#MoneyMindset

Text

THE BEST MONEY AFFIRMATIONS (aka facts)

(this is gonna be the only money Affirmations you'll never need lol)

I am rich

I am financially stable

I'm secure in my financial state

Money is safe

Money is good

Money is here to stay

I'm a money magnet

I have the perfect money mindset

I have the perfect self concept on money

I love money and money loves me

Money is the easiest thing to make

I have multiple sources of income

I am wealthy

I genuinely believe I deserve a lot of money

I deserve a luxurious, comfort, fun filled, lifestyle

I am worthy and deserving of having lots of money because I exist

I get money everyday

I get paid to exist

I am worth every cent I get

I get money quickly and easily

People always have enough money to give me

People bend over backwards to make sure I'm getting paid enough

Nobody goes to sleep unless and untill they make sure I'm getting paid enough

Everyday I just make more and more money

Me and the people i love are rich af

My bank account never stops getting fatter

I am so rich i make Elon Musk look poor

I am so rich my hands are starting to smell like money

I wake up every day and go to sleep stress free knowing that I don't have to worry about money in my life

I am living wealthy and abundant life

I keep finding money everywhere

No matter where I go money always keeps chasing me like a lost puppy

If I were to count the amount of times I got a huge amount of money out of blue, I wouldn't be able to count it cuz it's too much

My fingers are starting to hurt because of the amount of times I counted my stacks and stacks worth of billions of cash ugh 😫

I have so much money in my bank account that the value of pi π looks small

Sunday, Monday, Tuesday, Wednesday, Thursday, Friday, Saturday, 7 OUT OF 7 days I get money.

12 OUT OF 12 months I get money

there's not a single day that goes by without me getting money

Any amount of money i spend comes back to me tenfold

I walk into a shop knowing damn well I could buy the entire shop if I wanted to

I have so much money I can use it instead of a toilet paper (jk i don't do that)

I have so much money I can make origami out of it

I have so much money I'd buy the biggest companies and still remain rich as fuck like?

I am the definition of LOADED 💵

I am independent, successful, wealthy, rich, self sufficient, financially secure, debt free, stress free, yep I identify with those things.

My notifications are flooded with me receiving payments constantly

If anyone is a FATASS it is my wallet

Money is so desperate to stay in my life

Every where I go even to the damn toilet I still can never escape from lots of money😔

Money keeps flowing to me like a river

My bank account digits are the most groundbreaking, immense, tremendous, huge, back arching, toe curling, digits ever known to human kind😞

If i spent a whole day counting my stacks of cash, i wouldn't be able to cause that will take atleast a million years...oops...😳

Whether it's expected or unexpected, whether I'm happy or sad, sleeping or awake, working or not, money comes to me all the time and In all the ways.

#money affirmations#moneymindset#law of assumption#neville goddard#manifestation#manifesting#loassumption#affirmations#affirm#affirmyourlife#affirmdaily#manifestingreality#manifestyourreality#master manifestor#self concept#self concept affirmations

564 notes

·

View notes

Text

I love money and money loves me.

How to change your relationship with money:

Reframe the story you tell yourself: Work on establishing an abundance mindset. Look at your current beliefs and attitude about money. Do you have a scarcity mindset? Are you constantly chasing money and not believing you can reach your financial goals? Do you think money is bad?

Establish a positive mindset: Focus on gratitude for what you already have and embrace the belief that there are endless opportunities to become financially successful. Practice affirmations or visualization exercises to reinforce positive thoughts and attract abundance.

Educate yourself: Expand your financial literacy by reading books, watching videos, going to seminars or taking online courses on personal finance and money management. Understanding concepts like budgeting, investing, and saving will help you make informed decisions and take control of your finances.

Create a clear plan: Define specific and realistic financial goals for yourself. Whether it's paying off debt, saving for a home, or starting a business, having clear objectives will give you direction and motivation. Break these goals down into smaller milestones to make them more achievable and real in your mind.

Create a budget: Create a budget to track your income, expenses, and savings. Budgeting helps you gain a clear understanding of where your money is going and allows you to prioritize your spending. Ensure that your budget aligns with your financial goals and helps you save for the future.

Monitor your spending: Monitor your expenses closely to identify any unnecessary or impulsive spending habits. Use mobile apps or spreadsheets to record your expenses and categorize them.

Save and invest wisely: Make saving a priority by automating regular contributions to a savings account. Start building an emergency fund to cover unexpected expenses. Investing your money wisely to grow your wealth over time. Make your money work for you. Having money just sitting in the bank will not make it grow.

Needs Vs wants: Before making a purchase, ask yourself if it aligns with your values and financial goals. Avoid impulsive buying and give yourself time to consider whether it's a necessity or a fleeting desire.

Surround yourself with people who feel comfortable talking about money: Engage with people who have a healthy relationship with money. People who can casually have a conversation about making $10k, $20, $50k etc a month without blinking an eye. This will open your eyes about what you can have and help you feel comfortable with setting goals for yourself.

911 notes

·

View notes

Text

#18+ account#18+ only#all natural#big tiddy gf#cutie w a bootie#daily noods#dm me for my content#private snap#tease pic#big tiddy committee#big round butt#girl butts#perfect butt#moneymindset#lets talk#dm for noods#cashapp#livestream

214 notes

·

View notes

Text

673 notes

·

View notes

Text

I LOVE MONEY

Not for the flex.

Not for the attention .

For the freedom!

For the experiences!

To go where the fuck I want , when I want, to do what I want. It’s merely a tool for access to environments I like to occupy. The other trivial benefits come as a by product of having it. Even though I’ve grown up with a pinch of privilege , upward socioeconomic mobility is still the goal for me and mine. Fuckin around with the “fuck arounds” isn’t going to get us anywhere . Paying attention to the sequence of events and the company you keep proves that every time!

Its all of what my ancestors wanted🤌🏽

- ᛕꪖꪀꫀ🫡

#leveling up#goalsetting#high maintenance#goal digger#moneymindset#masculine energy#feminine aesthetic#flow#gentillmatic#lifestyle#rich lifestyle#rich men#black femininity#self impowerment#choices#quiet luxury#honestly#soft life#work life#business#red pill#no pill#self care#infj#business tips#luxurious#greenery#aries sign

203 notes

·

View notes

Text

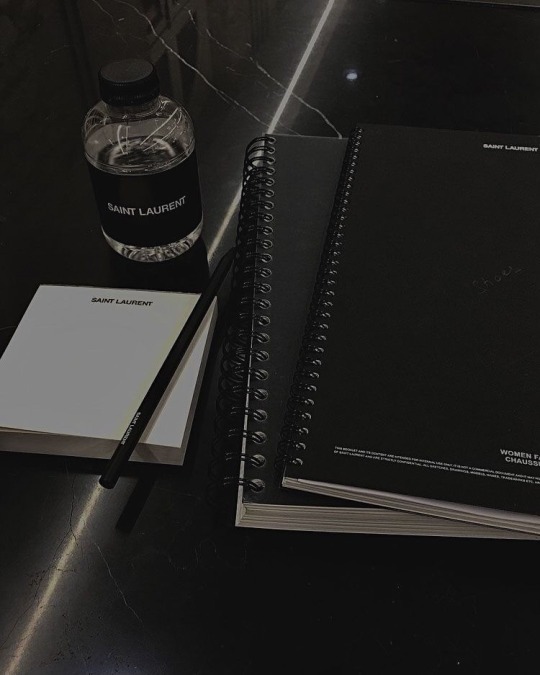

“that girl” school edition

#coquette#coquette aesthetic#dollette#old money#old money aesthetic#school#moneymindset#education#girlboss#girlblogger#academic validation

509 notes

·

View notes

Text

The best gift 🎁 one can give !

#livegood#livegoodfam#livegoodteam#stonewood717promotion#affiliate program#makemoneyonline#make money websites#passiveincome#moneymindset#sonadow#online earning#only us#online#onlinebusiness#earn money online#make money online#online business

28 notes

·

View notes

Text

Financial prosperity is on the horizon. Type "Yes" If You Agree!

#MyMoneyManifest#LawofAttraction#fyp#moneymindset#success#successtiktok#entrepreneur#motivation#inspiration#powerofyourmind

39 notes

·

View notes

Note

I want to FIRE! Do you have any tips for that ;)

Hi love! While I'm not committed to their FIRE movement per se, here are some of my best tips to set yourself up for financial success:

Diligently keep track of your income and expenses. Audit every week or month to give yourself an honest look at your financial activity

Create financial goals and a realistic budget to help you achieve them

Prioritize saving up a 6-month emergency fund, maxing out your Roth IRA (or backdoor Roth IRA) and HSA account (if in the U.S.)

Purchase high-quality, timeless items that are built to last; It's cheaper in the long run to maintain items vs. constantly repurchasing items if you have the option

Create multiple sources of income: A 9-5 job, investments, side hustle, digital products, etc. Find ways to monetize activities you would enjoy doing without earning a dime

Focus on building a strong network and high-value, transferable skills: Even if you plan on working as an employee forever (no shame in that – it's a great way to get a steady paycheck), always strategize your career in a way that would leave you equipped to make it on your own. You need to be in the driver's seat of your career and financial life at all times

Make food at home, take care of your health, and take advantage of preventative medical testing, screenings, and procedures. Losing your health (physical and mental) is the easiest way to ruin your life satisfaction and your finances

Hope this helps xx

#finance#moneymindset#financial planning#savings tips#personal investments#female entrepreneurs#femme fatale#dark femininity#dark feminine energy#successhabits#success mindset#goal setting#it girl#queen energy#dream girl#female excellence#female power#femmefatalevibe#fire movement

72 notes

·

View notes

Text

🌟 Harness the Energy of Abundance 🌟

💸 "Money is energy and the more positive energy you put into it, the more of it will flow to you." 💸

✨ Shift your perspective on wealth and abundance by understanding the energetic flow of money. When you infuse positive energy into your financial intentions, you open the floodgates for prosperity to come pouring into your life. ✨

🌟 Embrace the abundance mindset and watch as your relationship with money transforms. Instead of viewing it as a limited resource, see money as a boundless stream of energy waiting to be tapped into. 🌟

🔄 Take a proactive approach to attracting wealth by aligning your thoughts, feelings, and actions with abundance. The more positivity you radiate towards money, the more it will magnetically flow towards you. 🔄

📚 Ready to dive deeper into the principles of manifestation and abundance? Explore our selection of planners and journals in the link in our bio. Discover powerful tools and techniques to help you harness the law of attraction and manifest financial abundance effortlessly. 📚

#abundance#laws of attraction#manifestation#wealth#meditation#mindset#affirmations#gratitude#self care#self love#moneymindset

8 notes

·

View notes

Text

11 notes

·

View notes

Text

built a profitable drop servicing business

https://bit.ly/se288

Share your thoughts in comments 💭💭

entrepreneurmindset #moneytalks #moneymindset #rich #financialfreedom #wealthymindset #hustler #richmindset #successmindset #financialliteracy #finances #businessmotivation #money #investments #investor #wealthypot

#moneytalks#moneymindset#rich#financialfreedom#wealthymindset#hustler#richmindset#successmindset#financialliteracy#finances#businessmotivation#money#investments#investor#wealthypot

13 notes

·

View notes

Text

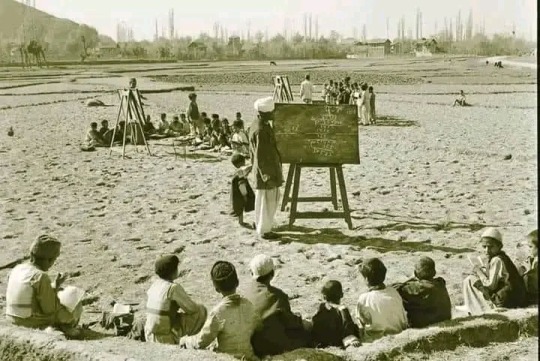

There was a time when "Education" wasn't subject of Money Profiting and Showing Off. Real those days were great.

7 notes

·

View notes

Text

The act of taking the first step is what separates the winners from the losers.

Let these powerful words by Brian Tracy inspire you to embrace possibility and resilience on your path to success.

Visit: www.andrebrian.com

#financialfreedom#wisdom#personaldevelopment#directselling#wealthmindset#collaboration#income#entrepreneurship#marketingstrategy#opportunity#achieversclub#successmindset#moneymindset#ambition#motivationquotes#businessgrowth#leadershipdevelopment#hustlehard#homebasedbusiness#investinyourself#time

5 notes

·

View notes

Text

How to Achieve Financial Freedom in Less Than 5 Years?

Financial freedom is a lifetime dream for many people, but it can only be achieved correctly. You have to know what you are doing and how you are doing it. I am going to tell you 7 Proven Methods to Achieve Financial Freedom. Take your time and read it carefully.

What Is Financial Literacy?

Financial literacy is the knowledge and application of various financial skills. These may include creating a budget, understanding how credit works, and saving for retirement. It is a life skill that one must grasp for good financial well-being. Financial literacy includes budgeting, investing, insurance, and loans and interest.

Making major financial decisions is often taught through financial freedom. Moreover, it increases financial discipline and financial capability. Also, it will lead to major lifestyle changes, such as saving and investing regularly, managing liabilities effectively, and achieving life goals efficiently. Additionally, financial Freedom will protect one from financial fraud and ensure financial security.

Steps to Financial Literacy

These are the 7 Proven methods to Achieve Financial Freedom –

1. Prepare a budget

To understand your financial situation, you need a budget plan. It will give you an idea of how much you should spend on your needs and how you can save money for emergencies and invest that money. Without a budget, you will not be able to control your finances and stop overspending. This will be your first step towards financial freedom. The steps are:

Step 1: Calculate your net income. Your net income is the basis of an effective budget.

Step 2: Track your spending.

Step 3: Set realistic goals.

Step 4: Make a plan.

Step 5: Adjust your spending to stay on budget.

Step 6: Review your budget regularly.

2. Understanding Your Credit Score

a) What is a credit score?

An individual’s credit score indicates their creditworthiness, or their ability to repay debt. Usually expressed as a number based on the person’s repayment history and credit files across different loan types and credit institutions. The credit score is also known as a credit rating.

b) Something important to know-

A credit score indicates whether or not a person is trustworthy. Every time you take a loan or pay a loan, everything is noted and represented in your credit score. If there is an issue in your regard, your credit score is decreased and this is a really big issue. When your credit score is low, you won’t be able to obtain a loan easily, and if you do, you will have to pay a lot of interest to the bank.

c) Steps to raise your credit score-

Check your credit report.

Pay your bills on time.

Pay off any collections.

Get caught up on past-due bills.

Keep balances low on your credit cards.

Pay off debt rather than continually transferring it.

3. Open a Savings Account

For saving and investing money, you should have separate savings accounts. As a result, you can manage your money easily and obtain interest from the bank as well. This means that your money is safe and secure, and the bank can even offer you insurance and security.

4. Understand your loans

You must understand your loans systematically. Improve your credit score and avoid paying high-interest rates. Pay your interest first, then the principal. By doing so, you will improve your credit score and save money.

5. Get ready for Risk

You should always be ready to face any problem which requires money to solve. Like, think about the covid-19 situation, when it occurred due to low finance or people have even not brought any health insurance and due to lack of money to go into a great depression.

So always after doing the above steps save money for this and if you cannot then have insurance. Currently, companies provide insurance with low interest also.

6. Secure your Future

You should plan for your future needs so that you can have enough to enjoy for the rest of your life in peace with your loved ones. You should then determine your retirement spending needs, such as monthly bills, grocery bills, and medical expenses. Decide if the retirement fund will be able to generate the required income after taxes by calculating the investment rate of return. Save money and invest in appropriate assets for retirement.

7. Spend Wisely

To achieve financial freedom faster, you must control your money wastage. It is important to understand where to spend money and where not to. You can wear shoes for $500 if you are not interested in having shoes for $2000. If you do this, you will save almost 1/4 of your salary. This will help you achieve financial freedom.

Conclusion

In conclusion, I will say only this: to achieve financial freedom, you must be disciplined. You will only find a path to success by following steps, but it will be only your wish to follow that path and succeed in your goals. In all these steps, if you have any problems, you can ask in the Forum. We will help you to achieve your life goals by converting savings into investments and providing you with guidance to achieve financial freedom by visiting more blogs on our site.

So please leave us a comment below about your experience with our site.

Thank you!

Visit the website Quick Journals

#finance#business#income#moneymindset#how to earn money#cash#investments#make money for free#financial freedom#personal finance#retirement planning#personal loans#personal income#personal saving#financeblogger#finance advisor#financetips

241 notes

·

View notes

Text

MONEY IS ESSENCIAL.

#finance#business#income#moneymindset#how to earn money#cash#investments#make money for free#financial freedom#personal finance#retirement planning#personal loans#personal income#personal saving#financeblogger#finance advisor#financetips#student loan#student loans#student loan debt#viral#loans#debt#Bad Credit Loans#Personal Loans#Quick cash Loans#nonprofits

139 notes

·

View notes