#three projects due on friday announced last week and today respectively

Text

.

#do not rb#emetophobia tw#i have felt. stress nauseated for the last. Several Weeks#and nothing recently has helped that#i only have six days of schools left but everything between me and the end of the year#makes me want to fucking puke#three projects due on friday announced last week and today respectively#multiple tests#ap exam#can't leave or i tank all my grades#the only saving grace is that i don't have to take finals as of right now#and i keep stressing that i'll miss the saf ticket sale#which is minor in comparison but still means a lot to me#every time i look at my to do list my stomach twists up and i feel Incredibly Paralyzed By Decisions#so incredibly ill#i'm gonna scream#and possibly strangle multiple people#i feel. the worst i've felt in four years#radio free junebug

0 notes

Text

Unforeseen circumstances - Drabbles| MYG #2

Drabbles from Unforeseen Circumstances’ universe.

pairing: Min Yoongi x OC

genre/warnings: fluff, established relationship, college au

words: 1260

(cross-posted on AO3)

2. House of Cards

“A house made of cards, and us, inside

Even though the end is visible

Even if it’s going to collapse soon

A house made of cards, we’re like idiots

Even if it’s a vain dream, stay like this a little more”

The worst day of your life often starts just like any other average day.

For Lee Yoonah it happened on a Friday, last day of the academic term at Seoul’s National University, what, in her experience, meant a packed morning scheduled, sustained by an iced americano and a piece of toast munched on the way to an exam. On that particular day, the final one for her Foreigner Correspondence’s class.

That was her strongest subject, and so the test wasn’t cause of any major distress. She finished it briskly and confidently, leaving the classroom with the surety of getting an outstanding grade, as was expected of her.

Having solved her first task of the day, she ran to SNU’s newspaper editor’s office, in order to handle the draft for the last article of her academic journalist’s career. She also fulfilled that chore briefly, stopping only for a a few minutes to chat with Euntak, her now former boss, wishing her the best and offering her gratitude for their time working together.

By the time she was done with everything in her morning’s schedule, it wasn’t even noon, and Yoonah found herself blessed with the unexpected gift of free time right before her lunch date with her mother.

Over the past few weeks leading to the end of this last semester as a student, unexpected leisure hours were so rare that she wasn’t able to control the maniac grin threatening to split her face in two all the while she made her way towards their favorite coffee shop and back to the Liberal Arts’ building on campus.

With the deadlines for their individual final projects clashing, the last time she saw Yoongi was on tuesday, when they had the luxury of a thirty minutes break at the nearest convenience store for a snack in between their classes. They were supposed to have had a lunch date on wednesday, but the due date for Yoongi to deliver his demo to a prospecting entertainment company was pushed forward, and he had to cancel their plans.

Since then, he’d been trenched in one of his department’s studios, composing and mixing like there was no tomorrow. By the scattered texts and the one call she received from her boyfriend following his self-imposed exile, Yoonah deduced that he left for a meal and a nap sometime on Thursday, but for the last twelve hours he had been MIA, and by now she was starting to worry if he could survive on music and crappy coffee for much longer.

The makeshift sign at his designated studio’s door - a piece of taped paper with ‘Genius Lab’ carefully written on it - stated clearly that he wasn’t to be disturbed, a warning she decided to ignore, simply entering the room with her load of provisions.

Yoongi was hunched over his keyboard, noise canceling headphones on, exhaustion written in every line of his body. She immediately notices a familiar pout adorning his lips, and opts to give him a moment to materialize whichever idea is surely sprouting on his mind. She uses the time to set the gimbab and the bowl of store bought tteokbokki on the only empty space of his desk, hanging her bag by the door before gently touching his hair.

When he looks up, her favorite producer needs to blink twice in order to situate himself back in the physical world, unconsciously smiling in response to the knowing smirk on Yoonah’s face.

“Jagiya, how are you here? Don’t you’ve a test today?” He asks, spinning his chair to face her and accepting the large cup of iced americano she offers.

“I did, at eight in the morning. it’s now past eleven, Min PD.” Yoona replies, gently stroking the soft brown strands of his hair “I’m just stopping by to check if you’re alive and bring food...” Yoongi swells at that.

“I’m not sure if I would’ve survived through college without you to keep me fed, princess.” he says, pulling her between his legs for a hug.

“You wouldn’t. You would have died long ago, during that project on our second year where you’d to compose that song for a fake girl group.” She quips, smiling happily to the ceiling, completely at peace in Yoongi’s hold.

The mock argument was one of their ongoing inside jokes, but it held a bit of truth. Yoongi had the terrible habit of ignoring his body’s most basic needs while in the middle of a project, and for the last three years Yoonah got used to looking after him during those times.

She called it her duty just to aggravate him, but in truth, it never felt like that. Taking care of Yoongi felt nothing like the responsibilities she had with her family. He had never expected anything from her, and even though Yoongi cherished her in similar fashion, pampering her constantly, he never demanded retribution, and would still be grateful for the smallest gestures. It made her feel happy, knowing she had his back and him hers. It felt right.

“You have that lunch thingie today, right?” He questions, taking a large sip of his drink “thank you, by the way. You’re a fairy.”

“You’re welcome, and, yeah, the lunch with my mother. Last obligation of the school year!” She announces happily.

“Good! Joon will be here later today to listen to this whole thing with me and give some fresh perspective. It’s almost done, can you believe?!” Yoongi sends her a gummy smile to express his satisfaction towards his own music “I was going to ask you for an opinion, but thought better of it, I want it to be a surprise!”

He laughs at the groan she emits in response, throwing her head back in false disgust.

“Surprises make me nervous!” She whines cutely, squirming out of his hug in rebellion, but Yoongi only laughs.

“You’ll like this one, promise! I’ll play it for you on the train ride to Daegu tomorrow‘s afternoon!”

The alarm on her phone goes off then, cutting through their conversation before she can think about a proper answer for his indignant suggestion and remembering her of the next appointment on the agenda. Suddenly the idea of a surprise sounds much more appealing.

“I gotta go, Min PD …” she announces, and he only pouts in response “text me when you’re done, so we can plan the weekend, alright? Tell Namjoon I said hi!”

Yoongi waves and pouts some more for good measure, throwing a whole pity party at her leaving, even though he’s ready to turn back to his keyboards. Ever the workaholic.

Yoonah smirks at his antics, adjusts her purse and makes to the door, before thinking better of it and going back to give him a soft kiss on the lips, barely more than a peck.

“I love you, Yoon.” She announces, now truly ready to leave and face an afternoon with her mother.

“I love you too, Jagiya.” He answers softly, putting his earphones back on when the door closes behind her.

Lee Yoonah leaves with rare elation filling her up. Her academic obligations are over, Yoongi’s demo is almost done, and they have a well deserved weekend trip to look forward to. It’s the perfect way to end her college years, that Friday feels like a good day of respite to end a draining week. It feels like all is well.

But then, as the universe was never known for its respect towards people’s plans, it is not even an hour later when her whole world falls apart.

#min yoongi#bts fanfiction#bts scenario#bts au#min yoongi fanfic#yoongi fanfic#yoongi scenario#suga fanfic#suga x oc#romance#college au#bts fanfic

13 notes

·

View notes

Text

Investing in a VUCA World

We were clearly surprised by Trump’s tweet last Sunday informing us that he was raising tariffs to 25% from 10% on the initial $250 billion of Chinese imports as well as implement tariffs on the remaining $300+ billion. However, we had an action plan ready to go if trade talks broke down and it helped us last week. We have continued to outperform the market averages.

We have long commented that we live in a VUCA world. This a climate characterized by volatility, uncertainty, complexity and ambiguity. Therefore, you must always be prepared for the unexpected. Trump’s optimism that a trade deal was in reach shifted a week ago Friday after he heard from lead trade negotiator Robert Lighthizer that the Chinese had backpedaled on key portions of previously agreed to trade deal. Clearly, he was annoyed and who could blame him as he was made to look foolish having just announced that a deal was in sight.

Negotiations began again Thursday in DC but ended without a deal being reached, so the hike in tariffs went into effect Friday morning. In addition, the Chinese were given an ultimatum to reach a deal over the next month or else the tariffs on the additional $300+ billions of goods will go into effect, too. The Chinese responded with its price to conclude a trade deal yesterday. The simple truth is that we do not know what will happen, so we must plan for the worst and hope for the best.

We agree with Trump that we should all compete on a level playing field without tariffs, government subsidies, unfair regulations and currency manipulations. Protecting IP and having equal access is of paramount importance, too. The U.S. has run massive trade deficits for years with our major trading partners running huge trade surpluses. It is time to level the playing field while protecting our IP. Fortunately, we have a strong domestic economy more than just offsetting our trade deficit. The U.S. trade deficit is approximately $600 billion reducing our GNP by approximately 3% (exports are 10% of GNP reduced by massive imports). And, we have become an exporter of energy after years of huge importing from the Middle East.

Our trade deficit with China, alone, was over $420 billion in 2018: imports of $539 billion offset by export of $120 billion. There is an enormous imbalance that needs to be addressed. And that does not even deal with the greatest problem which is stolen IP over the years. Companies, if they wanted access to China, had to agree to share IP or else. And many companies, nonetheless, have not been granted access to China. Clearly the playing field has not been unfair.

While you may not agree with Trump’s tactics, it is a necessity for the U.S. to finally address unfair trade practices wherever they may exist including with our closest allies. Can you imagine the positive impact to our GNP if our trade deficit was reduced over time due to fair trade policies and a level playing field? And what is the downside dealing with trade imbalances/huge deficits now when our domestic economy is so strong? While prices may go up slightly near term due to the impact of tariffs, it is hard to imagine our trade deficit pressuring reported GNP. Will demand be hit by higher prices? Probably a little but most likely not as much as expected as the exporter as well as the importer absorb a slice of the tariffs while the supply chain is being moved. Herein lies a HUGE RISK to China. Already many companies have shifted production from China and that will grow exponentially over time without a trade deal. Just look at Under Armour as one example here. The company has lowered its production in China from 35% 6 months ago to less than 15% today and going down further fast. The key to our future success globally is for the U.S. to remain at the forefront of technological advancement which gives you some idea why our IP must be protected at all costs.

As you can imagine from our comments, we feel that China and our other key trading partners are at far more risk than the U.S. when/if trade conflicts escalate. What is our downside when we are already running huge trade deficits? Also, we really doubt whether there will be a surge in prices as global competition is more likely to escalate to maintain production and market share in home markets. The Chinese are keenly aware that production is moving offshore as supply chains are being shifted at an accelerating rate. China is also losing its cost advantage much like Japan did over 25 years ago. So, what will China do to hold onto market share? Cut prices in the face of tariffs sacrificing profits. China loses and prices don’t go up as many anticipate due to tariffs.

So why does Trump feel that this is the time to go to the mat on unfair trade policies? He sees domestic strength and foreign weakness. Is he right? Let’s look at the most recent data points:

The U.S. is in an enviable position compared to the rest of the world. Our economy just came off a surprisingly strong first quarter and it now appears that the second quarter is shaping up well to despite really bad weather in many parts of the country. We were particularly impressed that March wholesale sales rose 2.3 percent while actual inventories fell 0.1 percent therefore the inventory/sales ratio fell to 1.32 which should lead to higher production down the road as demand increases seasonally. We were equally pleased that both the CPI and PPI came in lower than projected and beneath the Fed projections testing the Fed’s view that low inflation is transitory.

It was also reported that the trade deficit came in at $50 billion in March with the trade gap with China declining to a three year low of $28.3 billion. China still is nearly 60% of our trade deficit. Our trade deficit will be penalized for a while by the absence of Boeing Max 737 sales. Finally, job openings continued to grow and now stands at an amazing 7.49 million unfilled jobs. Opening increased in transportation, construction and real estate.

While we still believe that our economy will chug along for the rest of the year into 2020, we remain concerned about the impact on consumer/business psychology if trade conflicts escalate. We must acknowledge that our Fed, unlike other monetary bodies, has ample room to lower rates need be to offset any domestic weakness or fear in the system. It is equally important to recognize how financially strong our banks are especially compared to overseas banks. And never forget that 2020 is an election year. Trump will do whatever he can to stimulate the economy and have a good stock market going into elections.

We clearly are more concerned about China’s growth prospects without a trade deal with the U.S.. There is little question that the Chinese government/monetary authorities have done as much as they could do to stimulate the economy in 2019: taxes have been lowered; domestic spending hiked; reserve requirements reduced and money has been flooded into the system. The government went so far as to buy stocks on Friday to boost their market to try and show the world that the new tariffs would not hurt. FALSE!

While we won’t predict the magnitude of the impact of higher tariffs on China, it is clear that growth will be hit for a host of reasons as discussed earlier. And if the government lets the yuan fall to offset the impact of tariffs, it will eventually boomerang and hurt China’s financial system and economy. China is clearly between a rock and a hard place. While we can appreciate their desire to stand up to Trump, it is time to face reality by opening up its economy and ending huge subsidies while protecting everyone’s IP.

By the way, China’s exports fell 2.7% in April while imports rose 3%. No matter what China says, its economy is at risk without a trade deal.

We remain pessimistic about the growth prospects of Europe without major fiscal, monetary, regulatory and trade reforms. And we see no way for any of that to occur with such differences between the members. The EU cut its economic forecasts for 2019 and 2020 to 1.2% and 1.5% respectively which we feel is still too optimistic. There really is not much more the ECB can do to stimulate growth in the Eurozone. That says it all!

Japan’s future prospects rest sorely on trade deals being reached with the U.S. and with the U.S. and China. What more can the BOJ do too at this point? It appears that first quarter GNP actually fell by 0.2% as firms postponed capital spending and consumer demand fell as well. We don’t believe that Japan reaching a deal with the U.S. is enough to really stimulate Japan’s economy.

So, what are we doing now?

We quickly adjusted our portfolios last week considering that the probability of a trade deal being reached near term had diminished substantially which would lower our outlook for accelerating global growth into 2020. Could it still occur? Of course, but we learned a long time ago that it was better to be risk averse in unsettled times so that we have the liquidity to take advantage of market weakness. We sold stocks Monday that would be penalized by an escalating trade conflict with China raising cash above 17% of our assets. In fact, we did some buying Friday morning as some stocks hit our buy points.

We agree with Lee Cooperman’s comments Friday on CNBC that the markets are fine longer term as the Fed is friendly, valuations are reasonable, and the chances of a recession are very low. We believe that the environment for risk assets is still favorable with an accommodative Fed; an expanding economy without inflationary pressures; a pro-business administration going into a national election next year; 10-year treasury yields hovering around 2.5%, bank liquidity and capital ratios at new highs; a strong dollar and rising earnings/cash flow. We do believe that long-term inflation will stay surprisingly low therefore the stock market multiple should be higher than 17 times earnings making the market still undervalued by 10% today. But we recognize that corrections can occur at any time especially in a VUCA environment.

We have adjusted our portfolios ever so slightly reducing our exposure to China while raising some cash. The overriding theme in our portfolios is owning companies with excellent managements; winning long-term business strategies in a globally competitive environment; rising volume, margins, earnings, cash flow/free cash flow and above market dividend yields.

Finally, we feel that each company sells well beneath its long-term intrinsic value.

Our holdings include pharmaceuticals with major new products; global industrial and capital goods companies; technology that enhances productivity and security; cable with content; housing related; U.S. based global financials selling beneath book; domestic steel; and many special situations. We remain flat the dollar and own no bonds as yields are just too low relative to even inflation at 1.5%.

Remember to review all the facts; pause, reflect and consider mindset shifts; look at your asset mix with risk controls; do independent research and…

Invest Accordingly!

Bill Ehrman

Paix et Prospérité LLC

1 note

·

View note

Text

Your Selection

Summary: Prom season has finally arrived, and the students at Midtown are not immune to all of the drama and excitement that comes with it. Peter's junior class is thrilled to be attending for the first time. People are pairing off to buy tickets a month in advance, and the ones who are in relationships have a new commitment to make to the dance.

This year, that includes Michelle Jones.

Peter does not know what he feels as he realizes exactly what this means, but as MJ is pulled further away from the trio they worked so hard to form, he knows it feels wrong. What feels even worse is watching MJ change without them for someone who takes her for granted... And then some. But it is not his place to say anything about her relationship. If it makes her happy, then it is his job to respect it.

However, each day brings Midtown closer to prom, and each day mounts tensions higher. How much pressure can Peter and MJ's relationship take until it snaps in two?

Characters: Michelle Jones x Peter Parker

Word Count: 1,498

Warnings: Swearing, Self-Consciousness

@one-way-ride @prettylilparker @transient-transition @nerdofthehighestcalibre

26.5 Days Until Prom

Peter doesn’t know why he feels so good that MJ is coming to movie night tonight.

The thing on Friday was a one-time thing, he reminds himself, nothing more than a fluke. It was just because of stupid prom, which will be over in a little less than a month, anyway. But Peter is more relieved than he would like to admit that MJ is coming, and he tries to ignore the fact that her decline to come over had spooked him more than he cares to admit.

When the end of the day comes, Peter is more than ready to go home. Their wood shop class completely numbed up his mind, and he is looking forward to having some stimulating conversation and Star Wars banter to massage his brain back to life. Ned is waiting by his locker at the end of the day, and Peter watches as his best friend’s face light up.

“Hey!” Ned greets cheerfully. “Guess what?” Before Peter has a chance to answer, Ned is rattling forward. Unbothered, Peter opens his locker and slides a few books into their places, leaving his backpack lighter and his books organized. “Betty actually talked to me today. I mean, it was about the project we have due on Friday, but like, she didn’t seem bored. And after she asked me about my shirt! I had to, like, explain basically all of Star Trek for her to get the reference, but you know. She even laughed and stuff!”

A grin spreads across Peter’s face, and he nods. “That’s great, man!” he exclaims, turning to lean against his locker so that they can wait for MJ. “Hey, at this rate, maybe by the time you’re thirty you’ll actually have asked her out.”

Ned doesn’t seem bothered by the comment. Rather, he takes on a lofty attitude, saying, “Hey, don’t joke, man. You gotta take your time, make sure that you give her a while to realize she’s into you, then that’s when you make your move-”

“-and then you wake up and realize that you’re still a nerd with no balls,” MJ’s serene voice finishes from behind Ned. Though her tone is as lofty as ever, both Peter and Ned have learned to tell when she’s joking, and based upon the way that one corner of her mouth is quirked upwards, she doesn’t mean it. Peter doesn’t know why, but he straightens up and tugs lightly at his collar at her approach, and he can’t stop a grin from crossing his face.

Ned makes a face and shoots her a look. “Come on, man! Is it so hard to believe that I could actually ask someone out?”

“I would like to be able to say no, but you don’t exactly have to best history with things that put you under pressure,” she replies as she quickly opens her own locker. Peter watches as MJ takes the massive pile of books in her hands and shoves them into the locker, shoving it shut before they can all fall out on her.

“I don’t know what you’re talking ab-”

“Last week, you squeaked when the toaster popped and you didn’t expect it. The toaster.”

Ned’s face turns red, but he tries to look stubborn. “That’s a perfectly legitimate reaction!”

“Then you unplugged it, and kept doing that every time we went back there for days.”

Peter lets out a small huff of laughter, and a grudging smile crosses Ned’s lips. “Whatever. Can we just go? I want pizza.”

“I agree with that sentiment,” MJ pipes up, turning to look at Peter for confirmation. For a moment, her dark gaze catches him off-guard, but he quickly nods.

“R-right, um, yeah! Yeah, we can order it on the phone on the walk home.”

“I want sausage,” Ned announces as they begin to walk. “And onions.”

“And remember,” MJ reminds as she falls into step with Ned. “Half has to be-”

“Mushroom, spinach, and full tomato slices,” Peter finishes as he pulls out his phone, grinning slightly. “I know. You’re not exactly the most unpredictable.”

MJ looks affronted, but Peter can tell she’s hiding a grin. “Excuse you, I am not predictable.”

“You wear, like, the same three hoodies on repeat with that jacket thrown in there every once in a while,” he responds, not looking up as he selects the number for the pizza place.

It is Ned’s turn to let out a little snort of laughter, and Peter hears her mumble of, “Yeah, whatever, loser.” But it’s comfortable, this trio of theirs, and the walk home is relaxed even though Peter spends most of it on the phone while Ned and MJ compete over who can kick an empty beer can farther down the sidewalk.

The pizza has arrived, the movie is rolling, and the smell of MJ’s hot chai tea is mingling with that of tomato sauce in Peter’s living room, the way that it always does when she is here. Peter shouldn’t be on edge, really. He should be paying attention to Ned’s Jar Jar Binks impression, which is absolutely perfect in every way. Normally, it never fails to get a laugh out of Peter. But today, it isn’t working the way that it normally does, and Peter hates it.

He knows it’s because MJ has been texting furiously for the last twenty minutes.

As far as Peter can remember, MJ hasn’t ever so much as looked at her phone during a movie night. She doesn’t particularly like her old Blackberry, and it rarely goes off. She comments every so often that the only person who really texts her is her mom, and only about their schedules and the like. If Peter has to guess, however, he doesn’t think that this is her mom. If it was, MJ would hardly have any reason to be letting out the soft, frustrated puffs of breath that she does whenever the phone buzzes again, normally just after she’s set it down.

After a while, Ned picks up on it, too. He glances over when the phone buzzes, then back at Peter as MJ picks it up and starts to type furiously. She only seems to begetting more and more annoyed, and finally after a particularly long time spent typing she sets down the phone with unnecessary force.

Ned swallows, glancing at Peter before looking back to MJ. “Hey, uh...” he says slowly, trailing off when MJ’s intense, frustrated gaze fixes on him. “You good?”

“Of course I’m ‘good,’“ MJ mutters, glancing back to the movie. “Why wouldn’t I be good?” Peter and Ned exchange another look as her phone buzzes at that specific moment, and a soft, frustrated exclamation escapes her lips.

There is a moment of silence, and for a moment all three of them are just looking at one another.

“Fine,” she mumbles after a moment, letting a long tuft of hair fall in her face. “It’s... It’s this stupid freaking dance.”

“You mean prom?” Peter asks, raising an eyebrow. “Stupid, freaking prom?”

“Stupid, freaking prom,” MJ repeats, nodding. “I just... Ugh.”

Ned looks slightly concerned. “So what exact stupid, freaking thing happened?”

MJ glares over at her phone. “Lukas said he was paying for the tickets,” she mutters. “I said I could pay for mine, but he was all like, ‘No, I want to pay for my date!’ And I’m an idiot, so I let him, and I ended up spending a little more on a dress than I would have, since I had that extra money I wasn’t spending on a ticket.”

Peter nods slowly, trying to ignore the sinking feeling he gets in his chest when she says ‘my date.’ MJ isn’t anybody’s anything, but he doesn’t feel like she wants him to point that out right now.

“And now, he’s texting me saying he didn’t buy the tickets and used the money to pay for some ‘unexpected thing’ in his stupid tech class, and he’s asking me if I can buy my own ticket.” MJ’s eyes are filled with a peeved irritation, and Peter decides that he is glad he is not on the receiving end of that look. “I wouldn’t have minded, but now I’m going to have to take on extra shifts to pay for it, and--” She breaks off, running an agitated hand through her hair. “Ew. Now I sound like a stupid, whiny girlfriend. Shoot me, Parker.”

Girlfriend. Peter rather feels like the one who is getting shot.

“Nah, that sucks, man,” Ned chimes in, glancing at Peter. “I’d be ticked off.”

“Yeah, well,” MJ sighs, shaking her head and picking up the phone to shove it in her pocket. “It’s dumb. I guess I probably shouldn’t have said anything anyway, so if you tell anyone I’ll murder you. I think I read something about not talking about being pissed at your partner with anyone but your partner, so I should probably just talk to him. But I’ll do it after I’m doing roasting Anakin to a crisp.”

Ned laughs, and a little grin spreads across Peter’s lips. Still, it’s small and slightly strained... She’s trying so hard, and she should be, of course. But Peter can feel that little bit of worry inching in again, because she’s drawing closer to Lukas and away from them. It’s stupid and childish to feel that way, but Peter can’t help but feeling like if it were anyone else, he wouldn’t have that issue.

Because MJ deserves more than being used and inconvenienced.

#Your Selection#michelle jones#michelle jones fic#peter parker x michelle jones#michelle jones x peter parker#michelle jones fanfiction#mj#mj x peter#peter x mj#peter parker#ned leeds#aunt may#spider-man: homecoming#spiderman:homecoming hc#spiderman#spideychelle#spideychelle fic#spideychelle prom au#original work

36 notes

·

View notes

Link

Health workers collect swab samples from people for COVID-19 tests, in New Delhi. PTI

Coronavirus India update: The confirmed coronavirus cases jumped to 23,077 on Friday as the death toll rose to 718 in India.

The biggest lesson the COVID-19 pandemic has taught India is to become self-reliant, Prime Minister Narendra Modi said during the day. He was interacting with gram panchayat members and complimented them for describing social distancing in simple words 'Do Gaz Ki Doori' (maintaining distance of two yards) so that people can understand it easily.

Coronavirus world updates: The worldwide death toll from the coronavirus pandemic crossed 190,000 on Friday, with nearly two-thirds of the fatalities in Europe, according to an AFP tally. A total of 190,089 people have died and 2,698,733 been infected since the virus emerged in China in December. The hardest-hit continent is Europe, with 116,221 deaths and 1,296,248 cases.

Stay tuned for all coronavirus LIVE updates

CATCH ALL THE LIVE UPDATES

Auto Refresh

02:53 PM

Inter-Ministerial Central Team writes to the WB Chief Secretary on coronavirus

Inter-Ministerial Central Team (IMCT) writes to the West Bengal Chief Secretary after their visit to COVID19 hospitals in Kolkata, say wait time for Covid test results for some patients is over 5 days, recommends increasing tests to 2500-5000/day. The teams asked to explain methodology used by ‘Committee of Doctors’ in West Bengal to ascertain death due to #COVID19 and also if it is in line with ICMR guidelines.

02:49 PM

Two more patients cured in Chandigarh; recovery count at 30

Two COVID-19 patients were discharged from the All India Institute of Medical Sciences (AIIMS) in Chhattisgarh's Raipur city on Friday after recovering from the infection, a health official here said. So far, 30 COVID-19 patients have recovered in the state, which has not reported any new case in the last one week, the official said. "Two men from Katghora town in Korba district were discharged at around 11.30 am after their results came out negative in two consecutive tests," a public relations officer of the AIIMS here told PTI. As of now, six persons were undergoing treatment in the hospital's isolation ward and were in a stable condition, he added. Located around 200 km from the state capital Raipur, Katghora has emerged as the COVID-19 hotspot in the state, with 27 cases reported so far there.

02:44 PM

Rahul Gandhi attacks Centre on suspending DA

The decision to suspend the DA of central government employees and pensioners serving the public, instead of suspending the bullet train project or the beautification of the central vista by the government is condemnable.

Rahul Gandhi

✔

@RahulGandhi

लाखों करोड़ की बुलेट ट्रेन परियोजना और केंद्रीय विस्टा सौंदर्यीकरण परियोजना को निलंबित करने की बजाय कोरोना से जूझ कर जनता की सेवा कर रहे केंद्रीय कर्मचारियों, पेंशन भोगियों और देश के जवानों का महंगाई भत्ता(DA)काटना सरकार का असंवेदनशील तथा अमानवीय निर्णय है।https://aajtak.intoday.in/story/centre-stops-da-installment-for-govt-employees-pensioners-may-save-above-1-lakh-crore-tutk-1-1183766.html …

DA पर कैंची: 1.20 लाख करोड़ की होगी बचत, मजबूत होगा सरकारी खजाना

कोरोना वायरस महामारी का असर अब सरकारी कर्मचारियों पर भी पड़ने लगा है. इसी के तहत सरकार ने महंगाई भत्ते की बढ़ोतरी पर रोक लगा दी है.

aajtak.intoday.in

3,916

11:08 AM - Apr 24, 2020

Twitter Ads info and privacy

2,042 people are talking about this

02:42 PM

IIT professor develops software to detect COVID-19 within 5 seconds using X-ray scan

An IIT-Roorkee professor claims to have developed a software which can detect COVID-19 within five seconds using X-ray scan of the suspected patient. The professor, who took over 40 days to develop the software, has filed a patent for the same and has approached the Indian Council of Medical Research (ICMR) for a review Kamal Jain, a professor at the institute's civil engineering department, claims that the software will not only reduce testing costs but will also reduce the risk of exposure to healthcare professionals. So far, there is no verification of his claim by a medical institution. "I first developed an artificial intelligence-based database after analysing over 60,000 X-ray scans, including those of COVID-19, pneumonia and tuberculosis patients to differentiate between the kind of chest congestion suffered in the three diseases. I also analysed the chest x-ray database of the United States' NIH Clinical Center," Jain told PTI.

02:37 PM

Deep Dive with AKB - Oil's great slide: What this means for India

The oil market recently saw something that it had never seen before. For the first time in history, the prices slid to less than zero on 20th April. Because of a supply glut in the wake of the global coronavirus crisis, and a demand slump, US crude oil futures collapsed to less than $38 per barrel. Desperate traders were paying to get rid of oil. So much so that President Donald Trump had to intervene and announce that the US would add 75 million barrels to its strategic petroleum reserves. The Organization of the Petroleum Exporting Countries (OPEC), also stepped in along Russia and other allies, and announced a cut in production. Listen to BS Podcast Here

02:33 PM

44 fresh cases & three deaths have been reported in Rajasthan today

44 fresh cases & three deaths have been reported in Rajasthan today, taking total number of cases & deaths to 2008 & 31 respectively in the State: Rajasthan Health Department

02:28 PM

PM Modi speaks to his Singapore counterpart

Prime Minister Narendra Modi had a telephone conversation with Lee Hsien Loong, Prime Minister of Singapore on yesterday. The two leaders exchanged views on the health and economic challenges posed by the #COVID19 pandemic: Prime Minister's Office (PMO)

02:23 PM

Goa govt to provide thermal guns to industries

Goa Chief Minister Pramod Sawant on Friday said the government will provide all necessary infrastructure, including thermal guns and screening devices, to industries to fully resume their operations in the state. The Goa government granted conditional permits to industrial estates in the state, which have started operating in phases since April 20, after all COVID-19 patients in the state had recovered. Industries should take proper precautions in order to prevent the spread of the disease, Sawant said, adding that it was mandatory for all industrial compounds to use thermal guns for screening at their entrances. "Employees will be allowed to return to work only after getting their temperature checked," he said.

02:20 PM

Man commits suicide after being quarantined in MP

A 30-year-old farm labourer who was quarantined at a school in Madhya Pradesh's Sidhi district, allegedly committed suicide, police said on Friday. The man, who belongs to the Baiga tribe, was found hanging from a tree near the quarantine facility at Dubri Kala village, some 80 km from the district headquarters, on Thursday, superintendent of police R S Bevanshi said. As per preliminary investigation, the man did not wish to be kept in isolation and wanted to be with his children. The deceased, along with 21 other farm labourers, had returned to the village after harvest from neighbouring Sagar district amid the COVID-19 lockdown on Wednesday, the official said.

02:16 PM

India may see second wave of COVID-19 outbreak in monsoon, say scientists

The trajectory of COVID-19 cases could have plateaued and might even fall for some weeks after the lockdown is lifted but India is likely to see a second wave in late July or August with a surge in the number of cases during the monsoon,say scientists. The timing of the peak will depend on how India is able to control physical distancing and on the level of infection spreads after restrictions are relaxed, they said. It looks apparentthat the trajectory of daily new cases has reached a plateau and eventually it will take a downward fall, maybe for some weeks or even months, Samit Bhattacharya, associate professor at the Department of Mathematics, Shiv Nadar University, told PTI. Still, we may get a surge of new cases of the same coronavirus and this will be considered a second wave,Bhattacharya explained.

Health workers work on samples of swab test of police personnel inside a Covid-19 testing mobile van. Photo: PTI

Health workers work on samples of swab test of police personnel inside a Covid-19 testing mobile van. Photo: PTI

02:10 PM

At least 40 healthcare staff at AIIMS under self-quarantine

At least 40 healthcare staff including doctors, nurses and paramedics posted at gastroenterology department of AIIMS are under self-quarantine after a 35-year-old male nurse detected positive for COVID19. This has been done as a precautionary measure, and after 5 days all 40 healthcare staff would be tested for #COVID19. Contact tracing is being done: AIIMS authorities

0 notes

Text

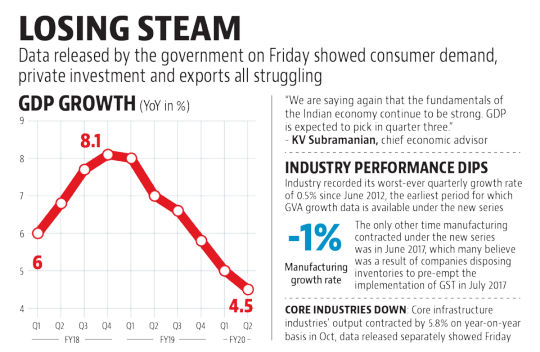

India’s GDP growth falls to 4.5%, lowest in 6 years - india news

India’s economy grew 4.5% in the July-September quarter (the second quarter of fiscal 2019-20), the slowest pace of expansion since March 2013, hurt by inadequate revival in consumption and stagnant investment, with only strong government spending preventing an even steeper slowdown. The latest numbers mark the longest continuous deceleration in gross domestic product (GDP) growth, which has been slowing for six straight quarters. Top officials of the finance ministry said the worst was over and the economy will grow faster in the last two quarters of the current financial year, although high-frequency indicators and anecdotal accounts are yet to reflect this. The index of eight core sector industries contracted by 5.8% on a year-on-year basis in October. This is the second consecutive monthly contraction after September, when the index shrank 5.1%. Crop destruction due to excess rains in the past month might adversely affect agricultural growth in the third quarter. Friday’s numbers put India’s GDP growth in the first half of the current fiscal year at 4.8%, the lowest since the new GDP series was launched in 2012-13. Addressing reporters immediately after announcement of the GDP numbers, Department of Economic Affairs (DEA) secretary Atanu Chakraborty and chief economic adviser (CEA) KV Subramanian said the country’s economic fundamentals were strong, and that consumption and investment were expected to pick up in the subsequent quarters.“The economy has bottomed out,” Chakraborty said, adding that the fundamentals of the Indian economy were very strong, as reflected in factors such as “low inflation, macro-economic stability, low fiscal deficit and good foreign reserves”.

Rumki Majumdar, economist, Deloitte India, an audit firm, agreed: “Compared to the past four slowdown cycles, several economic fundamentals are in much better shape today. Inflation is low and is expected to remain so because of the excess capacity in the economy.” Earlier this week, finance minister Nirmala Sitharaman indicated as much in Parliament. On Thursday, she put out a series of tweets highlighting her government’s record at keeping inflation under control, growing manufacturing faster, and maintaining the fiscal health of the economy. “Marcroeconomic fundamentals of India are strong under the Narendra Modi led NDA government,” she tweeted.Sitharaman said in Parliament earlier this week that the government had taken 32 measures to address issues faced by the various sectors. These include a cut in corporate taxes, a real estate fund aimed at reviving incomplete projects, the merger of banks, and a large-scale disinvestment exercise. The low GDP growth numbers provoked an immediate attack by the opposition. “The economy has been pushed into a coma by the BJP, the Prime Minister, and the Finance Minister,” Congress spokesperson Randeep Singh Surjewala told reporters. “Lowest GDP growth in 26 quarters! No answers from FM....”, All India Trinamool Congress MP Derek O’Brien said. The GDP growth is 50 basis points lower than what it was in the April-June quarter. One basis point is one hundredth of a percentage point. Both figures are the lowest since March 2013, when GDP growth plummeted to 4.3%. Gross Value Added (GVA), which actually measures the value of goods and services produced in the economy, was 4.3% in the quarter ended September, the lowest in the current GDP series. In terms of sector-wise performance, industry recorded its worst ever quarterly growth rate of 0.5% since June 2012, the earliest period for which GVA growth data is available under the new series. Manufacturing contracted by 1%. The only other time manufacturing contracted under the new series was in June 2017, which many believe was a result of companies disposing of inventories to pre-empt the implementation of the Goods and Services Tax (GST) in July 2017. Service sector growth fell to 6.8%, the lowest since 5.3% in March 2014. Private Final Consumption Expenditure, which accounts for more than 50% of GDP, made a recovery in the quarter, growing at 5.1% from 3.1% in the first quarter, although some experts said that on-ground evidence of rising exception is patchy. Gross Fixed Capital Formation, a measure of investment by firms, only grew at 1%, the lowest since December 2014, when it grew at 0.8%. The other major takeaway from the latest GDP numbers is a collapse in the nominal growth rate. Nominal GDP growth was only 6.1% in the quarter, the lowest since March 2009, when it crashed to just 5.6%. Nominal GDP growth was 8% in the first quarter. Nominal growth rates form the basis of tax estimates in the budget, as taxes are a proportion of nominal rather than real GDP. This year’s budget assumed 12% growth in nominal GDP for the current fiscal year. The nominal GDP numbers might continue to be grim even in the third quarter, as the GDP deflator – difference between growth at current and constant prices – seems to be following the Wholesale Price Index (WPI) rather than the Consumer Price Index (CPI). CPI and WPI growth in the quarter was 3.5% and 0.9% respectively. The GDP deflator in the September quarter was 1.5 percentage points. These two inflation metrics have diverged even further, with the WPI going down and the CPI increasing. A massive shortfall in nominal GDP growth, a reduction in corporate tax rates -- according to the government’s estimates this will lead to a revenue loss of ~1.45 lakh crore -- is bound to create a major disruption in this year’s fiscal math. GST collections have been less than Rs.1 lakh crore for more three consecutive months ending October. Reuters reported on Friday that India’s April to October fiscal deficit had already crossed the entire year’s budget target. Earlier this week, the government extended the tenure of the 15th Finance Commission – a constitutional body which prepares the roadmap for sharing of resources between Centre and the states every five years – by another year. Growing uncertainly around revenue collections will only complicate the Finance Commission’s tax math. Economists said the numbers are worrying. “Manufacturing growth has turned negative, core sector industry index is contracting by 6% -- these are signs of a serious crisis of production in the economy”, said Himanshu, an associate professor of economics at Jawaharlal Nehru University. Spiralling food inflation and growing concern about the economy will only make things worse, and complicate a recovery, unless the government does something, he added.Another expert said the poor GDP number for the second quarter was expected and strong policy measures are required to boost the sagging economy. Ranjen Banerjee, leader of the public finance and economics practice at PwC India, an audit and consulting firm, said it was clear that monetary interventions are not working -- RBI has cut rates by 1.35 percentage points this year -- and called for a fiscal stimulus in “areas with higher multipliers and where spends could be immediate” and a “monetary policy push to address the effective transmission of rate cuts to the NBFCs ”. He also emphasised the importance of revival in rural demand to “avert a 5% annual growth rate”. Majumdar, however, expressed the belief that things will be better in the coming quarters. He pointed to the slew of measures taken by the government and said their impact will be felt with a lag. Former Prime Minister Manmohan Singh, however, sought to link the slowdown to what he termed the “state of society”. Speaking at a seminar in Delhi, he said the GDP growth rate of 4.5% was unacceptable and worrisome. “Aspiration of our country is to grow at 8-9%. The sharp decline of GDP from 5% in Q1 to 4.5% in Q2 is worrisome. Mere changes in economic policies will not help revive the economy,” he said. “We need to change the current climate in our society from one of fear to one of confidence for our economy to start growing at 8% per annum. The state of the economy is a reflection of the state of its society. Our social fabric of trust and confidence is now torn and ruptured,” he added

Source link

Read the full article

0 notes

Text

10 To Watch : Mayor’s Edition 9919

RICK HORROW’S TOP 10 SPORTS/BIZ/TECH/PHILANTHROPY ISSUES FOR THE WEEK OF SEPTEMBER 9 : MAYOR’S EDITION

with Jacob Aere

1. NFL Network rolls out centennial celebrations on air. Thursday marked an historic occasion as the NFL's 100th season got under way with the 2019 NFL Kickoff. NFL Media has been building up to the occasion with a slate of NFL Network series and specials that celebrate the “memories, moments and people that have made the NFL an iconic brand for 100 seasons.” The league announced that “NFL 100 Greatest” and “NFL 100 All-Time Team” would be serving as the anchor series for the full lineup of NFL 100 programming, with additional series “NFL 100 Roundtables” and “NFL 100 Sessions” also showcased across the network this fall. NFL 100 Greatest debuts September 13, rolling out over 10 weeks with two one-hour episodes airing back-to-back every Friday night. NFL Films conducted more than 400 interviews with celebrities, current NFL stars, and legends that will air across 20, one-hour episodes. “NFL 100 Roundtables” debuts September 27 as a special eight-part series that connects some of the greatest to play the game by position. It’s also worth noting that Thursday’s NFL season kickoff on NBC scored 22 million viewers, a 16% jump over last year.

2. Nearly one-quarter of adults in the United States say they would bet on an NFL game this season if it were legal in their state, according to a recent survey commissioned by the American Gaming Association. An online poll conducted for the gambling trade association by Morning Consult last month found that 24% of adults would bet if they could do so legally, while 39% of avid NFL fans plan to bet on a game this season, legally or not. The survey also drew the now familiar correlation between betting and engagement. Three-fourths of NFL bettors said they are more likely to view a game when they wager on it, while 51% said they are more likely to watch pregame shows if they intend to bet. Based on the survey, the AGA projects that 38 million American adults will bet on NFL games this season – and you can bet the league will continue to monitor this scenario very closely.

3. Buffalo Wild Wings moves toward the sports gambling world alongside MGM. According to USA Today, the two giants released a mobile football game designed to let customers pick favorite NFL teams, choose weekly fantasy performers and make proposition picks. The name of the partnership is called Roar Digital, and it tries to offer a sports betting-style experience beginning with a free-to-play football game. Odds and point spreads will appear on screens at select Buffalo Wild Wings. The long term goal is to have Buffalo Wild Wings expand in states where sports betting is legal through a mobile app called BetMGM. Although there won’t be cash bets at first, players can win prizes such as trips to Las Vegas or to the Borgata casino in New Jersey to compete in the first BetMGM sports betting competition. This partnership looks to capitalize on the casual gamer and new sports bettors – a route that may find success on the back of Buffalo Wild Wings’ 1,200 restaurants across 10 countries, with abundant clientele to test the new venture.

4. Spaniard Rafael Nadal won the 2019 U.S. Open and his 19th Grand Slam title. Canadian Bianca Andreescu won her first Open and first Slam respectively. Both singles winners took home $3.85 million paychecks. But those winnings are a mere blip to the cash cow tennis tournament. According to Hashtag Sports, in 2018, the two-week-long U.S. Open generated $65 million in sponsorship deals alone. Tickets and broadcasting pulled in $120 million each; while concessions added $30 million. And in 2019, the annual tournament, put on by the nonprofit USTA, was on target to have the biggest year in its 51-year history. The U.S. Open is evolving, and becoming more brand-friendly, by design, and tennis is reaching a global audience at an unprecedented scale. The sponsors on the ground at Billie Jean King Tennis Center reflect the global appeal of the sport. Heineken is the official beer, not a domestic brew. Rolex replaced Citizen as the official timekeeper. Emirates is the official airline. And the spacious newly-renovated facility attracted 737,872 spectators this year, an all-time attendance record. If you build it, the brands, and the fans, will come.

5. Disney has completed the sale of its 80% stake in the YES Network for $3.47 billion to an investor group comprising the New York Yankees, Sinclair Broadcast Group, and Amazon. Sinclair acquired a majority stake in the YES Network as part of its $71.3 billion purchase of Fox assets in 2017, though it had to divest the property due to a Department of Justice order last summer, along with 21 other RSNs purchased by Sinclair for $10.6 billion. The YES Network, of which the Yankees already own a 20% share, broadcasts Yankees games and also those of the Brooklyn Nets. An announcement made by all parties on August 29 confirmed the transaction, which brings an end to a year of negotiations between Disney and prospective buyers for the 22 Fox RSNs. The networks were originally valued in the region of $20 billion, though have been sold for just over $14 billion. For Sinclair, the deal adds to its portfolio or regional sports rights while Amazon continues its push into sports broadcasting.

6. Oracle launches a new series of lower-tier professional tennis tournaments across the U.S. As the American leg of the global pro tennis circuit drew to a close, Larry Ellison’s company announced the Oracle Pro Series, comprising approximately 25 new women’s tournaments and 25 new men’s tournaments, with the intention of providing American players with a better route to the top-tier ATP and WTA tours. Most of the tournaments will be staged as combined events, with equal prize money and many will take place on college campuses. The prize funds will range from $25,000 to $108,000 per competition. Crucially, according to the New York Times, ATP and WTA ranking points will be up for grabs at each of the tournaments, which will enable players to step up to tennis’ elite men’s and women’s circuits. The new series is to be managed by InsideOut Sports & Entertainment, the New York-based event production company founded by former World Number One player Jim Courier. Seven combined events will take place later this year in California, Florida, and Texas before the series begins in full next year.

7. Cleveland Indians pitcher Carlos Carrasco will donate $200 per strikeout for the rest of the season to childhood cancer research after just beating cancer himself. According to CBS Sports, Carrasco returned to the mound on September 3 for the first time since May 30 after he was diagnosed with leukemia. On top of being celebrated by his teammates for such a healthy and quick return, Carrasco came up with the new charity name to support his childhood cancer research: Punch Out Cancer with Cookie. As September is Childhood Cancer Awareness Month, it is only appropriate that Carrasco announced his charity during the final month of MLB’s regular season. Further, New Balance and other MLB partners play a role in donations to fight childhood cancer. The sporting goods company will even match donations made on punchoutcancerwithcookie.com to St. Jude Children's Research Hospital up to $200,000. After defeating his own form of cancer, it seems Carrasco isn’t taking any moment for granted and is already giving back to those similarly afflicted.

8. Former NFL player Mike Brown is using gaming as a way to modernize philanthropy. According to Black Enterprise, the former Colts linebacker created Win-Win after he observed an overall decline in the number of people donating to charity. Win-Win tackles this problem to help pro athletes, entertainers, and anyone with influence activate their fans to support causes they care about through games in which users pick winners for upcoming sporting events. After making picks, users donate to enter the competition and unlock unique perks and prizes like dinner with their favorite athlete – the activity becomes a mixture of gambling and philanthropy for a charity cause. To push his company to the next level, Brown recently launched an equity crowdfunding campaign for Win-Win to allow for fan investments. After exceeding his initial fundraising goal, he is now building the platform and launching new partnerships. By leveraging star power and the newest forms of technology into philanthropy, Brown looks to be a leader in sports philanthropy.

9.From an agency perspective, the NFL is moving in the right direction. Rick recently sat down with Arnold Wright, Executive Vice President and co-head of consulting for Octagon. Wright brings NFL team, league, and player deals to life for sponsors including Castrol, Delta, Bank of America, and others. “The league is obviously an incredible platform that leaps up year to year in terms of ratings and engagement,” Wright said. “The on field action is also as good as it’s ever been.” From a global perspective, Wright says, “The international piece in particular has been great for the league. You continue to see key markets like the UK, Mexico, and even Brazil growing internationally. It’s bringing other brands into the NFL ecosystem from a partner and promotional perspective.” As for the NFL’s 100th season platform, Wright says, “The league has done a lot of really great work in terms of positioning themselves, celebrating the history of the league from a player and a fan perspective. They have demonstrated a real savviness around their marketing and their connectivity to fans. The league several years ago probably would not have demonstrated that level of flexibility in terms of their marketing and what you could do with their platforms. But that’s certainly changed.”

10. The new Roc Nation and NFL partnership will donate $400,000 to Chicago charities. The two charities that will receive the support are the Better Boys Foundation Family Services organization and the Crusher’s Club. According to Variety, both groups are designed to present local at-risk youth with alternatives to gang violence and criminal activity. The donation is attached to a free concert in a “Songs of the Season” series that featured Meek Mill, Meghan Trainor, and Rapsody in Chicago. The three performers, along with Chicago rapper Vic Mensa, will visit the programs this week. The event is the first in a planned Inspire Change series that will make similar donations in each NFL city. Songs of the Season is an initiative that will run throughout the season in which selected musicians will create and deliver a song to be integrated in all NFL promotions each month and their songs’ proceeds will go toward Inspire Change. Although Jay-Z took heat for partnering with the NFL, it seems that through his collaboration he will be able to make a large impact on social injustices.

0 notes

Text

Swedish Academy to reform after controversy postpones Nobel prize

STOCKHOLM (Reuters) – The Swedish Academy which decides the Nobel Prize for Literature said it would not make an award in 2018 and instead focus on internal reforms to restore its reputation in the wake of allegations of sexual harassment and information leaks.

FILE PHOTO: A general view of the Swedish Academy’s annual meeting at the Old Stock Exchange building in Stockholm, Sweden December 20, 2017. TT News Agency/Jonas Ekstromer via REUTERS/File Photo

The scandals have threatened to undermine the credibility of the award and attracted unprecedented scrutiny of the Academy, a highly secretive body whose choices of prize winner fascinate and often baffle literature lovers the world over.

Below are key elements of the controversy and its consequences.

WHAT SPARKED THE CRISIS?

At heart of the row are allegations of sexual assault and harassment made by several women against Jean-Claude Arnault, a photographer and well-known cultural figure in Sweden who is married to poet and Academy member Katarina Frostenson.

He is also accused of leaking prize-winners’ names ahead of their official announcement, a major cultural event which is covered each year by the world’s media.

Arnault denies all the allegations against him, including that of being the source of leaks, his lawyer said.

State prosecutors are conducting a preliminary investigation of assault allegations against Arnault. Another such investigation, regarding alleged assaults dating between March 2013 and April 2015, was dropped last month due to a lack of evidence and because for some the statute of limitations had passed.

The allegations made by 18 women against Arnault were first published in Swedish newspaper Dagens Nyheter in November. The same paper also reported that the Academy had carried out an internal investigation alleging that Arnault had leaked the closely-guarded names of Nobel prize winners on seven different occasions.

The paper said these included Bob Dylan in 2016 as well as French author Jean-Marie Gustave Le Clezio in 2008 and British playwright Harold Pinter in 2005.

The Swedish Academy last month acknowledged that names had been leaked though it did not specify which laureates this concerned nor who was the source of the leaks.

WHY DID THE CONTROVERSY CAUSE A RIFT IN THE ACADEMY?

After cutting ties with Arnault, the Academy held a vote on whether to exclude Frostenson from the body for allegedly breaching conflict of interest rules and divulging names of prize winners to her husband, who could then leak them.

The motion failed, with Frostenson allowed to stay, prompting three of the Academy’s 18 members to resign in protest. In the following weeks another three, including the Permanent Secretary of the Academy, Sara Danius and Frostenson herself, also withdrew.

Eight Academy members said in an open letter to a newspaper that they had voted against excluding Frostenson on the grounds that the evidence, some of it from anonymous sources, was insufficient.

Frostenson has so far not commented publicly on the vote and accusations against her. She did not respond to a request for comment on Friday.

WHAT REFORMS ARE UNDERWAY?

Sweden’s king has stepped in to drive reforms of the Swedish Academy, established in 1786 by his forebear Gustav III and of which he is the formal patron.

Appointments to the Academy have been for life and there has been no formal provision under the arcane rules for members to resign. That has meant those who withdrew could not be replaced.

This week, King Carl XVI Gustaf revised the Swedish Academy’s rules to allow members resign. The change also means that members who have not participated in the Academy’s work for two years will be considered to have resigned.

Other changes are likely in store. In connection with its decision to postpone the prize, the Swedish Academy said it had begun a wide-ranging project to alter the way it conducted its business while still seeking to respect its historic legacy.

Besides the right to resign, procedures for handling conflicts of interest and secret information would be strengthened while its external communication would also be modernized, it said in a statement.

“The active members of the Swedish Academy are of course fully aware that the present crisis of confidence places high demands on a long-term and robust work for change,” it said.

WHAT ARE THE CONSEQUENCES?

The Academy took the rare decision to postpone the 2018 Nobel literature prize to next year, meaning it will award two prizes in 2019.

The prize has been postponed or canceled only a handful of times, for instance during World War Two. The most recent postponement was the award to American novelist William Faulkner, who received his 1949 prize a year late, in 1950.

The biggest risk by far is to the reputation of the prize, which has come to be seen as one of the most important international honors in the field of literature.

The Nobel Foundation, which administers the estate of dynamite inventor Alfred Nobel, said the crisis at the Academy had “adversely affected” the Nobel Prize.

“Their decision underscores the seriousness of the situation and will help safeguard the long-term reputation of the Nobel Prize,” the Foundation said in statement.

Reporting by Niklas Pollard, Simon Johnson and Johan Sennero; Editing by Raissa Kasolowsky

The post Swedish Academy to reform after controversy postpones Nobel prize appeared first on World The News.

from World The News https://ift.tt/2rjl88K

via Today News

0 notes

Link

The benchmark indices settled around 2 per cent lower on Monday following a sell-off in the global markets and due to uncertainty over the outcome of state assembly elections, due on Tuesday.

Exit polls, which came on Friday, predicted a tight finish between the Bharatiya Janata Party (BJP) and the Congress in Madhya Pradesh and Chhattisgarh and a win for the opposition party in Rajasthan. READ MORE HERE

The S&P BSE Sensex ended at 34,960, down 714 points or 2 per cent, while the broader Nifty50 index settled at 10,488, down 205 points or 1.92 per cent.

Among sectoral indices, the Nifty Bank index settled 1.9 per cent lower weighed by Axis Bank, Punjab National Bank and ICICI Bank. The Nifty IT index, too, fell 1.7 per cent dragged by Infibeam Avenues, Infosys and Tata Consultancy Services (TCS).

In the broader market, both the S&P BSE Midcap index and S&P BSE SmallCap index settled 1.8 per cent lower each to 14,446 and 13,846 levels respectively.

Weak rupee

The rupee traded on a weak note slipping to 71.44 against the US dollar in intra-day trade on Monday, down from its previous close of 70.82.

Global Markets

Losses in global stock markets snowballed on Monday, with US equity futures and Asian shares sliding on worries over slowing growth and fears that a rise in tensions between Washington and Beijing could torpedo chances of a trade deal.

MSCI’s broadest index of Asia-Pacific shares outside Japan slid 1.5 per cent to a near three-week low. The Shanghai Composite Index retreated 0.6 per cent. Australian stocks lost 2.2 per cent, brushing the lowest level since December 2016, and South Korea's KOSPI fell 1 per cent. Japan's Nikkei shed 2.1 per cent.

Oil Prices

Brent crude oil rose on Monday after producer club OPEC and some non-affiliated suppliers last Friday agreed to a supply cut from January.

International Brent crude oil futures were at $62.02 per barrel, up 35 cents, or 0.6 per cent, from their last close. US West Texas Intermediate (WTI) crude futures were weaker, however, dropping 12 cents from their last settlement to $52.59 per barrel, weighed by surging US output as the booming American oil industry is not taking part in the announced cuts.

(With Reuters input)

CATCH ALL THE LIVE UPDATES

03:48 PM

Sectoral losers of the day on NSE

03:46 PM

BSE Sensex: gainers and losers of the day

03:33 PM

Market at close

The S&P BSE Sensex ended at 34,960, down 714 points or 2 per cent, while the broader Nifty50 index settled at 10,488, down 205 points or 1.92 per cent.

03:14 PM

Gold futures weaken to Rs 31,557 per 10 gram

Gold prices fell Rs 38 to Rs 31,557 per 10 gram in futures trade Monday as speculators reduced exposure despite a firm trend in the precious metal overseas. At the Multi Commodity Exchange, gold for delivery in February next year traded lower by Rs 38, or 0.12 per cent, to Rs 31,557 per 10 gram in a business turnover of 14,809 lots. READ MORE

03:10 PM

NEW FUND OFFER

Aditya Birla Sun Life AMC Limited (formerly known as Birla Sun Life Asset Management Company Ltd.), a subsidiary of Aditya Birla Capital Limited (formerly known as Aditya Birla Financial Services Ltd.), and investment manager to Aditya Birla Sun Life Mutual Fund (ABSLMF) announced the launch of Aditya Birla Sun Life Nifty Next 50 ETF (“the ETF”), an open ended scheme tracking Nifty Next 50 Index. The ETF offers investors an opportunity to invest in the next rung of 50 stocks below Nifty 50. The ETF will hold all the securities forming the Nifty Next 50 Index in the same proportion of the index.

The new fund offer would open for subscription on December 11, 2018 and would close at the end of business hours on December 17, 2018. The ETF will reopen for continuous sale and repurchase within five business days from the date of allotment. The investment objective of the scheme is to provide returns that closely correspond to the total returns of securities as represented by Nifty Next 50 Index, subject to tracking errors

(Source: Company release)

02:58 PM

SoftBank's blockbuster IPO reaches $23.5 billion after extra share sale

SoftBank Corp priced its initial public offering (IPO) at 1,500 yen per share and will sell an extra 160 million shares to meet solid demand, a regulatory filing showed, raising 2.65 trillion yen ($23.5 billion) in Japan's biggest-ever IPO. That makes the share sale one of the largest of all time globally, just shy of the record $25 billion that Chinese e-commerce firm Alibaba Group Holding Ltd raised in 2014. Read more

02:50 PM

Brent oil rises after deal to cut supply, but 2019 outlook weakens

Brent crude oil futures rose on Monday after producer club OPEC and some non-affiliated suppliers last Friday agreed to a supply cut from January. Despite this, the price outlook for next year remains muted on the back of an economic slowdown. International Brent crude oil futures were at $62.03 per barrel, up 36 cents, or 0.6 per cent, from their last close. Read more

02:40 PM

Nifty Financial Service index is trading 2% lower

02:21 PM

Stocks that touched 52-week low on BSE500

COMPANY LATEST 52 WK LOW PREV LOW PREV DATE VOLUME

ADVANCE. ENZYME. 167.25 165.00 166.10 09-OCT-2018 13061

AMARA RAJA BATT. 695.10 683.30 688.00 06-DEC-2018 16113

ASHOK LEYLAND 100.25 97.70 101.20 06-DEC-2018 1179392

B H E L 63.90 63.55 64.40 07-DEC-2018 665309

BAJAJ CORP 343.90 341.10 342.00 29-OCT-2018 2074

BALKRISHNA INDS 885.20 853.45 882.00 07-DEC-2018 50612

BHARAT FORGE 504.00 489.40 502.05 07-DEC-2018 80145

CIPLA 512.20 503.95 508.10 22-MAY-2018 63640

COAL INDIA 236.10 228.50 236.55 07-DEC-2018 233847

DEEPAK FERT. 138.25 135.85 141.25 07-DEC-2018 36390

Click here to read more

02:16 PM

Jet Airways extends fall as ICRA downgrades credit rating

Shares of Jet Airways have slipped 6% to Rs 258 on Monday, extending its previous week’s 10% decline, after the rating agency ICRA on Friday downgraded cash-strapped airline's long-term ratings from 'B' to 'C', the second such action by it since October. The short-term ratings have, however, been reaffirmed to 'A4'. Jet Airways, the largest loser among aviation stocks, as compared to a 3% fall in SpiceJet and 2% decline in InterGlobe Aviation at 01:40 pm. In comparison, the S&P BSE Sensex was down 1.5% at 35,141 points. Read more

02:02 PM

S&P BSE Sensex top gainers and losers

01:49 PM

How will the state poll outcome impact the market sentiment on Tuesday?

We firmly believe that the results of state elections, which would be declared on Tuesday (11th December), do not matter much for the stock markets. There may be a knee-jerk reaction in the markets depending upon the outcome, but it shouldn’t give any fear for the markets for two reasons. Firstly, the objectives of state elections are different from those of general elections. While state elections are generally influenced by anti-establishment waves and local political issues, the elections for the Lok Sabha are largely fought for all-India leadership. Click here to read more

01:37 PM

Realty stocks crack

COMPANY NAME LATEST HIGH LOW CHG

() CHG(%) VALUE

( CR) VOLUME

NBCC 49.25 51.95 48.00 -2.65 -5.11 2.87 583000

UNITECH 2.09 2.20 2.09 -0.10 -4.57 0.05 260429

INDBULL.REALEST. 71.70 73.35 70.70 -3.55 -4.72 1.45 202734

H D I L 20.50 21.05 20.25 -0.85 -3.98 0.40 196604

DLF 166.75 169.70 165.00 -5.80 -3.36 2.59 155540

CLICK HERE FOR MORE

01:35 PM

Top losers today

COMPANY PRICE() CHG() CHG(%) VOLUME

INFIBEAM AVENUES 40.65 -3.75 -8.45 2141100

NLC INDIA 69.40 -5.95 -7.90 133405

INDIABULLS VENT. 339.45 -27.40 -7.47 39697

ADANI POWER 48.90 -3.55 -6.77 672642

KOTAK MAH. BANK 1204.25 -78.00 -6.08 772231

» More on Top Losers

01:34 PM

Morgan Stanley bets on emerging markets

Our thesis is that EMs have maintained a favourable domestic policy mix and, with external headwinds receding, growth will be well supported even as DM growth slows. The growth differential will therefore swing back in EMs’ favour.

Risks to outlook: The risks to the outlook are four-fold: (1) A repeat of 2018 with USD strength, (2) US recession triggered by corporate credit risks, (3) trade tensions and (4) political risks in EM.

The corporate logo of financial firm Morgan Stanley is pictured on the company's world headquarters in New York, New York January 20, 2015. REUTERS The corporate logo of financial firm Morgan Stanley is pictured on the company's world headquarters in New York, New York January 20, 2015. REUTERS

01:32 PM

Centrum on Kirloskar Ferrous

Kirloskar Ferrous (KFIL) won another iron ore mine in the Karnataka e-auctions which is a long term positive event for the company as this provides i) ~70% captive integration (on combined basis with previous mine) for pig iron business, ii) close proximity of mines to KFIL plant, iii) cost savings v/s open market purchase and iv) improved efficiency due to better value in use.

We remain positive on KFIL’s prospects as it features i) increasing share of high-margin casting business which has spare capacity, ii) cost efficiencies from upcoming low-payback projects albeit slightly delayed, iii) an enviable cash flow generation track record coupled with strong balance sheet. We expect strong earnings growth during FY18-20E driven by castings volume CAGR of 20%. Maintain Buy with target price of Rs140.

01:31 PM

Elara Capital on HCL Tech

We reiterate Buy and revise our estimates for IBM products acquired. We increase INR revenue by 1.1% for FY19E and 2.8% each for FY20E & FY21E. We hike EBITDA margin by 44bp, 117bp and 170bp for FY19E, FY20E and FY21E, respectively expecting improved gross margin from the products portfolio. We arrive at a new target price of Rs 1,330 from Rs 1,360 on 15x (unchanged) FY20E P/E.

We continue to expect a rerating as concerns over IMS portfolio and IP investments recede and expect this to be visible by 3QFY20 (seasonally the strongest quarter for IBM software).

01:30 PM

MARKET COMMENT Kotak Securities

In our view, a 3-0 (BJP winning Chhattisgarh, Madhya Pradesh and Rajasthan) or 2-1 (BJP winning Chhattisgarh and Madhya Pradesh) score for the BJP may result in a moderate market rally, subject to global developments with the market ascribing a higher probability of the BJP winning the national elections in April-May 2019. However, a 0-3 (BJP losing all the three states) or 1-2 score (BJP losing Madhya Pradesh and Rajasthan) for the BJP may result in a sharp market correction as the market will likely take a dim view of the BJP’s prospects in the next national elections given the large contribution of these three states to the BJP’s 2014 win.

01:24 PM

Web Exclusive Chart check: 10 Nifty stocks that can slip further from the current levels

BHARTI AIRTEL : The stock has been continuously trading below its 200-day moving average (DMA) since March 2018, as per chart patterns. The recent pattern indicates a double-bottom. However, the stock has failed to break out and has been unable to move past the 100-DMA at around Rs 345 – 340 levels.

CIPLA : The stock has seen a consistent sell-off. The technical indicators suggest a negative crossover, which is unlikely to change anytime soon. Click here to read more Markets, Buy, Sell, Stocks, Shares Photo: Shutterstock.com

01:15 PM

NEWS ALERT HDFC Bank hikes base rate by 15 bps to 9.30 per cent w.e.f today

01:09 PM

India's April-November net direct tax mop up rises 14.7 per cent to $77.8 billion

India's direct tax collection grew 14.7 per cent from a year earlier to 5.51 trillion rupees ($77.77 billion) during April to November, the finance ministry said in a statement on Monday. READ MORE

12:54 PM

PFC not to make open offer to REC's minority shareholders after acquisition

Power Finance Company (PFC) will not be required to make an open offer to minority shareholders of REC after buying out the government's 52.63 per cent stake in the company as it is a related party transaction, an official said. READ MORE

12:39 PM

JSW Steel lone stock that's set to end in green among metal indices

While demand for metals has been accelerating as the South Asian nation plans major investments to overhaul its creaking infrastructure, shares of most producers have slumped this year. JSW Steel is the lone stock that’s set to end in the green in the 10-member S&P BSE Metal Index, which lost nearly a quarter of its value in 2018. The index is set for its first annual decline in three years, while the country’s benchmark index is edging toward its third year of gains. The Sajjan Jindal-led mill has risen about 12 percent this year. Read more

12:23 PM

Web Exclusive 4 reasons why the Sensex tanked over 600 points on Monday

The S&P BSE Sensex lost over 600 points, or nearly 2 per cent, in intra-day trade on Monday. The 50-share Nifty, on the other hand, slipped nearly 200 points to test the 10,500 mark. Last week, while the S&P BSE Sensex ended 1.4% lower, the Nifty50 slipped 1.7%. The S&P BSE Mid-cap and the S&P BSE Small-cap indices, too, are trading weak with losses of up to 1.7 per cent each in intra-day deals. India VIX, a gauge of market volatility, climbed 4.6 per cent to 19.44 levels. Click here to read full article

Stock market

12:17 PM

Market check

Index Current Pt. Change % Change

S&P BSE SENSEX 35,162.31 -510.94 -1.43

S&P BSE SENSEX 50 11,030.10 -150.31 -1.34

S&P BSE SENSEX Next 50 30,971.22 -410.68 -1.31

S&P BSE 100 10,776.19 -146.30 -1.34

S&P BSE Bharat 22 Index 3,280.50 -37.84 -1.14

11:59 AM

Ashoka Buildcon up 11% on receipt of LoA from Rail Vikas Nigam

Shares of Ashoka Buildcon rose as much as 11 per cent to Rs 133 apiece on National Stock Exchange (NSE) in intra-day trade on receipt of Letter of Acceptance (LoA) from Rail Vikas Nigam Limited (RVNL) for projects in Bihar and Jharkhand. Read more

11:46 AM

7 Sensex stocks hit 52-week low; Sun Pharma falls 33% in a month

Shares of Coal India, Oil and Natural Gas Corporation (ONGC), NTPC, Sun Pharmaceutical Industries, Tata Motors, Tata Motors DVR and Vedanta were among seven stocks from the S&P BSE Sensex index hitting their respective 52-week lows on the BSE. READ MORE

11:27 AM

Passenger vehicle sales decline 3.43 pc in Nov

Domestic passenger vehicle sales declined 3.43 per cent to 2,66,000 units in November from 2,75,440 units in November 2017.