#college education

Text

Medger Evers .. But did you know he was also a college football star at Alcorn State, where he was a teammate of his brother, Charles? He was. “Medgar played halfback and I played center,” Charles Evers, 94, said recently during an interview at his WMPR radio office in west Jackson.

#medgar evers#black tumblr#black history#black literature#black community#black excellence#civil rights#black history is american history#blackexcellence365#college education#alcorn state#college football#black lives matter#equal#equal rights#football player#american history

299 notes

·

View notes

Text

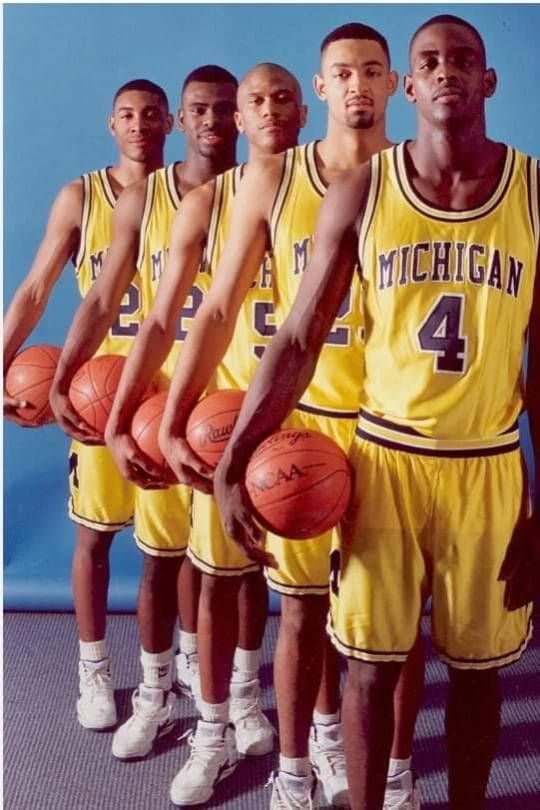

The Fab Five was the 1991 University of Michigan men's basketball team recruiting class that many consider one of the greatest recruiting classes of all time. The class consisted of Detroit natives Chris Webber (#4) and Jalen Rose (#5), Chicago native Juwan Howard (#25), and two recruits from Texas: Plano's Jimmy King (#24) and Austin's Ray Jackson (#21). The Fab Five were the first team in NCAA history to compete in the championship game with all-freshman starters.

#chris webber#juwan howard#jalen rose#jimmy king#austin ray jackson#basketball team#university of michigan#black excellence#black archives#black community#basketball#college athletes#college education#college sports#sportscaster#nba#nba players

229 notes

·

View notes

Text

#us politics#news#twitter#tweet#olayemi olurin#2023#us supreme court#scotus#affirmative action#college for all#college education#constitutional rights#republicans#conservatives#alt right#students for fair admissions v. harvard

86 notes

·

View notes

Text

13 year old me would shit themself and die if they knew for my COLLEGE ENGLISH CLASS I was writing a rhetorical analysis of Be More Chill.

12 notes

·

View notes

Photo

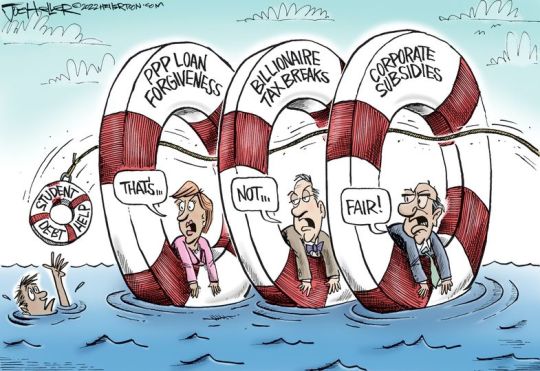

Today's Cartoon- Lifesavers :: [Joe Heller]

* * * *

August 24, 2022 :: Letters From An American :: Heather Cox Richardson

Today, Biden announced another key change in American policy, this time in education. The Department of Education will cancel up to $20,000 of student debt for Pell Grant recipients with loans held by the federal government and up to $10,000 for other borrowers. Pell Grants are targeted at low-income students. Individuals who make less than $125,000 a year or couples who make less than $250,000 a year are eligible. The current pause on federal student loan repayment will be extended once more, through the end of 2022, and the Education Department will try to negotiate a cap on repayments of 5% of a borrower’s discretionary income, down from the current 10%.

The Department of Education estimates that almost 90% of the relief in the measure will go to those earning less than $75,000 a year, and about 43 million borrowers will benefit from the plan.

Opponents of the plan worry that it will be inflationary and that it will not address the skyrocketing cost of four-year colleges. But its supporters worry that the education debt crisis locks people into poverty. They also note that there was very little objection to the forgiveness of 10.2 million Paycheck Protection Program (PPP) loans issued as of July 2022, with $72,500 being the average dollar amount forgiven.

The administration’s plan is a significant pushback to what has happened to education funding since the 1980s. After World War II, the U.S. funded higher education through a series of measures that increased college attendance while also keeping prices low. Beginning in the 1980s, that funding began to dry up and tuition prices rose to make up the difference.

A college education became crucial for a high-paying job, but wages didn’t rise along with the cost of tuition, so families turned to borrowing. Many of them choose the lowest monthly repayment amounts, and some put their loans on hold, meaning their debt balances grow far beyond what they originally borrowed. The shift to “high-tuition, high-aid” caused a “massive total volume of debt,” Assistant Professor of Economics Emily Cook of Tulane University told Jessica Dickler and Annie Nova of CNBC in May. Today, around 44 million Americans owe about $1.7 trillion of educational debt.

Because of the wealth gap between white and Black Americans—the average white family has ten times the wealth of the average Black family—more Black students borrow to finance their education.

Canceling a portion of student debt is a resumption of the older system, ended in the 1980s, under which the government funded cheaper education in the belief it was a social good. In his explanation of the plan, White House National Economic Council Director Bharat Ramamurti told reporters today that “87% of the dollars…are going to people making under $75,000 a year, and 0 dollars, 0%, are going to anybody making over $125,000 in individual income.” He told them it was “instructive” to compare this plan “to what the Republican tax bill did in 2017. It’s basically the reverse. Fifteen percent of the benefits went to people making under $75,000 a year, and 85% went to people making over $75,000 a year. And if you zoom in even more on that, people making over $250,000 a year got nearly half of the benefits of the GOP tax bill and are getting 0 dollars under our [plan].”

#Joe Heller#Student Loan debt#Letters From An American#Heather Cox Richardson#education#student debt#college education

81 notes

·

View notes

Text

to anyone who needs to hear it: you are doing fine. you will find a way to pay for college without going broke. you will make friends at your new school. you will get an A on that test. you will be happy and healthy, if not now then soon. please give yourself the grace you deserve.

#soft suggestion#reminder#college#college education#can you tell what im stressed about#yes you guessed it ao3 is down /j#life#school#students#student inspiration

2 notes

·

View notes

Text

Was talking with a friend about Reaganomics today, and both of us elaborating on the downsides of the Economic theory. I thought that was the only time I was going to talk about Reaganomic today. Nope, rented a book from my college’s library, as reading fun (and not doing this for a class), and it turns out, it is authored by Niskanen. Not knowing who that was, it sparked my curiosity to find out, and sure enough, it’s the guy who was an architect of the system…

Will be reading After Enron through its entirety.

1 note

·

View note

Text

#huey p newton#the black panthers#black history#black tumblr#black literature#black excellence#black community#civil rights#black history is american history#civil rights movement#black lives matter#american history#us history#educational#educator#college graduate#college education#black archives#black culture

209 notes

·

View notes

Text

Ralph Sampson and Sam Perkins

#ralph sampson#black archives#black excellence#black community#sam perkins#nba#nba players#basketball#virginia#university of virginia#university of north carolina#college education#college basketball

100 notes

·

View notes

Link

It’s a little embarrassing to ask for help but I need it! I’ve gotten into NYU but I need help paying for it. Any amount is appreciated.

#nyu#gofundme#go fund her#education#college education#new york university#game design#dungeons and dragons#dnd#help#nyu game design#mfa#masters program#ttrpg stuff

10 notes

·

View notes

Text

#poet#poetry#college#college education#college degrees#trappin#drug#drugs#success#addicts#addicted#images#imagery#student loans#student loan debt#prison#reality#another statistic#statistic#poems#poem#spoke word#higher education#trap#a trap#it’s a trap#life#lessons#lesson#life lessons

3 notes

·

View notes

Text

"If it's not peer-reviewed its not science"

3 notes

·

View notes

Text

I am getting quite an education about college and scholarships. My daughter is a National Honor Society kid. She's actually president of the society at her school. She's been straight As since 9th grade.

I've been warned that despite her academic excellence, she most likely will NOT get any scholarships because we make too much money. We look really, really good on paper.

-super sigh-

Can I pay for her to go to school?

Possibly? Probably?

And I realize that's a huge blessing and privilege.

But, shouldn't she get rewarded for her hard work? Yes, she's been rewarded by being accepted to almost every school she's applied to, but...I don't know. I guess I just thought she'd be rewarded for academic excellence vs. being told, you get nothing because your parents can write a check.

And, yes. I want the kids who really need the money to have it. My kid has so much more than most, but...I don't know.

#True first world problems#I'm not complaining just trying to get it straight in my head#College education#College finances#Education in America

3 notes

·

View notes

Text

37K notes

·

View notes