#AssetAllocation

Text

#529Plan#AssetAllocation#CryptoInvesting#Diversification#DividendInvesting#FinancialAdvice#FinancialAdvisor#FinancialEducation#FinancialGoals#FinancialPlanning#HighYieldSavings#InvestmentOptions#InvestmentPortfolio#PassiveIncome#PeerToPeerLending#RealEstateInvesting#RetirementPlanning#RoboAdvisors#RothIRA#SavingsStrategies#SideBusiness#StockMarket#StocksAndBonds#WealthManagement#Investing#SHARE.#Facebook#Twitter#Pinterest#LinkedIn

2 notes

·

View notes

Text

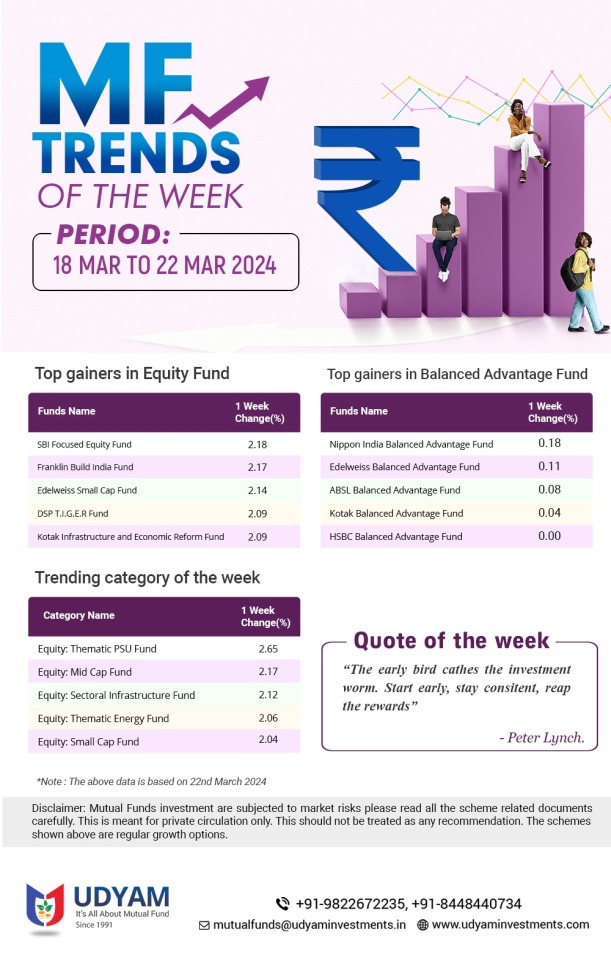

#udyaminvestments#mutualfunds#investment#mutualfundssahihai#udyamitsallaboutmutualfunds#assetallocation#investmentawareness#sip#wisedecisions

0 notes

Text

Navigating Investment Portfolio Management with IMF Pvt Ltd Financial Consultants

Investing can be a daunting task, especially when it comes to managing a diverse portfolio of assets. With so many investment options available, it's easy to feel overwhelmed and unsure of where to start. That's where IMF Pvt Ltd Financial Consultants come in. Our team of experienced advisors specializes in helping clients navigate the complexities of investment portfolio management, offering expert guidance and personalized strategies to help you achieve your financial objectives. In this guide, we'll delve into the world of investment portfolio management and explore how our consultants can help you optimize your investment portfolio for long-term success.

Understanding Investment Portfolio Management

Investment portfolio management is the process of strategically allocating assets to achieve specific financial objectives while minimizing risk. It involves carefully selecting a mix of investments, such as stocks, bonds, mutual funds, and alternative assets, and periodically rebalancing the portfolio to maintain the desired asset allocation.

Developing a Personalized Investment Strategy

One of the key roles of IMF Pvt Ltd Financial Consultants is to help clients develop a personalized investment strategy tailored to their unique financial goals, risk tolerance, and time horizon. By taking the time to understand your individual needs and objectives, our consultants can recommend a diversified portfolio mix designed to maximize returns while minimizing volatility.

Monitoring and Adjusting Your Portfolio

Effective investment portfolio management doesn't end with the initial allocation of assets. It requires ongoing monitoring and periodic adjustments to ensure that your portfolio remains aligned with your objectives and market conditions. IMF Pvt Ltd Financial Consultants provide regular portfolio reviews and recommendations to help you stay on track and adapt to changing market dynamics.

In conclusion, effective investment portfolio management is essential for achieving long-term financial success. With the guidance of IMF Pvt Ltd Financial Consultants, you can navigate the complexities of investing with confidence and peace of mind. Whether you're saving for retirement, funding your child's education, or building wealth for the future, our team is here to help you develop a personalized investment strategy that aligns with your goals and aspirations. Contact us today to schedule a consultation and take the first step towards optimizing your investment portfolio.

#InvestmentPortfolioManagement#FinancialConsultants#IMFPvtLtd#AssetAllocation#InvestmentStrategy#Diversification#TaxEfficiency#EconomicTrends#ESGInvesting

0 notes

Text

Video: How I built my portfolio

The video looks at #assetallocation, as suggested by the #riskprofile, #timeframe and #return. I also share my own #portfolio classifications, and how I organize my portfolio.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

Visit: http://www.canadianmoneytalk.caThe Investing & Personal Finance Basics course is at…

View On WordPress

0 notes

Text

Learn how real estate offers long-term growth, while mutual funds provide diversification and expert management. Tailor your investment strategy to match your goals, risk tolerance, and time horizon. Unlock the potential of both worlds – read the full analysis at HavenDaxa Blog

#RealEstateInvesting#MutualFunds#InvestmentOptions#FinancialPlanning#Diversification#WealthBuilding#InvestmentStrategies#RiskManagement#LongTermInvesting#PersonalFinance#MoneyManagement#AssetAllocation#PropertyInvestment#PortfolioDiversification#InvestmentTips#fractionalownership#fractional ownership#investment#commercial fractional ownership#commercial real estate development#commercial property#havendaxa#realestate#commercialrealestate

0 notes

Text

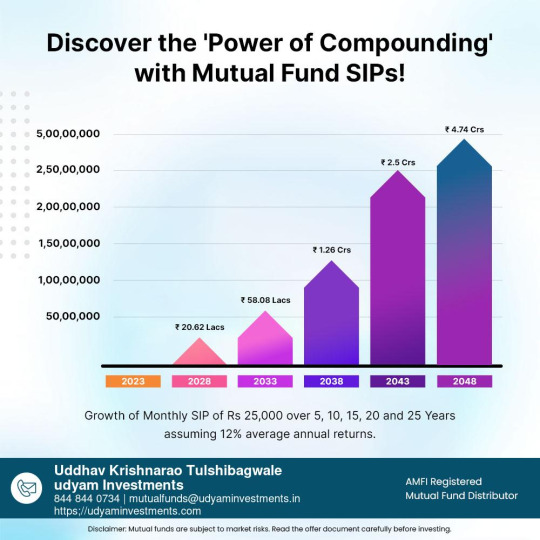

#SIPinvestment#MutualFunds#InvestmentStrategy#FinancialPlanning#PersonalFinance#WealthManagement#LongTermInvesting#MoneyManagement#FinanceTips#InvestmentPlanning#FinancialEducation#Savings#RetirementPlanning#CompoundInterest#PassiveIncome#AssetAllocation#RiskManagement#DollarCostAveraging#InvestmentPortfolio#FinancialLiteracy#InvestmentGoals#FinancialFreedom#SIPcalculator#MutualFundSIP#WealthBuilding

0 notes

Text

Pioneers in Actuaries & Consultants, KGA has a strong presence in 5 location serving 2500+ clients across India.

Pioneers in Financial Planning, we provide our clients with Financial planning, Insurance Advisory and Investment Planning and Implementation to help them develop a competitive edge and achieve their goals.

To know more, please visit: kapadiaglobal.com

#Kapadia#KGA#FinancialSolutions#WealthManagement#Insurance#Valuation#InsuranceConsulting#AssetAllocation#Derivatives#F&O#Investment#Finance#Money#FinancialPlanner#FinancialAdvisor

0 notes

Text

Dive into our latest article on 'Diversification as a Cornerstone of Effective Portfolio Management.' Uncover the strategic significance of diversification across asset classes, sectors, and geographies to master the art of risk management and return maximization. Learn about the evolving strategies in diversification, the importance of rebalancing, and how to adapt to global market changes. A must-read for savvy investors and finance professionals.

#InvestmentStrategy#PortfolioManagement#Diversification#FinancialMarkets#AssetAllocation#RiskManagement#MarketTrends#InvestmentSuccess#upcomingtradera#futures trading#day trading#investing#finance#financial literacy#investments#investors#personal finance

0 notes

Text

Optimizing Investments: A Guide to Portfolio Management" offers a comprehensive roadmap for individuals seeking to maximize their investment potentials. This guide dives deep into the principles and strategies of portfolio management, providing valuable insights into asset allocation, risk assessment, and diversification techniques.

#InvestmentOptimization#PortfolioManagementGuide#FinancialStrategy#DiversificationTechniques#AssetAllocation#RiskAssessment#FinancialGoals

0 notes

Text

Cost Segregation Service Helps Commercial Property Owners Recoup Depreciation On A Faster Schedule With Reclassification.

Our Cost Segregation service if one of three flagship services making up our Specialized Incentives.

Cost Segregation is an engineering based study that permits commercial real estate owners to reclassify real property for depreciation purposes and reclassify it as more rapidly depreciating personal property. This reclassification results in significant cash flow benefits in both present and…

View On WordPress

#AcceleratedDepreciation#AssetAllocation#AssetOptimization#BuildingDepreciation#CommercialProperty#CommercialRealEstate#CostSegregation#CostSegServices#Depreciation#DepreciationStudy#IRSCompliance#PropertyTax#RealEstateInvesting#RealEstateTax#TaxBenefits#TaxCode#TaxDeductions#TaxPlanning#TaxSavings#TaxStrategy

0 notes

Text

Mastering Diversification: Your Key to Investment Success

Investing wisely is a bit like cooking up the perfect recipe. It requires the right ingredients, precise measurements, and a pinch of strategy. One essential ingredient in the recipe for investment success is diversification. In this article, we’ll explore the art of diversification and how it can help you achieve your financial goals.

What is Diversification?

Diversification is the practice of…

View On WordPress

0 notes

Text

#udyaminvestments#mutualfunds#investment#mutualfundssahihai#udyamitsallaboutmutualfunds#assetallocation#investmentawareness#wisedecisions#sip

0 notes

Text

Building a Strong Financial Foundation for Your Future

Introduction

Financial planning for the future is a critical component of securing a comfortable and prosperous life. It involves setting specific goals, managing your income, and making informed decisions about savings and investments. In a world of economic uncertainty and rapidly changing financial landscapes, having a well-thought-out financial plan is more important than ever.

Your financial future depends on the choices you make today. Whether you're looking to retire comfortably, buy a home, fund your child's education, or simply achieve financial security, strategic financial planning is the key to realizing your dreams. This article explores the importance of financial planning and provides practical guidance on how to create a robust financial plan for your future.

The Significance of Financial Planning

Financial planning is the process of assessing your current financial situation, identifying your financial goals, and developing a comprehensive strategy to achieve those goals. Here are some compelling reasons why financial planning is essential for your future:

Goal Achievement: Financial planning allows you to set clear objectives and work towards them systematically. It helps you prioritize what's most important, whether it's building wealth, buying a home, or saving for retirement.

Risk Mitigation: An effective financial plan includes strategies for managing and mitigating financial risks. This can involve creating an emergency fund, securing insurance, and diversifying investments to protect your assets.

Wealth Accumulation: Through careful investment and savings strategies, financial planning can help you accumulate wealth over time. This wealth can provide financial security and support your long-term goals.

Retirement Planning: Planning for retirement is a critical aspect of financial planning. It ensures that you have the resources needed to maintain your desired lifestyle when you stop working.

Budget Management: Financial planning helps you create a budget that aligns with your financial goals. This ensures that you have enough money to cover your expenses, save, and invest.

Steps in Financial Planning

Creating a sound financial plan involves several key steps:

Assess Your Current Financial Situation: Begin by evaluating your current income, expenses, assets, and liabilities. This forms the foundation of your financial plan.

Set Clear Goals: Determine what you want to achieve with your finances. Goals could include buying a home, paying off debt, saving for your children's education, or building wealth.

Budgeting: Develop a realistic budget that outlines your income and expenses. This will help you understand where your money is going and how much you can save.

Emergency Fund: Set aside an emergency fund to cover unexpected expenses, like medical bills or car repairs. Aim to have three to six months' worth of living expenses saved.

Investments: Create an investment strategy that aligns with your risk tolerance and financial goals. Diversify your investments to spread risk.

Insurance: Ensure you have adequate insurance coverage to protect yourself and your family in case of unforeseen events.

Review and Adjust: Regularly review and update your financial plan to account for changes in your life, financial goals, or the economic environment.

Conclusion

Financial planning for the future is a vital component of building a secure and prosperous life. It empowers you to set and achieve your financial goals, manage risks, accumulate wealth, and ensure a comfortable retirement. By following the steps outlined in this article and regularly reviewing your financial plan, you can take control of your financial future and work towards the life you've always envisioned. Don't wait; start planning for your future today. Your financial well-being depends on it.

#FinancialPlanning#FutureFinancialGoals#WealthManagement#RetirementPlanning#Budgeting#InvestmentStrategies#EmergencyFund#FinancialSecurity#FinancialWellness#SmartMoney#MoneyMatters#SavingsGoals#InsuranceCoverage#FinancialSuccess#BudgetManagement#FinancialFreedom#AssetAllocation#FinancialEducation#EconomicSecurity#FinancialFuture

0 notes

Text

Sigma Consultants your ultimate partner in business funding and growth. Unlock your financial potential with our expert fund consultancy services; Get started today and enjoy a complimentary portfolio analysis.

Mob. +918127569832, +918009543832

Visit here: sigmaconsultants.net.in

E-mail: [email protected]

Add: B2/0616, 6th floor,DLF Mypad, Vibhuti Khand, Gomti Nagar, Lucknow, Uttar Pradesh -226010.

#FundConsulting#InvestmentStrategies#FinancialAdvisor#WealthManagement#AssetAllocation#PortfolioManagement#InvestmentInsights#RiskManagement#CapitalAllocation#FinanceExperts

0 notes

Text

Navigating the Numbers: How to Analyze Mutual Fund NAVs to Identify the Best Mutual Funds

Picking the best mutual funds to invest in can seem like a daunting task for many investors. With thousands of mutual funds to choose from, how do you narrow down the options and identify funds that are likely to outperform? One useful tool is analyzing a mutual fund's net asset value (NAV). Understanding how to read and assess NAVs can provide valuable insights into a fund's performance and help investors make informed investment decisions.

The NAV is the per-share value of the mutual fund's investments. It is calculated by taking the total value of the securities held by the fund and dividing it by the number of outstanding shares. Mutual fund NAVs fluctuate daily as the prices of the underlying securities change. Tracking NAV trends over time can reveal a lot about how skilled a fund manager is and the fund's growth prospects.

When analyzing MF NAVs, investors should start by looking at the fund's historical NAV patterns. Consistent growth in NAV over the long term indicates that the fund manager has been making wise investment choices and benefiting from rising share prices. Meanwhile, drastic NAV drops or periods of stagnant NAV growth could signal issues like poor stock selection or high fees dragging down returns. Comparing NAV trends to overall market performance benchmarks can also help assess whether a fund is simply riding wider market growth or genuinely outperforming.

Digging deeper into the drivers behind NAV movements is also important. Was a spike in NAV tied to gains in a few star holdings or broad growth across assets? Did a drop result from market volatility or manager mistakes? Understanding the context behind NAV patterns provides insight into the fund manager's strategy and decision-making.

Investors should also compare NAV growth rates across similar funds in the same category. If a large cap equity fund's NAV rose 12% over the past year while its peers averaged 15% growth, it may indicate the fund is lagging behind the competition. Checking NAV growth versus category benchmarks helps investors spot top-performing funds.

By regularly analyzing and comparing MF NAVs, investors can spot winning funds with skilled managers and strong recent returns. Focusing on long-term NAV growth rates, examining what's driving NAV movements and benchmarking against similar funds ensures you pick funds poised for sustained success. Assessing MF NAVs takes a bit of work, but it enables making wise investment choices that pay off over time.

#MutualFunds#Investing#FinancialPlanning#TopFunds#SIP#Diversification#WealthManagement#SmartInvesting#LongTermInvesting#AssetAllocation#nav

0 notes

Text

Pioneers in Financial Planning

we provide our clients with Financial planning, Insurance Advisory and Investment Planning and Implementation to help them develop a competitive edge and achieve their goals.

To know more, please visit: kapadiaglobal.com #Kapadia #KGA #FinancialSolutions

#WealthManagement#Insurance#Valuation#InsuranceConsulting#AssetAllocation#Derivatives#F&O#Investment#Finance#Money#FinancialPlanner#FinancialAdv

0 notes