#regulation

Text

Source

Source

Source

Source

#important#capitalism#end capitalism#current events#government#regulation#the left#progressive#working class

7K notes

·

View notes

Text

#free healthcare#free education#anti capitalism#eat the rich#late stage capitalism#capitalism#fuck capitalism#socialism#antiwork#capitalist hell#poverty#social issues#society#social security#social commentary#social justice#social skills#regulation#investments#social distancing

3K notes

·

View notes

Text

Apple to EU: “Go fuck yourself”

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/06/spoil-the-bunch/#dma

There's a strain of anti-anti-monopolist that insists that they're not pro-monopoly – they're just realists who understand that global gigacorporations are too big to fail, too big to jail, and that governments can't hope to rein them in. Trying to regulate a tech giant, they say, is like trying to regulate the weather.

This ploy is cousins with Jay Rosen's idea of "savvying," defined as: "dismissing valid questions with the insider's, 'and this surprises you?'"

https://twitter.com/jayrosen_nyu/status/344825874362810369?lang=en

In both cases, an apologist for corruption masquerades as a pragmatist who understands the ways of the world, unlike you, a pathetic dreamer who foolishly hopes for a better world. In both cases, the apologist provides cover for corruption, painting it as an inevitability, not a choice. "Don't hate the player. Hate the game."

The reason this foolish nonsense flies is that we are living in an age of rampant corruption and utter impunity. Companies really do get away with both literal and figurative murder. Governments really do ignore horrible crimes by the rich and powerful, and fumble what rare, few enforcement efforts they assay.

Take the GDPR, Europe's landmark privacy law. The GDPR establishes strict limitations of data-collection and processing, and provides for brutal penalties for companies that violate its rules. The immediate impact of the GDPR was a mass-extinction event for Europe's data-brokerages and surveillance advertising companies, all of which were in obvious violation of the GDPR's rules.

But there was a curious pattern to GDPR enforcement: while smaller, EU-based companies were swiftly shuttered by its provisions, the US-based giants that conduct the most brazen, wide-ranging, illegal surveillance escaped unscathed for years and years, continuing to spy on Europeans.

One (erroneous) way to look at this is as a "compliance moat" story. In that story, GDPR requires a bunch of expensive systems that only gigantic companies like Facebook and Google can afford. These compliance costs are a "capital moat" – a way to exclude smaller companies from functioning in the market. Thus, the GDPR acted as an anticompetitive wrecking ball, clearing the field for the largest companies, who get to operate without having to contend with smaller companies nipping at their heels:

https://www.techdirt.com/2019/06/27/another-report-shows-gdpr-benefited-google-facebook-hurt-everyone-else/

This is wrong.

Oh, compliance moats are definitely real – think of the calls for AI companies to license their training data. AI companies can easily do this – they'll just buy training data from giant media companies – the very same companies that hope to use models to replace creative workers with algorithms. Create a new copyright over training data won't eliminate AI – it'll just confine AI to the largest, best capitalized companies, who will gladly provide tools to corporations hoping to fire their workforces:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

But just because some regulations can be compliance moats, that doesn't mean that all regulations are compliance moats. And just because some regulations are vigorously applied to small companies while leaving larger firms unscathed, it doesn't follow that the regulation in question is a compliance moat.

A harder look at what happened with the GDPR reveals a completely different dynamic at work. The reason the GDPR vaporized small surveillance companies and left the big companies untouched had nothing to do with compliance costs. The Big Tech companies don't comply with the GDPR – they just get away with violating the GDPR.

How do they get away with it? They fly Irish flags of convenience. Decades ago, Ireland started dabbling with offering tax-havens to the wealthy and mobile – they invented the duty-free store:

https://en.wikipedia.org/wiki/Duty-free_shop#1947%E2%80%931990:_duty_free_establishment

Capturing pennies from the wealthy by helping them avoid fortunes they owed in taxes elsewhere was terribly seductive. In the years that followed, Ireland began aggressively courting the wealthy on an industrial scale, offering corporations the chance to duck their obligations to their host countries by flying an Irish flag of convenience.

There are other countries who've tried this gambit – the "treasure islands" of the Caribbean, the English channel, and elsewhere – but Ireland is part of the EU. In the global competition to help the rich to get richer, Ireland had a killer advantage: access to the EU, the common market, and 500m affluent potential customers. The Caymans can hide your money for you, and there's a few super-luxe stores and art-galleries in George Town where you can spend it, but it's no Champs Elysees or Ku-Damm.

But when you're competing with other countries for the pennies of trillion-dollar tax-dodgers, any wins can be turned into a loss in an instant. After all, any corporation that is footloose enough to establish a Potemkin Headquarters in Dublin and fly the trídhathach can easily up sticks and open another Big Store HQ in some other haven that offers it a sweeter deal.

This has created a global race to the bottom among tax-havens to also serve as regulatory havens – and there's a made-in-the-EU version that sees Ireland, Malta, Cyprus and sometimes the Netherlands competing to see who can offer the most impunity for the worst crimes to the most awful corporations in the world.

And that's why Google and Facebook haven't been extinguished by the GDPR while their rivals were. It's not compliance moats – it's impunity. Once a corporation attains a certain scale, it has the excess capital to spend on phony relocations that let it hop from jurisdiction to jurisdiction, chasing the loosest slots on the strip. Ireland is a made town, where the cops are all on the take, and two thirds of the data commissioner's rulings are eventually overturned by the federal court:

https://www.iccl.ie/digital-data/iccl-2023-gdpr-report/

This is a problem among many federations, not just the EU. The US has its onshore-offshore tax- and regulation-havens (Delaware, South Dakota, Texas, etc), and so does Canada (Alberta), and some Swiss cantons are, frankly, batshit:

https://lenews.ch/2017/11/25/swiss-fact-some-swiss-women-had-to-wait-until-1991-to-vote/

None of this is to condemn federations outright. Federations are (potentially) good! But federalism has a vulnerability: the autonomy of the federated states means that they can be played against each other by national or transnational entities, like corporations. This doesn't mean that it's impossible to regulate powerful entities within a federation – but it means that federal regulation needs to account for the risk of jurisdiction-shopping.

Enter the Digital Markets Act, a new Big Tech specific law that, among other things, bans monopoly app stores and payment processing, through which companies like Apple and Google have levied a 30% tax on the entire app market, while arrogating to themselves the right to decide which software their customers may run on their own devices:

https://pluralistic.net/2023/06/07/curatorial-vig/#app-tax

Apple has responded to this regulation with a gesture of contempt so naked and broad that it beggars belief. As Proton describes, Apple's DMA plan is the very definition of malicious compliance:

https://proton.me/blog/apple-dma-compliance-plan-trap

Recall that the DMA is intended to curtail monopoly software distribution through app stores and mobile platforms' insistence on using their payment processors, whose fees are sky-high. The law is intended to extinguish developer agreements that ban software creators from informing customers that they can get a better deal by initiating payments elsewhere, or by getting a service through the web instead of via an app.

In response, Apple, has instituted a junk fee it calls the "Core Technology Fee": EUR0.50/install for every installation over 1m. As Proton writes, as apps grow more popular, using third-party payment systems will grow less attractive. Apple has offered discounts on its eye-watering payment processing fees to a mere 20% for the first payment and 13% for renewals. Compare this with the normal – and far, far too high – payment processing fees the rest of the industry charges, which run 2-5%. On top of all this, Apple has lied about these new discounted rates, hiding a 3% "processing" fee in its headline figures.

As Proton explains, paying 17% fees and EUR0.50 for each subscriber's renewal makes most software businesses into money-losers. The only way to keep them afloat is to use Apple's old, default payment system. That choice is made more attractive by Apple's inclusion of a "scare screen" that warns you that demons will rend your soul for all eternity if you try to use an alternative payment scheme.

Apple defends this scare screen by saying that it will protect users from the intrinsic unreliability of third-party processors, but as Proton points out, there are plenty of giant corporations who get to use their own payment processors with their iOS apps, because Apple decided they were too big to fuck with. Somehow, Apple can let its customers spend money Uber, McDonald's, Airbnb, Doordash and Amazon without terrorizing them about existential security risks – but not mom-and-pop software vendors or publishers who don't want to hand 30% of their income over to a three-trillion-dollar company.

Apple has also reserved the right to cancel any alternative app store and nuke it from Apple customers' devices without warning, reason or liability. Those app stores also have to post a one-million euro line of credit in order to be considered for iOS. Given these terms, it's obvious that no one is going to offer a third-party app store for iOS and if they did, no one would list their apps in it.

The fuckery goes on and on. If an app developer opts into third-party payments, they can't use Apple's payment processing too – so any users who are scared off by the scare screen have no way to pay the app's creators. And once an app creator opts into third party payments, they can never go back – the decision is permanent.

Apple also reserves the right to change all of these policies later, for the worse ("I am altering the deal. Pray I don't alter it further" -D. Vader). They have warned developers that they might change the API for reporting external sales and revoke developers' right to use alternative app stores at its discretion, with no penalties if that screws the developer.

Apple's contempt extends beyond app marketplaces. The DMA also obliges Apple to open its platform to third party browsers and browser engines. Every browser on iOS is actually just Safari wrapped in a cosmetic skin, because Apple bans third-party browser-engines:

https://pluralistic.net/2022/12/13/kitbashed/#app-store-tax

But, as Mozilla puts it, Apple's plan for this is "as painful as possible":

https://www.theverge.com/2024/1/26/24052067/mozilla-apple-ios-browser-rules-firefox

For one thing, Apple will only allow European customers to run alternative browser engines. That means that Firefox will have to "build and maintain two separate browser implementations — a burden Apple themselves will not have to bear."

(One wonders how Apple will treat Americans living in the EU, whose Apple accounts still have US billing addresses – these people will still be entitled to the browser choice that Apple is grudgingly extending to Europeans.)

All of this sends a strong signal that Apple is planning to run the same playbook with the DMA that Google and Facebook used on the GDPR: ignore the law, use lawyerly bullshit to chaff regulators, and hope that European federalism has sufficiently deep cracks that it can hide in them when the enforcers come to call.

But Apple is about to get a nasty shock. For one thing, the DMA allows wronged parties to start their search for justice in the European federal court system – bypassing the Irish regulators and courts. For another, there is a global movement to check corporate power, and because the tech companies do the same kinds of fuckery in every territory, regulators are able to collaborate across borders to take them down.

Take Apple's app store monopoly. The best reference on this is the report published by the UK Competition and Markets Authority's Digital Markets Unit:

https://assets.publishing.service.gov.uk/media/63f61bc0d3bf7f62e8c34a02/Mobile_Ecosystems_Final_Report_amended_2.pdf

The devastating case that the DMU report was key to crafting the DMA – but it also inspired a US law aimed at forcing app markets open:

https://www.congress.gov/bill/117th-congress/senate-bill/2710

And a Japanese enforcement action:

https://asia.nikkei.com/Business/Technology/Japan-to-crack-down-on-Apple-and-Google-app-store-monopolies

And action in South Korea:

https://www.reuters.com/technology/skorea-considers-505-mln-fine-against-google-apple-over-app-market-practices-2023-10-06/

These enforcers gather for annual meetings – I spoke at one in London, convened by the Competition and Markets Authority – where they compare notes, form coalitions, and plan strategy:

https://www.eventbrite.co.uk/e/cma-data-technology-and-analytics-conference-2022-registration-308678625077

This is where the savvying breaks down. Yes, Apple is big enough to run circles around Japan, or South Korea, or the UK. But when those countries join forces with the EU, the USA and other countries that are fed up to the eyeballs with Apple's bullshit, the company is in serious danger.

It's true that Apple has convinced a bunch of its customers that buying a phone from a multi-trillion-dollar corporation makes you a member of an oppressed religious minority:

https://pluralistic.net/2024/01/12/youre-holding-it-wrong/#if-dishwashers-were-iphones

Some of those self-avowed members of the "Cult of Mac" are willing to take the company's pronouncements at face value and will dutifully repeat Apple's claims to be "protecting" its customers. But even that credulity has its breaking point – Apple can only poison the well so many times before people stop drinking from it. Remember when the company announced a miraculous reversal to its war on right to repair, later revealed to be a bald-faced lie?

https://pluralistic.net/2023/09/22/vin-locking/#thought-differently

Or when Apple claimed to be protecting phone users' privacy, which was also a lie?

https://pluralistic.net/2022/11/14/luxury-surveillance/#liar-liar

The savvy will see Apple lying (again) and say, "this surprises you?" No, it doesn't surprise me, but it pisses me off – and I'm not the only one, and Apple's insulting lies are getting less effective by the day.

Image:

Alex Popovkin, Bahia, Brazil from Brazil (modified)

https://commons.wikimedia.org/wiki/File:Annelid_worm,_Atlantic_forest,_northern_littoral_of_Bahia,_Brazil_%2816107326533%29.jpg

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/deed.en

--

Hubertl (modified)

https://commons.wikimedia.org/wiki/File:2015-03-04_Elstar_%28apple%29_starting_putrefying_IMG_9761_bis_9772.jpg

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#apple#malicious compliance#dma#digital markets act#eu#european union#federalism#corporatism#monopolies#trustbusting#regulation#protonmail#junk fees#cult of mac#interoperability#browser wars#firefox#mozilla#webkit#browser engines

594 notes

·

View notes

Text

Just 57 companies and nation states were responsible for generating 80% of the world's CO₂ emissions from fossil fuels and cement over the last seven years, according to a new report released by the thinktank InfluenceMap. This finding suggests that net zero targets set by the Paris climate change agreement in 2015 are yet to make a significant impact on fossil fuel production.

The report uses the Carbon Majors database, established in 2013 by Richard Heede of the Climate Accountability Institute, to provide fossil fuel production data from 122 of the world's largest oil, gas, coal and cement producers.

Continue Reading.

176 notes

·

View notes

Video

youtube

Is Crypto Really Going To Crash? (Yes)

Crypto is going to crash and could take your savings with it.

In June 2022, Bitcoin dropped over 30 percent to its lowest values since December 2020, and Ethereum, the second-most valuable cryptocurrency, fell about 35 percent. TerraUSD, a so-called “stablecoin,” also collapsed when its underlying cryptocurrency LUNA lost 97 percent of its value in just 24 hours, apparently destroying some investors’ life savings. The implosion helped trigger a crypto meltdown that erased $300 billion in value across the market.

As cryptocurrency prices plummeted, Celsius Network — an experimental cryptocurrency lender — announced it was freezing withdrawals “due to extreme market conditions.”

These crypto crashes and freezes have fueled worries that the complex crypto banking and lending system is on the brink of ruin.

But this crash shouldn’t surprise anyone familiar with the industry – or anyone who remembers the financial crashes of 1929 and 2008.

Let me explain.

In the murky world of crypto decentralized finance, known as DeFi, it’s hard to understand who provides money for loans, where the money flows, or how easy it is to trigger currency meltdowns.

There are no standards for issues of custody, risk management, or capital reserves. There are no transparency requirements. Investors often don’t know how their money is being handled. Deposits are not insured.

It’s a Ponzi scheme. Like all Ponzi schemes, getting rich depends on how many other investors follow you into it – until somebody’s left holding the worthless crypto coin.

Why isn’t this market regulated? Follow the money.

The crypto industry is pouring huge amounts into political campaigns. It has hired scores of former government officials and regulators to lobby on its behalf — including three former chairs of the Securities and Exchange Commission, three former chairs of the Commodity Futures Trading Commission, three former U.S. senators, and even former Treasury Secretary Larry Summers.

In the past, cryptocurrencies kept rising by attracting new investors and big Wall Street money, along with celebrity endorsements. But all Ponzi schemes topple eventually – just like the Wild West finances of the 1920s did.

Back then, Americans had been getting rich by speculating on shares of stock, as other investors followed them into these risky assets — pushing their values ever upwards. When the toppling occurred in 1929, it plunged the nation and the world into the Great Depression.

That crash resulted in the Glass-Steagall Act, signed into law by Franklin D. Roosevelt in 1933. Glass-Steagall separated commercial banking from investment banking, putting an end to the giant Ponzi scheme that had overtaken the American economy and led to the Great Crash of 1929.

It took a full generation to forget that crash and allow the forces that caused it to repeat their havoc.

By the mid-1980s, as the stock market soared, speculators noticed they could make even more money if they gambled with other people’s money, as speculators did in the 1920s. They pushed Congress to deregulate Wall Street, arguing that the United States financial sector would otherwise lose its competitive standing internationally.

The final blow was in 1999, when the Clinton administration succumbed to intensive lobbying and ditched what remained of Glass-Steagall. With its repeal, American finance once again became a betting parlor.

Inevitably, Wall Street suffered another near-death experience when its Ponzi schemes began toppling in 2008, just as they had in 1929. While the U.S. government bailed out the biggest banks and financial institutions, millions of Americans lost their jobs, their savings, and their homes – but only a single banking executive went to jail. In the wake of the 2008 financial crisis, a new but watered-down version of Glass-Steagall was enacted — the Dodd-Frank Act.

Which brings us — nearly a century after Glass-Steagall — to today’s crypto crash.

If we should have learned anything from the crashes of 1929 and 2008, it’s that regulation of financial markets is essential. Otherwise they turn into Ponzi schemes — leaving small investors with nothing and endangering the entire economy.

It’s time for the Biden administration and Congress to end the crypto Ponzi scheme.

In the meantime, share this video so your friends and family don’t fall for it.

2K notes

·

View notes

Text

#abortion#pro choice#pro life#reality#children#roe v. wave#roe vs. wade#men#women#birthing#regulation#real shit#true shit#united states of america#USA#united states#war on women#the reason#reasons#supreme court#abortion laws#abortion ban#current reality#reality is#in real life#twitter#tweet#she said what she said#no but seriously#no but for real

186 notes

·

View notes

Photo

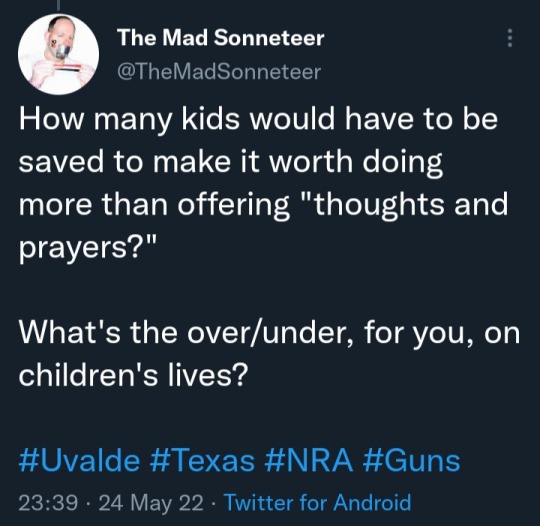

#Uvalde#Texas#gun#guns#regulation#regulations#law#laws#NRA#National Rifle Association#kid#kids#child#children#thoughts and prayers#school shooting#school shootings#The Mad Sonneteer#Bud Koenemund#Koenemund

2K notes

·

View notes

Note

on: "there is no ethical consumption under capitalism," would you agree to the corollary that: "and there CAN be no ethical consumption under capitalism" or is there some meliorist path towards ethical consumption under capitalism

As a social democrat, I'm very much a believer in "meliorist" solutions and deeply skeptical of the undistributed middle. It is a matter of historical fact that capitalism can function in a number of ethical "registers," and anyone who tells you otherwise is trying to sucker you into pseudo-revolutionary defeatism.

There is a real difference between completely unrestrained dark Satanic mills powered by child labor and slave cotton and a fully-realized social democratic mixed economy, complete with tripartite bargaining and co-determination, economic planning organized through a jobs state and decommodified/nationalized economic sectors including a social democratic welfare state, and a robust regulatory state that can enforce safety and environmental and labor standards at home and abroad - and there are many different points along that spectrum.

My main critique of the whole "ethical consumption under capitalism" thing is that the variant of it that stresses individual consumer behavior is a total fantasy.

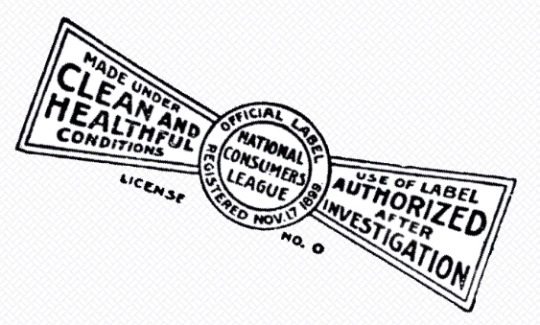

It is simply impossible to exert pressure on capitalist systems on your own, or even through ad hoc or single-issue boycott efforts. You need social movements like the National Consumers League that combine mass mobilization with permanent infrastructure, those movements need to be in coalition with the labor movement and civil rights movements, all of them need a regulatory state with the capacity to enforce its will on corporations - and that state needs them as countervailing forces against corporate lobbyists.

youtube

#history#historical analysis#economic policy#political economy#regulation#regulatory state#ethical consumption under capitalism#economic history#social democracy#mixed economy#co-determination#boycotts

60 notes

·

View notes

Text

New boots for office doll!

#thigh boots#chinese lady#thigh high boots#office manager#hot asian girl#shiny boots#employment#regulation#friends with secrets#office girl#distraction

51 notes

·

View notes

Text

Regulation Ideas

NeuroWild

103 notes

·

View notes

Text

#actually autistic#actually disabled#autism#autism acceptance#autism acceptance month#autism awareness#autism awareness month#autism poll#autism spectrum disorder#autistic#autism positivity#meltdowns#poll#tumblr polls#meltdown#self regulation#regulation

26 notes

·

View notes

Text

216 notes

·

View notes

Text

At long last, a meaningful step to protect Americans' privacy

This Saturday (19 Aug), I'm appearing at the San Diego Union-Tribune Festival of Books. I'm on a 2:30PM panel called "Return From Retirement," followed by a signing:

https://www.sandiegouniontribune.com/festivalofbooks

Privacy raises some thorny, subtle and complex issues. It also raises some stupid-simple ones. The American surveillance industry's shell-game is founded on the deliberate confusion of the two, so that the most modest and sensible actions are posed as reductive, simplistic and unworkable.

Two pillars of the American surveillance industry are credit reporting bureaux and data brokers. Both are unbelievably sleazy, reckless and dangerous, and neither faces any real accountability, let alone regulation.

Remember Equifax, the company that doxed every adult in America and was given a mere wrist-slap, and now continues to assemble nonconsensual dossiers on every one of us, without any material oversight improvements?

https://memex.craphound.com/2019/07/20/equifax-settles-with-ftc-cfpb-states-and-consumer-class-actions-for-700m/

Equifax's competitors are no better. Experian doxed the nation again, in 2021:

https://pluralistic.net/2021/04/30/dox-the-world/#experian

It's hard to overstate how fucking scummy the credit reporting world is. Equifax invented the business in 1899, when, as the Retail Credit Company, it used private spies to track queers, political dissidents and "race mixers" so that banks and merchants could discriminate against them:

https://jacobin.com/2017/09/equifax-retail-credit-company-discrimination-loans

As awful as credit reporting is, the data broker industry makes it look like a paragon of virtue. If you want to target an ad to "Rural and Barely Making It" consumers, the brokers have you covered:

https://pluralistic.net/2021/04/13/public-interest-pharma/#axciom

More than 650,000 of these categories exist, allowing advertisers to target substance abusers, depressed teens, and people on the brink of bankruptcy:

https://themarkup.org/privacy/2023/06/08/from-heavy-purchasers-of-pregnancy-tests-to-the-depression-prone-we-found-650000-ways-advertisers-label-you

These companies follow you everywhere, including to abortion clinics, and sell the data to just about anyone:

https://pluralistic.net/2022/05/07/safegraph-spies-and-lies/#theres-no-i-in-uterus

There are zillions of these data brokers, operating in an unregulated wild west industry. Many of them have been rolled up into tech giants (Oracle owns more than 80 brokers), while others merely do business with ad-tech giants like Google and Meta, who are some of their best customers.

As bad as these two sectors are, they're even worse in combination – the harms data brokers (sloppy, invasive) inflict on us when they supply credit bureaux (consequential, secretive, intransigent) are far worse than the sum of the harms of each.

And now for some good news. The Consumer Finance Protection Bureau, under the leadership of Rohit Chopra, has declared war on this alliance:

https://www.techdirt.com/2023/08/16/cfpb-looks-to-restrict-the-sleazy-link-between-credit-reporting-agencies-and-data-brokers/

They've proposed new rules limiting the trade between brokers and bureaux, under the Fair Credit Reporting Act, putting strict restrictions on the transfer of information between the two:

https://www.cnn.com/2023/08/15/tech/privacy-rules-data-brokers/index.html

As Karl Bode writes for Techdirt, this is long overdue and meaningful. Remember all the handwringing and chest-thumping about Tiktok stealing Americans' data to the Chinese military? China doesn't need Tiktok to get that data – it can buy it from data-brokers. For peanuts.

The CFPB action is part of a muscular style of governance that is characteristic of the best Biden appointees, who are some of the most principled and competent in living memory. These regulators have scoured the legislation that gives them the power to act on behalf of the American people and discovered an arsenal of action they can take:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

Alas, not all the Biden appointees have the will or the skill to pull this trick off. The corporate Dems' darlings are mired in #LearnedHelplessness, convinced that they can't – or shouldn't – use their prodigious powers to step in to curb corporate power:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

And it's true that privacy regulation faces stiff headwinds. Surveillance is a public-private partnership from hell. Cops and spies love to raid the surveillance industries' dossiers, treating them as an off-the-books, warrantless source of unconstitutional personal data on their targets:

https://pluralistic.net/2021/02/16/ring-ring-lapd-calling/#ring

These powerful state actors reliably intervene to hamstring attempts at privacy law, defending the massive profits raked in by data brokers and credit bureaux. These profits, meanwhile, can be mobilized as lobbying dollars that work lawmakers and regulators from the private sector side. Caught in the squeeze between powerful government actors (the true "Deep State") and a cartel of filthy rich private spies, lawmakers and regulators are frozen in place.

Or, at least, they were. The CFPB's discovery that it had the power all along to curb commercial surveillance follows on from the FTC's similar realization last summer:

https://pluralistic.net/2022/08/12/regulatory-uncapture/#conscious-uncoupling

I don't want to pretend that all privacy questions can be resolved with simple, bright-line rules. It's not clear who "owns" many classes of private data – does your mother own the fact that she gave birth to you, or do you? What if you disagree about such a disclosure – say, if you want to identify your mother as an abusive parent and she objects?

But there are so many stupid-simple privacy questions. Credit bureaux and data-brokers don't inhabit any kind of grey area. They simply should not exist. Getting rid of them is a project of years, but it starts with hacking away at their sources of profits, stripping them of defenses so we can finally annihilate them.

I'm kickstarting the audiobook for "The Internet Con: How To Seize the Means of Computation," a Big Tech disassembly manual to disenshittify the web and make a new, good internet to succeed the old, good internet. It's a DRM-free book, which means Audible won't carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#privacy#data brokers#cfpb#consumer finance protection bureau#regulation#regulatory nihilism#regulatory capture#trustbusting#monopoly#antitrust#private public partnerships from hell#deep state#photocopier kickers#rohit chopra#learned helplessness#equifax#credit reporting#credit reporting bureaux#experian

308 notes

·

View notes

Text

One in 10 premature births in the United States have been linked to pregnant women being exposed to chemicals in extremely common plastic products, a large study said on Wednesday.

The chemicals, called phthalates, are used to soften plastic and can be found in thousands of consumer items including plastic containers and wrapping, beauty care products and toys.

Continue Reading.

86 notes

·

View notes

Quote

You cannot regulate desire.

Tom Holland

206 notes

·

View notes