#SAVE plan

Text

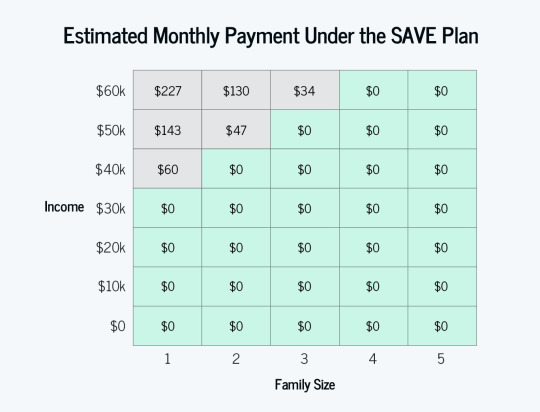

The Biden administration yesterday rolled out its latest tool to tackle the student debt crisis, and as we discussed earlier this year, it’s a good one. While the administration is still working on a broader debt forgiveness plan that it hopes will survive the Trump/McConnell Supreme Court, the new income-driven repayment program, called the “Saving on a Valuable Education” (SAVE) plan, should drastically cut the amount of student loan payments for lower-income borrowers, and for many, will actually get those payments down to zero.

[ ]

With the SAVE plan, the Education Department will no longer charge any interest that isn’t covered by the monthly loan payment, putting an end to the interest-accumulating hamster wheel that so many of us know all too well, where you make your payments on time but your goddamn loan balance keeps growing. As the fact sheet explains:

For example, if a borrower has $50 in interest that accumulates each month and their payment is $30 per month under the new SAVE plan, the remaining $20 would not be charged as long as they make their $30 monthly payment. The Department of Education estimates that 70 percent of borrowers who were on an IDR plan before the payment pause would stand to benefit from this change.

As with other income-driven plans, once a borrower has made payments for 20 years (for undergrad debt) or 25 years (for grad school debt), any remaining balance will be forgiven — yes, even if the monthly payment amount was zero for some or all of that period. Explain to your rightwing uncle that such forgiveness is not a new gimmick Joe Biden made up; it’s how IDR plans have worked since Congress authorized them in the 1990s.

#student debt relief#SAVE plan#us politics#in support of an informed and engaged electorate#recommended reading

1K notes

·

View notes

Text

Hey, student loans payments are coming back in October, you should know about the SAVE plan.

this is america-centric but pls spread this around if you think any of ur mutuals could use the info.

If you're currently shitting yourself thinking how you're gonna start making student loan payments again, I suggest taking a deep breath, first off. Get comfy, put on some music and strap in.

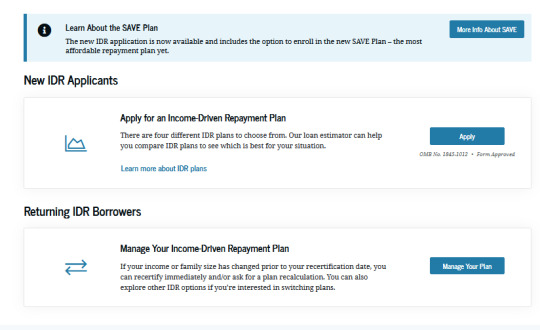

If you got your student loans through the Federal Student Aid program FAFSA, then you can apply for an IDR (Income Driven Repayment plan) called SAVE.

what is SAVE?

This got my $115 monthly payment down to $40 a month, if you don't work or you can't afford much, this has the potential to reduce your payment even further.

Alls you need to do is go to https://studentaid.gov/idr/ and log into your federal student aid account, there's a section for both first time applicants and returning borrowers who previously may have had an IDR.

Even if you've done an IDR before! Look into the SAVE plan!! It forgave about 10k of debt for me!

Anyway, first time applicants can click the first option, "Apply for an Income-Driven Repayment Plan" and just go through and answer all their prompts, make sure you have all your financial information on hand (tax returns, most recent pay stub, etc) and go through the prompts until it gives you the option to apply for the SAVE plan. CLICK IT!

It should let you know at the end exactly how much you'll be paying per month and you should get an email confirmation as well. Any account specific questions should be directed to their call center

+1 (800) 433-3243

GOOD LUCK AND BE PATIENT, THE SITE IS SLOW AS SHIT.

DON'T GIVE UP! I BELIEVE IN YOU!!

if you have any questions feel free to DM me btw

#student loans#SAVE plan#FAFSA#student loan forgiveness#IDR#income driven repayment plan#THIS DOES NOT PAUSE INTEREST BTW#adulting#life tips#helpful#resources#websites#og post

401 notes

·

View notes

Text

Hey y'all please I know it's scary but if you've graduated in the past year make sure you know exactly what's up with your student loans (federal and private).

You should have gotten emails from places like Advantage or Navient or whatever pestering you about your loans and you may want to ignore them thinking they're scams. No they are your loan servicer, corporations that the government hands over management of your federal loans to.

The email should tell you how to register for an account which will let you see your loan payments. They'll probably be in the hundred's of dollars depending on how long it's been since you graduated.

Don't fret! Thanks to Bidens efforts (the like one good thing he's doing), you can easily get put on the SAVE plan, where the department of education pays your interests and you make minimum payments based on your current income (which, if you're following me, probably isn't that high).

Honestly, I'd recommend calling and asking about the SAVE plan. The lady was actually super nice (I have aidvantage so your experience may differ) and my minimum payments went from like $400 a month to $0 (now they're $10 bc I got a raise last summer)

And please, for the love of god, keep an eye on your account. I thought I had set up autopay but for the past couple of months autopay wasn't on, so I got charged $30 in late fees.

These loan servicers will try to wring as much money as they can out of either you or the government. You need to babysit them and make sure everything is up to snuff.

I'd also recommend saving and making large payments every once in a while to push down your total debt. That's what the SAVE plan is great for. Instead of using all your money to pay for interest, you use that money to push down the principle.

#wrenfea.exe#student loans#save plan#new graduates#life advice#also i am not an expert on this stuff this is just my experience and what ive learned from news articles and research#dont feel bad if you struggle with this stuff its purposely made to be scary and confusing#they make more money that way#dont let them#usa centric

13 notes

·

View notes

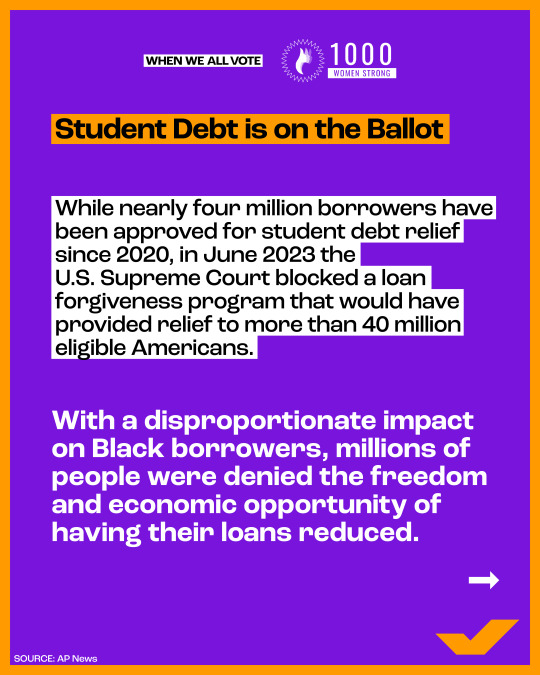

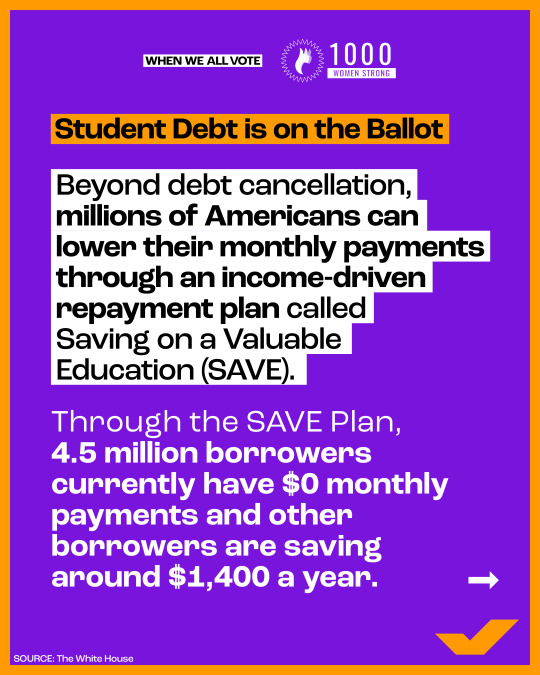

Photo

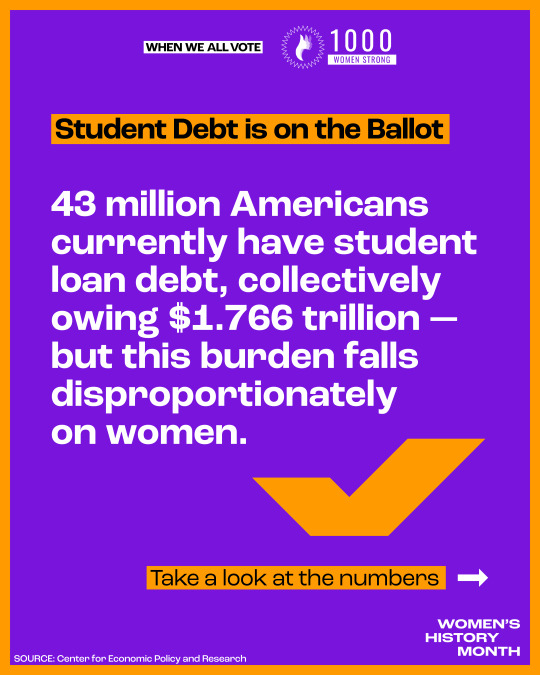

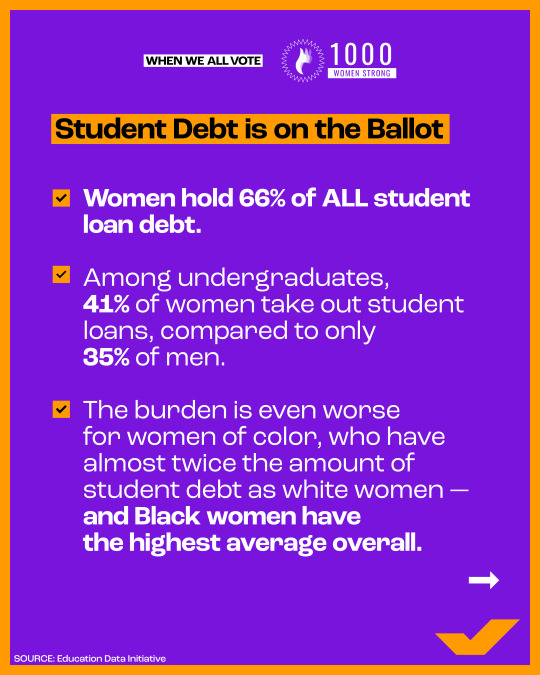

Millions of Americans have student debt on their minds heading into the ballot box this year — especially women of color, who are disproportionately impacted by this burden. 👩🏿🎓👩🏽🎓👩🏾🎓👩🏻🎓

The politicians WE elect can create policies to address student debt relief, college affordability, and repayment plans. Student debt is on the ballot in 2024, and we’ll be voting. 🗳️

Join us and 1k Women Strong in making YOUR voice heard this year. Make sure you’re registered and ready to vote NOW at weall.vote/1kwomenstrong.

#student debt#student debt relief#student loans#college#college affordability#loan forgiveness#SAVE plan#ballot#voting#vote#1k women strong#when we all vote#register to vote

5 notes

·

View notes

Text

When one needs to get around the hateful ass SCOTUS for student debt forgiveness:

0 notes

Text

I don't know who needs to hear this, but as a creator -

I am fine with "the audience" -

downloading my fics

printing my fics

copy/pasting or screenshotting my fics

sharing your saved copy of my fics with anyone else who might want them in the unlikely but never impossible case that my fics are no longer available on ao3

making a book of my fic(s) and running your fingers across the pages while lovingly whispering my precioussss

doing these things with anything I create for fandom, such as meta, headcanons, au nonsense like 'texts from the brodinsons,' etc

I am not fine with "the audience"

doing any of the above with the purpose/intent of plagiarizing my work or passing it off as their own in any capacity

feeding my work into ai for any reason whatsoever

Save the fandom things. Preserve the fandom things. Respect the fandom things.

Enjoy the fandom things.

#fanfic#ao3#archive of our own#fandom things#tumblr things#i may have said this at some point#i'm sure i have#but whatever - just in case#i don't say this with the presumption that i'm so amazing and people are clamoring to save my fics#but just if anyone is so inclined that's all#ftr i don't intend on ever removing my fics from ao3 or deleting fandom things from this blog#i've always shared my fandom things with the intent of keeping them shared bc that's the whole point of posting#but the fandom atmosphere and ao3 constantly being under attack who knows what can happen#not that this applies to anyone but should all else fail you can also reach out to me and i will personally give you a copy#at least of fics bc i save everything#not so much the tumblr things but this is a good reminder to myself that i should do that for the things i care about#that i've made or done and only posted here#anyway sorry i have now used up my quota of the putting words into sentences doing for today#i have plans to stare into the void now

21K notes

·

View notes

Text

i never understood ppl claiming percy has never suffered the consequences of his loyalty. you're talking about percy "i know the prophecy said my friend would betray me but these are my friends they wouldn't betray me" jackson, who walked into a remote part of the forest with luke and almost died in book one. you're talking about percy "kronos told me point-blank there was a traitor but i can't imagine any of these ppl betraying me" jackson, who decided to stop looking for the traitor and moved on. you're talking about percy "nico is acting suspicious and very clearly hiding something from me but he's my friend and i trust him" jackson, who walked into nico's very obvious set up and almost got himself held hostage during the titan war. percy is so loyal that he cannot fathom betrayal until it's happening, and it has nearly killed him multiple times.

#i think ppl focus on what athena said#'you would destroy the world to save a friend'#but that's not fatal for percy! that's what makes percy dangerous *to the gods*#loyalty is a fatal flaw *for percy* bc he can be told point blank that his friend will betray him and still not be able to comprehend it!#i don't know that percy ever voiced his inability to consider betrayal to anyone (in the books i'm pretty sure it's internal dialogue)#so all anyone else sees is the danger he poses to *them* and *their plans*#percy jackson#percy jackon and the olympians#pjo hoo toa#pjo books#fatal flaws#percy#min talks pjo

15K notes

·

View notes

Text

Please remember to sign up for the SAVE repayment plan for your student loans. Payments are officially due in October and if your income is low enough they won’t make you pay anything at all. Like, my bill was originally going to be $138 a month and is now $0. Please do yourself a favor and sign up as soon as possible

0 notes

Text

Prompt:

After some very eventful weeks of Jason’s debut as the Red Hood he takes a well deserved night off and decides to crash in one of his safe houses.

He did not count on one of the Bats finding him there.

So to keep his plans from being torpedoed entirely Jason goes with the split second decision of pretending he was held captive by the Red Hood.

#Jason I-did-not-Plan-this-through Todd#Jason pretends he got kidnapped by—- himself#he’s going the full victim act here#breaking out the tears for this one#maybe Batman and Nightwing find him#and it’s a huge shock for everyone involved#Jason has that one moment of ‘do I shoot them?’#and then promptly decides to enter an a grade acting class by crying for his ‘family’ to please save him from the red hood#jason todd#batfamily#dick grayson#bruce wayne#batfam#robin#tim drake#red hood#batman#prompts#fanfiction#fanfic#batfam fic#batdad#under the red hood#Au#alternate universe

7K notes

·

View notes

Text

"it's okay to live with your parents as an adult if you're disabled" "it's okay if it's a cultural thing" "it's okay if you're trying to save mon-" shh. listen. it is okay for any reason. you don't need to have a justification. if your parents are alright with it and you're alright with it you can just do it. peace and love on planet earth etc etc

#im not a dependent and im white and british so it isnt expected that ill stay living with family#and whether or not i need to save money#im planning to stay with my parents after i graduate#just because i want to :) i like my family

50K notes

·

View notes

Text

How to Prepare for Student Loans in September: Introducing the SAVE Plan

Written by Delvin

As the payment pause for student loans comes to an end and interest resumes in September, it becomes crucial to ensure that your monthly payments remain affordable. Fortunately, the Biden-Harris Administration has introduced a new income-driven repayment (IDR) plan called the Saving on a Valuable Education (SAVE) Plan. This plan offers several benefits, including lower monthly…

View On WordPress

#dailyprompt#Financial#knowledge#money#Personal Finance#SAVE Plan#September 1 Student Loan Repayment#student loans

1 note

·

View note

Text

🐶💗🥒

#he is planning how to become shizun's wife as we speak#and I don't blame him#svsss#svsss fanart#scum villian self saving system#scum villain#bingqiu#luo binghe#luo bingmei#shen qingqiu#shen yuan#mxtx#mxtx svsss#danmei#my art#this was going to be dumb meme but then i thought they looked too cute for the pun

5K notes

·

View notes

Text

Eden was their ✨disney princess era✨

#it's canon#source: it was revealed to me in a dream#aziraphale being good with reptiles was all part of the ineffable plan#crowley is having the time of his life here#my only regret is that I forgot to include a baby aardvark#but I put ducklings there instead#aardvarks will have to wait#btw the snake aziraphale is holding is my pet snake that died in 2020#my poor precious baby she was such a sweetheart#she liked to knock the thermometer off the glass and hide it#I was supposed to draw like an ordinary garter snake there buuut#it's MY silly doodle and I get to do what the heck I want with it 👁️👁️#lmao crowley's brain is really malfunctioning here#guys he's a demon the creature of darkness foul fiend devil serpent#guys he can't get up the lamb is sleeping#somebody save him#there are vicious animals#and she's exp-#*JUMPS OUT THE WINDOW AND FLIES AWAY*#hey where the fuck is the gecko going#aziraphale#good omens fanart#crowley#aziracrow#good omens#ineffable husbands

5K notes

·

View notes

Text

How the phantom menace should have gone, imo😌

#Obi-Wan “I can fix him” Kenobi saves the whole galaxy by seducing the Sith apprentice#the Naboo queen is safe#the Sith’s plans are thwarted#long live the Republic!#milks artsies#star wars#darth maul#obi wan kenobi#obimaul#the phantom menace#Star Wars: the phantom menace

4K notes

·

View notes