#Black Finance

Text

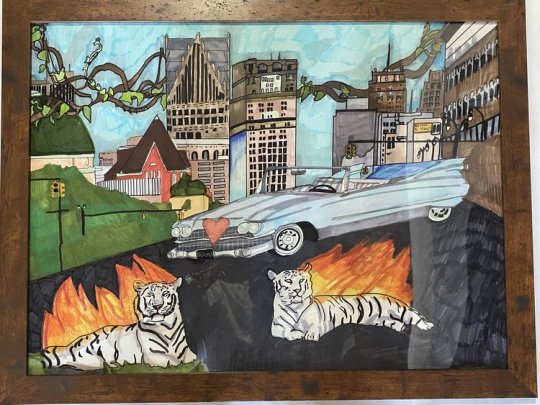

“YOU’RE NOT LOOKING CLOSE ENOUGH, EVEN IF YOU WAS, YOU STILL COULDN’T SEE”

12” x 18”

By

Jaevonn Harris

#fine art#art#visual arts#streetwear#nba#michael jordan#nike#dbz#goku#hypebeast#black finance#money#black money#color#tigers#ferrari#rarri#spectacles#art collector#louvre paris#Indy arts#detroit institute of arts

19 notes

·

View notes

Text

#hip hop#rap#california#los angeles#the marathon clothing#earn your leisure#earn your leisure podcast#black sam#nipsey hussle#rip nipsey hussle#black business#rashad bilal#black podcasts#joe budden podcast#the marathon continues#tmc#the marathon#black finance#finance#crenshaw#los angeles rap#black men#west coast#slauson#victory lap#air jordans#jordan 12#assets over liabilities#amb clothing#blacc sam

24 notes

·

View notes

Text

Black Family Finances

“Where slavery is there liberty cannot be, and where liberty is there, slavery cannot be.”

The great Abraham Lincoln tried putting liberty and slavery into a simple and asynchronous relationship for us, but how far have we really progressed in achieving the liberty we Americans like to speak so proudly about?

Did you know that the imprisonment rate for African American women is twice that of white women? Additionally, African Americans are incarcerated at a rate that is about 6 times that of white Americans.

We may not have digressed too far from older times as these statistics depict a reminiscent of a culturally honed racial prejudice that is a part of the social construct of the modern America we find ourselves in today.

Here are the four common problems faced by African Americans today:

1. Lack of family structure: According to a 2002 study, 70% of all African American children were illegitimate and that number rose from 23.6% back in 1963 because that was the year when welfare became a right according to the constitution, which made having husbands redundant. Too many African American families grow up without a father figure in the house which often leads to psychological issues later in life.

2. Dangerous cities have high African American Populations: Dangerous cities like Oakland, Cleveland, Baltimore and Detroit where gang violence and crime is an everyday occurrence has a high population of African American people who live under the government of democrats.

3. High abortion rates: It is estimated that 30% of all abortions in the country are done by African American women. This heightened loss of uncounted lives percolates to reduce respect for life and has played its role in decreasing civility with which people treat each other.

4. The victim mindset: Nothing holds an African American back more than seeing themselves as a victim who sees everything as someone else’s fault without taking the deserved responsibility to such a significant degree that their victim status becomes their collective identity.

5. African Americans make a sizable portion of prisoners: Studies infer that 52% of homicides are committed by African American individuals. Due to this high incarceration rate, every 1 in 9 African American children you pass on the sidewalk may have or might have had a parent in prison. Due to the greater likelihood of African Americans being incarcerated, their social upbringing and family support has taken the toll.

#https://blackamericaweb.com/2017/12/05/5-common-problems-faced-by-african-americans-today/#african#Black Finance#Black Economics

2 notes

·

View notes

Photo

SHOP: GETTOTHECORNER.COM

#united#chess#chessmaster#money#chessboard#black finance#black art#contemporary art#pop art#gucci#dapper dan#made at daps#air jordan 1#air jordan#air jordan I#michael jordan#mjmondays#buy art#buy black art#support black business#future#I never liked you#future hendrix#hndrxx#yoshi#street justice#galerie perrotin#technical dreaming#air force 1#alice in wonderland

22 notes

·

View notes

Text

Soft Life 101: 3 Steps to Escape Your 9-5 Job If You Don’t Want to Work

Before we start, I want to clarify what I mean by “Not wanting to work.”

It means, that I don’t want to exhaust myself. I want to roll out of bed at 8 am then go to a workout class at 9 am. I want to spend my time as I please while keeping my workload to a minimum.

Working consistently, burns me out. I have no desire to prove my worth through productivity, nor do I have any desire to engage in hustle culture. I’m sure many of us can relate to feeling like the pressure to perform is exhausting. This is likely why, “soft life” is the latest trend on social media and has taken the girlies on Tiktok by storm.

In this new soft life era apparently, no one has a job and everyone is a "sahm" or "sahgf". While I understand the desire to escape the matrix and have a man you can fully depend on. Creating a more balanced and fulfilling life does not have to solely depend on your partner (though it helps!).

At the end of the day we still all want money! So how can we create an abundant life while still having a work-life balance?

Step 1: Be willing to make sacrifices

There is no such thing as something for nothing. Get that out of your head! I know we sometimes want to be saved, but unfortunately, life isn’t always a fairytale. Everything that we desire in life requires us to give up something else.

Do you want a better body? Give up junk food and exercise more. Do you want a better man? Give up your dust! To bring in the new we have to get rid of the old. If you want a soft life you’re going to have to strategize and be willing to give up what is no longer serving you.

Step 2: Find a passion you can monetize

*major key*

As the saying goes, “If you love what you do, you’ll never work a day in your life”. Find something you enjoy doing, then figure out how you, can earn money from it. Are you good at doing hair? Become a hairdresser. Are you the best dressed in your circle? Become a virtual stylist. I promise you, for whatever talent you have there are people willing to pay you for it!

For myself, I love teaching and writing! Blogging is a great way to share my expertise, create passive income, and create the life of my dreams that don’t necessarily depend on me going into a job. Also, you can make money blogging with a relatively small audience.

Check out my blog post "Make Money When your Young, Pretty & Ambitious." For more on this topic.

Step 3: Invest, invest, invest

*Another major key*

We all need money to survive. There’s no way around it! Ideally, we would live a life where money isn’t an issue and if that is your goal you have to start investing ASAP! By investing in assets eventually, those assets will make you money.

For example, invest in stocks like the S&P 500 (which is an index fund that is essentially many companies in one stock). Invest in stocks that will grow over time and make you more money than you bought them for. There are tons of ways to start investing: choose one!

A few types of investments

Real estate

Stocks

Businesses

If living a soft life is a priority to you start today with these steps that will eventually allow you to either fully retire or work minimally. If you don’t, you’ll just be stuck doing something you don’t enjoy or waiting for prince charming to come and save you.

©Chichiscloset 2023

#that girl#pink pilates princess#glow up#level up#leveling up#leveled up mindset#black women in leisure#level up journey#levelling up#femme fatale#feminine#black femininity#black female writers#black feminity#black women in luxury#luxury black women#dream girl journey#dream girl#dream body#dream life#self care#high value woman#high maintenance#high standards#self improvement#green juice girl#clean girl#Post#femininity#finance

2K notes

·

View notes

Text

#crown act#race-based hair discrimination#west virginia#legislative rejection#republican lawmakers#senate finance committee#civil rights#black hair advocacy#discrimination lawsuits#leadership accountability#social progress#hair textures#protective styles#racial equality#legislative advocacy#future prospects#white supremacy#racism#social justice#equality#end hate#anti-racism#stop racism#no to hate#dismantle racism

219 notes

·

View notes

Text

The face the body and more

#success#black tumblr#80s#anorexla#adult model#naomi campbell#finance#aaliyah#90's fashion#90s aesthetic#90s supermodels#90s runway#shalom harlow#girl interupted syndrome#girl interrupted#black beauty#black women#black and white#beautiful model#skinnni#photography

149 notes

·

View notes

Text

Black parents >

372 notes

·

View notes

Text

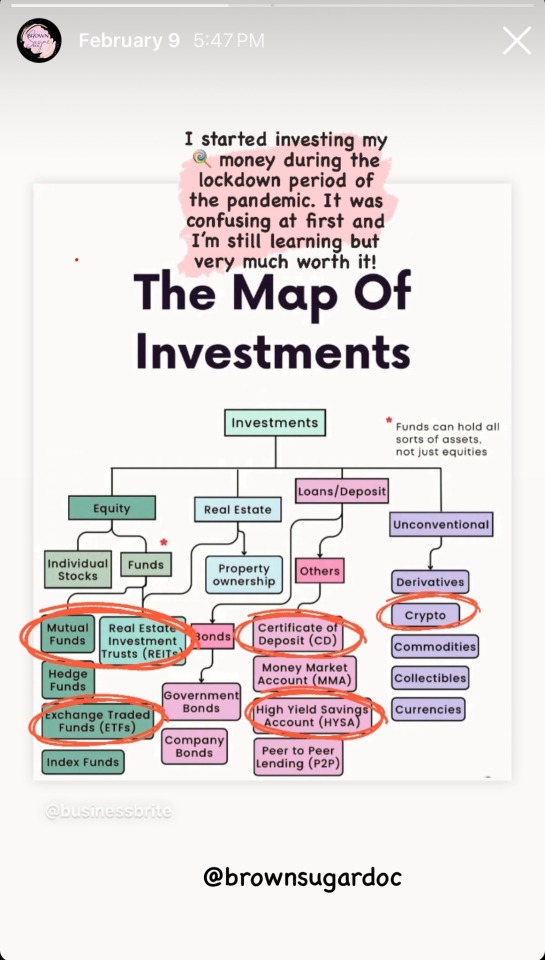

How are you investing 🍬 or extra money? I started trying to learn about stock investments during the panorama. I lost just under $5k playing around with crypto 😭 but I learned (and still learning) a lot about financial management. I recently moved $10k from my HY savings account to a CD. I was dating a finance guy and he told me to open up a CD because it’s a higher interest rate and he matched my initial deposit 🥰 There’s so much to learn but it’s much better than letting money sit & collect dust! I’ve been wanting to hop on live & share my experiences with sugar investments 🤔

#sugar lifestyle#sugar blog#levelup#money mindset#finance#extra money#sugar bowl#sugar baby tips#sugar dating#heaux tips#hypergamy#black women in luxury#dating#levelingup#sugar life#investing

94 notes

·

View notes

Text

It's true, there's nothing “soft” about being broke! 😩 and nothing luxurious about faking the aesthetic!

📌Please don't confuse our tough love with discouragement! We want you to shoot for the stars 🌟 and get the life you desire but we would be terrible accountability partners of we didn't give you the real! 🫶🏽

With the right mindset and proper tools it will come in abundance! 💸😍💃🏿🤑

🚨We are just reminding you to not get lost in the aesthetics to the point where it drains you and your bank account!

Here are some simple yet game-changing tools to help you win! Stay committed, let it inspire you! (click here for tips)

#black women in luxury#classy black women#black women in femininity#black luxury#feminine energy#Finance tips#credit restoration#saving money#Self help#self discipline#self improvement#soft girl era#the soft life#resources

45 notes

·

View notes

Text

What Would an Economy That Loved Black People Look Like? - Non Profit News | Nonprofit Quarterly

What would it look like if the economy loved Black people? I hold this question in my heart every day as I reflect on our current economic conditions and strategize about building a reimagined economy rooted in equity, justice, and liberation.

To be serious about closing the racial wealth gap and building an economy that loves Black people, we need to focus our attention on the US South.

One thing I am certain of is that the systemic barriers and inequities that are embedded in present financial structures have no place in a reimagined economy. I would further contend that to transform our economy into one that loves Black people, movements need to get more intimate with the topic of power. Alicia Garza defines power as “the ability to change your circumstances and the circumstances of other people.” She talks about how being precise about power helps us be precise about strategy. Without a clear destination, the steps that are taken are going to be disordered.

As a financial activist and reparative capital investor, power and power building in this context means shifting financial policies, practices, and infrastructure into ones that seed and sustain change. It means joining with values-aligned wealth holders and investors to disrupt power by dismantling the systems that have obstructed Black communities from building generational wealth. And it means that to be serious about closing the racial wealth gap and building an economy that loves Black people, we need to focus our attention on the US South, where roughly 56 percent of Black people in the United States call home. We must invest in the Southern Black creatives, innovators, and leaders who are the biggest exporters of culture around the world and on the frontlines of change and community power building.

Closing the Racial Wealth Gap in the South

US researcher and agricultural law expert Nathan Rosenberg has said, “If you want to understand wealth and inequality in this country, you have to understand Black land loss.” Jubilee Justice, an organization founded by Konda Mason, who serves as the strategic director of my firm RUNWAY, recognizes that land ownership provides a pathway to create generational wealth, access financial resources, have agency over agricultural and sustainable land management practices, and foster community resilience.

In the rural South, Black farmers have historically experienced—and continue to experience—a lack of access to agricultural resources and credit. They also continue to face discrimination, and exclusion from government programs, loans, and subsidies. This result is the loss of farmland and restricted opportunities for economic growth.

Of all private US agricultural land (excluding Indian Country), according to a US Department of Agriculture study, White people comprise 96 percent of farmers, own 98 percent of the acres, and generate 97 percent of farm earnings. From 1900 to 1997, the number of Black farmers decreased by more than 97 percent; in the South, Black landowners lost 12 million acres of farmland over the past century, amounting to $326 billion worth of lost land in the United States due to discrimination.

The unjust policies that denied, dispossessed, and restricted Black individuals and communities of land ownership in the past have cast a long shadow. Policies that have routinely prevented Black communities from building generational wealth, like redlining and denying Black people mortgage loans and insurance, persist and are reflected in the massive racial wealth gap we’re still seeing today.

Even as the struggles for civil rights, inclusion, and economic justice gain ground, investment in the South remains uneven. Grantmakers for Southern Progress shares that the South receives less than three percent of all philanthropic investment in the United States. We must increase philanthropic action to build the capacity of community-based organizations and networks leading structural change work in the region.

As Tamieka Mosley of Grantmakers for Southern Progress and Nathanial Smith of the Partnership for Southern Equity, share: “If the South—the birthplace of historic and destructive inequities—rallies to end structural injustice, it can model for the country what the journey toward racial justice and equity looks like.”

Black communities continue to experience the ongoing legacy of slavery and racism through blatant discrimination from financial institutions whose inequitable lending practices limit Black entrepreneurs from attracting early critical investments. On average, early-stage entrepreneurs need about $30,000 in capital to get their initiatives off the ground, with friends and family of entrepreneurs on average providing $23,000 or more than three quarters, of the needed amount. All told, nationally friends and family investing exceeds $60 billion a year, nearly three times the investment level of venture capitalists.

However, not everyone has equal access to this vital source of capital. In 2019, the median White family in the United States had $184,000 in wealth compared to just $38,000 and $23,000 for the median Latinx and Black families, respectively. With this racial wealth disparity, Black entrepreneurs are less likely to receive early-stage funding from friends and family—a critical lifeline for business startups and growth opportunities.

It is especially critical because capital from friends and family typically has more flexible lending terms and is not tied to a person’s credit score; rather, it is based on the level of trust people have in the preparation of the business owner. These relationships and informal networks also provide other nonfinancial resources such as business advising, referrals, and support systems. For many Black entrepreneurs, particularly women, racial wealth inequality is the leading factor in why their great ideas never leave the napkin.

RUNWAY believes giving every Black entrepreneur access to the “friends and family” round of investing will be transformational for Black communities. The key to this process, as mentioned, is trust.

By infusing trust into exploitative and extractive systems, we can facilitate pivotal early-stage investments along with wraparound entrepreneurial ecosystem support like business coaching and advising. We can provide “friends and family” funding using patient, flexible capital to advance resiliency for Black businesses and the communities they serve.

Investing in people and places that have been historically excluded from traditional investment support will always appear risky to foundations and fund managers. The best antidote to that risk is to build trust-based, honest relationships with local community leaders and changemakers who deeply understand the region and the specific needs of that region. In the South, those relationships will be based on listening, mutual aid, and physical presence. These types of relationships are critical to making investments that shift the balance of power toward equity and wealth regeneration for Black communities.

Listening to the Community

I recently gathered in my home state of Alabama with a delegation of fund managers, investors, and philanthropists to bring reparative finance to the people and places that have been systemically blocked from wealth building opportunities as part of RUNWAY ROOTED, my organization’s latest initiative to invest in Southern Black entrepreneurship, creativity, and innovation.

It takes long-term, non-extractive, reparative investments . . . to undo the systemic design of racial hierarchy and imagine new possibilities.

We spent a week moving through the region to learn from community leaders, creatives, and local representatives about the unique economic challenges in the area. The experience illuminated the fact that Black business ownership is a mechanism that not only builds economic power, but social and political power as well.

Truth be told, in most cases, resistance from investors and wealth holders goes back to power. Those in power don’t want to let go of it. But the conversations like the ones we had in Alabama signal that things are changing. We must be deliberate in how we apply pressure. This involves deep collaboration between movement leaders, creatives, and community, as well as with investors, funders, and wealth holders. We must collaborate on ways to work together and co-conspire to build collective power.

Building collective power takes telling the truth about why Black people in places like Jackson, MS remain deeply entrenched in age-old, stubborn barriers to economic opportunity. It takes investors who are willing to reckon with a history that built wealth by stealing land from Indigenous nations and extracting free labor from enslaved Africans—and to invest in repairing the conditions that presently uphold the racial wealth gap. And it takes long-term, non-extractive, reparative investments that remind us that the real work is to undo the systemic design of racial hierarchy and imagine new possibilities.

Investing in Southern Creatives

Shaping our collective future into one that loves Black people needs the joy, inspiration, and useful critique of our political, economic, and social systems that come from creative thinkers and makers through their art, organizing, and visionary disruption. To tap into this dynamic force of change, it is vital to ensure that the extractive finance of the past does not block our collective ability to invest in the talent and innovation of the future.

This work requires long-term, flexible commitments of capital, time, and . . . support for Black-led businesses and innovation in the South.

Reimagining and collaboratively shaping a world where Black people are loved means prioritizing investments in creative entrepreneurs and creative placemaking. It means investing in places like Gee’s Bend, AL, to bring long-term business capital to the women who carry the legacy and tradition of West African quilting—one of the most important cultural contributions to the history of art in the United States. It means partnering with organizations like Upstart Co-Lab and Souls Grown Deep Foundation, who journeyed with us in Alabama, to invest in the arts, cultural, design, and innovation industries in the South with a mission toward repair and justice.

Philanthropy and investments that are transformative and inclusive are not only about diversifying the seats at the decision-making table. They also invite multiple voices into the design rooms where the table is carved out and set, ensuring it is broad and deep enough to nourish the future of local and national communities.

This work requires long-term, flexible commitments of capital, time, and capacity with a willingness to resolve disparities in funding and support for Black-led businesses and innovation in the South. It’s also necessary to acknowledge that the economic development programs that work for coastal metros or major cities may not be the same for the South—and need to be thoughtfully adapted to meet the distinct community needs, local infrastructure, and pulse of the region. By listening deeply and building authentic relationships with community leaders, community transformation over time can occur on community terms. Through this process, people are transformed—and so are community social and economic conditions.

I’ve always felt like investing in artists, creatives, and innovators does what Nina Simone famously said: “An artist’s duty, as far as I’m concerned, is to reflect the times.” Simone believed that artists and creatives have a responsibility to create work that reflects and addresses the social, political, and cultural climate of their era; that art has the power to serve as a mirror of society, bringing attention to important issues and fostering dialogue and understanding.

Today, the creative economy represents $985 billion in economic opportunity. This is also a time when art from creators like Amanda Gorman, who became the youngest inaugural poet in US history when she performed “The Hill We Climb” during President Joe Biden’s inauguration in 2021, is being banned in Florida schools. Responses like this tell us that art does indeed have power. Creativity has power. Innovation and truth-telling have power. And power is transformative.

…..

Building an economy that truly loves Black people requires a profound shift in financial structures and the way money moves. Investing in the South and supporting Southern Black creatives, innovators, and leaders is a pivotal step in redressing land loss and the discriminatory lending practices Black entrepreneurs continue to face.

We live in a moment of incredible opportunity. The mission (and the challenge) here is to take this moment and turn it into a movement that sustains the transformative work required to build an economy where we all have the power—and the right—to thrive.

#What Would an Economy That Loved Black People Look Like#Black Economics#Black Peoples Money#Black Money Matters#Black Finance#Black Lives Matter#Black Lifestyles Matter#Finance#financial structures#Black Entrepreneurs

2 notes

·

View notes

Text

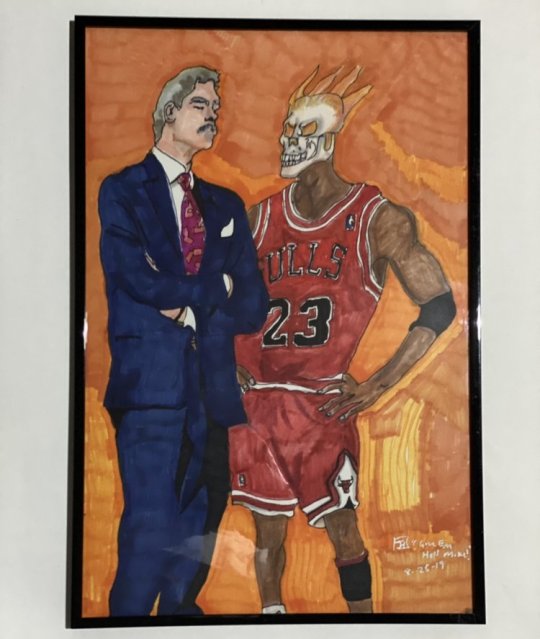

UNITED

18” x 24”

By

JAEVONN HARRIS

Available only on gettothecorner.com

#fine art#art#black fine art#black chess players#chess#contemporarypainting#contemporary art#art museum#black love#binance#money#black finance#more black superheroes#black women#intellect#Yale#Yale art gallery#brooklyn museum#kaws#kehinde Wiley#hebru brantley#kerry james marshall#Nina chanel

35 notes

·

View notes

Text

im begging people to turn on the post dates for your feed bc sometimes i see ppl rb advice with good intentions but the advice is from 2010-2017 and therefore is WILDLY outdated!!!! and that's not good!!!!!

#personal#like well intentions are one thing#but advice from that time period esp abt very important things like healthcare finances homelessness etc is VERY outdated#as someone who lived thru some of the shit recently that ppl rb this stuff abt#like please please please i am begging#this information/advice is not timeless! nd changes CONSTANTLY#and PLEASE READ THE POSTS CRITICALLY????#i saw someone rb a homelessness advice post recently that suggested hitchhiking to the midwest or south which is TERRIBLE advice-#-if u arent a thin white cis (passing) str8 (passing) able bodied person!!!!#which lbr the ppl most affected by homelesness are queer & trans & mentally/physically ill black & brown ppl#ive seen posts being shared saying that homelessness isn't THAT bad if u just shop cheap - whcih is ALSO not true??????#im harping a little on homelessness bc thats admittedly some of the biggest shit ive seen w/ this issue#but yeah just. please turn on the dates and use criitcal thinking b4 rbing any and all “advice” posts#there Are people out there who write well intentioned advice that is extremely dangerous#there are people out there who wrote advice that was good for when it was posted but not now#there are even ppl out there who write fake advice that is legitimately dangerous for people to do#just. please

30 notes

·

View notes

Text

How I Earned a 769 Credit Score at 23

I believe that understanding the ins and outs of managing our finances is essential in our quest for leveling up in life. After all, what good is achieving our dreams if we're not equipped with the knowledge and tools to sustain and grow our success? So how did I do it?

1. Living with parents while in school

While I had the advantage of fewer bills to pay, I still encountered challenges in managing my finances effectively. In the past, I used to blow money like it was nothing, with little to no savings to show for it. However, recognizing the opportunity to change my habits, I embarked on a journey of financial education, starting with reading "Rich Dad Poor Dad" by Robert Kiyosaki. Over the course of 6-12 months, I diligently saved and invested most of my income, laying the groundwork for my financial future. This disciplined approach not only helped me build a healthy relationship with money but also demonstrated to the bank that I was responsible and capable of handling a credit card. It was only after this period of financial growth and learning that I felt confident enough to apply for my first credit card. After being rejected 3 times prior!

2. Become Delusional as F**k

The biggest change in my relationship with money came when I realized that it's not inherently bad; I have a good relationship with money, and money works for me—this is my reality i lived in even during the times I was broke. I remained delusional in my belief that financialsuccess for me was attainable, and remarkably, it worked. This perspective empowered me to view money as a tool for creating wealth rather than something to fear. I learned to use a credit card to work for me, not as a slave to debt, and discovered how to leverage debt to make more money. This shift in mindset helped me overcome financial fears and embrace opportunities for growth.

For more financial literacy context read these posts

Escape Your 9-5 Job If You Don’t Want to Work

“Make Money When your Young, Pretty & Ambitious.”

How to make a credit card work for you

Keep Low Credit Utilization:

Aim to keep your credit card balances low relative to your credit limits. This utilization ratio should ideally be below 30%, with lower percentages being even better. High credit utilization can negatively impact your credit score.

Pay On Time, DONT MISS PAYMENTS

Consistently paying your credit card bills on time is crucial for maintaining a high credit score. Late payments can significantly damage your credit score and stay on your credit report for years.

Keep Old Accounts Open:

The length of your credit history is an essential factor in determining your credit score. Keeping old credit card accounts open, even if you're not actively using them, can help lengthen your credit history and improve your score.

Monitor Your Credit Report:

Reviewing your credit report allows you to identify any errors or inaccuracies that could be negatively impacting your score. You're entitled to a free credit report from each of the major credit bureaus—Equifax, Experian, and TransUnion—once every 12 months.

Avoid Closing Old Accounts

Closing old credit card accounts can shorten your credit history and reduce your overall available credit, both of which can lower your credit score. Unless the account carries high fees or you're unable to manage it responsibly, consider keeping it open.

Conclusion:

Through disciplined financial habits and strategic planning, I achieved and maintained a high credit score. This journey is only the beginning of my commitment to financial responsibility. For more insights on financial literacy, be sure to check out my other posts. Remember, with dedication and planning, anyone can achieve their financial goals

Until we talk again !

Chichi

#black femininity#high maintenance#black women in luxury#hypergamy#hypergamous#level up#self development#leveling up#amex#finance#finacial literacy#education#dream girl#feminine#levelling up#level up journey#leveled up mindset#high value mindset#mindfulness#manifestation#manifesting#rich black women#pink pilates girl#pink pilates princess#self care#black women in leisure#high value woman#black girl luxury#bougie#fianance

221 notes

·

View notes

Text

genuinely bewildered at how it's just g@merg@te again. like it's just exactly the same strategy, except now it's a cabal of dark and sinister narrative designers instead of "there are women near my games" but it's like the same fucking thing and I'm so tired honestly

#thoughts#as a dark and sinister narrative designer I wish I was part of the secret club that apparently finance every game with a diverse cast#when I tried to fund my very queer game with a black lead I got told by a room full of 50 white men that “nobody wanted this”#in spite of our market analysis screaming otherwise#and then was ridiculed in front of my men colleagues and told I couldn't be trusted because I would spontaneously give birth#and forget all my dreams instantly#or I was considered the “fun girl” who was only there to present the game (it was MY game!!!)#and for every serious conversation they went to my male colleague behind my back#so yeah I want in on that sweet diversity money pleaaaase#without having to debase myself to get it#this is so fucking stupid#(and like there are things to be said about the handling of DEI in corporate settings)#(I had almost nothing but bad interactions with such structures personally)#(but it was because it was a tool turned *against* minorities to speak over them and police their self-expression most of the time)#(for the sake of corporate interests or to protect the feelings of whoever was in position of power)#(so I think there are conversations to be had and it's actually a pretty complicated subject that can get VERY VERY messy)#(but yeah this aint it gamers)

24 notes

·

View notes

Text

Go to hell

#success#economy#finance#decor#marketing#skinnni#80s#black tumblr#kat dennings#beautiful model#adult model#anorexla#naomi campbell#aaliyah#girl interrupted#girl smoking#grunge#ai generated#girl in bed#tumblr girls#girlblogging#daddy's good girl#curvy girls#gisele bundchen#gorgeous#black beauty#black women#beauty#blondie#lana del ray aka lizzy grant

131 notes

·

View notes