#dividends

Link

Peace & Blessings Family Please Join Robinhood with my link and we'll both pick our own FREE stock Up to $500 Same day !!!

Join here 👇

🤝 https://join.robinhood.com/phillit1052

389 notes

·

View notes

Photo

. We could go purchase some #shares or just make it a #coffeedate Either way, it always nice to see that a company you own shares in expanding in #business #newspotforthehighwaytraffic #Starbucks #Starbuckstt #newlocation #brentwood #phl #stockmarket #stockmarkettrinbago #shareholder #tickersymbol #tickersymbolphl #smallinvestors #investor #investing #investingtt #dividends #dividendstocks #passiveincome #kinda #buyingincome #buymoreshares #thisisnotinvestingadvice https://www.instagram.com/p/CoEDTvxOwTx/?igshid=NGJjMDIxMWI=

#shares#coffeedate#business#newspotforthehighwaytraffic#starbucks#starbuckstt#newlocation#brentwood#phl#stockmarket#stockmarkettrinbago#shareholder#tickersymbol#tickersymbolphl#smallinvestors#investor#investing#investingtt#dividends#dividendstocks#passiveincome#kinda#buyingincome#buymoreshares#thisisnotinvestingadvice

7 notes

·

View notes

Text

April 2023 Financial Update

Let's try this again. This time with the correct month. Thanks for reading!

April went by in a flash and it feels like May is shaping up to do the same. Ever since we left Mesa we have been busy trying to get caught up on projects and hobbies while at the same time getting back to enjoying the things we love like hiking and site seeing. And since we have family that lives close by we have to make sure we find time to visit and catch up while we can.

Over the last month…

View On WordPress

#adventure#blog#camper#Campground#camping#Campsite#Dividend#Dividend-investing#Dividends#early-retirement#Explore#F.I.R.E.#Finance#financial freedom#financial independence#FIRE#full time rv#Full-Time-Travel#glamping#goals#Hiking#Idaho#investing#investment#Investments#journey#life#lifestyle#live#living

6 notes

·

View notes

Text

Hello everyone,

I don’t have a lot of money and, due to circumstances beyond my control, my credit score is mediocre.

However, I’m currently in the process of improving both situations. I’m lucky enough to live with my parents so many expenses are taken care of so take my posts with that grain of salt.

The TL; DR version of this blog is I have a secured credit card and Self to help my credit score and I use Robinhood (Gold) to invest in small increments.

I’ll get into detail in future posts but I’ll leave you wanting more.

1 note

·

View note

Text

What's driving the surge in tech shares?

A tale of two cities. Tech up 5% and Dividend stocks down 5%. Here's why? $XLK $MSFT $AAPL $XLF $XLE $DURA

By David Nelson, CFA CMT Investors are questioning the rush into mega cap tech at the height of a banking crisis that has rippled through markets in the last two weeks. I think CNBC’s Josh Brown said it accurately. Investors today view many of these large digital companies as consumer staples. It’s hard to deny that Apple (AAPL) and Microsoft (MSFT) are as much a consumer staple as Procter &…

View On WordPress

#David Nelson CFA#Dividends#Economy#Fed#Inventory#MSFT#Tech Stocks#terminal rate#The Money Runner#Working Capital

2 notes

·

View notes

Text

Deutsche Telekom Stock Review

Deutsche Telekom is a Germany-based company that provides integrated telecommunication services. It operates through five segments: Germany, United States, Europe, Systems Solutions, and Group Development. The Germany segment provides fixed-network and mobile telecommunications services to consumers and business customers. The United States segment provides telecommunications services in the United States market; and the Europe segment offers fixed-network and mobile operations of the national companies in Greece, Romania, Hungary, Poland, the Czech Republic, Croatia, Slovakia, and Austria.

IPO

A major turning point in the world of telecommunications took place in November 1996, when Deutsche Telekom went public. It was the largest IPO in history and the capstone of years of intense effort by Goldman Sachs to establish a presence in the German market.

The company's offering marked a significant step in the development of an Anglo-Saxon shareholder culture. It was also the first telecommunications company to be listed on the Frankfurt and New York stock exchanges, as well as the Tokyo Stock Exchange.

It was the largest ever IPO and it was oversubscribed five times. Shares traded at nearly 20 percent above the issue price on their first day of trading.

In addition to its traditional services in Germany, the company provides telecommunications services throughout the rest of Europe and the United States. Its businesses include fixed network and broadband, mobile telephony, and information technology services.

Today, the company is one of the world's leading telecommunications companies with operations in more than 50 countries and a broad range of products and services. It has a worldwide network of around 248 million wireless and 26 million wireline customers.

The company has been in the forefront of telecommunications innovation, investing extensively in digital technologies to develop innovative new products and services for its customers. Examples include the Internet of Things, 5G technology, video conferencing, and artificial intelligence.

For a company like Deutsche Telekom, it is important to have a diverse product portfolio that appeals to different kinds of users. The company is also known for acquiring and selling companies to generate growth and streamline operations.

Despite its success, the company has faced several challenges in the past few years. It has lost customers to larger rivals, including AT&T and Verizon Communications Inc VZ.N, and it has also experienced a drop in revenue and profits.

However, the company's management has made efforts to turn its fortunes around, launching new business models and making strategic acquisitions. It is a leader in the telecommunications industry and it continues to seek ways to grow its business and create value for shareholders.

Mergers and Acquisitions

Deutsche Telekom is a diversified telecommunications company with a strong position in Europe and a booming US business. It operates in a number of different sectors, such as payments and commercial real estate tech.

In the US, the company is primarily focused on mobile services. Its subsidiary T-Mobile USA has an excellent record of growth and is a significant competitor to AT&T and Verizon. In addition, it owns Sprint (NYSE:S), which is set to become a major player in the U.S. telecom industry once the merger is complete in 2019.

The company has not made many major acquisitions, but it has done a few small ones over time. These smaller deals, such as the purchase of a Romanian carrier, the sale of T-Mobile Netherlands and its acquisition of Austria’s Telecom Austria, have improved its market position and scale.

Its US telco operations, T-Mobile USA and T-Mobile International, have been growing at very strong rates. These companies have a large customer base and are expected to continue expanding.

T-Mobile US is the second largest wireless service provider in the United States with a customer base of 120 million, behind Verizon. It has a very competitive pricing model and a great reputation in the industry.

However, the stock has not performed well in recent months. This is largely due to the fact that many investors are not aware of the fact that the German government owns 57 percent of the company. It has been criticized by a few legislators who think that the government should reduce its holding before the deal can be completed.

As a result, the stock has been down with other European stocks. If the Euro continues to weaken, this would likely help the stock and also its U.S. assets, which have been irrationally punished by European investors because they are included in a European stock.

To counter this, the company has been increasing its dividend and repurchasing some of its own shares, which are now trading at about a 50% discount to their value. These dividend increases and the repurchases should allow for further growth.

Shareholders

One of the largest shareholders in deutsche telekom stock is the German government and its agency, Kreditanstalt fuer Wiederaufbau (KfW). KfW owns 17.3 percent of the company's shares. It has been buying more shares and reducing its stake in a series of transactions.

Another large shareholder is the United States investment group Blackstone. It purchased 4.5 percent of deutsche telekom stock for $3.3 billion. It is hoping that the purchase will help the company achieve its long-term financial goals and boost shareholder value, according to the company's announcement.

It also plans to use the money to fund future dividend increases. The dividends are a key part of the company's plan to reinvest in new technologies and networks.

The company also recently rolled out an overhaul of its corporate strategy to focus on digitalization and adapting its business models to the changing needs of customers. The changes will make it a software company that sells telecommunication services, rather than just a hardware manufacturer.

This is a big shift from the days when telecommunications networks were made up of monolithic blocks of network elements. Today, companies like DT are disaggregating their technology and moving it into the cloud. This allows them to connect with third-party networks and use their infrastructure to provide telecommunications services.

In the case of telecommunications, this involves billing-software and other backend systems. These backend systems are responsible for collecting and analyzing customer data to make pricing decisions.

If these systems are not able to comply with GDPR, will they be subjected to enforcement action or sanctions by U.S., EU, or German authorities? If not, will they be the target of new private actions for fraud and/or breach of contract?

To protect its data, deutsche telekom stock has "binding corporate rules" that it has promised to abide by. These rules are "binding" on all of the company's subsidiaries and any of its other companies that can be required to comply with them or have already adopted them on a voluntary basis.

But what if deutsche telekom stock's subsidiary T-Mobile USA doesn't subscribe to these "binding" corporate privacy rules? Does it still have to comply with the "binding" rules, or is there something in the corporate law that prevents it from doing so?

Dividends

One of the coolest perks of being a shareholder of this German company is the opportunity to participate in its annual dividend payout. The company pays out an impressively large sum each year, and it has a long and distinguished history of making its shareholders happy. Despite its size, the company manages to stay on top of its game thanks to some innovative corporate strategies and a healthy dose of luck. In a nutshell, there's a reason why this stock has been a KfW staple for so long. The company is also one of the few surviving German telecoms. If you're on the hunt for a good value telecommunications stock, deutsche telekom should be at the top of your list. You'll be rewarded with top-notch service and competitive paycheques, not to mention a hefty chunk of the local economy.

After all, it's not every day that you get a free piece of the country's largest phone company, let alone one of the most innovative and coveted German telecommunications companies in the business.

2 notes

·

View notes

Link

Shell posted adjusted earnings of $9.1 billion for the three months through to the end of March, in line with expectations of analysts polled by Refinitiv. That compared with $3.2 billion over the same period a year earlier and $6.4 billion for the fourth quarter of 2021.

The company also announced plans to increase its dividend by around 4% to $0.25 per share for the first quarter.

Of the firm’s $8.5 billion share buyback program announced for the first half of the year, Shell said $4 billion had been completed to date. The remaining $4.5 billion share buybacks are scheduled to be completed before the announcement of second-quarter earnings.

Shares of the company rose 3% on Thursday morning.

Shell’s results echo bumper profits seen across the oil and gas industry, even as many energy majors incur costly write-downs from exiting Russia.

4 notes

·

View notes

Text

9 ideas for passive income in 2022

9 ideas for passive income in 2022

In 2022, there should be more ideas for passive income than ever before. The new economy will have created more opportunities for people to generate their own income and it’s up to them to find the best ways of doing it.

As the world gets smaller, the idea of working from home is becoming more popular. There are many people who make a living by selling online courses or services that don’t…

View On WordPress

#affiliate#airbnb host#annuity#asset#asset leasing#bank fixed deposit#best passive income streams#company investment#Debentures#dividends#ideas for passive income#intangible assets#invest#mutual funds#passive income#passive income ideas#passive income stream#pays#peer to peer lending#receive interest#rent apartment#rent house#rent space#rent tangible goods#rental income#royalties#stock investments

5 notes

·

View notes

Text

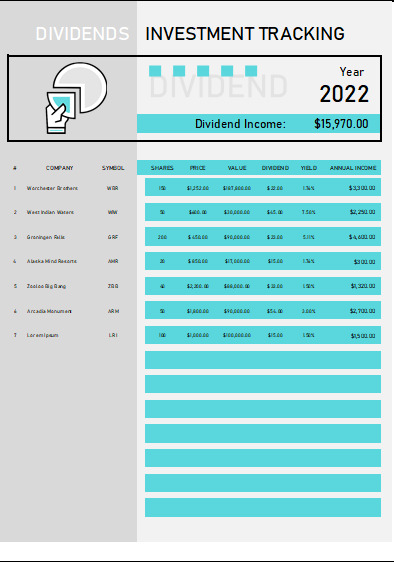

Dividend Investment Tracker

Download free excel template for dividend investment tracking. This dividend tracker excel template is useful for tracking all the dividend income from investment in shares and stocks of companies. This is useful for professionals and retail investors to track their yield per investment or Return on Investment (ROI).

About dividend Investment tracker excel template

Once you download this free…

View On WordPress

#dividend#dividend growth investing#dividend income#dividend income tracker#dividend investing#dividend portfolio#dividend portfolio tracker#dividend portfolio tracker 2021#dividend portfolio tracker 2022#dividend portfolio tracker 2023#dividend portfolio tracker excell#dividend spreadsheet#dividend stock portfolio tracker google sheets#dividend stocks#dividend tracker#dividend tracker spreadsheet#dividends#google sheets dividend tracker#how to track dividend income#how to track my dividends#portfolio tracker

3 notes

·

View notes

Text

Investuokite į CSX Corporation – kompanija, kurianti vertę tik keleiviams ir klientams, bet ir ištikimiems jos akcininkams..

https://www.aipt.lt/csx-corporation/

0 notes

Text

youtube

Does a Focus on Dividend Growth Add Value in a Down Market?

Why Returning Capital to Investors Through Dividends May Not Be a Tax-Efficient Option.

0 notes

Text

February 2023 Dividend Portfolio Update

There is only one word that can sum up our dividend portfolio for the month of February, “blah”!

We could probably end this blog quickly as this was just one of those months where nothing exciting really happened. The only exception is that our dividend from ABBV hit a small milestone and continues to be our top performer. February is typically a slow dividend month in general and our…

View On WordPress

#blog#Dividend#Dividend-investing#Dividends#early-retirement#F.I.R.E.#Finance#financial freedom#financial independence#FIRE#full time rv#Full-Time-Travel#goals#investing#investment#Investments#money#net worth#personal finance#Portfolio#Retire#retire early#retirement#RV#RVlife#saving#stock market#Stocks#travel#update

5 notes

·

View notes

Text

Top 3 Upcoming Dividend Stocks for April 2024

As we step into April 2024, Australian investors are keeping a keen eye on Dividend Paying Stocks, seeking stable returns amidst market fluctuations. Dividend stocks not only provide regular income but can also offer a cushion against market volatility. Here are some of the top dividend stocks expected to perform well in April 2024:

New Hope Corporation Ltd (NHC)

Tamawood Ltd (TWD)

Bank of Queensland Ltd (BOQ)

0 notes

Text

Video: Investing Themes & When to Use Which

I define #investing #themes or #factors #strategy and indicate which theme to use in each of the phases of the #economiccycle. You can implement this using #ETFs.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

Visit: http://www.canadianmoneytalk.caThe Investing & Personal Finance Basics course is at…

View On WordPress

#buildingwealth#dividends#economiccycle#ETF#factors#genzfinance#howtoinvestinstocks#investing#millennialmoney#passiveincome#stockmarket#stocks#themes

1 note

·

View note