#Hong Kong stocks

Text

指数,重组,数据,港股,走势,债券,涨停,资本,概念股,发行,股权,k线 #机构 #ipo #炒股

Index, reorganization, data, Hong Kong stocks, trends, bonds, daily limit, capital, concept stocks, issuance, equity, k-line, institutions, ipo, stocks

#指数#重组#数据#港股#走势#债券#涨停#资本#概念股#发行#股权#k线#机构#ipo#炒股#Index#reorganization#data#Hong Kong stocks#trends#bonds#daily limit#capital#concept stocks#issuance#equity#k-line#institutions#stocks

0 notes

Text

#How to trade 中国石油股份 stock#中国石油股份 is a China-based integrated oil and gas company. They have around 52% of the market share in China#and they should be able to grow with the growth of the Chinese economy. So it is not surprising that so many traders look at CSG stock. If#you can use this trading guide to help you get started with 中国石油股份 stock trading.#International Trading in 中国石油股份 Stock#Did you know that you can trade in US/Hongkong stocks to buy 中国石油股份 stock most straightforwardly? Biyapay is a new brokerage that is very g#and it is a Chinese online brokerage company. It offers trading services for individual investors for Chinese stocks#Hong Kong stocks#and US/HK ETFs. You can use Biyapay as your broker when you want to invest in China stocks.#Biyapay has a mobile app that makes it easy for customers to open an account#trade#and keep track of their portfolios on the go. In addition#Biyapay supports all kinds of payment methods#including Visa/MasterCard credit cards and Alipay.#You can trade in 中国石油股份 stock through Biyapay:#1) Register an account with Biyapay; no requirements need. All you have to do is to pass the KYC authentication.#2) No minimum deposit is required to open an account.#3) Buy 中国石油股份 stock with the money deposited into your account; US/Hongkong Stocks will do.#Why Biyapay is more convenient than other trading platforms to trade Chinese Petroleum stocks#You're probably wondering why I'm telling you all this before even telling you what Biyapay is. I want to put smile on your face when I tel#the Chinese e-commerce platform revolutionizing how investors buy stock for global companies in the United States and Hong Kong. They also#accept cryptocurrency deposits#and you'll only need to go through KYC to open US/HONGKONG account.#To provide customers with the best possible customer service experience#Biyapay offers several different online chat options#including WeChat#WhatsApp#and Skype.#There are many reasons why Biyapay is more convenient than other trading platforms to trade Chinese Petroleum stocks:#1)Biyapay provides 24 hours online customer service support;

1 note

·

View note

Text

....Ringdoll, how did you do that???

I was fortunate enough to get something during their sale.....

Guys....he arrived in FOUR DAYS.

#everyday rambles#bjd#ringdoll#i know he was an already in stock doll BUT FOUR DAYS?????#HE SHIPPED FROM HONG KONG HOW????

7 notes

·

View notes

Text

Eileen is onto something here...

#business#businesscore#nostalgia#office space#retro#retro tech#business memes#vaporwave#1980s#80s aesthetic#wall street journal#wall street#stock markets#asian markets#japan#hong kong#business woman#clip art#clipart

2 notes

·

View notes

Text

理想汽車:盈利閃崩?不致命,但很“尬”

理想汽車上周五晚發佈了2022你愛你三季度財報,這次雖然 10、11 月的銷量慢慢恢復了,但是三季度還是埋雷了。主要要点:

1、理想 One 銷量崩盤太快,公司沒有預料到,原本為理想 One 準備的庫存和供應商合同都面臨損失,導致這個季度理想 One 上計提了 8 億多的存貨減值和合同損失。最直接的後果是,這個季度汽車銷售毛利率出現閃崩;

2、剔除理想 One 這次相對的意外一次性減值,汽車銷售毛利率是 20.8%,與市場預期基本一致,不過趨勢上還是下滑的狀態;

3、四季度的銷量指引4.5-4.8 萬,只能說是勉強過關;

4、單車價格因為 L9 銷量占比從零直接到了 40%,所以單價直接拉到了 34 萬,但這個數據也在市場預期之內,甚至有點稍不及市場預期;

5、對於理想這種還需要研發純電車的新勢力而言,研發的投入剛性高增幾乎板上釘釘,這個季度飆升地尤其明顯,只有銷售費用看起來稍微克制了一下,但也只是相對的。

整體上雖然毛利率因為理想 One 備貨問題大幅下滑,但這種整體算是一次性失誤,而且目前銷量也算慢慢恢復了,對股價在情緒上有影響,但應該不會很大。

但主要的問題是,除了這個相對利空的問題,理想這個季度的業績其他並無非常樂觀的邊際資訊,反而指引是在預期之內偏靠下的位置,收入 93 億、單車價格 34 萬也都只能說是勉強及格。

而展望的話,毛利率上四季度明顯不好;明年整車市場競爭加劇,整體收入和單車毛利率不確定都非常大,而目前理想的股價其實已經恢復到了今年十一時候的價位。

2 notes

·

View notes

Text

#Brand new in Hong Kong#Ready stock 7-10 days#L7 9050M $12100#Order from 5 units#PM me pls#https://t.me/asic_minermachine/#https://www.asic-minermachine.com/#dogecoin mining machine#crypto mining machines#mining machines

3 notes

·

View notes

Text

The Year of the Dragon

The Hong Kong Stocks Market dropped over 56% from its January, 2018 all-time high to its 2022 low.

The HSI retested that low back in January, 2024.

2024 is the Year of the Dragon and so far the HSI is up 13% over from its January 22., 2024 low. Could the Year of the Dragon bring good fortune to the Chinese Market?

In my special report, The Year of the Dragon, we will look at the daily,…

View On WordPress

0 notes

Text

The total value of shares listed on Indian exchanges hit $4.3 trillion on Monday

0 notes

Text

A Guide to Navigating Corporate Legal Requirements in Hong Kong

Operating a business in Hong Kong comes with ample opportunities but also an array of legal and regulatory requirements that corporations must comply with. Failing to adhere to the rules around company formation, securities trading, taxation, employment and other key areas can land your business in hot water. This guide outlines the major legal landscape that HK corporations should be aware of.

Choosing a Business Structure

One of the first steps is deciding how you will formally constitute your HK company. Common structures for small to mid-sized companies include a Private Limited Company and Limited Company. Key legal paperwork includes filing Articles of Association and a Memorandum that specifies company objectives and structure. You’ll also need to formally issue company shares and understand share classes as well as share types like ordinary or preference shares with varying ownership rights. Statutory meetings must be held annually.

Following Securities Trading Laws

If your company seeks investment from the public, then you must comply with Hong Kong securities regulations around registering prospectuses, issuing financial reports and disclosing shareholder equity changes, governed overall by the Securities and Futures Ordinance (SFO). Listed firms face continuing regulatory burdens around price sensitive information – any data that may impact share prices must be announced. Insider trading is also tightly regulated under SFO, least employees use undisclosed financial information for profit.

Paying Taxes and Filing Returns

As a HK corporation, key taxes will include Profits Tax on company earnings as well as potential Withholding Tax on payments like royalties or service fees sent overseas. Proper calculation of tax residency status is essential to determine tax exposure. Audited accounts may be required, and tax returns generally must be filed annually under strict guidelines. FAILURE_DETECTED

Meeting Employment, Payroll Regulations

Critical employment law issues span offering employment contracts that meet government standards on pay, overtime, leave policies and more per Hong Kong’s Employment Ordinance. Preventing discrimination and sexual harassment is also mandated. Retirement schemes equivalent to at least the Minimum Wage level (currently HK$37.5 hourly) must be provided. Consult deeply on hiring and termination best practices.

Protecting Intellectual Property Rights

Register trademarks and patents early to establish legal ownership over key company innovations and brands in the Hong Kong market. Also enact document management procedures focused on retaining contracts, transaction records, board minutes and other materials that may be involved in potential disputes or investigations for 6-7 years as best practice.

The regulatory pressures on HK corporations are significant, but with proper legal guidance around formation, trading, hiring, tax policies and IP rights, your company can securely navigate the Hong Kong landscape. Government agencies like InvestHK provide additional resources on ongoing compliance requirements as corporate policies evolve. Taking a conservative approach with oversight from your company secretary or legal team is wise as your business grows and expands.

#Hong Kong company law#Hong Kong corporate regulations#Hong Kong business setup#Hong Kong company structure#Hong Kong private limited company#Hong Kong limited company#Hong Kong Companies Ordinance#Hong Kong business registration#Hong Kong company incorporation#Hong Kong company shares#Hong Kong company meetings#Hong Kong Securities and Futures Ordinance (SFO)#Hong Kong public companies#Hong Kong stock market compliance#Hong Kong price sensitive information#Hong Kong insider trading laws#Hong Kong company prospectus#Hong Kong company reporting requirements#Hong Kong Profits Tax#Hong Kong withholding tax#Hong Kong tax filing

0 notes

Text

Vintage Putz Elf Gnome christmas ornaments Mini ebay antiques4sell2012

Lot of 3 Vintage Unieboek Gnome Porcelain Ornaments 1970's ebay katchamp

2 Unieboek Gnome Christmas Ornaments Korea 1979 Vintage ebay a71c1a67

5 vintage Emson Gnome, Elf,Dwarf Christmas Ornaments “Hong kong” ebay renveg_0

Vintage 1950’s PINE CONE GNOME ELVES Ornaments ebay thriftonby2014

Set of 6 Vintage Christmas Gnome Ornaments ebay VintageandChicFinds

#ornament#christmas ornament#porcelain#cotton#elf#gnome#pinecone#ski#skier#japan#japanese#korea#hong kong#chinese#stocking#fairy#angel

1 note

·

View note

Text

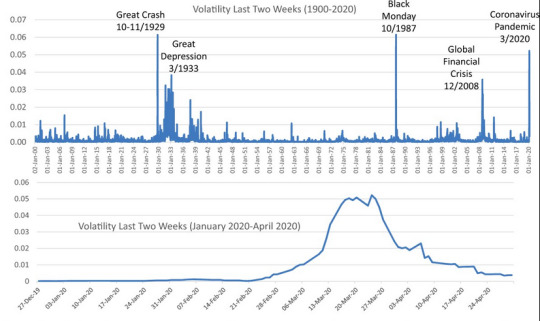

How Capitalist Objectives Impact on Global Public Health

An Oxford University study showed, in June 2020, that despite the Spanish Flu pandemic of 1918-1919 and two subsequent flu pandemics in the USA in the 1960s and 1970s had proven to be multiple times more lethal than COVID-19, that they had very limited impacts on the stock market at the time.

In comparison, the Oxford University article reports that:

The evidence we amass suggests that…

View On WordPress

#coronaviruses#crash#crisis capitalism#fall#Hong Kong Flu#previous pandemics#Spanish Flu#stock market#stock market jumps#unprecendent activity

0 notes

Text

https://www.philstar.com/business/2023/08/28/2292014/china-developer-evergrande-resumes-trading-hong-kong

HONG KONG, China — Shares in troubled Chinese property giant Evergrande resumed trading in Hong Kong on Monday after the company was suspended for 17 months for not publishing its financial results.

Trading "resumed at 9:00 am (0100 GMT) today", according to a notice posted on the Hong Kong stock exchange.

The move comes after the company said in a filing on Friday that it had "fulfilled the resumption guidance" set out by the bourse, including belatedly publishing its financial results and complying with other listing rules.

Its shares plunged 86.67 percent at the opening.

Once China's largest real estate firm, Evergrande defaulted in 2021 and is saddled with more than $300 billion in liabilities, becoming a symbol of the nationwide property crisis that many fear could spill over globally.

The company on Sunday reported fresh losses for the first half of the year amounting to 33 billion yuan ($4.53 billion), as well as dwindling liquidity, with just $556 million in cash assets.

Evergrande's creditors will vote Monday on a proposal from the developer regarding its offshore debt that is shaping up to be one of China's biggest restructurings ever.

The plan offers creditors a choice to swap their debt into new notes issued by the company and equities in two subsidiaries, Evergrande Property Services Group and Evergrande New Energy Vehicle Group.

Earlier this month, the company filed for bankruptcy protection in the United States, a measure to protect its US assets during its restructuring.

0 notes

Text

HANG SENG ends up +1.41% in Friday

Best performer:

Sunny Optical Technology Company Limited

Trading Up(+8.82%) - known as Sunny Optical or just Sunny is a Chinese civilian-run enterprise and listed company that produces optical lenses.

It was founded in 2006 and became a listed company in 2007. It is one of the largest optical lens manufacturers in the world, with a market share of over 20%. Sunny Optical's products are used in a wide range of applications, including mobile phones, cameras, microscopes, and automotive safety systems.

Customers include major Chinese smartphone brands such as Huawei, Oppo, and Vivo. The company also supplies lenses to other leading global brands, such as Sony, Panasonic, and Olympus.

Sunny Optical is a research-intensive company with a strong focus on innovation. The company has over 1,000 R&D personnel and has filed over 10,000 patents. Sunny Optical is committed to developing new optical technologies and products that meet the needs of its customers.

In recent years, it has expanded its global footprint. The company has established subsidiaries in North America, Europe, and Asia.

It is also a major supplier to the automotive industry, and the company has established a manufacturing plant in Germany to meet the growing demand for automotive lenses.

Sunny Optical's customers include a wide range of companies, including:

Mobile phone brands: Huawei, Xiaomi, Oppo, Vivo, Lenovo, Samsung

Camera brands: Sony, Panasonic, Olympus, Carl Zeiss

Automotive brands: Magna, TRW, Continental

Medical device brands: Hikvision

Optical instrument brands: Edmund Optics, Thorlabs

Sunny Optical also supplies lenses to other industries, such as security surveillance, industrial automation, and virtual reality.

Sunny Optical Technology (Group) Company Limited (HKSE: 2382) reported its financial results for the third quarter of 2023 on March 20, 2023.

The company's revenue for the third quarter of 2023 was RMB 8.11 billion (US$1.2 billion), down 1.7% from the same quarter last year.

Net income was RMB 2.21 billion (US$320 million), down 10.4% from the same quarter last year.

The company's gross margin was 19.9%, down from 20.9% in the same quarter last year.

Operating margin was 7.56%, down from 8.2% in the same quarter last year.

Despite the challenges, the company's management remains confident in the company's long-term growth prospects. The company is investing in new technologies, such as augmented reality and artificial intelligence, to drive future growth.

Sunny Optical's prospects are positive for the following reasons:

The global optical lens market is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2022 to 2027.

Sunny Optical is a major player in the global optical lens market, with a market share of over 20%.

The company has a strong track record of innovation, and it is constantly developing new products to meet the needs of its customers.

Sunny Optical has a strong financial position, with a healthy balance sheet and a low debt load.

However, there are some challenges that could impact Sunny Optical's prospects, such as:

The global smartphone market is expected to slow down in the coming years.

The company faces increasing competition from Chinese and Japanese lens manufacturers.

The company's supply chain could be disrupted by political or economic events.

Here are some of the factors that could drive Sunny Optical's future growth:

The growth of the smartphone market, particularly in emerging markets.

The increasing demand for high-quality optical lenses in the automotive and medical device industries.

The development of new technologies, such as augmented reality and virtual reality, which will require high-performance optical lenses.

Overall, Sunny Optical is a leading player in the global optical lens market with a bright future. The company is well-positioned to benefit from the growth of the market and the development of new technologies.

HSI Friday Top Risers and Fallers

0 notes

Text

Hong Kong: Wabtec to Modernise 25 MTR Battery-Electric Locomotives

Hong Kong’s Mass Transit Railway (MTR) has contracted Wabtec to modernise 25 Mk3 battery-electric locomotives.

This order is valued at approximately 12 million GBP and is expected to help MTR meet the growing demands on its transit network.

MTR’s modernisations come as the company looks to maximise and extend the capabilities of the locomotive fleet

The purpose of these upgrades is to extend the…

View On WordPress

0 notes

Text

Uber:美國 “滴滴”:這波小而美 “完爆” 大而強?

Uber的2022年四季度財報整體來說,營收端表現四平八穩,並無太大的驚喜,但在控費和做利潤上則持續好於預期。

海豚君越發認為在當前週期下,面向 C 端的互聯網企業,2B的互聯網企業將進入相對占優的階段。相比大幅裁員和持續縮減開支的企業,2023 年內居民消費可能會更具韌性,因此 Uber 的營收增長可能並不會再顯著的放緩。同時,由於公司已經證明的極強控費能力,海豚君認為可以期待 Uber 在 2023 年 topline 和 bottomline 都有不俗的表現。

打車&外賣增速趨穩;

外賣業務繼續提升變現,打車變現則在趨勢性下降;

營收表現平穩無意外;

增長沒驚喜,但要瘋狂做利潤。

0 notes

Text

In New York and London, owners of gleaming office towers are walking away from their debt rather than pouring good money after bad. The landlords of downtown San Francisco’s largest mall have abandoned it. A new Hong Kong skyscraper is only a quarter leased.

The creeping rot inside commercial real estate is like a dark seam running through the global economy. Even as stock markets rally and investors are hopeful that the fastest interest-rate increases in a generation will ebb, the trouble in property is set to play out for years.

It's amazing how little I care.

I recall stories about house-flippers who were drowning in high-interest mortgages they never expected to need to float for more than a year, simply leaving the keys to perfectly good homes in the mailbox and walking away.

4K notes

·

View notes