#wealthbuilding

Text

Passive Income for Beginners: How to Build a Sustainable Income Stream with Minimal Effort

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Definition of Passive Income

Passive income refers to earnings derived from ventures in which an individual plays a limited, hands-off role. Unlike active income, where one is compensated for time and effort, passive income allows for the accumulation of wealth with minimal ongoing involvement.

Growing Interest in Passive Income

In recent years, there has been a surge in interest surrounding passive income, driven by a desire for financial independence and a shift in the way people view work and wealth creation.

Importance of Building a Sustainable Income Stream

While the allure of passive income is undeniable, building a sustainable income stream requires careful consideration and strategic planning. This article aims to guide beginners through the process, offering insights into the different forms of passive income and the steps to take for long-term success.

Understanding Passive Income

Different Forms of Passive Income

1. Rental Income

One of the classic forms of passive income involves owning and renting out real estate. Property owners receive rental payments regularly, providing a steady income stream.

2. Dividend Income

Investing in dividend-paying stocks allows individuals to earn a share of the company’s profits regularly. This form of passive income is common in the stock market.

3. Interest Income

Putting money into interest-bearing accounts or bonds can generate interest income over time. It’s a less risky but often lower-yielding option.

4. Royalty Income

For those with creative talents, royalties from intellectual property such as books, music, or artwork can serve as a passive income source.

Pros and Cons of Passive Income

1. Advantages

Diversification: Passive income provides an opportunity to diversify income sources, reducing financial risk.

Flexibility: Unlike traditional jobs, passive income ventures often offer flexibility in terms of time and location.

Wealth Accumulation: Over time, passive income has the potential to accumulate substantial wealth.

2. Challenges

Initial Effort: Despite the term “passive,” many forms of passive income require significant upfront effort.

Market Risks: Investments come with inherent risks, and passive income is no exception.

Continuous Management: Even passive income streams need occasional monitoring and management.

Common Misconceptions

Myth: Passive Income Requires No Effort

One prevalent myth surrounding passive income is that it requires no effort. In reality, while the effort may be less intensive than in traditional employment, there is often a need for initial setup and ongoing management.

Reality Check: Initial Effort and Continuous Management

Whether it’s setting up a rental property, investing in stocks, or creating online content, the initial effort is crucial. Continuous management ensures the sustainability and growth of passive income.

Dispelling Other Misconceptions

Beyond the effort misconception, it’s essential to address other common myths, such as the notion that passive income is exclusively for the wealthy or that it guarantees instant financial success.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Building Blocks for Passive Income

Choosing the Right Income Stream

Before diving into passive income, it’s crucial to assess personal preferences, risk tolerance, and available resources. Choosing the right income stream sets the foundation for a successful venture.

Investment Strategies for Beginners

1. Real Estate Investments

Real estate offers tangible assets and the potential for appreciation. Beginners can start with rental properties or real estate investment trusts (REITs) for a more hands-off approach.

2. Stock Market Investments

Investing in stocks, particularly dividend-paying ones, is a common way to generate passive income. Researching and diversifying a stock portfolio is key to managing risks.

3. Peer-to-Peer Lending

For those interested in financial technology, peer-to-peer lending platforms provide opportunities to earn interest by lending money directly to individuals or small businesses.

Importance of Diversification

Diversifying passive income streams across different assets helps mitigate risks. Relying on a single source exposes individuals to the specific risks associated with that income stream.

Creating Passive Income Online

Blogging and Content Creation

In the digital age, creating and monetizing content through blogs, videos, or podcasts is a popular avenue for passive income. Quality content, coupled with strategic monetization, can lead to a consistent income stream.

Affiliate Marketing

By partnering with companies and promoting their products or services, individuals can earn commissions on sales generated through their referral links. Successful affiliate marketing requires understanding the target audience and building trust.

E-commerce Ventures

Setting up an online store and selling products or services can be a lucrative source of passive income. Automation in payment processing and order fulfillment contributes to the passive nature of this income stream.

Challenges and Tips for Success

While creating passive income online is accessible, it comes with its challenges. Saturated markets and changing algorithms can impact visibility. Consistent effort, adaptation, and staying informed about industry trends are crucial for success.

Automating Passive Income

Utilizing Technology for Automation

Advancements in technology offer tools and platforms to automate various aspects of passive income ventures. From scheduled posts to automated investment algorithms, technology streamlines processes.

Passive Income Apps and Tools

Numerous apps and tools cater specifically to passive income enthusiasts. These range from investment tracking apps to social media scheduling tools, simplifying management tasks.

Streamlining Processes for Efficiency

Efficiency is key to maintaining passive income with minimal effort. Streamlining processes, whether in content creation or investment management, allows individuals to focus on scaling their ventures.

Overcoming Challenges

Patience and Persistence

Building a sustainable passive income stream takes time. Patience is essential, and persistence in the face of challenges is crucial for long-term success.

Learning from Setbacks

Setbacks are inevitable, but they offer valuable lessons. Instead of viewing failures as roadblocks, consider them stepping stones toward refining strategies and improving outcomes.

Adjusting Strategies Based on Experience

As individuals gain experience, they may need to adjust their strategies. Market conditions change, and being adaptable is key to maintaining and growing passive income.

Case Studies

Success Stories of Passive Income

Highlighting real-life success stories provides inspiration and practical insights. Case studies can showcase diverse paths to achieving passive income, emphasizing the importance of individualized approaches.

Learning from Failures: What Went Wrong

Analyzing failures is equally instructive. Understanding where others went wrong can help beginners navigate potential pitfalls and make informed decisions.

Financial Planning for Passive Income

Budgeting and Saving

Managing passive income effectively requires sound financial planning. Budgeting and saving ensure that individuals can weather economic downturns and capitalize on investment opportunities.

Tax Implications of Passive Income

Understanding the tax implications of passive income is crucial. Different income streams may be taxed at varying rates, and tax planning is essential for maximizing profits.

Seeking Professional Financial Advice

For those unfamiliar with financial intricacies, seeking advice from professionals is advisable. Financial advisors can provide tailored guidance based on individual circumstances.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Tips for Beginners

Setting Realistic Goals

Beginners should set realistic and achievable goals. Whether aiming for a specific monthly income or diversifying income streams, clear goals provide direction.

Continuous Learning and Adaptation

The landscape of passive income is dynamic. Continuous learning, staying informed about industry trends, and adapting strategies are vital for sustained success.

Networking and Building Connections

Networking with like-minded individuals and building connections within chosen industries can open doors to collaboration, mentorship, and valuable insights.

Realizing Financial Freedom

The Link Between Passive Income and Financial Freedom

Passive income serves as a vehicle toward financial freedom. As income streams become more stable and diversified, individuals gain greater control over their financial destinies.

Achieving Long-Term Stability

Striving for long-term stability involves consistently reassessing and optimizing passive income strategies. By doing so, individuals can build a robust financial foundation that withstands economic fluctuations.

Conclusion

In conclusion, the path to financial independence through passive income is a journey worth embracing. By carefully selecting income streams, diversifying strategies, and staying resilient in the face of challenges, you pave the way to a stable and enduring financial future. Remember, each step you take toward passive income is a stride toward a life of financial freedom, where your money works for you, allowing you to enjoy the fruits of your labor effortlessly.

FAQs

Q. How much money do I need to start generating passive income?

The amount varies based on the chosen income stream. While some options require minimal investment, others may necessitate a more significant initial capital. It’s essential to assess individual financial circumstances and start within one’s means.

Q. Can passive income fully replace a traditional job?

While passive income has the potential to replace or supplement traditional employment, it’s crucial to recognize that success often requires time and effort. Complete replacement depends on factors such as income goals, chosen strategies, and market conditions.

Q. Are there risks associated with passive income?

Yes, like any investment, passive income carries inherent risks. Market fluctuations, economic downturns, and unforeseen challenges can impact earnings. Diversification and careful planning can help mitigate these risks.

Q. How long does it take to see significant returns from passive income?

The timeline for significant returns varies. Some passive income streams may yield quicker results, while others require a more extended period of growth. Patience and consistent effort are key to building a substantial income over time.

Q. Is passive income suitable for everyone?

Passive income is accessible to a broad audience, but its suitability depends on individual preferences, risk tolerance, and financial goals. Exploring various income streams and assessing personal circumstances can help determine the appropriateness of passive income pursuits.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Affiliate Disclaimer :

This article Contain may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

Source : Passive Income for Beginners: How to Build a Sustainable Income Stream with Minimal Effort

Thanks for reading my article on “Passive Income for Beginners: How to Build a Sustainable Income Stream with Minimal Effort“, hope it will help!

#FinancialFreedom#IncomeStream#FinancialIndependence#InvestmentStrategies#OnlineVentures#WealthBuilding#SmartFinance#howtomakemoneyonline#makemoneyonline#makemoneyonline2023#makemoneyonlinefromhome#makemoneyfast#affiliatemarketing#cpamarketing#blogging#dropshipping#ecommerce#passiveincome#makemoneytutorials#methodsandtutorials#internetmarketing#digitalmarketing#clickbankaffiliatemarketing#affiliatemarketingtraining#cpamarketingtraining#cpa#blog#makemoney#makemoneyonlineguide#freelancingtraining

2 notes

·

View notes

Text

"Mastering Finances: Unlocking Wealth with Our Money-Making Tutorials"

------------------------------------------------------------------------

DM ME (instagram: z3tko) SAME MONEY ONLY FOR 20$ 💳💸

#FinanceTips#MoneyTutorials#FinancialSuccess#WealthBuilding#IncomeBoost#MoneyManagement#FinancialFreedom#InvestingAdvice#BudgetingTips#FinancialEducation#PersonalFinance#MoneyMatters#FinancialEmpowerment#FinancialGoals#MoneySkills#FinancialWisdom#MoneySavvy#MoneyTalks#EconomicEmpowerment#FinancialResources#FinancialJourney

2 notes

·

View notes

Text

Maximize Earnings & Build Generational Wealth: Precious Metals Secrets Revealed | Metal Mastery Gold

youtube

#preciousmetals#wealthbuilding#goldinvesting#silvertrading#riskmanagement#environmentalprotection#exporting#documentation#mininglicense#metalstesting#tradeinsight#negotiationmasterclass#goldbuying#pricestructure#thomasbelova#24kgold#22kgold#metalslogistics#Youtube

2 notes

·

View notes

Text

BHAGAVAD GITA DECODED - SOLUTIONS FOR A SUCCESSFUL LIFE

Receive this gift from The Supreme Pontiff of Hinduism Bhagavan Nithyananda Paramashivam - Bhagavad Gita Decoded available for FREE Download.

Any problem you can experience in life, you will find the solution here, and Swamiji has decoded the core powerful cognitions to help us better understand how to apply this knowledge nectar to our life.

Free download link: Https://Kailaasa.org/Bhagavadgita/

Bhagavat Gita Decoded by Bhagavan Nithyananda Paramashivam

Learn more about the SPH here - https://kailaasa.org/

#Nithyananda #Kailasa #booksm #VedicScriptures#lifesolutions #healthylifestyle #healthandwellness #wealthbuilding

#Nithyananda#Kailasa#booksm#VedicScriptures#lifesolutions#healthylifestyle#healthandwellness#wealthbuilding

2 notes

·

View notes

Text

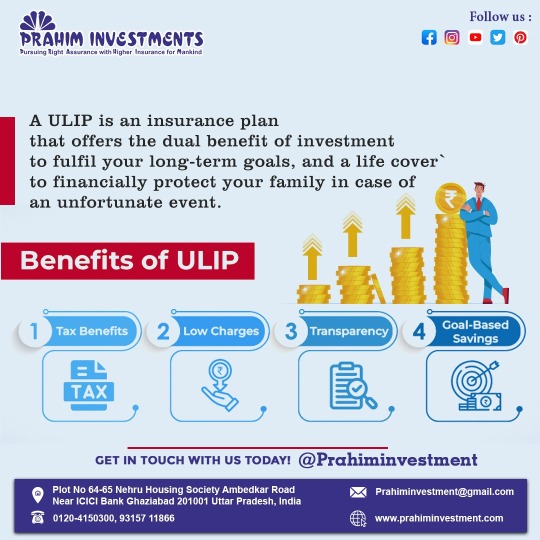

"Unlock the power of ULIPs and embrace financial growth with tax advantages, minimal fees, transparent operations and focused savings to achieve your aspirations."

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahiminvestments#Ulip#financialgrowth#taxadvantages#aspirations#investments#wealthcreation#financialplanning#longterminvesting#lifeinsurance#taxsavings#financialfreedom#investmentstrategy#securefuture#moneymanagement#SmartInvesting#wealthbuilding#FinancialGoals#retirementplanning

2 notes

·

View notes

Text

Traders reaction on tiktok #shorts

🔔Subscribe to the channel for tips & strategies for managing money & achieving financial independence: https://www.youtube.com/@your_finance_account/

✅ Stay Connected with Us.

👉Twitter: https://mobile.twitter.com/your_finance_?t=rr4nnhz-e3j1KAtHHwWc-w&s=09

✅ For Business Inquiries: [email protected]

=============================

✅ Recommended Playlists

👉 Motivational Videos

https://www.youtube.com/watch?v=RcFJAHHVBMw&list=PLYxqx3-R5Rlg6uJu6hzoH1RmzhFl1lRJB

👉Videos about finance

https://www.youtube.com/watch?v=NfDTd6CpFyk&list=PLYxqx3-R5Rlh2BGPUCJoij3xX1MiSxRNJ

✅ Other Videos You Might Be Interested In Watching:

👉Expert tips for saving a massive down payment and Achieving Your homeownership dreams

https://www.youtube.com/watch?v=D_Xjr5q6M_0

👉How to become a Billionaire like Jeff Bezos in 2023

https://www.youtube.com/watch?v=0495kUXBGkE

👉BEST WARREN BUFFET SPEECH THAT WILL CHANGE YOUR FUTURE IN 2023

https://www.youtube.com/watch?v=aSsFFed9tdo

👉Unlock the Secrets to Billionaire Success: 6 Expert Tips to Achieve Billionaire Status!

https://www.youtube.com/watch?v=c5iRreERdHE

👉The ultimate top 10 money-earning apps without investment in 2023

https://www.youtube.com/watch?v=mi0qULllG8A

=============================

✅ About Your Finance.

Welcome to Your Finance channel, where we empower you to achieve financial freedom. Our mission is to bridge the gap in financial education and equip you with the knowledge and tools needed to take control of your finances. From saving and investing strategies to budgeting and debt management, our team of experts will guide you every step of the way.

Join us on this journey to financial stability and independence. Subscribe now and hit the notification bell to stay updated on all things finance. Your financial success starts here!

For Collaboration and Business inquiries, please use the contact information below:

📩 Email: [email protected]

🔔 Subscribe to the channel for tips & strategies for managing money & achieving financial independence: https://www.youtube.com/@your_finance_account/

=================================

#budgetingtips #personalfinance #moneymanagement #financialplanning #savingsplan #financialfreedom

Disclaimer: We do not accept any liability for any loss or damage incurred from you acting or not acting as a result of watching any of my publications. You acknowledge that you use the information I provide at your own risk. Do your own research.

Copyright Notice: This video and my YouTube channel contain dialog, music, and images that are the property of Your Finance. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to my Youtube Channel is provided.

© Your Finance

https://ifttt.com/images/no_image_card.png

https://www.youtube.com/watch?v=bq0bSBudHn0

#wealthbuilding#financialfreedom#investing#personalfinance#financialplanning#multipleincomestreams#debtfree#savemoney#financialgoals

2 notes

·

View notes

Text

#barbie has it right!I discuss this during our #trainderailment

You can listen to it anywhere you get your #podcasts or you can #clickhere and #listen on @podbean https://www.podbean.com/ew/pb-na7sc-140e392 #theonetowatch #UFO #mania #champions #wealthbuilding #spotify #multiverse #usa

#theonetowatch#UFO#mania#champions#wealthbuilding#spotify#multiverse#usa#barbie#podcasts#clickhere#listen

5 notes

·

View notes

Photo

The 🌎 bends to those that see value in themselves and move to that energy. - We're not talking about arrogance or narcissism, but rather a kind of respect and reverence for your individuality. Have the courage to infuse your roots, your culture, and any other combination of codes that are specific to your life pattern into different mediums of creative expression. - It doesn't matter if you're building a business with that unique energy or making oil paintings, the point is to value your perspective, get kinetic, and make things that positively impact the 🌎. - If you need help with your business, brand, a/o career, and you would like to put these types of insights directly into action, get in touch. Click the link in our bio. - Be a WÜLF about your dream. - #MYUBERLIFE, we advise, develop, & empower BIPOC, The Creative Community, Entrepreneurs and Companies. #MULFMAB #leadership #entrepreneurship #business #finance #diversity #equality #culture #creativity #money #multicultural #multiculturalownedbusiness #multiculturalInvestors #multiculturalentrepreneurs #multiculturalWealth #wealthbuilding #multiculturalenterprise #trending #foryou #viral #fyp #Beawolfaboutyourdream #WULF https://www.instagram.com/p/CnnIL_vpBVCHpvT8nH4VrF65xm5JinvTW__XhY0/?igshid=NGJjMDIxMWI=

#myuberlife#mulfmab#leadership#entrepreneurship#business#finance#diversity#equality#culture#creativity#money#multicultural#multiculturalownedbusiness#multiculturalinvestors#multiculturalentrepreneurs#multiculturalwealth#wealthbuilding#multiculturalenterprise#trending#foryou#viral#fyp#beawolfaboutyourdream#wulf

5 notes

·

View notes

Text

Welcome to Rich Aunt Finance: Empowering Childfree Women to Build Wealth and Live Luxuriously

Welcome to Rich Aunt Finance, a personal finance blog for childfree women who prioritize financial freedom and luxury living. Here, we believe that financial success is achievable for anyone, and we're committed to helping our readers make informed decisions about budgeting, investing, and buying luxury goods.

At Rich Aunt Finance, we understand that being childfree allows us to live a certain lifestyle that may not be possible for those with children. That's why we focus on the unique financial challenges and opportunities that come with this lifestyle, including the choice to be solo by choice. We're all about creating a life of abundance, without the burden of debt.

We're committed to providing our readers with insightful and practical advice on a wide range of personal finance topics. From saving for retirement and building an emergency fund to investing in stocks and real estate, we've got you covered. We'll also share our experiences with luxury goods and services, showing you how to indulge in the finer things in life without breaking the bank.

So, whether you're just starting on your financial journey or you're a seasoned investor, Rich Aunt Finance has something for you. Let's embark on this journey together and achieve financial success!

#finance#money management#luxury goods#childfree#solo by choice#antidebt#wealthbuilding#financialplanning

3 notes

·

View notes

Text

"Money is like a sixth sense - and you can't make use of the other five without it." - William Somerset Maugham

#wealth#money#financialfreedom#investing#personalfinance#entrepreneur#success#rich#budgeting#savingmoney#wealthbuilding#millionairemindset#financialplanning#debtfree#financialindependence#passiveincome#stocks#investments#moneymanagement#cashflow

2 notes

·

View notes

Text

Start Any Business In 5 Steps

Starting a business can seem like an overwhelming task, but it doesn't have to be. With the right steps, you can get your business up and running in no time. In this article, we'll break down five essential steps that will help you start any business in just five easy steps. So if you're looking to turn your dreams into reality, read on for some helpful tips!

Ready to get started? First things first: Have a plan. Before you make any big decisions, take the time to consider your goals and objectives. Research the market and competition, create a budget, and make sure you have enough capital to get started. It may seem tedious at first, but having a well-thought-out plan will save you a lot of headaches down the road.

Next up is choosing the right legal structure for your business. This can range from sole proprietorship to limited liability company (LLC) and more. Depending on your situation and goals, one type of structure may be better than another - so it pays to do some research before making a decision! Once you've chosen the right legal entity for your business, it's time to move onto the next step: filing paperwork with the government.

Analyze The Market

Before launching any business, it’s important to analyze the market and get a complete understanding of the industry. Researching the industry will help you determine what makes your product or service unique, who your competition is, and what the consumer trends are. This will lay the groundwork for creating a successful business plan.

Start by researching your target market. This means identifying who you’re looking to serve and how you can best serve them. To do this, look at demographics such as age, gender, income level, location, etc. as well as psychographics like interests, lifestyle choices and values. Once you’ve identified these areas, begin identifying customer segments that share common characteristics that could benefit from your product or service.

You should also take time to study existing products and services in the industry to understand what your competition is offering and how they're meeting customer needs better than you can. Analyzing competitors can help you identify opportunities in the market that have yet to be tapped into or uncover gaps in service that need to be filled. Doing this research ahead of time will give you an edge when developing your product or service so it stands out from others on the market.

Finally, use all of this information to create a comprehensive business plan for launching and sustaining your venture over time. This plan should include detailed descriptions of your target audience, how you'll reach them through marketing strategies and tactics, pricing for products/services offered, potential growth plans for scaling up operations over time and more. With this data in hand, you'll be ready to move onto step two: setting up shop!

Evaluate Your Budget

Before you dive into starting any business, it's important to evaluate your budget. This helps you determine if the project is feasible and how much money you'll need to invest in the venture. Start by setting a realistic budget which accounts for all the necessary expenses. These can include anything from rent, payroll, marketing and advertising costs, inventory, and other overhead costs. Consider also any potential sources of funding such as bank loans or investor capital.

Next, create a plan for your budget that outlines where money will go each month. Knowing what money is coming in and going out will help keep you organized and on track with your goals. Additionally, make sure to take into account taxes and other fees associated with running your business. Keeping track of these details can ensure that you don’t run into any costly surprises down the road.

Lastly, consider ways to save money when possible. Look for discounts on equipment or supplies needed for your business and don’t be afraid to negotiate on prices wherever possible. Doing this can help ensure that you are getting the most bang for your buck while still reaching success with your venture.

Develop A Business Plan

Creating a business plan is an important step for any entrepreneur. It helps you to think through all the details of your business and create a roadmap for success. A well-thought-out plan can help you secure financing, attract investors, and guide your operations. Here are some key points to consider when creating your business plan:

The first step is to define your business’s mission statement. This should include what products or services you will offer, who your target customers are, and how you plan to differentiate yourself from competitors. Additionally, you should outline what your long-term goals are and how they fit into the overall mission of the business.

Next, it’s important to research the industry and market trends in order to better understand where opportunities exist. You should also assess any potential risks that could affect the success of your businesses such as regulatory changes or competition from other companies. This information can then be used in developing a comprehensive marketing strategy which should include detailed plans on how you will reach potential customers and promote your products or services.

Finally, financial projections are essential for evaluating the potential success of a business venture over time. These projections should include estimated costs to start up the business as well as estimated revenue for each year of operation. It’s also important to consider how much capital needs to be raised in order to get started and when profitability may be achieved. By doing this analysis ahead of time, it can help ensure that there is enough cash flow in place to sustain operations while allowing for future growth opportunities.

Creating a comprehensive business plan is an important part of starting any new venture so it’s important to take the time necessary to do it right. Doing so can provide clarity on what steps need to be taken next and increase the chances of achieving success down the road.

Register Your Business

After having a well-crafted business plan in hand, it's time to get the official paperwork out of the way. Registering your business is a critical step in getting your venture off the ground. Depending on where you live, and the type of business you want to run, there may be different requirements for registering. Here are some common steps to take when registering your business:

First, you'll need to come up with a name for your business and make sure that it is not already taken. You can check online or consult with an attorney who specializes in business law in order to verify if your desired name is available. Once you have chosen an appropriate name, you will need to register it with the Secretary of State or other relevant government agency where your business will be located.

Next, depending on what type of legal structure you've chosen for your business - such as sole proprietorship, limited liability company (LLC), or corporation - you'll need to fill out the necessary forms and register with the proper department within the government. Once registered, you will receive a unique identification number that must be used when filing taxes and other documents related to running a business. It's important that all official paperwork is filled out accurately and filed timely in order to avoid any potential penalties from government agencies.

Finally, once registered with the state or local government agency, you'll need to obtain any required permits or licenses specific for conducting certain types of businesses in certain states or countries. For example, if opening a restaurant there may be health department regulations that must be followed in order for it to open legally. Make sure all these steps are taken prior to starting operations so that everything is done properly from day one.

Obtain Necessary Licenses & Permits

Before you can start any business, it's important to obtain the necessary licenses and permits. Depending on your industry and where you're located, the licensing and permitting requirements may vary. It's best to research what specific licenses and permits you need before moving forward with setting up your business.

First, contact your local government to find out what types of licenses or permits are required. You may also want to check with other agencies such as the IRS or Department of Revenue, as they may have additional requirements for taxes and reporting. Be sure to ask about any costs associated with these documents too.

Once you know what's required, you'll need to fill out an application and submit it along with any supporting documentation that is needed. Once everything is in order, the application will be processed and if approved, you'll receive your license or permit in the mail.

Keep track of all paperwork related to your license or permit, including renewal dates if applicable. Staying up-to-date on paperwork will ensure that everything is in order so there won't be any delays when it comes time to open for business.

Choose A Business Structure

With the licenses and permits in place, it’s time to decide how your business should be structured. This is an important decision that will affect the taxation of your business and your personal liability. There are four main types of business structures: sole proprietorship, partnership, LLC (Limited Liability Company) and corporation.

A sole proprietorship is the most common type of business structure for startups because it's simple to set up and requires minimal paperwork. In a sole proprietorship, you are personally liable for all debts associated with the business. The profits are also taxed under your personal income tax rate.

In a partnership, two or more people share ownership of the business and divide profits based on their agreement. As with a sole proprietorship, both partners are personally liable for all obligations of the business. A Limited Liability Company (LLC) combines features from both partnerships and corporations by allowing owners to have limited protection from financial risk while operating as a separate legal entity with its own taxes.

Finally, a corporation is its own independent entity that has been created through state filing procedures and must use its own name upon incorporation. It offers many advantages such as limited liability protection for shareholders, but requires more paperwork than other structures due to more stringent reporting requirements at federal and state levels.

Depending on your needs, one of these structures may better suit you than others. Research each option carefully before making a decision so that you can choose the best fit for your business goals.

Choose A Location

Choosing a location for your business is an important decision. It should be based on factors such as cost of rent, access to customers, and accessibility for employees. Consider if the space meets the needs of your business; will it provide enough room for staff, storage, and customer flow? It's also important to investigate zoning regulations and other legal requirements in the area.

The type of business you operate will determine whether you need a physical store or office space. If you are running a retail shop or restaurant, you'll need a storefront that's easily visible and accessible to customers. On the other hand, an online business may require co-working space or a home office.

Take time to research potential locations thoroughly before committing to one. Investigate if there are any crime trends in the area which could affect customer safety or security; check with local authorities about parking restrictions; visit during different times of day to assess traffic levels; and consult with a real estate expert who knows the neighborhood well. Ultimately, choosing the right location can help grow your business in many ways.

Hire Employees

Once you have secured a location, it's time to start thinking about hiring employees. This is an important step in launching any business, as your employees will be the face of your company and help to shape its reputation in the marketplace.

First, you'll need to decide on the type of person you want to hire. Consider their skills, experience, and other qualities that are necessary for the job. You should also think about whether or not they will be full-time or part-time. Once you have identified the type of person you want to hire, it's time to begin recruiting.

You can recruit potential employees through job postings on various websites and social media platforms. You may also consider attending career fairs or hosting information sessions at your business. When reviewing applications and interviewing candidates, make sure to take into consideration their qualifications and how well they fit with your company culture.

Hiring the right people is essential for any successful business venture, so take your time and be selective when making your decisions. Make sure that each employee has all the tools and support they need to do their job properly and provide excellent customer service for your clients.

Find Vendors And Suppliers

Finding vendors and suppliers is a critical part of starting any business. Without them, you won't be able to acquire the necessary items to produce your product or service. To find vendors, start by researching potential suppliers online. Look for reviews from previous customers and read about their policies and procedures. You should also consider visiting trade shows or conventions where you can meet potential vendors in person and get a better feel for who they are and what they provide.

After narrowing down your list of potential vendors, contact each one directly to learn more information about their products, pricing, delivery times, minimum order requirements, payment methods, return policies, etc. Be sure to ask questions so that you can make an informed decision regarding which vendor is the best fit for your needs.

Once you have selected a vendor or suppliers, it's time to sign an agreement outlining the terms and conditions of the relationship. Negotiate prices if possible to ensure that you're getting a fair deal while still making sure that your vendor will remain profitable as well. This agreement should protect both parties involved in the transaction and help prevent disputes down the line.

To ensure that your relationship with your vendor remains positive over time, make sure to communicate openly and often about changes in inventory levels, payment schedules or timelines for orders. Additionally, make sure to thank them for any extra effort they put into ensuring your satisfaction with their products or services when appropriate.

Promote Your Business

Now that you have found vendors and suppliers for your business, it's time to promote it. Getting the word out about your new venture is key for its success. Here are five steps for promoting your business.

First, create an online presence. This includes registering a domain name, building a website, and being active on social media platforms such as Facebook, Twitter, and Instagram. Not only will this make it easier for customers to find you, but it also allows you to interact with them directly and build relationships.

Second, take advantage of local marketing opportunities like partnering with other businesses or hosting events in the community. You can also join local chambers of commerce or attend business-related seminars in your area to gain more visibility.

Third, create an email list of potential customers so you can reach out to them with offers and updates about your business. You can also use email marketing campaigns to keep current customers informed about new products or services. Finally, consider investing in paid advertising like Google Ads or Facebook Ads to reach a wider audience.

By following these steps and staying consistent in your promotion efforts, you can ensure that your business reaches its full potential!

Frequently Asked Questions

How Do I Know If My Business Is A Good Fit For The Market?

When starting any business, it's important to consider the marketability of the product or service. Knowing whether your business is a good fit for the market can be the difference between success and failure. Before investing time and money into a venture, you should assess the potential of what you're offering by conducting market research.

Market research involves understanding consumer needs and preferences, as well as what similar businesses are doing in the same industry. This helps you to identify opportunities that may not have been obvious at first glance, while also highlighting potential problems or issues before they become unmanageable. Additionally, obtaining feedback from potential customers can provide invaluable insight into how to shape your product or service and ensure that it meets their needs.

It's also important to keep an eye on current trends in order to stay competitive. By staying up-to-date with industry news and developments, you can quickly adjust your approach if needed in order to remain relevant and successful. Furthermore, gaining a detailed understanding of your target audience can help you craft marketing strategies that will resonate with them more effectively than generic approaches. The combination of these factors ensures that entrepreneurs have a clear picture of their intended customer base and how best to reach them.

Overall, understanding the basics of market research is essential for any business owner who wants to identify whether the product or service they offer is a good fit for their desired market. Taking time to explore these topics ahead of launching your venture can save considerable headaches down the line and give you an edge over competitors who neglect this step entirely.

What Is The Best Way To Secure Financing For My Business?

Starting a business can be daunting. Securing financing is one of the most important steps to ensure a successful launch. With the right preparation, understanding the best way to secure a loan or other form of financing can help budding entrepreneurs take their first steps towards success.

Researching different types of financing available and which are best suited for your particular business model is essential. There are many options, including traditional bank loans, venture capital, angel investments and crowdfunding platforms. Each option has its own set of requirements and it’s important to understand how they work before committing to any particular one.

Having a well-crafted business plan is key when seeking financing from any source. It should include comprehensive information about your business idea, research into the market you plan to enter and a realistic budget with projected revenues and expenses. Additionally, it’s important to have an understanding of what lenders are looking for before attempting to secure funding – this could include personal credit scores and collateral in addition to the viability of the business itself.

Once you have all this in place, you can begin searching for potential investors or lenders who might be willing to fund your venture in exchange for ownership equity or repayment agreements. You may also want to consider joining local networking groups or industry-specific organizations that could provide access to resources or contacts who might be able to help you secure financing. Taking time upfront to educate yourself on the best ways to finance your business will pay off in dividends down the road as you strive towards success as an entrepreneur.

How Can I Protect My Intellectual Property?

Protecting your intellectual property is a vital part of starting any business. It ensures that all the hard work you put into developing, creating and marketing your products or services isn't taken by someone else without your permission. There are several steps you can take to protect your intellectual property, from registering trademarks or copyrights to setting up non-disclosure agreements with partners.

The first step in protecting your intellectual property is to determine what kind of protection it needs. Different types of intellectual property require different levels of security. For example, if you have a patent for a product, you will need to register it with the US Patent and Trademark Office in order to protect it from being copied or sold by someone else without your permission. If you have an idea for a book or software program, then copyrighting it is essential.

Once you know what type of protection is necessary for your intellectual property, the next step is to make sure that all contracts related to it are properly written and executed. This includes contracts between yourself and any partners involved in creating the IP as well as contracts related to its sale or licensing. All contracts should clearly define who owns the IP, how it can be used and what rights each party has when it comes to its use and exploitation. Additionally, confidentiality agreements should also be established between parties whenever possible so that confidential information remains protected from potential competitors or other third parties.

Lastly, once all the legal paperwork has been taken care of, monitoring and enforcing usage rights becomes paramount in order to ensure that no one else is using your IP without permission. Keeping an eye on those who may be infringing upon your creation can help ensure that they don't continue doing so without consequence while also deterring others who may think about taking advantage of others' IP without proper authorization.

What Are The Legal Requirements For Setting Up A Business?

Starting a business can seem like an overwhelming process, especially when it comes to understanding the legal requirements. Knowing what steps you must take to set up your business is essential for ensuring that everything is done correctly and that you are in compliance with any applicable laws. This article will provide an overview of the legal requirements for setting up a business so that entrepreneurs can begin their businesses with confidence.

The first step in setting up a business legally is to choose and register a business name. This can be done through local government offices or online, depending on the type of business you’re starting. After registering the name, you’ll need to determine the type of business structure you’d like to use. Common types include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each type has different benefits and obligations, so it’s important to do your research before selecting one.

Next, you’ll need to obtain any necessary permits or licenses from local, state, or federal governments depending on what kind of business you’re running and where it’s located. Depending on the nature of your business, there may also be taxes or fees associated with obtaining these permits or licenses. Once all the paperwork is taken care of, it’s time to open a bank account for your new company as well as register for any applicable taxes such as income taxes or sales taxes.

By understanding and following these steps for setting up a legal business structure upfront, entrepreneurs can ensure they are in compliance with all regulations while also taking advantage of benefits such as limited liability protection or tax advantages associated with certain structures. Taking the time to understand these legal requirements before starting a new venture will put entrepreneurs on track for lasting success in their new ventures.

How Can I Create A Competitive Advantage Over Other Businesses In My Industry?

Creating a competitive advantage over other businesses in your industry is an important step to setting up a successful business. It's essential to understand the market you are entering and what makes your business unique in order to stand out from the competition. There are various strategies that can be used to gain an edge over competitors, such as offering superior services, creating innovative products, and providing better customer service.

One way of gaining a competitive advantage is by focusing on innovation. This could involve introducing new products with improved features or using cutting-edge technology that rivals don't have access to. To ensure that your business remains ahead of the game, it's important to stay up-to-date with the latest trends and developments in your industry and invest in research and development activities. Additionally, investing in marketing campaigns can help you reach potential customers who may not be aware of your business or its offerings.

Customer service is another key factor when it comes to gaining a competitive advantage. Providing excellent customer service can make all the difference between customers choosing your business or opting for a competitor's product or service instead. You should strive to build relationships with your customers by offering helpful advice and support when they need it. Additionally, developing loyalty programmes or special discounts can help keep existing customers coming back for more and encourage them to recommend your business to others as well.

By understanding the market you're entering and having an effective strategy for gaining a competitive edge, you can set yourself up for success by establishing a strong presence within your industry right from the start. With careful planning and implementation of these strategies, you can ensure that your business stands out from its competitors and continues to thrive long into the future.

Conclusion

Starting a business isn’t easy, but with the right amount of planning and research, it can be done. Knowing if your business is a good fit for the market, securing financing, protecting intellectual property and understanding legal requirements are important steps in the process. Creating a competitive advantage over other businesses in your industry is also essential.

By taking the time to consider these five steps before starting any business, you’re taking an important step towards success. You’ll need to do plenty of research and put together a solid plan to ensure that you have all the information necessary before launching your venture. With some hard work and dedication, you can create a successful and profitable business.

Good luck as you embark on this journey! With the right mindset and enough determination, you can make it happen – and don’t forget to enjoy yourself along the way! Starting your own business can be an incredibly rewarding experience, so don’t hesitate to take that first step towards success today.

#startingabusiness#entrepreneurship#smallbusiness#businessmindset#makemoney#financialfreedom#hustle#sidehustle#businessgoals#successmindset#moneytips#startupadvice#moneymanagement#personalfinance#businessadvice#profitablebusiness#businessopportunities#moneymakingideas#businessgrowth#wealthbuilding#businesstips

3 notes

·

View notes

Text

#tradingportfolio#wordstoliveby#topgthinking#topg#projectplatnum🥇#business#finance#knowledge#dontlosemoney#daytrader#money#millionairemindset#WEALTHBUILDING#passiveincome#ebooks#BusinessFinance#vcfunding#wisdom#invest#wealth#investing#healthfitness#mindset

2 notes

·

View notes

Text

#MakeMoney#Investment#FinancialFreedom#WealthBuilding#Savings#PassiveIncome#Entrepreneurship#StockMarket#RealEstateInvesting#FinancialLiteracy#Cryptocurrency#InvestingTips#RetirementPlanning#PersonalFinance#SavingsGoals#FinanceGoals#EntrepreneurLife#SideHustle#OnlineBusiness#WorkFromHome#MakeMoneyOnline#BusinessIdeas#StartUp#MoneyMotivation#FinancialSuccess#IncomeStreams.

5 notes

·

View notes

Photo

#harghartiranga #hargharsip #systematicinvestmentplan #wealthbuilding #wealthcreation #wealthmanagement #mutualfunds #investment #investthroughsip #sip #goals #goalsetting #familygoals #kidsfuture #retirement #retirementplanning #housing #dreamhome #homeloans #emi #buyhomes https://www.instagram.com/p/Chix8clqZmf/?igshid=NGJjMDIxMWI=

#harghartiranga#hargharsip#systematicinvestmentplan#wealthbuilding#wealthcreation#wealthmanagement#mutualfunds#investment#investthroughsip#sip#goals#goalsetting#familygoals#kidsfuture#retirement#retirementplanning#housing#dreamhome#homeloans#emi#buyhomes

3 notes

·

View notes

Text

instagram

#amulets#thaiamulet#thaiamulets#buddhist#buddhism#buddha#temple#wealth#wealthy#wealthamulet#wealthbuilding#luckypendant#luckylovecharm#luckythaiamulet#protectioncharm#luckycharm#holyblessed#holyamulet#thailand#Sacred#dhamma#dharma#rarities#relics#relicsandrarities#fournobletruths#Instagram

2 notes

·

View notes

Text

Earn Money Without Investment: Top 10 Apps To Use In 2023 | Your Finance

youtube

#wealthbuilding#financialfreedom#investing#personalfinance#financialplanning#multipleincomestreams#debtfree#savemoney#financialgoals#financialliteracy#financialindependence#successmindset#downpayment#homeownership#savings#budgeting#realestate#homebuying#firsttimehomebuyer#mortgage#moneymanagement#dreamhome#moneyearningapps#passiveincome#workfromhome#onlinemoneymaking#makemoneyonline#top10apps#Youtube

4 notes

·

View notes