#how to invest in stocks

Text

#how to invest in stocks#investing for beginners#stock market#investing#the most important thing in investing in stocks#stock market investing#stock market for beginners#stocks#value investing#share market basics for beginners#stock market in india#the single most important metric for stock market investing#the most important things when buying stocks#how to begin investing in the share market#investing in your 20s#investing in international stocks

2 notes

·

View notes

Text

All you should know about starting an investment in stocks

If you have some cash that you can set aside, you should consider investing it in stocks. This way, you can let this money grow without having to leave everything behind to look after this investment. If you are new to the investment world, you will need to know how to start investing in the share market. If you want to know the basics of investing in stocks for beginners, this blog can shed some light on this matter.

What to do to start investing in stocks?

If you have your money ready and are confident in this investment, keep the following points in mind:

The type of investor you want to be

Many people want to invest on their own, while others want some professional assistance by their side. The first type will try to study and choose the accounts they find right for their needs and requirements. The other type of investor will definitely look for a reliable broker who can help them make the most of their stock market investment. There is no right or wrong in this, but the first option takes a lot of time and effort, and you may still not be able to choose or handle your investment portfolio properly. The other option spares you a lot of mistakes, as your broker can handle everything on your behalf and in your best interest.

Robo-advisors for DIY stock investors

If you choose and manage your investments on your own, you can use the services of robo-advisers. Many people who are learning how to start investing in share market rely on relevant algorithms for help.

This might seem unfamiliar to you, but it is in fact what the name suggests. This is a product of using technology in providing sane investment advice, especially for beginners. This concept first appeared back in 2008 with the echoes of the financial crisis. But currently, there are various service providers in this field.

Investing in your own employer

If you want to start your DIY investment properly, you can start by investing in your employer’s company. You can do it with a small amount of your monthly paycheck. Being an insider at your employer's company will give you a knowledge advantage. Starting small can also provide you with knowledge and practise in how to buy shares. You will need that type of knowledge before expanding your investment portfolio.

A full-service or discount broker?

A full-service broker gives you complete peace of mind, as you won’t need to worry about a thing. However, their professional services are more suited to larger-scale investors. Their fees can be truly high and they can get a percentage of your operations as a commission. For someone who is still learning how to invest in stocks, a discount broker would charge less than a full-service one. But keep in mind, they offer a smaller range of services that do not include personal consultation or opinion. For instance, this type of broker will let you enjoy full freedom in making the final decision regarding investing in stocks.

5 notes

·

View notes

Text

How to Invest in Stocks: A Beginner's Guide

Written by Delvin

Investing in the stock market can be daunting for beginners. With so many options and a lot of jargon to learn, it’s easy to feel overwhelmed. However, investing in stocks can be a great way to grow your wealth in the long run. In this beginner’s guide, we’ll go over the basics of investing in stocks.

1. Educate Yourself: The first step in investing in stocks is to educate…

View On WordPress

#dailyprompt#Financial#Financial Literacy#How to Invest in Stocks#knowledge#money#Personal Finance#Stock Market#Stocks

0 notes

Text

youtube

#Why Bitcoin's Cryptocurrency ETF is a Game changer#how much should you invest in bitcoin#InsightDollars#Insight Dollars#InsightDollar#Why Bitcoin's Cryptocurrency ETF is a Game-changer#should you buy the bitcoin etf#bitcoin etf#how to invest in stocks#how to invest in real estate#bitcoin price prediction#should you buy bitcoin etf#how much bitcoin should you buy#should you invest in bitcoin#should you invest in bitcoin ETF#how much ETF bitcoin should you invest#Youtube

0 notes

Text

Do you want to be an investor? Learn to invest

How to learn to invest Introduction

Investments are a way to grow your money over time. Investments can be in the form of stocks, bonds, mutual funds, real estate, or any other form of assets.

Learning to invest is an important skill that can help you achieve your financial goals. There are many different ways to learn investing, including

How to learn to invest

reading:

There are many books…

View On WordPress

#come fare trading online#corso di trading online gratis#day trading#forex trading#how to invest#how to invest as a teen#how to invest as a teenager#how to invest for beginners#how to invest for teenagers#how to invest in 2020#how to invest in index funds#how to invest in real estate#how to invest in stock market#how to invest in stocks#how to invest in stocks for beginners#how to invest in stocks for teens#how to invest in the stock market#how to invest money#how to invest money as a teenager#how to invest money in stock market#how to invest under 18#How to learn to invest#how to pick stocks to invest in#how to start trading#intraday live trading#intraday trading#learn to invest#live day trading#live intraday trading#live options trading

0 notes

Text

#finacial blogs#how to invest in stocks#investment#investing#stock market#cryptocurency#cryptocurency news#mortgage#insurance

1 note

·

View note

Text

youtube

Charlie Munger's Best 10 Snowball Dividend Stocks For Increasing Income

#dividend stocks#how to invest in stocks#stock market for beginners#stocks#barang selalu ready stock#financial freedom#passive income#financial education#how to make money#how to make money online#passive income ideas#stock market#smart money#Youtube

0 notes

Text

Unlock the Future with Crypto Quantum Leap: Your Guide to Cryptocurrency Success!

"What sparked your interest in cryptocurrency, and what potential do you see in it?"

"Have you had any successful experiences with cryptocurrency investments or trading strategies that you'd like to share?"

"For those new to cryptocurrency, what advice would you give to get started safely and effectively?"

"What are your thoughts on the future of cryptocurrency and its impact on the traditional financial system?"

"Are there specific cryptocurrencies or blockchain projects that you're particularly excited about, and why?"

"How do you stay informed about the latest trends and developments in the cryptocurrency space?"

"Can you share any personal success stories or lessons learned from your cryptocurrency journey?"

"What challenges have you encountered in the world of cryptocurrency, and how did you overcome them?"

"In your opinion, what role will cryptocurrency play in the global economy in the coming years?"

"Are there any particular resources, books, or experts you recommend for those looking to expand their knowledge of cryptocurrency?"

you can get more detailed information and product link by clicking on 👈🏿

#money guy show#debt#budget#cash#real estate#insurance#how to make money#save#credit card#compound interest#buying house#buy stock#success#personal finance#millionaires share their secrets to financial success! (2023 edition)#how to get rich#how to become a millionaire#millionaire mindset#how to invest#how to invest in stocks#investing for beginners#how to build wealth#passive income ideas 2022#how to get rich in 2023#how to be a millionaire#quantum cryptography#quantum#quantum computing#crypto quantum leap#crypto quantum leap works

0 notes

Text

Darvas Box Theory: How I Made $2,000,000 in the Stock Market

#how i made 2 million in the stock market#stock market#darvas box#nicolas darvas box theory#darvas box theory#nicolas darvas how i made 2 million in the stock market#nicolas darvas#how i made 2 million in the stock market summary#darvas box strategy#how i made $2000000 in the stock market#darvas trading#trading the stock market#how to invest in stocks#darvas#how i made $2m in the stock market#stock market for beginners#darvas box indicator

0 notes

Text

How to make money in Stock Market - EARN WHILE YOU LEARN | How to earn money | Easiest way!!!

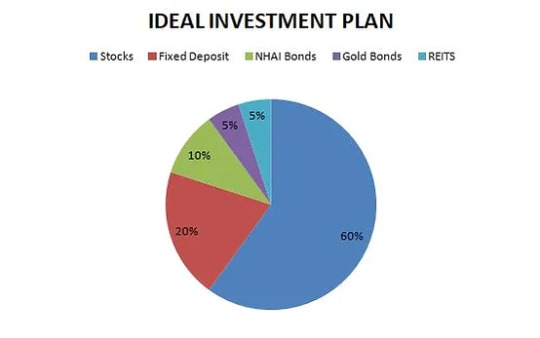

Ideal Investment Plan Pie Chart

If you put ₹ 1 lakh in education you will get a certificate.

If you put ₹ 1 lakh in FD at 7%, it will become 2 Lakh in 10 yrs & 2 months.

If you put ₹ 1 lakh in good stocks, it will become minimum 10 Lakh in 10 yrs.

Real Life Example:

MRF share price over last 10 yrs.

o Rs 1 Lakhs invested In MRF in 10 yrs became 13 Lakhs

Minda Share Price over last 10…

View On WordPress

#how to invest#how to invest in stock market#how to invest in stocks#how to invest in the stock market#how to make money#how to make money in stock market#how to make money in stocks#how to make money in the stock market#how to make money online#how to start investing in the stock market#make money#make money in the stock market#stock market#stock market for beginners#stock market investing#stock market investing for beginners

1 note

·

View note

Text

The stock market and personal investing

The stock market and personal investing

The stock market can be a daunting and confusing place for those who are new to personal investing. However, understanding the basics of how the stock market works and learning some key strategies can help you make informed decisions and potentially see a return on your investments.

First, it’s important to understand that the stock market is a…

View On WordPress

#how to invest in stocks#how to invest in the stock market#how to invest in the stock market for beginners#how to start investing in the stock market#investing#investing 101#investing for beginners#investing in stocks for beginners#investing in the stock market#personal finance#stock market#stock market crash#stock market for beginners#stock market investing#stock market investing for beginners#value investing

1 note

·

View note

Link

The US stock market is one of the oldest stock markets, making it a desirable option to invest in the Stock market. The reason behind this is the market’s maturity, less volatile nature, and higher returns on investments. The US being the strongest market is home to big firms like Amazon, Apple, Microsoft, etc which gives the investors a chance to be a part of these companies’ tremendous growth.

0 notes

Text

How To Buy Stocks For Beginners | Charles Schwab Tutorial 2022 (Step By Step)

How To Buy Stocks For Beginners | Charles Schwab Tutorial 2022 (Step By Step)

If you're looking to buy a stock I'm Going to show you step by step how to do It in this video there's no sponsor no Affiliate or as I like to say it no let's get straight to it so First I think this goes without saying But you really need to learn the basics Of investing before you buy your first Stock so in order to do that I'm going To refer you to a video I put together Earlier this year…

View On WordPress

#brokerage#buy a stock#buying a stock#buying stocks#buying your first stock#charles schwab#charles schwab tutorial#how to buy a stock#how to buy stocks#how to buy stocks for beginners#how to buy stocks for beginners on iphone#how to buy stocks on charles schwab#how to buy stocks on schwab#how to invest in stocks#how to invest in stocks for beginners#schwab#schwab review#schwab tutorial#stock market for beginners#stock market guide#stock market tutorial

0 notes

Text

8 Best Proven STEPS To Invest In Gold & Silver: (Easy & Simple) In 2022

How To Invest In Gold and Silver

Introduction

Gold and silver are two of the most popular precious metals in history. They have been used as currency and as an investment for hundreds of years, but they’re also great at insuring against inflation or a bad economy. The price of gold has risen by nearly 30% over the last year alone, making it more affordable than ever before. But how do you invest in something that isn’t tangible? Here’s what you need to know:

“Gold was a gift to Jesus. If it’s good enough for Jesus, it’s good enough for me!”

– Mr. T

Investing in gold and silver is mostly for people who are conservative with their money and wish to hedge against inflation or a bad economy.

Investing in gold and silver is mostly for people who are conservative with their money and wish to hedge against inflation or a bad economy. Gold and silver are haven assets, which means they provide an additional layer of protection against financial instability. Investing in these precious metals can also help you make money during times of economic uncertainty, such as when there is a stock market crash or currency devaluation. If you’re worried about geopolitical risk affecting the global economy, then investing in gold makes sense because it has historically been associated with countries that were undervalued on paper (like South Africa).

You may choose to invest in gold and silver for their financial benefits, but there’s also a psychological aspect to it. When you own precious metals, you can feel more secure because they are tangible assets that you can hold on to and touch. In times of financial uncertainty, this sense of security can be important as well.

Investing in gold and silver is a popular choice of investment for those that do not want to be exposed to market volatility.

If you are looking for an investment that will protect you from market volatility, gold and silver are popular choices. Gold has been used as money since ancient times, but the price of gold has gone up and down over time. Inflation is one reason why people buy gold; they want their money to retain its purchasing power when inflation happens. Another reason why people invest in gold is that they believe it can help them weather economic downturns or even wars that affect economies around the world.

How To Buy Gold & Silver | Practical Guide

How To Buy Gold & Silver | Practical Guide For Beginners | Gold & Silver Invest In 2022 | Invest In Precious Metals For Future Retirement Accounts

Gold prices have risen significantly over recent years (as shown by this graph). This means that if someone owns physical bars of gold now then they would have made more money than if they sold their holdings now at current prices.

Gold is also used as an investment by people who want to protect their wealth from negative economic events or geopolitical instability. For example, if someone buys gold today and then there’s a financial crisis tomorrow, their investment will retain its value while other investments lose theirs.

“I like gold because it is a stabilizer; it is an insurance policy.”

– Kevin O’Leary

Gold and silver coins have been held as investments for hundreds of years, especially by people looking to stay safe during times of crisis.

Photo by http://Zlaťáky.cz on Unsplash

Gold and silver coins have been used as currency for thousands of years, especially by people looking to stay safe during times of crisis. During times when paper money is no longer a reliable form of storing wealth, gold and silver coins can be valuable assets that provide a store of value in uncertain economic times. You can buy physical gold and silver online through reputable dealers or coin shops in your area.

You can also take delivery of your gold or silver at home or store it safely at home with the help of an online storage service like [insert name here] (StorageToolBox.com domain is for sale | Buy with Epik.com).

Physical gold and silver coins are a popular choice for investors looking to keep their wealth safe. You can buy them online or in person at an online coin shop or local dealer. You can also take delivery of your gold or silver at home, and store it safely with

There are only two ways to invest in gold and silver- physical possession, or indirectly through the stock market (mutual funds, ETFs, stocks, etc.).

There are only two ways to invest in gold and silver- physical possession, or indirectly through the stock market (mutual funds, ETFs, stocks, etc.).

Physical possession means owning the metal itself. Indirect investment is buying stock or other securities that deal in gold and silver.

The cost of physical possession is higher than indirect investment because it involves taking delivery of your metal coins (usually at a bank) while investing directly into an exchange-traded fund such as SPDR Gold Shares ETF or iShares Silver Trust ETF gives you exposure to metals without having to buy them outright.

The benefits of physical possession are that you have complete control over your investment and can sell it at any time. However, if you choose this route, be prepared for potentially large transaction costs as well as storage fees (if you do not want to keep the gold at home).

“The finest compliment you can pay a man is that his word was as good as gold.”

– Evel Knievel

Physical possession means that you own the physical metal and can take delivery at any time.

Physical possession means that you own the physical metal and can take delivery at any time. Physical possession is the most direct way to invest in gold and silver.

You can also sell it to someone else at any time, but this will require an additional fee from your dealer (which may be more than their fee if they’re not offering this service).

The last step is to purchase your physical gold or silver from a dealer who offers these products directly through themselves, rather than going through another intermediary like an online broker or trading platform like Investing In Gold And Silver & Silver Bullion Bankers Official Site Online Brokers Forex Commodities Futures Contracts Options Forwards Futures Contracts Options Futures Currency Markets Commodities Commodity Indexes – Learn About How To Trade Forex Currency Market Online Brokers Forex Commodities Futures Contracts Options Forwards Futures Contracts Options

Futures Contracts Options Futures Currency Futures Currency Markets Commodities Commodity Indexes – Learn About How To Trade Forex Currency Market Online Brokers Forex Commodities Futures Contracts Options Forwards Futures Contracts Options

Indirectly means that you aren’t taking delivery of actual metal but rather you are buying company stocks or other related securities that deal in gold and silver.

If you’re looking to invest in gold and silver, the best way is to do it indirectly. Indirect means that you aren’t taking delivery of actual metal but rather you are buying company stocks or other related securities that deal in gold and silver.

If a company mines gold or silver, it will have an impact on the price of these metals because they have their supply chain. Companies can also be impacted by environmental issues like water contamination or pollution, which could send them into bankruptcy if they get too far behind schedule on repairs and upgrades needed at their facilities.

Companies that are involved in the mining, refining, and distribution of gold and silver can also be affected by the price of these metals. For example, when gold prices rise, the cost of refining goes up because more inputs are used to process each ounce of metal. This is why many companies that rely on gold as an input will see their profits drop during periods where prices go up.

“Gold and silver is money, everything else is credit.”

– J.P. Morgan

Investing in precious metals can be accomplished either by buying actual physical metal or indirectly by purchasing shares of a mining company or ETFs (exchange-traded funds).

Investing in precious metals can be accomplished either by buying actual physical metal or indirectly by purchasing shares of a mining company or ETFs (exchange-traded funds). Physical means that you own the metal that you bought on your behalf, but it comes with some disadvantages like storage costs, insurance, and gold dealers often charge a premium when buying or selling physical gold or silver. Indirectly means that you aren’t taking delivery of actual metal but rather you are buying company stocks or other related securities.

If you want to invest in gold and silver without breaking the bank then this option may be the best choice for most people because there are no additional costs associated with owning these assets beyond what they would normally cost if they were sold outright at the market value.

The most common way to invest in precious metals is through a gold and silver ETF. A gold and silver ETF is an investment fund that allows you to buy shares of a company that owns gold bullion or silver bullion. The prices of these funds are based on the spot price of their holdings which means they will be priced higher than if you bought them outright.

Physical means that you own the metal that you bought on your behalf.

Physical means that you own the metal that you bought on your behalf.

Indirectly, investing in precious metals can be accomplished either by buying actual physical metals or indirectly by purchasing shares of a mining company or ETFs (exchange-traded funds).

Buying physical metal is a safe way to invest in precious metals because you know that you have actual possession of the metal at all times. However, it can be difficult to store and sell large amounts of physical gold or silver if you don’t already have a place to keep it.

“Gold is forever. It is beautiful, useful, and never wears out. Small wonder that gold has been prized over all else, in all ages, as a store of value that will survive the travails of life and the ravages of time.”

– James Blakeley

Read More:

1- How To Invest In Gold For Beginners: The 7 Best Ways

2- The Best Time of the Year to Buy Gold & Silver in 2022

3- 7 Best Ninja Hacks To Invest In Gold For Beginners: (Profit & Loss) 2022

Conclusion

There’s no shortage of ways to invest in gold and silver. The two metals are a great way to diversify your portfolio because they have a history of being relatively stable compared with other investments like stocks and bonds. And although both metals have their pros and cons, they can work well together as an investment strategy when used correctly.

#Top 8 Proven STEPS To Invest In Gold & Silver#How To Invest In Gold & Silver#How To Invest In Gold and Silver#how to invest in gold and silver#How To Invest In Precious Metals#How To Invest In Stocks#how to invest in stocks#Investing In Gold and nd Silver#Retirement Accounts Invest In Gold and Silver#Best Gold & Silver Investment To Invest In Future#Best Way To Invest In Gold & Silver#Best Way To Invest In Gold and Silver#Best Way To Invest In Gold and Silver For Beginners#Best Way To Invest In Precious Metals#Gold & Silver Investment Companies#Gold & Silver Investment In 2022#How To Become A Millionaire From Invest In Gold and Silver#Gold 401k Rollover#Gold IRAs#How To Buy Bitcoin#How To Buy Bitcoin For Beginners#How To Invest In Bitcoin#Buy Gold and Silver#Bitcoin IRAs#Business Ideas#Finance Advisor#Financial Freedom#Wealth#wealthbuilding#millionaire

1 note

·

View note

Text

How to start investing in stocks? — upsurge

The stock market is a highway that leads to wealth-building opportunities. The stock market has the potential to make you a lot of money, but also is volatile enough to wipe out wealth. As a result, learning how to trade in the stock market is essential.

Click On the link to know more: How to start investing in stocks?

0 notes