Text

FDA Approves Eli Lilly's Diabetes Drug Mounjaro for Obesity as Zepbound: New Weight Loss Treatment Option Available

What is Zepbound and Mounjaro?

How Does Zepbound Work for Weight Loss?

Impacts of FDA Approval on Diabetes and Obesity

Comparing Zepbound with Other Weight Loss Drugs

Understanding Eli Lilly's Role in Diabetes and Obesity Treatment

When will Zepbound be available?

Who is eligible to take Zepbound?

what do you need to know about Mounjaro? ( Zepbound )

The Food and Drug Administration (FDA) has recently approved Eli Lilly's diabetes drug Mounjaro for obesity under the brand name Zepbound. This significant development has sparked interest and raised hope for addressing the unmet medical need for obesity treatment. Zepbound, containing the active ingredient tirzepatide, offers a new approach to chronic weight management for people with obesity and overweight in the United States

. https://www.fda.gov/news-events/press-announcements/fda-approves-new-medication-chronic-weight-management

What is Zepbound and Mounjaro?

Understanding the Active Ingredient in Zepbound

Zepbound, also known as Mounjaro, contains tirzepatide as its active ingredient. Tirzepatide is a GLP-1 (glucagon-like peptide-1) receptor agonist, which has shown promising results in managing blood sugar and body weight in people with type 2 diabetes and obesity.

The Brand Name Zepbound and Its Relation to Mounjaro

The brand name Zepbound refers to the FDA-approved formulation of tirzepatide for managing obesity and overweight. Mounjaro, on the other hand, is the diabetes drug containing the same active ingredient, repurposed and approved for obesity treatment under the name Zepbound.

How Zepbound Works for Obesity

Zepbound works by targeting the GLP-1 receptor to regulate blood sugar levels and control body weight. It offers a potential solution for individuals struggling with obesity and its related health issues.

How Does Zepbound Work for Weight Loss?

Potential Benefits of Zepbound for Obesity

Zepbound offers potential benefits for people with obesity, including significant weight loss and improved blood sugar management. Clinical trials have demonstrated its efficacy in reducing body weight and controlling obesity-related comorbidities.

Insight into Zepbound's Role in Weight Management

Zepbound plays a crucial role in weight management by modulating appetite, reducing food intake, and increasing feelings of fullness. These mechanisms contribute to its effectiveness in promoting weight loss in individuals with obesity.

Possible Side Effects of Zepbound

While Zepbound has shown promising outcomes in weight management, it may also have potential side effects such as nausea and gastrointestinal discomfort. Patients considering Zepbound for weight loss should discuss the possible side effects with their healthcare provider.

Impacts of FDA Approval on Diabetes and Obesity

FDA Approval of Zepbound for Diabetes and Obesity

The FDA's approval of Zepbound for both diabetes and obesity signifies a significant advancement in addressing the healthcare needs of individuals with obesity and type 2 diabetes. It reflects the growing understanding of the interconnection between these conditions and the need for comprehensive treatment options.

Zepbound's Role in Managing Blood Sugar and Weight

Zepbound plays a critical role in managing both blood sugar levels and body weight, offering a holistic approach to the treatment of individuals with type 2 diabetes and obesity. Its approval for dual indications marks a pivotal moment in obesity and diabetes management.

Addressing the Unmet Medical Need for Obesity Treatment

The FDA's approval of Zepbound addresses an unmet medical need for obesity treatment, providing healthcare professionals and patients with a new therapeutic option for managing obesity and its associated health risks, such as heart disease and chronic conditions.

Comparing Zepbound with Other Weight Loss Drugs

Zepbound vs. Wegovy: Understanding the Differences

When comparing Zepbound with other weight loss drugs such as Wegovy, it is essential to understand the unique mechanisms of action and potential benefits each medication offers. Healthcare providers can evaluate the suitability of these drugs based on individual patient needs, comorbidities, and treatment goals.

Exploring the Similarities Between Zepbound and Other Diabetes Drugs

Despite their different primary indications, there are similarities between Zepbound and other diabetes drugs, particularly in their potential effects on body weight. Understanding these similarities can provide valuable insights into the broader therapeutic implications of medications like Zepbound.

Potential Impact of Zepbound on Weight Loss in People with Obesity

Zepbound's potential impact on weight loss in people with obesity holds promise for addressing the significant public health challenges posed by increasing rates of both obesity and overweight in the United States. Its role in enhancing weight management strategies is a key consideration for healthcare professionals and policymakers alike.

Understanding Eli Lilly's Role in Diabetes and Obesity Treatment

Eli Lilly's Contribution to Diabetes and Obesity Medication

Eli Lilly has been a pioneer in developing innovative medications for diabetes and obesity, with a strong focus on addressing unmet medical needs and improving patient outcomes. Its commitment to advancing therapeutic options reflects a dedication to improving the lives of individuals affected by these conditions.

How Mounjaro and Zepbound Align with Eli Lilly's Diabetes Portfolio

Mounjaro and Zepbound align with Eli Lilly's comprehensive diabetes portfolio, expanding the company's offerings to include obesity treatment. This strategic expansion underscores Eli Lilly's commitment to diversifying its healthcare solutions and addressing multifaceted health challenges.

Future Prospects and Research in Obesity Management by Eli Lilly

Eli Lilly's foray into obesity management marks the beginning of a new chapter in the company's research and development efforts. The approval of Zepbound and the ongoing exploration of its potential applications in obesity treatment signal promising prospects for future innovations in the field of weight management and metabolic health.

How much will I have to pay for Zepbound?

Zepbound, a popular trampoline park, offers various pricing options for visitors. The price for Zepbound varies depending on the duration of the visit and any additional services or features selected. Typically, the standard price for a one-hour session at Zepbound ranges from $15 to $20, although this may fluctuate based on peak times and special promotions. For those looking to extend their visit, a two-hour session is usually priced at around $25, with additional charges for longer durations. Zepbound also offers special packages and discounts for groups, parties, and regular customers, allowing for potential savings on the overall price. In addition, extra fees may be incurred for renting equipment, participating in certain activities, or accessing exclusive areas within the trampoline park. Overall, the price for Zepbound is reasonably affordable and offers a range of options to accommodate various budgets and preferences.

When will Zepbound be available?

Zepbound is scheduled to be available for purchase starting next month. The team behind the product has been working diligently to ensure that it meets all quality standards and is ready for release. With its innovative design and exciting features, Zepbound has already garnered a lot of attention and anticipation from consumers and enthusiasts. The company has been keeping the public updated through their social media channels and website, with sneak peeks and teasers to build up excitement. Pre-orders are expected to open in the coming weeks, giving eager customers the opportunity to secure their own Zepbound before it hits the shelves. The company has also been working on distribution partnerships to ensure that the product is widely available globally. With the official release date just around the corner, fans of Zepbound can look forward to getting their hands on this impressive new product very soon

https://risetomastery.com/2023/08/21/how-to-choose-the-right-virtual-fitness-program/

.

Who is eligible to take Zepbound?

Zepbound is a recreational activity that is suitable for individuals of all ages and fitness levels. As long as participants are in good health and do not have any medical conditions that could be exacerbated by jumping and bouncing, they are eligible to take part in Zepbound sessions. This means that children, teenagers, adults, and seniors can all enjoy the health and fitness benefits of Zepbound. It is important for participants to follow the guidelines and safety instructions provided by the instructor to ensure a safe and enjoyable experience. Additionally, individuals who are new to exercise or looking for a low-impact activity can also benefit from Zepbound, as it provides a fun and effective way to improve cardiovascular health, strength, and coordination. Whether you are looking to improve your fitness, relieve stress, or simply have fun, Zepbound is accessible to a wide range of people and is a great way to get active and have a good time.

https://risetomastery.com/2023/08/11/self-care-for-women-how-to-thrive-in-a-busy-world/

what do you need to know about Mounjaro? ( Zepbound )

Mounjaro is an injectable prescription medicine that is used along with diet and exercise to improve blood sugar (glucose) in adults with type 2 diabetes mellitus.

It is not known if Mounjaro can be used in people who have had pancreatitis. Mounjaro is not for use in people with type 1 diabetes. It is not known if Mounjaro is safe and effective for use in children under 18 years of age.

https://www.mounjaro.com/

Based on the information provided in the document https://www.accessdata.fda.gov/drugsatfda_docs/label/2023/217806s000lbl.pdf

, ZEPBOUND (tirzepatide) is indicated as an adjunct to a reduced-calorie diet and increased physical activity for chronic weight management in adults with obesity (BMI 30 kg/m² or greater) or overweight (BMI 27 kg/m² or greater) in the presence of at least one weight-related comorbid condition. It is important to note that ZEPBOUND contains tirzepatide and should not be coadministered with other tirzepatide-containing products or any glucagon-like peptide-1 (GLP-1) receptor agonist.

The document outlines the recommended dosage and administration instructions for ZEPBOUND. The starting dosage is 2.5 mg injected subcutaneously once weekly, which is increased to 5 mg after 4 weeks. The dosage may be further increased in 2.5 mg increments based on treatment response and tolerability. The recommended maintenance dosages are 5 mg, 10 mg, or 15 mg injected subcutaneously once weekly.

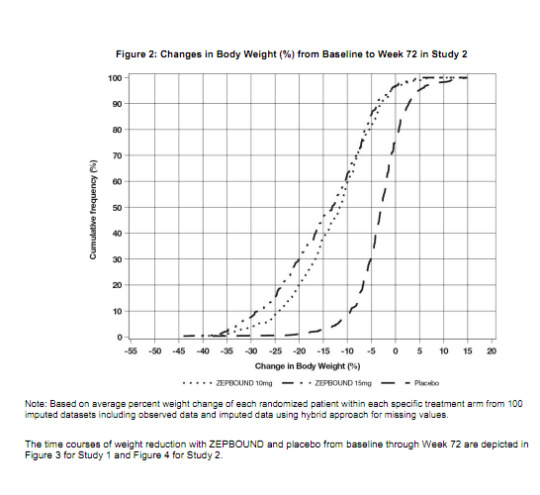

Clinical studies have demonstrated the efficacy of ZEPBOUND in chronic weight management. After 72 weeks of treatment, ZEPBOUND resulted in a statistically significant reduction in body weight compared to placebo. A greater proportion of patients treated with ZEPBOUND achieved at least 5%, 10%, 15%, and 20% weight reduction compared to placebo.

The document also highlights the potential risk of thyroid C-cell tumors associated with tirzepatide. ZEPBOUND is contraindicated in patients with a personal or family history of medullary thyroid carcinoma (MTC) or Multiple Endocrine Neoplasia syndrome type 2 (MEN 2). Patients should be counseled regarding the potential risk for MTC and informed about the symptoms of thyroid tumors.

In conclusion, ZEPBOUND is an adjunct treatment option for chronic weight management in adults with obesity or overweight and weight-related comorbid conditions. It has demonstrated efficacy in reducing body weight and offers different dosage options for individualized treatment. However, it is important to consider the contraindications and potential risks associated with tirzepatide, particularly the risk of thyroid C-cell tumors. Patients should be closely monitored and provided with appropriate counseling and education throughout the treatment process.

Zepbound (tirzepatide)Download

Read the full article

0 notes

Text

How to Turn Your Online Business Dreams into Reality

Introduction: The Digital Frontier of Entrepreneurship

Selecting a Niche and Business Model: The Foundation of Success

Building Your Online Platform and Brand: Your Digital Headquarters

Creating High-Demand Products and Services: Delivering Value to Your Audience

Implementing Effective Marketing Strategies: Attracting Targeted Traffic

Diversifying Revenue Streams for Maximum Profits: Building Financial Stability

Optimizing for Maximum Profitability Long-Term: Building a Sustainable Business

Conclusion: Turning Dreams into Reality

True successful story

Introduction: The Digital Frontier of Entrepreneurship

In today's digital age, the rise of the internet and technology has revolutionized the way we do business. It has opened a world of opportunities for entrepreneurs to start and run their own businesses online. Online businesses offer flexibility, scalability, and the potential for global reach. This comprehensive guide will provide you with a step-by-step framework for building a profitable online business from the ground up. Whether you want to start a side business or build a full-time online empire, follow this ultimate guide to turn your idea into a thriving, sustainable online business. With focus, grit, and commitment to continuous improvement, you can build the profitable online business of your dreams.

Selecting a Niche and Business Model: The Foundation of Success

The foundation of every successful online business is choosing a profitable, in-demand niche and a business model tailored to your goals. Select a niche you're passionate about; this will make creating content a breeze. Conduct thorough keyword research to assess search volume and demand. Join relevant online communities to connect with your audience and understand their needs. Evaluate direct competitors in the niche and aim for less saturated niches or unique angles. Consider affiliate marketing potential, as some niches offer higher commissions. Assess opportunities to create multiple products and monetize in diverse ways. Examples of popular online business niches include health, fitness, personal finance, pet care, tech, travel, content marketing, home design, spirituality, language learning, and more.

Choose a business model that complements your niche and provides multiple income stream opportunities. Many successful online businesses incorporate 3-4 monetization models. Some of the best online business models to consider include:

1. Blogging: Make money with display ads, affiliates, and branded products.

2. Online Courses: Sell your knowledge and expertise as courses.

3. Dropshipping: Curate and sell products without inventory.

4. Affiliate Marketing: Earn commissions promoting other companies' products.

5. Information Products: Sell online books, templates, checklists, and more.

6. Virtual Services: Provide consulting, freelancing, coaching, or other services.

7. Subscription Membership Site: Offer exclusive content or tools for a monthly fee.

8. E-commerce Store: Sell physical products, merchandising, and more.

Your choice should complement your niche and offer multiple income streams. Many successful online businesses incorporate 3-4 monetization models.

Building Your Online Platform and Brand: Your Digital Headquarters

Your website or blog will serve as the headquarters for your online business. Invest time upfront in creating an optimized, professional-looking platform. Purchase a domain name that matches your brand, ideally a .com if available. Select reliable web hosting with optimal speed and uptime. Install WordPress or ecommerce platforms like Shopify or WooCommerce. Design an on-brand, mobile-responsive theme that conveys your style. Include essential pages like Home, About, Contact, Services, Blog, and Shop. Set up email marketing and analytics to capture leads and track traffic data. Create visually branded assets such as logos, color palettes, fonts, and graphics. Ensure a cohesive user experience across all touchpoints. If you lack web development skills, consider hiring a freelance designer to bring your vision to life. Continually optimize your website for higher traffic, leads, and sales over time. This includes technical enhancements, user experience improvements, and page speed optimizations.

Creating High-Demand Products and Services: Delivering Value to Your Audience

The key to running a profitable online business is consistently creating products and services that deliver extreme value to your audience. Popular digital products you can create include online courses, eBooks, guides, checklists, software, premium memberships, virtual events, video tutorials, templates, and more. When brainstorming products, look for opportunities to simplify lives, save time, educate, entertain, or improve outcomes for your target customers. Leverage your expertise and tap into the skills of others to create premium offerings.

High-value services like consulting, freelancing, coaching, and more can also be extremely lucrative. Promote your services through your website and social platforms. Structure your offerings to passively earn income over time, such as online courses that continually generate sales vs. 1-on-1 services that require ongoing effort. Deliver an excellent user experience across your products and relentlessly optimize based on feedback to foster raving fans who refer others.

Implementing Effective Marketing Strategies: Attracting Targeted Traffic

Once your online platform and offerings are ready, it's time to start attracting targeted traffic using proven marketing tactics. A diverse marketing mix is key. Some of the top strategies include:

1. Content Marketing: Create engaging blog posts, videos, and visual content.

2. SEO: Optimize your website for search engines through on-page optimization and link-building.

3. PPC Ads: Utilize platforms like Google, Facebook, Instagram, and YouTube for pay-per-click advertising.

4. Email Marketing: Build your email list with lead magnets, newsletters, and automation.

5. Social Media Marketing: Employ organic and paid tactics to engage your audience.

6. Affiliate Marketing: Recruit others to promote your products and earn commissions.

7. Influencer Partnerships: Collaborate with relevant influencers in your niche.

8. Live Events: Host local meetups or virtual events to connect with your audience.

9. Podcast Guest Appearances: Grow your authority and reach new audiences.

10. Retargeting Ads: Remarket to previous site visitors across the web.

Start by focusing on 1-3 core channels, then expand your efforts over time. Pay-per-click and social ads can help quickly scale an audience, while SEO and content creation tend to be most cost-effective in the long-term. Leverage tools like Google Analytics, Facebook Business Suite, and landing page builders to optimize results across all campaigns. Don't hesitate to enlist help from digital marketing agencies and specialists.

Diversifying Revenue Streams for Maximum Profits: Building Financial Stability

Generating multiple streams of revenue is key for building a highly profitable online business. Diversification reduces risk and provides stability as each income channel goes through ups and downs. Here are some of the most lucrative online business revenue models:

1. Product/Service Sales: Your core monetization stream. Ensure competitive yet profitable pricing.

2. Advertising: Display ads, sponsorships, native advertising, etc. Set up Google Ad Manager.

3. Affiliate Marketing: Promote other company's products for commissions. Join affiliate networks.

4. Memberships/Subscriptions: Offer exclusive benefits, content, or tools for a monthly fee.

5. Events: Sell tickets for online or in-person events and training programs.

6. Dropshipping: Curate and sell products without holding inventory.

7. Physical Merchandise: Sell branded products with print-on-demand services.

8. Consulting/Freelancing: Sell your skills and expertise through 1-on-1 services.

9. Tip Jars/Donations: Allow fans to tip or donate to show support.

Aim to generate income from both active efforts like service packages and passive streams like online courses that earn as you sleep. Automate processes wherever possible to scale income without increasing workload proportionally. Reinvest profits back into growing your business and diversifying income channels to create an unstoppable snowball effect over time.

Optimizing for Maximum Profitability Long-Term: Building a Sustainable Business

Launching a profitable online business is an important first step. However, creating systems and processes that enable high profitability long-term is vital for sustaining growth. Here are some best practices for optimizing operations and profitability:

- Obsessively track KPIs and metrics for all marketing channels and funnels. Analyze data to optimize underperforming areas.

- Create excellent customer support systems. Provide prompt, personalized support to increase satisfaction and referrals.

- Automate repetitive tasks wherever possible with tools like Zapier. Automate lead collection, customer onboarding, analytics, inventory management, etc.

- Systematize your product creation process to quickly test and validate new product ideas, then scale those that resonate.

- Document your systems and processes so future hires can replicate them. This includes SOPs for customer service, product fulfillment, etc.

- Build a skilled team over time by hiring virtual assistants, freelancers, agencies, and eventually full-time employees. Focus on higher-level strategy.

- Maintain work-life balance as a long-term entrepreneur. Make time for adequate rest, leisure, and self-care to avoid burnout.

By staying agile, embracing innovation, and relentlessly providing value to your audience, you can build an online business that delivers meaningful income for decades to come.

Conclusion: Turning Dreams into Reality

Starting and running a profitable online business takes consistent effort and persistence. However, by zeroing in on a niche, selecting the right model, crafting high-value offerings, implementing diverse marketing strategies, diversifying your revenue streams, and optimizing for maximum efficiency, you can build an online business that provides freedom and fulfillment for years to come. Remember to stay obsessively focused on understanding and serving your target audience. Combine your passion with grit, resilience, and creativity. With the right mindset and business foundations in place, you have immense potential to build a thriving online business that stands out and makes a lasting impact. The time to stop dreaming and start taking action is now. Follow this comprehensive guide to turn your online business idea into reality, step-by-step. You can build an online empire that allows you to live life on your terms. The possibilities are truly endless if you commit to continuous learning and improvement. Let this guide spark the fire within and set you on the path to online business success. Start pursuing your online entrepreneur dream today.

True successful story

To illustrate the principles and strategies discussed in this comprehensive guide, let's delve into the inspiring true story of Pat Flynn and his online business, Smart Passive Income.

Smart Passive Income - About Pat Flynn

Background:

Pat Flynn was once an aspiring architect who unexpectedly found himself laid off during the economic downturn in 2008. Faced with uncertainty, he turned to the online world to seek alternative income sources. His journey began with a blog, which he aptly named Smart Passive Income (SPI).

Selecting a Niche and Business Model:

Pat recognized that there was a significant demand for information about creating online businesses and generating passive income. He was passionate about sharing his experiences, both successes and failures, and helping others navigate the world of online entrepreneurship. Pat's chosen niche was personal finance, but his business model extended beyond blogging.

Building Your Online Platform and Brand:

Pat invested in creating a professional-looking platform for SPI. He purchased a domain name, set up reliable web hosting, and designed an appealing website. His commitment to providing value was evident through the content he produced on his blog, podcast, and YouTube channel. His brand, Smart Passive Income, became synonymous with transparency, authenticity, and actionable advice.

Creating High-Demand Products and Services:

One of Pat's significant successes came from his creation of online courses and informational products. He developed courses on topics like email marketing, affiliate marketing, and podcasting, leveraging his expertise and audience trust. These products delivered immense value to his audience and contributed significantly to his income.

Implementing Effective Marketing Strategies:

Pat's marketing strategy was built on content marketing, podcasting, and email marketing. He consistently produced high-quality blog posts and podcasts, which not only attracted a dedicated audience but also positioned him as an industry expert. His email list grew as he offered valuable lead magnets and nurtured his subscribers.

Diversifying Revenue Streams for Maximum Profits:

Pat's income streams diversified over time. In addition to course sales, he earned from affiliate marketing, book sales, and speaking engagements. He also ventured into software development, creating tools like the Smart Podcast Player. This diversification provided stability and mitigated risk.

Optimizing for Maximum Profitability Long-Term:

Pat was relentless in optimizing his operations. He regularly analyzed data and user feedback to improve his products and content. His team expanded as the business grew, allowing him to focus on strategic decision-making. Pat prioritized work-life balance, emphasizing family and well-being.

Conclusion:

Pat Flynn's journey from unexpected job loss to the creation of a successful online business, Smart Passive Income, serves as an inspiring real-life example of the principles discussed in this guide. His dedication to providing value, commitment to continuous improvement, and willingness to diversify income streams are key takeaways for anyone aspiring to build a thriving online business. Pat's story reminds us that with the right mindset and a clear vision, online entrepreneurship can lead to a fulfilling and prosperous career.

Read the full article

#business-model#guide#marketing#niche#online-business#products#profitability#revenue#services#Success

4 notes

·

View notes

Text

5 Proven Ways to Build Confidence and Overcome Self-Doubt

How can I overcome self-doubt and build confidence?

What are some ways to deal with self-doubt?

How does imposter syndrome contribute to self-doubt?

How can affirmations help in overcoming self-doubt?

What are some recommended strategies from Medium to overcome self-doubt?

Conclusion

Self-doubt can often hold you back from reaching your full potential and living a fulfilling life. It is common to experience feelings of self-doubt from time to time, but it is important to find ways to overcome it and build your confidence. In this article, we will explore 10 effective strategies recommended by Psychology Today to help you overcome self-doubt and boost your self-confidence.

How can I overcome self-doubt and build confidence?

1. Recognize and acknowledge your self-doubts

The first step in overcoming self-doubt is to recognize and acknowledge your feelings of doubt. It is important to acknowledge that self-doubt is a normal part of being human, and many people struggle with confidence at some point or another. By acknowledging your self-doubts, you can begin to work on overcoming them.

2. Challenge negative thoughts and beliefs

Negative thoughts and beliefs often contribute to feelings of self-doubt. It is important to challenge these thoughts and replace them with more positive and empowering beliefs. For example, instead of thinking "I can't do this," try reframing it as "I am capable and have the skills to succeed."

3. Practice self-compassion

Practicing self-compassion can help you build your self-esteem and overcome self-doubt. Treat yourself with kindness and understanding, just as you would treat a friend. Remind yourself that it is okay to make mistakes and that self-doubt does not define your worth as a person.

"The greatest discovery of all time is that a person can change his future by merely changing his attitude." - Oprah Winfrey

What are some ways to deal with self-doubt?

1. Set realistic expectations for yourself

Setting realistic expectations for yourself can help manage feelings of self-doubt. Break down your goals into smaller, achievable steps and celebrate your accomplishments along the way. By setting realistic expectations, you can build your confidence and stay motivated.

2. Focus on your strengths and achievements

When experiencing self-doubt, it can be helpful to remind yourself of your strengths and past achievements. Reflect on the times when you have overcome challenges and succeeded. By focusing on your strengths, you can build your confidence and overcome self-doubt.

3. Seek support from others

Seeking support from others can provide reassurance and help you overcome self-doubt. Reach out to trusted friends, family, or mentors who can offer guidance and encouragement. Remember that you are not alone in your struggles, and sometimes all you need is a little support to feel good about yourself again.

"You have power over your mind - not outside events. Realize this, and you will find strength." - Marcus Aurelius

How does imposter syndrome contribute to self-doubt?

1. Understand what imposter syndrome is

Imposter syndrome is a psychological pattern in which individuals doubt their accomplishments and have a persistent fear of being exposed as a "fraud." It can contribute significantly to feelings of self-doubt and low self-esteem.

2. Challenge the thoughts and beliefs associated with imposter syndrome

To overcome self-doubt associated with imposter syndrome, it is essential to challenge the thoughts and beliefs that perpetuate it. Recognize that your achievements are valid and that you deserve your success. Remind yourself that imposter syndrome is a common experience, and you are not alone.

3. Shift your focus to your skills and experiences

Instead of dwelling on feelings of inadequacy, shift your focus to your skills, experiences, and the value you bring. Reflect on your accomplishments and remind yourself that you are capable and deserving of your achievements. By shifting your focus, you can build your confidence and overcome self-doubt.

"The beauty of the impostor syndrome is you vacillate between extreme egomania and a complete feeling of: 'I'm a fraud! Oh God, they're on to me! I'm a fraud!' So you just try to ride the egomania when it comes and enjoy it, and then slide through the idea of fraud." - Tina Fey

How can affirmations help in overcoming self-doubt?

1. Choose positive affirmations that resonate with you

Affirmations are positive statements that can help rewire your mindset and overcome self-doubt. Choose affirmations that resonate with you and address your specific doubts and insecurities. For example, if you struggle with the fear of failure, repeat affirmations such as "I embrace failure as an opportunity for growth."

2. Repeat affirmations daily to rewire your mindset

To make affirmations effective, repeat them daily to rewire your mindset. Say them out loud or write them down where you can see them regularly. Consistency is key in using affirmations to overcome self-doubt and build your confidence.

3. Use affirmations to counteract negative self-talk

Affirmations can be powerful tools in countering negative self-talk. Whenever you catch yourself doubting or criticizing yourself, replace those thoughts with your chosen affirmations. By consistently countering negative self-talk, you can gradually shift your mindset and boost your self-confidence.

"Expectation is the root of all heartache." - William Shakespeare

What are some recommended strategies from Medium to overcome self-doubt?

1. Identify and challenge your limiting beliefs

Identify the limiting beliefs that contribute to your self-doubt and challenge them. Explore where these beliefs originated from and examine their validity. Replace them with empowering beliefs that support your growth and confidence.

2. Set small goals and celebrate your accomplishments

Setting small, achievable goals can help you overcome self-doubt. Break down your larger goals into manageable tasks and celebrate each accomplishment along the way. By acknowledging your progress, you can build your confidence and motivate yourself to continue.

3. Surround yourself with positive and supportive people

The people we surround ourselves with can have a significant impact on our self-confidence. Surround yourself with positive and supportive individuals who lift you up and believe in your abilities. Their encouragement and belief in you can help you overcome self-doubt and build your confidence.

"Surround yourself with only people who are going to lift you higher." - Oprah Winfrey

Conclusion

In conclusion, self-doubt is a universal challenge that affects us all at some point in our lives. However, armed with the right strategies, we can overcome it and build unshakable confidence. The insights shared here, inspired by Psychology Today and Medium, provide a comprehensive guide to help you on your journey to self-assuredness.

Remember that recognizing and acknowledging self-doubt is the first step. Challenge those negative thoughts and beliefs that hold you back, and practice self-compassion because everyone is worthy of self-love and acceptance. Setting realistic expectations, focusing on your strengths, and seeking support from trusted individuals can be transformative.

Imposter syndrome is a common companion to self-doubt but understanding it and challenging its beliefs can help you break free. Shift your focus to your skills and experiences, realizing that your achievements are valid.

Positive affirmations can be your daily companions, helping you rewire your mindset and counteract negative self-talk. Choose affirmations that resonate with you and repeat them consistently.

Medium offers some additional strategies, such as identifying and challenging limiting beliefs, setting small goals, and surrounding yourself with positive and supportive people.

Now, let's explore some questions and answers that can provide even more clarity and guidance to your readers.

"The journey of a thousand miles begins with one step." - Lao Tzu

Q: What are some common causes of self-doubt?

A: Self-doubt often arises from past failures, negative feedback, unhealthy comparisons to others, imposter syndrome, and low self-esteem. Identifying potential roots of your self-doubt can help you address it.

Q: Why do we tend to dwell more on our failures than successes?

A: Our brains have a negativity bias, meaning we remember unpleasant experiences more vividly. Make a conscious effort to fixate less on failures and celebrate even small wins and achievements.

Q: How can I practice self-compassion when self-doubt is strong?

A: Self-criticism often accompanies self-doubt. Interrupt negative self-talk by speaking to yourself as you would a dear friend in the same situation. Give yourself permission to be imperfect.

Q: What if my doubts feel valid, not irrational?

A: Some self-doubt is grounded in real limitations or skills we need to improve. Reframe this as an opportunity for growth, not condemnation. Focus on progress.

Q: Are there physical practices that can help lower self-doubt?

A: Yes. Exercise, meditation, yoga, and breathing exercises help reduce stress and cultivate mindfulness. This creates mental space to address destructive thoughts.

Q: How can I stop comparing myself to others?

A: Comparing your weaknesses to others' strengths is unhealthy. Instead, reflect on your own growth and how you can learn from others' successes. Comparison breeds self-doubt.

Q: Is it self-doubt will ever fully go away?

A: For most, occasional self-doubt is inevitable. The goal isn't perfection but managing it effectively when it arises. With practice, you can reduce its frequency and impact.

Q: If I open about my self-doubt, will it reveal my weakness?

A: Sharing vulnerabilities requires courage and reveals our humanity. Far from weak, it can help build meaningful connections and gain needed support.

Q: How can I cultivate a growth mindset?

A: View abilities as learnable, not fixed. Embrace failures as lessons, focus on progress over perfection, and see setbacks as opportunities to improve. This counters self-doubt.

Q: Are there any books or resources you recommend?

A: Yes, books like "The Gifts of Imperfection" by Brene Brown, "Mindset" by Carol Dweck, and "The Confidence Gap" by Russ Harris are great resources.

Q: Should I seek professional help like therapy for severe self-doubt?

A: Therapy can be beneficial, especially cognitive behavioral therapy. If self-doubt is significantly impacting your mental health and daily functioning, consulting a professional can help.

Q: What are examples of empowering daily affirmations?

A: Affirmations like "I trust in my abilities," "I grow more confident each day," and "Challenges help me grow" can positively reframe negative self-talk when repeated.

Q: How can I stop procrastinating due to self-doubt?

A: Break down big goals into smaller, manageable tasks that spur momentum. Celebrate completing each step to build self-efficacy and reduce avoidance.

Q: If I am open to others about my self-doubt, what language should I use?

A: Use "I" statements like "I feel doubtful about this upcoming presentation." These invite support rather than judgment. Vulnerability connects us.

Success Story: Oprah Winfrey - From Poverty to Media Mogul

Oprah Winfrey, one of the most influential and successful media personalities in the world, faced extreme adversity and self-doubt in her early life. Her journey from poverty to becoming a media mogul is a testament to the power of determination and self-belief.

Early Life and Struggles:

Oprah was born into poverty in rural Mississippi and faced numerous challenges during her childhood, including a difficult family life. She experienced abuse and hardship, which left her with feelings of self-doubt and inadequacy. Despite these early setbacks, Oprah showed a keen intellect and a passion for communication.

Education and Early Career:

Oprah's journey to success began when she secured a scholarship to Tennessee State University, where she studied communications. After college, she worked in local radio and television, gradually honing her skills as a broadcaster.

The Oprah Winfrey Show:

In 1986, Oprah's life changed dramatically when she launched "The Oprah Winfrey Show." At the time, talk shows were dominated by sensationalism, but Oprah took a different approach. Her show focused on issues that mattered to people, from personal growth and self-improvement to social issues and inspirational stories.

Challenges and Triumphs:

Despite the show's initial success, Oprah faced skepticism and challenges. She was told that she didn't have the right look for television and that her weight was a liability. However, Oprah's determination and belief in herself allowed her to persevere.

Impact and Philanthropy:

Over the years, "The Oprah Winfrey Show" became a cultural phenomenon, making Oprah a household name. She leveraged her platform to promote reading through her book club, address important social issues, and donate millions to charitable causes.

Media Empire:

Oprah's success extended beyond her talk show. She founded her own media company, Harpo Productions, and launched the Oprah Winfrey Network (OWN). Her influence expanded into the realms of publishing, film, and television production.

Legacy:

Today, Oprah Winfrey is not only a media mogul but also a philanthropist, actress, and advocate for education and personal growth. Her story inspires millions worldwide and demonstrates that self-doubt can be overcome with determination, self-belief, and a commitment to making a positive impact on others' lives.

References:

- Oprah Winfrey - Biography

- Oprah Winfrey - OWN Network

- Oprah Winfrey's Top 10 Rules for Success

https://www.youtube.com/watch?v=yxcFKtupjL4

- The Impact of Self-Compassion:

- Research by Dr. Kristin Neff has shown that self-compassion, which involves treating oneself with kindness and understanding in moments of self-doubt or failure, can lead to increased self-esteem and reduced self-criticism. Neff's work suggests that practicing self-compassion can be a powerful tool in overcoming self-doubt.

- Reference: Neff, K. D. (2003). Self-compassion: An alternative conceptualization of a healthy attitude toward oneself. Self and Identity, 2(2), 85-101.

- Cognitive Behavioral Techniques for Challenging Negative Thoughts:

- Cognitive-behavioral therapy (CBT) is a well-established psychological approach for addressing self-doubt. Studies have shown that CBT techniques, such as cognitive restructuring, can effectively challenge and change negative thought patterns.

- Reference: Beck, A. T., Rush, A. J., Shaw, B. F., & Emery, G. (1979). Cognitive therapy of depression. Guilford Press.

- Imposter Syndrome and its Prevalence:

- Research has indicated that imposter syndrome, characterized by persistent self-doubt despite evidence of success, is more common than previously thought. Studies have explored its prevalence across different professions and demographics, shedding light on its impact.

- Reference: Clance, P. R., & Imes, S. A. (1978). The imposter phenomenon in high achieving women: Dynamics and therapeutic intervention. Psychotherapy: Theory, Research & Practice, 15(3), 241-247.

- The Efficacy of Positive Affirmations:

- Psychological research has examined the effectiveness of positive affirmations in building self-confidence. Studies suggest that affirmations can have a positive impact on self-esteem and self-efficacy when used consistently and in a personally meaningful way.

- Reference: Wood, J. V., Perunovic, W. E., & Lee, J. W. (2009). Positive self-statements: Power for some, peril for others. Psychological Science, 20(7), 860-866.

- Social

Read the full article

#achievegoals#buildconfidence#embracestrengths#overcomeself-doubt#personalgrowth#self-confidence#self-esteem#unshakeableconfidence

0 notes

Text

"Driving Business Success: The Power of Strong Leadership Unveiled"

Why is strong leadership important for business success?

What are the qualities of an effective leader?

How does leadership style affect organizational success?

Why is leadership development important in an organization?

What role do leaders play in fostering a positive work environment?

Q: Why is strong leadership crucial for driving business success?

Q: How does strong leadership impact employee performance?

Q: What qualities and skills are important for strong leadership?

Q: How can strong leadership drive innovation within a business?

Q: Can strong leadership impact the overall company culture?

Q: How can leaders adapt their leadership style to different situations?

Q: How can organizations develop strong leaders?

Welcome to our article on the crucial role of strong leadership in driving business success. In today's highly competitive business landscape, having effective leaders is more important than ever. Strong leaders can create a positive work environment, foster employee engagement, and develop strong leadership skills in team members. In this article, we will explore why strong leadership is important for business success, the qualities of an effective leader, how leadership style affects organizational success, the importance of leadership development, and the role leaders play in fostering a positive work environment.

Why is strong leadership important for business success?

Creating a positive work environment

Strong leaders play a critical role in creating a positive work environment. They set the tone for the entire organization by exemplifying professionalism, respect, and integrity. By fostering a positive work environment, leaders inspire their team members to feel motivated, valued, and engaged. This, in turn, leads to higher levels of productivity and a more enjoyable workplace.

Fostering employee engagement

Employee engagement is essential for the success of any business. When employees are engaged, they are more likely to work towards achieving the company's goals and objectives. Strong leaders foster employee engagement by creating a culture of trust, open communication, and collaboration. They encourage their team members to take ownership of their work and provide them with opportunities for professional growth and development.

Developing strong leadership skills in team members

Effective leaders understand the importance of developing strong leadership skills in their team members. They provide mentorship, guidance, and support to help their team members grow both personally and professionally. By investing in the development of their team members, leaders not only enhance the overall performance of the organization but also build a strong pipeline of future leaders.

"The function of leadership is to produce more leaders, not more followers." - Ralph Nader

What are the qualities of an effective leader?

Charismatic leadership

Charismatic leaders have a magnetic personality that inspires and motivates others. They can create a vision that others can rally behind and believe in. Charismatic leaders are excellent communicators, confident decision-makers, and have a strong presence that commands respect.

Servant leadership

Servant leaders prioritize the needs of their team members over their own. They lead by example and are focused on serving the needs of their team and the organization. Servant leaders empower their team members, provide them with the necessary resources and support, and encourage them to reach their full potential.

Creating a culture of innovation

Effective leaders understand the importance of creating a culture of innovation within their organizations. They encourage their team members to think creatively, take risks, and embrace failure as a learning opportunity. By fostering a culture of innovation, leaders enable their organizations to stay ahead of the competition and adapt to changing market demands.

"Success is not final, failure is not fatal: It is the courage to continue that counts." - Winston Churchill

How does leadership style affect organizational success?

Creating a sense of purpose and direction

Leadership style plays a crucial role in creating a sense of purpose and direction within an organization. Effective leaders have a sharp vision and can communicate it to their team members in a way that inspires and motivates them. They provide a clear roadmap for success and help their team members understand how their individual roles contribute to the overall success of the organization.

Empowering team members and giving autonomy

Leaders who empower their team members and give them the autonomy to make decisions are more likely to achieve organizational success. By trusting their team members, leaders not only foster a sense of ownership and accountability but also unleash the full potential of their employees. Empowered team members are more motivated, innovative, and willing to go the extra mile to achieve the organization's goals.

Promoting productivity and generating innovative ideas

Leadership style has a direct impact on the productivity and creativity of the organization. Effective leaders create an environment that encourages collaboration, teamwork, and the exchange of ideas. They provide the necessary resources and support to ensure that their team members have everything they need to succeed. By promoting productivity and generating innovative ideas, leaders drive innovation and help the organization stay ahead in the market.

"The only way to do great work is to love what you do." - Steve Jobs

Why is leadership development important in an organization?

Building a strong pipeline of future leaders

Leadership development is essential for building a strong pipeline of future leaders. Effective leaders invest in the development of their team members by providing them with opportunities for growth, mentorship, and training. By developing the leadership skills of their team members, leaders ensure a smooth transition of leadership roles and empower their employees to take on new challenges.

Enhancing overall organizational performance

Leadership development has a direct impact on the overall performance of the organization. When leaders are equipped with the necessary skills, knowledge, and abilities, they are better able to make informed decisions, motivate their team members, and drive organizational success. Effective leaders inspire their team members to perform at their best and create an environment that fosters high performance.

Ensuring long-term success and continuity

Leadership development is crucial for ensuring the long-term success and continuity of an organization. Effective leaders groom their successors and prepare them to take on leadership roles in the future. By developing a pipeline of future leaders, organizations can navigate through challenges, adapt to changes, and continue to thrive in a dynamic business environment.

"Leadership and learning are indispensable to each other." — John F. Kennedy

Top 10 Startup Mistakes and How to Avoid Them

What role do leaders play in fostering a positive work environment?

Creating an environment of trust and collaboration

Leaders play a crucial role in creating an environment of trust and collaboration. They lead by example and build trust with their team members through open and honest communication. Effective leaders encourage collaboration, teamwork, and the sharing of ideas. They create a safe space where team members feel comfortable expressing their opinions, taking risks, and challenging the status quo.

Supporting work-life balance and employee well-being

Leaders who prioritize work-life balance and employee well-being contribute to a positive work environment. They understand that employees who are well-rested, healthy, and happy are more productive and engaged. Effective leaders support and encourage their team members to maintain a healthy work-life balance, take time off to recharge, and prioritize their well-being.

Encouraging a culture of open communication and feedback

Leaders who encourage a culture of open communication and feedback create an environment where team members feel heard and valued. They actively seek input and feedback from their team members, encourage constructive dialogue, and are open to innovative ideas and perspectives. Effective leaders provide regular feedback and recognition to their team members, fostering a culture of continuous improvement and growth

"Leadership is not about being in charge. It is about taking care of those in your charge." — Simon Sinek

Q: Why is strong leadership crucial for driving business success?

A: Strong leadership is crucial for driving business success because it sets the vision, direction, and goals for the organization. Effective leaders inspire and motivate employees, foster a positive work culture, make strategic decisions, and ensure efficient execution of plans. They also provide guidance, support, and mentorship to employees, which leads to increased productivity, innovation, and overall business growth.

Q: How does strong leadership impact employee performance?

A: Strong leadership has a significant impact on employee performance. When leaders effectively communicate expectations, provide clear guidance, and offer support and recognition, employees feel motivated and engaged. Strong leaders also create a positive work environment that encourages collaboration, creativity, and continuous improvement. This, in turn, boosts employee morale, productivity, and leads to improved business outcomes.

Q: What qualities and skills are important for strong leadership?

A: Several qualities and skills are important for strong leadership. These include excellent communication and interpersonal skills, the ability to inspire and motivate others, the capacity to make tough decisions, adaptability, strategic thinking, and emotional intelligence. Strong leaders are also good at building relationships, fostering teamwork, and empowering their employees to reach their full potential.

Q: How can strong leadership drive innovation within a business?

A: Strong leadership plays a crucial role in driving innovation within a business. Leaders who encourage creativity, embrace innovative ideas, and foster a culture of innovation create an environment where employees feel empowered to take risks and be creative. By setting a sharp vision and providing resources and support, strong leaders can inspire and motivate employees to produce innovative solutions, products, and services that give the business a competitive edge.

Q: Can strong leadership impact the overall company culture?

A: Yes, strong leadership has a significant impact on the overall company culture. Leaders set the tone for the organization and their behavior and actions shape the values, norms, and behaviors of employees. A strong leader who promotes transparency, trust, and open communication can create a positive and inclusive work culture. On the other hand, a weak or ineffective leader can contribute to a toxic work environment, low morale, and high employee turnover.

Q: How can leaders adapt their leadership style to different situations?

A: Effective leaders understand the importance of adapting their leadership style to different situations. They recognize that different circumstances and individuals require different approaches. For example, in times of crisis, a leader may need to be more directive and authoritative. In other situations, a more collaborative and democratic leadership style may be appropriate. Adapting leadership style involves being flexible, understanding the needs of the team and organization, and being willing to adjust approaches accordingly.

Q: How can organizations develop strong leaders?

A: Organizations can develop strong leaders through various means. These include providing leadership training and development programs, mentoring and coaching opportunities, rotational assignments, and regular feedback and performance evaluations. Encouraging employees to take on leadership roles and providing them with opportunities to lead projects or teams can also help in developing strong leaders. Additionally, organizations can create a culture that values and supports leadership development through recognition and promotion of individuals who demonstrate strong leadership skills.

Read the full article

#BusinessSuccess#collaboration#Communication#conflictresolution#continuousimprovement#effectiveleaders#emotionalintelligence#employeeengagement#empowerment#leadership#leadershipdevelopment#mentorship#positiveworkenvironment#professionalgrowth.#recognition#teamwork#well-being#work-lifebalance#workplaceculture

0 notes

Text

The Best Investment Options During Global Conflicts and Cold Wars

1. Why is it important to invest during global conflicts and cold wars?

2. How can alliances and partnerships help secure your investments?

3. What are the best investment options during global conflicts and cold wars?

4. How can defense stocks be a stable investment during global conflicts?

5. The importance of investing for the long term during cold wars

Case Study

Q: What is the impact of international peace on modern security and trade?

Q: How does international peace affect supply chains?

Q: What role does international peace play in the overall strategy of nations?

Q: Is international peace influenced by geopolitical tensions?

Q: How does international peace impact the resilience of economies?

Q: What is the role of international organizations in promoting international peace?

Q: How does international peace contribute to the security of cyberspace?

Q: Can the outbreak of conflicts impact international trade?

Q: What is the relationship between international peace and the deployment of new technologies?

Q: How does international peace impact policymaking?

Global conflicts and cold wars can create economic and geopolitical uncertainties that can significantly impact investments. However, it is important to consider investing during these periods as it can offer various advantages and opportunities for financial growth and stability.

1. Why is it important to invest during global conflicts and cold wars?

1.1 Safeguarding your investments

During times of global conflicts and cold wars, there is a higher risk of economic and political upheaval. By investing in secure assets, you can better safeguard your investments and minimize potential losses.

1.2 Building resilience in your portfolio

Investing during global conflicts and cold wars allows you to build resilience in your portfolio. Diversifying your investments across different sectors and asset classes can help mitigate risks and protect your wealth.

1.3 Strengthening your economy amidst crisis

Investments during global conflicts and cold wars can strengthen your economy by providing stability and growth. Your investments contribute to the overall Gross Domestic Product (GDP) and support economic development despite the challenging circumstances.

2. How can alliances and partnerships help secure your investments?

2.1 Investing in sectors with strong alliances

Choosing investment options in sectors that have strong alliances and partnerships can help secure your investments. Companies that collaborate internationally and have a strong network of allies are more likely to weather geopolitical uncertainties.

2.2 Leveraging the power of international cooperation

International cooperation is crucial during times of global conflicts and cold wars. By investing in industries that heavily rely on export and benefit from international cooperation, you can capitalize on the stability and growth that these alliances provide.

2.3 The role of the private sector in safeguarding investments

The private sector plays a vital role in safeguarding investments during global conflicts and cold wars. By investing in companies that prioritize research and development, intellectual property protection, and have the capacity to withstand economic shocks, you can secure your assets.

3. What are the best investment options during global conflicts and cold wars?

3.1 Investing in precious metals like Gold and Silver

Precious metals like Gold and Silver are considered safe-haven assets during times of geopolitical tensions. These metals have a long history of retaining their value and can act as a hedge against inflation and currency fluctuations.

3.2 Real estate as a secure investment during geopolitical tensions

Real estate investments are often viewed as secure during global conflicts and cold wars. Investing in properties can provide both financial stability and rental income, making it an attractive option for long-term investors.

3.3 Healthcare stocks as a defensive investment

Healthcare stocks can be a defensive investment during times of global conflicts and cold wars. Regardless of the geopolitical climate, healthcare remains an essential industry. Investing in companies in this sector can provide stability and potential growth.

top 10 startup mistakes

4. How can defense stocks be a stable investment during global conflicts?

4.1 The long-term prospects of defense stocks

Defense stocks can offer stability and growth potential during global conflicts and cold wars. Governments tend to prioritize defense spending to ensure national security, making defense companies a stable investment option.

4.2 Capitalizing on international peace and cooperation

During periods of international peace and cooperation, defense stocks can experience growth. As tensions ease and countries focus on rebuilding relationships, defense companies can benefit from increased defense budgets and cooperation.

4.3 Boosting your portfolio with investments in the defense sector

Investing in the defense sector can provide diversification and stability to your portfolio. Defense companies often have long-term contracts and government support, making them a reliable investment during global conflicts and cold wars.

5. The importance of investing for the long term during cold wars

5.1 Understanding the impact of global challenges on investments

Investing for the long term during cold wars requires a deep understanding of the impact of global challenges on investments. It is crucial to analyze the geopolitical climate, economic trends, and potential risks to develop a resilient investment strategy.

5.2 Complementing your investment strategy with long-term goals

Investing for the long term allows you to align your investment strategy with long-term goals. By focusing on stable assets and sectors that thrive during cold wars, you can capitalize on potential growth opportunities while managing risks.

5.3 Exploring investment opportunities in sectors that thrive during cold wars

Some sectors tend to thrive during cold wars, such as technology, healthcare, and defense. These sectors often benefit from increased government spending and advancements in technologies. Exploring investment opportunities in these sectors can lead to long-term financial growth.

How to Achieve Real Estate Success With No Money

Case Study

1: Warren Buffett and the Art of Long-Term Value Investing

Warren Buffett, often referred to as the "Oracle of Omaha," is one of the most renowned investors in the world. His investment philosophy is deeply rooted in the principles of long-term value investing, which has allowed him to navigate through numerous global conflicts and economic crises.

Background:

- Warren Buffett's investment journey began in the 1950s, during the Cold War era, and he faced various geopolitical uncertainties over the years.

- He is the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company with investments in various industries.

Key Strategies:

- Long-Term Perspective: Buffett is known for his unwavering commitment to long-term investing. He famously said, "Our favorite holding period is forever." This approach has helped him weather market volatility during global conflicts.

- Diversification: Buffett has built a diversified portfolio of companies in various sectors, reducing the risk associated with concentrated investments.

- Value Investing: He seeks undervalued stocks and businesses with strong fundamentals, even during turbulent times. This strategy helped him capitalize on opportunities when others were fearful.

Success Story: During the 2008 financial crisis, one of the most significant global economic downturns in recent history, Warren Buffett made some shrewd investments. He injected $5 billion into Goldman Sachs, which was struggling at the time, in exchange for preferred stock. This move not only supported a major financial institution but also yielded substantial returns as the market recovered.

Buffett's ability to stay calm during tumultuous times, combined with his disciplined approach to value investing, serves as a remarkable case study for investors seeking to navigate global conflicts and cold wars successfully.

2: George Soros and the Power of Adaptive Strategies

George Soros, a prominent hedge fund manager and philanthropist, is renowned for his ability to adapt his investment strategies to changing global circumstances.

Background:

- Soros founded the Quantum Fund in 1973 and actively managed it through various global conflicts and financial crises.

Key Strategies:

- Adaptive Investing: Soros is known for his theory of "reflexivity" in financial markets, where he believes that investor sentiment and market conditions are interconnected. He adapts his strategies based on evolving situations.

- Global Macro Investing: Soros takes a top-down approach to investing, focusing on macroeconomic factors and political developments.

- Risk Management: He emphasizes the importance of risk management and setting stop-loss orders to limit potential losses.

Success Story: Soros is famous for his shorting of the British pound in 1992, a trade known as "Black Wednesday." He bet against the pound's stability in the European Exchange Rate Mechanism, capitalizing on the UK's economic struggles. His successful trade led to substantial profits and is still studied by investors and economists today.

Soros' case study highlights the significance of adaptability, global awareness, and calculated risk-taking during times of global conflicts and economic uncertainty.

Case Study 3: Ray Dalio and the Principles of All-Weather Portfolios

Ray Dalio, the founder of Bridgewater Associates, one of the world's largest hedge funds, is a proponent of creating "all-weather" investment portfolios that can withstand various economic and geopolitical conditions.

Background:

- Dalio's investment career spans decades, during which he encountered numerous global conflicts and economic crises.

Key Strategies:

- Diversification: Dalio emphasizes the importance of diversifying across asset classes to reduce risk. He advocates for a balanced portfolio that includes stocks, bonds, and alternative investments.

- Risk Parity: He pioneered the concept of risk parity, which allocates investments based on their risk rather than traditional market capitalization weightings.

- Scenario Analysis: Dalio and his team conduct extensive scenario analysis to prepare for various economic and geopolitical scenarios.

Success Story: One of the key takeaways from Dalio's approach is the performance of Bridgewater's "All Weather" fund during the 2008 financial crisis. While many investors suffered substantial losses, this fund remained stable due to its diversified and risk-balanced nature.

Dalio's case study underscores the importance of building resilient portfolios that can navigate global conflicts and economic downturns while achieving consistent returns.

Q: What is the impact of international peace on modern security and trade?

A: International peace has a significant impact on modern security and trade. When nations are at peace with each other, it creates a resilient environment that safeguards economic and national security. It promotes stability, allowing for the growth of prosperity and the smooth functioning of investment and trade.

Q: How does international peace affect supply chains?

A: International peace is essential for the smooth operation of supply chains. It reduces the risk of disruption caused by conflicts or potential adversaries. When countries are at peace, supply chains can function efficiently, ensuring the timely delivery of goods and facilitating economic growth.

Q: What role does international peace play in the overall strategy of nations?

A: International peace is a vital component of the overall strategy of nations. It helps create a favorable environment for economic growth and prosperity. Countries that prioritize peace and security are more likely to attract investment, establish successful trade partnerships, and maintain stability in various sectors.

Q: Is international peace influenced by geopolitical tensions?

A: Yes, international peace can be influenced by heightened geopolitical tensions. When there are ongoing disputes or conflicts between nations, it poses a threat to peace and security. Effective diplomacy and peaceful resolutions are necessary to mitigate the risks of escalation and move towards a peaceful coexistence.

Q: How does international peace impact the resilience of economies?

A: International peace enhances the resilience of economies. By avoiding conflicts, countries can focus on building strong economic foundations, diversifying their industries, and creating opportunities for growth.

Read the full article

#casestudies#coldwars#defensestocks#economicresilience#geopolitics#GeorgeSoros#globalconflicts#gold#healthcarestocks#internationalpeace#Investing#policymaking#preciousmetals#RayDalio#realestate#secureinvestments#silver#supplychains#technologydeployment#WarrenBuffett

0 notes

Text

The Best Investment Options During Global Conflicts and Cold Wars

1. Why is it important to invest during global conflicts and cold wars?

2. How can alliances and partnerships help secure your investments?

3. What are the best investment options during global conflicts and cold wars?

4. How can defense stocks be a stable investment during global conflicts?

5. The importance of investing for the long term during cold wars

Case Study

Q: What is the impact of international peace on modern security and trade?

Q: How does international peace affect supply chains?

Q: What role does international peace play in the overall strategy of nations?

Q: Is international peace influenced by geopolitical tensions?

Q: How does international peace impact the resilience of economies?

Q: What is the role of international organizations in promoting international peace?

Q: How does international peace contribute to the security of cyberspace?

Q: Can the outbreak of conflicts impact international trade?

Q: What is the relationship between international peace and the deployment of new technologies?

Q: How does international peace impact policymaking?

Global conflicts and cold wars can create economic and geopolitical uncertainties that can significantly impact investments. However, it is important to consider investing during these periods as it can offer various advantages and opportunities for financial growth and stability.

1. Why is it important to invest during global conflicts and cold wars?

1.1 Safeguarding your investments

During times of global conflicts and cold wars, there is a higher risk of economic and political upheaval. By investing in secure assets, you can better safeguard your investments and minimize potential losses.

1.2 Building resilience in your portfolio

Investing during global conflicts and cold wars allows you to build resilience in your portfolio. Diversifying your investments across different sectors and asset classes can help mitigate risks and protect your wealth.

1.3 Strengthening your economy amidst crisis

Investments during global conflicts and cold wars can strengthen your economy by providing stability and growth. Your investments contribute to the overall Gross Domestic Product (GDP) and support economic development despite the challenging circumstances.

2. How can alliances and partnerships help secure your investments?

2.1 Investing in sectors with strong alliances

Choosing investment options in sectors that have strong alliances and partnerships can help secure your investments. Companies that collaborate internationally and have a strong network of allies are more likely to weather geopolitical uncertainties.

2.2 Leveraging the power of international cooperation

International cooperation is crucial during times of global conflicts and cold wars. By investing in industries that heavily rely on export and benefit from international cooperation, you can capitalize on the stability and growth that these alliances provide.

2.3 The role of the private sector in safeguarding investments

The private sector plays a vital role in safeguarding investments during global conflicts and cold wars. By investing in companies that prioritize research and development, intellectual property protection, and have the capacity to withstand economic shocks, you can secure your assets.

3. What are the best investment options during global conflicts and cold wars?

3.1 Investing in precious metals like Gold and Silver

Precious metals like Gold and Silver are considered safe-haven assets during times of geopolitical tensions. These metals have a long history of retaining their value and can act as a hedge against inflation and currency fluctuations.

3.2 Real estate as a secure investment during geopolitical tensions

Real estate investments are often viewed as secure during global conflicts and cold wars. Investing in properties can provide both financial stability and rental income, making it an attractive option for long-term investors.

3.3 Healthcare stocks as a defensive investment

Healthcare stocks can be a defensive investment during times of global conflicts and cold wars. Regardless of the geopolitical climate, healthcare remains an essential industry. Investing in companies in this sector can provide stability and potential growth.

top 10 startup mistakes

4. How can defense stocks be a stable investment during global conflicts?

4.1 The long-term prospects of defense stocks

Defense stocks can offer stability and growth potential during global conflicts and cold wars. Governments tend to prioritize defense spending to ensure national security, making defense companies a stable investment option.

4.2 Capitalizing on international peace and cooperation

During periods of international peace and cooperation, defense stocks can experience growth. As tensions ease and countries focus on rebuilding relationships, defense companies can benefit from increased defense budgets and cooperation.

4.3 Boosting your portfolio with investments in the defense sector

Investing in the defense sector can provide diversification and stability to your portfolio. Defense companies often have long-term contracts and government support, making them a reliable investment during global conflicts and cold wars.

5. The importance of investing for the long term during cold wars

5.1 Understanding the impact of global challenges on investments

Investing for the long term during cold wars requires a deep understanding of the impact of global challenges on investments. It is crucial to analyze the geopolitical climate, economic trends, and potential risks to develop a resilient investment strategy.

5.2 Complementing your investment strategy with long-term goals

Investing for the long term allows you to align your investment strategy with long-term goals. By focusing on stable assets and sectors that thrive during cold wars, you can capitalize on potential growth opportunities while managing risks.

5.3 Exploring investment opportunities in sectors that thrive during cold wars

Some sectors tend to thrive during cold wars, such as technology, healthcare, and defense. These sectors often benefit from increased government spending and advancements in technologies. Exploring investment opportunities in these sectors can lead to long-term financial growth.

How to Achieve Real Estate Success With No Money

Case Study

1: Warren Buffett and the Art of Long-Term Value Investing

Warren Buffett, often referred to as the "Oracle of Omaha," is one of the most renowned investors in the world. His investment philosophy is deeply rooted in the principles of long-term value investing, which has allowed him to navigate through numerous global conflicts and economic crises.

Background:

- Warren Buffett's investment journey began in the 1950s, during the Cold War era, and he faced various geopolitical uncertainties over the years.

- He is the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company with investments in various industries.

Key Strategies:

- Long-Term Perspective: Buffett is known for his unwavering commitment to long-term investing. He famously said, "Our favorite holding period is forever." This approach has helped him weather market volatility during global conflicts.

- Diversification: Buffett has built a diversified portfolio of companies in various sectors, reducing the risk associated with concentrated investments.

- Value Investing: He seeks undervalued stocks and businesses with strong fundamentals, even during turbulent times. This strategy helped him capitalize on opportunities when others were fearful.

Success Story: During the 2008 financial crisis, one of the most significant global economic downturns in recent history, Warren Buffett made some shrewd investments. He injected $5 billion into Goldman Sachs, which was struggling at the time, in exchange for preferred stock. This move not only supported a major financial institution but also yielded substantial returns as the market recovered.