#DollarCostAveraging

Text

Grow Your Wealth: Expert Tips for Investing $1 Million and Achieving Financial Goals

#compounding #diversification #dollarcostaveraging #financialadvisors #growwealthovertime #highgrowthassets #investing1million #longtermperspective #lowriskinvestments #strategicplanning #substantialcapital #successfulinvestmentoutcomes #wealthmanagers

#Business#compounding#diversification#dollarcostaveraging#financialadvisors#growwealthovertime#highgrowthassets#investing1million#longtermperspective#lowriskinvestments#strategicplanning#substantialcapital#successfulinvestmentoutcomes#wealthmanagers

0 notes

Text

How I saved My First $100K (And How You Can Too) https://muscleinvesting.com/?p=6867

0 notes

Text

Consistency is Key! 🗝️💼 See how $100 monthly investments have soared over 9 years with Bitcoin leading the way! 🚀💰

#DollarCostAveraging#InvestmentGrowth#BitcoinSuccess#GoldSteady#StockMarketGains#FinancialWisdom#Coinverse

0 notes

Text

#SIPinvestment#MutualFunds#InvestmentStrategy#FinancialPlanning#PersonalFinance#WealthManagement#LongTermInvesting#MoneyManagement#FinanceTips#InvestmentPlanning#FinancialEducation#Savings#RetirementPlanning#CompoundInterest#PassiveIncome#AssetAllocation#RiskManagement#DollarCostAveraging#InvestmentPortfolio#FinancialLiteracy#InvestmentGoals#FinancialFreedom#SIPcalculator#MutualFundSIP#WealthBuilding

0 notes

Text

How to Invest With Little Money

How to Start Investing with Little Money: 19 Tips for Beginners to Invest $50, $100 or $500 per Month"

How to Start Investing with Little Money: 19 Tips for Beginners to Invest $50, $100 or $500 per Month"

Start with an Emergency Fund

Use a Retirement Account

Invest in Low-Cost Index Funds

Use a Micro-Investing App

Look Into Robo-Advisors

Employ Dollar Cost Averaging

Reinvest Dividends

Invest in Yourself

19 Tips for beginners

Final Thoughts

Investing can seem intimidating, especially if you don't have much money to spare. However, you don't need thousands of dollars to get started investing. With some planning and discipline, you can begin investing even small amounts and build your portfolio over time. Here are some tips for investing with little money:

Start with an Emergency Fund

Before you start investing, make sure you have a rainy day fund with 3-6 months of living expenses. This will prevent you from having to cash out investments prematurely if an unexpected expense comes up. Once you have an emergency cushion, you can focus any extra funds on investing.

The FDIC recommends having at least $500 set aside for emergencies, but preferably 3-6 months worth of expenses. Calculate your average monthly costs for necessities like housing, food, transportation, and utilities. Multiply that by 3-6 months to see how much you need saved. This money should be kept in an accessible account like a savings account, money market account or short-term CDs. High yield savings accounts can earn over 2% interest these days.

Having an emergency fund prevents you from tapping into long-term investments if an unexpected expense pops up like a car repair or medical bill. It helps you adhere to the investing maxim “Don’t touch your principal.” Knowing you have a backup cushion helps remove emotion from investing decisions.

Use a Retirement Account

Retirement accounts like 401(k)s and IRAs offer great tax benefits that can supercharge your investment gains. The key benefits are tax-deferred growth and often tax-deductible contributions. Investments in a retirement account grow tax-free each year since you don't pay taxes on capital gains and dividends. You aren’t taxed until you withdraw funds in retirement. This enables faster compound growth compared to taxable accounts.

Many employers offer 401(k) plans where you can contribute pre-tax dollars from your paycheck up to an annual limit ($20,500 in 2023). Some employers also match a percentage of your contributions, essentially giving you free money toward retirement. Even without an employer match, 401(k)s allow tax-free investing for retirement.

IRAs also offer tax perks. With a traditional IRA, your contributions may be tax deductible depending on income limits. Roth IRAs, on the other hand, don't offer a tax deduction but allow tax-free withdrawals in retirement. The IRS currently allows contributions of up to $6,000 per year to an IRA if under 50 years old. This applies to both traditional and Roth accounts combined. If you have an employer retirement plan, your ability to deduct traditional IRA contributions phases out at higher incomes.

For early investors, prioritizing retirement accounts is smart because of the tax savings. Plus, money in these accounts is harder to access before retirement so it keeps your investments on track for the long-term. Contribute at least enough to get any employer match if available. Then you can consider funding a taxable investing account.

Invest in Low-Cost Index Funds

Once you’ve saved emergency cash and are funding retirement accounts, it’s time to actually invest your money. Index funds are the best way for beginner investors to gain diversified exposure to the stock market. They provide instant diversification across hundreds or thousands of stocks in a single fund while requiring very low investment amounts to get started.

Index funds simply aim to track the performance of a specific market index like the S&P 500. Since they aren’t managed actively by a fund manager, their fees are extremely low compared to actively managed mutual funds. The average expense ratio for index funds is around 0.1% versus over 1% for active funds. This makes index funds ideal for long-term buy-and-hold investing.

Over the past decades, index funds have consistently outperformed the majority of more expensive actively managed funds. Their simplicity, diversification, and low costs are the reasons why many experts recommend index funds for retirement investing.

For beginners, basic index funds that track the entire U.S. stock market are best. Examples are S&P 500 index funds like Vanguard’s VOO or Fidelity’s FSKAX. These contain over 500 of the largest U.S. companies. Investing in the entire stock market provides safety versus picking individual stocks. The average expense ratio for S&P 500 index funds is around 0.03%.

Many brokers like Vanguard and Fidelity allow minimum investments of just the fund's expense ratio or $1-3,000 for index mutual funds. This makes index funds achievable even with limited savings. Investing small amounts monthly allows dollar cost averaging into the market at different prices over time.

Use a Micro-Investing App

Micro-investing apps help make investing more automated and painless. They allow you to invest your "spare change" from everyday credit and debit card purchases into diversified portfolios. Examples are Acorns, Stash, Chime and Robinhood’s new Recurring Investments.

Here’s how they work: you connect your bank cards to the app. After each card purchase, the transaction amount gets rounded up to the nearest dollar. The app takes that “spare change” and invests it into your portfolio. For instance, a $2.50 coffee would lead to a $0.50 investment.

While the invested amounts start small, they add up over time with regular card spending. The portfolios recommended contain low-cost ETFs spanning thousands of stocks and bonds. The apps handle automatic rebalancing and dividend reinvesting. There are minimal fees of just $1-3 monthly.

Micro-investing apps make saving and investing effortless. Even if you have just $5 or $10 weekly to invest, these platforms allow you to put your money to work in the markets. The “set it and forget it” approach helps develop the investing discipline needed for long-term success. Though you likely won’t get rich quick, micro-investing provides an easy way to build savings and investing habits.

Look Into Robo-Advisors

Robo-advisors like Betterment and Wealth front are another good option for beginner investors. These are automated investment platforms that use algorithms to recommend and manage portfolios tailored to your goals. After filling out a questionnaire, robo-advisors will recommend a portfolio of low-cost ETFs spanning various asset classes like stocks, bonds and real estate based on your timeline and risk tolerance.

The minimum investment can be as low as $500 to get started. Robos automatically handle portfolio rebalancing, dividend reinvesting, tax loss harvesting and systematic deposits/withdrawals. Management fees range from 0.25% to 0.50% annually. While fees are higher than self-managed index fund portfolios, robos are extremely convenient and provide guidance for new investors.

For hands-free investing, robo-advisors are great set-it-and-forget-it solutions. Just be wary of inappropriate risk recommendations or overconcentration in cash for younger investors by some robos. Check their investment methodology before jumping in. For DIY investors willing to rebalance occasionally, low-cost index funds may be preferable. But robo-advisors are still a solid choice for easily building a diversified portfolio.

Employ Dollar Cost Averaging

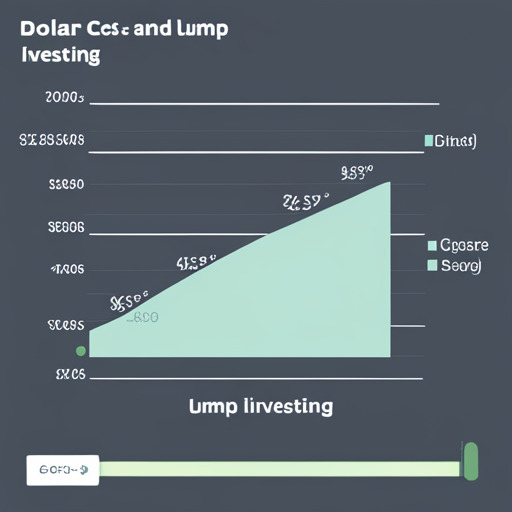

Dollar cost averaging is a strategy all beginner investors should utilize when investing small amounts continuously over time. With dollar cost averaging, you invest a fixed dollar amount on a regular schedule, like $50-100 monthly. Since the market fluctuates daily, this allows you to buy more shares when prices are low and fewer shares when prices are high.

While dollar cost averaging doesn’t guarantee a profit or avoid losses in declining markets, it does help smooth out volatility. Going “all in” by investing a large lump sum at once can provide poor timing if a market drop follows soon after. But investing incremental amounts lessens the risk of putting your money in at a peak right before a downturn.

Apps mentioned like Acorns along with monthly automatic transfers into mutual funds or ETFs make dollar cost averaging simple to implement. The key is consistency and avoiding the tendency to only invest when you “feel” like the market is doing well. Set up automatic periodic investments and let dollar cost averaging improve your timing.

Reinvest Dividends

Another smart strategy is reinvesting any dividends paid out by your investments. Dividend reinvesting automatically uses paid distributions to buy additional shares. This compounds your wealth over time by increasing the number of shares you own.

Many brokerages and robo-advisors offer automatic dividend reinvesting. For example, Vanguard mutual fund holders can elect to have dividends reinvested back into the funds to grow their positions. Apps like M1 Finance also allow dividend reinvesting for individual stocks and ETFs.

Even dividend reinvesting small amounts will power compound growth. And companies that pay steady dividends tend to be stable, established businesses. The combination of dividend payouts plus reinvestment can enhance long-term total returns. Just make sure any fees for dividend reinvesting are minimal.

Invest in Yourself

Your own skills, education and career trajectory are likely your greatest “asset” when it comes to earning potential over your lifetime. Don’t underinvest in yourself through self-education and career development. The monetary return on learning new skills and moving up in your career is often far beyond what stock market investing can provide.

Make sure to leave room in your budget for self-improvement. Take courses to gain skills in coding, marketing, accounting, design and more based on your career interests. Seek mentorships and apprenticeships in your industry. Attend conferences and classes to network and showcase your abilities. Further education like an associate’s, bachelor's or master’s degree can really pay off career-wise in the long run.

If your employer offers tuition reimbursement for approved courses, take full advantage of this great benefit. The education will enhance your knowledge, and your improved skills can lead to promotions down the road. Investing in yourself boosts future cash flow. Don't just think of it as spending, but as investing in your human capital.

Beyond career development, also invest in your mental and physical health. These factors drive well-being and productivity. Make fitness a habit and get regular checkups. Managing stress through yoga, meditation or therapy can give your mindset and motivation a boost. Ultimately, investing in yourself across skills, education and health delivers big dividends.

19 Tips for beginners

- Build an emergency fund first

- Use retirement accounts like 401(k)s and IRAs

- Invest in low-cost index funds

- Try a micro-investing app

- Consider a robo-advisor

- Dollar cost average into the market

- Reinvest dividends to compound gains

- Invest in yourself through skills and education

- Automate deposits into investment accounts

- Don't panic during market swings

- Focus on long-term compound growth

- Keep investment fees low

- Diversify with broad market funds

- Set a consistent investing schedule

- Start small and scale up over time

- Educate yourself on investing basics

- Create a financial plan and stick to it

- Live below your means to free up money to invest

- Delay gratification today for better returns tomorrow

Final Thoughts

Investing, even with small amounts, is very achievable for beginners. The key is consistency by making regular deposits into vehicles like retirement accounts, index funds, micro-investing apps and robo-advisors. Reinvest dividends, dollar cost average, and enhance your earning potential.

Investing does require discipline, delayed gratification and tuning out market swings. But the process can be simple by automating deposits into broadly diversified, low-cost funds you hold for the long term. Compounding works wonders over 5, 10 or 20 year periods.

Start wherever you can, even if it’s just pocket change amounts to begin. Investing apps have lowered the barriers. With education and discipline, anyone has the ability to steadily build wealth and reach financial goals through investing.

Read the full article

#beginnerinvesting#beginnertips#compoundinterest#dividendreinvesting#dollarcostaveraging#ETFs#financialplanning#indexfunds#Investing#investmentstrategies#micro-investingapps#moneytips#PersonalFinance#retirementaccounts#RetirementPlanning#robo-advisors

0 notes

Text

#CryptocurrencyTrading#CryptoMarket#TradingPrinciples#CryptocurrencyTips#CryptoStrategy#DollarCostAveraging#TradingEmotions#TechnicalAnalysis#CryptocurrencyInvesting#CryptoExperience

0 notes

Text

dollar cost averaging : A Simple Yet Effective Investment Strategy

dollar cost averaging Introduction:

dollar cost averaging Hello everyone! Today, let's dive into an investment strategy called (DCA).

Among the various strategies in the investment world,

DCA focuses uniquely on using price volatility for long-term investment performance, without the heavy dependence on market predictions.

What is Dollar Cost Averaging?

First, you should understand that DCA means making periodic investments of a fixed amount, regardless of the economic situation and market volatility.

By following this strategy,

you can lower the average cost of an asset during the investment period, diversify risk, and seek stable returns.

Advantages of DCA

DCA begins by eliminating the need to worry about market timing. Moreover, this approach remains less influenced by investor psychology, and its steady investments can counter short-term and long-term volatility. Lastly, DCA allows you to benefit from compound investments over time.

Disadvantages of DCA

On the other hand, some downsides to DCA exist. For example, the performance might be lower compared to lump-sum investments during a bull market. Also, you might experience investment losses with assets that face rapid spikes in a short time.

How to Implement Strategy

To implement a DCA strategy effectively, you should start by determining the desired asset and investment amount. Then, set a consistent investment period and frequency. Finally, commit to the strategy with discipline, irrespective of market conditions.dollar cost averaging

https://www.investopedia.com/investing-4689710

"Explore various investment strategies and optimize your portfolio."

Conclusion:

"worldcoinindex :Investment Strategies in the WorldCoinIndex Era"

In summary, Dollar Cost Averaging presents an accessible and effective strategy for investors who prefer to avoid the stress and challenges of timing the market.

Implementing gradual, systematic investments enables you to reduce the impact of volatile markets and foster long-term growth in your investment portfolio.

However, analyzing different investment strategies, including DCA, and identifying the best fit for your financial situation,

risk tolerance, and investment goals remains crucial to achieving success in investing.

Read the full article

0 notes

Text

Blog: How to Invest Your Money for Success 2023

Link: https://lifenillusion.com/how-to-invest-your-money-investing-tips/

#InvestingTips#FinancialSuccess#LongTermInvesting#DiversifyYourPortfolio#CompoundInterest#FinancialGoals#StartInvestingEarly#DollarCostAveraging#LowCostInvesting#IndexFunds#PatienceInInvesting#NoPanicSelling

1 note

·

View note

Text

🚀💰 Investing in Cryptocurrencies for Low Investors: A Smart Approach! 💰🚀

Are you a low investor intrigued by the potential of cryptocurrencies? 🤔💡 Well, you're not alone! The crypto market offers exciting opportunities, even for those with modest budgets. But before you dive in, let's explore a smart approach to investing in cryptos that maximizes your potential gains while minimizing risks. Here are some tips to consider:

📊 Start with a Budget: Determine a sensible budget you can comfortably invest without jeopardizing your financial stability. Remember, investing in cryptocurrencies can be volatile, so it's best to start small.

📚 Educate Yourself: Knowledge is the key to success in the crypto world! Take the time to research and understand how cryptocurrencies and blockchain technology work. Arm yourself with valuable insights to make informed decisions.

💼 Diversify Your Portfolio: Don't put all your eggs in one basket! Diversification is crucial in reducing risk. Instead of investing solely in one cryptocurrency, spread your funds across different coins or tokens with promising potential.

💰 Consider Dollar-Cost Averaging (DCA): A nifty strategy for low investors! Instead of investing a lump sum, consider spreading your investments over time with regular contributions. DCA helps to mitigate the impact of short-term price fluctuations.

🔍 Choose Reputable Exchanges: Opt for reputable and secure cryptocurrency exchanges to trade and invest. Research their security measures and user reviews to ensure your funds are in safe hands.

💡 Stick to Established Coins: For a safer start, focus on well-established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). These have proven track records and are less susceptible to wild price swings.

🌲 Avoid High-Risk Ventures: Beware of schemes promising quick riches or unscrupulous projects. Prioritize investments in projects with solid use cases and transparent development teams.

😌 Manage Risk and Emotions: The crypto market can be a rollercoaster ride! Set clear investment goals, implement risk management strategies, and avoid making impulsive decisions based on emotions.

📰 Stay Informed: The crypto space evolves rapidly. Stay up-to-date with the latest news and developments to make well-timed investment decisions.

🤖 Consider Robo-Advisors: For a helping hand, explore platforms offering robo-advisors. These automated services can manage your portfolio based on your risk tolerance and investment objectives.

Remember, investing in cryptocurrencies carries inherent risks, and there are no guarantees of immediate profits. Take a cautious and informed approach, and let your crypto investment journey grow over time. The crypto world is full of possibilities, and with a smart strategy, you can make the most of this digital frontier! 🚀🌟

Are you a low investor venturing into the crypto realm? Share your thoughts, tips, and experiences in the comments below! Let's support each other on this thrilling journey! 💬👇

#CryptoInvesting#SmartInvestment#LowInvestors#CryptocurrencyOpportunities#CryptoKnowledge#DiversifyYourInvestment#DollarCostAveraging#ReputableExchanges#EstablishedCryptocurrencies#InvestmentStrategies#CryptoTips#RiskManagement#StayInformed#CryptocurrencyEducation#InvestSmart#CryptoPotential#RoboAdvisors#CryptoCommunity#CryptoInsights#DigitalFrontier#InvestmentJourney#CryptocurrencyPossibilities

1 note

·

View note

Text

Preparing for a cryptocurrency market rally

youtube

📈 Get ready for the upcoming crypto market trends! 🔥 Unlike last year's bearish trend, we expect a positive outlook this year, and we explain the important actions you need to take 🚀.

1️⃣ Stay tuned to the latest market news and opportunity updates.

2️⃣ Focus on risk management and utilizing trading strategies such as dollar cost averaging.

3️⃣ Pay attention to tokens with enhanced security.

Invest in safe coins like ViCA TOKEN. 💎

Get more information and win in the crypto market! 🌟

#Cryptocurrency#MarketTrends#BePrepared#Investment#News#DollarCostAveraging#TradingStrategies#RiskManagement#Security#ViCATOKEN#Youtube

1 note

·

View note

Text

Smart Share Trading: How to Make the Right Moves for Your Money

#buyingshares #disciplinedapproach #dollarcostaveraging #financialobjectives #industrytrends #investmentgoals #investmentknowledge #marketvolatility #optimalnumberofshares #portfoliodiversification #risktolerance #sellingshares #sharetrading #timehorizon

#Business#buyingshares#disciplinedapproach#dollarcostaveraging#financialobjectives#industrytrends#investmentgoals#investmentknowledge#marketvolatility#optimalnumberofshares#portfoliodiversification#risktolerance#sellingshares#sharetrading#timehorizon

0 notes

Text

Non-millionaire Reacts to $4000 PER MONTH Apartment | Ida Bergfoth | DO THIS with Your Money Instead https://muscleinvesting.com/?p=5709

0 notes

Text

STRATEGIES FOR SMART INVESTING

Investing is a crucial part of building and preserving wealth, but it can be a daunting task for those who are new to it. It’s important to have a solid strategy in place to make smart investment decisions, and to ensure that your investments are working hard for you.

Here are some strategies for smart investing to help you get started

Define your investment goals. Before you begin investing,…

View On WordPress

#Diversificatin#dollarcostaveraging#emotionalinvesting#financialliteracy#indexfund#INVESTING#investment strategy#Long term investing#smart investing#wealth building

0 notes

Photo

#OneOneOne #ElevenZeroOne #2301 #Guao #WackyFunny #Funny #Weird #Timing #EPHIAT #Fiat #EFiat #IncentiveToken #Token #Crypto #DollarCostAverage @dollarcostcrypto #CryptoMindset #Knowledge https://www.instagram.com/p/Cpy7gxeOXXT/?igshid=NGJjMDIxMWI=

#oneoneone#elevenzeroone#2301#guao#wackyfunny#funny#weird#timing#ephiat#fiat#efiat#incentivetoken#token#crypto#dollarcostaverage#cryptomindset#knowledge

0 notes

Text

#euipost #analysis #economy #stocks #dollarcostaverage #notwhatyouthinkitis

1 note

·

View note

Photo

#Bearmarket📉 #Reversestocksplit #Recessionproof #Recession #Stockmarketcrash #Wallstreet #Bankers #Housingbubble #REALESTATE #Roi #Dollarcostaveraging #Swingtraders #Daytraders #Coins #Crudeoil $Gbtc #Traders $Fnma $Fmcc $Drem $Ustc $Rven $Plpl #Dowjones #Dowtherory #Dotcombubble $Dis https://www.instagram.com/p/B4cRNrAjXdm/?igshid=1spgwvbkguvhv

#bearmarket📉#reversestocksplit#recessionproof#recession#stockmarketcrash#wallstreet#bankers#housingbubble#realestate#roi#dollarcostaveraging#swingtraders#daytraders#coins#crudeoil#traders#dowjones#dowtherory#dotcombubble

1 note

·

View note