#market economics

Text

Wow so history really does just run on a 100-year cycle huh. We humans are doomed to make the same mistakes for the rest of time

#first the pandemic#now the titanic#now a coup in Russia????#can history just chill for like a year or two?#how did I forget about all the economic turmoil lol#russia#titanic#oceangate#stock market

11K notes

·

View notes

Text

LeftTards use “Capitalism” the same way grade schoolers use “Gay”

“I don’t like this so CAPITALISM!”

Capitalism can be defined in three words: The market decides.

We don’t have capitalism. The Reaganites murdered it off back in the 1980s. We have “Supply side” or “Trickle down” which is the opposite of capitalism. It’s antithetical. And before we heap all the blame on the Republicans: Obama out Reaganed Ronald Reagan!

Google it, for Christ’s sake...

“Capitalism” is market economics and “Capitalism” REQUIRES sound government regulations.

Think of a farmer’s field. Okay? Plants know how to grow. Leave nature be and an empty field will become overgrown with plants. Left on it’s own it’ll become a forest. Nature needs no help to grow plants.

But we do. If we want to maximize that field, if we want to get food from that field and not weeds... if we want to harvest crops from that field instead of seeing them devoured by insects and other pests... if we want to see those plants flourish instead of dry up & die... we have to regulate that field. We have to stop weeds and other intrusive plants from growing. We have to keep vermin from chewing it all up. We have to water it when the rains fail.

Get it? Nature needs no help to grow plants, but we do. And the same it true for the economy.

Economies exist. They always exist. We don’t need government, we don’t need laws. Trade has existed into cavemen times and it will always exist. It’s if we want to maximize the benefit of the economy, the market. If we want it to remain fair. If we want to be able to hold people accountable for abusing the market THEN we need regulations. We need government.

Capitalism, the free market will stop being free without regulation, just as sure as the farmer’s field will be overrun with weeds & saplings if he fails to regulate it.

We don’t have capitalism. We have the 1%, the corporations, the billionaires and even the millionaires dictating TO THE MARKET, not the other way around.

Our problem is the lack of capitalism. Our solution is the restoration of capitalism.

#Capitalism#market economics#free trade#fair trade#regulation#money#jobs#tax codes#taxes#trickle down#supply side

1 note

·

View note

Text

#communism#communist#socialism#socialist#social issues#economy#finance#markets#business#economics#business news#corrupt gop#democrats are corrupt#governors#alleged#billionaires#billionaire#eat the rich#tax the rich#expensive#wealth#money#luxury

3K notes

·

View notes

Text

#politics#ronald reagan#stock buybacks#capitalism#living wages#republicans#stock market#corporate greed#reaganism#economics#neoliberalism

829 notes

·

View notes

Text

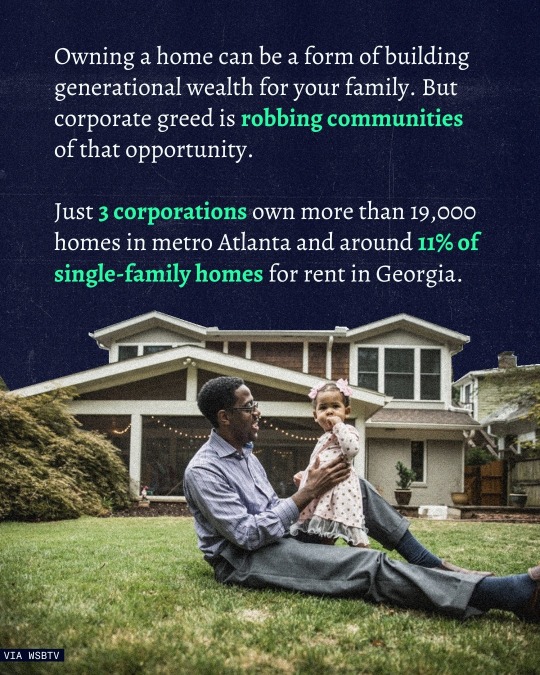

#housing inequality#corporate ownership#home equity#affordable housing#real estate market#wealth disparity#housing crisis#single-family homes#working-class families#corporate landlords#Georgia housing market#property investment#economic disparity#housing affordability#rental market#housing market inequality#corporate real estate#wealth gap#homeownership barriers#housing investment#financial disparity#real estate monopoly#housing affordability crisis#rental housing#economic inequality#property ownership#housing accessibility#corporate influence#affordable homeownership#investment firms in real estate

140 notes

·

View notes

Text

can we stop speedrunning history on repeat, please

#russia#russian coup#ukraine#pandemic#international conflict#economic crash#government corruption#stock market

599 notes

·

View notes

Text

All for the game au where everything is exactly the same but instead of playing exy it's some kind of academic decathlon and they go just as hard. Neil absolutely bodies every math question and Kevin's undefeated in history. Aaron obviously handles everything bio. Andrew is an absolute academic weapon because of his eidetic memory but he doesn't give a single fuck about any of it so he only ever answers questions when no one else knows the answer.

Renee's incredible with religious studies and Allison WRECKS the other teams with anything art/music related. Dan is a chemistry and physics wizard and could probably be building bombs or going to space but instead she's essentially playing team jeopardy. Matt's reign is English because I ran out of subjects and I can imagine him dramatically reading Shakespeare monologues out loud in his free time.

The mafia still exists and so do the Ravens and riko was still trying to build a "perfect court" which I think makes the face tattoo thing funnier because it's just as intense but they're all nerds.

Instead of Neil fangirling over exy racquets he's really impressed by the little buzzer things you push during competitions and the elaborate, color coded flashcard system the Foxes come up with.

#aftg#aftg fandom#all for the game#andrew minyard#neil josten#aftg neil#aftg andrew#aftg funny#aftg au#matt boyd#dan wilds#nicky hemmick#aaron minyard#aftg allison#renee walker#kevin day#Just realized I forgot about Nicky and I guess he would do something technology or business related#maybe economics since he is a marketing#major

550 notes

·

View notes

Text

Big Tech’s “attention rents”

Tomorrow (Nov 4), I'm keynoting the Hackaday Supercon in Pasadena, CA.

The thing is, any feed or search result is "algorithmic." "Just show me the things posted by people I follow in reverse-chronological order" is an algorithm. "Just show me products that have this SKU" is an algorithm. "Alphabetical sort" is an algorithm. "Random sort" is an algorithm.

Any process that involves more information than you can take in at a glance or digest in a moment needs some kind of sense-making. It needs to be put in some kind of order. There's always gonna be an algorithm.

But that's not what we mean by "the algorithm" (TM). When we talk about "the algorithm," we mean a system for ordering information that uses complex criteria that are not precisely known to us, and than can't be easily divined through an examination of the ordering.

There's an idea that a "good" algorithm is one that does not seek to deceive or harm us. When you search for a specific part number, you want exact matches for that search at the top of the results. It's fine if those results include third-party parts that are compatible with the part you're searching for, so long as they're clearly labeled. There's room for argument about how to order those results – do highly rated third-party parts go above the OEM part? How should the algorithm trade off price and quality?

It's hard to come up with an objective standard to resolve these fine-grained differences, but search technologists have tried. Think of Google: they have a patent on "long clicks." A "long click" is when you search for something and then don't search for it again for quite some time, the implication being that you've found what you were looking for. Google Search ads operate a "pay per click" model, and there's an argument that this aligns Google's ad division's interests with search quality: if the ad division only gets paid when you click a link, they will militate for placing ads that users want to click on.

Platforms are inextricably bound up in this algorithmic information sorting business. Platforms have emerged as the endemic form of internet-based business, which is ironic, because a platform is just an intermediary – a company that connects different groups to each other. The internet's great promise was "disintermediation" – getting rid of intermediaries. We did that, and then we got a whole bunch of new intermediaries.

Usually, those groups can be sorted into two buckets: "business customers" (drivers, merchants, advertisers, publishers, creative workers, etc) and "end users" (riders, shoppers, consumers, audiences, etc). Platforms also sometimes connect end users to each other: think of dating sites, or interest-based forums on Reddit. Either way, a platform's job is to make these connections, and that means platforms are always in the algorithm business.

Whether that's matching a driver and a rider, or an advertiser and a consumer, or a reader and a mix of content from social feeds they're subscribed to and other sources of information on the service, the platform has to make a call as to what you're going to see or do.

These choices are enormously consequential. In the theory of Surveillance Capitalism, these choices take on an almost supernatural quality, where "Big Data" can be used to guess your response to all the different ways of pitching an idea or product to you, in order to select the optimal pitch that bypasses your critical faculties and actually controls your actions, robbing you of "the right to a future tense."

I don't think much of this hypothesis. Every claim to mind control – from Rasputin to MK Ultra to neurolinguistic programming to pick-up artists – has turned out to be bullshit. Besides, you don't need to believe in mind control to explain the ways that algorithms shape our beliefs and actions. When a single company dominates the information landscape – say, when Google controls 90% of your searches – then Google's sorting can deprive you of access to information without you knowing it.

If every "locksmith" listed on Google Maps is a fake referral business, you might conclude that there are no more reputable storefront locksmiths in existence. What's more, this belief is a form of self-fulfilling prophecy: if Google Maps never shows anyone a real locksmith, all the real locksmiths will eventually go bust.

If you never see a social media update from a news source you follow, you might forget that the source exists, or assume they've gone under. If you see a flood of viral videos of smash-and-grab shoplifter gangs and never see a news story about wage theft, you might assume that the former is common and the latter is rare (in reality, shoplifting hasn't risen appreciably, while wage-theft is off the charts).

In the theory of Surveillance Capitalism, the algorithm was invented to make advertisers richer, and then went on to pervert the news (by incentivizing "clickbait") and finally destroyed our politics when its persuasive powers were hijacked by Steve Bannon, Cambridge Analytica, and QAnon grifters to turn millions of vulnerable people into swivel-eyed loons, racists and conspiratorialists.

As I've written, I think this theory gives the ad-tech sector both too much and too little credit, and draws an artificial line between ad-tech and other platform businesses that obscures the connection between all forms of platform decay, from Uber to HBO to Google Search to Twitter to Apple and beyond:

https://pluralistic.net/HowToDestroySurveillanceCapitalism

As a counter to Surveillance Capitalism, I've proposed a theory of platform decay called enshittification, which identifies how the market power of monopoly platforms, combined with the flexibility of digital tools, combined with regulatory capture, allows platforms to abuse both business-customers and end-users, by depriving them of alternatives, then "twiddling" the knobs that determine the rules of the platform without fearing sanction under privacy, labor or consumer protection law, and finally, blocking digital self-help measures like ad-blockers, alternative clients, scrapers, reverse engineering, jailbreaking, and other tech guerrilla warfare tactics:

https://pluralistic.net/2023/01/21/potemkin-ai/#hey-guys

One important distinction between Surveillance Capitalism and enshittification is that enshittification posits that the platform is bad for everyone. Surveillance Capitalism starts from the assumption that surveillance advertising is devastatingly effective (which explains how your racist Facebook uncles got turned into Jan 6 QAnons), and concludes that advertisers must be well-served by the surveillance system.

But advertisers – and other business customers – are very poorly served by platforms. Procter and Gamble reduced its annual surveillance advertising budget from $100m//year to $0/year and saw a 0% reduction in sales. The supposed laser-focused targeting and superhuman message refinement just don't work very well – first, because the tech companies are run by bullshitters whose marketing copy is nonsense, and second because these companies are monopolies who can abuse their customers without losing money.

The point of enshittification is to lock end-users to the platform, then use those locked-in users as bait for business customers, who will also become locked to the platform. Once everyone is holding everyone else hostage, the platform uses the flexibility of digital services to play a variety of algorithmic games to shift value from everyone to the business's shareholders. This flexibility is supercharged by the failure of regulators to enforce privacy, labor and consumer protection standards against the companies, and by these companies' ability to insist that regulators punish end-users, competitors, tinkerers and other third parties to mod, reverse, hack or jailbreak their products and services to block their abuse.

Enshittification needs The Algorithm. When Uber wants to steal from its drivers, it can just do an old-fashioned wage theft, but eventually it will face the music for that kind of scam:

https://apnews.com/article/uber-lyft-new-york-city-wage-theft-9ae3f629cf32d3f2fb6c39b8ffcc6cc6

The best way to steal from drivers is with algorithmic wage discrimination. That's when Uber offers occassional, selective drivers higher rates than it gives to drivers who are fully locked to its platform and take every ride the app offers. The less selective a driver becomes, the lower the premium the app offers goes, but if a driver starts refusing rides, the wage offer climbs again. This isn't the mind-control of Surveillance Capitalism, it's just fraud, shaving fractional pennies off your paycheck in the hopes that you won't notice. The goal is to get drivers to abandon the other side-hustles that allow them to be so choosy about when they drive Uber, and then, once the driver is fully committed, to crank the wage-dial down to the lowest possible setting:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

This is the same game that Facebook played with publishers on the way to its enshittification: when Facebook began aggressively courting publishers, any short snippet republished from the publisher's website to a Facebook feed was likely to be recommended to large numbers of readers. Facebook offered publishers a vast traffic funnel that drove millions of readers to their sites.

But as publishers became more dependent on that traffic, Facebook's algorithm started downranking short excerpts in favor of medium-length ones, building slowly to fulltext Facebook posts that were fully substitutive for the publisher's own web offerings. Like Uber's wage algorithm, Facebook's recommendation engine played its targets like fish on a line.

When publishers responded to declining reach for short excerpts by stepping back from Facebook, Facebook goosed the traffic for their existing posts, sending fresh floods of readers to the publisher's site. When the publisher returned to Facebook, the algorithm once again set to coaxing the publishers into posting ever-larger fractions of their work to Facebook, until, finally, the publisher was totally locked into Facebook. Facebook then started charging publishers for "boosting" – not just to be included in algorithmic recommendations, but to reach their own subscribers.

Enshittification is modern, high-tech enabled, monopolistic form of rent seeking. Rent-seeking is a subtle and important idea from economics, one that is increasingly relevant to our modern economy. For economists, a "rent" is income you get from owning a "factor of production" – something that someone else needs to make or do something.

Rents are not "profits." Profit is income you get from making or doing something. Rent is income you get from owning something needed to make a profit. People who earn their income from rents are called rentiers. If you make your income from profits, you're a "capitalist."

Capitalists and rentiers are in irreconcilable combat with each other. A capitalist wants access to their factors of production at the lowest possible price, whereas rentiers want those prices to be as high as possible. A phone manufacturer wants to be able to make phones as cheaply as possible, while a patent-troll wants to own a patent that the phone manufacturer needs to license in order to make phones. The manufacturer is a capitalism, the troll is a rentier.

The troll might even decide that the best strategy for maximizing their rents is to exclusively license their patents to a single manufacturer and try to eliminate all other phones from the market. This will allow the chosen manufacturer to charge more and also allow the troll to get higher rents. Every capitalist except the chosen manufacturer loses. So do people who want to buy phones. Eventually, even the chosen manufacturer will lose, because the rentier can demand an ever-greater share of their profits in rent.

Digital technology enables all kinds of rent extraction. The more digitized an industry is, the more rent-seeking it becomes. Think of cars, which harvest your data, block third-party repair and parts, and force you to buy everything from acceleration to seat-heaters as a monthly subscription:

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

The cloud is especially prone to rent-seeking, as Yanis Varoufakis writes in his new book, Technofeudalism, where he explains how "cloudalists" have found ways to lock all kinds of productive enterprise into using cloud-based resources from which ever-increasing rents can be extracted:

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

The endless malleability of digitization makes for endless variety in rent-seeking, and cataloging all the different forms of digital rent-extraction is a major project in this Age of Enshittification. "Algorithmic Attention Rents: A theory of digital platform market power," a new UCL Institute for Innovation and Public Purpose paper by Tim O'Reilly, Ilan Strauss and Mariana Mazzucato, pins down one of these forms:

https://www.ucl.ac.uk/bartlett/public-purpose/publications/2023/nov/algorithmic-attention-rents-theory-digital-platform-market-power

The "attention rents" referenced in the paper's title are bait-and-switch scams in which a platform deliberately enshittifies its recommendations, search results or feeds to show you things that are not the thing you asked to see, expect to see, or want to see. They don't do this out of sadism! The point is to extract rent – from you (wasted time, suboptimal outcomes) and from business customers (extracting rents for "boosting," jumbling good results in among scammy or low-quality results).

The authors cite several examples of these attention rents. Much of the paper is given over to Amazon's so-called "advertising" product, a $31b/year program that charges sellers to have their products placed above the items that Amazon's own search engine predicts you will want to buy:

https://pluralistic.net/2022/11/28/enshittification/#relentless-payola

This is a form of gladiatorial combat that pits sellers against each other, forcing them to surrender an ever-larger share of their profits in rent to Amazon for pride of place. Amazon uses a variety of deceptive labels ("Highly Rated – Sponsored") to get you to click on these products, but most of all, they rely two factors. First, Amazon has a long history of surfacing good results in response to queries, which makes buying whatever's at the top of a list a good bet. Second, there's just so many possible results that it takes a lot of work to sift through the probably-adequate stuff at the top of the listings and get to the actually-good stuff down below.

Amazon spent decades subsidizing its sellers' goods – an illegal practice known as "predatory pricing" that enforcers have increasingly turned a blind eye to since the Reagan administration. This has left it with few competitors:

https://pluralistic.net/2023/05/19/fake-it-till-you-make-it/#millennial-lifestyle-subsidy

The lack of competing retail outlets lets Amazon impose other rent-seeking conditions on its sellers. For example, Amazon has a "most favored nation" requirement that forces companies that raise their prices on Amazon to raise their prices everywhere else, which makes everything you buy more expensive, whether that's a Walmart, Target, a mom-and-pop store, or direct from the manufacturer:

https://pluralistic.net/2023/04/25/greedflation/#commissar-bezos

But everyone loses in this "two-sided market." Amazon used "junk ads" to juice its ad-revenue: these are ads that are objectively bad matches for your search, like showing you a Seattle Seahawks jersey in response to a search for LA Lakers merch:

https://www.bloomberg.com/news/articles/2023-11-02/amazon-boosted-junk-ads-hid-messages-with-signal-ftc-says

The more of these junk ads Amazon showed, the more revenue it got from sellers – and the more the person selling a Lakers jersey had to pay to show up at the top of your search, and the more they had to charge you to cover those ad expenses, and the more they had to charge for it everywhere else, too.

The authors describe this process as a transformation between "attention rents" (misdirecting your attention) to "pecuniary rents" (making money). That's important: despite decades of rhetoric about the "attention economy," attention isn't money. As I wrote in my enshittification essay:

You can't use attention as a medium of exchange. You can't use it as a store of value. You can't use it as a unit of account. Attention is like cryptocurrency: a worthless token that is only valuable to the extent that you can trick or coerce someone into parting with "fiat" currency in exchange for it. You have to "monetize" it – that is, you have to exchange the fake money for real money.

The authors come up with some clever techniques for quantifying the ways that this scam harms users. For example, they count the number of places that an advertised product rises in search results, relative to where it would show up in an "organic" search. These quantifications are instructive, but they're also a kind of subtweet at the judiciary.

In 2018, SCOTUS's ruling in American Express v Ohio changed antitrust law for two-sided markets by insisting that so long as one side of a two-sided market was better off as the result of anticompetitive actions, there was no antitrust violation:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3346776

For platforms, that means that it's OK to screw over sellers, advertisers, performers and other business customers, so long as the end-users are better off: "Go ahead, cheat the Uber drivers, so long as you split the booty with Uber riders."

But in the absence of competition, regulation or self-help measures, platforms cheat everyone – that's the point of enshittification. The attention rents that Amazon's payola scheme extract from shoppers translate into higher prices, worse goods, and lower profits for platform sellers. In other words, Amazon's conduct is so sleazy that it even threads the infinitesimal needle that the Supremes created in American Express.

Here's another algorithmic pecuniary rent: Amazon figured out which of its major rivals used an automated price-matching algorithm, and then cataloged which products they had in common with those sellers. Then, under a program called Project Nessie, Amazon jacked up the prices of those products, knowing that as soon as they raised the prices on Amazon, the prices would go up everywhere else, so Amazon wouldn't lose customers to cheaper alternatives. That scam made Amazon at least a billion dollars:

https://gizmodo.com/ftc-alleges-amazon-used-price-gouging-algorithm-1850986303

This is a great example of how enshittification – rent-seeking on digital platforms – is different from analog rent-seeking. The speed and flexibility with which Amazon and its rivals altered their prices requires digitization. Digitization also let Amazon crank the price-gouging dial to zero whenever they worried that regulators were investigating the program.

So what do we do about it? After years of being made to look like fumblers and clowns by Big Tech, regulators and enforcers – and even lawmakers – have decided to get serious.

The neoliberal narrative of government helplessness and incompetence would have you believe that this will go nowhere. Governments aren't as powerful as giant corporations, and regulators aren't as smart as the supergeniuses of Big Tech. They don't stand a chance.

But that's a counsel of despair and a cheap trick. Weaker US governments have taken on stronger oligarchies and won – think of the defeat of JD Rockefeller and the breakup of Standard Oil in 1911. The people who pulled that off weren't wizards. They were just determined public servants, with political will behind them. There is a growing, forceful public will to end the rein of Big Tech, and there are some determined public servants surfing that will.

In this paper, the authors try to give those enforcers ammo to bring to court and to the public. For example, Amazon claims that its algorithm surfaces the products that make the public happy, without the need for competitive pressure to keep it sharp. But as the paper points out, the only successful new rival ecommerce platform – Tiktok – has found an audience for an entirely new category of goods: dupes, "lower-cost products that have the same or better features than higher cost branded products."

The authors also identify "dark patterns" that platforms use to trick users into consuming feeds that have a higher volume of things that the company profits from, and a lower volume of things that users want to see. For example, platforms routinely switch users from a "following" feed – consisting of things posted by people the user asked to hear from – with an algorithmic "For You" feed, filled with the things the company's shareholders wish the users had asked to see.

Calling this a "dark pattern" reveals just how hollow and self-aggrandizing that term is. "Dark pattern" usually means "fraud." If I ask to see posts from people I like, and you show me posts from people who'll pay you for my attention instead, that's not a sophisticated sleight of hand – it's just a scam. It's the social media equivalent of the eBay seller who sends you an iPhone box with a bunch of gravel inside it instead of an iPhone. Tech bros came up with "dark pattern" as a way of flattering themselves by draping themselves in the mantle of dopamine-hacking wizards, rather than unimaginative con-artists who use a computer to rip people off.

These For You algorithmic feeds aren't just a way to increase the load of sponsored posts in a feed – they're also part of the multi-sided ripoff of enshittified platforms. A For You feed allows platforms to trick publishers and performers into thinking that they are "good at the platform," which both convinces to optimize their production for that platform, and also turns them into Judas Goats who conspicuously brag about how great the platform is for people like them, which brings their peers in, too.

In Veena Dubal's essential paper on algorithmic wage discrimination, she describes how Uber drivers whom the algorithm has favored with (temporary) high per-ride rates brag on driver forums about their skill with the app, bringing in other drivers who blame their lower wages on their failure to "use the app right":

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4331080

As I wrote in my enshittification essay:

If you go down to the midway at your county fair, you'll spot some poor sucker walking around all day with a giant teddy bear that they won by throwing three balls in a peach basket.

The peach-basket is a rigged game. The carny can use a hidden switch to force the balls to bounce out of the basket. No one wins a giant teddy bear unless the carny wants them to win it. Why did the carny let the sucker win the giant teddy bear? So that he'd carry it around all day, convincing other suckers to put down five bucks for their chance to win one:

https://boingboing.net/2006/08/27/rigged-carny-game.html

The carny allocated a giant teddy bear to that poor sucker the way that platforms allocate surpluses to key performers – as a convincer in a "Big Store" con, a way to rope in other suckers who'll make content for the platform, anchoring themselves and their audiences to it.

Platform can't run the giant teddy-bear con unless there's a For You feed. Some platforms – like Tiktok – tempt users into a For You feed by making it as useful as possible, then salting it with doses of enshittification:

https://www.forbes.com/sites/emilybaker-white/2023/01/20/tiktoks-secret-heating-button-can-make-anyone-go-viral/

Other platforms use the (ugh) "dark pattern" of simply flipping your preference from a "following" feed to a "For You" feed. Either way, the platform can't let anyone keep the giant teddy-bear. Once you've tempted, say, sports bros into piling into the platform with the promise of millions of free eyeballs, you need to withdraw the algorithm's favor for their content so you can give it to, say, astrologers. Of course, the more locked-in the users are, the more shit you can pile into that feed without worrying about them going elsewhere, and the more giant teddy-bears you can give away to more business users so you can lock them in and start extracting rent.

For regulators, the possibility of a "good" algorithmic feed presents a serious challenge: when a feed is bad, how can a regulator tell if its low quality is due to the platform's incompetence at blocking spammers or guessing what users want, or whether it's because the platform is extracting rents?

The paper includes a suite of recommendations, including one that I really liked:

Regulators, working with cooperative industry players, would define reportable metrics based on those that are actually used by the platforms themselves to manage search, social media, e-commerce, and other algorithmic relevancy and recommendation engines.

In other words: find out how the companies themselves measure their performance. Find out what KPIs executives have to hit in order to earn their annual bonuses and use those to figure out what the company's performance is – ad load, ratio of organic clicks to ad clicks, average click-through on the first organic result, etc.

They also recommend some hard rules, like reserving a portion of the top of the screen for "organic" search results, and requiring exact matches to show up as the top result.

I've proposed something similar, applicable across multiple kinds of digital businesses: an end-to-end principle for online services. The end-to-end principle is as old as the internet, and it decrees that the role of an intermediary should be to deliver data from willing senders to willing receivers as quickly and reliably as possible. When we apply this principle to your ISP, we call it Net Neutrality. For services, E2E would mean that if I subscribed to your feed, the service would have a duty to deliver it to me. If I hoisted your email out of my spam folder, none of your future emails should land there. If I search for your product and there's an exact match, that should be the top result:

https://www.eff.org/deeplinks/2023/04/platforms-decay-lets-put-users-first

One interesting wrinkle to framing platform degradation as a failure to connect willing senders and receivers is that it places a whole host of conduct within the regulatory remit of the FTC. Section 5 of the FTC Act contains a broad prohibition against "unfair and deceptive" practices:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

That means that the FTC doesn't need any further authorization from Congress to enforce an end to end rule: they can simply propose and pass that rule, on the grounds that telling someone that you'll show them the feeds that they ask for and then not doing so is "unfair and deceptive."

Some of the other proposals in the paper also fit neatly into Section 5 powers, like a "sticky" feed preference. If I tell a service to show me a feed of the people I follow and they switch it to a For You feed, that's plainly unfair and deceptive.

All of this raises the question of what a post-Big-Tech feed would look like. In "How To Break Up Amazon" for The Sling, Peter Carstensen and Darren Bush sketch out some visions for this:

https://www.thesling.org/how-to-break-up-amazon/

They imagine a "condo" model for Amazon, where the sellers collectively own the Amazon storefront, a model similar to capacity rights on natural gas pipelines, or to patent pools. They see two different ways that search-result order could be determined in such a system:

"specific premium placement could go to those vendors that value the placement the most [with revenue] shared among the owners of the condo"

or

"leave it to owners themselves to create joint ventures to promote products"

Note that both of these proposals are compatible with an end-to-end rule and the other regulatory proposals in the paper. Indeed, all these policies are easier to enforce against weaker companies that can't afford to maintain the pretense that they are headquartered in some distant regulatory haven, or pay massive salaries to ex-regulators to work the refs on their behalf:

https://www.thesling.org/in-public-discourse-and-congress-revolvers-defend-amazons-monopoly/

The re-emergence of intermediaries on the internet after its initial rush of disintermediation tells us something important about how we relate to one another. Some authors might be up for directly selling books to their audiences, and some drivers might be up for creating their own taxi service, and some merchants might want to run their own storefronts, but there's plenty of people with something they want to offer us who don't have the will or skill to do it all. Not everyone wants to be a sysadmin, a security auditor, a payment processor, a software engineer, a CFO, a tax-preparer and everything else that goes into running a business. Some people just want to sell you a book. Or find a date. Or teach an online class.

Intermediation isn't intrinsically wicked. Intermediaries fall into pits of enshitffication and other forms of rent-seeking when they aren't disciplined by competitors, by regulators, or by their own users' ability to block their bad conduct (with ad-blockers, say, or other self-help measures). We need intermediaries, and intermediaries don't have to turn into rent-seeking feudal warlords. That only happens if we let it happen.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/03/subprime-attention-rent-crisis/#euthanize-rentiers

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#rentiers#euthanize rentiers#subprime attention crisis#Mariana Mazzucato#tim oreilly#Ilan Strauss#scholarship#economics#two-sided markets#platform decay#algorithmic feeds#the algorithm tm#enshittification#monopoly#antitrust#section 5#ftc act#ftc#amazon. google#big tech#attention economy#attention rents#pecuniary rents#consumer welfare#end-to-end principle#remedyfest#giant teddy bears#project nessie#end-to-end

204 notes

·

View notes

Text

I was not expecting a Discworld reference in the book I'm reading about the invention of the index fund.

Describing conflicting management styles of mutual fund managers going through a merger, the author explains one is egalitarian. The other "had a more Ankh Morpork style philosophy of one man, one vote. He was the man, so he had the vote."

#gnu terry pratchett#discworld#seriously this book has mostly been about economic academics in the 50s and 60s#and it's about the american stock market#so not exactly a british perspective#the book is called Trillions btw#if they get into boots theory i'm going to lose it

117 notes

·

View notes

Text

I know complaining about the lack of socioeconomic information on the various societies in FFXIV is a bit like complaining about my omelet not having any chocolate syrup on it. But Robert Jordan has truly brain scorched me because I can't look at the Crystarium without wanting to scream how are you a functional society, what on EARTH must your tax code look like?, followed by shaking the whole place like an etch-a-sketch until it gives me answers.

#FFXIV#Final Fantasy XIV#Shadowbriners#The Crystartium#I have spent DAYS thinking about the trade tariffs G'raha must be imposing on that god damn market#To support even a FRACTION of what his government is doing#and THEN I spent hours wondering WHO THE HELL IS MAINTAINING IS SOCIAL AND ECONOMIC POLICY#NOW THAT HE's FUCKED OFF BACK TO THE SOURCE IN ORDER TO CHASE THAT WOL DICK#*gargles furiously*#G'raha Tia

277 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

63 notes

·

View notes

Text

#socialism#leftist#anticapitalism#communism#anti capitalist#anti imperialism#economy#markets#business news#finance#business#economics#anti capitalism#fuck capitalism#late stage capitalism#capitalism#capitalist system#ftx

448 notes

·

View notes

Note

the secret of the game is that if we find all the keys to open the basement, you get out and kill the wolf

actually the secret is that if you find all the keys you can get out of the house, go to the store and buy some flowers, and come back to take the wolf out on a date

#ive already attracted a few monsterfuckers to that post im just following the invisible hand of the market or something#idk i dont understand economics

109 notes

·

View notes

Text

Born to love the pathetic little box man, forced to talk about his creepy little crush all the time.

#send help#i love vox#hes so babygirl#but you ask me to talk about him and#😐#but ask me about Alastor#and I’ve got a million head canons about that creepy little guy#I’m an economics history gal#and he likes the stock market crash of 1929#alastor the radio demon#hazbin alastor#hazbin hotel alastor#alastor#hazbin vox#hazbin hotel vox#vox

27 notes

·

View notes

Text

#political commentary#capitalism#corporate power#consumerism#economic policy#socialism#government intervention#market dynamics

134 notes

·

View notes

Text

Every time I say “dual mandate” during this report out, take a shot.

#federal reserve#the fed#federal open market committee#interest rates#jerome powell#economics#jay speaks#I don’t care that it is the middle of the afternoon

28 notes

·

View notes