#25%downpayment

Text

#development#future#property#money#LaVidaDevelopment#SangreGrande#residential#land#negotiable#allapprovals#TownandCountry#WASA#RegionalCorporation#LandSurveyBoard#deal#valueformoney#DwightLyons#mortgage#investment#insurance#phase2#finalapproval#terms#25%downpayment#twentyfivepercent#downpayment#preconstruction#bargain#construction#bank

0 notes

Text

🌸🍓 leucistic fawn girl 🍓🌸

Sb: $35

Ab: $150

Comment or dm to offer ty for your interest mwah 🫰

#hi yes ty for dealing with me rn lol#i love drawing ponies but i am in the mood for character design and like ive said before#selling them helps me raise money for tinywhiskers#especially because the little guy im fostering is heading to the vet on monday#sorry im rambling mb#im scared of coming off like im guilting people i just want to be transparent about where your money is going idk#aaa#art#digital art#furry adoptable#furry art#furry adopt#anthro#furry#deer character#adoptable#character adopt#i take paypal and cash app and i can do payment plans i just need a 25% downpayment ty

120 notes

·

View notes

Text

Recently, I was watching television when a formless ghoul appeared and told me that it was my fault for not owning a house. Despite the fact that I do own a house thanks to the unsolved death of my landlord and the subsequent squatters-rights law that allows me to keep adverse possession of the property unless I leave for over 24 hours at a time, something else about what she said stuck in my craw.

She explained that if I would just take $1500 a month out of my paycheque, and put it aside, and never touch it, I would have enough to make a down payment on a house. This made sense, but only that kind of sense which is made until you put down the bong and ask the other person at the party to repeat themselves very slowly while you pull out your Bowie knife and body-snatcher detector.

if you did indeed start saving $1500 a month in January 1st, 2018, you would indeed have $90,000 by January 1st, 2023. Probably a little more from interest, but not nearly as much as you would have had by repeatedly putting that money into literally any investment vehicle, such as a 1978 Plymouth Volare.

Now, here's where things get really crazy.

If you take that same $1500 a month and you start putting it in your bank account in the year 620, by January 1, 2023, you will be able to afford a $25 million house, all cash. Or the 20% downpayment on a $125 million house if you’re feeling like you can stretch it a little. And you also will have experienced the entire arc of the industrial revolution, which you will have been unable to enjoy while paying rent to more than two dozen landlords, even as the concept of serfdom collapses around you.

Here's where things get even crazier.

If you had $1500 American dollars per month in the year 620, you would actually be able to just buy the papacy and install yourself as Pope, replacing the uncharismatic Boniface V. In this case, you would be living rent free in the Vatican for over 1400 years, unable to be removed unless through direct sub-papal fiat, although still vulnerable to the radical side-effects of internecine warfare in Italy and especially the pressures of standing up to a politically strong emperor in a time when the Church’s absolute power over politics is beginning to wane. Then, you can spend that $1500 a month on whatever you like, instead of housing or food. I recommend a 1978 Plymouth Volare.

This is the real life hack, and it's shocking nobody talks about it.

Subscribe to my tiktok for more finance tips, and by “tiktok” I mean the sound that the broken camshaft on my 1978 Plymouth Volare is making. If you buy it, I swear it’s an easy fix.

1K notes

·

View notes

Text

NGL, I come from a place of privilege, given that I am under 25 and have no debt.

I have about $30,000 in assets - just my savings, car, tech, jewelry, and all my worldly goods that could be resold put together, at their current value. If I lost that 30k, which is really just (one) medical emergency away from bankruptcy, I would have to strip everything for the cash. In just cash alone, I'm not even close enough for a downpayment on a starter home, a multi year endeavor.

By comparison, millionaires such as Lady Gaga (130 million) and Keanu Reeves (380 million) are far above me. To be on the same level, I would have to earn and retain in financial or asset form, $129,970,000 or $379,970,000 respectively. Anything I spent on rent, insurance, gas, food, medicine, and other consumables that can't be resold doesn't count towards that net worth total.

That's a lot. But this pales in comparison to billionaires such as Jeff Bezos (117 billion) and Elon Musk (191 billion). I would have to retain $116,999,970,000 and $190,999,970,000 respectively. At my current income of $50k, which is above the median income for people with my level of education, assuming I magically don't need to spend any money on consumables and can just bank it all:

It would take me 2,599 years and 146 days to obtain Lady Gaga's wealth, or almost 26 CENTURIES.

It would take me 7,599 years and 146 days to obtain Keanu Reeve's wealth, or almost 76 CENTURIES.

It would take me 2,339,999 years and 146 days to obtain Jeff Bezo's wealth, or almost 2,340 MILLENIA.

It would take me 3,899,999 years to obtain Elon Musk's wealth. It would take me nearly 3,900 MILLENIA.

Oh, this is after having paid off all my debt and with my existing assets, by the way. For even Lady Gaga, the least wealthy of this list, I would have to work tirelessly from before the Roman Empire was even founded.

But that's just me, a college-educated middle-class American citizen who is both debt and child-free.

It's much more fascinating to compare these to each other.

Lady Gaga makes $25 million a year.

Keanu Reeves makes $40 million a year.

So, if I deduct what these millionaires already have in assets and divide the total of the billionaire's assets by their income to find how many years of just banking money (no consumables):

Lady Gaga would have to bank another $116,870,000,000 to have Jeff Bezo's wealth. Assuming she stops spending on consumables like food or whatever and every penny of her $25 million income goes into future asset wealth, it would still take Lady Gaga 4,674 years and 293 days for her to obtain Bezo's wealth.

Keanu Reeves would have to bank another $190,620,000,000 to achieve Elon Musk's wealth. Again, in a fantasy world where Keanu doesn't have to feed and clothe himself, it would take him 4,765 years and 6 months to obtain Elon Musk's wealth.

The gap between the assets of famous multimillionaires like Lady Gaga and Keanu Reeves (who make MILLIONS every year) and that of famous multi-billionaires is a little less than HALF what it would take me to become as wealthy as Lady Gaga at my income level, which is, again, above the median. I could never achieve that wealth in my entire fucking lifetime, because, even if I assumed my income would go up and actually outpace inflation, I still need to eat and I can only use my body for labor until I'm 80, tops, which is only 56 years of work and nowhere near the thousands.

This sounds very conspiracy-brain, but sometimes I think the United States deliberately undermines math education and the corresponding understanding of how to problem-solve and comprehend magnitude of these kinds of numbers. Because if kids sat down and did the math, they just might realize that there is no way to become this rich on your own hard work.

Sure, you can invest in the stock market - but that's gambling. Most people might be able to hamper the effects of inflation on their asset values with stock investment.

The American dream is a lie.

The middle class is closer to becoming homeless than they are to becoming multimillionaires.

Even multimillionaires are closer to becoming middle class or even homeless than they are to becoming multi-billionaires.

Don't fucking tell me to budget and I'll become a millionaire. It's more likely I'll get hit by lightning or lose it all to medical bills.

If this doesn't radicalize you, I don't know what will.

#anti capitalism#late stage capitalism#billionaires should not exist#elongated muskrat#fuck jeff bezos#us politics#economics#math#budget#yip speaks

716 notes

·

View notes

Text

Wife and I are currently in a financial bind because wife's mental illness mental illness-ed when under additional stress of their phone suddenly needing repairs (another expense we weren't exactly ready for but could have eaten if not for Symptom aggravation)

They don't currently have access to a therapist/psych because their last one decided they were well enough to drop them when the clinic lost staff, plus don't currently have the freedom to take time off work with me being currently unable to work a normal/lucrative job.

We're at risk of being unable to pay for the water bill, the payment plan from my recent surgery, uber fare for me to get to my dr. appointment this week, and gas for wife to get to work.

$78.24/205

Water - $85

Surgery payment plan - $50

Uber to/from Dr. Appt - $45

Gas for about 2 weeks - $25

I have complete art prints and TTRPG products available on my marketplaces at linktr.ee/bekandrew if you'd like something in return

I can also take (art and writing) commission requests at this time (details in pinned post and linktree), and you'd pay the downpayment of half after we agree what it is. I'm finishing up a large commission and may take more time than usual to start.

If you'd rather donate, my cashapp is $bekandrewttrpg and my Paypal is paypal.me/bekandrewTTRPG

#queer mutual aid#mutual aid#signal boost#bek speaks#art commissions#writing commissions#queer artist#trans artist#disability#sorry this has happened again

45 notes

·

View notes

Text

YESTR'S COMMISSIONS ARE OPEN!

Please view my carrd for further details!

I write for: genshin impact, honkai star rail, blue lock, bungou stray dogs, jujutsu kaisen, obey me, original fics, ask me if you there's a fandom you want and isn't listed

I won't do: scat, incest (minus pseudo/adopted), necrophilia

COMMISSIONING PROCESS:

1. Fill in the GDocs for your commission

2. I will contact you on your given social media for confirmation that I have accepted/denied your request.

3. After talking out any more details, I will link you to my PayPal that where you will put down a 25% downpayment

4. During the writing process, I will update continuously update you.

5. Once finished, I'll give you a non-editable draft to know whether or not you're satisfied with it.

6. I will send you the official file after paying the remaining 75% of the payment.

NOTE: I only take up to three commissions at a time. Check Tumblr pinned to see if there are slots left.

11 notes

·

View notes

Text

Opening writing commissions!

My portfolio ^-^

Any and all requests would be highly appreciated <3

[ID: two posters with a green wavy stripe background and sparkly pink border. text boxes and titles are in yellow. the first one titled "Prism's Writing Commissions!" details the following information:

<100 words: $3

100-499: $5

500-999: $10

1000-1499:$20

1500-1999: $25

2000-2499: $30

2500-3000: $35

>2k wordcount is $3 per 100 added words.

Will do:

My fandoms---check my blog or my portfolio!

Different styles: Prose, poetry, or scripts.

Original fiction

Angst

Ships

Gore

AUs

OCs

Won't do:

NSFW

Heavy subjects such as abuse, harrassment, discrimination etc.

Incest

Adult/minor

Note: I have the right to reject a commission!

the second poster reads:

Process:

I’ll send a first draft and WIP screenshots to keep the client updated and to allow them to request for adjustments.

If it’s for OCs, please send me sufficient information about them--I want to get them right!

Writing will take approximately one week to two months. If it takes longer, I’ll say.

If I am unable to complete the piece, I’ll allow a refund to be made.

It will be sent in PDF format.

I might post the commission on Ao3––if you don’t want it to be public, just say so!

Payment:

Contact me on Tumblr OR by email.

I take Paypal or Ko-fi.

Note: contact: [email protected]. I won't take less than a 50% downpayment.

End ID.]

#unintelligible rants#writing commissions#writing comms open#writers on tumblr#described#repost bc i adjusted the prices woohoo

9 notes

·

View notes

Text

I really would like financial assistance without having to pour out my heart and soul but I think in order to get the help that i need I'm going to have to do that. So let me share what my year has been like since I'm genuinely not open about it:

First of all my brother and I got an apartment together, we get along like peach cobbler and vanilla ice cream. We both suffer from an unexplained seizure disorder. I was lucky enough to have been battling with the doctors until i was put on antiseizure medications but my brother hasn't gotten that far yet he's still waiting out for nine months before seeing a neurologists because they Will Not medicate him otherwise. We got the apartment about an hour drive from where we both worked, i dropped my job and got hired at the same company as my brother so our commute would be the same.

My brother was sick as a dog, i understood. I'd been there barely a year before and i was unemployed for the most part of it as i fought doctors.

I just got out of a bad relationship and i had saved up three quarters of the downpayment and our landlord decided that we'd pay off the rest thru our rent. (Only after we moved out did we learn from our neighbors that we were also spending an extra 200 dollars a month more than everyone else in the complex because we were both openly queer). We were barely scraping by.

Then we tested positive for covid. Spent a week on our asses. And it got worse.

My brother had been taking my dad to court for sa. My father was being investigated under FEDERAL COURT for sa, acts domestic terrorism, and war crimes when he toured in Afghanistan. Instead of being detained, he went to a local gun shop with one bullet, asked to see a gun, loaded it and shot himself in the head in the shop.

My brother was battling him in court for about 6 months and the stress of the news along with planning the funeral, which I have no idea why my mother thought he should be responsible for it, anyways the stress was making his seizures worse and more frequent so we were out of luck for another week. Two weeks without a paycheck was all it took for us to get evicted from our apartment.

My mother took us in, and emotionally abused the both of us KNOWING THE WHOLE TIME about the sa and deciding to live with that man for 25 years and looked the other way. She threatend to call the cops on us and kicked us out of the house after being there for two months and we ended up having to place our belongings in a storage unit. Before that i haven't spoken to my mother in 5 years and i will never speak to her again.

Then my uncle on the other side of the country invited us to live under his roof, so he paid for us to come here. The idea was that he was going to support us until we could move out on our own. We gave up our jobs, our friends our medical appointments and therapists. Everything. To come live with our uncle and we asked him several times if he was SURE he could handle two autistic people with medical issues.

The other day his wife sat us down and said she was tired of taking care of us and she wants us out of her house in at least the next two weeks. My uncle backed her up but said nothing the whole time. This was AFTER she made us pull out credit cards that we didn't want because of debt. Literally since we've got here she's drilled us about "hitting the bricks" and "having a side hustle". She said that she didn't want to build any animosity towards us so its better if we don't live under her roof anymore. SINCE WE GOT HERE She gave us about a month to find a job and pay 300 for rent each (which we're living in her BASEMENT by the way) and we DID find a job in that time. We got hired and filled out the paperwork and they NEVER SCHEDULED US IN. We called and called and showed up at the doorstep several times and it just fell through so my brother got a SECOND JOB. I'm still looking for a second job he just got his first paycheck in.

So now we have less money than we did before the move we used all of it for the move. We have No money saved up for a downpayment even for subletting. We have credit card debt and we have nowhere to go. I have a cat that I'd rather D I E than part with and my brother and I can't be separated. We're both chronically ill, trans, have severe PTSD and need medications to mentally and physically perform. Every family memeber I've ever had has royally SCREWED ME.

I've been trying to get commissions in but right now i cannot fill in the gaps quick enough we're going to either need to find a shelter or live in our car WHICH ITS A 100 DEGREES OUT HERE ON THE EAST COAST.

Please I need help. I need to get back on my feet so I can start making income. I can't lose the only two things i have left in this world. I've never been so low in all my life and I've got nothing to show for.

Help line sources. Inner community stuff. Money. Signal boost. Literally anything.

I'll still do commissions but i need more support than that.

93 notes

·

View notes

Photo

[ OTA ] FB #032

OFFER TO ADOPT

────────────────────────

STATUS/OFFER ON DISCORD OR TOYHOUSE

────────────────────────

PAYPAL USD ONLY

Payment Plans are available if you know the specific date you will be able to pay! , please be able to at least do a 25% downpayment of the SB price. This only applies if the bid goes over $100.

────────────────────────

Social Media | Ask me anything! | Buy me a Ko-Fi | Discord

#auction#adoptme#adopt me#adoptablesopen#digitalart#bta#ocadopt#paytoadopt#buytoadopt#originalcharacter#artist#adoptableoc#openadopts#cute#fbseries#oc#characterdesign#character#digital art#digital painting#anime#art#shiroukami#adopts#adoptables#open adopts#open adoptables#adoptable#adoptable batch#character design

3 notes

·

View notes

Text

COMMISIONS OPEN!!!

Feel free to preorder via askbox when it's closed, and DM for commissioning when it's open. DM for insta, and we can discuss pricing or detail from there if you wish to.

25% downpayment!

BUST/FACE+ : normal price

FULL BODY: + $5

INTRICATE DETAILS ON CLOTHING/ SKIN/ HAIR: +$2

BUILDINGS/ STRUCTURES in bg: +$3

NON-PLANAR PERSPECTIVES: +$5

No NSFW, No Potter fandom, No Reylo, No Namuri

WHY SHOULD YOU COMMISSION FROM ME?

> It's value for money! I give quality and don't price for more than it's worth.

> You're supporting someone who needs the money.

> I can turn your headcanon into a picture, much better than any AI can!

> I have diverse art styles and I'm willing to try out new ones.

> Black Panther fans get to skip downpayment:D

#commissions#queer artists#branium#blackarrowpheonix#Black panther#black panther fanart#black panther wakanda forever#shuri#artists of color#black panther#inspo#indian artists#black panther art#digital art#tchalla

23 notes

·

View notes

Text

Commissions Open!

My car died, and I really need to find extra work to afford a downpayment on a car to use. I commute to work and public transport is unavailable, so it’s a necessity for me.

The “quick sketch” style like the top left image is only $25. Icons with various expressions like the top right are only $30. Full commissions like the bottom examples here range in price from $50 and up.

I have a carrd with my prices listed in more detail:

3 notes

·

View notes

Note

I think most americans look at a house as a primary store of wealth because there isn't really anything else available to store wealth in.

If you keep your money in a bank, you are losing single digit percentages of value every year (or double digit last year depending on how you do the math). Stock market investments are dubious on the best of days if you don't already possess the vast quantities of wealth needed to mitigate risk effectively, and most americans alive today have lived through multiple major recessions now, they know exactly how bad those can get. Motor vehicles don't typically last longer than a decade and a half even with the best maintenance possible, and other big ticket items that hold onto value well like businesses or resource rich property are inaccessible to someone who isn't interested in dedicating themselves to maintaining them.

By contrast, a house is something you benefit from very directly by owning, will maintain by virtue of needing to live in it, and are offered a variety of legal protections and insurance options to mitigate much of the risk of ownership. It may not make for an ideal society, but it does make sense from the perspective of someone who would like to try and actually accumulate wealth during their lifetime.

I do get the appeal of homeownership from a flexibility and personal benefit thing, not having to wait for some asshole to tell you you can't hang pictures is great, but I think for every person who values control over their home, there's someone else who just wants a place to live for the next two years.

The faulty instinct is that the house is the valuable part, as noted by that article. Buying a house as a store of value only works if the land it's on goes up in value. Buying land in bumfuck nowhere because you want to buy a house isn't a good idea, and buying land in a valuable area is probably beyond most people who are worried about where to direct their very limited funds.

I'm not as convinced as you about the idea that a modern diversified index fund is worse than landownership (especially for the non-ultra-wealthy) for your median American living in suburbs outside of high-demand city centers. I'm also not sure land is much less resilient to financial crashes, especially if you're still paying off your mortgage on pre-crash pricing.

Any idiot can invest in your basic Vanguard mutual fund without having to save up $25+k on a downpayment, versus what, like $2000 minimum initial investment for Vanguard? I don't know what S&P500 minimums are like. And they strongly tend to beat inflation year on year without the ongoing costs of home maintenance, bubble risk, and risk of just getting a crap location that doesn't improve.

That's to say nothing of significant transaction fees, land and property taxes, and overhead if you ever need to move homes. It's also much easier to continuously siphon off a little money to put into a mutual fund than it is to add money to a house.

Of course, stock prices crash, but that tends to coincide with housing price crashes, and it's harder to weather out a housing price crash with a huge mortgage to pay off than it is to weather leaving your investments to recover, especially if you're dealing with them in the long view. There's definitely certain situations where a house is a sensible investment but I think that's rarely the best reason to buy a house.

13 notes

·

View notes

Text

Taking Comissions! 10 Open Slots!

BUST/HEADSHOT COMMISSIONS

Hello! I know I barely have a following on here, but I needed to put this up somewhere. I'm running very tight on expenses and if you felt like chipping in on my groceries, it would be very appreciated! We can talk prices over to better specifics depending on what you ask of me, but it should follow this guideline pretty closely. I won't go below the waist, I don't have nearly enough time for a full scale commission right now, but I will slip in parts of a hand if you really want them.

I am only taking PayPal at this time. Send me a DM at any time and I will provide you the link. I request a 5 dollar downpayment ($4 for a 1 character head/bust sketch) before I send my finished piece over, which will be completed within 2 weeks at most of your downpayment. I'll try to keep you in the loop with progress updates to make sure both of us are happy with the finished piece!

I will do humans, furries, animatronics, ferals, etc. If it's something else we can talk it over. I would consider doing a mech depending on the detail, and if you are alright with me simplifying the detail.

Prices:

Head/Bust Sketches: $8

(Optional Background Color and Monochrome Character)

Extra Character: + $4

Grayscale

Clean Line: $15

Loose Line: $10

Extra Character: + $8

Loose Color

Loose Line Coloring: $20

Loose Line Minimal Shading: $18

Extra Character: + $14

Clean/Paint Style (You choose)

Detailed: $25

Extra Character: + $18

Simple Background: + $6

(I will only do backgrounds on the Detailed artworks. Also an apology that I don't have any recent multiple character pieces for busts.)

If you have any questions, please send me a DM!

2 notes

·

View notes

Text

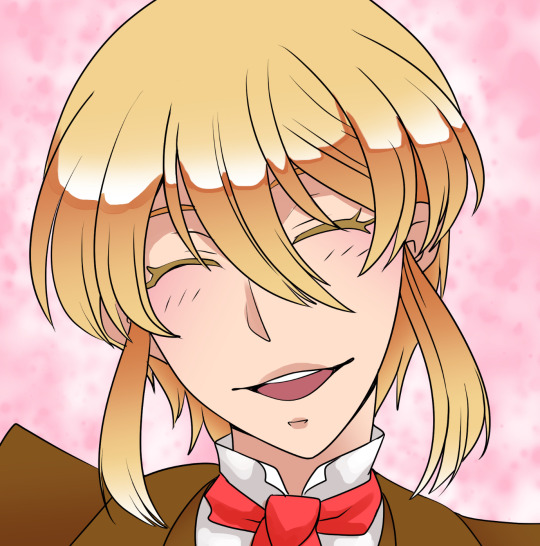

🖤❤️💚April's Real Estate Tip🖤❤️💚

To all my folks who LOVE to party🍹🥃 & get "LIT"😵😜almost weekly AND still don't own their own home🏡🏠just know your partying ways just might be keeping you from making the smartest investments💰💵 in your life...owning a home.🏠🏡This usually applies to those between the ages of 25-40. You see the weekend turn up sessions certainly add up & we all know all to well it's getting more & more expensive to go out & "have a good time." Have you've ever sat back & did the math???➕✖️With a little discipline you could actually save that turn up money for the 3%-5% downpayment needed for your new home. It's time to think smarter y'all.💡🤔Kings & Queens✊🏾✊🏾We must get our money to work for us, instead of us working for it.💯💯

The housing market is still "LIT"🔥(pun intended😂). If you're looking to Buy or Sell in DC, MD or VA please inbox/DM me TODAY!!! Let's put together a strategy for homeownership. Brasher Property Group/Paint Boy & Sons Home Improvement

5 notes

·

View notes

Text

Budgeting

You Need a Budget

On payday, add paycheck into “To Be Budgeted”

Give every dollar a job: start with essentials like groceries and bills

For fun expenses like going out to eat, include these as part of your monthly budget; use a prepaid Visa like KOHO and transfer over your set amount each month

Open a High Yield Savings Account

Ally Bank

Capital One

Automate an amount to set aside for short term goals like travel or an upcoming downpayment

Automate your bills with the service company or your bank

Set aside an emergency fund

Automatic savings transfer

Zero-based budget

Debt avalanche

Pay the minimums on all of your debt except for the debt with the highest interest rate

Put extra $$ toward the highest interest rate debt

Refinance Debt to a 0% APR Credit Card

Make sure there aren’t annual or sign on fees

Make sure they allow balance transfers and find out the fee before applying (both the old and the new card)

Do the math to make sure the fees are worth it

Creating a Budget

Write down how much you make and how often you get paid, how much $$ in checking, how much in savings, and ow much debt you have

Write down fixed expenses: rent, utilities, internet, insurance, Spotify, Amazon prime, loans, etc.

List variable expenses: estimates of gas, food, groceries, fun, misc.

List sinking funds: car repairs, medical, holidays, technology

Zero-based budget: give every dollar a job

Add total variable and fixed expenses to get a monthly total and determine how much you have left for sinking funds

Staying Motivated to Pay Off Debt

Give yourself fun money

Use visual trackers

Make small, sustainable changes to your budget

Start a savings challenge

Money-Saving Apps

GetUpside (gas)

Investing

Roth IRA: low fee index funds, invest $300/mo starting at age 25

Tax Deductions

1098E: can deduct if you pay more than $600 in student loan interest per year

Income Streams

Profit income: side hustle

Investing: dividend income and capital gains

Royalty income (something you sold)

Earned income: full time job

Interest income

Side Hustle

Studypool

Goals

Save $500/mo or more for retirement

At least 10% of my paycheck goes to savings

50/30/20

50% for needs like rent and food

30% for wants

20% for debt repayments and savings

Retirement

Withdraw up to 4% of investments yearly to save enough for retirement

Annual expenses * 25 = amount needed for retirement

Accounts to Have

Bill payment account

Daily spending/allowances

High yield short term savings account

Long term savings

5 notes

·

View notes

Text

Round 4 - Article 1239

ARTICLE 1239 STATES THAT :

“IN OBLIGATIONS TO GIVE, PAYMENT BY ONE WHO DOES NOT HAVE THE FREE DISPOSAL OF THE THING DUE AND CAPACITY TO ALIENATE IT SHALL NOT BE VALID, WITHOUT PREJUDICE TO THE PROVISIONS OF ARTICLE 1427 UNDER THE TITLE ON “NATURAL OBLIGATIONS”.

WHAT IS ARTICLE 1427 OF THE CIVIL CODE?

When a minor between eighteen and twenty-one years of age, who has entered into a contract without a consent of a parent or guardian, voluntarily pays a sum or delivers a fungible thing in fulfillment of the obligation, there shall be no right to recover the same from the obligee who has spent or consumed it in good faith.

WHAT IS REPUBLIC ACT NO. 6809?

Republic Act No. 6809 is an act lowering the age majority from twenty-one to eighteen years, amending for the purpose of Executive Order 209, and for other purposes. This means that individuals in the Philippines are considered adults and granted emancipation at the age of eighteen.

WHAT IS EMANCIPATION AND ITS EFFECTS?

Emancipation refers to the parental authority over the person and property of a child. Once the person reaches the age of eighteen, they become qualified and responsible for all acts of civil life, with some exceptions established by existing laws in special cases.

RA No. 6809 also includes the provision of the existing wills, bequests, donations, grants, insurance policies, and similar instruments that contain references and provisions favorable to t minors. The law states that these instruments will not retroact to the prejudice of minors upon the effectivity of the Act.

G.R. 172825

Spouses Miniano dela Cruz and Leta dela Cruz

vs.

Ana Marie Concepcion

Ponente : Associate Justice Diosdado Peralta

Facts:

On March 25, 1996, petitioners (as vendors) entered into a Contract to Sell with respondent (as vendee) involving a house and lot in Cypress St., Phase I, Town and Country Executive Village, Antipolo City for a consideration of P2,000,000.00

The respondent paid the total amount in four equal payments every six months, to wit:

(1) P500,000.00 by way of downpayment;

(2) P500,000.00 on May 30, 1996;

(3) P500,000.00 paid on January 22, 1997; and

(4) P500,000.00 bounced check dated June 30, 1997 which was subsequently replaced by another check of the... same amount, dated July 7, 1997.

However, the petitioners claimed that the respondent had an unpaid obligation of Php 487, 384.15, which includes principal balance and interest, while the respondent claimed that she already paid the balance to certain Adoracion Losloso.

Issues:

Whether or not respondent's obligation had already been extinguished by payment made to the authorized person to receive?

Ruling:

In order to extinguish obligation, payment should be made to the proper person as set forth in Article 1240 of the Civil Code which states that “Payment shall be made to the person in whose favor the obligation has been constituted, or his successor in interest, or any person authorized to receive it”.

Payment made by the debtor to the person of the creditor or to one authorized by him or by the law to receive it extinguishes the obligation. When payment is made to the wrong party, however, the obligation is not extinguished as to the creditor who is without fault... or negligence even if the debtor acted in utmost good faith and by mistake as to the person of the creditor or through error induced by fraud of a third person.

In the case, the payment of the remaining balance of P200,000.00 was not made to the creditors themselves, but to allegedly Losloso as the authorized agent of petitioners. Losloso's authority to receive payment was embodied in petitioners' letter addressed to respondent, dated August 7, 1997. In the same letter, petitioners’ informed the respondent about the remaining balance and the payment for the 1997 real estate taxes. The petitioners also advised the respondent to leave the payment to a certain to Adoracion Losloso as their authorized agent.

The Court ruled that as shown in the receipt signed by the petitioner’s agent and pursuant to the authority granted by petitioners to Adoracion Losloso, payment was made to the latter by the respondent. The Court affirmed the decision of the RTC and the CA that payment had already been made and that it extinguished respondent’s obligations.

0 notes