#fintech

Text

When you hear "fintech," think "unlicensed bank"

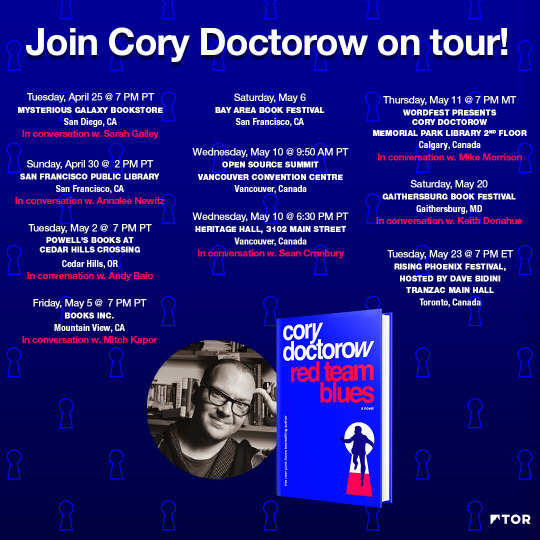

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.

These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set. They’re grifters, but they’re celebrated grifters. There’s a whole bottom-feeding sludge of tech exceptionalists that don’t get the same kind of attention, like patent trolls.

Oh, and the fintech industry.

As Riley Quinn says, “when you hear ‘fintech,’ think: ‘unlicensed bank.’” The majority of fintech “innovation” consists of adding “with a computer” to highly regulated activities and declaring them to be unregulated (and, in the case of crypto, unregulatable).

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is definitely doing and claims it isn’t). Most people don’t buy or sell securities regularly — indeed, most Americans own little or no stocks.

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars’ worth of debt. Many of us are privileged to borrow money by walking into a bank and asking for a loan, but millions of Americans are denied that genteel experience.

Instead, working Americans increasingly rely on payday lenders and other usurers who charge sky-high interest rates, on top of penalties and fees, trapping borrowers in an endless cycle of indebtedness. This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out — the crop comes in, say — and the debt is repaid.

But eventually, you’ll get a bad beat. The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you’re in an even worse situation, and the next time you catch a bad break, you go further into debt. Over time, all production comes under the control of creditors.

The historical answer to this is jubilee: a regular wiping-away of all debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it. Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors’ tables. Then, as starvation sets in, civilization collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

As the debt historian Michael Hudson says, “Debts that can’t be paid, won’t be paid.” Without jubilee, indebtedness becomes a chronic and inescapable condition. As more and more creditors attach their claims to debtors’ assets, they have to compete with one another to terrorize the debtor into paying them off, first. One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm. Debts that can’t be paid, won’t be paid — but when you have a choice between a broken arm and stealing from your kid’s college fund or the cash-register, maybe the debt can be paid…a little. Of course, digital tools offer all kinds of exciting new tools for arm-breakers — immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Under Trump, payday lenders romped through America. A lobbyist for the payday lenders became a top Trump lawyer:

https://theintercept.com/2017/11/27/white-house-memo-justifying-cfpb-takeover-was-written-by-payday-lender-attorney/

This lobbyist then oversaw Trump’s appointment of a Consumer Finance Protection Bureau boss who deregulated payday lenders, opening the door to triple digit interest rates:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as “inclusive.” These papers were secretly co-authored by payday loan industry lobbyists:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

Of course, Trump doesn’t read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved Rohit Chopra from the FTC to the CFPB, where, as director, he has overseen a determined effort to rein in the sector. As the CFPB re-establishes regulation, the fintech industry has moved in to add “with a computer” to many regulated activities and so declare them beyond regulation.

One fintech “innovation” is the creation of a “direct to consumer Earned Wage Access” product. Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they’ve already worked. The direct-to-consumer EWA offers loans without verifying that the borrower has money coming in. Companies like Earnin claim that their faux EWA services are free, but in practice, everyone who uses the service pays for the “Lightning Speed” upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers’ arms into leaving a “tip” for the service (yes, they expect you to tip your loan-shark!). Anyone desperate enough to pay triple-digit interest rates and tip the service for originating their loan is desperate and needs to the money now:

https://prospect.org/power/05-01-2023-fintech-ewa-payday-loan-scam/

EWA annual interest rates sit around 300%. The average EWA borrower uses the service two or three times every month. EWA CEOs and lobbyists claim that they’re banking the unbanked — but the reality is that they’re acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

This fact is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state’s 18% interest rate cap — remember, the true APR for EWA loans is about 300%.

In Texas, payday lenders are classed as loan brokers, not loan originators and are thus able to avoid the state’s usury caps. EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the “it’s different: we do it with a computer” logic.

But as Jarod Facundo writes for The American Prospect, quoting Monica Burks from the Center for Responsible Lending, a loan is a loan even if it’s with a computer: “The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws… When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that’s what a loan is.”

Catch me on tour with Red Team Blues in Mountain View, Berkeley, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A stately, columnated bank building, bedecked in garish payday lender signs.]

Image:

Andre Carrotflower (modified)

https://commons.wikimedia.org/wiki/File:30_North_%28former_Pontiac_Commercial_%26_Savings_Bank_Building%29,_Pontiac,_Michigan_-_entrance_and_Chief_Pontiac_relief_sculpture_-_20201213.jpg

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cfpb#earned wage access#digital armbreakers#loansharks#payday lenders#tech exceptionalism#jubilee#debt#fintech#usury#michael hudson#graeber#debts that can't be paid wont be paid

670 notes

·

View notes

Text

somewhere, in a cold, lonely data center, there is a daily cron job running on a forgotten Solaris server generating critical financial data that everyone uses to make retirement investment decisions.

37 notes

·

View notes

Text

To survive here, I have split myself in two: my true self and my false self.

Here are the facts: I am thirty-three, almost a year into a job in Silicon Valley, waiting for the truth of my life to crack open and reveal itself. Here, I am surrounded by all of the signs of money crushing the life out of a place: the rich live inside tall town homes, the poor live in faded dirty tents if they are lucky, there are boarded-up businesses next to new juice bars, people either defecating in the streets or buying gourmet groceries, eating at overpriced restaurants or out of the dumpsters in the back alley. It’s a city of extremes. The city is full of Believers. The Believers want to be here, were born to be here. They come from the Ivy League and throw their entire beings into technology. Their eyes glow as if pixelated. Their pulses thrum from stocks, driverless cars, phones that collect the data of their lives in digital dashboards reporting: songs listened to, steps taken, places visited, workouts completed, hours slept. Those of us who aren’t Believers are here in an attempt to heave ourselves up out of dying towns, out of in-state colleges, out of lower-class pasts and into the upper strata of wealth. We’ve come here to reinvent ourselves, with our families pushing us forward, their hands on our backs, urging us to go west, to strike gold. But out here, out west, there are endless hours of commuting, constant emails and notifications, top secret projects, impossible deadlines. Whether you’re a Believer or not, the very pressure of the atmosphere in San Francisco changes you, molds you, shapes you into a new breed of worker. It has changed me. To survive here, I have split myself in two: my true self and my false self. My fake self rises up to take over when the demands are too great. Maybe there must always be two of us—our real selves and the ones we create to survive in the world as it is.

— Sarah Rose Etter, Ripe: A Novel (Scribner, July 11, 2023)

57 notes

·

View notes

Text

How Blockchain is transforming the finance industry

Blockchain technology has recently emerged as a game-changer in many different industries, with finance being one of the most affected sectors. Due to the decentralized and transparent nature of blockchain, traditional financial services may transform, improving accessibility, efficiency, and security. Through this blog, we will explore how the financial sector is changing as a result of blockchain technology. Let's get going!

What is blockchain technology? Let's quickly review.

Blockchain technology is a sophisticated database technique that enables the transparent sharing of information within a business network. Data is stored in blocks that are connected in a chain in a blockchain database. Blockchain is a technique for preserving records that makes it hard to fake or hack the system or the data stored on it, making it safe and unchangeable. It is a particular kind of distributed ledger technology (DLT), a digital system for simultaneously recording transactions and associated data in numerous locations.

Now let’s see how blockchain technology is impacting the finance industry.

Enhanced Security

Blockchain offers a very safe and impenetrable means to transfer and store financial data. It establishes a decentralized, unchangeable ledger using cryptographic methods, where each transaction is recorded across a network of computers. By doing so, the necessity for middlemen is removed, and the likelihood of fraud, identity theft, and data manipulation is decreased.

Improved Transparency

With blockchain, everyone involved in a transaction can access the same copy of the ledger. This openness lessens the need for third-party verification and promotes confidence between the parties. Additionally, it gives auditors and regulators access to real-time information on financial activities, which improves compliance and accountability.

Faster and Cheaper Transactions

Traditional financial transactions sometimes include several middlemen, which causes delays and expenses. Blockchain makes direct peer-to-peer transactions possible, doing away with the need for middlemen. Particularly for cross-border transactions, which can take days or even weeks with conventional systems, this greatly lowers transaction costs and accelerates settlement times.

Smart Contracts

Blockchain systems commonly enable smart contracts, which are self-executing contracts with predefined rules and conditions. These contracts take effect right soon as the requirements are satisfied, eliminating the need for middlemen and reducing the likelihood of errors or conflicts. Smart contracts may simplify several financial processes, including trade finance, insurance claims, and supply chain financing.

Financial Inclusion

Blockchain has the potential to increase financial inclusion by giving unbanked and underbanked people access to financial services. Through blockchain-based digital identities, anyone can access financial services and demonstrate their creditworthiness without relying on traditional institutions. Remittance services supported by blockchain also offer affordable and efficient cross-border transactions, benefiting people in developing countries.

Tokenization and Asset Management

Tokenizing tangible assets like stocks, commodities, and real estate is made possible by blockchain technology. These digital tokens, which represent ownership rights, can be exchanged in a secure setting. Tokenization creates possibilities for fractional ownership, effective asset management, and liquid markets. New financial instruments like security tokens and decentralized finance (DeFi) protocols can also be developed thanks to it.

By enhancing existing financial services with efficiency, security, and transparency, blockchain technology has the potential to completely transform the financial sector. Its uses span from cross-border payments to smart contracts and supply chain financing, as we have already explored in this blog. Despite major obstacles, the use of blockchain in financial services seems to have a bright future. Adopting this ground-breaking technology could open up new doors for financial inclusion and fundamentally transform how we conduct business and handle our finances in the digital era.

41 notes

·

View notes

Text

BLINDED BY THE MEME

leveraged up like a douche,

missing another runnner on dex screen[er]

Mental Barf 2024

#mental barf#mentalbarf#dark art#gif#blinded#meme art#tradfi#traditional finance#fintech#finance#investing#investors#financial#business#meme coin#memes#meme culture#crypto art#base#ethereum#manifoldxyz#nft#digital art

11 notes

·

View notes

Text

The Disruptive Potential of Cryptocurrency, Blockchain, and DLT

Cryptocurrency, blockchain, and Distributed Ledger Technology (DLT) have been disrupting industries and challenging traditional business models since their inception. These technologies have the potential to revolutionize the way we do business, interact with each other, and even govern ourselves. In this blog post, we will explore the disruptive potential of cryptocurrency, blockchain, and DLT.

Cryptocurrency

Cryptocurrency, such as Bitcoin and Ethereum, is a decentralized digital currency that uses cryptography to secure transactions and control the creation of new units. Cryptocurrency has the potential to disrupt traditional financial systems by providing a more secure and transparent way to transfer value. Cryptocurrency eliminates the need for intermediaries, such as banks, and can help reduce transaction fees and increase financial inclusion.

Blockchain

Blockchain is a distributed ledger that records transactions in a secure and transparent way. Each block in the chain contains a cryptographic hash of the previous block, creating an immutable record of all transactions on the network. Blockchain has the potential to disrupt a wide range of industries, including finance, healthcare, and supply chain management. Blockchain can help increase transparency, reduce fraud, and improve efficiency.

Distributed Ledger Technology (DLT)

DLT is a type of database that is distributed across a network of computers. Each computer in the network has a copy of the database, and any changes to the database are recorded in a transparent and immutable way. DLT has the potential to disrupt a wide range of industries, including finance, healthcare, and government. DLT can help increase transparency, reduce fraud, and improve efficiency.

Disruptive Potential

The disruptive potential of cryptocurrency, blockchain, and DLT is significant. Here are some of the ways that these technologies could disrupt traditional industries:

Finance

Cryptocurrency and blockchain have the potential to disrupt traditional financial systems by providing a more secure and transparent way to transfer value. Cryptocurrency eliminates the need for intermediaries, such as banks, and can help reduce transaction fees and increase financial inclusion. Blockchain can also help reduce fraud and increase transparency in financial transactions.

Healthcare

Blockchain and DLT have the potential to disrupt the healthcare industry by providing a more secure and transparent way to store and share patient data. Blockchain can help increase patient privacy and reduce the risk of data breaches. DLT can also help improve the efficiency of healthcare systems by reducing administrative costs and improving supply chain management.

Government

DLT has the potential to disrupt traditional government systems by providing a more secure and transparent way to store and share data. DLT can help increase transparency and reduce fraud in government transactions. DLT can also help improve the efficiency of government systems by reducing administrative costs and improving data management.

Conclusion

Cryptocurrency, blockchain, and DLT have the potential to disrupt traditional industries and revolutionize the way we do business, interact with each other, and even govern ourselves. These technologies offer a more secure and transparent way to transfer value, store and share data, and reduce fraud. As these technologies continue to evolve, we can expect to see more innovative solutions emerge that have the potential to disrupt traditional industries even further.

#Cryptocurrency#blockchain#DLT#disruption#finance#fintech#Cryptocurrencies#BlockchainTechnology#DistributedLedgerTechnology#FutureOfFinance#DigitalCurrency#FinancialInclusion#Healthcare#HealthTech#blockchaininhealthcare#patientdata#government#govtech#blockchainingovernment#transparency#innovation#technologydisruption#revolutionizingindustries

43 notes

·

View notes

Text

High-Risk Credit Card Processing: Overcoming the Challenges

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In today's ever-changing digital landscape, businesses, regardless of their size, are flocking to e-commerce to connect with a global clientele. However, for specific industries categorized as high-risk, the journey towards accepting credit card payments is riddled with distinctive challenges. High-risk credit card processing spans sectors such as CBD sales, credit repair, and others, which frequently grapple with stringent regulations and heightened scrutiny. In this piece, we dive deep into the realm of high-risk payment processing, shedding light on the obstacles that merchants face and unveiling the strategies available to expertly navigate this intricate terrain.

DOWNLOAD THE HIGH RISK CREDIT CARD INFOGRAPHIC HERE

Understanding the Complex World of High-Risk Payment Processing

High-risk payment processing casts a wide net, encompassing various industries, from credit repair services to CBD product sales. This classification often arises from factors like heightened chargeback rates, intricate regulatory frameworks, or perceived risks to a company's reputation. Merchants operating in these sectors frequently encounter hurdles when seeking payment processing solutions due to these perceived risks.

The Indispensable Role of High-Risk Merchant Accounts

For businesses entrenched in high-risk domains, obtaining a high-risk merchant account is of paramount importance. This specialized account is meticulously tailored to meet the unique needs of high-risk sectors. It provides a level of security and flexibility that conventional merchant accounts may not offer, allowing businesses to navigate the world of credit card payments with enhanced confidence.

Navigating the Maze of Regulatory Hurdles

At the heart of high-risk credit card processing are the ever-evolving regulatory challenges. Industries such as CBD and credit repair are entangled in a web of regulations that vary across jurisdictions. Staying up-to-date with these regulatory intricacies and ensuring compliance is absolutely essential. Collaborating with payment processors well-versed in the multifaceted regulations governing these industries is a key strategy for merchants to overcome this hurdle.

Mitigating Fraud and Chargebacks

High-risk sectors often contend with a higher incidence of fraud and chargebacks. This predicament can be attributed to factors such as the digital nature of transactions or the perceived risk inherent in these industries. Implementing robust fraud prevention measures, coupled with transparent product information, can bolster customer trust and reduce the likelihood of chargebacks.

The Pivotal Role of Payment Gateways in High-Risk Processing

Payment gateways play an indispensable role in high-risk credit card processing. They serve as the conduits for secure and seamless transactions between merchants and customers. Opting for a payment gateway that specializes in high-risk industries equips merchants with the necessary security features and fraud detection tools to fortify transactions.

Building the Foundations of Customer Trust

Operating within a high-risk sector necessitates the prioritization of trust-building with customers. Clear, transparent communication regarding product offerings, pricing, and refund policies is of paramount importance. Displaying security certifications and leveraging recognized payment logos can provide reassurance to customers, encouraging them to complete their purchases.

youtube

Selecting the Ideal Partner for Merchant Processing Services

In the intricate realm of high-risk credit card processing, the choice of payment processing service provider can prove to be a game-changer. Reputable Merchant Processing Services offer tailor-made solutions for high-risk industries, encompassing CBD, credit repair, and more. Armed with expertise, merchants can navigate the labyrinthine challenges of high-risk payment processing while ensuring security, compliance, and customer satisfaction.

While high-risk credit card processing undeniably presents its share of challenges, businesses entrenched in such sectors can overcome them through strategic approaches and savvy partnerships. By securing high-risk merchant accounts, adhering to regulatory mandates, and investing in trustworthy payment gateways, merchants can assert their credibility within their industries. In an e-commerce landscape that continually evolves, embracing the distinctive demands of high-risk payment processing isn't merely a necessity; it represents a pathway to growth and success.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#credit card payment#payment processing#credit card processing#accept credit cards#fintech#credit card payment processing#Youtube

19 notes

·

View notes

Text

Financial Technologies and Law

Abstract:

One needs to bear in mind that technology-related improvements have been a hot topic over the past few years around the globe. Traditional financial services have been rendered more globally, more cheaply, more accessible, more easily and more quickly by virtue of digital service providers. In a nutshell, FinTech has been undergoing a major transformation that also directly changes our lives. It is a living phenomenon. Tech-owned payment systems revolutionize and reshape the whole financial environment all over the world. The main intention of this book is to present a comprehensive FinTech guidance to all interested parties, especially entrepreneurs, investors and competent national authorities. It is intended to clarify the changing nature and current structure of contactless payment systems. Although tech-driven models support the facilitation of economic growth and improvement of financial inclusion on the global scale, they give rise to severe hardships in terms of financial stability and integrity. This available research, thus, further offers comprehensive observations about emerging risks and challenges associated with the e-payment financial markets. It is displayed that multifaceted aspects of electronic payment phenomena raise a variety of regulatory needs together with proper supervision over FinTech. Most jurisdictions have already improved legislation for FinTech but there are certain emerging challenges. Additionally, this book focuses on an adequate synthesis of the articulation of FinTech regulations in the light of universal principles. The available research also contributes to identifying the outcomes of supervisory authorities’ intervention and the involvement of judicial institutions in the tech-driven improvement.

My book is available online here: https://scholarpublishing.org/sse/eb351/

7 notes

·

View notes

Text

Amen

#funny#memes#funny memes#memesrandom#memesdaily#humorous#sarcastique#sarcasm#dark humor#sarcastic#fintech#finance#salary#self deprecating humor#office humor#meme humor#dank humor#stupid humor

9 notes

·

View notes

Link

Some of Europe's top fintech firms are starting to crumble as investors question their true valuation. Asset manager Schroders has cut the value of its stake in financial "superapp" Revolut by 46%, according to a filing on April 17 that threatens Revolut's title as the UK's most valuable fintech. The writedown suggests the London-headquartered firm is now valued at about $17.7bn (£14.2bn), which is substantially less than the $33bn it was valued at in a funding round last July. Revolut has been criticised for the late filing of accounts, EU regulatory breaches and corporate culture. It has also been waiting two years for regulators to approve its UK banking license. Schroders has also marked down its stake in Atom Bank by 31%. Meanwhile, Allianz is selling its stake in struggling fintech N26 at a heavily-reduced price, according to the Financial Times, while buy-now-pay-later firm Klarna has seen its valuation tumble from $45.6bn to $6.7bn.

39 notes

·

View notes

Text

#vagas de emprego#vagas#vagas Nubank#Nubank#fintech#novas vagas#vagas de emprego Nubank#oportunidades#oportunidades de carreira#empregosdiarioinfo#emprego#trabalho

6 notes

·

View notes

Text

Dissecting Crowdfunding Platforms: Are They Making Waves or Waning?

Hey Tumblr fam! Today, let's dive into the world of crowdfunding platforms and take a closer look at their effectiveness. 💸🌟

🤔 The Power of the Crowd: Crowdfunding platforms have revolutionized how entrepreneurs, artists, and innovators fund their projects. By tapping into the collective power of the crowd, they offer a decentralized way to raise capital and bring ideas to life.

💼 Supporting Creative Ventures: From indie films to tech startups, crowdfunding platforms like Kickstarter and Indiegogo have been instrumental in supporting a wide array of creative ventures. They provide a platform for creators to showcase their projects and connect with potential backers worldwide.

📈 Success Stories vs. Struggles: While many projects have found success through crowdfunding, it's essential to acknowledge the challenges and pitfalls that come with it. Not every project reaches its funding goal, and even those that do may face hurdles during execution.

🔍 Analyzing Effectiveness: So, how effective are crowdfunding platforms, really? It's a complex question that requires a nuanced analysis. Factors like project quality, marketing efforts, and audience engagement all play a role in determining success.

🌱 Nurturing Community Engagement: One of the most significant benefits of crowdfunding is its ability to foster community engagement. Backers aren't just providing financial support; they're investing in ideas they believe in and becoming part of the journey.

💡 Future Outlook: As crowdfunding continues to evolve, we can expect to see innovations in platform design, fundraising models, and project management tools. The future holds exciting possibilities for creators and backers alike.

What are your thoughts on crowdfunding platforms? Have you backed any projects or launched one of your own? Share your experiences and let's keep the conversation going! 💬✨

#CommunitySupport#CreativeVentures#Crowdfunding#finance#thefinrate#payment gateway#fintech#financialinsights

3 notes

·

View notes

Text

Wie wird ein ETF entwickelt?

Große Finanzalchemie oder Kochen nach klassischen Finanzrezepten? Wir erklären dir, wie ein neuer ETF entwickelt wird.

#finanzen#geld#investing#finance#fintech#aktie#ETF#investieren#finanziellefreiheit#finanziellunabhänig#financialfreedom#investierenlernen#investierenfueranfaenger

3 notes

·

View notes

Text

Hey #crypto and #blockchain community! We've just launched a good old school link directory at

https://crypto.bookmark.guru/

to make it easier to navigate that vast space of websites. Do you run a website and want it added, then comment below.

#bitcoin#crypto#blockchain#ethereum#nft#defi#altcoin#fintech#cryptoexchange#nftcommunity#digitalcurrency

2 notes

·

View notes

Text

Você sabe como desbloquear o Cartão Nubank? Te ensinamos o passo a passo completo. Venha ver!

8 notes

·

View notes

Text

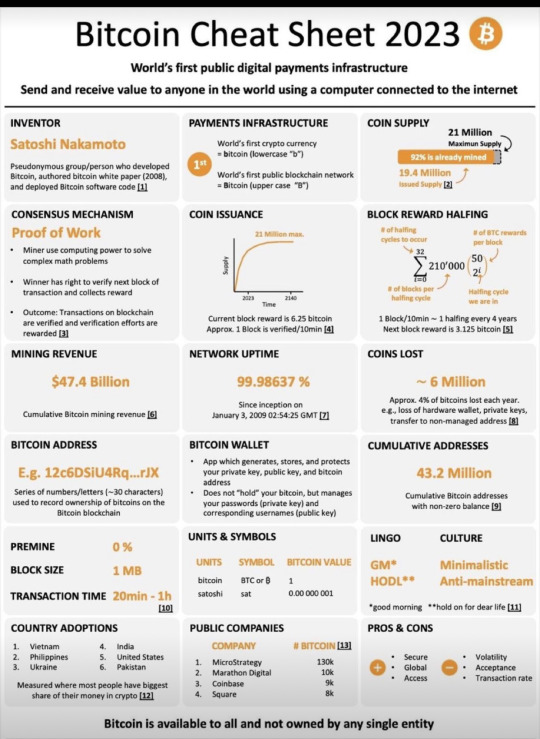

Bitcoin Cheat Sheet 2023

#tumovs#blockchain#тумовс#reinis tumovs#neobankers#crypto#defi#bitcoin#fintech#rtumovs#wkwgroup#crypto market

29 notes

·

View notes