#InvestmentPlanning

Text

Utilize SIP Crorepati Calculator from Ajmera Xchange to unleash the power of systematic investing

With the use of systematic SIP investments, you may plan and visualize your journey toward attaining the coveted crorepati title with the aid of this user-friendly application. At Ajmera X-change their SIP Crorepati Calculator provides useful insights into how monthly investments might develop over time to meet your financial milestones by allowing you to enter important factors like investment amount, estimated rate of return, and investment length. Regardless of your level of experience, our calculator enables you to make wise choices and clear the path to a stable financial future. To know more about their services, have a look at their website - https://www.ajmeraxchange.co.in/tools-and-calculators/crorepati-calculator

#AjmeraXChange#CrorepatiCalculator#InvestmentPlanning#FinancialCalculator#WealthBuilding#InvestmentTools#FinancialPlanning#SecureFuture#BuildWealth#FinancialFreedom#SmartInvesting#PlanYourFuture#InvestmentGoals#FinancialWellbeing#CalculateYourWealth

0 notes

Text

Are you seeking tailored financial guidance in Kingston? Look no further! Our seasoned financial planners are dedicated to crafting personalized strategies to help you achieve your financial goals. for more information visit :

#FinancialPlannerKingston#WealthManagement#FinancialAdvisor#InvestmentPlanning#RetirementPlanning#EstatePlanning#MoneyManagement#PersonalFinance#FinancialGoals

0 notes

Text

Looking to give your children a head start? Prahim Investments has got you covered! Our amazing child plans are designed to help your little ones soar towards their dreams. Let's make their future shine bright together!

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 01204150300

#prahiminvestments#investments#investmentplanning#investmentstrategy#betterfuture#betterfutureofyourchild#educationplanning#EducationInvestment#educationmatters#EducationForAll#educationforkids#educationforallchildren#education#buildingpath#successtips#invest#investinyourself#investinyourfuture

0 notes

Text

Sam Higginbotham Advice on Selecting the Perfect Wealth Advisor

When it comes to managing your finances and planning for the future, selecting the right wealth advisor is crucial. As an entrepreneur and financial advisor, Sam Higginbotham understands the importance of this decision. With his expertise, he offers valuable advice on how to choose the perfect wealth advisor for your needs.

Understanding the Role of a Wealth Advisor

A wealth advisor plays a pivotal role in helping individuals and families achieve their financial goals. From investment planning to retirement strategies, they provide personalized guidance tailored to your unique circumstances and objectives.

With their expertise, you can navigate complex financial landscapes and make informed decisions for a secure financial future.

Sam Higginbotham's Tips for Selecting the Perfect Wealth Advisor

Define Your Goals: Before selecting a wealth advisor, clarify your financial goals and objectives. Whether you're planning for retirement, saving for a major purchase, or building wealth, understanding your priorities will help you find an advisor who aligns with your vision.

Evaluate Credentials and Experience: Look for a wealth advisor with relevant credentials and extensive experience in the financial services industry. Consider certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) as indicators of expertise and commitment to professional excellence.

Assess Communication Style: Effective communication is key to a successful advisor-client relationship. Choose an advisor who listens attentively, explains complex concepts clearly, and keeps you informed about your financial matters.

Consider Fee Structure: Different advisors may have varying fee structures, including hourly rates, flat fees, or a percentage of assets under management. Evaluate these options and choose a fee structure that aligns with your preferences and financial situation.

Seek Personalized Advice: Avoid one-size-fits-all approaches and look for an advisor who offers personalized advice tailored to your specific needs and goals. A customized financial plan will be more effective in helping you achieve your objectives.

Why Sam Higginbotham's Advice Matters

As an entrepreneur and financial advisor, Sam Higginbotham has firsthand experience in navigating the complexities of wealth management. His insights are based on years of experience and a deep understanding of the financial landscape.

By following his advice, you can make a well-informed decision and select the perfect wealth advisor to guide you on your financial journey.

Conclusion

Selecting the perfect wealth advisor is a significant decision that can have a lasting impact on your financial well-being.

By following Sam Higginbotham's advice and conducting thorough research, you can find an advisor who understands your goals and works diligently to help you achieve them. With the right guidance, you can build a secure financial future and enjoy peace of mind knowing your finances are in good hands.

#SamHigginbotham#WealthAdvisor#FinancialPlanning#EntrepreneurAdvice#FinancialAdvisor#WealthManagement#FinancialGoals#InvestmentPlanning#RetirementPlanning#FinancialAdvisorTips#PersonalFinance#MoneyManagement#FinancialLiteracy#FinanceAdvice#WealthBuilding#InvestingTips#FinancialFreedom#FinancialSuccess#WealthCreation#ChooseWisely#MoneyMatters#SmartInvesting#FinancialInsights#ExpertAdvice#SamHigginbothamTips

0 notes

Text

#SIPinvestment#MutualFunds#InvestmentStrategy#FinancialPlanning#PersonalFinance#WealthManagement#LongTermInvesting#MoneyManagement#FinanceTips#InvestmentPlanning#FinancialEducation#Savings#RetirementPlanning#CompoundInterest#PassiveIncome#AssetAllocation#RiskManagement#DollarCostAveraging#InvestmentPortfolio#FinancialLiteracy#InvestmentGoals#FinancialFreedom#SIPcalculator#MutualFundSIP#WealthBuilding

0 notes

Text

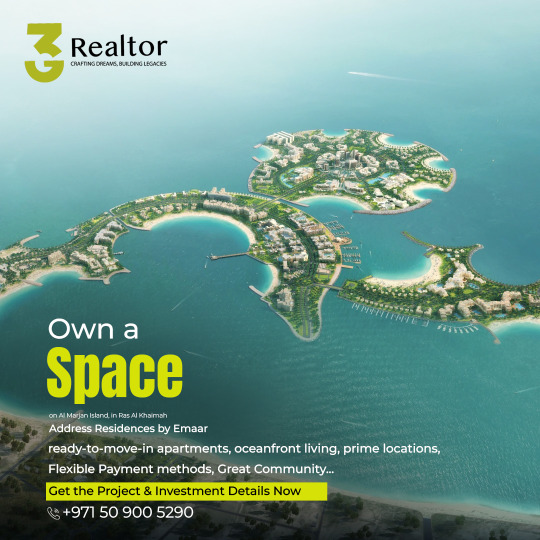

#Unlock your path to prosperity with the best real estate investment opportunities in the UAE! 🏡 Explore strategic property investments in Du#property valuation#and portfolio management services for profitable ventures. 💰 Discover the best residential and commercial real estate investments#guided by the top 10 investment planning strategies. 📊 Mitigate risks with our expert risk assessment in property investments. 🛡️ Explore r#RealEstateInvestment#PropertyConsultants#InvestmentAdvisors#RealtyExperts#StrategicInvestments#ProfitableVentures#InvestmentOpportunities#ResidentialInvestments#CommercialRealEstate#MarketAnalysis#PropertyValuation#PortfolioManagement#InvestmentPlanning#RiskAssessment#WealthBuilding#RentalProperty#MarketTrends#AssetGrowth#PropertyDevelopment#InvestmentStrategies#DubaiRealEstate#UAERealty 🌟

1 note

·

View note

Text

ISPM Financial Services

Your Personalized Financial Solutions Discover how ISPM Financial Services in Aveiro, Portugal can provide personalized investment guidance, retirement planning, debt management, and estate planning.

Their core principles include confidentiality and added value, making them the go-to provider of specialized financial services.

Have a free, in-person consultation with their expert team today.

https://traveljiffy.com.ng/location/ispm-financial-services/

0 notes

Text

This article explores diverse investment strategies tailored to meet the unique needs of NRIs in the US.

0 notes

Text

New Year, New Financial Goal 🌟 As the year winds down, it's the perfect time to review your investment portfolio. With fluctuating interest rates, consider bonds for stable returns. #EndOfYearInvesting #SmartFinance #SageStreetRealty #InvestmentPlanning

0 notes

Text

Chit Funds Demystified A Deep Dive Into Profitable Investment Strategies

Are you an investor searching for a profitable and low-risk investment option? Or maybe you've heard of chit funds but don't fully understand how they work. Either way, this blog post is for you. We'll demystify chit funds, explain how they work, and share profitable investment strategies.

Chit funds are a type of informal saving scheme popular in India. A group of people comes together to pool their money towards a common goal, with one person receiving the lump sum each month. The distribution of the money is decided in advance through an auction or lottery, with the person who bids the lowest percentage of their monthly savings receiving the lump sum that month.

While chit funds can seem risky due to their informal nature, they are regulated by the State governments, and their legality is recognized by the Reserve Bank of India. They are a popular option for individuals looking for a low-risk investment option, especially those who might not have access to traditional banking services.

So, how do you make money from chit funds? There are a few different strategies for maximizing your returns. One is to bid the lowest percentage possible to win the monthly lump sum. This strategy takes patience and involves saving up enough money each month to bid low, but it can result in a significant return on investment.

Another strategy is to join a chit fund that offers a higher interest rate. Some chit funds advertise rates as high as 20%, making them an attractive investment option for those looking to earn a higher return on their savings.

It's essential to do your research before joining a chit fund. Look for a reputable organization with a solid track record of distributing winnings fairly and on time. It's also crucial to understand the terms of the chit fund, Best Investment Plans including how much you'll need to save each month and the length of the investment period.

Finally, understand the risks involved with chit funds. While they are regulated, they're still an informal investment option, and there is always the possibility of fraud or mismanagement. Be sure to read the fine print, ask questions, and choose a chit fund with a proven track record.

Must Read This: How And Why Do Investment Goals Change Over A Person's Lifetime And Circumstances?

Conclusion:

Chit funds are a viable investment option for those looking for a low-risk, informal savings option. By understanding how they work, doing your research, and mitigating risk, you can maximize your returns and earn a profitable investment. So why not consider a chit fund for your next investment option?

0 notes

Text

Financial planning and investment planning are vital components of personal finance, but distinguishing between the two is essential for a secure financial future. Financial planning involves a holistic approach to managing your finances, encompassing budgeting, savings, insurance, and long-term financial goals. Investment planning, on the other hand, centers on allocating your resources into different assets like stocks, bonds, and real estate to maximize returns.

This guide provides an in-depth comparison of financial planning and investment planning, helping you understand their distinct roles and how they work together. Learn how these strategies can enhance your financial well-being, secure your future, and achieve your goals. By the end, you'll be equipped to make informed financial decisions and take control of your financial destiny.

0 notes

Text

निवेश योजना: बचत करें, एहसास करें, परिपक्वता के समय धन प्राप्त करें

नौकरी करते समय हम में से अधिकतर लोग अपने रिटायरमेंट के बाद की जिंदगी को सुरक्षित करने के लिए फाइनेंशियल प्लानिंग करने लगते हैं। अगर आप अपने रिटायरमेंट के बाद की जिंदगी को आर्थिक रूप से सुरक्षित नहीं करते हैं। ऐसे में आपको कई तरह की आर्थिक दिक्कतों का सामना करना पड़ सकता है।

#InvestmentPlanning#SaveInvestRealize#FinancialFreedom#WealthBuilding#SmartInvesting#MoneyAtMaturity#InvestWisely#SecureFuture#GrowYourWealth#PlanForSuccess

0 notes

Text

Don't fall for 'get-rich-quick' schemes! Take your time, do research and make smart choices. Prahim Investments has your back!

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 01204150300

#prahiminvestments#investmentplanning#InvestmentStrategy#invest#getrich#GetRichQuick#taketime#taketimeforyou#DoReserch#smartinvestment#SmartChoice

0 notes

Text

Roadside RetailRetailing … is the NEW Normal- Costas Souris Quality Group

Roadside RetailRetailing … is the NEW Normal

Insights of shoppers, “Roadside retailing is changing fast. It is no longer possible to rely on fuel sales and a limited impulse offering – customers expect much more! - Costas Souris Quality Group

“To thrive, retailers need to use shopper insights and tailor an in-store offering that meets the changing needs of the modern consumer. The modern roadside retailer needs to offer a broad range of products, including fresh produce, covering a variety of meal occasions.

“In short, the roadside retailer of the future should aim not to be a fuel retailer with a grocery offering, but a full-service grocery retailer with a fuel and state-of-the-art rapid electric charging point offering.

The move towards modern state of the art roadside retail infrastructure is a key area of expertise of our UK provider.

The Developer

Established in 2003, and headquartered in Birmingham, the Group has offices in Nottingham and central London and employs over 45 property professionals supported by a high-calibre Property Advisory Board.

Roadside Retail

The Groups commercial division develops and delivers projects for leading brands such as Lidl, McDonald’s, Burger King, Euro Garages, Greggs, Starbucks and Costa Coffee. At the same time the team works closely with electric vehicle charging providers, helping power the UK’s low carbon future.

Non-Bank Lending

Investors, known as non-bank lenders provide funding which enables the Group to secure property opportunities and progress the property projects at pace. The non-bank funding enables early phase development, and the cost of such funding is included in the purchase price paid by future partners and global brands that the Group delivers bespoke turnkey solutions to.

Investors in fixed income by private lending benefit from above average returns with income or deferred income options

Click Steady Fixed Income for a Fixed Term with Protected Capital

By Costas Souris

Quality Group SA

#investmentplanning#personalfinance#fixedincome#income#privatelending#incomeopportunities#passiveincome#incomesource#investment#lucrativeincome#QualitygroupSA#Retirement#Retirementincome#financialfreedom#financialplanning#finance#money#hardcurrency#investing#beatbankrates#fnancialfreedom#buildinghardcurrency#qualitygroupsa#usdinvestment#fixedyieldnotes#buildingwealth

0 notes

Text

#StockMarket#TradingHolidays#FinancialCalendar#MarketClosure#InvestingTips#MarketAnalysis#TradingStrategies#InvestmentPlanning#MarketUpdates#FinancialNews

0 notes

Text

The Ultimate Guide to Real Estate Investing

Welcome to the ultimate guide to real estate investing! If you've ever wondered how to turn properties into profitable assets or are simply curious about this dynamic field, you're in the right place. In this comprehensive guide, we'll take you from novice to savvy investor, exploring everything you need to know about real estate investing.

Understanding the Basics of Real Estate Investment

Before we dive into the depths of real estate investing, it's essential to build a solid foundation of knowledge. Let's start by defining the key concepts:

What is Real Estate Investment? Real estate investment involves acquiring, owning, and managing properties with the primary goal of generating income or realizing long-term capital appreciation.

Types of Real Estate Investments: There are various types of real estate investments, including residential properties like single-family homes and condos, commercial properties like office buildings and retail spaces, and Real Estate Investment Trusts (REITs), which allow you to invest in real estate without owning physical properties.

Getting Started in Real Estate Investing

1. Setting Clear Goals: Define your investment objectives. Are you looking for steady rental income, or do you want to flip properties for quick profits? Having clear goals will help you choose the right path.

2. Understanding Financing Options: Financing plays a crucial role in real estate. Learn about mortgage rates, down payments, and loan types to determine the best financial approach for your investments. Mortgage Rates Explained

3. Choosing the Right Location: Location is key in real estate. Research areas with growth potential, good schools, and low crime rates. These factors can significantly impact your investment's success.

4. Property Selection: Whether you're buying a fixer-upper or a turnkey property, conducting thorough inspections is crucial. Use this Property Inspection Checklist to ensure you don't overlook essential details.

Real Estate Investment Strategies

Now that you're equipped with the basics, let's explore some popular investment strategies:

Buy and Hold: This strategy involves purchasing a property and holding it for an extended period, usually renting it out. It's a great way to build long-term wealth through rental income and property appreciation.

House Flipping: House flipping is the art of buying distressed properties, renovating them, and selling them for a profit. Learn from success stories to understand the ins and outs of this strategy.

Real Estate Crowdfunding: For those with limited capital, real estate crowdfunding allows you to pool resources with other investors to fund larger projects. Explore platforms that facilitate this collaborative approach, such as Real Estate Crowdfunding Platforms.

Managing Your Real Estate Investments

Successful real estate investing goes beyond acquisition; it involves effective management. Here are some tips:

Tenant Screening: Screening tenants is essential to ensuring a reliable income stream and protecting your property. Follow this guide to conduct thorough tenant screenings.

Property Maintenance: Regular maintenance is key to preserving your property's value. Create a maintenance schedule to address issues promptly.

Risk Management: Every investment carries risks. Learn about the potential risks associated with real estate investing and strategies to mitigate them. Check out this article on Real Estate Investment Risks.

Diversifying Your Real Estate Portfolio

As you gain experience, consider diversifying your portfolio to spread risk:

Commercial Real Estate: Explore opportunities in the commercial sector, such as office buildings or retail spaces, to balance your portfolio.

International Investments: Investing in international markets can provide exposure to different economic cycles and opportunities for growth. Learn more about global real estate markets.

Conclusion

Real estate investing offers a world of opportunities for those willing to learn and take calculated risks. By understanding the fundamentals, choosing the right strategy, and continuously educating yourself, you can embark on a rewarding journey towards financial success.

So, whether you're a budding investor or looking to expand your real estate portfolio, remember that knowledge is your most valuable asset in this dynamic field. Happy investing!

Disclaimer: This article provides general information and should not be considered financial or investment advice. Always consult with a financial professional before making investment decisions.

Read the full article

#Cashflow#financialfreedom#Investmentplanning#Investmentproperties#Investmentstrategies#Passiveincome#Propertyinvestment#Propertymanagement#Propertyvaluation#Realestateanalysis#Realestateassets#Realestatediversification#Realestateinvesting#Realestatemarket#RealestateROI#Realestatewealth#Rentalproperties#Riskmanagement#Ultimateguide#wealthbuilding

0 notes