#PortfolioDiversification

Text

Safe Investment: Unveiling the Reasons for Purchasing Silver Coins

For a very long time, people have recognized the value of silver as a means of wealth preservation. Due to their portability, liquidity, and resistance to inflation, silver coins are a beloved investment option. They provide capital returns and growth. Due to the scarcity of limited editions, silver coins are excellent investments for both amateurs and experts. Plus, they're physically present, which is reassuring. The value of culturally significant coin collections has risen due to the widespread use of silver in trade throughout human history. Silver stock prices will likely keep going up, according to numismatic experts, because of fundamental difficulties. There are several good reasons why you should buy silver coins. Silver coins, with their inherent value, provide a sense of stability and security in an unpredictable economic world. Let’s discuss the benefits of investing in silver coins in more detail.

Diversification

A mixed-asset portfolio can benefit from silver's hedging and balancing qualities, thanks to the precious metal's reputation as a safe haven. With an allocation of silver, an investor can potentially diversify their portfolio risk, allowing them to raise their risk appetite in other asset classes. The recent global recession has put traditional paper assets at risk, so owning actual silver in the shape of coins or bars is an extra layer of protection.

Silver is a Hard Asset

In a world where paper earnings, digital trade, and currency production are commonplace, actual silver stands out as one of the rare assets that can be carried in your pocket, even between countries. And it can remain completely discreet, if that is what you prefer. If you buy silver coins, it is another powerful defense against cybercrime and hacking. A silver coin is impervious to erasure, whereas a digital asset is equally susceptible.

Protection Against Inflation

In times of economic instability and inflation, silver, like most physical commodities, can serve as a shelter. Silver coins can be a good inflation hedge, meaning that even if the value of fiat money, equities, and bonds decreases, your silver coins and bars will gain in value.

Offer Higher Returns

Compared to gold, silver is far more inexpensive, yet it yields greater returns. When silver prices start to go up, you can anticipate a bigger percentage gain. When it comes to short-term speculative investments, silver has historically performed better than gold during bull runs. One strategy for investors is to hold a higher percentage of silver and a lower percentage of gold.

Control

You can protect some of your wealth from the many counterparty risks faced by banks by purchasing silver in the form of coins or bars. This is one of silver's benefits that a lot of investors fail to see.

The Takeaway

Value, collectability, liquidity, performance history, and portfolio diversification are just a few of the reasons why the silver coin is an outstanding investment. These coins offer unfaltering stability in the ever-changing financial world, making them ideal for anyone seeking to protect funds or increase their investment opportunities. Before moving forward with any investment choices, you should do your research and talk to professionals like Global Gold Investments. Due to their combined 25 years of expertise in the gold and commodities markets, many investors have put their faith in Global Gold Investments members to buy silver coins. Even if you want to sell silver coins in Beverly Hills, CA, you can contact Global Gold Investments.

0 notes

Text

Why Real Estate Debt Funds are an Investor's Hidden Gem

Discover why real estate debt funds are considered a hidden gem for investors. This article sheds light on the benefits of investing in real estate debt funds, including regular income, lower risk compared to equity investments, and portfolio diversification. Understand how these funds operate, the types of loans they invest in, and the potential returns they offer. Whether you're a seasoned investor or exploring new opportunities, this guide provides valuable insights into the advantages of real estate debt funds.

Uncover the benefits of real estate debt funds for investors at ReRx Funds.

#RealEstateDebtFunds#InvestmentOpportunities#RegularIncome#PortfolioDiversification#LowerRiskInvesting

0 notes

Text

Navigating the Financial Seas: Diving into Portfolio Diversification 🌊💼

Hey Tumblr fam! Today, let's sail through the fascinating waters of portfolio management and explore the crucial concept of diversification. 🚢⚓️

📊 Understanding Diversification: Picture your investment portfolio as a ship navigating the unpredictable seas of the financial markets. 🌊📈 Diversification is like having multiple sails – it's the strategy of spreading your investments across different asset classes, industries, and regions to reduce risk and maximize returns.

💼 Managing Risk: By diversifying your portfolio, you're essentially minimizing the impact of any single investment's performance on your overall returns. 🎯 If one sector or asset class experiences turbulence, the others can help keep your ship steady.

🌍 Global Exposure: Diversification isn't just about investing in different stocks. It's also about venturing into various geographic regions and currencies. 🌏 This global exposure can help mitigate risks associated with localized economic downturns or political instability.

🔍 Analyzing Impact: When analyzing the impact of diversification on portfolio management, consider factors like correlation among assets, risk tolerance, and investment goals. 📊💡 A well-diversified portfolio can potentially enhance long-term performance while minimizing volatility.

📈 Maximizing Returns: While diversification aims to reduce risk, it doesn't mean sacrificing returns. 💰 In fact, by strategically allocating assets across a diversified portfolio, you can optimize the risk-return tradeoff and potentially achieve better overall performance.

🚀 Takeaway: Diversification isn't just a buzzword – it's a fundamental principle of prudent investing. ⚖️ Whether you're a seasoned investor or just dipping your toes into the financial waters, understanding and implementing diversification can help steer your portfolio towards smoother sailing and greater financial success.

So there you have it, a deep dive into the impact of diversification on portfolio management. 🌊💼 Feel free to share your thoughts and experiences in the comments below! Let's navigate this journey together! 🚀💬

#FinancialWisdom#Investing101#finance#payment system#thefinrate#PortfolioDiversification#financialinsights

0 notes

Text

In Zeiten wirtschaftlicher Unsicherheit wird die Frage, wo man seine Ersparnisse parken soll, immer wichtiger.

Im Bereich der finanziellen Entscheidungen gibt es eine immerwährende Debatte, die immer wieder für Kontroversen sorgt: Bargeld oder Gold? Beide spielen in der Weltwirtschaft eine wichtige Rolle, haben jedoch unterschiedliche Eigenschaften, die verschiedene Anleger und Wirtschaftsideologien ansprechen. Goldinvestitionen sind in den letzten Jahren jedoch immer beliebter geworden - vor allem wegen der einzigartigen Vorteile, die sie in jeder Wirtschaftslage bieten.

Die Entscheidung, ob man in Gold oder Bargeld spart, ist eine persönliche Entscheidung. Dennoch ist das Sparen in Gold im Moment eine sehr attraktive Option. Hier sind ein paar Gründe dafür:

1. Gold wirkt als Absicherung gegen die Inflation, Bargeld nicht.

2. Gold kann Ihr Portfolio diversifizieren, Bargeld aber nicht

3. Im Gegensatz zu Bargeld ist Gold ein Wertbewahrungsmittel

Bargeld hat eine schlechte Haltbarkeit. Papiergeld verschlechtert sich mit der Zeit und muss ersetzt werden. Gold glänzt in puncto Haltbarkeit. Es korrodiert nicht, läuft nicht an und zerfällt nicht mit der Zeit.

Letztendlich hängt die Entscheidung, ob Sie in Gold oder Bargeld sparen, von Ihren individuellen finanziellen Umständen und Zielen ab. Bevor Sie eine Entscheidung treffen, sollten Sie sich jedoch gründlich informieren und eine fundierte Entscheidung treffen, die Ihren finanziellen Zielen entspricht.

Wenden Sie sich an die GOLDINVEST Edelmetalle GMBH für Ihre Gold- und andere Edelmetallanlagen.

#goldinvest#gold#Bargeld#inflationprotection#portfoliodiversification#goldkaufen#TrustedGoldSeller#trustedshop

0 notes

Text

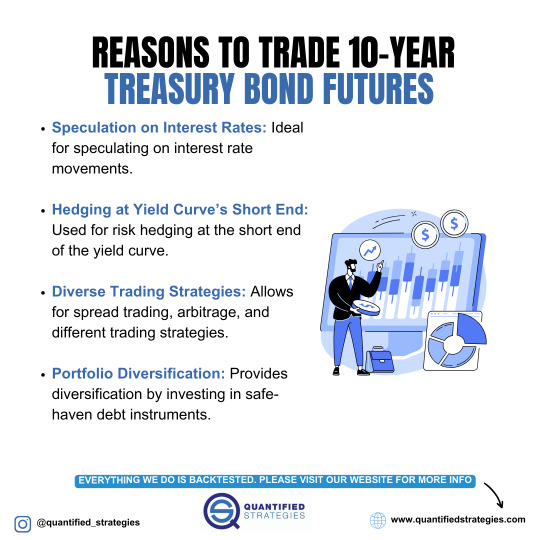

REASONS TO TRADE 10-YEAR TREASURY BOND FUTURES

Trading 10-Year Treasury Bond Futures offers opportunities for speculating on interest rate movements and hedging risks at the short end of the yield curve. With diverse trading strategies like spread trading and arbitrage, it facilitates portfolio diversification through safe-haven debt instruments.

0 notes

Text

Learn how real estate offers long-term growth, while mutual funds provide diversification and expert management. Tailor your investment strategy to match your goals, risk tolerance, and time horizon. Unlock the potential of both worlds – read the full analysis at HavenDaxa Blog

#RealEstateInvesting#MutualFunds#InvestmentOptions#FinancialPlanning#Diversification#WealthBuilding#InvestmentStrategies#RiskManagement#LongTermInvesting#PersonalFinance#MoneyManagement#AssetAllocation#PropertyInvestment#PortfolioDiversification#InvestmentTips#fractionalownership#fractional ownership#investment#commercial fractional ownership#commercial real estate development#commercial property#havendaxa#realestate#commercialrealestate

0 notes

Text

"Your Gateway to the Crypto Universe: Start Trading Now!"

"Embark on your crypto journey with us! Our exchange platform offers a gateway to the vast world of digital currencies. Trade securely, access real-time market data, and diversify your portfolio effortlessly."

0 notes

Text

Ethereum Price Analysis: Long-Term Resistance and Short-Term Challenges

Ethereum's Journey Beyond Fibonacci Resistance

Stay updated on the latest Ethereum updates and cryptocurrency market analysis as Ethereum breaks through long-term Fibonacci resistance, signaling potential bullish momentum.

Breakthrough and Challenges

Explore Ethereum's recent breakthrough above the Fibonacci resistance line and its subsequent challenges. While Ethereum closed above the resistance, short-term Fibonacci levels have hindered further growth, prompting a closer look at market dynamics.

Technical Insights and Analyst Views

Gain insights from technical analysis as Ethereum's price movement interacts with Fibonacci levels. Discover perspectives from crypto analysts, including predictions of a bullish trend continuation and cautionary notes about potential selling pressure from Ethereum co-founder's asset movements.

Chart Analysis and Future Trajectory

Analyze Ethereum's price trajectory based on chart patterns and Fibonacci retracement levels. Assess potential scenarios, including a bullish breakout towards $3,000 or a pullback towards intermediate support levels, and understand the implications for traders and investors.

Risk Management and Disclaimer

Understand the importance of risk management in crypto investments and stay informed about market trends and price forecasts. Remember to conduct thorough research and exercise caution when making investment decisions.

Read the full article

#Altcoinscomparison#Bitcoinvs.Ethereum#CryptocurrencyConferences#Cryptocurrencyinvestmenttips#Cryptocurrencywallets#Exchangesecuritymeasures#Fundamentalanalysis#ICOreviews#Interviewswithindustryexperts#Long-termvs.short-terminvestments#Marketforecasts#Meetupsandevents#Newblockchainstartups#Portfoliodiversification#Privacy-focusedcryptocurrencies#Projectpartnerships#RegulatoryUpdates#Riskmanagementincrypto#Stablecoinsoverview#TechnicalAnalysis#Tokensales#Two-factorauthentication(2FA)

0 notes

Text

#EnergyInvestment#InstitutionalInvesting#PortfolioDiversification#EnergyAssets#FamilyOffices#Advisors#Producers#Sellers#CommodityExposure#AssetMonetization

0 notes

Text

Smart Share Trading: How to Make the Right Moves for Your Money

#buyingshares #disciplinedapproach #dollarcostaveraging #financialobjectives #industrytrends #investmentgoals #investmentknowledge #marketvolatility #optimalnumberofshares #portfoliodiversification #risktolerance #sellingshares #sharetrading #timehorizon

#Business#buyingshares#disciplinedapproach#dollarcostaveraging#financialobjectives#industrytrends#investmentgoals#investmentknowledge#marketvolatility#optimalnumberofshares#portfoliodiversification#risktolerance#sellingshares#sharetrading#timehorizon

0 notes

Text

Which Silver Coin Types Are Good for Investing?

Invest in collectible silver coins such as the American Silver Eagle, Silver Canadian Maple Leaf, Austrian Silver Philharmonic, Australian Silver Kangaroo, and Chinese Silver Panda to diversify your holdings and safeguard your investment. Seek advice from professionals such as Global Gold Investments for safe and informed investing decisions.

0 notes

Text

A well-balanced portfolio that can withstand market fluctuations and help you reach your long-term investment goals with less risk. Understand more about mutual funds and invest better with us!

0 notes

Text

Navigating the Small-Cap Terrain: Opportunities or Pitfalls for Equity Investors?

Are small-cap stocks potential goldmines or treacherous territories? Investing in the small-cap segment often presents a tantalizing mix of lucrative opportunities and substantial risks. According to financial experts, treading this path demands strategic and cautious approaches for investors seeking to navigate the equity bourses successfully.

What Defines Small Caps in the Equity Market?

Expert Perspectives on Small-Cap InvestingA Balancing Act of Risk and Reward

Current Scenario and Market Dynamics

Growth Potential and Opportunities Ahead

Unveiling Alpha: Small and Mid-Cap Opportunities

Strategies for Navigating the Small-Cap OceanAssessing Information and Quality of Data

Strategic Portfolio Allocation

Investing in Small Caps: MF Route or Direct Investment?

Actively Managed vs. Passive Funds

Conclusion: Navigating Risks in Small Caps

A Prudent Approach for Investors

What Defines Small Caps in the Equity Market?

Small caps essentially denote stocks listed on exchanges with a market capitalization below ₹5,000 crore. These stocks, while carrying immense potential for substantial returns, are also prone to heightened fluctuations and risks compared to larger counterparts.

Expert Perspectives on Small-Cap Investing

A Balancing Act of Risk and Reward

Anil Ghelani, Head of Passive Investments & Products at DSP Mutual Fund, emphasizes the potential for higher returns in the long term within the small-cap space. However, he cautions that they also carry the risk of greater declines compared to larger stocks during market downturns.

Current Scenario and Market Dynamics

In the current market landscape, Pankaj Shrestha, Head of Investment Services at Prabhudas Lilladher Wealth, believes that the risk-reward equation appears more favorable for large-cap indices compared to their small-cap counterparts in the upcoming year.

Growth Potential and Opportunities Ahead

Despite these nuances, Amar Ranu, Head of Investment Products & Insights at Anand Rathi Shares and Stock Brokers, foresees a potential movement of 12-15% in the small-cap space in the next year. Factors such as anticipated earnings growth and decreased raw material costs could contribute to this potential upswing.

Unveiling Alpha: Small and Mid-Cap Opportunities

Deepak Jasani, Head of Retail Research at HDFC Securities, highlights the possibility of gaining alpha (profit) within the small and mid-cap segments. However, he notes that larger indices like the Nifty may outperform these segments in certain periods.

Strategies for Navigating the Small-Cap Ocean

Assessing Information and Quality of Data

Sriram BKR, Senior Investment Strategist at Geojit Financial Services, underscores the challenge of evaluating data quality in the less-researched small-cap universe. Even relying on research or brokerage house recommendations may not provide comprehensive insights for retail investors.

Strategic Portfolio Allocation

Amar Ranu suggests maintaining a balanced portfolio across large-cap, mid-cap, and small-cap stocks. He recommends a mix of 50-60% in large caps and 20-25% each in mid and small caps, adjusting allocations tactically based on opportunities and valuations.

Investing in Small Caps: MF Route or Direct Investment?

For retail investors less confident in stock picking or lacking expertise in equity research, experts advise considering the mutual fund (MF) route. This avenue offers diversification, professional management, and controlled exposures to mitigate volatility.

Actively Managed vs. Passive Funds

While actively managed funds may outperform benchmarks, the choice between actively managed and passive funds in the small-cap space remains crucial. Actively managed funds offer information arbitrage but might not consistently outperform, whereas passive funds through SIPs present a prudent, low-cost approach.

Conclusion: Navigating Risks in Small Caps

Small caps' vulnerability to external shocks due to limited resources and market capitalization cannot be overlooked. These factors can disrupt operations and impact smaller companies more severely than larger counterparts, highlighting the need for cautious navigation in this segment.

A Prudent Approach for Investors

Given the potential for substantial gains alongside inherent risks, a balanced and strategic approach, combined with a mix of actively managed and passive funds, could offer a prudent path for investors eyeing the small-cap segment.

Read the full article

#ActivelyManagedFunds#EquityInvestment#FinancialMarkets#Investmentstrategies#MarketCapitalization#MarketVolatility#MutualFunds#PassiveFunds#Portfoliodiversification#Riskmanagement#Small-CapStocks

0 notes

Text

"Alternative Investment Funds (AIFs)" are the dynamic and diverse force behind modern investment portfolios. This guide unravels the complexities of AIFs, offering insights into this innovative approach to wealth management.

Explore the world of alternative investments, from private equity and hedge funds to real estate and venture capital. AIFs provide a platform for diversifying portfolios and managing risk, often offering non-traditional asset classes with unique risk-return profiles.

Learn about the investment strategies, structures, and regulatory frameworks that govern AIFs, shaping the landscape of financial innovation. AIFs are redefining traditional investment norms, catering to investors seeking higher returns, lower correlation with conventional markets, and enhanced wealth management solutions.

Join us as we demystify the potential of AIFs and how they can be leveraged to optimize your investment strategies, opening doors to new opportunities in the ever-evolving world of finance.

#AIFs#AlternativeInvestments#PortfolioDiversification#InvestmentStrategies#WealthManagement#FinancialInnovation

0 notes

Text

CRAFTING AN EFFECTIVE STRATEGY PORTFOLIO

Discover the significance of crafting an effective strategy portfolio in both long-term investing and short-term trading. Diversification goes beyond asset classes, emphasizing the importance of avoiding overlap and reduced performance when running multiple similar strategies in one market. The holy grail in trading lies in the accumulation and trading of diverse, well-structured strategies across various markets and instruments.

0 notes

Text

#FinancialServices#ICICIDirectPartner#StockMarketTrading#DematAccount#InvestmentOpportunities#WealthManagement#FinancialSuccess#ExpertFinancialAdvice#TradingAccount#SecureInvestments#FinancialPartnership#FinancialFreedom#SmartInvesting#ICICIDirectResources#PortfolioDiversification#FinancialGoals#DematAccountOpening#InvestmentPlanning#StockMarketAccess#WealthGrowth#ExpertiseInFinance#TradingOpportunities#FinancialConsultation#ICICIDirectSupport#TradingSolutions#ICICIDirectTools#FinancialEmpowerment#SecureAssetHolding#InvestWithConfidence#ICICIDirectPartnership

1 note

·

View note