#wealthmanagement

Text

Fintlivest Services Private Limited is a financial service provider with personalized solutions for all types of financial planning. Our aim is to provide single window access to a wide range of financial products, including mutual funds, equities, IPO, ETFs, bonds, FDs, insurance PMS, NPS, loans etc, to help meet diverse financial objectives. We provide all financial services with transparency. Our focus is on putting the customer first and ensuring a guaranteed high return on investment.

2 notes

·

View notes

Text

10 Essential Tips for Effective Financial Management

Introduction

Effective financial management is the cornerstone of a stable and prosperous life. Whether you're an individual or a business owner, mastering the art of managing your finances can lead to greater financial security and opportunities. In this article, we will delve into the 10 essential tips for effective financial management, providing you with actionable advice to help you make informed financial decisions.

1. Create a Detailed Budget

Managing your finances starts with creating a detailed budget. A budget helps you track your income, expenses, and savings goals. By understanding where your money goes, you can make necessary adjustments to achieve your financial objectives.

2. Set Clear Financial Goals

To effectively manage your finances, set clear and achievable financial goals. These goals will serve as a roadmap for your financial journey, helping you stay motivated and focused.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

4. Reduce Debt

High-interest debts can hinder your financial progress. Create a plan to reduce and eventually eliminate your debts. Start by paying off high-interest debts first.

5. Invest Wisely

Make your money work for you by investing wisely. Diversify your investments, consider long-term strategies, and seek advice from financial experts if needed.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life. Regularly monitor it and take steps to improve it if necessary. A good credit score can lead to better borrowing terms and financial opportunities.

7. Save for Retirement

Don't wait until retirement is around the corner to start saving. The earlier you begin, the more you can accumulate. Explore retirement account options and contribute regularly.

8. Review and Adjust

Financial management is not a one-time task. Periodically review your budget, goals, and investments. Make adjustments as your financial situation changes.

9. Seek Professional Advice

If you find financial management overwhelming, consider seeking advice from a financial advisor. They can provide personalized guidance and strategies to optimize your finances.

10. Stay Informed

Stay updated on financial news, trends, and opportunities. Knowledge is power, and being informed will help you make better financial decisions.

10 Essential Tips for Effective Financial Management

In this section, we will briefly recap the ten essential tips for effective financial management:

Create a Detailed Budget

Set Clear Financial Goals

Build an Emergency Fund

Reduce Debt

Invest Wisely

Monitor Your Credit Score

Save for Retirement

Review and Adjust

Seek Professional Advice

Stay Informed

FAQs

Q: How do I start creating a budget?

A: Begin by listing all your sources of income and your monthly expenses. Categorize your expenses and identify areas where you can cut back.

Q: What's the ideal emergency fund size?

A: Aim for three to six months' worth of living expenses, but adjust based on your personal circumstances and risk tolerance.

Q: Can I manage my investments on my own?

A: While it's possible to manage your investments independently, seeking advice from a financial advisor can help you make more informed decisions.

Q: How often should I review my financial goals?

A: Regularly review your financial goals, at least once a year, and adjust them as needed to reflect changes in your life or financial situation.

Q: What's the best way to improve my credit score?

A: To boost your credit score, pay bills on time, reduce outstanding debts, and avoid opening too many new credit accounts.

Q: When should I start saving for retirement?

A: Start saving for retirement as early as possible to maximize your savings. The earlier you begin, the more you can accumulate over time.

Conclusion

Effective financial management is a skill that anyone can master with dedication and commitment. By following these 10 essential tips for effective financial management, you can take control of your finances, secure your future, and achieve your financial dreams. Remember that financial management is an ongoing process, so stay informed, adapt to changes, and always strive for financial excellence.

#FinancialManagement#MoneyManagement#PersonalFinance#FinancialGoals#Budgeting#InvestingTips#CreditScore#RetirementPlanning#DebtManagement#FinancialFreedom#Savings#FinanceTips#SmartInvesting#BudgetingTips#FinancialPlanning#WealthManagement#FinancialEducation#Finance101#FinancialAdvisor#MoneyMatters#MoneySmarts

4 notes

·

View notes

Text

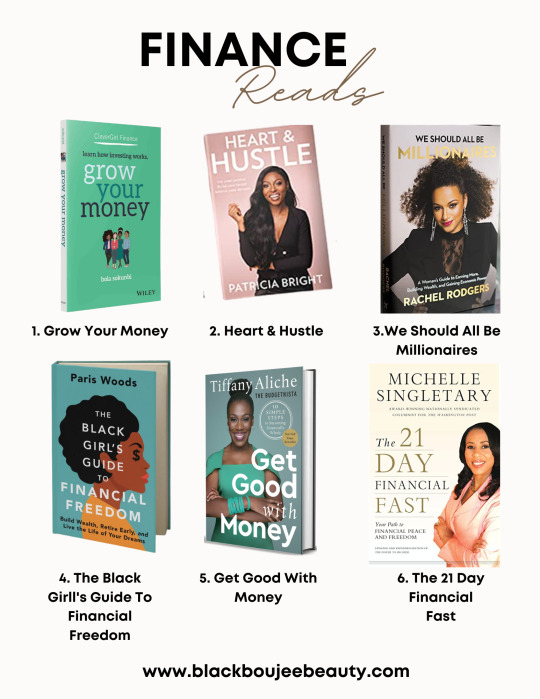

6 Finance Reads To Grow Your Wealth In 2023

Did you enjoy these books and want access to more like them? Head over to the BlackBoujeeBeauty Storefront and make sure to tag @blackboujeebeauty on Instagram so that we can tune into what you're reading this month and build healthy discussions around the related topics!

#blogging#blog#blog post#black girls who blog#blackgirlmagic#blacktumblr#trending#black girl luxury#blackgirlbloggers#black woman appreciation#wealth#moneymindset#wealthmanagement#manifestation#affirmations#wealth affirmations#luxury lifestyle#black women in luxury#personal development

10 notes

·

View notes

Link

Wealth management is no longer the same as it used to be! The rise of fintech companies has brought innovative investment solutions, making them more accessible and efficient than ever before.

Let's dive into the impact of fintech app development on wealth management in the UK and how it's changing the industry.

#fintech#financial#finserv#financialservices#wealthmanagement#investmentsolutions#mobileapp#appdevelopment#mobiosolutions#uk

8 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes

Text

Gambit is a company that offers forex trading courses, and referral programs.

Gambit is a company that offers forex trading courses, and referral programs. It recently held a forex expo in Bangkok, which aimed to inform people about forex trading and how Gambit uses artificial intelligence and machine learning to generate profitable signals and trades. Gambit also teaches its clients the gambit trading strategy, which is a method of sacrificing a small amount of money to gain an advantage over the market. By using Gambit’s services, clients can benefit from low-risk and high-reward forex trading opportunities.

#financialservices#forextrading#gambit#marketing#youtube#forexbot#accounting#forex online trading#wealthmanagement#forex#trading bot#tech#forex trading#tranding#usa#dollor

5 notes

·

View notes

Text

Unlock the Power of Generational Wealth with My Wealth Locker!

Secure your family's future with our comprehensive wealth management solution. My Wealth Locker empowers you to build a strong financial legacy that spans generations. 🏦✨

🔒 Robust Security: Rest easy knowing your valuable assets and documents are protected with advanced security measures.

🌈 Plan Ahead: Create customized financial strategies to secure your family's prosperity for years to come.

Start building generational wealth today with My Wealth Locker! 💪🏼💼👉 https://bit.ly/3LvMJfo

#GenerationalWealth#FinancialLegacy#WealthManagement#SecureFuture#FinancialPlanning#FamilyLegacy#InvestSmart#MyWealthLocker

3 notes

·

View notes

Text

4 notes

·

View notes

Text

#finance#money#investing#budgeting#savings#personalfinance#financialplanning#wealthmanagement#retirementplanning#credit#debtfree#financialfreedom#stocks#investments#financialliteracy#moneymanagement#taxes#mortgages#loans#insurance#entrepreneurship#bank

3 notes

·

View notes

Text

5 Key Considerations for Successful Wealth Management

Wealth management is a complex process that requires careful consideration and thought. There are many factors to consider when developing a successful wealth management strategy, including risk tolerance, life goals, long-term objectives, asset allocation, and estate planning. In this article, we will discuss five key considerations for successful wealth management so you can ensure your investments are managed wisely. With the right guidance, you can rest assured that your wealth will be effectively managed and protected. Let's get started!

What is Wealth Management?

Wealth management can be defined as the integration of financial planning, investments, and estate planning in order to help individuals and organizations manage their wealth. It is typically done with the guidance of a professional such as a financial advisor or an investment manager. A wealth manager typically takes into account all aspects of an individual or organization's finances, including investments, taxes, retirement plans, and estate planning. They strive to create a comprehensive plan to help maximize investment returns while minimizing risk.

Here are five key considerations for successful wealth management:

There are several important steps to consider when managing wealth. The most important of these are:

Risk Tolerance

How much risk are you comfortable taking with your investments? It is important to assess your appetite for risk when developing a wealth management strategy. This will help determine which types of investments would be the most appropriate for you and how aggressive or conservative your portfolio should be. It's always important to consider any investment decision's potential long-term outcomes.

Life Goals

What are your short and long-term goals? Is the goal to accumulate wealth, prepare for retirement, or do something else entirely? A clear understanding of your life goals will help you make well-informed decisions about managing your wealth best.

Long-term Objectives

It is important to consider how your investment will perform in the long term. Many investors make decisions based on short-term performance, which can lead to costly mistakes and missed opportunities. A successful wealth management strategy should take into account both current market conditions and future objectives.

Asset Allocation

Asset allocation means dividing an investor's portfolio into different types of investments, like bonds, stocks, and cash. It helps to minimize risk by ensuring that no single asset class takes up too much exposure in a portfolio. It is important to understand how each type of investment works and how they are affected by different market conditions.

Estate Planning

Estate planning is essential for ensuring that your wealth is distributed according to your wishes after you pass away. It also ensures that any taxes, legal expenses, and other costs associated with death are taken care of in an orderly fashion. Taking the time to develop an effective estate plan is essential for a successful wealth management strategy.

By taking these five considerations into account, you can ensure your investments are managed wisely and that your wealth is protected. With the right guidance, you can rest assured that you will be able to achieve all of your financial goals in the most efficient way possible.

Conclusion

Wealth management is a complex process, but by following the five considerations outlined in this article, you can ensure that your investments are managed wisely and that your wealth is protected. With the right guidance, you can rest assured that all of your financial objectives will be achieved.

It's important to do your research, ask questions, and familiarize yourself with the various investment strategies available in order to make informed decisions. Doing so will put you on the path to financial freedom and peace of mind.

4 notes

·

View notes

Photo

Join Us For Episode #50 The First Episode Of Season 4 Of Pest Equity Business Podcast Were We Discuss Building Sustainable Wealth,The Steps To Help You Achieve Your Goals And Set Yourself Up For Success. Learning The 4 Categories Needed Moving Forward, Becoming Financially Educated, Discussing Mainstream Sources Of Income, and Much More.. Our Social Places: Email: [email protected] https://cash.app/$pestequitypodcast instagram.com/@pestequitypodcast https://www.youtube.com/channel/UCtdyZsZW5MgiumnYbLDfxmw Facebook.com/pestequitypodcast https://teespring.com/stores/pest-equity-podcast-shop #pestequitypodcast #pestequitybusinesspodcast #pestcontrol #buildingwealth #sustainablewealth #podcast #smallbusiness #businessgrowthstrategy #salestips #financaleducation #wealthmanagement #nyc #likes #moneymoves #sayyestosuccess #ceomindset #ceomillionaires #entrepreneurs #startupbusiness #rothira #401k #retirementplanning #womenownedsmallbusiness #marketing #followformoretips #followus #follow #moneytree #moneystore @pestequitypodcast (at Manhattan, New York) https://www.instagram.com/p/CkIpvbJOFN6/?igshid=NGJjMDIxMWI=

#50#pestequitypodcast#pestequitybusinesspodcast#pestcontrol#buildingwealth#sustainablewealth#podcast#smallbusiness#businessgrowthstrategy#salestips#financaleducation#wealthmanagement#nyc#likes#moneymoves#sayyestosuccess#ceomindset#ceomillionaires#entrepreneurs#startupbusiness#rothira#401k#retirementplanning#womenownedsmallbusiness#marketing#followformoretips#followus#follow#moneytree#moneystore

2 notes

·

View notes

Photo

#harghartiranga #hargharsip #systematicinvestmentplan #wealthbuilding #wealthcreation #wealthmanagement #mutualfunds #investment #investthroughsip #sip #goals #goalsetting #familygoals #kidsfuture #retirement #retirementplanning #housing #dreamhome #homeloans #emi #buyhomes https://www.instagram.com/p/Chix8clqZmf/?igshid=NGJjMDIxMWI=

#harghartiranga#hargharsip#systematicinvestmentplan#wealthbuilding#wealthcreation#wealthmanagement#mutualfunds#investment#investthroughsip#sip#goals#goalsetting#familygoals#kidsfuture#retirement#retirementplanning#housing#dreamhome#homeloans#emi#buyhomes

3 notes

·

View notes

Text

Retirement Planning: Securing Your Golden Years

Introduction

Retirement planning is a critical aspect of financial stability and ensuring a comfortable life during your golden years. While it may seem distant, the earlier you start planning, the better prepared you'll be. In this guide, we'll delve into the intricate details of retirement planning, covering everything from setting financial goals to investment strategies. Get ready to embark on a journey towards a secure retirement.

Retirement Planning Essentials

Setting Clear Financial Goals

Retirement planning begins with setting clear financial goals. Ask yourself how much you'll need to maintain your desired lifestyle post-retirement. This includes housing, healthcare, and leisure activities. Create a detailed budget to estimate your future expenses accurately.

Creating a Retirement Timeline

Establishing a retirement timeline is crucial. Determine when you'd like to retire and consider factors such as your current age, life expectancy, and any unexpected early retirements. A well-defined timeline helps shape your savings and investment strategies.

Assessing Your Current Financial Situation

Take stock of your current financial situation. Calculate your assets, liabilities, and net worth. This assessment forms the foundation for developing a personalized retirement plan.

Investment Strategies for Retirement

Diversifying Your Portfolio

Diversification is key to managing risk in your retirement investments. Spread your investments across different asset classes, including stocks, bonds, and real estate. This minimizes the impact of market fluctuations.

Tax-Efficient Investments

Explore tax-efficient investment options, such as IRAs and 401(k)s. These accounts offer tax advantages, allowing your retirement savings to grow more effectively.

Seeking Professional Advice

Consider consulting a financial advisor who specializes in retirement planning. Their expertise can help you make informed decisions and optimize your investment strategy.

FAQs on Retirement Planning

What is the ideal age to start retirement planning?

Begin retirement planning as early as possible. Ideally, start in your 20s or 30s to take advantage of compounding interest.

Can I rely solely on Social Security for retirement income?

While Social Security provides some income, it's advisable to have additional savings and investments to ensure financial security during retirement.

How do I calculate my retirement savings goal?

Calculate your retirement savings goal by estimating your future expenses and factoring in inflation. Online retirement calculators can assist in this process.

Should I pay off all debts before retiring?

It's generally wise to minimize high-interest debts before retiring. However, low-interest debts may be manageable during retirement.

What if I haven't started saving for retirement yet?

Start now, regardless of your age. Even small contributions can accumulate over time and make a significant difference.

How can I adjust my retirement plan if unforeseen circumstances arise?

Regularly review and adjust your retirement plan as needed. Life changes, such as health issues or job changes, may require modifications.

Conclusion

Retirement planning is a journey that requires careful consideration, diligent saving, and informed decision-making. By setting clear goals, assessing your financial situation, and adopting the right investment strategies, you can pave the way for a secure and enjoyable retirement. Remember, it's never too early or too late to start planning for your golden years.

#RetirementPlanning#FinancialSecurity#RetirementGoals#InvestmentStrategies#FinancialFreedom#RetirementSavings#EstatePlanning#WealthManagement#TaxEfficiency#FinancialAdvisors#RetirementIncome#EarlyRetirement#SecureFuture#FinancialWellness#RetirementJourney#Toronto#Canada

2 notes

·

View notes

Photo

Retirement Meditation – Should my plan offer managed models?

In Retirement Meditation #16, we defined managed models and we concluded with the question – “Does my plan offer managed models?”

This week’s Retirement Meditation asks whether a fiduciary should offer managed models in their participant-directed plan.

Spoiler alert – It already may offer managed models, whether you realize it or not.

A year ago, we were approached by a retirement plan committee to review their plan and propose our advisory services. The plan had never had an advisor, the committee preferring a bundled-recordkeeper-direct-approach.

Why the change of heart from the committee?

An employee had questioned why she was 100% invested in the plan’s cash equivalent option. The committee investigation revealed that the participant had been using the recordkeeper’s investment management services. The managed model algorithm had effectively placed her into full stability of balance mode because of several important factors including her age, her incredible retirement savings history, and her state of financial retirement preparedness.

Many recordkeepers offer managed models, or the potential to provide managed models. While this can be a great thing, fiduciaries should be actively aware of the details in and around the managed model program.

Some of the starter questions:

Is the managed model the QDIA?

Is the managed model a backup QDIA, especially for participants who are entering the twilight of their career (translation: those aged 50 and older)?

Do participants actively choose a managed account program for themselves?

Is the managed model portfolio advised by an affiliate of the recordkeeper, by an outside third-party, or by the plan’s advisor?

Are there glidepaths associated with the managed model portfolios? If yes, are they the correct glidepaths within DOL guidelines?

At the individual participant level, who decides which managed model portfolio is best and how is that decision arrived at?

What is the fee for the managed model and who is paying that fee?

Managed model portfolios are often a welcome addition to a participant-directed retirement plan. Just know that the retirement plan fiduciary should be as keenly aware of the nuances as with all other matters involving the plan.

Which plan participants are using the managed model portfolios your plan is offering?

#employeebenefits#wealthmanagement#retirementplan#lifeinsurance#disabilityinsurance#healthinsurance#medicare#studentinsurance

2 notes

·

View notes

Text

Tigers of Wealth: Singapore vs. Hong Kong in the Family Office Faceoff

Two Asian titans, Singapore and Hong Kong, are locked in a high-stakes battle for supremacy in the realm of family offices - private havens managing the wealth of the ultra-rich. Once an undisputed leader, Hong Kong faces challenges, while Singapore strategically positions itself as a global wealth management destination. Let's unpack the strategies of these financial powerhouses and see why it matters.

Hong Kong's Eclipsing Luster

Hong Kong's once radiant image as a haven for wealth has dimmed. A significant exodus of millionaires, with estimates suggesting a 25% drop in the past year, paints a concerning picture. This can be attributed to several factors:

COVID-19 Conundrum: Stringent pandemic measures hampered Hong Kong's appeal as a business hub, pushing an estimated 3,000 millionaires to seek more relaxed environments.

Shifting Sands of Power: The tightening grip of Beijing on Hong Kong, coupled with security crackdowns, has cast a shadow over the city's economic landscape.

Zero-Covid Fixation: Hong Kong's unwavering commitment to a "zero Covid" strategy further impeded its economic performance.

As a symbolic shift, Hong Kong recently relinquished its crown as Asia's leading financial hub to Singapore, according to the Global Financial Centres Index (GFCI). This has led to a surge in Chinese wealth, families, and businesses migrating to the Lion City, with nearly 2,800 HNWIs (High Net Worth Individuals) relocating in 2022.

Singapore's Strategic Ascendancy

Singapore's rise is no stroke of luck, but a result of carefully crafted policies and inherent strengths:

Business Nirvana: Singapore consistently ranks among the most business-friendly nations. Transparent regulations, unwavering political stability, and a proactive government make it a haven for investors.

Tax Paradise: The city-state's tax-friendly regime fosters investment. Over the past decade, assets under management (AUM) have skyrocketed from US$1.2 trillion to a staggering SGD 5.4 trillion.

Wealth Management Oasis: Singapore actively cultivates its image as a hub for wealth management and fund management. The number of family offices has seen a significant rise, solidifying its position as a wealth preservation powerhouse.

The Battle Rages On

The competition intensifies. Singapore, boasting 25% of Asia's family offices, has established itself as a global leader in wealth management. Hong Kong, with its concentration of ultra-high net worth individuals, strives to regain its lost footing.

In this high-stakes game, both cities play to their strengths. Singapore offers stability and predictability, while Hong Kong seeks to recapture its former glory. As this Asian financial showdown unfolds, families of immense wealth stand to benefit from the innovation and competition it breeds.

0 notes