial management, providing you with actionable advice to help you make informed financial decisions.

1. Create a Detailed Budget

Managing your finances starts with creating a detailed budget. A budget helps you track your income, expenses, and savings goals. By understanding where your money goes, you can make necessary adjustments to achieve your financial objectives.

2. Set Clear Financial Goals

To effectively manage your finances, set clear and achievable financial goals. These goals will serve as a roadmap for your financial journey, helping you stay motivated and focused.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

4. Reduce Debt

High-interest debts can hinder your financial progress. Create a plan to reduce and eventually eliminate your debts. Start by paying off high-interest debts first.

5. Invest Wisely

Make your money work for you by investing wisely. Diversify your investments, consider long-term strategies, and seek advice from financial experts if needed.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life. Regularly monitor it and take steps to improve it if necessary. A good credit score can lead to better borrowing terms and financial opportunities.

7. Save for Retirement

Don't wait until retirement is around the corner to start saving. The earlier you begin, the more you can accumulate. Explore retirement account options and contribute regularly.

8. Review and Adjust

Financial management is not a one-time task. Periodically review your budget, goals, and investments. Make adjustments as your financial situation changes.

9. Seek Professional Advice

If you find financial management overwhelming, consider seeking advice from a financial advisor. They can provide personalized guidance and strategies to optimize your finances.

10. Stay Informed

Stay updated on financial news, trends, and opportunities. Knowledge is power, and being informed will help you make better financial decisions.

10 Essential Tips for Effective Financial Management

In this section, we will briefly recap the ten essential tips for effective financial management:

Create a Detailed Budget

Set Clear Financial Goals

Build an Emergency Fund

Reduce Debt

Invest Wisely

Monitor Your Credit Score

Save for Retirement

Review and Adjust

Seek Professional Advice

Stay Informed

FAQs

Q: How do I start creating a budget?

A: Begin by listing all your sources of income and your monthly expenses. Categorize your expenses and identify areas where you can cut back.

Q: What's the ideal emergency fund size?

A: Aim for three to six months' worth of living expenses, but adjust based on your personal circumstances and risk tolerance.

Q: Can I manage my investments on my own?

A: While it's possible to manage your investments independently, seeking advice from a financial advisor can help you make more informed decisions.

Q: How often should I review my financial goals?

A: Regularly review your financial goals, at least once a year, and adjust them as needed to reflect changes in your life or financial situation.

Q: What's the best way to improve my credit score?

A: To boost your credit score, pay bills on time, reduce outstanding debts, and avoid opening too many new credit accounts.

Q: When should I start saving for retirement?

A: Start saving for retirement as early as possible to maximize your savings. The earlier you begin, the more you can accumulate over time.

Conclusion

Effective financial management is a skill that anyone can master with dedication and commitment. By following these 10 essential tips for effective financial management, you can take control of your finances, secure your future, and achieve your financial dreams. Remember that financial management is an ongoing process, so stay informed, adapt to changes, and always strive for financial excellence.

#FinancialManagement#MoneyManagement#PersonalFinance#FinancialGoals#Budgeting#InvestingTips#CreditScore#RetirementPlanning#DebtManagement#FinancialFreedom#Savings#FinanceTips#SmartInvesting#BudgetingTips#FinancialPlanning#WealthManagement#FinancialEducation#Finance101#FinancialAdvisor#MoneyMatters#MoneySmarts

4 notes

·

View notes

Text

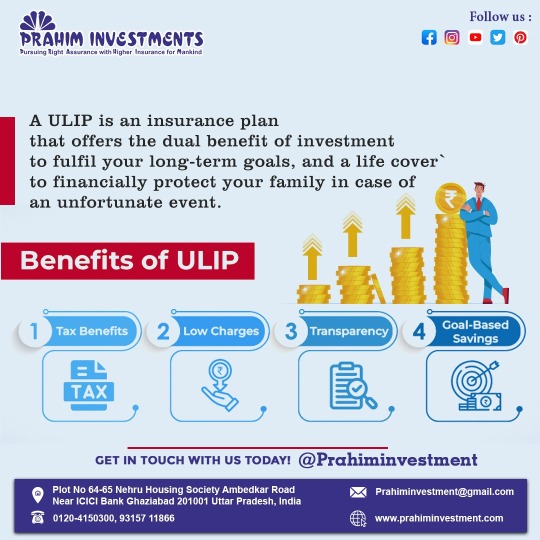

"Unlock the power of ULIPs and embrace financial growth with tax advantages, minimal fees, transparent operations and focused savings to achieve your aspirations."

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahiminvestments#Ulip#financialgrowth#taxadvantages#aspirations#investments#wealthcreation#financialplanning#longterminvesting#lifeinsurance#taxsavings#financialfreedom#investmentstrategy#securefuture#moneymanagement#SmartInvesting#wealthbuilding#FinancialGoals#retirementplanning

2 notes

·

View notes

Text

Every $1 invested in User Experience (UX) design yields a whopping return of $100! That's an incredible ROI of 9,900%. Investing in UX isn't just about creating better products, it's about making smart business decisions.

0 notes

Text

Utilize SIP Crorepati Calculator from Ajmera Xchange to unleash the power of systematic investing

With the use of systematic SIP investments, you may plan and visualize your journey toward attaining the coveted crorepati title with the aid of this user-friendly application. At Ajmera X-change their SIP Crorepati Calculator provides useful insights into how monthly investments might develop over time to meet your financial milestones by allowing you to enter important factors like investment amount, estimated rate of return, and investment length. Regardless of your level of experience, our calculator enables you to make wise choices and clear the path to a stable financial future. To know more about their services, have a look at their website - https://www.ajmeraxchange.co.in/tools-and-calculators/crorepati-calculator

#AjmeraXChange#CrorepatiCalculator#InvestmentPlanning#FinancialCalculator#WealthBuilding#InvestmentTools#FinancialPlanning#SecureFuture#BuildWealth#FinancialFreedom#SmartInvesting#PlanYourFuture#InvestmentGoals#FinancialWellbeing#CalculateYourWealth

0 notes

Text

Estate agent for Residential rental in Hisar- Deal Acres

Are you tired of finding a residential property that matches your needs? It is hard to find the right property for you but not anymore. Deal Acres is offering a wide range of options in the Hisar real estate market that is hard to navigate alone. This is where Deal Acres becomes the best real estate company in Hisar with in-depth Knowledge of market localities and years of experience.

Deal Acres is your trusted partner in Hisar’s Real Estate market. We are here to help you find the ideal residential property for you by providing the best estate agent for residential rental in Hisar city. Our priority is customer happiness and satisfaction. For more info and help Visit Deal Acres on our website and Social Media let’s find your Ideal property.

Visit us - Deal Acres

#dealacres#realestateagents#realestate#dreamhome#propertyinvestment#hisarrealestate#propertyfinders#investmentopportunity#smartinvesting

0 notes

Text

Understanding Social Security Benefits Maximize your retirement potential with strategic saving and optimized Social Security benefits. Let's craft a plan together to secure your financial future with confidence! 💼💰

0 notes

Text

The Ultimate Guide to Smart Investing: A Comprehensive Overview

In today's fast-paced world, understanding the fundamentals of smart investing is crucial for securing your financial future. Whether you're a seasoned investor or just starting out, having a comprehensive guide can make all the difference. Welcome to "The Ultimate Guide to Smart Investing," where we delve into the essential principles and strategies to help you make informed decisions and maximize your returns.

What is Smart Investing?

Smart investing goes beyond simply putting your money into the stock market or other assets. It involves a strategic approach that takes into account your financial goals, risk tolerance, and time horizon. At its core, smart investing is about making well-informed decisions based on thorough research and analysis.

Establishing Your Financial Goals

Before diving into the world of investing, it's essential to clearly define your financial goals. Whether you're saving for retirement, buying a home, or funding your child's education, knowing your objectives will guide your investment strategy. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, you can create a roadmap for your financial journey.

Understanding Risk and Reward

Risk is an inherent part of investing, and understanding how to manage it is key to success. Different investments carry varying levels of risk, with higher potential returns often accompanied by greater volatility. By diversifying your portfolio across different asset classes, industries, and geographic regions, you can mitigate risk and improve your chances of achieving long-term growth.

Building a Diversified Portfolio

Diversification is a fundamental principle of smart investing. Instead of putting all your eggs in one basket, spread your investments across a mix of stocks, bonds, real estate, and other asset classes. This not only helps reduce risk but also ensures that your portfolio is well-positioned to weather market fluctuations.

The Power of Compounding

One of the most potent forces in investing is the power of compounding. By reinvesting your earnings, you can generate additional returns over time. The earlier you start investing, the more time your money has to grow, thanks to compounding. Even small contributions can snowball into significant sums over the long term.

Strategies for Smart Investing

There are various strategies you can employ to optimize your investment returns:

Value Investing: This strategy involves identifying undervalued stocks that have the potential for long-term growth.

Dollar-Cost Averaging: By investing a fixed amount of money at regular intervals, you can smooth out market fluctuations and accumulate more shares over time.

Asset Allocation: Allocating your investments across different asset classes based on your risk tolerance and investment horizon can help optimize returns while managing risk.

Tax-Efficient Investing: Minimizing taxes on your investment gains through strategies such as investing in tax-advantaged accounts or holding investments for the long term can enhance your after-tax returns.

Start Smart Investing with mysmartcousin

In conclusion, smart investing is not about timing the market or chasing hot stocks; it's about adopting a disciplined approach that aligns with your financial goals. By understanding the principles of smart investing and implementing sound strategies, you can build wealth over the long term.

At mysmartcousin, we're committed to helping you navigate the world of investing with confidence. Whether you're a novice investor or a seasoned pro, our comprehensive guide provides the insights and resources you need to make informed decisions and achieve your financial objectives. Start your smart investing journey today with mysmartcousin and unlock the potential for financial success.

0 notes

Text

Sam Higginbotham Shares Tax-Efficient Investment Strategies

In the realm of investing, one of the most critical aspects often overlooked is tax efficiency. Enter Sam Higginbotham, a seasoned investor with a knack for navigating the complexities of taxation while maximizing returns. With 20 years of experience under his belt, Sam has honed his skills in deploying smart strategies that not only grow wealth but also minimize the tax burden. Let's delve into some of his insightful approaches to tax-efficient investing.

Understanding Tax-Efficiency

Before diving into specific strategies, it's crucial to grasp the concept of tax efficiency. Simply put, tax-efficient investing involves structuring your investment portfolio in a way that minimizes the impact of taxes on returns. This involves strategic asset allocation, utilizing tax-advantaged accounts, and employing tactics to optimize tax consequences.

Strategic Asset Allocation

Sam Higginbotham emphasizes the importance of strategic asset allocation as a cornerstone of tax-efficient investing. By diversifying across asset classes, such as stocks, bonds, and real estate investment trusts (REITs), investors can spread risk while potentially reducing tax liabilities.

For instance, holding tax-inefficient assets like high-yield bonds or actively managed mutual funds in tax-advantaged accounts can shield their returns from immediate taxation, allowing for compounded growth over time.

Utilizing Tax-Advantaged Accounts

One of Sam Higginbotham's go-to strategies is leveraging tax-advantaged accounts to their fullest potential. These accounts, such as Individual Retirement Accounts (IRAs) and 401(k)s, offer tax benefits that can supercharge investment returns.

By contributing to traditional IRAs or 401(k)s, investors can defer taxes on their contributions until withdrawal, potentially benefiting from lower tax rates in retirement. Similarly, Roth IRAs provide tax-free growth, making them ideal for investments with high growth potential.

Sam advises maximizing contributions to these accounts annually, taking advantage of employer matching programs whenever possible to turbocharge savings.

Tax-Loss Harvesting

Another tactic in Sam Higginbotham's arsenal is tax-loss harvesting, a strategy that involves selling investments at a loss to offset capital gains and reduce taxable income. By strategically selling underperforming assets, investors can capture losses to offset gains, thereby reducing their tax liability.

However, it's essential to adhere to IRS guidelines to avoid running afoul of wash-sale rules, which prohibit repurchasing a substantially identical asset within 30 days of sale.

Investing in Tax-Efficient Funds

Sam Higginbotham recommends investing in tax-efficient mutual funds or exchange-traded funds (ETFs) to minimize taxable distributions. These funds are designed to minimize portfolio turnover and capital gains distributions, reducing the tax burden on investors.

Index funds, in particular, tend to be more tax-efficient than actively managed funds due to their passive management style and lower turnover rates. By choosing funds with low expense ratios and tax efficiency, investors can maximize after-tax returns over the long term.

Long-Term Perspective

Above all, Sam stresses the importance of maintaining a long-term perspective when implementing tax-efficient strategies. While it's tempting to chase short-term gains or react to market volatility, staying disciplined and focused on long-term goals is key to success.

By adhering to a well-thought-out investment plan, rebalancing periodically, and staying the course through market fluctuations, investors can optimize tax efficiency while building wealth over time.

Conclusion

Tax-efficient investing is a crucial component of building and preserving wealth. By understanding the principles of tax efficiency and implementing smart strategies like strategic asset allocation, utilizing tax-advantaged accounts, tax-loss harvesting, and investing in tax-efficient funds, investors can minimize their tax burden and maximize after-tax returns. With guidance from experts like Sam Higginbotham, investors can navigate the complexities of taxation with confidence, paving the way for long-term financial success.

#TaxEfficientInvesting#SmartInvesting#MaximizeReturns#FinancialPlanning#WealthBuilding#TaxAdvantagedAccounts#StrategicAssetAllocation#TaxLossHarvesting#InvestmentStrategies#LongTermInvesting

0 notes

Text

Da die Gold- und Silberpreise weiter steigen, suchen Anleger nach Möglichkeiten, von diesem Aufwärtstrend zu profitieren. Eine Strategie, die sich zunehmender Beliebtheit erfreut, ist die Umsetzung eines Goldsparplans.

Im Folgenden werden wir herausfinden, warum die Einführung eines Goldsparplans in einem steigenden Markt zu profitablen Ergebnissen führen kann und wie Sie diese Strategie nutzen können, um Ihre Anlagerenditen zu maximieren.

Ergreifen Sie die Chance bei steigendem Markt: Die aktuellen Marktbedingungen bieten Anlegern eine hervorragende Gelegenheit, von der Aufwärtsdynamik der Gold- und Silberpreise zu profitieren. Angesichts der wirtschaftlichen Unsicherheiten und des Inflationsdrucks, der die Nachfrage nach sicheren Anlagen antreibt, ist der Wert von Gold und Silber stetig gestiegen.

Langfristiges Wachstumspotenzial: Gold dient seit langem als zuverlässiges Wertbewahrungsmittel und als Absicherung gegen Inflation. Sein Wert und seine Knappheit machen es zu einem attraktiven Vermögenswert für die langfristige Erhaltung des Vermögens.

Diversifizierung und Risikomanagement: Die Aufnahme von Gold in Ihr Anlageportfolio im Rahmen eines Sparplans bietet Diversifizierungsvorteile, die zur Risikominderung beitragen und die Gesamtperformance des Portfolios verbessern können.

Flexibilität und Zugänglichkeit: Die Umsetzung eines Goldsparplans bietet Anlegern Flexibilität und Zugänglichkeit, so dass er für Anleger aller Erfahrungsstufen und Finanzressourcen geeignet ist.

Unabhängig davon, ob Sie ein erfahrener Anleger oder ein Neueinsteiger sind, sollten Sie in Erwägung ziehen, einen Goldsparplan in Ihre Finanzstrategie einzubinden, um das Gewinnpotenzial zu erschließen und Ihre finanzielle Zukunft zu sichern.

Sprechen Sie mit unseren Spezialisten, wie Sie Ihr Geld in einen Goldsparplan sinnvoll investieren können.

#FinanzielleFreiheit#GewinnenSieIhrGold#SmartInvesting#goldsparplan#goldsavingplan#goldinvest#GoldPriceIncrease#goldpricehike

0 notes

Text

Beginner's Guide to Investing: Quick Start

Embarking on the investment journey can seem daunting, but with the right information, it’s a powerful step towards financial freedom. At InvestSmart, we're here to demystify investing for beginners, offering you a concise guide to getting started confidently.

Understanding Investment Types

Investments vary in forms, each with different risk and reward levels. Key types include:

Stocks: Owning a piece of a company. Stock prices fluctuate based on company performance.

Bonds: Lending money to an entity in exchange for fixed interest payments.

Mutual Funds: Pooled money from multiple investors managed by professionals, invested in stocks, bonds, or other assets.

Cryptocurrency: Digital currency with high volatility but potential for significant returns.

Setting Financial Goals

Identify what you’re saving for, whether it’s retirement, a home, or an emergency fund. Clear goals help tailor your investment strategy.

Risk Assessment

All investments carry risk. Higher potential returns usually come with higher risk. It’s crucial to assess your risk tolerance and diversify accordingly.

Starting Small

You don’t need a fortune to begin. Many online investment platforms allow small initial investments, providing a low-risk way to learn.

Commit to Learning

The investment landscape constantly evolves. Stay informed by following financial blogs, reading books, and joining investment communities.

Conclusion

Investing can significantly impact your financial future. Armed with knowledge and a cautious approach, you can build a robust investment portfolio over time. Remember, successful investing hinges on knowledge, patience, and consistency.

For more insights and tips on maximizing your investments, follow InvestSmart on Tumblr. We're dedicated to helping you make informed financial decisions and achieve your financial goals.

#InvestingBasics#FinancialFreedom#StartInvesting#InvestmentTips#MoneyMatters#WealthBuilding#SmartInvesting#FinanceForBeginners#InvestSmart#GrowYourWealth#RiskAndReward#MoneyGoals#BuildYourPortfolio#FinancialLiteracy#Investing101

0 notes

Text

Is DHS Ventures a Legit Investment Option?

In the vast landscape of investment opportunities, it's crucial to distinguish between legitimate options and potential scams. DHS Ventures stands out as a reliable investment choice, offering a range of strategies and services that have been proven effective over time. If you're wondering, Is DHS Ventures legit? The answer is a resounding yes. Let's delve into why DHS Ventures is a trustworthy investment option.

Trustworthy Track Record

DHS Ventures has a long-standing history of success in the investment sector. With a team of seasoned professionals at the helm, DHS Ventures has consistently delivered impressive returns for its clients. The company's track record speaks for itself, showcasing its commitment to excellence and transparency.

Transparent Approach

One of the key factors that set DHS Ventures apart is its transparent approach to investment. The company provides detailed information about its investment strategies, risk management practices, and past performance. This transparency builds trust with investors, demonstrating DHS Ventures' commitment to honesty and integrity.

Proven Investment Strategies

DHS Ventures employs a range of proven investment strategies designed to maximize returns while managing risk. From diversification to active management, DHS Ventures' strategies are tailored to suit the needs of investors looking for long-term growth and stability. These strategies have been thoroughly tested and have a track record of success.

Client-Centric Focus

At DHS Ventures, clients come first. The company takes a personalized approach to investment, taking the time to understand each client's unique financial goals and risk tolerance. This client-centric focus ensures that investments are aligned with individual needs, maximizing the chances of success.

Regulatory Compliance

DHS Ventures operates within the bounds of regulatory compliance, ensuring that all investment activities are conducted ethically and legally. This commitment to compliance further enhances DHS Ventures' credibility and trustworthiness as an investment option.

Conclusion

DHS Ventures is indeed a legit investment option. With a strong track record, transparent approach, proven strategies, client-centric focus, and regulatory compliance, DHS Ventures offers a reliable and trustworthy investment opportunity for those looking to grow their wealth. If you're considering investing with DHS Ventures, rest assured that you're making a sound choice.

#InvestmentOpportunity#LegitInvestment#FinancialFreedom#InvestWisely#WealthManagement#FinancialPlanning#SecureInvestments#DHSVentures#InvestmentStrategy#GrowYourWealth#FinancialSecurity#SmartInvesting#InvestmentPortfolio#LongTermInvesting#StableReturns

0 notes

Text

🌟 Embark on your investment journey with confidence! 🚀

Here's a glimpse into the steps you'll take:

= Advisor -> Investor -> Goal

Ready to kickstart your financial journey?💼💰

0 notes

Text

Best Realtor in Hisar - Deal Acres

Let us guide you to your perfect haven. Discover your dream home with our expert assistance. From cozy cottages to luxurious estates, we'll navigate the market to find exactly what you desire. Your ideal sanctuary awaits – let's make it a reality together.

Visit dealacres.com and embark on your Real Estate journey today!

Contact - 7015963201, 8307757571

#dreamhome#realestateagents#buyinghouses#dealacres#propertyfinders#HisarRealEstate#InvestmentOpportunity#SmartInvesting#DreamHome

0 notes