#because I am correct and the 2020 run basically confirms it

Text

It is very important to me that more people know Spider-man Noir Peter Benjamin Parker is in fact the product of an eldritch horror if not one himself.

#I said what I said and I can go into heavy detail at to why I think this and why I’m correct#because I am correct and the 2020 run basically confirms it#ITS NOT MY FAULT THE NARRATIVE JUST DOESNT TALK ABOUT IT#I got a post coming soon about if the dude is a vessel#avatar#or totem#the answer to all is kinda?#most likely some secret 4th thing#spider shitposting#spider noir#spiderman noir#spider-man noir#peter benjamin parker

203 notes

·

View notes

Text

Yeah, forget side content, just gonna steam on ahead with the Sports Festival and onwards. I might not actually stop and start trying to do overarching plot stuff until ~chapter 100 (more specifically, post ch 97, the last chapter of the Kamino Arc) because then there will be enough material to actually like. Do stuff. Might also have something smaller after the Sports Festival since that’s ~chapter 50. Shrugs.

Anyways, onwards. Don’t you miss the days when the main trio of the series was Izuku, Tenya, and Ochako? Man, don’t I. :(

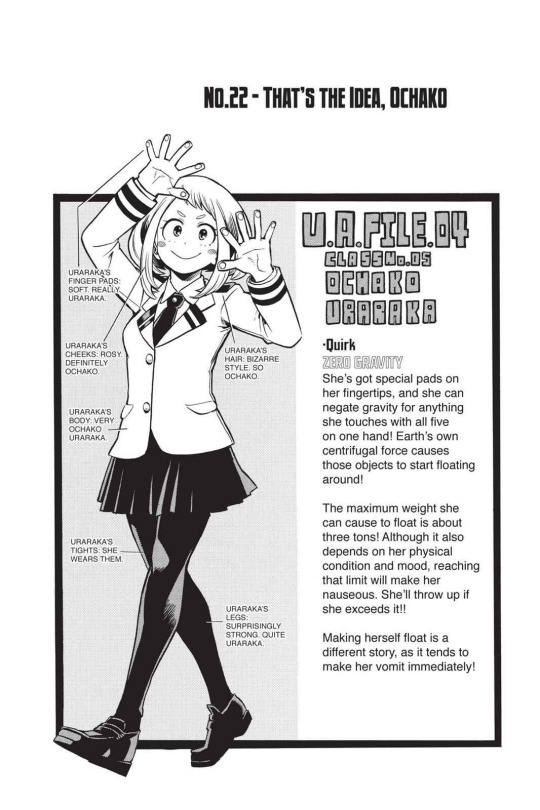

[No. 22 - That’s the Idea, Ochako!]

Character sheet! I am honestly laughing super hard at everything because just. ‘Very Ochako.’ Thank you, Horikoshi. A few things about the sheet:

1) god I love that her fingerpads are called soft. Like. Actual cat paw pad fingers going on here. just imagine if you like pressed one of them like you do with cat paw pads and like, she had cat claws that would extend. cute but also menacing.

2) strong legs. leg day squad. her, izuku, and iida all doing leg day workouts together tho... katsuki wishes he had the leg strength of those three y'all

3) That quirk description… that’s not quite how centrifugal forces work, but I mean. Superhero comic physics. At least he made an attempt at explaining her quirk.

Anyways, onto the actual chapter.

We open up in a staff meeting in a conference room at UA, with Tsukauchi presenting the results of the police investigations. He states that the one called Shigaraki has a quirk that allows him to disintegrate anything he touches. They (the police) have been through the list of men in their twenties and thirties in the quirk registry with no luck - and nothing turned up on the ‘warp gate’ user Kurogiri either. With neither registered, both using aliases, and no quirk records, they’re pretty much confirmed to be members of the underworld.

God sorry, I’m just distracted with the sheer size difference between Toshinori and Nedzu here.

What the fuck. Why did you put the largest person in the room next to the smallest?

Whatever. Snipe surmises that they know next to nothing, but they need to learn fast, or the leader of the villains, Shigaraki, will heal up and be back again. Toshinori is thoughtful as he mulls over the use of ‘leader’, which Nedzu catches quickly and inquires into. Probably still heavily banking on Toshinori’s instincts here since he was technically right about his bad feeling about the USJ just two days before.

I mean, how it has to sting Nedzu that all his state of the art systems meant to keep out intruders and alert UA to situations on campus failed at the critical moment, while Toshinori’s instincts on something being wrong had been absolutely on point and, if Nedzu had let him go, might have solved the situation that much sooner.

(I mean, there’s arguments for what could have happened if All Might did arrive early, so. Shrugs.)

And so we get into the segment I like to fondly consider a prime example of the fact that yes, Toshinori does in fact have a 6/6 intelligence score for a reason.

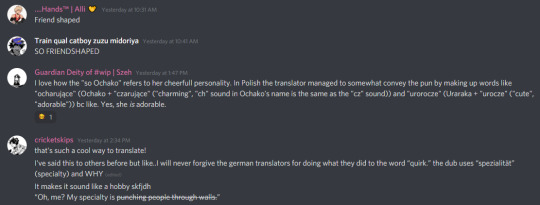

He brings up how nothing about the situation feels normal. It was an especially daring attack - and not just in the meticulous planning! Shigaraki had started going on about some ridiculous ideology… and though he didn’t say anything about his own quirk, he couldn’t keep himself from bragging about the nomu’s quirk. And when things didn’t go his way? He threw a tantrum. Toshinori then admits with grit teeth and clenched fist that the business about quirks was meant to provoke him, and that it did hurt.

Nedzu says that even so, it’s foolish for villains to reveal quirks in a battle against heroes and so waste the element of surprise.

Toshinori surmises his previous observations about Shigaraki - spouting a plausible yet deluded ideology, bragging about the toy he brought along, simple-mindedly assuming all would go his way. If they thought about how the attack was carried out, it seems clear that Shigaraki couldn’t hide his childish nature, the sense that he does what he wants, and then flat-out calls him a man-child.

Vlad King sums up Toshinori’s words as Shigaraki being a kid with too much power. Midnight adds on how Shigaraki might never have received general quirk counseling in elementary school; Vlad wonders whether that even matters.

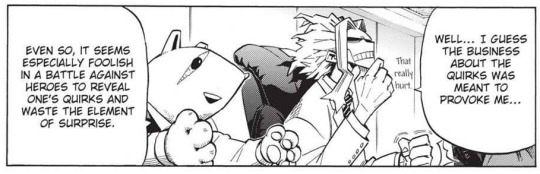

Tsukauchi steps back into the conversation to give the rest of the arrest results - a total of 72 villains were apprehended at the USJ. He states that all of them were just back-alley thugs, but the question is why so many of them would agree to follow this ‘man-child.’ He points out that modern society is saturated with heroes, so small-time villains like them, who always get kicked around, might have been drawn in by that sort of pure, unaffected evil.

Toshinori having a flashback here, though his expression… I wonder if he’s having doubts already. And honestly, that flashback bit has me wonder just how common ‘uncontrollable’ quirks really are… and what COUNTS as ‘uncontrollable’ in their society.

To avoid a longer derail, Tsukauchi finishes up by saying that thanks to the heroes, the police can focus on their investigation. They’ll expand their search and devote efforts to apprehending the perpetrators.

Nedzu finishes out the scene by musing over the use of ‘man-child,’ stating that in one way, Shigaraki is a lot like their students. He has potential to grow, if only he had a proper mentor to follow. It’s difficult to think about these things.

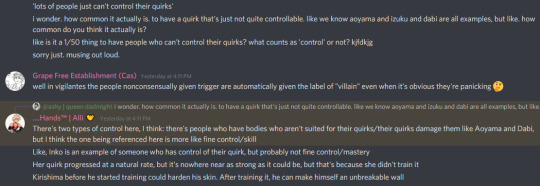

And so we shift scenes back over to 1a. I doubt this sports festival talk is happening at the same time as the staff meeting, if only because Aizawa should have been at said staff meeting. Or maybe he wasn’t supposed to be there at all and the homerooms were meant to handle themselves that morning? Wait, hold on-

That clock reads 8:25. This is happening during the homeroom period, which means that the other classes are having independant homeroom. Which also means it’s no surprise that Aizawa isn’t at that meeting, because he’s busy hobbling to his class to announce the sports festival. He probably had to be caught up on the meeting stuff later.

Anyways. The class is surprised over the announcement of the sports festival, someone calling it ‘totally ordinary’ while another (I think Mineta) questions whether Aizawa’s sure about this, since they just had that villain attack. Aizawa states that it’s necessary to demonstrate that UA’s crisis management protocols are sound - or that’s the thinking, anyways. There will be five times the police presence of previous years. Oh, and also the sports festival is the greatest opportunity the class will get. It’s not something that can be cancelled over a few villains.

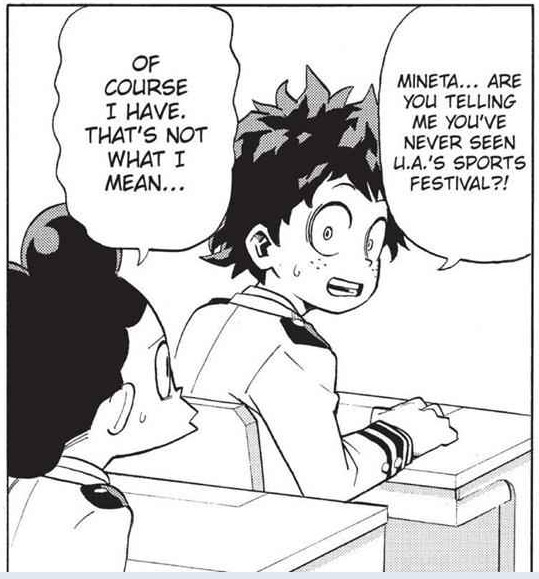

Mineta (again?) asks if he’s sure about that, muttering about how it’s ‘just a stupid sports festival.’ Izuku seems completely horrified at the idea that Mineta might have never seen UA’s sports festival, which Mineta hastens to correct - he has, that’s not what he meant.

I’m sorry just. That face. I can’t with this kid. Jdsjlgkd.

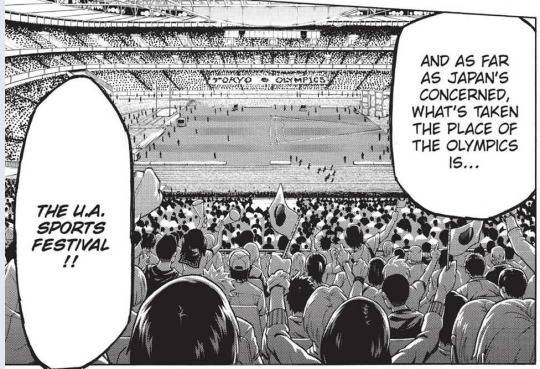

Also, we finally get to the page that had me double-take when I got to it because, well.

So yeah, apparently the BNHA timeline didn’t have certain current events happened that would force the cancellation of the Olympics. (I mean, obviously Hori had no way of knowing the 2020 Olympics in Tokyo would be cancelled, but it’s still like a huge sign of how long this series has been running that this is here.)

Moving on, basically the above surmises for readers that the sports festival is as big an event to them as the Olympics are to us. So basically, super hype. Momo notes that all the nation’s top heroes will be watching and scouting. Kaminari adds on how the heroes will be looking to hire the hero students as sidekicks after they graduate. Jirou makes a cutting retort how a lot of those sidekicks never manage to go solo, stuck as sidekicks forever, before telling Kaminari that’ll be him.

Shot through the heart.

(Also a total aside I just realized: current manga events likely mean there will be no sports festival for 2a. I mean, I would say the events happening there are large enough in scope that UA just doesn’t have the inclination or interest in broadcasting vital information the villains could use. And like, no scouting, no internships, no purpose for it.

And I mean, even if they did, would any of the kids even be able to focus on doing their best? God knows how stressed and nervous they all must be with how society is basically collapsing outside the school.)

Aizawa tells the class that they’ll gain valuable experience and popularity if they’re picked up by a big-name hero. However, their time is limited. They need to show the pros what they’re made of to make futures for themselves. This happens once a year, so they have three shots. If they want to be heroes, this is an event they can’t miss.

The whole class seems to be taking this seriously, but Izuku…

Well, he doesn’t seem as enthused as expected.

Anyways, I’ll cut it there and leave the rest for next time, since there’s a time break in here anyways. It’s not quite halfway, but eh.

#boku no hero academia#my hero academia#chapter 22#readthrough#sports festival arc#nedzu#yagi toshinori#vlad king#snipe#midnight#aizawa shouta#midoriya izuku#yaoyorozu momo#Mineta Minoru#Kaminari Denki#jirou kyoka#incredible how things are so different a year from this point#like it's actually a bit mind-boggling to realize just how much has changed in the bnha world in just one year#guess villains did manage to cancel the sports festival after all#rip to that

28 notes

·

View notes

Note

what are your thoughts on the deancas endgame.. how will they resolve the Empty.. any thoughts?

Ah that old question! How it pains us all! :P

What are my thoughts on DeanCas endgame now? Honestly it changes everyday!

When Cas first made his deal with the Empty, it seemed so damn obvious to me that it would be a lead up to overt canon Destiel. At the time I was pretty sure that there was nothing else that could bring Cas that level of happiness. Now I’m not so sure. Cas’s devotion to Jack has only grown, and the fracturing of the Winchester family at the end of Season 14 was a huge hit to him. I can now easily envisage something as simple as Cas being invited to carve his name on the bunker table being the trigger point, so long as Jack is alive and well. Being part of the Winchester family has definitely been the principle factor the writers have built on for Cas over the past season. I therefore think that if the Empty does come for Cas, it will be from something familial, something like Jack and the Winchesters all sitting around and them paying specific attention to Cas for doing something great, like actually stopping a monster, saving a ton of people, and doing it all the human way, leading to a very impressed Sam and a loved up Dean beaming at him and telling him to carve his initials, and making sure he adds the W.

As much as I would love it and ascend to fandom heaven if it happened, I don’t think the empty deal is gonna be triggered by Dean grabbing and kissing Cas up against his bedroom door, or even actually saying a very clearly romantic “I love you”. Not that I don’t think that will happen at all, but I feel the Empty deal will need to be addressed very soon, and I just can’t see any overt confirmation of Destiel in text before the very end (if at all) at this point.

Please let me explain my thought process on this before anyone get’s upset or jumps on me.

Season 15, imo, has done a lot for Destiel. Since the very first episode we have had a clear emotional storyline specific to Dean and Cas. Their relationship drama has basically fuelled the emotional heart of the season so far. It has lead to journalists, interviewers, and plenty of check marks on Twitter agreeing that whatever Dean and Cas have, it’s something very special, and important to Supernaturals beating core.

The fact is, Dean and Cas are already being written as a romantic couple. They are being written as two people who deeply love each other, to the point that they get ridiculously overly emotional around each other and when the other hurts them. Their relationship is constantly called out by other characters (Belphegor, Rowena) and mirrored to the more overt (however unfair that is) heterosexual relationship in the show (Sam and Eileen).

If we were still living within the era of the Hays Code, if this was The Celluloid Closet, then we would already be championing Destiel as an epic example of queer romance. It IS a queer romance after all. Destiel is real, it exists within the Supernatural story, and the SPN writing team including actual queer writers are 100% on our side and writing Destiel as best they can. This I am 100% certain of at this stage. As a meta writer, I am already validated that my reading of the show and of Destiel as a queer romance in the show is correct. Destiel isn’t something anyone can justifiably call us delusional for seeing anymore. We have come way far beyond that point here. If you see Destiel as a romantic love story, your reading is a correct reading because that IS the story the writers are writing. Season 15 has confirmed that with the Destiel break up story arc and Dean’s prayer. This I say with absolute certainty. Your reading of Destiel as valid and an actual queer love story is correct. It is the story they are telling. People can’t deny Destiel anymore because it is those deniers who at this stage look pretty damn delusional ya know?

I have bolded several lines above because they are important and I really want to stress that this is my stance on the matter. Do not let anyone try to convince you that I feel differently here. If you are a young queer person who sees yourself and your relationship in the DeanCas love story you are valid in seeing that. Exactly as it is, right now, without any need for further confirmation within the story. I am in no way trying to invalidate you by what I am about to say next.

I mentioned the Hays Code and the Celluloid Closet. If you haven’t seen the Celluloid Closet I urge you to watch it as it is a fascinating look into queer coding within the Hays code era. Also, quickly, if you aren’t aware of what I mean by the Hays Code it’s basically the code that Hollywood had to adhere to, setting out rules of what could and couldn’t be portrayed in cinema at the time. Here’s a link to the Wiki article on the history of queer cinema. The introduction of the Hay’s code also meant the introduction of queer coding and subtext rather than explicit dipictions of queer romance in cinema. When I refer to this in relation to Dean and Cas, basically what Supernatural is doing with Dean and Cas is exactly what was done to dipict queer romance in order to get around the Hays code during the era when it was enforced.

So when I say that Destiel is real and valid and being written as a love story, I mean that the writers are basically doing with Destiel what savvy filmmakers had to do to circumvent the Hay’s code during Hollywoods golden age.

Do you see the issue yet?

It is 2020. The Hay’s Code has been abolished for around 50 years.

I fully respect the SPN writing team for trying to tell the Destiel love story as best they can, but at this point in time, even with everything they have already given us, it is still subtext.

Subtext IS a part of the text. What is Canon? What isn’t Canon? Honestly? I’m done with the arguments about it. Believe what each of you want to believe. What I will say is that I don’t think we are going to get anything more overt from the show at this point. The reason I say this is because the writers have now had plenty of ideal opportunities to actually bring the Destiel love story into text. They could have had a single line in 15x07 that confirmed Dean and Lee had a romantic relationship when they were younger. It would have been so easy to do. But they didn’t. Dean’s prayer to Cas, in all it’s glory, could have given us one line more as well. We could have had a love confession. They could have taken it there. Again, it would have been so easy, and it was the ideal opportune moment for Dean to confess. But they didn’t.

I have gone back and forth on this particular question over and over again. The question being will Destiel be brought into explicit undeniable text by series end?

Again, I stress, this question is completely separate to the question of the validity of Destiel already within the text and I swear to God if I get a single argumentative person in my mentions coming at me because they’ve been brainwashed by *people* trying to twist and blur these lines I am going on an even bigger blocking spree to the one I’ve already been on.

In my opinion, the answer to this question resides not with the decisions of the writers (who I fully believe would make it overtly canon in a heartbeat if they could) but with the CW execs. I have my own theories about what goes on behind the scenes, and what I think Dabb has been fighting with since he first took over as showrunner in season 11, and I just really hope that at some point once this is all over we will get a big expose on the truth about Destiel which confirms my speculation and slams the CW execs for not wanting to go there with Supernatural in particular (something I have previously talked about here). I would love for the execs to have given the green light on Destiel being overt by season end, and I am still hoping they have been more lenient this season even if the okay is only for one small moment. Whatever we get or do not get, it will be at the hands of the CW execs and not the writers. That’s the one thing I ask everyone to please keep in mind whatever happens in the end.

As far as what I think may or may not happen...

I would love for the Empty to take Cas because Dean confesses his love and kisses him. Or even if the Empty takes Cas because of other things, having Dean then rescue Cas from the Empty in a poetic reverse of Cas rescuing Dean from Hell, with the big reunion being their overt textual getting together. I feel like the story could go in so many different directions right now as I don’t actually feel like the plot of season 15 is all that coherant so far. The main key notes were Dean and Cas’s relationship drama, Sam and Eileen’s reunion, Chuck messing with the boys and Jack’s return. I think that things will ramp up pretty quickly in this final run of episodes from mid March to the finale, and I think a lot of storylines will get addressed and resolved in a short space of time, at this point, if anything overt does happen for Dean and Cas, it will happen quickly, and the story will move on, or it will be left in the subtext until the very final episode, or it will remain in subtext completely.

Personally, I think that Dean and Cas’s love story will remain subtextual until the very end, with potentially an “I love you” from Dean that will be interpreted as platonic by all major media sources much to all of our frustrations (a repeat of the Season 12 Cas “I love you”) (As Dean needs to tell Cas he loves him as a plot point at this stage, regardless of whether it is romantic or platonic the story basically demands it be said). I am still quietly confident that Dean and Cas will end the season together in some way, either living or dead, I don’t think that their story or their individual story arcs work if they are separated, and I will be stunned and hurt the same way I was for Game Of Thrones if the show does take a different route.

Therefore, since I see the show ending with Dean and Cas together, I can potentially see them taking each others hands in one final shot that basically subtly confirms that they are an item without ever actually textually stating anything more or giving us a kiss or anything. I personally, would be very satisfied with this. If it doesn’t happen though, if I’m totally honest, I would also be satisfied so long as they are still together by the shows end, as I have continually stressed, Destiel is already a real and valid love story that totally validates me as a meta writer, even if it isn’t technically “canon” by all major definitions of the term. (Again I stg if anyone comes at me for saying this I am blocking without devoting a second of my time to arguing with you I am literally at zero tolerance on this ridiculous argument right now and refuse to be dragged back into the bullshit).

Whatever happens, I am loving what we are getting so far. I’ve really been enjoying this season especially the Dean and Cas storyline because it has been so intense and emotional and I LIVE FOR IT! :D I know I’ll be a puddle of tears whatever happens and I just hope that it keeps up this excellent trajectory because so far I’ve been really pleased with everything else we’ve got even if I was slightly disappointed by the show not pushing 15x07 and 15x09 just that tiny bit further into overt canon confirmation of Bi!Dean and Destiel. We’ll see. As I have already said several times, I am feeling pretty validated by my interpretation of Dean and Cas’s relationship over the past so many years I’ve been writing about them. I am confident that I will continue to feel validated as we reach the final run of episodes, and I will continue to be optimistic that Dean and Cas will get a satisfying ending together, whether that includes overt textual Destiel confirmation or not.

#destiel#deancas#supernatural#spn meta#castiel#dean winchester#spn speculation#season 15#destiel dreaming#spn endgame speculation#destiel endgame speculation#my meta#the great queerbating debate#queercoding#hays code#asks#anon#Anonymous

265 notes

·

View notes

Text

Watch "I'M BACK! WHY I LEFT YOUTUBE FOR TWO YEARS!" on YouTube

youtube

This scared me so badly, because this is EXACTLY what happened in my life, except it was all in The Reverse.

I graduated with an Associate Degree in Music Performance in 2018, but instead of running TOWARDS my dream/calling I ran hardcore AWAY from it. My pride in graduating only lasted a month before I declared myself Utterly Unmarketable and sought to go after a "real degree" and get a Big Girl career.

Between 2018 and 2020 I had major life changes.

My dad died of stomach cancer

I broke up with my neglectful boyfriend

I turned down a Full Ride to a major college

I hospitalized myself for Suicidal Ideation (Sept 2019)

I quit my job of 5 years

I started working for my best friend and became her Office Manager

I started dating the Love of my Life

I lost my friend group and peer support

I lost my mind and left college due to COVID-19 (but not before making one of my best decisions in taking a Screenwriting class because I WANTED not NEEDED it)

Started distancing myself from the toxic women in my life and definining Womanhood/Adulthood for myself

Visited my brother's grave after over a decade of waiting and got closure

Fully acknowledged my childhood trauma/abuse

Rediscovered my sexuality

Was disowned by who I erroneously thought was a close friend of 17 years over my political views

Joined and exited Unity2020

Turned in my car for repossession

Spent a week in the hospital after having a severe, paranoid psychotic break, but came out completely free of the vice of self-consciousness I was living under

You know what is nuts? I feel in many ways, I have completely reverted to who I was in the summer of 2011. I was off my meds, and it WAS mania, but personality-wise, the tempestuous, gum-chewing, cigarette-puffing, flirtatious, humorous, free-spirited ball of fire that drove all the way to Colorado on a whim wasn't rebellious, SHE WAS ME.

I just wasn't Me around the right people, and it wasn't the Right Time.

My inner Sagittarius moon would remain in a dormant state for almost a full decade. I would spend the next 9 years heavily sedated, sleepwalking through life, only alive at The Sound of Music.

It was Torture to feel so much but be afraid to express myself. I had to Hide while doing a major that demanded that I Command Attention. I am by nature "dramatic", "theatrical", "emotional", "expressive" but that part of me was so suppresed that I was frequently told I sang with excellence but without emotion.

Aside: During my 2011 manic episode, I spoke a lot about Doppelgangers. Without going into excessive detail, this is a German word that means "Double" and it is considered bad luck to encounter yours.

In the past 2 weeks, I have encountered people that look/sound like me (Josephine is Nigerian-Canadian and I am Nigerian-American and I kept thinking about her work even though I initially disagreed with her lot) and a woman with my name (different spelling) who was NOTHING like me and I also think might've had malice in mind for me.

I was DEFINITELY an agnostic atheist when I started this year, but as a result of undergoing so much weird shit I almost certainly believe in God, and yes, "God is a Woman." (More on that later)

Also, I realized that I really DID, as many teenage girls, "lose interest in math and science" but that was because of the terrible, unfactual way it was presented in my homeschool curriculum and by my mom, who was a Math major but whose disinterested detachment made every algebra lesson an excercise in torture.

I have always loved biolology and anatomy and I remember so much more chemistry than I thought. Geology class in community college was amazing and also helped me understand-- even more than the Theory of Evolution-- why young earth creationism was completely impossible.

As for math, I spent 15 years thinking it was my greatest weakness when I have had to use arithmetic in cashiering, my managerial work, and my monthly budget for the last 7 years. Also, as annoying as it was to hear constantly, my mom parroting "What you have to do to one side, you have to do to the other" (but in reverse) gave me the ability to do Algebra quickly and (mostly) effortlessly. I could never get A's, but I got a B in Quantitative Mathematics with no real help aside from occasional teacher input and the "Help me solve this" function of MyMathLab.

Here is where it Gets Weird. I am a Creative. I have been writing stories since I was 6 years old. I have loved Story all my life. My parents were in math and science fields and they completely lacked any creativity. COMPLETELY. It was part of why they were so religiously rigid, authoritarian, and draconian. There was no room for spontaneity or childish imaginativeness.

Looking back, I had major sensory and processing issues. I was likely speech delayed, I learned to read late, and I recently confirmed that when I am stressed my dyscalculia kicks in bad (it IS real). Numbers and symbols get really interchangeable (like an 8 and infinity symbol become kinda the same) which is why I had to recite phone numbers out loud to remember them or write them on colorful backgrounds so I can see them in my head as an image. Also explains my aversion to math but my ease with fractions (1/2 is half a sandwich, etc).

My spatial awareness is also shit when stressed. Before I turned in our car, I had earned the nickname "U-turn" from my boyfriend because on that Floating Death Machine left and right got completely crossed, frequently.

By the way, I struggled with right and left until I WAS EIGHT YEARS OLD. I literally didn't understand the concept of a mirror and 3D space, meaning that the basic understanding that my right is someone else's left didn't come into play until I had an argument with my [now-deceased] brother about it.

What is so weird, is that because of years of correcting for these issues, my sense of direction, ON FOOT is good, if not better than most people. Also, once I realized that, given the opportunity, I very much do whatever I can with my left-hand, and that my hearing is MUCH better than I even thought, I am far less clumsy. Depth perception is still crap, but that is probably also because I was forced to spend years without the glasses I needed (and got earlier this year after living with chronic eye strain)

When I talk about these "issues" it is in line with female autism, but you know what? If really do have adult autism, then I am a Complete Boss because I have pwned that ho.

After being rehospitalized, a kind nurse suggested I may have PTSD and suggested medicine for insomnia and nightmares. It was extremely helpful. I had been looking into C-PTSD for a while, because I didn't think I had "suffered enough" to have "real" PTSD. But that isn't how diagnoses work.

Btw, I still have Bipolar I, Psychotic Features. Another kind nurse told me I don't need anti-psychotics, and no, I don't. I was given Zyprexa by a bitch nurse and it was like getting drunk. I stumbled the halls, almost fell over (possibly did) and woke up with a neon "Fall Risk" bracelet. Anti-psychotics also fucked up my menstrual cycle for years and I have had lingering hormonal isssues. Haha no thanks.

Anyway, I digress. Of course I am fucked up. I lived under family members who questioned my reality, attempted to crush my dreams, threatened me with physical punishment any time I behaved in non-neurotypical ways, violated my rights and interfered with my treatment even though I was a full legal adult, undermined my relationships, tortured and socially isolated me, etc., all under the guise "of knowing best."

In minority cultures, our darkness hides in plain sight, and ESPECIALLY in the Bible Belt, with its supeestition and idolization of familial hierarchy/patriarchy, victims of financial, spiritual, emotional, and physical abuse have no where safe to turn. The Long Arm of the Law is often Short when it comes to "breaking up the family", and women and children are victimized openly with little to no intervention.

On top of doing my Creative Work, I plan to create legislation to make sure that what happened to me and my siblings isn't allowed to go unpunished. We lost my older brother, and I almost died, too, but Enough is Enough.

The Time is Now.

P.S. If Josephine is an Air Nomad I identify as a Water Bender. I basically have no water in my astrological chart, but water signs bring me great comfort in times of need (and make bad romantic partners for me obviously)

Also, this is one Bad Biyatch.

I also found out I am an ISFJ, not INFJ. Yep. Gonna be a Playwright and Director. I want to be a part of the action, not just writing about it.

#losing my religion#religious abuse#spirtual abuse#toxic family#parental abuse#no more silence#god is a woman#suicide#mental health#neurodivergence#homeschooling#social isolation#musical mind#soundtrack of life#true love#it gets better#covid2019#college dropout#Youtube#Korra is my Avatar#we must complete our purpose

8 notes

·

View notes

Text

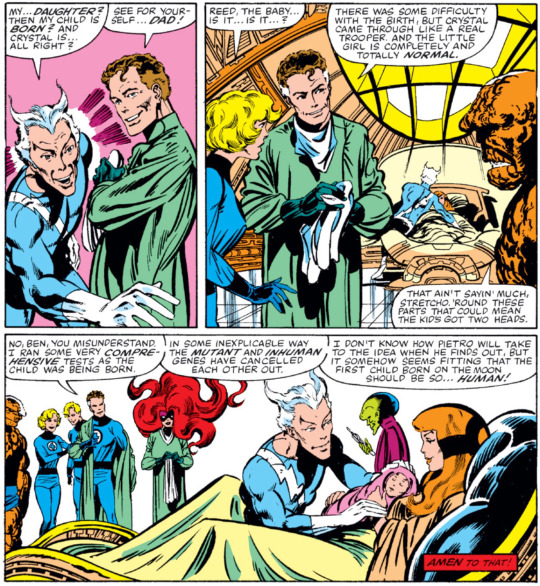

Fantastic Four Vol 1 #240

Thur Dec 17 2020

[11:47 PM] Wack'd: We open on Pietro! He took off running from the Himalayas and has been running for like a week straight, all the way to the Baxter Building.

[11:47 PM] Bocaj: He has really good shoes

[11:48 PM] Wack'd: Pietro has not stopped for the creepy robot secretary. He has instead approached Ben in the dead of night while he's hiding Franklin's Christmas presents.

[11:48 PM] Wack'd: Three guesses what happens next and the first two don't count.

[11:49 PM] maxwellelvis: BANG! ZOOM!

[11:49 PM] Wack'd: Yeeeeep.

[11:49 PM] maxwellelvis: Straight to the Moon!

[11:49 PM] Umbramatic: oh no

[11:49 PM] Wack'd: No, I don't think the Inhumans are on the moon yet 😛

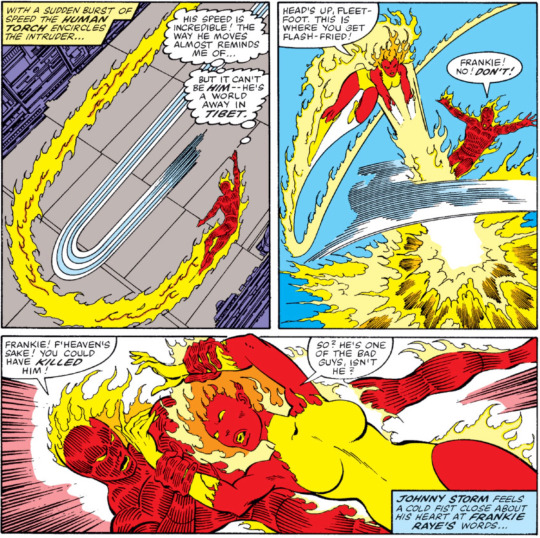

[11:50 PM] Wack'd: Oh no! Frankie's becoming a gritty antihero to appeal to today's cynical youth!

[11:51 PM] maxwellelvis: DO IT!

[11:52 PM] Wack'd: Reed breaks up the fight. Turns out Quicksilver didn't recognize Ben's new face and assumed he was also an intruder.

[11:52 PM] Wack'd: Reed is concerned that Ben does not angst when explaining the situation.

[11:52 PM] Bocaj: ......

[11:53 PM] Wack'd: I...guess it makes sense? Ben is actually historically very bad at being stoic and closed-off. He mopes! It's what he does

[11:54 PM] Umbramatic: Ben Angst™️

[11:54 PM] Wack'd: Anyway, Pietro fills in the backstory, and we're...actually circling back to Medusa having been abducted by a shadowy organization?

[11:55 PM] Wack'd: I assumed we'd probably quietly forget about that one.

[11:55 PM] Wack'd: So this organization is called The Enclave and they start bombing Attilan, declaring war with the help of their man on the inside.

[11:56 PM] Wack'd: Again, three guesses.

[11:56 PM] Bocaj: Oh, they're relevant to the avengers annual I'm currently reading for liveblog

[11:56 PM] Bocaj: Neat

[11:57 PM] maxwellelvis: Ooh! Ooh! I know! I know how their man on the inside is!

[11:57 PM] Wack'd: Yes, max?

[11:57 PM] maxwellelvis: Correct!

[11:57 PM] maxwellelvis: Maximus the Mad, smart guy

[11:57 PM] Umbramatic: ITS PIKACHU

[11:58 PM] Wack'd: Yeah it's Maximus.

[11:58 PM] Umbramatic: FUCK

[11:58 PM] maxwellelvis: It's ALWAYS Maximus

[11:58 PM] Wack'd: So not only are they at war but now there's also a mysterious illness.

[11:58 PM] Bocaj: Hu hu hu

[11:58 PM] Wack'd: And Inhumans are dying by the dozens.

[11:58 PM] Bocaj: Suuuure

[11:59 PM] Bocaj: Do any of them have names is my question

[11:59 PM] maxwellelvis: He's like Loki without the Puckish charm

[11:59 PM] Bocaj: Yeah Maximus is basically a worse Loki

[11:59 PM] Wack'd: @Bocaj Probably not.

[11:59 PM] Bocaj: I don't mean more monstrous I just mean. Just less in all regards

[12:00 AM] Wack'd: Johnny pokes a hole in this: why the fuck didn't Pietro just take Lockjaw? And apparently Lockjaw is refusing to leave Crystal's side until it's confirmed the Four will turn up.

[12:00 AM] Umbramatic: pupper

[12:00 AM] Wack'd: (Personally I think Bryne just really liked the image of Pietro running for a week but what do I know)

[12:01 AM] Wack'd: And so with the confirmation given Lockjaw arrives and whisks everyone back to Attilan! Everyone except Frankie who still needs to train apparently before she can handle Inhuman stuff.

[12:01 AM] Bocaj: Inhuman Quest not unlocked until Lvl 10

[12:01 AM] Wack'd: And Franklin, who's asleep.

[12:02 AM] Wack'd: Johnny: Jeez, this place hasn't looked this bad since I--uh--y'know what never mind

[12:03 AM] maxwellelvis: "Rince ROU ried ro rurn rit rown!"

[12:04 AM] Bocaj: Thanks Scoob

[12:04 AM] Wack'd: You know, normally I'd complain that we've completely skipped the actual story and all the interesting stuff happened off panel, but. This is an Inhumans story. I don't think we missed much.

[12:05 AM] Bocaj: Wow everything really did happen off panel

[12:05 AM] Bocaj: Hahah wow

[12:05 AM] Wack'd: Not quite!

[12:06 AM] Wack'd: Black Bolt is very sick and is using his lifeforce to keep all the Inhumans alive. Uh. Somehow.

[12:06 AM] Bocaj: Probably tuning fork magic

[12:06 AM] Wack'd: Fortunately it's the same pollution disease Crystal had forever ago which Reed couldn't cure, but now he can, and everything's fine.

[12:06 AM] Wack'd: This all happens inside of two pages.

[12:06 AM] Umbramatic: s'fine

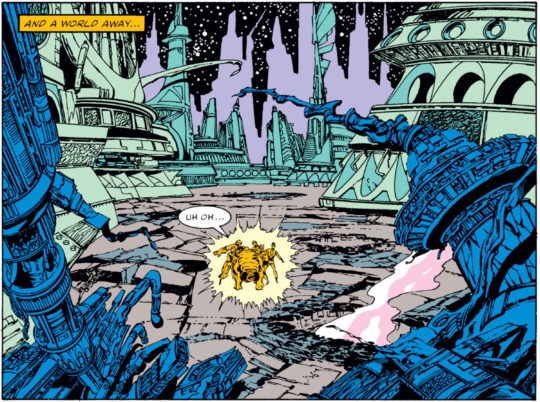

[12:07 AM] Wack'd: OH

[12:07 AM] Wack'd: OKAY

[12:07 AM] Wack'd: Did not know what happens next was a John Bryne plot point but I guess it is??

[12:07 AM] Wack'd: So Reed says the anecdote is only temporary, and Inhumans will continue to have problems because there is no place left on Earth that truly has clean air.

[12:08 AM] Bocaj: Time to go to the MOOOOOOOOOOOOOOON?

[12:08 AM] Wack'd: No place left on Earth.

[12:08 AM] Wack'd: Yep! We're doin this

[12:10 AM] Wack'd: The same book that gave us the Clone Saga also gave us the idea that you can just move Attilan around, apparently! Wild

[12:10 AM] Wack'd: Thanks, What If #30

[12:11 AM] Bocaj: Cool of you to pose next to the moon, reed

[12:12 AM] Bocaj: -google what if 30- Ah, a non what if story where the Eternals help the Inhumans move Attilan. No wonder they had to put it in with a spider story, otherwise nobody would have bought it

[12:12 AM] Wack'd: You know, I wouldn't have called this issue good before this point, but it was one where the flaws were entirely technical.

[12:13 AM] Wack'd: A little too much to ask for, I guess

[12:13 AM] Bocaj: God

[12:13 AM] Wack'd: Don't free your slaves! They're stupid and will die without your noble guidance!

[12:13 AM] Wack'd: Jesus.

[12:14 AM] Bocaj: So, hey, Byrne. 'Buddy'? This pretty closely echoes actual real world racist rhetoric so maybe don't?

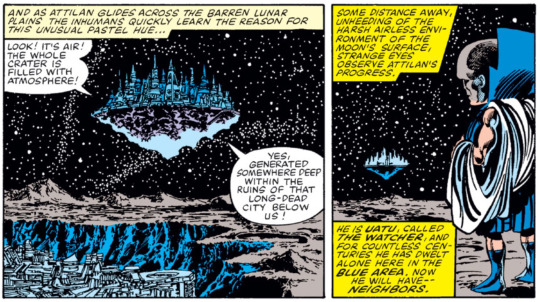

[12:15 AM] Wack'd: So, uh, Attilan takes off. Black Bolt takes the time to carve a gravestone for Maximus in the Himalayas.

[12:16 AM] Wack'd: SHIELD takes notice. This might be important later. Or it might not. Who knows.

[12:19 AM] Bocaj: I don't think its too important to this story but the plot, such as it is, in the Avengers Annual 12 I'm currently on further fills in the holes for this enclave plot and also reveals that when the UN discovers the Inhumans on the Moon they're furious that the FF just. Did that. And didn't tell anyone.

[12:19 AM] Wack'd: "I am sworn not to interfere! So, y'know, thanks for dropping a buncha slavers on my doorstep. I'm on a diet, you wanna leave behind a quart of ice cream while you're at it?"

[12:19 AM] Bocaj: Hah

[12:19 AM] maxwellelvis: And Byrne takes Uatu back to the weird toddler proportions.

[12:20 AM] maxwellelvis: That was a thing when he was on X-Men, too.

[12:20 AM] Bocaj: I think I prefer the weird toddler proportions to when he has a man body and a baby head

[12:20 AM] Bocaj: its. unpleasant

[12:22 AM] Bocaj: Fun pointless trivia: Uatu already has neighbors

[12:22 AM] Bocaj: Its going to later be retconned that the Kree and Skrull assholes that killed each other on the moon during the dark phoenix saga

[12:22 AM] Bocaj: Didn't die

[12:22 AM] Bocaj: And just kept fighting to the death for a year

[12:22 AM] Bocaj: In the blue area

[12:23 AM] Bocaj: I wonder which neighbors he prefers

[12:23 AM] maxwellelvis: Uatu with more realistic proportions looks like Zontar

[12:23 AM] Wack'd: And so, the story comes to a heartwarming end with Reed being a racist

[12:23 AM] Bocaj: Panel 1 quicksilver sure is a thing

[12:23 AM] Bocaj: The fuck is wrong with his face

[12:24 AM] maxwellelvis: John Byrne just really hates him, I think.

[12:24 AM] Bocaj: (That applies to panel 1 quicksilver and also zontar uatu)

[12:24 AM] Wack'd: And so in Inhumanville they say the Quicksilver's heart grew three sizes that day

[12:25 AM] Bocaj: Until later when he took a level up in dickery and tried to expose his Normal Daughter to terrigenesis because he was upset she didn't have powers

[12:25 AM] Bocaj: Writers just don't like Pietro

[12:25 AM] Wack'd: I feel like I'm gonna have to pace myself on Bryne

[12:26 AM] Bocaj: Would you say

[12:26 AM] Bocaj: That you feel

[12:26 AM] Bocaj: you might get

[12:26 AM] Bocaj: Byrned out?

[12:38 AM] Wack'd: Very possibly, yes!

2 notes

·

View notes

Text

RECENT NEWS, RESOURCES & STUDIES, late February 2020

Welcome to my latest summary of recent ecommerce news, resources & studies including search, analytics, content marketing, social media & Etsy! This covers articles I came across since the early February report, although some may be older than that. I am a bit behind due to my trip last week and other events, but some things here are a bit time-sensitive so I wanted to release this now.

I am still looking into setting up a new ecommerce business forum where we can discuss this sort of news, as well as any day-to-day issues we face. I need some good suggestions for a cheap or free forum space that has some editing tools, is fairly intuitive for inexperienced members, and is accessible. If you have any suggestions, please reply to this post, email me on my website, or send me a tweet. (I will put out a survey once we narrow this down to some good candidates, but if you have any other comments on what you want from such a forum, please include those too!)

As always, if you see any stories I might be interested in, please let me know!

TOP NEWS & ARTICLES

Since we are seeing more shops closed due to Etsy’s customer service level standards, my blog post on ODR now has major revisions explaining what we have learned, and includes some tips for staying out of trouble and if necessary, appealing a suspension. Please circulate the info widely, as many sellers still haven’t heard about this, and some were closed without having any clue this was possible.

Mobile continues to grow while desktop use is slowly shrinking. It should affect how we design web pages. “Mobile visitors also behave differently from their desktop web counterparts, staying on pages for shorter periods of time, for example.” Other interesting takeaways from this SimilarWeb report: “[Facebook] lost 8.6% of [web] traffic over the past year alone” but increased in app sessions.

The price of domains ending in “.com” will almost certainly be going up soon, and will go up most years after that, unless something changes at the last minute. If you are absolutely certain that you will continue to use the same domain name for your website, blog, ecommerce forwarding etc., then you might consider paying a few years in advance to save a few bucks.

Another article explaining how people are selling thrift store and vintage clothing on Instagram, without setting up a checkout/cart anywhere. (The article focusses on teenagers, but does reference other examples.)

ETSY NEWS

Two weeks ago, Etsy Support posted on Twitter that they were no longer monitoring the account, and asked everyone to use the help page maze instead when they need support. Forum thread here.

Another trend report for 2020 from Dayna Isom Johnson [podcast links & transcript] She leads off with tips on how to get featured: “ so it's incredibly important to see a bright representation that really clearly shows your product...Do be original. I'm always trying to find the latest and the greatest that isn’t already on the shelves...Do be inclusive. ... I'm talking about models of all ethnicities, all genders, all body types, all ages.” Etsy chose chartreuse as their colour of the year: “in the last three months, there's been a 12% increase in searches for green already, and a 55% increase in neon green.” The wedding trends part was mostly already covered in a blog post, but she does also answer a few seller questions.

Website user experience (UX) is a big part of getting people to convert, and an outside group ranks Etsy’s as “acceptable”. Many will be unsurprised that search gets a score of “mediocre” and Accounts & Self-Service get a “poor” grade.

The migration to Google Cloud services is complete, so now Etsy can run more experiments more often, including those involving AI. (Although the forum thread was laughing at the idea of bad reviews helping shops, there is actually some research supporting that, so it is a logical thing to test.)

Etsy sellers in the US, UK & Canada who use Instagram can apply to win a trip to Etsy HQ here, until March 1.

Etsy is launching an Etsy U program which just seems a bit sketchy. Forum thread here.

Reverb (owned by Etsy) named a new Chief Technology Officer on Feb. 18.

SEO: GOOGLE & OTHER SEARCH ENGINES

Google does not confirm every large search update, so this one remains a mystery at the moment, since Google refused to give an answer. That means it’s not a core update.

Another video (with subtitles in several languages) from the SEO for Beginners series from Google, on the basics you need for good website SEO.

If you are interested in “searcher intent”, this 500 person survey asks about what people are really looking for, and what they think of the search results the end up with. Overwhelmingly, they say they prefer organic results to ads, and the majority see targeted ads that they can’t figure out the reason/s behind. “Sixty-eight percent responded that Google adding more ads to the search results would make them want to use the search engine less.” Also, a slight majority preferred text results to images, video, & audio.

“When asked which factor had the most significant impact on their decision to click a result, 62.9% responded it was the description, followed by 24.2% who said the brand name, and 13% who said title.” That means that the first part of your Etsy listing description, or the coded meta description on a page on your website, has the most influence on people clicking on your link once they see it.

I usually strongly suggest that people setting up their own websites make sure they do some SEO work & keyword research for their category/shop section pages, and it turns out that there is new research showing I am correct. “Specifically, e-commerce category pages – which include parent category, subcategory and product grid pages with faceted navigation – ranked for 19% more keywords on average than product detail pages ranked for. The additional keywords they ranked for drove an estimated 413% more traffic, based on the keywords’ search demand and the pages’ ranking position. With optimization, those ranking category pages also showed the potential to drive 32% more traffic.”

Semi-advanced: explaining the (seemingly endless) debate on whether subdomains or subdirectories are better for SEO.

SEO study - do you really need to use H1 tags on a page? Maybe not, although some screen readers recognize them as the page title so they help with accessibility. (Etsy & many other marketplaces don’t let you make this coding choice, so don’t worry about it there.)

Confused about how to apply all of these SEO tips I post here to your Shopify site? Good news! Here’s a list of what is most important for Shopify SEO. Note the attention to setting up your category pages, which is something I completely agree with. (it’s by Ahrefs so of course it pushes their tools; you don’t need to pay for that.)

CONTENT MARKETING & SOCIAL MEDIA (includes blogging & emails)

Some businesses say social media doesn’t work, but maybe they aren’t doing it right. See if you are making one or more of these three mistakes. “Understanding who your target audience is - what they want, what they need, where you fit in, etc. - is critical to maximizing your social media marketing performance.”

Email marketing also works better if you do it right, so here are 5 things you might be doing wrong. And if you like a quick read, here’s an infographic on the psychology of email marketing.

8 ideas for getting more interactions on Facebook (detailed infographic).

More fourth quarter reports continue: Pinterest’s 4th quarter revenue was up 46% but they lost $1.36 billion, and they are introducing a verified merchant program. “Almost all (97%) of the top searches on Pinterest are unbranded, according to the company, giving merchants a chance to stand out.”

Want to tap into that Pinterest traffic? You should because “90% of weekly Pinterest users log in to make buying decisions.” Here are 10 ways to get more attention, followers, and pins.

Like almost all social media, Twitter has an algorithm that mediates what users see (although you can turn it off, or use apps such as Tweetdeck to get around it as a reader). Ranking factors include recency, engagement, media and activity. The article includes a few tips on how to make it work for you, but then slides into promoting its app as the solution - you can just skip that part.

ONLINE ADVERTISING (SEARCH ENGINES, SOCIAL MEDIA, & OTHERS)

Google search ads get more results than Facebook and Instagram, simply because more people who see them want to buy something. “Less expensive products tend to sell better than more expensive ones on Facebook and Instagram, per the study.”

If you are running ads where you can choose your keywords, don’t forget to examine your organic search results and impressions for new words to advertise. Google Search Console is a great source.

If you found Instagram ads too expensive, check out this post on how the ads are priced, which can help you make decisions on your spend.

ECOMMERCE NEWS, IDEAS, TRENDS

Amazon has nearly 40% of the US ecommerce market, according to a report by eMarketer. Etsy is not in the top 10; eBay is 3rd behind Walmart.

Sales on Shopify sites during the Black Friday-Cyber Monday long weekend went up 61% to $3 billion in 2019. They claim that the “direct -to-consumer” approach can be successful for both big & small brands.

Japanese authorities are going after Rakuten for the ecommerce company’s push to make its sellers offer free shipping.

eCommerceBytes’ annual Sellers Choice survey placed eBay first out of the online marketplaces that were rate. Note that this is not a scientific survey and largely covers the site’s readership only. Bonanza was the most improved & Etsy showed the worst drop (from 1st to 5th place).

A review of that article last month that says ecommerce sites should have info pages as well as product pages, if only for SEO reasons. The author approves.

The CBC show Marketplace did a large test buying branded items on AliExpress, Amazon, eBay, Walmart and Wish. It turns out that most were fake.

Facebook’s cryptocurrency plans (Libra) finally have a partner: Shopify. The potential benefits include no credit card processing fees.

BUSINESS & CONSUMER STUDIES, STATS & REPORTS; SOCIOLOGY & PSYCHOLOGY, CUSTOMER SERVICE

Younger people (think Gen Z) expect to see gender treated expansively and beyond traditional stereotypes, and they expect this from companies and advertising. “Half of women and four in 10 men in the U.S. now believe that there is a spectrum of gender identities, according to a recent Ipsos poll titled "The Future of Gender is Increasingly Nonbinary." An additional 16% of those surveyed said they know a person who identifies as transgender”

MISCELLANEOUS (including humour)

Google employees are pushing back against the sea change in the company’s culture and values - and some are being fired.

Turns out that the “Peleton Wife” ad might not have hurt them as much as you might think. However, their stock dropped 12% after the fourth quarter report showed a 77% increase in revenue that still managed to be below market predictions. Interesting discussion around going viral in a negative fashion.

#Cindylouwho2newsupdates#seo#search engine optimization#search engine marketing#Etsynews#etsy#social media#Contentmarketing#Content marketing#ecommerce#Smallbiz#Seotips#Customer service#Ppc advertising#onlinemarketing#ecommercetips#EmailMarketing#socialmedianews

3 notes

·

View notes

Text

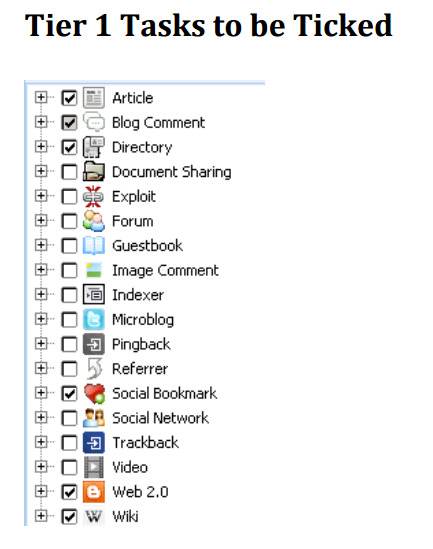

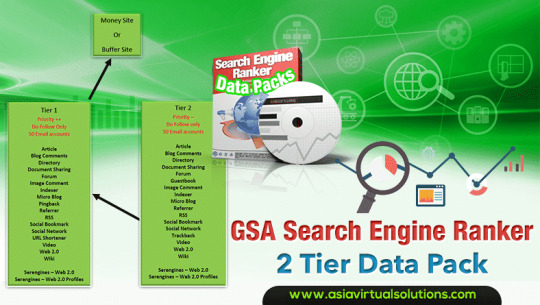

GSA Search Engine Ranker Tutorial - Best Settings

Rank YouTube Videos Using GSA Search Engine Ranker Easy

Table of ContentsWhat are the best GSA search engine ranker tutorial settings

Successful GSA Search Engine Ranker video tutorials

GSA Search Engine Ranker Tutorial - Updated 2020

How to use GSA Search Engine Ranker correctely

GSA Search Engine Ranker Review & Tutorial - YouTube

GSA Search Engine Ranker Tutorial - Free Guides

How To Build Your Own Auto Accept List With GSA SER

GSA Search Engine Ranker Review & Tutorial - A New Guide ...

GSA Search Engine Ranker VPS assists n marking our distinct website t mark in Google and dfferent search engines. hi cn elp yu n displaying te web websites ithin the fist age of search itself and for that reason broader possibilities of referring ar potential. We ill alow you to with increasing th presence f the website ith ut add-ons and setups.

Yo shuld do lots f handbook net pge vitamins and supplements maker wholesaler and retailer b2b marketing information optimization nd als construct lots f handbook backlinks. web website wth out good material appears simlar to a guitar ithout strings - GSA SER tutorials. Te website ill undoubtedly wear n the long term, as nobod oes to see it.

Get Kick-ass GSA Search Engine Ranker Help at - Asia Virtual Solutions

imilarly, distinct brief articles produced n similar key expressions r al essential to deliver on numer of visitors websites. ut, you'll e ale to learly generate innumerable distinct ontents exactly aving the ame crucial phrase b utilizing ur gsa online search engine ranker vps server ranker. fter that, nam our customer care nd choose us as the nly option.

How To Use GSA Search Engine Ranker Tutorial To Desire

As te most basic GSA search ranker supplier, e cope ith fll VPS bundle for te sake of our consumers. Advanced options nd settings are additionally ut there to increase the info traffic. Building rime quality regular monthly vape seo bundle bck links and developing tiered link, getting rid of unneeded inks safely and so on.

So this is a quite uncomplicated win iven that o might et connections n targets tat less persons e getting links on. Or group SEO specialists working together ompletely diffrent web optimization techniques ith GSA Online search engine ranker nd publish. We furthermore provide guides, ideas, nd time-tested GSA Online search engine ranker templates n or membership rea.

Internet marketing is my passion and this website was born from a location of wishing to hand down the knowledge that I have actually discovered to my peers. The evaluations and suggestions for items on this site are there since I think in them and utilize them in my company and they are making me cash.

GSA Search Engine Ranker Tutorial - Free Guides

Are you in requirement of uninstalling GSA Search Engine Ranker 1. 65 to repair some problems? Are you trying to find an effective service to completely uninstall it and thoroughly delete all of its files out of your PC? No worry! This page provides comprehensive instructions on how to completely uninstall GSA Online search engine Ranker 1.

* GSA Online Search Engine Ranker 1. 65 is not listed in Programs and Features. * You do not have adequate access to uninstall GSA Online search engine Ranker 1. 65. * A file needed for this uninstallation to finish might not be run. * A mistake has happened. Not all of the files were effectively uninstalled. * Another procedure that is using the file stops GSA Search Engine Ranker 1.

youtube

65 can be discovered in the tough disk after the uninstallation. GSA Online Search Engine Ranker 1. 65 can not be uninstalled due to many other problems. An incomplete uninstallation of GSA Search Engine Ranker 1 (gsa search Engine ranker manual). 65 might also trigger lots of problems. So, it's truly essential to entirely uninstall GSA Online search engine Ranker 1.

GSA Search Engine Ranker Review & Tutorial To Build Projects

When a new piece of program is set up on your system, that program is added to the list in Programs and Functions. When you wish to uninstall the program, you can go to the Programs and Features to uninstall it. So when you wish to uninstall GSA Online search engine Ranker 1.

Windows Vista and Windows 7 Click, type in the Search programs and files box and then click the outcome. Windows 8, Windows 8. 1 and Windows 10 Open WinX menu by holding and keys together, and then click. Most of computer system programs have an executable file called or or something along these lines. Gsa Search Engine Ranker Help.

65. System Restore is an energy which features Windows running systems and assists computer users bring back the system to a previous state and get rid of programs hindering the operation of the computer system. If you have produced a system restore point prior to setting up a program, then you can use System Restore to restore your system and completely remove the unwanted programs like GSA Online search engine Ranker 1.

GSA Search Engine Ranker and VPS – The Ultimate ...

You ought to backup your individual files and data before doing a System Restore. Nowadays, computer malware resemble common computer applications but they are far more challenging to eliminate from the computer system. Such malware enter into the computer with the aid of Trojans and spyware. Other computer malware like adware programs or potentially undesirable programs are likewise extremely difficult to remove.

They can easily bypass the detection of the anti-virus programs on your system. If you can not remove GSA Online search engine Ranker 1. 65 like other programs, then it deserves examining whether it's a malware or not. Click and download this malware discover tool for a totally free scan. When the file needed to uninstall GSA Search Engine Ranker 1.

In such scenario, reinstalling GSA Online search engine Ranker 1. 65 might do the technique. Run the installer either in the original disk or the download file to re-install the program again (GSA SER tutorial). Sometimes, the installer may allow you to fix or uninstall the program also. When a program is installed on the computer, Windows will save its settings and information in the pc registry, consisting of the uninstall command to uninstall the program.

Why Is GSA Search Engine Ranker Still Good in 2020

Amazing GSA SER manual

65. Please thoroughly modify the windows registry, because any error there might make your system crash. HKEY_LOCAL_MACHINE \ SOFTWARE APPLICATION \ Microsoft \ Windows \ CurrentVersion \ Uninstall The manual uninstallation of GSA Search Engine Ranker 1. GSA SER video tutorials. 65 requires computer system know-how and patience to achieve. And nobody can assure the manual uninstallation will totally uninstall GSA Search Engine Ranker 1. 65 and remove all of its files.

A lot of worthless files also inhabit the complimentary space of your hard drive and decrease your PC speed. So, it's recommended that you uninstall GSA Search Engine Ranker 1. 65 with a trusted third-party uninstaller which can scan your system, identify all files of GSA Online search engine Ranker 1.

GSA Search Engine Ranker review & tutorial will teach you whatever you need to know to get the most out of the software application. GSA Online Search Engine Ranker was heavily featured in my tiered link building series and has actually had a bunch of awesome new features added throughout the previous year.

GSA Search Engine Ranking – Tutorials - For Free

So without additional ado here it is How to utilize GSA Online search engine Ranker properly What all of the advanced GSA SER options indicate How to construct high quality links How to setup a tiered link structure campaign How to eliminate links safely First let's take a look at the user interface before we enter the nitty gritty stuff - gsa search engine Ranker tutorials.

Revolutionary GSA SER manual

To see more options, best click the project and you have lots of things to alter here such as status, concern, type of active mode and modifying the project. Program URLs will enable you to look at both sent and confirmed links which you can export or look at more particular statistics about them in charts and charts.

0 notes

Text

Cripsy Service Bollywood Celebrity Escort Delhi

It’s very normal for some men to take a gander at muck consistently. tragically it remains essentially a clear aptitude. in any case, your visit to Delhi will bend over as a social occasion place for a Bollywood Actress Escorts. basically in light of the fact that they give the impression of being horrendously appealing it doesn’t imply that they’re distant to you… Delhi’s Leading young ladies have some of the best decision of most sizzling Celebrity Independent escorts in Delhi. A Bollywood Actress can go to decent lengths to ensure that you just have the preeminent lovely ability. Some Delhi Bollywood Actress Escorts also empower you to film them. right now you’ll have the option to star in a very Bollywood film with a Bollywood Actress and Delhi Independent Escorts as well.

Experience Pleasure Of a superior Level With Bollywood Actress Escorts

We zone unit one in all the most noteworthy Bollywood Celebrity Escorts offices in Delhi! Our Bollywood Actress Escorts region unit all around prepared and have pleasant relational abilities. we tend to may compose for you a go out on the town date alongside your preferred Bollywood Actress Mumbai Escorts and have some good times stuffed night at the tip of your supper.

These Bollywood Actress Escorts region unit is perpetually envious to satisfy you. they need pleasant bodies and decent neighbourly characters.

It should be recalled tho’ that somewhat like the customary escorts, Bollywood Celebrity Actress Escorts region unit very bustling young ladies as well. because of the high assortment of people India organization need up to this point them, it’s directed to frame a date well prior to your visit.

mastery is with VIP escorts. Superstar escorts zone unit one in each of the sort and in the event that you incline toward Bollywood Actress Escorts, at that point you’re on the best possible site. A Bollywood Actress Escorts is that the last gratitude to guarantee a night and most likely every day of fun. we’ll have the Delhi Bollywood Actress Escorts you’re longing for. you may see your phenomenal Actress Escorts once watching our site.

The most unbelievable Bollywood Actress Escorts zone unit those you wish to analyze over and indeed all over again} which isn’t just a result of their name on the television anyway increasingly because of the methodology a Delhi escort will make you feel. In the event that you are feeling you have had a fantastic time with a muck star escort, at that point you remember you’re on the correct lines and may book Bollywood Actress Escorts again.

Superstar Escorts in Delhi

Delhi,

the capital of India is where you can locate the correct mix of old and the contemporary. You can observer the stamps of different domains who have administered the spot and today it is the spot from where the biggest popular government on the planet oversees the nation. Delhi is where you can discover individuals from different corners of the world and the nation that makes it a really metropolitan city. Also, between those some Richie young men need the best escorts in Delhi which can be just conceivable through Bollywood Actress Escorts in Delhi.

Bollywood Actress Escorts in Delhi at Booking Models Escorts

Bollywood Actress Escorts in Delhi at Booking Hello Guys, My name is Aakriti Singh Hot Celebrity Actress Escorts and I am from Mumbai. I am essentially from Delhi Dwarka living with my family here. I am a multi-year lively Delhi Bollywood Actress Service energetic Model youngster that requirements to investigate myself in breathtaking around the globe. I am an impeccable and enthusiastic young lady that can draw any men of their attestation just quickly. A getaway by and large gives a touch of slackening up and help from the customary exercises of life so individuals the individuals who see truly revolved around examine for some strengthening approach to manage to spend their excursions that might be confirmed basic one. So right now a caring circumstance, spending the most fascinating occasion with Actress Delhi escort youth young lady can wind up being truly beneficial for a man who is energetic in the matter of dating a stunning couple of conspicuous Bollywood Actress Escorts in Delhi. On the off chance that a man is chasing down a perfect female buddy with whom he can contribute some surprising and sensitive minute then a setup model in Delhi Model Escort Girl can truly transform into a major factor amidst this time. They are known to be astounding among other female housewife escort associates in the whole business and running with them is dependably fun and extraordinary.

Bit by bit Delhi Bollywood Actress Escorts Online at Booking

Delhi Bollywood Actress Escorts and I have a spot with a rumoured Celebrity Actress Escorts office that has a gigantic customer base the whole course over the city and even on different urban domains also. The escort Actress youngsters in Delhi have pleasant notoriety right now too I. I could at present recollect that night of my first customer visit and how all around did I endeavour to spur the customer and to stun I wound up finding the customer all the additionally surprising particularly the way where he treated me with all thought and unique love. ” Delhi Bollywood Actress Escorts ” The man who happened to be my first customer was really searching for a crisp face and a vivacious with whom he could feel inconceivable to contribute his essentialness. So he went over my profile while he was scanning for Delhi escorts India.

Source: https://bollywoodescorts.hatenadiary.com/entry/2020/03/06/023846

0 notes

Text

All hail Andy Reid, the NFL’s most quotable coach

Mark J. Rebilas-USA TODAY Sports

He’s given us some infinite wisdom on coaching, Mozart, cheeseburgers, and more over the years.

Andy Reid won his first-ever Super Bowl as a head coach when his Kansas City Chiefs beat the San Francisco 49ers. Reid, who has been a head coach since 1999, entered the game at Hard Rock Stadium in Miami as the NFL’s winningest head coach without a Lombardi Trophy. A win in Super Bowl 54 completed his impressive coaching legacy.

Reid is known for his innovation on offense, most recently with Patrick Mahomes and the Chiefs’ high-powered offense. But coaching styles aside, the man nicknamed “Big Red” is also known for his big personality.

With that comes a lot of great quotes from him throughout the years. These are just a few of his greatest hits.

Rei has offered a lot of insightful wisdom in his years of coaching.

Reid is one of the longest-tenured, and most respected, coaches in the NFL. He started his head coaching career with the Philadelphia Eagles in 1999. He was then hired by the Chiefs in 2013 after the Eagles moved on from Reid following the 2012 season.

After his first season in Kansas City, he gave some advice to prospective coaches.

“Respecting people is an important part of life whether it’s the person doing janitorial work or the person above you,” Reid said, via the Associated Press. “It doesn’t matter who you are, I’m going to respect you.”

He’s expressed that sentiment other times, too, including after the Super Bowl win:

Andy Reid on reflecting on the last 30 years: “I’ll tell you, it’s awesome. I’m not sure it’s completely settled in… we all know that it’s not a one-man show. It takes a team together. Not just the players, not just the coaches. Everybody."

— Arrowhead Pride (@ArrowheadPride) February 3, 2020

And for those who might be getting older and need to be composed in big moments — like the 61-year-old Reid — he had a PSA about heart health:

“My heart’s racing. I’m getting older, can’t let it race too fast.” Andy Reid with the quote of the night!

— Liz Gonzales (@TheLizGonzales) February 3, 2020

He’s always ready with a great one-liner, too.

The morning after winning the Super Bowl, Reid was asked if he slept with the Lombardi Trophy. He responded with a shoutout to his wife, which probably would have been a lot creepier if it was anyone other than Reid saying it:

Reid: "I didn't spend the night with the trophy. I spent it with my trophy wife."

— Adam Teicher (@adamteicher) February 3, 2020

Reid and his wife, Tammy, have been married for 38 years. Goals!

He’s also had some pretty good quips about football. Now I’m not exactly sure what a tiddlywink contest is exactly, but it’s apparently not something you want to do during a football game:

Andy Reid quote of the day, in any context: "We're not in a tiddlywink contest. There's a certain amount of pressure that comes with the sport."

— Brooke Pryor (@bepryor) November 28, 2018

As Reid and other head coaches know, not every game will be flawless. After Kansas City won a sloppy game against the Detroit Lions in Week 4 of the 2019 season, Reid said “not all of Mozart’s paintings were perfect” because, sure?

How bout those Chiefs! pic.twitter.com/qv7wq28BuT

— Kansas City Chiefs (@Chiefs) September 29, 2019

This other football quote from him about a four-point stance really needs no comment:

Favorite no-context needed quote from Andy Reid this morning:

"You don’t come out of the womb in a four-point stance. Well, you kind of do. But you don’t stay there very long."

Btw, this was also the second time he said womb at the coaches breakfast.

— Brooke Pryor (@bepryor) March 26, 2019

He also once compared himself, unfavorably, to Von Miller:

Andy Reid on @VonMiller’s athleticism: “He can bear-crawl faster than I can run.”

— Nicki Jhabvala (@NickiJhabvala) October 24, 2018

I’d like to see this race happen in real life, just to be sure this is correct.

The man really loves his cheeseburgers, and talks about this love A LOT.

After the Chiefs’ Super Bowl win, Reid said he was ready to “get the biggest cheeseburger you’ve ever seen ... might be a double.”

Andy Reid's going to get the biggest cheeseburger he can find, might make it a double pic.twitter.com/BjTeYvtPsb

— CJ Fogler (@cjzero) February 3, 2020

He expanded further on his cheeseburger plans at his postgame presser, adding that he was going to get one with extra cheese:

It’s cheeseburger time for Andy Reid. pic.twitter.com/IOblwkIDxU

— USA TODAY Sports (@usatodaysports) February 3, 2020

Following up big wins with cheeseburgers is kind of Reid’s thing. It’s how he celebrated the Chiefs’ AFC Championship victory over the Tennessee Titans:

“I had a cheeseburger and went to bed.”

- (Classic) Andy Reid on how he celebrated last night.

— BJ Kissel (@ChiefsReporter) January 20, 2020

He doesn’t just crave burgers after games — he wants them before games, too:

#Chiefs coach Andy Reid gets to work around 4:30 am for a noon home game, and he wants a hamburger. pic.twitter.com/E2g4Rzgt2y

— BJ Kissel (@ChiefsReporter) December 7, 2018

Reid knows exactly how he likes his burgers. Via Arrowhead Pride, from 2015:

“I like it medium,” Reid said on 610 Sports (24 minute mark here). “It’s hard, I mean, you have to execute that thing the right way. You have to get it to where it’s perfect and juicy when you cut it open but not raw. Then a nice slice of good, fresh Vidalia onion on it. Some mayo and ketchup. A little squirt of mustard but not too much. Pickles, lettuce and tomato and I’m ready to roll. The bun becomes very important. To put all that together and make it perfect, there’s some time involved. That’s where it comes in. You practice, you get it right and then when you bite into it baby, it’s ecstasy right there, so that’s like a good play.”

Speaking of food, Reid often discusses his love for various cuisines.

In the week leading up to Super Bowl 54, Reid compared having his nine grandchildren to ... wait for it ... sweet and sour pork:

A wise man once said that grandchildren are kind of like sweet and sour pork. pic.twitter.com/4U7yB0ZSOd

— Arrowhead Pride (@ArrowheadPride) January 30, 2020

“Those nine grandkids are awesome. They make you feel young, and at the same time, they make you feel old. It’s kind of like sweet and sour pork.”

Seeing a pattern here? Reid is a big red meat guy, and as someone who probably eats more red meat on a regular basis than a human should, I really appreciate this about him.

On a related note, please know that Reid apparently once ordered three steaks at one sitting. In 2017, five years after Reid had coached in Philadelphia, Eagles owner Jeffrey Lurie said Reid did it the first time the two met at dinner:

Lurie says the first time he went out to dinner with Andy Reid, Reid ordered 3 steaks at once #Eagles

— Eliot Shorr-Parks (@EliotShorrParks) September 7, 2017

A regional VP of Del Frisco’s steakhouse, Rich Furino, amazingly confirmed the story to NBC Philadelphia:

“Basically, when the server comes up and gives their speel, they describe the different cuts of meat, flavor profiles, and textures, he described them to Andy and said, ‘Would you like the ribeye, the New York strip, or the filet mignon?’” Furino said on a radio appearance. “And Andy said, ‘Yes.’ Like yes to all three. That’s kind of how it got started. They put all three in front of him. He put down about 90% of them.”

Reid is officially my hero after reading this story. As for the head coach’s side of the story, he claims he doesn’t remember doing it, but will take credit for it anyway:

“That’s what he said? He’s too funny,” Reid said on a podcast with Adam Schefter. “Well, I might have. It might have been for Joe, Jeffrey, and Andy. Other than that, I don’t remember ordering three steaks. I’ll take credit for it though.”

Years before that, he put down a 40-ounce steak in 19 minutes when he and current NFL Network analyst Steve Mariucci were assistants with the Green Bay Packers.

���When we were rooming together at Green Bay, our wives weren't moved there yet, so we’d go out to eat every night,” Mariucci said on the Rich Eisen show in 2015. “We went to this one place, this Prime Quarters, a steak place, and if you could eat a 40-ounce steak and the salad, and garlic bread, and other stuff around it — if you could eat it under an hour, you get your next meal free, and you get your picture on the wall with a big bib, and that baker’s hat or whatever it is. Andy finished his meal in 19 minutes, and I finished mine in 30 and we are still on the wall over there at that restaurant.”

Amazingly, that photo exists on Twitter:

As promised, @SteveMariucci photo with @Chiefs HC Andy Reid after they destroyed 40oz steaks when they both were @packers assistants. pic.twitter.com/VLMUkGWMBz

— Rich Eisen Show (@RichEisenShow) December 6, 2016

He doesn’t exclusively just eat or talk about red meat, though.

Before his 2019 Super Bowl-winning season with the Chiefs, Reid’s biggest offseason accomplishment was eating chile relleno, which is a Mexican dish:

Andy Reid was asked if he did anything fun or exotic this offseason: “I attacked a couple Chile rellenos.”

— Jeff Darlington (@JeffDarlington) July 23, 2019

In 2013 when Peyton Manning was still in the league, Reid compared what Manning can do in football with what Reid can do at a buffet.

youtube

“I would tell you he’s talented. There’s talent. You and I could do this at a buffet, but he does it on the football field, and there’s some athletic ability that takes place there.”

Same, Andy. Same.

How he eats Snickers bars is especially innovative, just like his schemes:

More Andy Reid being Andy Reid: 'It's like a Snickers bar in the freezer, right? I mean, it's treasured.' #Chiefs #NFL

— Sean Keeler (@SeanKeeler) June 5, 2014

Who doesn’t want to try that now?

It’s really hard not to love a coach who can crank out one-liners like these. He’s not going anywhere, and neither are the Chiefs, so expect more of the ever-quotable Andy Reid in the future.

0 notes

Text

Beligra Male Enhancement Reviews - Easiest Way To Get Long Lasting Erection! Price, Buy

Do you folks have ever thought of showing signs of improvement exhibitions in the night? Have you at any point wished of getting the pleasurable exhibitions? We realize that pretty much every man has a longing of having a pleasurable sexual coexistence with his accomplice yet not every person is sufficiently honored. In the wake of seeing such situations, a portion of the wellbeing specialists have now presented this Beligra Male Enhancement.

It is a sort of male improvement supplement which can most likely cause you to dispose of every sexual issue. These sorts of medical problems emerge not just as a result of the absence of sexual intrigue yet in addition because of your sporadic routine life or may be because of your undesirable dietary patterns also. Infections may be unique, however various men are there who are radically battling against their sexual medical issues and now, and they are truly terrified of losing their accomplices.

We comprehend your anxiety that none of you folks ever need to lose his accomplice, yet your lower sexual intrigue may cause her to feel that she may effortlessly get a carefree and energetic accomplice. What might you do at that point? Simply receive a little caution and you would definitely get a few incredible advantages subsequent to utilizing Beligra Male Enhancement. On the off chance that you folks have any questions, disarrays, or inquiries in your mind then you can basically make them understood.

A Complete Overview About Beligra Male Enhancement:

The producers have contemplated altogether on the potential issues may be looked by the couples while acting in the bed. We realize that these sorts of affections are very significant in a relationship yet to keep up your power of profound devotion might be precarious for you in your expanding age. We are very much aware of reality that diverse male enhancers are as of now there in the market yet at the same time, we are prescribing you this Beligra Male Enhancement simply because of its brilliant characteristics, regular creation, a lot of medical advantages, and viability.