#how to invest in growth stocks

Text

How To Invest In Growth Stocks For Beginners In 2022 [FREE COURSE]

How To Invest In Growth Stocks For Beginners In 2022 [FREE COURSE]

We're going to be doing a course here Talking about growth investing 101 some Of the basics i believe we have 15 Different videos outlined and in this Video being the very first one all i Want to talk about is what are growth Stocks what are growth investments these Are going to be some of the basic Characteristics of growth investments And First of all number one the reason why We call these…

View On WordPress

#best stocks to buy now#course#growth stock portfolio#growth stocks#growth stocks 2022#growth stocks explained#growth stocks vs value stocks#how to invest#how to invest in growth stocks#how to invest in stocks#stock market#stock market for beginners#stocks to buy#stocks to buy now#top stocks to buy now

0 notes

Text

10 Proven Ways To Boost Your Business Income

Introduction:

Running a successful business is not just about generating revenue; it’s also about maximizing your income potential. By exploring various strategies, such as upselling, cross-selling, and diversifying revenue streams, you can significantly increase your business income. In this blog post, we will discuss ten proven ways to boost your business income while providing examples to…

View On WordPress

#Blog#Business#Customer#Educational#Effective#Efficient#Finance#Gentlemen#Growth#How to#Investing#Men#Money#Self growth#Stock

7 notes

·

View notes

Text

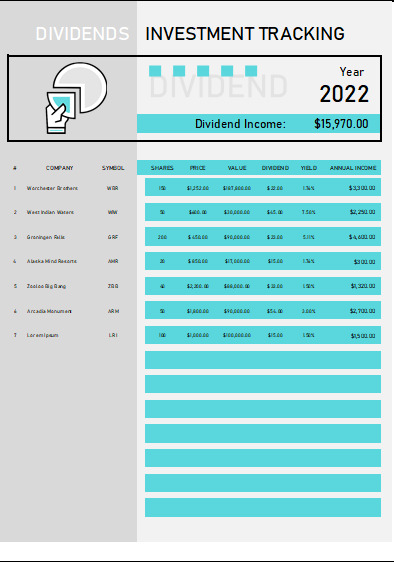

Dividend Investment Tracker

Download free excel template for dividend investment tracking. This dividend tracker excel template is useful for tracking all the dividend income from investment in shares and stocks of companies. This is useful for professionals and retail investors to track their yield per investment or Return on Investment (ROI).

About dividend Investment tracker excel template

Once you download this free…

View On WordPress

#dividend#dividend growth investing#dividend income#dividend income tracker#dividend investing#dividend portfolio#dividend portfolio tracker#dividend portfolio tracker 2021#dividend portfolio tracker 2022#dividend portfolio tracker 2023#dividend portfolio tracker excell#dividend spreadsheet#dividend stock portfolio tracker google sheets#dividend stocks#dividend tracker#dividend tracker spreadsheet#dividends#google sheets dividend tracker#how to track dividend income#how to track my dividends#portfolio tracker

3 notes

·

View notes

Text

youtube

🧠💰Warren Buffett's Secrets: How to Turn $1,000 into $1,000,000 - Make Money Online

#real estate#dividend investing#passive income#financial freedom#stock market#affiliate marketing#how to start affiliate marketing#stocks#dividend stocks#dividend growth investing#how to make money#how to make money online#smart money#dave ramsey#how to make money online 2023#affiliate marketing for beginners#passive income ideas#passive income 2023#passive income ideas 2023#Warren Buffett#make money#make money online#smart money tactics#Youtube

0 notes

Note

My question about growth/the venture capitalist mindset is like … how have venture capitalists and the like not figured this out already? It’s been a decade, give or take a few years, since the internet started being monetized to hell and back, and if we all know they’re not really making a profit (bc no one clicks on ads, obviously) then why are the structures still in place?im looking at all this and I feel like a dunce bc I just don’t get how ppl can keep ofunelling money into something that we all know doesn’t work lol ! :0

there's a couple reasons for this, but the tldr of it is that if you're wile e. coyote and you're running in the air over the edge of a cliff, it's in your material interests not to look down

let's say you're a venture capitalist and you've put $10 million into hypnospace, the hot new social media site. when you invest into a company, you invest at a certain price--the company has an idea of how much it's worth, and that determines what price they'll sell their shares at. let's say you buy at $10 a share, so you have a million shares in hypnospace. that $10-a-share-valuation was based on hypnospace telling you (in, say, 2012, when this was still believable and even seemed self-evident) that becuse they were seeing huge growth in daily active users, they'd eventually become insanely profitable.

now usually even you, a venture capitalist, a lifeform mostly resembling a parasitic flatworm, might be a little cautious about this investment. will they really become profitable? it seems risky. however because it's 2012, the US federal reserve has been giving out loans at their ZIRP (zero interest rate policy) for four years in a response to the 2008 financial crisis. what that means is that it's incredibly cheap for banks to borrow money, which in turn means it's incredibly cheap for you, a venture capitalist, to borrow that money from banks. when money is cheap, risky investments make a lot of sense--when you can get an extremely low-interest-rate loan, throwing that money down the toilet is unfortunate but no longer catastrophic. so you put your $10 million into hypnospace because the risk is artificially lowered by the ZIRP, making it well worth the reward.

now it's five years later and it's 2017 and it's becoming increasingly clear that hypnospace.horse is probably not going to became the new facebook and that perhaps there will in fact only be one facebook. bummer. but you've still got a million shares in it. this means that you're directly invested--not in the company becoming profitable, but in the valuation of that company going up. if people can be convinced to buy hypnospace shares at $12-a-share, you can make off with a cool $2 million even though the website never did anything useful or made any money. on the other hand, if people start thinking 'hey, this website has never made any money and it's obviously never going to, why would we buy shares in it'--shares plummet to $1 a share, and you're out $9 million! worst case scenario!

so even if you, the venture capitalist, realize that the website's a boondoggle, it's in your best interest to convince everyone around you that no, it really will become profitable, and its shares (that you hold some of!) are really valuable and you should want to buy them. and this doesn't just mean lying to other venture capitalists (although they love doing this)--capitalists pay close attention to sales of stocks. if you realize that hypnospace is never going to make money and decide to cut your losses and abruptly offload all million shares, other capitalists will interpret that for what it means--that you've totally lost confidence in seeing return on your investment--and many of them will panic and also start selling their shares, while capitalists with no hypnospace shares will think 'boy, this hypnospace thing seems like a real wash, i don't want to buy shares in that'.

so what do you do? you keep putting money in. if the company's increasing in valuation the more it grows, then even if you're crystal-clear aware that growth has no path to profitability, you still gain wealth for every month that the business stays afloat by burning money, because the valuation goes up and your shares are worth more. the ideal outcome for a venture capitalist investing into a tech company is to make a big investment, let the company bleed money while it grows for several years, then sell--not all at once, not abruptly, and not while the price is in stagnation or decline. it's one big game of hot potato for when the gig is finally up. not every venture capitalist has to be a totally credulous dipshit--just the last one in the line.

#ask#now a lot of the calculus on this has changed with interest rates on the rise again#but this explains basically the last decade of the tech sector

1K notes

·

View notes

Text

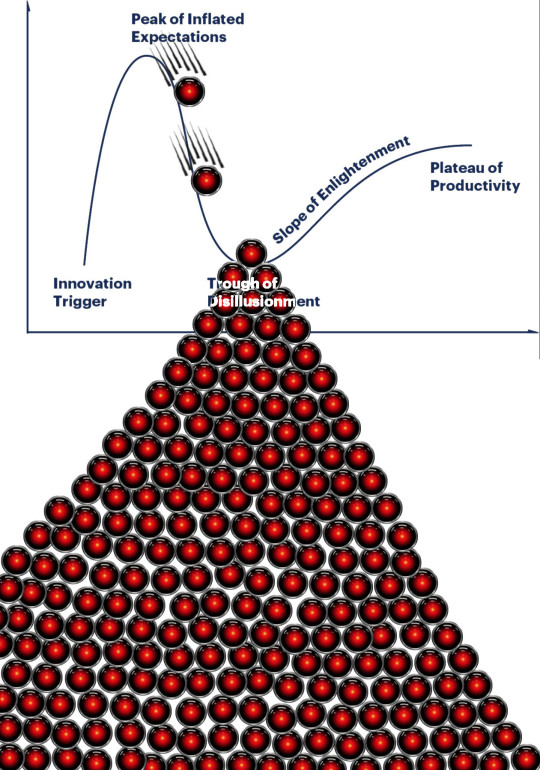

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days.

‘

They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

ok I know fluff all about economics but. we really need to move away from shareholders and stocks

look at Lego. It’s privately owned, all the stock is in family/company hands, no shareholders. The bricks are made just as well, they’ve kept up good business, they’re doing great. No degrading quality or crappy tricks to increase profits, a set from the 90s will work just as well as a brand new one. Only real difference is more complex pieces (I did their monthly builds before they ended it a few years back, you can see the improvements over the years.)

now look at apple. Apple went public, they’ve got plenty of shareholders. Apple changed their charger ports to a proprietary version. Apple got rid of headphone jacks on their phones. Apple forces you to get a new phone by making apps only use newer software versions that old phones can’t get. Or just killing their battery.

yeah, these are two specific and very different companies, but the point is that businesses that answer to shareholders have to convince them to keep those shares. they want a return on their investment- line go up, more more more, bigger and better. Private companies like Lego don’t - they can keep doing the same thing forever, as long as it still works, and make small improvements along the way. You go public, you chain yourself to the infinite growth cult. And at a certain point, you’ve hit the max. There’s only so many people who need so many things. There’s only so much material to make or run things. You physically can’t keep growing forever.

now this bit is my personal opinion, but shareholders. don’t actually do anything useful. it feels like if I gave you $20 one time and then expect you to give me 0.5% of your paycheck every week after that. I didn’t do anything to help you get that money, but I gave you that $20, so I deserve it. actually, I deserve more. you need to work harder so I can get more money from you. otherwise I’ll take that $20 back, plus interest. you don’t want that, do you? no. so go do some 14-hour shifts and ignore your friends so I can get more money out of you.

you get what I mean? it’s dumb. it sounds really, really dumb.

do not explain the stock market to me I know how it works it’s still stupid

anyway

if we want to still have a livable planet and make real progress towards… anything actually beneficial to the general population and not ten guys with more money than god, we need to step away from shareholder control of businesses. it helps no one, it causes so many problems, it’s not good. deincentivize eternal growth and expansion, center people over profit. use over profit. longevity over profit. etc.

#it speaks#enshittification#anti capitalism#i mean it I’m not hearing 1000 explanations about the stock market shut up

318 notes

·

View notes

Text

This is the first part of a long-form piece about a robot and a giant computer. I expect it to take 3-5 parts to finish in a state I'm happy with. It will contain adult topics, overt sexuality, blatant robotfuckery, toxic lesbians, unbalanced power dynamics, wireplay, and lots of other things that may be triggering or make you uncomfy. Be aware before reading that while I'm emphasizing worldbuilding, at the end of the day this is gay robot smut.

Salvage - 01

Time inside - 00D/00H/00M

Levels deep - 01

Your feet hit the floor with an echoing clang as you drop the few yards down into the access hatch. You stare into the blackness for a moment as your cameras adjust to the lack of light, small LED points in the hallway glowing brighter by comparison as the rest of your vision lights up. You glance back up the hatch at the giant roll of auxiliary cable you've set up to leech from the structure's solar paneling, plugging the end of the wire into your upper back and giving it a firm pull to make sure it will unspool properly. It does. You invested in the best on the market, and even if it takes you weeks to get to what you need you shouldn't have to worry about power.

The site is a centuries-old computation soul, built during the ninth conflict as a safeguard against any unforseen threats. It was machines like this which ultimately won the war and led the corporation to global dominance, but they haven't exactly been rewarded for it. Dozens of the city-sized structures now sit abandoned and restricted, looming forgotten over the scrap fields they once protected.

Unlike the rest of society, you haven't forgotten them. Though they're from long before your time, you're connected to them in a way few other bots are- You're a late activation, brought into existence a few decades ago, one of just a few old wartime reserve models powered on for the first time to meet the demand of a labor shortage. Aside from less than a hundred other late activations, either maintenence drones or combat units like yourself, these old computational souls are the only real family you have left. It's why you're here at all, both because your body is permitted to be here without setting off the alarms, and because your obsolete frame is failing without the parts that exist nowhere else.

A few years ago, your battery life allowed you to function unplugged for weeks at a time. The last time you tried to operate without an external power source, you didn't even make it a few hours. A battery canister from the computer soul should fix that, though. The worn manual you were given on activation has taught you that it's an easy fix, and a single non-faulty canister should keep you going for the entirety of the conceivable future, it's just a matter of getting one. You tug at the cable, and it slithers along the ground behind you as you march forward into the dark.

For a place this old, the upper decks are shockingly well-maintained. You're sure they're not sterile, but they're about as close as a place like this could get. Whichever soul this facility maintains, they're exceptionally diligent about flushing pests and unwanted growth from their halls. Your heels click against the reflective metal flooring as you make your way through the seemingly endless halls of clean white and grey, passing rooms where maintenence drones once stayed and the occasional whoosh of a colossal ventilation column.

A thin survey arm drops from the ceiling, structure panels silently parting and closing in a wave around it to make way for it as it zips down the hallway to take stock of you, twin lenses fixed intently on your body as you give it a nervous wave. You shouldn't be perceived as a threat, but it's still not comforting to imagine how that might change for a hyperintelligent being left alone for hundreds of years. If YOU were in its position, seeing a light-framed combat unit aimlessly making her way through your hallways, you probably wouldn't be too thrilled.

The arm takes a last look at you and retracts back up into the ceiling, just as you stop at the central stairwell. Even though it's gone, it's safe to assume you're always being watched from this point forward. You try to ignore that feeling as you lean into the stairwell, making sure its structure hasn't degraded. It should be able to take you all the way down to the soul's core systems, where you'd find the thousands of fresh battery canisters storing the energy it pulls from the sun. You grip your cable with both hands to steady yourself, and begin your descent.

#robophilia#robotfucker#computer fucker#wireplay#robot yuri#robot4robot#pov#ns4w#longer form#salvage

77 notes

·

View notes

Text

pick a card - how you can find balance

Hello everyone! today's pick a card will focus on:

-what you're placing all your energy into, what you're neglecting and how you can find more balance in between everything you're taking on at the moment. take a deep breath and allow your intuition to guide you towards your pile!!

pile one

what you're focusing on- page of wands and king of coins, Saturn in Scorpio

for you guys im seeing a focus on growth, expansion and exploring new ideas. youare wanting to grow your money and maximize your potential, not only with money you have the potential to make but money you already have whether it be savings, inheritance, loans, investments. you're pouring your energy into ambition and practicality and achieving financial freedom. intuitively i feel like this pile wants to achieve great things at a young age, you feel that you are destined for entrepreneurship, or making bold career moves that are risky but still grounded in reality. so overall pile one, you're energy is being poured into your longterm stability and financial freedom, especially financial freedom that is achieved through inheritance, investments, trading, traditional methods such as stocks or selling something.

what you're neglecting- nine of pentacles

Overall, the Nine of Pentacles suggests that you may be neglecting essential aspects of self-care, financial management, and appreciating the abundance that is already around you. you're being encouraged to find a balance between working towards your goals and taking time to enjoy life's simple pleasures. in the pursuit of finding financial freedom at a young age and achieving long term stability, you may be stifling social relationships too. pile one, its more than ok to pour more energy into your friendships, you can work towards your goals while still enjoying life's simple pleasures. your friends may miss you, dont listen to online creators who tell you that you can go out and have fun while striving towards an extraordinary lifestyle. longterm stablity may be difficult but it doesnt have to be miserbale or lonely.

pile two

what you're focusing on- the hanged man, the ten of swords, mecury in libra

the Hanged Man and the Ten of Swords together suggest that your energy is being poured into surrendering to, accepting, and embracing change. You may be in a period of transformation, releasing old patterns, and finding wisdom in challenging experiences. im feeling shadow work vibes, meditating on your fears and triggers to find the root of them. i feel like this energy is specifically demonstrating you placing a ''halt' on your fears to really examine every angle of them. im seeing the image of a spider creating a web, and one day they just stop to sit in what they've created before continuing to make their web. This combination of cards encourages you to be patient, with your life's direction, to find meaning in the journey. any delays or setbacks happening right now are trying to get you to stop, like the spider has, to exmaine where you are and what your triggers are, to build a foundation of something you ahve to know what the foundation is. i feel strongly that you're also being halted to examine your friendships and assoications before webbing a foundation in them. i also think that this pile is pouring energy into deciphering what media is influencing you and how its effecting you mentally, as well as how your words influence others, how your words effect your mind and reality. you could be getting into affirmations and manifestation.

what you're neglecting- the 6 of pentacles

you may not like hearing this, but you're neglecting fair, and balanced exchanges of energy, time and resources. The Six of Pentacles indicates that you may be neglecting the balance between giving and receiving. It's important to assess if you are being too generous to others at the expense of your own well-being or if you are hesitant to receive help or support from others when needed. or alternatively, are you not aware of how much you're expecting from others without giving in return?

pile three

what are you focusing on- three of cups and two of cups, mars in aries

friendships, close connections, building bonds, creating loving and harmonious relationships. you're pouring your energy into the more emotional, social aspect of life. i also feel that you're energy is going towards being emotionally vunerable and open in your relationships, you're placing emphasis on giving people quality time, sharing moments of openness, building mutual bonds with people. i also feel that there is also of impulsiveness going on, i think while you are pouring energy into a deeper bond, you're going head over heels, this feels like emotional compulsion to go 100 percent in on someone. i also keep getting the message about you being in a social group or friendgroup in which you break off into a partnership with someone in that group, and instead of balancing your time and energy between everyone, you're impulsively poring your emotional energy into one person. that wont resonate with everyone though.

what you're neglecting- 4 of pentacles

stability, solid foundations. the Four of Pentacles advises you to avoid neglecting areas related to financial generosity, planning, adaptability, and emotional connections. This card can indicate that you might be neglecting to embrace change or holding onto outdated financial beliefs or habits. It's essential to be open to new ideas, adapt to evolving financial circumstances, and be willing to make necessary adjustments. this card may also be coming up to signal that you're holding too tighly on something and neglecting everything else in pursuit of holding onto one thing, in your case, a relatiosnhip or bond with someone.

#tarot meanings#tarot pac#pick a card#pick a card tarot#pac tarot#tarot pick a pile#pick a pile#divine feminine#divine masculine#tarot predictions#pick a photo#pick an image#law of abundance#loa#lowtumblr#tarot community#tarot services#pick a card reading#astro notes#tarot cards#tarot deck#pick a picture#pick a pile reading#tarot pick a card#manifestingmindset#manifestion#law of assumption#affirmations#tarot readings#tarot

179 notes

·

View notes

Text

Trying to figure out if there are any actual, like, ethics to the stock market. Going public sounds unremarkable, just gaining capital for development in exchange for giving investors some voting power in operations and management.

But it completely changes the business model and general goals. Being beholden to shareholders ensures that "a successful business" is defined less by its ability to be stable and change with the times without faltering and growing to reasonably fill its niche, and rather by its ability to turn higher and higher profits in order to ensure greater dividends, a greater return on investment, to the shareholders, focusing on the short term investments rather than long-term stability. Companies that can't fulfill that role, staying stable or being unable to change with the times due to shareholder demands, get caught in stock gambits like shortselling (e.g. the GameStop incident) and driven out of business.

In theory, a company being led by a bunch of people instead of by a single person or family should make it less prone to abuses, but when the only people that can afford enough stock to have an impact on operations are people of extraordinary wealth...

Companies end up pursuing eternal growth even when it isn't feasible, suborning their own original goals and intentions in the name of turning ever-greater profits for their shareholders.

But then again, privately-owned means vulnerability to private equity, which probably makes them more likely to be destroyed by 'grow your wealth' folks...

(This isn't entirely for a recent Ko-Fi Prompt, but it's a big factor. I'm just trying to get my thoughts on the stock market in order before I dive into the more specific question I was given. My focus in university was primarily in international business/communications and marketing, rather than stock and equity, and it's been a while since I put deep thought into how the stock market functions and whether that function is inherently structured in a way that supports unethical action, or just one of many systems that wealthy people have taken advantage of.)

Does anyone here with experience or education in stocks and finance have thoughts to share?

I'm focusing on the ethics and morality of the stock market and its impacts on employees, the environment, and the public, not questions of 'do shareholders deserve to ask for a return.'

No libertarian takes on this, please, I'm trying to gather actual information, with a basis in the social contract, not USAmerican individualism.

207 notes

·

View notes

Text

The Power of Entrepreneurship

You need to own a business

In a world driven by innovation and ambition, owning and operating a business has become more than just a career choice – it’s a life-changing opportunity. The benefits are vast and the impact is profound. In this blog post, we will explore why it’s important to embrace entrepreneurship and embark on the journey of owning and operating a business.

1. Pursue Your Passion:

Owning a business…

View On WordPress

#Blog#Business#Business owner#Educational#Entrepreneur#Entrepreneurship#Finance#Gentlemen#How to#Investing#Men#Money#Passion#Passions#Profit#Self growth#Stock

5 notes

·

View notes

Text

It's been awhile, but I have a new thought for folks starting out investing

This blog is called "not financial advice" so this is not financial advice. Nothing on this blog is.

And.

I am working on a large-scale D&D-style banking system for a private client (my job is weird). This is putting me in touch with a lot of people in very expensive suits and it I keep pinging them:

"Let's say someone has $100 to start investing, what should they do. Like, literally $100. With $0.00 added after."

I've cobbled together some thoughts (not advice don't sue me) and cut out the bullshit and sales pitches.

Start a high-yield savings account in an FDIC insured bank. As of this writing (April 27, 2023, United States-based), it'll be somewhere between 3.5 - 4.25% APY (annual percent yield -- i.e. interest)

Go with a bank that is FDIC insured. Banks pay for this, you do not. Here are smart people talking about what FDIC is.

The percentage difference listed above is 0.75%. Moving money is a bitch, is it worth chasing 0.75%? That depends on your situation, time, etc. Here are smart people who built a calculator to help you figure it out if it's worth it to you.

Touch it as little as possible.

Start a spreadsheet that tracks your finances.

In the cell that lists the amount of this balance, give it a name. Something fun, something that speaks to you. I did this as an experiment + to participate, mine is "Slime Research Adventurer Destruction Fund".

Write a prospectus (fancy word for "this is what the goal for this cash is to do").

Slime Research Adventurer Destruction Fund prospectus: Follow the path of high-yield savings rates at {bank}. Review quarterly if other banks have a substantially better rate (+1.5%).

The entire point is to break the idea of "them not me" and "today vs. someday" and "I cannot begin to build wealth vs. someone else can."

A $100 savings INVESTMENT IN A SAVINGS ACCOUNT with a rate of 3.5-4.25% will give you interest of $3.50-4.25 at the end of the first year, then continue on growing onwards.

That is your return.

Is it as high as investing in the market? No.

Is it safer? Holy fuck yes.

When you invest in stocks, bonds, etc. you are looking for a return. This is your return.

This is not a grindset mindset work 24/7 chunk of advice. This is not a reality-disillusionment "I am struggling I need to work harder."

You need to be knowledgable about how things can work for you so you can leverage what you have, where you are, when you have it, as you can.

A high-yield savings account is not going to make you rich.

It probably won't make a difference in an emergency.

It will absolutely make a difference in non-emergency times, over a period of time.

Slime Research Adventurer Destruction Fund Destroying Adventurers.

That last point is where I'm coming to.

If you don't have enough cash to invest and/or you're not comfortable investing, that's fine.

Give your savings account a name that speaks to you. This is your investment. Your savings account = your investment account.

There is no moral or ethical difference between "I have cash shoved into a savings account" and "I have cash shoved into the stock market."

The only difference is potential risk, growth, and fees (never pay for a savings account), liquidity ("how quickly can I convert this thing into cash to buy an apple at the grocery store, pay a bill, etc.").

Make money less scary via weird names and fun graphics.

Go to a piccrew site and make a catgirl with pink and blue hair.

Name your fund "Catgirlsnax Fundsies".

Make.

Money.

Management.

Less.

Scary.

By.

Taking.

Control.

Via your own.

Desires.

Goals.

Weird quirks.

Here is to hoping these gifs are not from horrible shows I don't know anime I know money and business and monsters.

If they are then I apologize for it.

I've read the notes on my blog and a lot of you like anime. I'm hoping these resonate.

216 notes

·

View notes

Text

youtube

Stock Market for Beginners: A Step-by-Step Guide to Financial Freedom 💰📈

#dividend investing#passive income#financial freedom#stock market#stocks#dividend stocks#dividend growth investing#how to make money#smart money#financial education#passive income ideas 2023#best stocks to buy now#stocks to buy now#penny stocks to buy now#best stocks to invest in 2023#trading live#stock market for beginners#make money#make money online 2023#earn money online#make money online#earn money#stocks to buy#how to make money online#Youtube

0 notes

Text

#How to trade 中国石油股份 stock#中国石油股份 is a China-based integrated oil and gas company. They have around 52% of the market share in China#and they should be able to grow with the growth of the Chinese economy. So it is not surprising that so many traders look at CSG stock. If#you can use this trading guide to help you get started with 中国石油股份 stock trading.#International Trading in 中国石油股份 Stock#Did you know that you can trade in US/Hongkong stocks to buy 中国石油股份 stock most straightforwardly? Biyapay is a new brokerage that is very g#and it is a Chinese online brokerage company. It offers trading services for individual investors for Chinese stocks#Hong Kong stocks#and US/HK ETFs. You can use Biyapay as your broker when you want to invest in China stocks.#Biyapay has a mobile app that makes it easy for customers to open an account#trade#and keep track of their portfolios on the go. In addition#Biyapay supports all kinds of payment methods#including Visa/MasterCard credit cards and Alipay.#You can trade in 中国石油股份 stock through Biyapay:#1) Register an account with Biyapay; no requirements need. All you have to do is to pass the KYC authentication.#2) No minimum deposit is required to open an account.#3) Buy 中国石油股份 stock with the money deposited into your account; US/Hongkong Stocks will do.#Why Biyapay is more convenient than other trading platforms to trade Chinese Petroleum stocks#You're probably wondering why I'm telling you all this before even telling you what Biyapay is. I want to put smile on your face when I tel#the Chinese e-commerce platform revolutionizing how investors buy stock for global companies in the United States and Hong Kong. They also#accept cryptocurrency deposits#and you'll only need to go through KYC to open US/HONGKONG account.#To provide customers with the best possible customer service experience#Biyapay offers several different online chat options#including WeChat#WhatsApp#and Skype.#There are many reasons why Biyapay is more convenient than other trading platforms to trade Chinese Petroleum stocks:#1)Biyapay provides 24 hours online customer service support;

1 note

·

View note

Text

here's the thing: you've heard "there's no ethical consumption under capitalism" but i'd like to propose another sentiment that i feel: ethical employers under capitalism are as prevalent as ethical consumption.

i have worked for three companies. each of them have been extremely unique from the last. i initially worked in retail. then i worked for a call center. now i work in technology.

when i worked in retail, i saw how money and commerce and consumerism affects society. i saw the physical effects of capitalism on your body; managers who were in their 40s looking like they're in their 60s.. yeah, 20 years of retail will do that to you. i saw waste, i saw egregious labor violations, i saw regular people just flat out not get paid for work they did. work i watched them do. all because someone didn't put their punches in a timesheet. i worked in hr during this time, so i saw the truth about how hr is not on the side of the worker and is, in fact, an arm of the shareholders.

then i worked in a call center environment. and i saw the effect that capitalism has on the mind. the psychological warfare of an employer with over 100% attrition, the churn and burn of call center work. the dehumanizing feeling of being absolutely trashed by a drunk person or called slurs and knowing if you hang up, you lose your job. the constant surveillance state that monitors every website, every phone call, every movement you make.

now in technology, i see the The Emperor Has No Clothes. a facade of better wages, better benefits - but only if you're willing to sacrifice your every free minute, every second to the machine. and if you don't, you're cast as an outsider; someone who doesn't want to succeed and move up the ladder and grow. and i've seen that technology in the wrong hands is more harmful than the benefits of technology to a society by a magnitude. and i've seen the absolute terror that private investment eventually has on good, equitable and decent corporations. corporations with leadership that ultimately, in the end, settle on the billions of dollars in payouts over their worker's lives.

private investment companies are just one way that capitalism is eroding the fabric of the american workplace. offshoring, cutting costs to the bare bones and then flipping the company from private to public and making an absolute killing. constant stock buybacks, investing only in the future of their own capital. it's a smash and grab. the victims are the american taxpayer and the american worker.

the truth is that if you find an equitable, fair employer, they will eventually outgrow themselves. corporations are small scale capitalist experiments. success breeds massive growth, out of control, until the system topples or is razed for it's resources.

i'm not saying there's no ethical employment under capitalism but as the days pass, the truth is that unless you are working for a bonafide and vetted non-profit organization, that reality is that boasting you have an "ethical" employer is often going to be a short term claim. capitalism will seep in and poison your employer the moment that the profit motive appears too delicious to deny.

112 notes

·

View notes

Text

This blog contains mature content (but not financial advice, you must do your own research + make your own decisions)

Let’s talk about 401K Contributions. They are frequently great! Your employer may say “We will match up to 3% of your 401K contributions.”

That means if you invest 1%, they will invest 1%. A total of 2% is invested.

If you invest 2%, they invest 2%. A total of 4% is invested.

If you invest 3%, they will invest 3%. A total of 6% is invested.

If you invest 4%, they will invest 3%. A total of 7% is invested.

They may offer higher or lower than 3%.

401Ks are sometimes given a bad rap because the fees are high and/or your investment options are limited -- maybe the companies being invested in are not in line with your politics, maybe they are in company stock, maybe they are in line with your employer’s politics... you get the picture.

It should be noted that 401K rollovers are possible -- i.e. you take the money from this account and put it into another 401K, which has better options for you and/or lower fees.

401Ks are a bit tricky in a few ways.

Firstly, they are taken pre-tax. If you make $100, and invest 3%, and your company matches this, you have $6 invested -- and the resulting $97 paycheck is taxed ($100 - your $3 contribution). So your immediate tax bill is lowered a bit, and there is more money invested.

For easy math, let’s say your tax bill is 25% and you make $100/check

$100 check - 25% = $75 take home with $0.00 invested.

$100 check - 3% ($3) invested, matched = $97 taxable - 25% = $72.75 take home and $6 invested.

So, yes, you are functionally taking home less ($75 vs $72.75 = $2.75 less take home)

But your $3 invested has the potential to grow

And your immediate return is 100% (your company matched your $3, a total of $6 now exists in an account under your name).

So now your fund has $6 to grow.

Which means a combination of 401K fund fees + market downturn has to drop +50% before your contribution is affected.

...which is a significantly bigger drop than the October 28-29, 1929 crash that kicked off the Great Depression which was 13% then a secondary 12%. If that happened to you, your $6 would look like:

Day 1: $6 - 13% = $5.22

Day 2: $5.22 - 12% = $4.59

Which is still $1.59 more than half of what you invested btw.

Let’s be very ungenerous and truncate +0.8% of the S&P 500 growth since it began, and calculate an 11% average return over 10 years. You invested $3 ONCE, you were matched $3 ONCE, your fund is now worth about $15.35. It doubled between years 7 and 8. If you hold it another 10 years (total 20), it is now worth about $43.58.

I want to stress I did easy math and rounded down to 11%, nearly a full percentage point

And that this was a single investment of $3 and a single match of $3.

This is an averaged figure because “hey sometimes the market crashes” (I remember vividly the aftermath of coping mechanisms I took to get through 2008)

This means you have to be careful and patient. It also means that company match? It helps protect your cheddar. If it helps, think of it as “the company match lost money before my invested cash kicked in.” See above 1929 market crash example.

The tax is taken when you withdraw the cash from the fund, typically in retirement as there are typically pre-retirement penalties. The entire scheme is designed to encourage you to save for retirement (cough and propel the economy at the same time cough)

And when you’re in retirement, you take out bits and pieces at a time, so there is still cash kicking around and growing.

Secondly, as I say above, 401Ks roll over.

If you find yourself in a fund that has a high fee (”high” defined by “you have googled other 401K plans and see better deals”) and/or you leave this job and/or your 401K plan is limited, you can shove it somewhere else.

Consult your plan to see if there are penalties (probably not) or fees (probably not) and/or how to do this. You may have to wait a certain amount of time to be “vested” -- a fancy way of saying “your account must be THIS OLD to move and/or be considered fully yours.”

If you had an old job that you left ages ago and forgot to roll over the 401K, it is still out there somewhere, google “find old 401Ks” and pursue the research. You’ll get it back.

"So my employer match is additional money?”

Yes.

“I want the money before I can retire to buy a house and/or cover medical bills!”

This is possible through various paths, but is tricky, and frequently expensive. Consult your money folks (the people who handle your 401K, this will be separate from your employer) on risks and rewards.

However, and I want to stress this, even with the penalties, because your employer matched something, there is a bigger potential pool of cash there.

“...my 401K is down like -X%... why am I pumping money into something losing money...”

It’s tricky and requires a lot of discipline, but unless you’re preparing for retirement in the next 5-10 years, being down means buying stock is cheaper.

Shares in your 401K that cost $100 before are now priced at $75. If you’re 20+ years from retirement, if they are worth more, you’ll get more money out.

Thems the hard knocks of the stock market.

It’s easy to panic when things are low but unless you are selling the stock soon, it’s not affecting you directly.

Fund set ups vary greatly, but a massively common feature is your fund is not buying stock directly. It is buying any number of stock bundles.

Your 401K is dipping your stock group(s) are dropping, as the individual stocks in the group are dipping, and someone on the other end of the chain is in charge of fixing that as best as possible.

Sometimes that means “wait” because this is a predictable period (a company spending a ton of money to upgrade, etc). Sometimes that means “rebalance” (”these companies aren’t going to recover, we gotta ditch them and figure something out.”

The suits in charge of the 401k fund(s) are in charge of figuring this out.

“So... you’re saying... I should just trust these suits?”

Oh, moonbeams, no.

This is a litany of information that is very entry level and is frequently not taught anywhere. Use as information to begin Step 1 of Many. The number, shape, and direction of your steps will vary based on your individual circumstances and mindset and resources. None of this is financial advice!

“I can’t afford to contribute that much and/or at all.”

I hope your circumstances improve soon.

“This is a weird thing for a ghost post office to talk about.”

Besides having a chuckle at a blog that was labeled “mature content” and had just random stuff posted (the inspiration for this post), there is actually a long history of the post office offering basic banking services and some are being piloted again / another article.

Given the USPS’s legal obligation to every citizen in this country, I am a huge fan of any reasonable service that it can similarly offer that both boosts viability to the office and accessibility to people.

Plus the whole “atty is a agent of lunar chaos thing” and i am the atty in this equation, so, y’know, on brand.

“I would like to learn more about the stock market etc.”

I subscribe to and frequently enjoy ColdFusion’s financial videos and most everything The Plain Bagel produce on YouTube.

“It is too late, I am X years old.”

Cash-need circumstances should fuel your decision to stop or delay investing. Age should not. If you are 50 and starting, you’re setting yourself up for when you are 60, 70, etc.

“Okay last thing, my job doesn’t have a 401K matching and/or a 401K at all and/or I am self-employed”

Look into IRAs and Roth IRAs. They may be right for you, but more importantly, this will put you on the path of research. If they aren’t, you’ll find something that is.

“Seriously though last thing. I like to keep my cash liquid.”

At the very least you should keep your cash in something called a “high yield interest savings account.”

Your checking branch down the street is going to offer you 0.01 - 0.03% or so.

A high yield, fee free savings account is going to offer you something significantly higher for quick math sake, let’s say 3%.

Now let’s do the math on $100, untouched for 1 year, compounded monthly:

$100 * 0.03% annual yield compounded monthly = $100.30 after a year

$100 * 3.00% annual yield compounded monthly = $103.04 after a year

A difference of $2.74 without effort on your part

I don’t understand why / I hate that / basic savings accounts exist when high yield versions exist. But that bitterness at the financial industry at large is a secondary reason why this post is made.

The tertiary reason is I tremendously enjoy being your wacky, excessively colorfully dressed, gothy neighbor who you don’t quite know what they do for a living, but you do know they are living their best life. It’s a sitcom staple.

And now!

Time for coffee.

Go protect and grow your funds!

164 notes

·

View notes