#self millionaire

Text

youtube

#business#money#economy#financial security#wage#income#rent#food#grocery#credit#budgeting 101#cash is king#invest#investing#millionareire habits#millionaire#millionare#millionaire mindset#15 Intriguing Stories of Millionaires and their Unconventional Habits#millionaire habits#money tips#money lessons#life lessons#millionaire story#millionare habits#millionaire habits storytime#discipline#resilience#self millionaire#self made millionaire stories

2 notes

·

View notes

Text

#céline#bulgaria#cartier#porsche#luxury aesthetic#billionaire#level up#luxury#millionaire#glow up#girl boss aesthetic#self care#self love#boss#luxuries#designer jewelry#designer brands#that girl#women in luxury#it girl#black women in luxury#high value woman#high quality#luxury beauty#rich aesthetic

1K notes

·

View notes

Text

The energy of money flows to me with ease.

#venuslilgirl affirmations#manifest wealth#attract wealth#wealth affirmations#wealth#billionaire mindset#billionaire#millionaire mindset#millionaire#money manifestation#attract money#manifest money#money#manifestation#affirmations#law of attraction#law of assumption#positive affirmations#manifesting#self concept#affirm#affirmdaily

886 notes

·

View notes

Quote

Thoughts create emotions, emotions create feelings and feelings create behaviour. So it’s very important that our thoughts are positive, to attract the right people, events and circumstances into our lives.

Avis J. Williams, The Psychic Mind: A Practical Guide to Psychic Development & Spiritual Growth

#Avis J. Williams#The Psychic Mind: A Practical Guide to Psychic Development & Spiritual Growth#quotes#motivation#inspiration#thepersonalquotes#literature#lit#abundance-creation#believe#cosmic-ordering#fear#focus#goal-setting#happiness#law-of-attraction#life-changing#manifestation#manifesting#millionaire-mindset#mind-body-spirit#mind-power#new-age#new-thought#opportunity#positive-attitude#positive-thinking#positive-thoughts#positivity#self-belief

192 notes

·

View notes

Text

The way I completely lose all interest in Lawlight as a ship if Light isn't Kira. And frankly, I feel like L would agree with me on this one. I don't think he'd gaf abt Light in the slightest if Light wasn't Mr. Serial Killer.

#Lawlight only works if Light is Kira bc otherwise light is just some rly smart pretentious teenager.#Like you're telling me L a 24 y/o self made multi-millionaire and the world's greatest detective (top 3 if you count the aliases)-#would care in the slightest abt mr “i got a perfect score on my college entrance exam”. Be fr!!#Idk the ship loses everything that makes it fun and appealing to me if you remove Kira from the mix#Ik ppl do “Light isn't Kira” AUs to make the ship more wholesome but i'd argue it just becomes problematic in a diff way.#L is not only way older but also extremely rich and successful. If Light is innocent but still a suspect- L also has immense power over him#Ig i don't see the point of trying to make Lawlight wholesome. It's still problematic but without the goofy homoerotic enemyship.#Light being Kira not only makes them equals but gives them spice!#However I DO get the appeal of “Light isn't Kira” AUs where Light is still a fake asshole who's performatively nice but hides his real feel#But removing his misogynistic swag/superiority complex/his bitchy internal monologues to make him normal? No...#Imo even if he isn't Kira he'd still be a weirdo. The only Yotsuba!Light is so normal/nice is bc he's trying to prove to everyone-#but most importantly himself- that he's a good person incapable of being Kira. He's trying to be the best version of himself.#Pre-Death Note Light for example is never as outstanding and good as Yotsuba!Light for this reason. Yotsuba!Light is the exception.#Like the Death Note doesn't make you pretentious or hate women that was all Light Yagami.#this is such a random rant sorry guys XD again more power to ppl who enjoy this AU or normalguy!Light but I don't get it personally 😔#death note#light yagami#l lawliet#lawlight#💬 katposts#🤪 sillygoofy

380 notes

·

View notes

Text

Boss babe

#luxury aesthetic#billionaire#level up#millionaire#glow up#girlblog#femininity#luxury#goddess#self care#women in luxury#pretty#high value woman#high value mindset#money#motivation#self love#rich#rich aesthetic#make up#beauty#boss#girlblogging#girl boss aesthetic

90 notes

·

View notes

Text

The long sleep of capitalism’s watchdogs

There are only five more days left in my Kickstarter for the audiobook of The Bezzle, the sequel to Red Team Blues, narrated by @wilwheaton! You can pre-order the audiobook and ebook, DRM free, as well as the hardcover, signed or unsigned. There's also bundles with Red Team Blues in ebook, audio or paperback.

One of the weirdest aspect of end-stage capitalism is the collapse of auditing, the lynchpin of investing. Auditors – independent professionals who sign off on a company's finances – are the only way that investors can be sure they're not handing their money over to failing businesses run by crooks.

It's just not feasible for investors to talk to supply-chain partners and retailers and verify that a company's orders and costs are real. Investors can't walk into a company's bank and demand to see their account histories. Auditors – who are paid by companies, but work for themselves – are how investors avoid shoveling money into Ponzi-pits.

Attentive readers will have noticed that there is an intrinsic tension in an arrangement where someone is paid by a company to certify its honesty. The company gets to decide who its auditors are, and those auditors are dependent on the company for future business. To manage this conflict of interest, auditors swear fealty to a professional code of ethics, and are themselves overseen by professional boards with the power to issue fines and ban cheaters.

Enter monopolization. Over the past 40 years, the US government conducted a failed experiment in allowing companies to form monopolies on the theory that these would be "efficient." From Boeing to Facebook, Cigna to InBev, Warner to Microsoft, it has been a catastrophe. The American corporate landscape is dominated by vast, crumbling, ghastly companies whose bad products and worse corporate conduct are locked in a race to see who can attain the most depraved enshittification quickest.

The accounting profession is no exception. A decades-long incestuous orgy of mergers and acquisitions yielded up an accounting sector dominated by just four firms: EY, KPMG, PWC and Deloitte (the last holdout from the alphabetsoupification of corporate identity). Virtually every major company relies on one of these companies for auditing, but that's only a small part of corporate America's relationship with these tottering behemoths. The real action comes from "consulting."

Each of the Big Four accounting firms is also a corporate consultancy. Some of those consulting services are the normal work of corporate consultants – cookie cutter advice to fire workers and reduce product quality, as well as supplying dangerously defecting enterprise software. But you can get that from the overpaid enablers at McKinsey or BCG. The advantage of contracting with a Big Four accounting firm for consulting is that they can help you commit finance fraud.

Remember: if you're an executive greenlighting fraud, you mostly just want to be sure it's not discovered until after you've pocketed your bonus and moved on. After all, the pro-monopoly experiment was also an experiment in tolerating corporate crime. Executives who cheat their investors, workers and suppliers typically generate fines for their companies, while escaping any personal liability.

By buying your cheating advice from the same company that is paid to certify that you're not cheating, you greatly improve your chances of avoiding detection until you've blown town.

Which brings me to the idea of the "bezzle." This is John Kenneth Galbraith's term for "the weeks, months, or years that elapse between the commission of the crime and its discovery." This is the period in which both the criminal and the victim feel like they're better off. The crook has the victim's money, and the victim doesn't know it. The Bezzle is that interval when you're still assuming that FTX isn't lying to you about the crazy returns they're generating for your crypto. It's the period between you getting the shrinkwrapped box with a 90% discounted PS5 in it from a guy in an alley, and getting home and discovering that it's full of bricks and styrofoam.

Big Accounting is a factory for producing bezzles at scale. The game is rigged, and they are the riggers. When banks fail and need a public bailout, chances are those banks were recently certified as healthy by one of the Big Four, whose audited bank financials failed 800 re-audits between 2009-17:

https://pluralistic.net/2020/09/28/cyberwar-tactics/#aligned-incentives

The Big Four dispute this, of course. They claim to be models of probity, adhering to the strictest possible ethical standards. This would be a lot easier to believe if KPMG hadn't been caught bribing its regulators to help its staff cheat on ethics exams:

https://www.nysscpa.org/news/publications/the-trusted-professional/article/sec-probe-finds-kpmg-auditors-cheating-on-training-exams-061819

Likewise, it would be easier to believe if their consulting arms didn't keep getting caught advising their clients on how to cheat their auditing arms:

https://pluralistic.net/2023/05/09/dingo-babysitter/#maybe-the-dingos-ate-your-nan

Big Accounting is a very weird phenomenon, even by the standards of End-Stage Capitalism. It's an organized system of millionaire-on-billionaire violence, a rare instance of the very richest people getting scammed the hardest:

https://pluralistic.net/2021/06/04/aaronsw/#crooked-ref

The collapse of accounting is such an ominous and fractally weird phenomenon, it inspired me to write a series of hard-boiled forensic accountancy novels about a two-fisted auditor named Martin Hench, starting with last year's Red Team Blues (out in paperback next week!):

https://us.macmillan.com/books/9781250865854/redteamblues

The sequel to Red Team Blues is called (what else?) The Bezzle, and part of its ice-cold revenge plot involves a disillusioned EY auditor who can't bear to be part of the scam any longer:

https://www.kickstarter.com/projects/doctorow/the-bezzle-a-martin-hench-audiobook-amazon-wont-sell

The Hench stories span a 40-year period, and are a chronicle of decades of corporate decay. Accountancy is the perfect lens for understanding our modern fraud economy. After all, it was crooked accountants who gave us the S&L crisis:

https://scholarworks.umt.edu/cgi/viewcontent.cgi?article=10130&context=etd

Crooked auditors were at the center of the Great Financial Crisis, too:

https://francinemckenna.com/2009/12/07/they-werent-there-auditors-and-the-financial-crisis/

And of course, crooked auditors were behind the Enron fraud, a rare instance in which a fraud triggered a serious attempt to prevent future crimes, including the destruction of accounting giant Arthur Andersen. After Enron, Congress passed Sarbanes-Oxley (SOX), which created a new oversight board called the Public Company Accounting Oversight Board (PCAOB).

The PCAOB is a watchdog for watchdogs, charged with auditing the auditors and punishing the incompetent and corrupt among them. Writing for The American Prospect and the Revolving Door Project, Timi Iwayemi describes the long-running failure of the PCAOB to do its job:

https://prospect.org/power/2024-01-26-corporate-self-oversight/

For example: from 2003-2019, the PCAOB undertook only 18 enforcement cases – even though the PCAOB also detected more than 800 "seriously defective audits" by the Big Four. And those 18 cases were purely ornamental: the PCAOB issued a mere $6.5m in fines for all 18, even though they could have fined the accounting companies $1.6 billion:

https://www.pogo.org/investigations/how-an-agency-youve-never-heard-of-is-leaving-the-economy-at-risk

Few people are better on this subject than the investigative journalist Francine McKenna, who has just co-authored a major paper on the PCAOB:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4227295

The paper uses a new data set – documents disclosed in a 2019 criminal trial – to identify the structural forces that cause the PCAOB to be such a weak watchdog whose employees didn't merely fail to do their jobs, but actually criminally abetted the misdeeds of the companies they were supposed to be keeping honest.

They put the blame – indirectly – on the SEC. The PCAOB has three missions: protecting investors, keeping markets running smoothly, and ensuring that businesses can raise capital. These missions come into conflict. For example, declaring one of the Big Four auditors ineligible would throw markets into chaos, removing a quarter of the auditing capacity that all public firms rely on. The Big Four are the auditors for 99.7% of the S&P 500, and certify the books for the majority of all listed companies:

https://blog.auditanalytics.com/audit-fee-trends-of-sp-500/

For the first two decades of the PCAOB's existence, the SEC insisted that conflicts be resolved in ways that let the auditing firms commit fraud, because the alternative would be bad for the market.

So: rather than cultivating an adversarial relationship to the Big Four, the PCAOB effectively merged with them. Two of its board seats are reserved for accountants, and those two seats have been occupied by Big Four veterans almost without exception:

https://www.pogo.org/investigations/captured-financial-regulator-at-risk

It was no better on the SEC side. The Office of the Chief Accountant is the SEC's overseer for the PCAOB, and it, too, has operated with a revolving door between the Big Four and their watchdog (indeed, the Chief Accountant is the watchdog for the watchdog for the watchdogs!). Meanwhile, staffers from the Office of the Chief Accountant routinely rotated out of government service and into the Big Four.

This corrupt arrangement reached a crescendo in 2019, with the appointment of William Duhnke – formerly of Senator Richard Shelby's [R-AL] staff – took over as Chief Accountant. Under Duhnke's leadership, the already-toothless watchdog was first neutered, then euthanized. Duhnke fired all four heads of the PCAOB's main division and then left their seats vacant for 18 months. He slashed the agency's budget, "weakened inspection requirements and auditor independence policies, and disregarded obligations to hold Board meetings and publicize its agenda."

All that ended in 2021, when SEC chair Gary Gensler fired Duhnke and replaced him with Erica Williams, at the insistence of Bernie Sanders and Elizabeth Warren. Within a year, Williams had issued 42 enforcement actions, the largest number since 2017, levying over $11m in sanctions:

https://www.dlapiper.com/en/insights/publications/2023/01/pcaob-sets-aggressive-agenda-for-2023-what-to-expect-as-agency-enforcement-expands

She was just getting warmed up: last year, PCAOB collected $20m in fines, with five cases seeing fines in excess of $2m each, a record:

https://www.dlapiper.com/en/insights/publications/2024/01/pcaobs-enforcement-and-standard-setting-rev-up-what-to-expect-in-2024

Williams isn't shy about condemning the Big Four, publicly sounding the alarm that 40% of the 2022 audits the PCAOB reviewed were deficient, up from 34% in 2021 and 29% in 2020:

https://www.wsj.com/articles/we-audit-the-auditors-and-we-found-trouble-accountability-capital-markets-c5587f05

Under Williams, the PCAOB has enacted new, muscular rules on lead auditors' duties, and they're now consulting on a rule that will make audit inspections much faster, shortening the documentation period from 45 days to 14:

https://tax.thomsonreuters.com/news/pcaob-rulemaking-could-lead-to-more-timely-issuance-of-audit-inspection-reports/

Williams is no fire-breathing leftist. She's an alum of the SEC and a BigLaw firm, creating modest, obvious technical improvements to a key system that capitalism requires for its orderly functioning. Moreover, she is competent, able to craft regulations that are effective and enforceable. This has been a motif within the Biden administration:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

But though these improvements are decidedly moderate, they are grounded in a truly radical break from business-as-usual in the age of monopoly auditors. It's a transition from self-regulation to regulation. As @40_Years on Twitter so aptly put it: "Self regulation is to regulation as self-importance is to importance":

https://twitter.com/40_Years/status/1750025605465178260

Berliners: Otherland has added a second date (Jan 28 - THIS SUNDAY!) for my book-talk after the first one sold out - book now!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/26/noclar-war/#millionaire-on-billionaire-violence

Back the Kickstarter for the audiobook of The Bezzle here!

Image:

Sam Valadi (modified)

https://www.flickr.com/photos/132084522@N05/17086570218/

Disco Dan (modified)

https://www.flickr.com/photos/danhogbenspics/8318883471/

CC BY 2.0:

https://creativecommons.org/licenses/by/2.0/

#pluralistic#big accounting#auditing#marty hench#martin hench#big four accountants#management consultants#corruption#millionaire on billionaire violence#long cons#the bezzle#conflicts of interest#revolving door#self-regulation#gaap#sox#sarbanes-oxley#too big to fail#too big to jail#audits#defective audits#Public Company Accounting Oversight Board#pcaob#sec#scholarship#Francine McKenna#William Duhnke#administrative competence#photocopier kickers#NOCLARs

67 notes

·

View notes

Text

MY ORIGINAL FANTASY NOVEL JUST CAME OUT!

(Graphic design is my passion, amirite?)

A FANTASY NOVEL ABOUT DEATH, DECAY, AND LITTLE WITCHES!

Alma Evergreen lives a quiet life as a carnifex: a death-worshiping, magic-weaving, fancy-speaking little witch. When Prince Benjamin is found dead under mysterious circumstances, Alma is tasked with reaching the castle and solving the new mystery that’s befallen the great kingdom of Moonsong.

Joining her is Violet, one of the prince’s faithful fixers, on a quest of her own to ensure Alma reaches the castle swiftly and safely—but can she be trusted?

And for that matter, can Alma?

THE SMALLEST SAPLING is a feel-good "witchy" fantasy story that is full of humor and heart, and it stands as a testament to the adage that sometimes, the journey can be just as fulfilling as the destination.

I'm so excited to share this with everyone, and I hope you all have as much fun reading this as I did writing it!

I can't wait to create more stories for all of you 💚

You can find the story in multiple formats here!

https://www.amazon.com/dp/B0CP3XVKZW

#writing#slumbrrr#writeblr#aspiring author#new author#sapphic#wlw fantasy#new book#fantasy books#self publication#please read#and review#and share with all your millionaire friends#my first book

76 notes

·

View notes

Text

You don’t “try to start a business” you give it your all or nothing. Businesses don’t fail. People fail their businesses.

#self made#billionairequotes#ecommerce#make money from home#make money online#business mindset#dropshipping#quotes#success#amazon#entreprenuership#business tools#entrepreneur#millionaire mindset#mindset#start a business#successquotes#branding#new business#e-commerce#startup

485 notes

·

View notes

Text

#just imagine#you could bang ANYONE#a celebrity#your 2d husband#your goddamn oc#even Jesus#actually if i had poe's ability i'd write self-insert fanfiction for other ppl#for lots of money of course#i'd be a millionaire by now#bsd#bungou stray dogs#bsd poe

49 notes

·

View notes

Text

youtube

#business#money#economy#financial security#wage#income#rent#food#grocery#credit#budgeting 101#cash is king#invest#investing#millionareire habits#millionaire#millionare#millionaire mindset#15 Intriguing Stories of Millionaires and their Unconventional Habits#millionaire habits#money tips#money lessons#life lessons#millionaire story#millionare habits#millionaire habits storytime#discipline#resilience#self millionaire#self made millionaire stories

0 notes

Text

𝓨𝓾𝓶...

#luxury aesthetic#billionaire#level up#millionaire#boss#glow up#luxury#girl boss aesthetic#self care#self love#breakfast#fine dining#fine china#rich aesthetic#rich girl#rich#big money#money#women in luxury#black women in luxury#girl bosses#boss lady

978 notes

·

View notes

Text

It is so easy for me to make money.

#venuslilgirl affirmations#manifest wealth#attract wealth#wealth affirmations#wealth#billionaire mindset#millionaire mindset#luxury mindset#luxurious lifestyle#luxury lifestyle#luxury#money manifestation#attract money#manifest money#manifestation#affirmations#law of attraction#law of assumption#loa affirmations#self concept affirmations#affs#affirmdaily#affirm and persist

373 notes

·

View notes

Quote

A self-limiting belief is no stronger than the flimsy rope that tethers an elephant by its foot.

Stephen Richards, Six Figure Success: Time To Think Big - You Can Do It

#Stephen Richards#Six Figure Success: Time To Think Big - You Can Do It#quotes#motivation#inspiration#thepersonalquotes#literature#lit#abundance-creation#author-stephen-richards#believe#cosmic-ordering#fear#focus#goal-setting#happiness#law-of-attraction#life-changing#manifestation#manifesting#millionaire-mindset#mind-body-spirit#mind-power#new-age#new-thought#opportunity#positive-thoughts#positivity#self-belief#self-growth

72 notes

·

View notes

Text

#kira#Guess who just bought a bunch of millionaires merch#Guess who also misunderstood what millionaires band was playing in SD#but whatever#still going to support my girl and get a bunch of merge because I am a simp#narcan necromancer#narcan-necromancer#armoredandroid#selfie#self#personal#i think I'm gonna start wearing more makeup and fake eyelashes#me#the millionaires#$c3n3 Qu33n

45 notes

·

View notes

Text

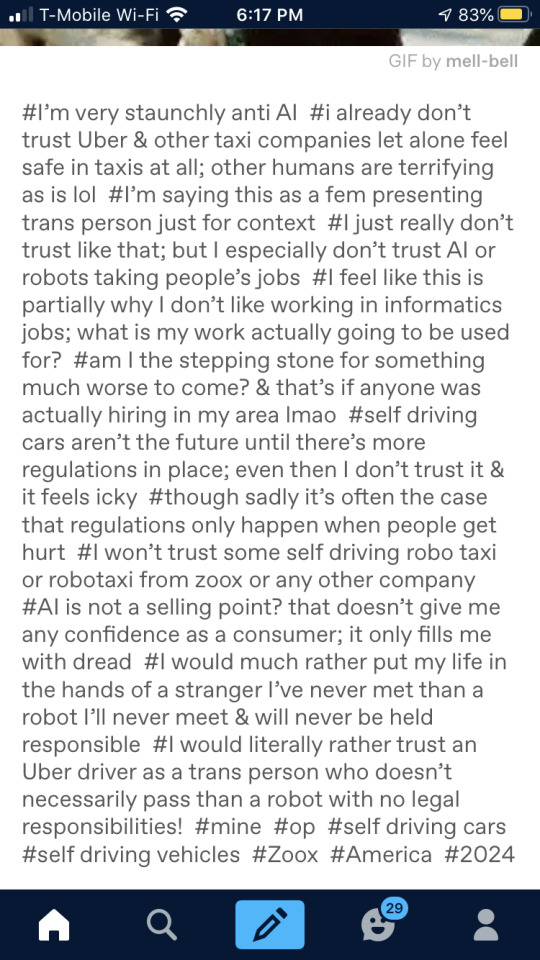

I refuse to hop in a Zoox car in my entire life if I can avoid it. I refuse to hop into any self-driving robo taxi (or robotaxi) that uses AI to keep it’s passengers “safe.” If this is actually a service they are legally allowed to provide publicly, there’s about to be a whole bunch of new laws made in hopefully very little time! Now you know me, obviously fuck the law, many laws are unjust, but sometimes we need some regulations to keep up with the shit that rich Silicon Valley tech bros “put out” while claiming it’s allegedly their own work. These rich bastards are dangerous! Now I’ll pass along the questions that my partner & I jokingly pondered. If something happens that the AI & detection systems doesn’t know how to handle, will us as the passengers be held legally responsible say if a child gets punted into the air by the self driving car & we can’t do anything to stop it? What if we’re asleep assuming the car is safe & it runs over a legally endangered animal? What if we’re on our phones & these self-driving robot cars cleave someone in half? What if it crashes into someone’s private property? Are we held responsible in any of these cases or is the big rich guy’s company? If it’s anything like Tesla, you should get your kids or pets out of the road when you see a Zoox car coming, it could allegedly cause some mortalities. Two more things. What’s stopping someone from hijacking, hacking, or planting a virus on these self-driving taxi services? What if one of them gets hijacked to take someone to a human trafficker meetup spot? Will the company be held responsible at all? The gifs below pretty much summarizes my feelings.

#I would sooner trust an Uber driver even though I’m kind of paranoid; than trust a robot with no legal responsibilities#we’re trying this post again since apparently I hit a key word that the algorithm didn’t like in my post or tags#I’ll put my trust in a random stranger before I put my trust in an AI whose owner is probably a billionaire or millionaire#zoox & any other robotaxi or robo taxi services who do self driving cars; I don’t trust like that#regulations for stuff like this often only happens once it’s too late & I actually hate that so much#robots are stealing our jobs & the government is just letting them; they don’t care about us#these tag rambles are probably gonna get my post wiped from being seen by anyone#I’m anti-AI btw just to clarify; in case that wasn’t blatantly obvious#I’ll always be anti AI#I’ll trust a Lyft driver before I trust a robot with no sense of self awareness of its own#mine#op#self driving vehicles#2024

7 notes

·

View notes