#tax codes

Text

0 notes

Text

Companies dump more stuff into garbage landfills than they make money off of.

But good news for them according to tax codes they get write offs for that so they get paid for “loses” .

(Stupid system because that money comes from US tax payers 🙄)

Hollywood does it , retail stores do it ect.

So any “loss” isn’t a loss for them.

But don’t ever let them convince you polllution is YOUR problem.

It’s theirs.

They make and produce the junk and then dispose of its

#mass garbage#garbage#landfills#pollution#trash#taxes tax write off#Tax codes#employers#Hollywood#movies#tv#film#ect.#tax money

0 notes

Text

Unraveling the Mysteries of PAYE: A Comprehensive Guide

New Post has been published on https://www.fastaccountant.co.uk/paye-a-comprehensive-guide/

Unraveling the Mysteries of PAYE: A Comprehensive Guide

The article today is all about a very important, yet often misunderstood concept – Pay As You Earn, or for short. Understanding how PAYE works can save you quite a bit of stress come tax time, and it can even help you plan your finances better. So, let’s jump right in!

The Basics of PAYE

PAYE, or Pay As You Earn, is a method of tax collection used by Her Majesty’s Revenue and Customs (HMRC). It’s pretty straightforward – as you earn income, tax is automatically deducted and sent to HMRC. This happens each time you’re paid, whether that’s weekly, monthly, or otherwise. PAYE is applied to most types of income from employment, including wages from your job and most pensions.

But why should you care about PAYE? Simple. It’s the system that determines how much income tax is deducted from your pay. The better you understand it, the better you can manage your financial planning.

How It Works: Step-by-Step Breakdown

At its core, PAYE is about calculating the correct amount of income tax to deduct from your earnings. Your employer plays a big role in this. They use your tax code to figure out how much to deduct from your wages before they hand over the net pay.

The tax code itself is issued by HMRC, and it’s designed to reflect your tax-free personal allowance – the amount you can earn before you start paying tax. If your tax code changes, your PAYE deductions will likely change too.

PAYE and Self-Assessment

It’s a common misconception that if you’re self-employed, PAYE doesn’t apply to you. This is not strictly true! Even if you’re your own boss, you might need to send a Self-Assessment tax return, and PAYE could still be relevant to your other income from employment related activities where tax is deducted at source.

PAYE and Self-Assessment may seem like strange bedfellows, but they do intersect. If you’re both employed and self-employed, for example, you may become subject to both. In this case, your PAYE income and deductions will be important details for your Self-Assessment return.

The Role of HMRC in PAYE

HMRC is like the conductor of the PAYE orchestra. They oversee the system, issue tax codes, and collect the tax that’s been deducted by employers. Your interactions with HMRC might include checking your tax code or making sure deductions from you pay are correct.

Remember, your PAYE history forms part of your tax record. So if something doesn’t look right, or you have any questions about Pay as you earn, it’s a good idea to contact your employer or HMRC. They’re there to help you understand and resolve any issues.

Potential Issues and How to Resolve Them

Even with the best-laid plans, issues can arise with PAYE. For example, you might have the wrong tax code, leading to incorrect PAYE deductions. Or perhaps you’ve started a new job, and there’s a delay in applying the correct tax code.

In most cases, these issues can be resolved by contacting HMRC directly. They can help you confirm your tax code, understand your deductions, and resolve any discrepancies. If things get complex, don’t hesitate to seek advice from a tax professional.

Optimizing Your Financial Planning

Understanding PAYE is more than just knowing what chunk of your wage goes to the taxman. It’s a key tool in your financial planning toolkit. Once you know how your deductions from your salary or wages are calculated, you can budget more accurately, because you’ll know what your take-home pay will be.

PAYE is also a big player in retirement planning. Your pension contributions may be made through a PAYE scheme, so it’s worth understanding how this will affect your income now and in retirement.

Conclusion

We’ve covered quite a bit of ground, haven’t we? From the basics of PAYE to its impact on your finances, I hope this guide has shed some light on the mysteries of PAYE. Remember, understanding PAYE isn’t a one-and-done deal. It’s an ongoing journey, just like your financial planning.

Frequently asked questions

Q: What is a tax code?

A: A tax code is used by HMRC to your employer or pension provider to work out how much Income Tax to take from your pay or pension.

Q: How is PAYE calculated?

A: It is calculated based on your income, using your tax code and official tax rates in operation.

Q: What if I have the wrong tax code?

A: If you believe your tax code is wrong, you should contact HMRC. They can help you to resolve this issue.

Remember, when in doubt, ask! If you have any questions or experiences with that you’d like to share, pop them in the comments.

#Employer Obligations#Income Tax#Pay As You Earn#PAYE#PAYE Deductions#PAYE for Self-Employed#Self Assessment Tax Return#Tax Codes

0 notes

Text

Unraveling the Mysteries of PAYE: A Comprehensive Guide

The article today is all about a very important, yet often misunderstood concept – Pay As You Earn, or for short. Understanding how PAYE works can save you quite a bit of stress come tax time, and it can even help you plan your finances better. So, let’s jump right in!

The Basics of PAYE

PAYE, or Pay As You Earn, is a method of tax collection used by Her Majesty’s Revenue and Customs (HMRC). It’s…

View On WordPress

#Employer Obligations#Income Tax#Pay As You Earn#PAYE#PAYE Deductions#PAYE for Self-Employed#Self Assessment Tax Return#Tax Codes

0 notes

Text

LeftTards use “Capitalism” the same way grade schoolers use “Gay”

“I don’t like this so CAPITALISM!”

Capitalism can be defined in three words: The market decides.

We don’t have capitalism. The Reaganites murdered it off back in the 1980s. We have “Supply side” or “Trickle down” which is the opposite of capitalism. It’s antithetical. And before we heap all the blame on the Republicans: Obama out Reaganed Ronald Reagan!

Google it, for Christ’s sake...

“Capitalism” is market economics and “Capitalism” REQUIRES sound government regulations.

Think of a farmer’s field. Okay? Plants know how to grow. Leave nature be and an empty field will become overgrown with plants. Left on it’s own it’ll become a forest. Nature needs no help to grow plants.

But we do. If we want to maximize that field, if we want to get food from that field and not weeds... if we want to harvest crops from that field instead of seeing them devoured by insects and other pests... if we want to see those plants flourish instead of dry up & die... we have to regulate that field. We have to stop weeds and other intrusive plants from growing. We have to keep vermin from chewing it all up. We have to water it when the rains fail.

Get it? Nature needs no help to grow plants, but we do. And the same it true for the economy.

Economies exist. They always exist. We don’t need government, we don’t need laws. Trade has existed into cavemen times and it will always exist. It’s if we want to maximize the benefit of the economy, the market. If we want it to remain fair. If we want to be able to hold people accountable for abusing the market THEN we need regulations. We need government.

Capitalism, the free market will stop being free without regulation, just as sure as the farmer’s field will be overrun with weeds & saplings if he fails to regulate it.

We don’t have capitalism. We have the 1%, the corporations, the billionaires and even the millionaires dictating TO THE MARKET, not the other way around.

Our problem is the lack of capitalism. Our solution is the restoration of capitalism.

#Capitalism#market economics#free trade#fair trade#regulation#money#jobs#tax codes#taxes#trickle down#supply side

1 note

·

View note

Text

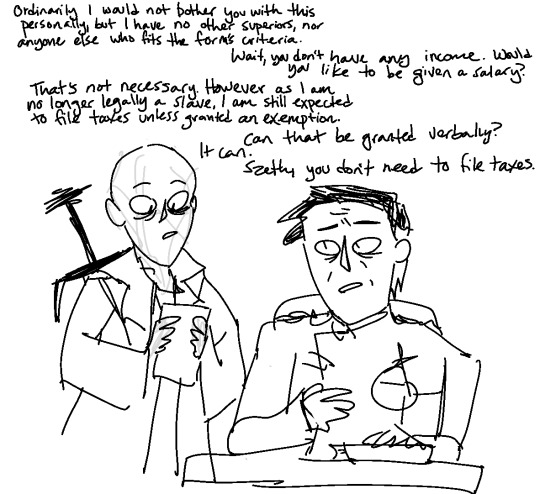

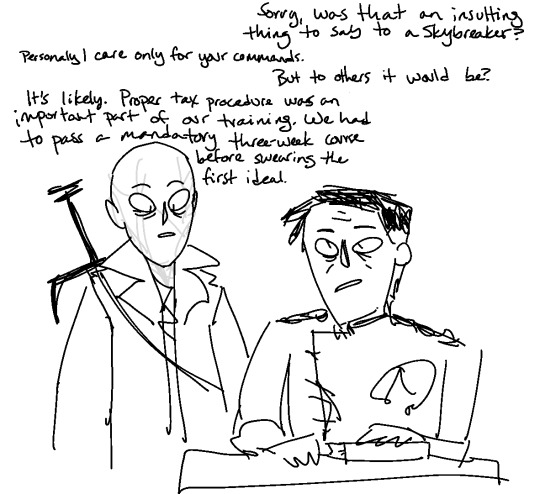

And before you ask, no, spren do not qualify as dependents.

#damn should have done this last week and made a tax psa out of it#szeth#dalinar#the form hasn't been used in thousands of years but it is still part of the tax code#although it's unclear how much radiants bother to distinguish their stormlight spheres from their personal cash#so even nale himself would be the first to admit that it allows for radiants to hoard wealth unequally and unfairly#noted polymath szeth only needed one week to complete the course because he already knew about international tax laws from his childhood#all part of his well-rounded education

138 notes

·

View notes

Text

This short article is a must read.

👆

#regressive tax codes#tax the rich#income inequality#republican assholes#income tax#1%#poor and middle class pay more than the rich

142 notes

·

View notes

Text

“in another life, i would have really liked just doing laundry and taxes with you” is so janto coded

#even tho jack would NOT do taxes#or laundry#im pretty sure it was shown ianto doing his laundry#BUT SERENITY CODED#SERENITY I LOVE YOU#janto#mine#jack harkness#captain jack harkness#ianto jones#torchwood#doctor who

491 notes

·

View notes

Text

for context, sometimes I volunteer at (redacted) running the live stream broadcast. it's come to my attention that I'm not exactly dressed for the location, even though those dress code suggestions are not meant for the tech desk lmao

also! hourly comics day is the first of feburary! I did exactly 1 (one) hourly comic before calling it a day. this is that singular comic a few days late.

#desk posting#technically. i'll make a proper desk post in a bit. the vietnamese community where i live is starting up the lunar new year celebrations#i gotta remember to wish my aunt in hong kong a happy lunar new year later this month too. ehrugh.#me trying to remember anything vs filing taxes. the absolute nightmare hell that taxes is.#anyway the dress code also says NO HATS!! but one lady here is still showing up with fantastic hats and honestly#good for her. wear those hats!!! fuck that dress code

94 notes

·

View notes

Note

What about drawing different Greek gods and goddesses like Apollo and Venus, etc. in a split view with one side being them in their traditional environment and depiction and on the other a modern take on them like how they’d dress and look like in todays day and age. Obviously you can draw whatever or whomever but I think it would be so cool to see especially with your art style which is a 12/10!

Even though I don't like Greek Mythology that much, this intrigued me enough to wanna do it cause it's also something I wouldn't have done normally. So here it is!

They're not as detailed, but I had fun doing them, esp. whimsigoth Persephone! They always do her cottagecore or something, but are we forgetting she's half queen of Hell? I think she'd like some edge.

I also just did four Gods cause these are the ones I like the most and I genuinely already struggled through Aphrodite's drawing, so I decided not to push my luck.

#thanks for your request it was fun!#now I'm resting my hand to get to the final request I got cause this was actually taxing for some reason#art requests#greek mythology#greek myth art#greek mythology au#in a way#fanart#persephone#hades#aphrodite#artemis#greek gods#art#digital art#my art#artists on tumblr#in retrospect I think Hades would look like Neil Gaiman or something#so think of Neil Gaiman vibes as well cause I'm not redrawing it (sorry)#if I draw him again he's gonna be Neil Gaiman coded probably#wmp requests

32 notes

·

View notes

Text

5 hours into writing this thing I had the thought “I should’ve gone into tax law” which is absolutely abhorrent and just a reflection of how terrible this week was.

#god knew what he was doing when he let me flop on the lsat#anyway im tired but had a lot of caffeine so I won’t be sleeping for a while#I told my boss I would send this tonight but she’s getting it at 7am#oh also what I was writing was related to tax law hence the thought#I had to teach myself part of the tax code 😖#pers

29 notes

·

View notes

Text

Today I created my own holiday called “handle your shit saturday” in which I had to actually deal with all the shit piling up in my house and actually do the projects I’d been planning and it was so satisfying and made me feel SO much better. If you’re struggling rn, I highly recommend, even if you just handle a small chunk of your shit, giving it a name made it feel all official and whatnot and somehow let me trick myself into doing things I’ve been putting off since November.

#I re-sealed around the basement window where I think ants were getting in last summer#I filed my taxes#I put away the candles in the windows from Christmas (all the other Christmas shit got put away a while ago)#I put away all the snowman decor#there’s still more to do:#I need to pay my water bill#i need to scan the QR code that came with the water bill to see if I have to test something about my pipes#I need to re-seal around the kitchen counters and also the kitchen window#(the other likely entry point for the ants)#I need to replace the picture frame I broke mopping last weekend (don’t ask I don’t know how I did it either)#but getting rid of the piles of paper for my taxes for example feels so good

36 notes

·

View notes

Text

The BR Tax Code: A Simplified Guide to Understanding its Implications

New Post has been published on https://www.fastaccountant.co.uk/br-tax-code/

The BR Tax Code: A Simplified Guide to Understanding its Implications

Hi everyone! Today, we’re going to unpack a topic that might seem tricky but is quite important for all taxpayers: the BR tax code. We’ll explore what it is, how it can affect your take home pay, and what to do if you find this tax code applies to you.

Tax Codes in General

Before we delve into the intricacies of the br tax code, let’s get a handle on tax codes in general. A tax code is the mechanism the tax authority uses to work out how much tax should be deducted from your income or pension. Here in the UK, HMRC (Her Majesty’s Revenue and Customs) dishes out tax codes, and there’s quite a variety to get to grips with. The BR tax code is one such example, with its own unique characteristics and implications.

Unravelling the BR Tax Code

So, what exactly does the BR tax code mean? BR stands for Basic Rate, which means that all the income under this code is taxed at the basic rate – 20% as of my last update. This tax code typically comes into play when you have more than one source of income. In this situation it is usually applied to your secondary income source (your second job or a pension, for instance).

It can also be applied when a person starts a new job without a P45 from a previous employer. This might occur for a number of reason including first employment or having been out of the work force for a number of years. Where this happens, the br tax code will only be temporary as HMRC will amend it to a standard one in a matter of time.

If you see ‘BR’ on your payslip, it indicates that you are taxed at the basic rate from the first pound earned, without any personal allowance deducted. This is because your personal allowance has already been accounted for in your primary income source.

The BR Tax Code and Your Tax Liability

Now, you might be wondering how the BR tax code affects your tax liability. As mentioned, a BR tax code means that you’re taxed at the basic rate on all your earnings from that income source.

Let’s take an example to help illustrate this. Suppose you have a full-time job where you earn £30,000 per year, and a part-time job where you earn an additional £10,000 per year. Your personal allowance (let’s say it’s £12,570) is used up in your main job, and so the entire £10,000 from your part-time job is taxed at the basic rate of 20%. So, you would pay £2,000 in taxes on your part-time job earnings.

What to Do If You’re on a BR Tax Code

Alright, so you’ve spotted ‘BR’ on your payslip. What now? The first step is to verify whether it’s correct. Tax codes aren’t infallible, and sometimes you might find you’re on the wrong one. You can check this by using the tax checking service provided by HMRC or by directly reaching out to them.

If you’ve confirmed that your tax code is incorrect, don’t hesitate to contact HMRC. They can help adjust your tax code and inform your employer or pension provider to modify your tax deductions accordingly.

youtube

Conclusion

Understanding your tax code, especially if it’s the BR tax code, is crucial. It ensures that you’re not paying too much (or too little) tax. So, always double-check your tax code, understand what it implies, and don’t hesitate to take action if you think it’s not right.

Frequently Asked Questions

What does a ‘BR’ tax code mean? A ‘BR’ tax code means that you are taxed at the basic rate on all your earnings from that income source, without any personal allowance deducted.

Will a ‘BR’ tax code make me pay more tax? A ‘BR’ tax code can result in paying more tax if it’s applied incorrectly. However, if it’s correct and it’s applied to your secondary income, it means you’re just paying the basic rate tax on that income, as you should.

What should I do if I think my ‘BR’ tax code is wrong? If you believe your tax code is incorrect, get in touch with HMRC. They can help you understand why you’ve been given a particular tax code and change it if it’s incorrect.

0 notes

Text

Emergency Tax Code: What to Do When You're on It

Today we’re chatting about something we all hope we never have to deal with, but need to know about just the same: the emergency tax code. This is one area of the UK tax system that can often lead to confusion and, potentially, overpayment on tax, so we’ll cover everything you need to know about it.

Understanding Tax Codes

So, let’s start with the basics: tax codes. These little alphanumeric…

View On WordPress

0 notes

Text

the infodumping is a necessary part of aftercare. send tweet

#hikey#i was told to post this#bc i nearly passed out from coming so hard and then not ten minutes later went on a tangent about tax policy#and i said hey listen infodumping is a necessary part of aftercare and they stopped dead in their tracks#and said that was sooo tumblr coded#and now here we are

13 notes

·

View notes

Text

Changes to the Tax Collection System in Revolutionary and Napoleonic France

My translation from Le prix de la gloire: Napoléon et l’argent by Pierre Branda.

This part is specifically about the reforms made to the tax collection system. Problems with taxation had been the source of many woes, so it went through major changes.

“The [tax] work of the Consulate mainly concerned the reorganization of tax collection. Until now, this essential element was not administered directly by the Ministry of Finance. The Constituent Assembly had wanted the tax rolls for direct contributions, that is to say the ‘tax slips’, to be established by municipal administrations. Their work was complex, because each year it was necessary to draw up a list of taxpayers, determine each person’s share of tax and send them the amount of the contribution to pay. Poorly motivated (or even corrupt), the municipalities had put little care in the execution of their mission since a large part of the taxpayers had not yet received anything for their taxes of year VIII, or even of year VII or year VI. Also, with two or three years of delay in preparing the rolls, it was not surprising that tax revenues were low (nearly 400 million francs were thus left outstanding). If the sending of tax matrices left something to be desired, the collection of direct contributions was hardly better. The tax collector was also not an agent of the administration: this function was assigned to any person who agreed to collect taxes with the lowest possible commission (otherwise called ‘collecte à la moins-dite’). With such a system, there were numerous inadequacies, often due to incompetence, but also due to the prevailing spirit of fraud. However, in their defense, the profits of the collectors were most of the time too low to provide such a service; also, to compensate for their losses, they were ‘forced’ to multiply small and big cheats. In any case, in such a troubled period, letting simple individuals carry out such a delicate mission could only be dangerous for the regularity of public accounts. In short, the mode of operation of taxation that Bonaparte and Gaudin inherited was failing on all sides and threatened to sink the State.”

“One month after Gaudin’s appointment, on December 13, 1799, the Directorate of Direct Contributions was created with the mission of establishing and sending tax matrices. This administration, dependent on the Ministry of Finance, was made up of a general director, 99 departmental directors and 840 inspectors and controllers. The organization of direct contributions became both centralized and pyramidal, the opposite of the previous system, decentralized and with a confused hierarchy. The work of preparing the rolls, for so long entrusted to local authorities, passed entirely ‘in the hands of the Minister of Finance’ and in this way the taxpayer found himself in direct contact with the administration. The tax system no longer having any obstacles, the beneficial effects of such a measure did not take long to be felt. With ardor, the agents of this new administration carried out considerable work: three series of rolls, that is to say more than one hundred thousand tax slips, were established in a single year. It must be said that the ministry had not skimped on their pay (6,000 francs per year for a director, 4,000 for an inspector and 1,800 for a controller), which was undoubtedly not unrelated to such success.”

“Tax reform was slower. It was not until 1804 that all tax collectors were civil servants. The consular system gradually replaced the collectors of the departments, then of the main cities and finally of all the municipalities whose tax rolls exceeded 15,000 francs. At the end of the Consulate, the entire tax administration was thus entirely dependent on the central government. Subsequently, the one in charge of indirect contributions (taxes on tobacco, alcohol or salt) created on February 25, 1804 and called the Régie des droits réunis was built on the same pyramidal and centralized model. It was the same later for customs.”

“According to Michel Bruguière, historian of public finances, ‘Napoleon and Gaudin can be considered the builders of the French tax administration. [...] They had also developed and codified the essential principles of our tax law, so profoundly derogatory from the rules of French law, since the taxpayer has nothing to do with it, while the administration has all the powers’. Basically, after having clearly understood the true cause of the ‘financial wound’, Bonaparte wanted an effective, almost ‘despotic’ instrument to avoid experiencing the unfortunate fate of his predecessors. As a good soldier, he created a fiscal ‘army’ responsible for providing the regime with the sinews of war. It was also necessary to definitively break the link between private interests and state service in everything that concerned public revenue. The time of the farmer generals of the Ancien Régime or the ‘second-hand’ collectors of the Directory was well and truly over. Napoleon Bonaparte, with his fierce desire to centralize power in this area as in many others, undoubtedly gave his regime the means to last.”

French:

Page 208

Page 209

Page 210

#Le prix de la gloire: Napoléon et l’argent#Le prix de la gloire#Napoléon et l’argent#napoleon#napoleonic era#napoleonic#napoleon bonaparte#19th century#first french empire#1800s#french empire#france#history#reforms#finance#economics#french revolution#frev#la révolution française#révolution française#Gaudin#tax#tax collection system#taxation#law#napoleonic code#source#french history#branda#Pierre branda

36 notes

·

View notes