#SIPcalculator

Link

The Mutual Fund Calculator - Calculate the rough estimate of SIP returns on Motilal Oswal MF SIP Calculator. Click to know more!

0 notes

Text

Mutual fund calculator - A Deeper Insight

There are different traditional and non-traditional investment instruments in India. Many people invest in traditional instruments such as FDs, RDs, and more. However, over the course of years, non-traditional instruments such as mutual funds have become popular too. Mutual funds are accessible and that’s why, even people from rural India are now investing in mutual funds. Despite all the popularity, there are still many who don’t understand mutual funds completely. In today’s blog, we will discuss everything about mutual funds:

A mutual fund is a pool of money collected by investors to purchase a range of securities and is managed by professionals. The returns are then distributed amongst all investors after standard deductions. This way, the investor can benefit from the market while not being actively involved in investments.

Some of the most important benefits of mutual funds include:

Risk management: Mutual funds are managed by experts who understand the market and thus, take wise investment decisions. These decisions keep in mind the risk appetite of the investors/fund and thus, the chances of loss are minimal. However, since most mutual funds are market-linked, there is some risk involved. Investors must understand the risk and only then invest in any mutual fund.

SIP: Investing a large chunk of money at once is not wise. Times have changed; most Mutual funds now allow investors to choose SIP (systematic investment planning). In SIP, you get to invest in a mutual fund every month. This reduces the financial burden and also helps in averaging the cost of investment. The SIP calculator will help you understand the power of compound interest. Once you use the SIP mutual fund calculator and compare the lump sum investment with the SIP investment, you will know the benefits of SIP.

Higher returns: Mutual funds are known to offer higher returns than traditional investment instruments such as FDs, RDs, and so on. If you are just starting to invest, you must have a healthy mix of traditional and non-traditional financial instruments.

For everyone: Mutual funds have become more accessible than ever. It won’t be wrong to say that mutual funds are for everyone. In fact, we’re seeing an influx of mutual funds from even rural India. This shows that the country’s financial literacy is rising and people are more receptive to non-traditional mutual funds.

When you invest in FD, you know exactly the amount that you will get on maturity. However, that’s not the case with mutual funds. Since mutual funds are subject to market risk, one cannot accurately tell how much would be the returns. That’s why, it’s important to use the mutual fund calculator.

A mutual fund calculator is an online tool that will tell you roughly how much returns you will get when you invest in a particular mutual fund. A mutual fund calculator uses historic data to estimate how would returns you could get in the coming years. Typically, most mutual fund calculators and SIP calculators provide estimates for 1 year, 3 years, 5 years, and 10 years time horizons.

The benefits of using a SIP calculator or mutual fund calculator are as follows:

Gives you a fair idea of the returns you can earn through the investment.

Eliminates manual calculations.

Convenient to use it anywhere on the go.

To use the SIP calculator or mutual fund calculator offered by Motilal Oswal Mutual Fund, click here.

0 notes

Photo

Calculate your returns with SIP calculator online at Motilal Oswal Mutual Fund. Invest across our diverse range of investing options, we offer mutual funds, AIF Index funds, PMS, and more. Invest now

0 notes

Link

A systematic investment plan is a process of investing by making regular equal investments in a mutual fund, fixed deposit, or stocks. Systematic investment plans (SIPs) are more popular with mutual funds. The frequency of equal investments in a SIP can either be weekly, monthly, or quarterly.

#sip#whatissipinvestment#sipinvestment#systematicinvestmentplan#sipcalculator#sipbenefits#stockquantum

0 notes

Link

#sipinhindi#sipkafullform#aboutsipinvestmentinHindi#sipmeaninginHindi#whatsipinvestmentinHindi#sipyojana#sipkefaydeinHindi#sip#siphdfc#bestsipplan#sipplanner#sipcalculator#sipaxisbank#howtostartsipinvestment#sip mutual fund

0 notes

Text

Tax saving instruments that everyone should invest in

Nobody likes the idea of paying taxes. A part of your hard-earned money goes directly into the pocket of the government in the form of direct taxes. The income that remains with you after deduction of tax is either spent on things that attract tax or are inclusive of tax. With so many taxes levied, it won’t be surprising to not have anything in hand at the end of every month.

Investments are often viewed as do-it-later kind of task. Every income-earning individual assumes that they should have a stable income before they start investing. To be honest, just like time, money is an asset that needs to be managed, otherwise, it won’t suffice. If you feel that you don’t have surplus money to make investments, we suggest you invest to create that surplus. Confused? Parking your money in certain investments is a tax-saving expense. As investments reap returns, you won’t have to fret about monthly crunch. Whether you want to go all-in or take baby steps, the tax-saving investments listed below come with a flexible payment option. Take your pick!

· Mutual Fund:

There are different types of mutual funds that cater to the diverse monetary objectives of every investor. For the ones who want to save tax should invest in equity-linked savings scheme or ELSS mutual funds. Amount invested and earned from ELSS funds is deductible u/s 80C of the Income Tax Act. If you are investing with a particular goal, for instance buying a car, you can use an SIP calculator on Axis Bank to know a tentative figure of investment every month.

· Unit Linked Investment Plan:

Unit linked plan or ULIP is the best of both investment and insurance world. A part of the premium is invested in equity, debt or a combination of both schemes while the rest of the part goes towards your protecting your life. In case of an unfortunate event, the sum assured along with the returns made from the investment will be payable to the nominee. Premiums paid are deductible u/s 80CCC of the Income Tax Act.

· Health Insurance:

It is impossible to know when and how you will acquire a disease. Medical expenses can rip you off your savings and can even put you in a debt trap if you don’t have a backup. The best way to save yourself and your family from medical predicaments is by investing in a health insurance plan. Also, premiums for securing health insurance come with tax benefit u/s 80D.

0 notes

Text

What is a SIP (Systematic Investment Plan) ? How it will make you Rich ?

What is SIP (Systematic Investment Plan)?

A Systematic Investment Plan or SIP is a smart and uncomplicated way to invest money in mutual funds. SIP allows you to invest a predetermined amount at a regular interval (weekly, monthly, quarterly, etc.). A SIP is a planned approach to investments and helps you instill the habit of saving and accumulating wealth for the future.

SIP works as...

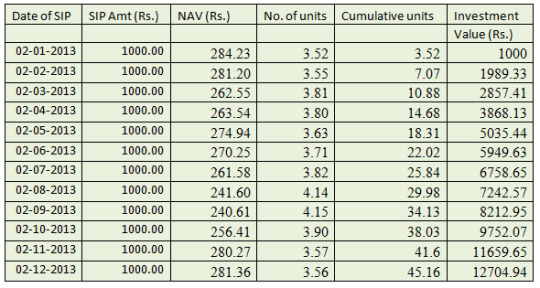

A SIP is a flexible and easy investment plan. Your money is automatically charged from your bank account and invested in a specific mutual fund plan. A certain number of units is assigned based on the current market rate (called NAV or net asset value) of the day.

]]

Each time you invest money, the additional units in the scheme are bought at the market rate and added to your account. Therefore, units are purchased at different rates and investors benefit from the Average Cost Rupees and the Power of Compounding.

Average cost of rupees

With volatile markets, most investors remain skeptical about the best time to invest and try to "time" their entry into the market. The average cost of rupees allows you to choose not to participate in the guessing game. As you are a regular investor, your money gets more units when the price is low and less when the price is high. During the volatile period, it may allow you to achieve a lower average cost per unit.

Power of Money composition

Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't... pays it.”

The rule to capitalize is simple: the sooner you start to invest, the longer your money will have to grow.

Here the simple earning of Sip Example...

]]

Benefits of SIP:

Disciplinary savings - discipline is the key to a successful investment. When you invest through SIP, you commit to save regularly. Every investment is a step towards achieving your financial goals.

]]

Flexibility - although it is advisable to continue SIP investments with a long-term perspective, there is no compulsion. Investors can discontinue the plan at any time. You can also increase / decrease the amount that is invested.

Long-term gains - due to the average cost of rupees and the power to capitalize the SIP, they have the potential to offer attractive returns over a long investment horizon.

Convenience - SIP is an investment mode without problems. You can issue permanent instructions to your bank to facilitate automatic debits from your bank account.

SIPs have proven to be an ideal investment mode for retail investors who do not have the resources to make active investments.

Read the full article

#bestsipinvestmentplan2018#howtostartsipinvestment#mutualfundsipreturncalculator#sipcalculator#sipcalculatoricici#sipcalculatormoneycontrol#sipcalculatorsbi#sipmeaning#sipplanner#systematicinvestmentplancalculator#systematicinvestmentplancomparison#systematicinvestmentplansbi

0 notes

Text

Calculate your returns with SIP calculator online at Motilal Oswal Mutual Fund. Invest across our diverse range of investing options, we offer mutual funds, AIF Index funds, PMS, and more. Invest now

0 notes

Link

Get personal loans, EMI calculators, SIP calculators, and more online only at Axis Bank

0 notes

Text

Smart & Advance Way To Start SIPs For Your Child’s Financial Future

Are you serious about your children's future?

Of course, I am.

Was this your response?

Please don't get annoyed by the question.

The intent of raising it now wasn't to hurt you.

Quite often it happens that, despite having a good purpose, we end up doing ordinarily in the end.

I want to send my child to a good college for higher studies—Great!

He/she should have an option to pursue a master's programme abroad—Excellent!

And soon after he/she settles abroad, I want to get him/her married in a grand destination wedding—Awesome!

But, are you doing enough to make all this happen?

Thus, saving money for the future needs isn't enough.

Inflation spoils the party.

You need to invest intelligently.

How should you plan for your child's better future?

Estimate the amount you would need in future.

Earmark the amount you will have to invest per month.

Select appropriate mutual fund schemes with a proven track record (or alternatively take expert help in choosing them)

Opt for Systematic Investment Plan (or SIPs) to invest in mutual funds.

And Using various hypothetical rates try to estimate where your investments might take you (You might use PersonalFN's SIP calculator for this purpose)

If you have not been SIP-ping in equity-oriented mutual funds until now, you should start soon!

What is SIP?

Simply put, SIP is a mode of investing in mutual fund schemes in a systematic and regular manner. The method of investing is similar to your investment in a recurring deposit (RD) with a bank, where you deposit a fixed sum of money (into your recurring deposit account), but the only difference here is, your money is deployed in a mutual fund scheme (equity schemes and / or debt schemes) and not in a bank deposit. Hence, your investments (in mutual funds) are subject to market risk.

A SIP enforces a disciplined approach towards investing, and you inculcate the habit of saving before spending, which we all probably learnt when we maintained a piggy bank.

Yes, those good old days where our parents gave us some pocket money, which after expenditure we deposited in our piggy banks and at the end of particular tenure, we saw that every rupee saved became a large amount.

SIPs work on the simple principle of investing regularly, which enables you to build wealth over the long-term. In case of SIPs, on a specified date which can be on a daily basis, monthly basis, or on a quarterly basis, a fixed amount you decide on is debited from your bank account (either through a ECS mandate or through post-dated cheques forwarded), and invested in the scheme as selected by you for a specified tenure (months, years).

Today some Asset Management Companies (AMCs) / mutual fund houses / robo-advisory platforms also provide the ease and convenience of transacting in mutual funds online. They have set up their own online transaction platforms, where one can do SIP investments by following the procedure as made available on the websites.

[Read: How To Invest In Mutual Funds Online]

So, you have fewer hassles while investing as well as tracking your investment dates.

To quote Albert Einstein, the eighth wonder of the world, the power of compounding plays a crucial role in generating a substantial corpus for your child's future.

But, it's important to invest in the right mutual fund scheme. Otherwise, you will wonder about the eighth wonder.

Here are 5 benefits of SIPs:

1. SIPs are light on the wallet

If you cannot invest Rs 5,000 in one shot, that's not a huge stumbling block, you can simply take the SIP route and trigger the mutual fund investment with as low as Rs 500 per month.

SIPs enable you to invest in smaller amounts at regular intervals (daily, monthly or quarterly).

2. SIPs make market timing irrelevant

Timing the market can be hazardous to your wealth and health. Instead, focus on 'time in the market' in the endeavour to create wealth by selecting the best mutual fund schemes to SIP. If you stay invested in a promising mutual fund scheme for the long-term, it can help you accomplish your financial goals.

3. SIPs enable rupee-cost averaging

Volatility is the very nature of the market; but with SIPs, you can mitigate this volatility. When markets undergo turbulence, rupee-cost averaging comes into play.

Meaning, typically buy more units of a mutual fund scheme when prices are low, and buy fewer mutual units when prices are high. SIPs work in your favour when markets go downhill, and when they are flat quite some time.

4. SIPs benefit from the power of compounding

As SIPs subscribe you to the habit of investing regularly, it enables you to compound your money invested.

So, say you start a SIP of Rs 1,000, in a mutual fund scheme following prudent investment system and processes, with a SIP tenure of 20 years and expect a modest return of 15% p.a., your money would grow to approximately Rs 15 lakh.

So, over the long-term, SIPs can compound wealth better and systematically as opposed to investing a lump sum, especially when the journey of wealth creation is volatile.

5. SIPs are effective medium for goal planning

All of us have financial goals – may be buying a house, buying a dream car, providing good education to children, getting them (children) married well, retiring etc.

But all this comes with systematic financial planning. Very often many invest in the equity markets, with a motive of making short-term gains, and often ignore to use the equity markets as a window for long-term wealth creation, to achieve one's financial goals. The earlier you start SIPs the better it is.

Do you know?

A difference of 4.4% compounded annualised returns on your SIP investments can fetch you additional Rs 45 lakh over 15 years?

The power of compounding and smart selection of mutual fund schemes, working in conjunction, can help you grow wealth.

Want a superlative research-backed guidance to select winning mutual fund schemes to plan your child's future needs?

Consider PersonalFN.

PersonalFN has a dependable track record, guiding investors to achieve their envisioned financial goals with its unbiased views.

PersonalFN does not take shortcuts with research before recommending mutual fund schemes to investors. A comprehensive rating methodology is followed.

PersonalFN analyses thousands of data points to shortlist schemes and also applies a whole host of quantitative and qualitative parameters to select winning mutual fund schemes for your portfolio.

PersonalFN's Mutual Fund Research service 'FundSelect' Vs. S&P BSE 200

Data as on March 28, 2018

(Source: ACE MF, PersonalFN Research)

Out of every four funds recommended in the

FundSelect

— a premium mutual fund research service of PersonalFN, three have always outperformed BSE 200 index. That's the success rate of PersonalFN.

Those who started following PersonalFN's recommendations in June 2003 might have grown their wealth at 21.0% compounded annualised rate vis-à-vis 16.6% returns generated by BSE 200.

Currently, the premium mutual fund research service, 'FundSelect', is celebrating 15 years of wealth creation. If you subscribe now you can avail this premium mutual fund research service for just Rs 2,950 and get 1-year additional access (worth Rs 5,000)... virtually free!

It will provide Buy, Hold, and Sell recommendations... intended at solidifying your mutual fund portfolio and make it free from any bias.

Click here to know more and subscribe to 'FundSelect' today!

You will get FREE access to our premium report, 'Top-5 Funds For 2020'

So, hurry and subscribe to PersonalFN's FundSelect now!

What's more?

PersonalFN is soon launching its robo-advisory platform offering Direct Plans only.

The lower expense ratio for Direct Plans of mutual fund schemes can add significant wealth in the long-run. The magic of power of compounding works better with Direct Plans.

You can potentially build a BIGGER corpus by opting for PersonalFN's robo-advisory platform that offers research-backed recommendations.

So, stay tuned!

Author: PersonalFN Content & Research Team

This post on " Smart & Advance Way To Start SIPs For Your Child’s Financial Future " appeared first on "PersonalFN"

#SIPsForYourChildsFinancialFuture#childrensfuture#mutualfunds#SIPcalculator#mutualfundschemes#recurringdeposit#benefitsofSIP

0 notes

Photo

A #SIP(systematic Investment Plan) is an ideal way of investing in the #mutualfunds. It is a planned way of investing, which helps cultivate the habits of savings and accomplish the goal of wealth.

For more information visit - https://play.google.com/store/apps/details…

#SIPCalculator #systematicinvestmentplanner #SIPplanner #investmentapp #financialapp #mobileapp #purplemad

0 notes

Link

IndiaNivesh offers Mutual Fund SIP Calculator helps you to check how much should you invest in SIP at regular intervals to meet your expected wealth gain.

#sip calculator#sip return calculator#mutual fund sip calculator#sip investment calculator#online sip calculator#sip calculator India#IndiaNivesh

0 notes

Photo

Higher education available but unaffordable commonly

Mr. Nair works at a bank and has a beautiful small family in which he lives with his wife, Rachna and daughter Ananya. In 2006, Mr. Nair after understanding the aspiration of his daughter Ananya to become an MBA started investing in a recurring deposit for 10 years @ 8.5% rate of return to accumulate funds for higher education of Ananya. He included the coaching fee and college fee in his calculation and set a target of Rs 6, 00,000 to achieve in 10 years. However, he didn't take inflation into his calculation to reach the financial goal, which Mr. Nair realized in 2016 when Ananya cleared the entrance exam and found that the college fee in 2016 was Rs 18.5 lacs.

Mr. Nair was taken aback looking at the fee structure because what he planned for his only child was not enough. Ultimately he had to take loan for the bright future of his daughter Ananya.

An analysis on the increase in the fees of higher education indicates that the tution fees in top management institutes have risen faster than inflation. Between 2007 to 2016 the average inflation on conservative outlook was 8.44 % whereas the increase in the fees of top management institutes in the country rose at 12 to 19 % per annum.

In case of Mr Nair it is evident that the money he invested in recurring deposit for last ten years might have increased in numbers but has not increased his purchasing power. In fact the purpose for which the investment was done, got defeated at the hands of inflation in education sector.

We at Investocafe analysed the case study of Mr Nair and further research indicated that inflation in education sector has actually increased cost of education manifold. A brief comparison of fee structure in 2007 and 2016 in respect of main course (MBA) offered by top management institutes in India is as following:

1. IIM AHEMEDABAD: Fee in Year 2007: Rs 5.50 Lakh: Fee in Year 2016: Rs 18.50 Lakh: Fee Growth in 9 years: 236.26 %

2. IIM Bangalore: Fee in Year 2007: Rs 5 Lakh: Fee in Year 2016: Rs 14 Lakh: Fee Growth in 9 years: 180 %

3. IIM Calcutta: Fee in Year 2007: Rs 4 Lakh: Fee in Year 2016: Rs 19 Lakh: Fee Growth in 9 years: 375 %

4. IIM KOZHIKODE: Fee in Year 2007: Rs 4 Lakh: Fee in Year 2016: Rs 13 Lakh:Fee Growth in 9 years: 225 %

5. IIM INDORE: Fee in Year 2007: Rs 4 Lakh: Fee in Year 2016: Rs 13 Lakh:Fee Growth in 9 years: 225 %

6. IIM LUCKNOW: Fee in Year 2007: Rs 4 Lakh: Fee in Year 2016: Rs 11.80 Lakh:Growth in 9 years: 195 %

7. IIFT DELHI: Fee in Year 2007: Rs 3.4 Lakh: Fee in Year 2016: Rs 15.70 Lakh:Fee Growth in 9 years: 348.57 %

8. MDI GURGAON: Fee in Year 2007: Rs 5.89 Lakh: Fee in Year 2016: Rs 18.86 Lakh:Fee Growth in 9 years: 220.20 %

9. ISB HYDERABAD: Fee in Year 2007: Rs 14 Lakh: Fee in Year 2016: Rs 35 Lakh:Fee Growth in 9 years: 150 %

The above comparison clearly indicates that the cost of education will continue to increase at a faster rate than CPI inflation. Experts opinion in this gard is also positive on the uptrend in the fee structure since globally the management institutes have to invest lot of money in buying case studies, faculty salaries including visiting professors and international collaboration to expose students to other markets.

Hence it is suggested to all such parents or going to be parent that you need to invest regularly with discipline a certain amount, which you can calculate at the tools section on https://www.investocafe.com/sipCalculation, keeping the inflation at 10 percent for education. For instance, cost of a course in today's value is Rs 20,00,000 then considering inflation at 10% for 15 years hence (in 2032), the value of the same course would be around Rs 83,54,496 and to reach this goal @14% rate of return you just need to invest Rs 13,791 per month in equity mutual fund for 15 years.

Remember the saying 'Fail to plan is plan to fail' therefore make a prudent decision today and set a financial goal and start investing through SIP way in mutual funds.

Best Wishes.

Happy Investing!!!

Team Investocafe

Written by: Anvesh Pandey, SEBI Registered Investment Advisor

To get in touch, write on [email protected] or reach through www.investocafe.com.

0 notes

Text

What is a SIP (Systematic Investment Plan) ? How it will make you Rich ?

What is a SIP (Systematic Investment Plan) ? How it will make you Rich ? #bestsipinvestmentplan2018 #howtostartsipinvestment #mutualfundsipreturncalculator #sipcalculator #sipcalculatoricici #sipcalculatormoneycontrol #sipcalculatorsbi #sipmeaning

Read the full article

#bestsipinvestmentplan2018#howtostartsipinvestment#mutualfundsipreturncalculator#sipcalculator#sipcalculatoricici#sipcalculatormoneycontrol#sipcalculatorsbi#sipmeaning#sipplanner#systematicinvestmentplancalculator#systematicinvestmentplancomparison#systematicinvestmentplansbi

0 notes