#financial reporting automation

Text

Adoption Trends of Financial Intelligence Tools – PathQuest Survey Report

Have you ever wondered what it takes to run a successful advisory business? Despite the availability of powerful financial intelligence solutions, over half of the advisory businesses in the accounting space still rely on manual methods. Our survey report sheds light on the shifting landscape of financial intelligence tools. You can explore adoption trends, preferences for generating valuable business insights through automation systems, and the reasons why 52% of businesses choose manual methods while 48% embrace BI tools.

By downloading this comprehensive survey report, you can gain exclusive access and unlock the untapped potential of BI tools to optimize financial performance for your advisory business. Discover key insights and trends that can propel your firm forward. Don’t miss out on this invaluable resource – Download the report now at https://pathquest.com/knowledge-center/sample-report/adoption-trends-of-financial-intelligence-tools-pathquest-survey-report/

#Financial analysis software#Financial Intelligence Software#Financial Business Intelligence Software#financial reporting automation

0 notes

Text

Unlocking Financial Excellence: The Power of Reporting Automation

Financial reporting automation emerges as a driving force in the finance domain, streamlining processes and ensuring accuracy and timeliness. This transformative tool empowers organizations to navigate the complexities of modern finance with enhanced agility and reliability. With advanced AI-driven software, critical aspects of financial reporting are streamlined, ushering in a new era of accuracy and effectiveness.

Understanding financial reporting automation is key. It represents the adoption of software specifically designed to manage crucial tasks seamlessly, from account reconciliation to the seamless generation of financial reports and statements. This not only simplifies processes for finance teams but also serves as a robust business intelligence reporting software solution, reducing errors and enhancing overall operational efficiency.

The benefits of automating financial reporting are substantial. From quick approvals to boosted efficiency, automation plays a pivotal role in eliminating delays and expediting tasks that once consumed significant time. Automated solutions instill confidence in the accuracy of financial data, minimizing the potential for human error and enhancing data integrity. User-level access and comprehensive audit trails further enhance accountability and facilitate adherence to industry regulations.

Selecting the right financial reporting automation tool is critical for effective implementation. Organizations should prioritize solutions with an understandable report structure, actionable insights, and customizable dashboards. User-friendly features enhance the overall user experience, making it easier for finance teams to navigate the software seamlessly.

Implementing tools for automation requires a structured approach. Standardizing processes, designing workflows, and checking integrations are essential steps to ensure optimal deployment. Automation extends to various financial reports, including MIS reports, annual and quarterly financial statements, financial statement analysis, budget vs. actuals, intercompany eliminations, and currency translations.

Financial reporting automation stands as an indestructible force in the finance sector, introducing unparalleled efficiency, accuracy, and transparency. Understanding its advantages, selecting the right tools, and adhering to best practices streamline operations and open avenues for intelligent decision-making. Through the adoption of business intelligence software, finance leaders can transcend traditional boundaries, liberating themselves from the burdensome, error-prone tasks associated with month-end stress. The focal point is redirecting attention towards substantial insights that empower effective leadership and propel entities towards progressive futures.

To read the full detailed blog please click here

Or

Visit our website by clicking here

#business intelligence#reporting automation#business solutions#software#bisolution#epm#enterprise performance management#businessintelligence#automated reporting#bi tool#financial reporting#financial reporting automation

0 notes

Text

INTERAC Applications for Public Accounting | Intersoft Systems Inc

The INTERAC core accounting applications are easily tailored to accommodate the needs of a variety of businesses. Intersoft Systems, Inc. offers NTERAC Client Accounting, Payroll, Time and Billing, Practice Management Software Solutions.

#INTERAC Applications#Public Accounting#Accounting Software#Financial Management#Accountancy Tools#CPA Software#Financial Reporting#Tax Preparation#Audit Solutions#Accounting Automation

0 notes

Text

#PropertyManagementSystem: General tag highlighting the system's purpose.#RealEstateTech: Indicates its role in the realm of real estate technology.#EfficientOperations: Emphasizes the system's ability to streamline processes.#TenantManagement: Indicates its role in managing tenant interactions and needs.#FinancialTracking: Highlights its function in tracking financial transactions and generating reports.#AutomatedTasks: Underlines its capability to automate repetitive tasks#saving time and resources.

1 note

·

View note

Text

Transform Your Finances: The Power of E-Accounting in the Digital Age

Introduction

In an era marked by relentless innovation, the quest for enhanced financial management solutions remains a top priority for both businesses and individuals. The dawn of technological advancements, particularly in the realm of e-accounting, has paved the way for unprecedented transformations in how we handle our finances. In this article, we embark on a journey through the landscape of e-accounting, exploring its profound impact on financial management and the invaluable benefits it brings through real-time financial reporting and automated financial management solutions.

The Emergence of E-Accounting

Gone are the days when ledger books and manual spreadsheets were the primary tools for financial record-keeping. E-accounting, also referred to as online accounting or electronic accounting, harnesses the power of digital technology to revolutionize financial processes. It encompasses a diverse array of software and platforms meticulously designed to automate tasks ranging from invoicing and expense tracking to payroll management and reporting.

Real-Time Financial Insights

Among the myriad advantages offered by e-accounting, perhaps none are as compelling as its capability to deliver real-time financial reporting. Unlike traditional methods that necessitate manual data entry and reconciliation, e-accounting systems seamlessly update financial data as transactions occur. This translates to instantaneous access to crucial financial metrics such as revenue, expenses, cash flow, and profitability. Whether monitoring sales performance, tracking expenses against budgets, or projecting future growth trajectories, real-time reporting empowers businesses to remain agile and responsive amidst dynamic market conditions.

Streamlined Financial Management

Another cornerstone feature of e-accounting lies in its ability to automate financial management processes. By automating tasks like invoice generation, bill payment, and payroll processing, businesses can unlock newfound efficiencies while conserving precious time and resources. Automation not only mitigates the risk of human error but also ensures adherence to regulatory standards, thereby enhancing overall operational efficiency.

Moreover, automated financial management plays a pivotal role in optimizing cash flow dynamics. By streamlining invoicing and payment workflows, businesses can expedite the cash conversion cycle, thereby optimizing working capital and bolstering liquidity. Additionally, automated alerts and notifications serve as invaluable tools in keeping businesses abreast of overdue payments, thereby minimizing the risk of late fees and disruptions to cash flow.

Maximizing the Potential of E-Accounting

Embracing e-accounting transcends mere adoption of software; it entails a paradigm shift towards harnessing technology to drive financial prowess. Here are key strategies to effectively leverage the power of e-accounting:

Assess Your Needs: Conduct a thorough evaluation of existing financial processes to identify areas ripe for enhancement through e-accounting solutions.

Select the Right Software: Choose e-accounting software that aligns with your organizational objectives, scalability requirements, and budget constraints.

Invest in Training: Provide comprehensive training to equip your team with the requisite skills to leverage e-accounting tools effectively.

Monitor Performance: Regularly track key performance indicators derived from e-accounting systems to gauge progress towards financial objectives and inform strategic decision-making.

Stay Ahead: Remain vigilant of emerging trends and advancements in the field of e-accounting to ensure your financial management practices remain cutting-edge.

Conclusion

In an era characterized by unprecedented technological innovation, the transformative potential of e-accounting cannot be overstated. From real-time financial reporting to automated financial management, e-accounting solutions offer an array of benefits for businesses seeking to optimize their financial operations. By embracing technology and embracing e-accounting practices, businesses can streamline processes, gain actionable insights, and propel sustainable growth in the digital age.

Suggested Blogs:

Financial e-Accounting Free tutorial

Excel data import techniques

Small business accounting

0 notes

Text

Navigating Revenue Recognition Complexity

In the realm of revenue recognition, some transactions are straightforward, like retail sales where revenue is recognized upon immediate delivery. However, complexities arise when goods or services are delivered over time, such as subscriptions or bundled products, leading to challenges in determining when and how to recognize revenue.

Adherence to established industry standards, such as Generally Accepted Accounting Principles (GAAP), is crucial for businesses to ensure legal compliance and accurate financial reporting. Proper revenue recognition, guided by principles like ASC 606, not only reflects a company's performance accurately but also fosters transparency and comparability across industries.

Understanding Revenue Recognition: A Crucial Accounting Principle

Revenue recognition GAAP dictates the timing and method of recording revenue in financial statements, emphasizing recognition upon realization and earning, rather than when cash is received.

This principle serves several purposes: it enables CFOs and accounting teams to accurately depict financial performance, ensures transparency and accountability in reporting, fosters consistency and comparability among companies, and enhances trust in financial markets.

Evolution of Revenue Recognition Standards

Historically, revenue recognition standards varied across industries until the introduction of ASC 606 in 2014, which unified the process and shifted towards a more judgment-based approach. This evolution aimed to streamline revenue recognition and align it with GAAP, fostering clearer financial reporting.

Implications of Revenue Recognition on Financial Statements

The ASC 606 framework, in conjunction with GAAP, shapes a company's financial statements by dictating when revenue should be recognized—once performance obligations are met. Adhering to GAAP ensures accurate and consistent reporting, influencing a company's profitability, liquidity, and solvency, thus impacting its valuation and creditworthiness.

Strategic Implications of Revenue Recognition

GAAP's revenue recognition rules inform a company's strategic planning by providing objective performance assessments. Accurate revenue recognition enables informed decision-making in pricing, sales, and marketing strategies, enhancing credibility and reputation in the eyes of investors and creditors.

Core GAAP Principles Supporting Revenue Recognition

Several key GAAP principles underpin revenue recognition, including the realization principle, matching principle, and specific criteria outlined in ASC 606. These principles guide companies in recognizing revenue accurately and consistently, preventing misrepresentation and ensuring compliance.

Industry-Specific Revenue Recognition Guidelines

Revenue recognition practices vary across industries, necessitating tailored approaches. Software, construction, SaaS, eCommerce, and other sectors each have unique considerations for revenue recognition under GAAP, requiring careful assessment of contractual terms and performance obligations.

Navigating Common Revenue Recognition Challenges

Despite standardization efforts, revenue recognition can pose challenges such as timing issues, variable considerations, and complex contractual arrangements. Addressing these challenges requires a systematic approach, accurate estimation of variables, fair value measurements, and robust documentation and communication practices.

Harmonizing GAAP with Revenue Recognition Standards

GAAP complements revenue recognition standards like ASC 606 and IFRS 15, providing essential guidelines for accurate revenue reporting. Automating revenue recognition processes, through services like RightRev, can mitigate complexities and ensure compliance with GAAP, enhancing efficiency and accuracy in financial reporting.

#Revenue Recognition#GAAP (Generally Accepted Accounting Principles)#ASC 606#Financial Reporting#Accounting Standards#Financial Statements#Revenue Management#Revenue Accounting#Compliance#Industry Standards#Performance Obligations#Financial Performance#Revenue Forecasting#Revenue Automation#Strategic Planning#Contractual Obligations#Revenue Challenges#IFRS 15#Revenue Measurement#Financial Compliance

0 notes

Text

⚙️💰 Revolutionize tax compliance and financial reporting with advanced payroll software! Discover the seamless integration, real-time updates, and customized reporting that empower businesses in navigating the complexities of taxation. 🚀📊 #TaxCompliance #PayrollSoftware

0 notes

Text

Boosting Efficiency: How ERPNext Revolutionizes Asset Management

Introduction

In today’s rapidly evolving business landscape, effective asset management is crucial for sustained growth and profitability. ERPNext, an open-source Enterprise Resource Planning (ERP) solution, has emerged as a game-changer in this domain. With its comprehensive suite of features, ERPNext, provided by Sigzen Technologies, is revolutionizing asset management for businesses across…

View On WordPress

#Accurate Tracking#business growth#Cost-effective ERP#Custom Dashboards#Customized Solutions#Efficiency Optimization#ERPNext Asset Management#Financial Reporting#Procurement Automation#Real-time Inventory#Scalable Solutions

0 notes

Text

Exploring the Multifaceted World of Accounting

In the fascinating sphere of business, accounting stands as an indispensable pillar, serving as the language that communicates an organization’s financial health. The field of accounting, with its inherent complexities and nuances, is a crucial discipline that transcends the mere crunching of numbers. It supports strategic decision-making, promotes ethical practices, provides a measure of…

View On WordPress

#Accounting Automation#Accounting Ethics#Accounting Principles#Auditing#Business Growth#Business Strategy#Digital Transformation#ESG Reporting#Financial Compliance#Financial Technology#FinTech in Accounting#Forensic Accounting#Fraud Detection#Management Accounting#Risk Management#Strategic Decision-Making#Sustainability in Accounting#Tax Accounting

1 note

·

View note

Text

Integration Of Financial Reporting Software With Other Accounting Systems

In today's fast-paced business environment, integrating financial reporting software with other accounting systems has become increasingly important for companies of all sizes. Financial reporting software helps businesses to collect, organize and analyze financial data in a more efficient manner. When integrated with other accounting systems, financial reporting software can offer several benefits that help businesses to streamline their financial operations, make more informed decisions, and achieve better financial outcomes.

Importance Of Integration Of Financial Reporting Software With Other Accounting Systems

It is no secret that integration of financial reporting software with other accounting systems is sacrosanct and leads to better productivity. Hence the following are the importance of integration.

Automation Of Financial Data

One of the key benefits of integrating financial reporting software with other accounting systems is that it enables businesses to automate financial data collection, processing, and reporting. This reduces the amount of time and effort required to prepare financial reports, which means that businesses can focus on more value-added tasks, such as analyzing financial data to make informed decisions. Automation also reduces the risk of errors that can occur when financial data is manually entered into multiple systems.

Provides A Comprehensive View Of Financial Data Across Several Functions

Integration of financial reporting software with other accounting systems also provides a comprehensive view of financial data across multiple business functions. This allows businesses to better understand the relationships between financial data and other operational data, such as sales, inventory, and customer data. With a holistic view of the business, financial managers can make better-informed decisions and develop more effective strategies to drive business growth.

Improves Collaboration

Another benefit of integrating financial reporting software with other accounting systems is that it improves collaboration and communication among different departments within a business. By integrating financial reporting software with other systems, such as customer relationship management (CRM) software, businesses can share financial data across different departments, enabling them to work together more efficiently to achieve common goals.

It Aids Businesses in Achieving Compliance

Furthermore, integrating financial reporting software with other accounting systems can help businesses to achieve compliance with regulatory requirements. Many financial reporting software solutions are designed to comply with various regulatory standards, such as GAAP, IFRS, and SOX. Integration with other accounting systems enables businesses to ensure that they are meeting these standards consistently across all systems, reducing the risk of non-compliance.

Improves Overall Financial Performance

Integrating financial reporting software with other accounting systems is crucial for businesses looking to improve their financial performance, make more informed decisions, and stay compliant with regulatory requirements. With automation, improved collaboration, and better visibility into financial data, businesses can achieve greater efficiency, accuracy, and agility, enabling them to compete more effectively in today's rapidly changing business landscape.

Benefits Of Integration Of Financial Reporting Software With Other Accounting Systems

Integration of financial reporting software with other accounting systems offers several benefits for businesses, including improved efficiency, accuracy, and agility. The following are some of the main benefits of integration:

Automation:

Integration of financial reporting software with other accounting systems enables businesses to automate financial data collection, processing, and reporting. This reduces the amount of time and effort required to prepare financial reports, which means that businesses can focus on more value-added tasks, such as analyzing financial data to make informed decisions. Automation also reduces the risk of errors that can occur when financial data is manually entered into multiple systems.

Improved Visibility:

Integrating financial reporting software with other accounting systems provides a comprehensive view of financial data across multiple business functions. This allows businesses to better understand the relationships between financial data and other operational data, such as sales, inventory, and customer data. With a holistic view of the business, financial managers can make better-informed decisions and develop more effective strategies to drive business growth.

Better Collaboration:

Integration of financial reporting software with other accounting systems improves collaboration and communication among different departments within a business. By integrating financial reporting software with other systems, such as customer relationship management (CRM) software, businesses can share financial data across different departments, enabling them to work together more efficiently to achieve common goals.

Regulatory Compliance:

Integration of financial reporting software with other accounting systems helps businesses to achieve compliance with regulatory requirements. Many financial reporting software solutions are designed to comply with various regulatory standards, such as GAAP, IFRS, and SOX. Integration with other accounting systems enables businesses to ensure that they are meeting these standards consistently across all systems, reducing the risk of non-compliance.

Improved Decision-Making:

Integration of financial reporting software with other accounting systems provides businesses with more accurate and timely financial data. This enables financial managers to make more informed decisions, such as identifying cost-saving opportunities, optimizing resource allocation, and forecasting financial performance.

In a nutshell, the integration of financial reporting software with other accounting systems offers numerous benefits that can help businesses improve their financial performance, make more informed decisions, and stay compliant with regulatory requirements. By automating financial data collection, improving visibility and collaboration, and providing more accurate and timely financial data, businesses can achieve greater efficiency, accuracy, and agility, enabling them to compete more effectively in today's rapidly changing business landscape.

Challenges of Integration with Inventory Management Systems

Integrating financial reporting software with inventory management systems can be a challenging task for businesses. This integration requires a seamless flow of data between systems, which can be difficult to achieve due to differences in data formats, data structures, and data security protocols. Some of the common challenges businesses face when integrating financial reporting software with inventory management systems are:

Data compatibility:

The data structures and formats used by inventory management systems can vary significantly from those used by financial reporting software. As a result, data needs to be properly mapped, and sometimes transformed, to ensure that it is compatible with both systems. This can be a time-consuming process that requires careful attention to detail.

Data quality:

The quality of data within inventory management systems can be a challenge. Often, the data within these systems is incomplete or inaccurate, which can lead to errors and inconsistencies when integrated with financial reporting software. Cleaning and validating data is a necessary step in ensuring the accuracy and reliability of financial reports.

Security:

Integrating financial reporting software with inventory management systems requires a secure data transfer protocol to ensure that sensitive information, such as financial data, is protected during transfer. Data encryption and access controls are necessary to prevent data breaches.

Customization:

Each business has unique j management requirements, and customization of software is often necessary to ensure integration with financial reporting software. Customization can be expensive and time-consuming, requiring a significant investment of time and resources.

Technical expertise:

Integrating financial reporting software with inventory management systems requires specialized technical expertise. It requires knowledge of both systems, as well as expertise in data mapping, transformation, and integration. As a result, businesses may need to hire additional technical personnel or engage external consultants to ensure a successful integration.

In a nutshell, integrating financial reporting software with inventory management systems is a complex process that requires careful planning and execution. The challenges of data compatibility, data quality, security, customization, and technical expertise must be addressed to ensure a successful integration. Businesses should seek out experienced partners who have successfully integrated financial reporting software with inventory management systems to help them navigate this process. By overcoming these challenges, businesses can achieve greater efficiency, accuracy, and agility in their financial operations, enabling them to compete more effectively in today's rapidly changing business landscape.

Future Outlook for Integration

The future outlook for the integration of financial reporting software with other accounting systems looks promising. Advancements in technology, such as cloud computing, artificial intelligence, and machine learning, are driving the development of more robust and efficient integration solutions. Here are some of the key trends that are shaping the future of integration:

Cloud Computing:

Cloud-based financial reporting software solutions are becoming more popular due to their scalability, flexibility, and cost-effectiveness. Integration of these solutions with other accounting systems can be achieved through application programming interfaces (APIs), which enable data to be shared seamlessly between systems.

Artificial Intelligence:

The use of artificial intelligence (AI) and machine learning (ML) algorithms can help automate the integration process. These technologies can analyze and interpret data, reducing the need for manual data mapping and transformation. This can improve the speed and accuracy of integration, while also reducing the risk of errors.

Internet of Things:

The Internet of Things (IoT) is enabling businesses to capture real-time data from connected devices, such as sensors and RFID tags. Integrating this data with financial reporting software can provide businesses with more accurate and timely insights into their operations, enabling them to make more informed decisions.

Blockchain:

Blockchain technology is being explored as a potential solution for secure and transparent integration of financial reporting software with other accounting systems. Blockchain can provide a distributed ledger that enables the secure and transparent transfer of data between systems, reducing the risk of data breaches and ensuring data integrity.

Compliance:

Compliance with regulatory requirements is an ongoing challenge for businesses. Integration of financial reporting software with other accounting systems can help businesses to achieve compliance by providing consistent and accurate data across all systems. Advances in integration technology can help automate compliance reporting, reducing the burden on financial managers.

In conclusion, the future outlook for the integration of financial reporting software with other accounting systems looks bright. Advancements in cloud computing, artificial intelligence, machine learning, IoT, blockchain, and compliance reporting are driving the development of more robust and efficient integration solutions. Businesses that invest in integration technology can achieve greater efficiency, accuracy, and agility in their financial operations, enabling them to compete more effectively in today's rapidly changing business landscape.

0 notes

Text

The Skills Needed to Be a Strategic Financial Advisor

Be a Financial Advisor: Building your advisory practice can take some time, but adding advisory to your firm gives you, your team, and your firm a chance to grow, so it’s a good move. Many businesses are requesting advisory services along with standard compliance services from their accounting firms. This is your firm’s chance to provide the type of value your clients are looking for. It also gives you and your team the ability to grow professionally with new skills and do more face-to-face work with clients.

But advisory requires a different set of skills than compliance work. Here are the key skills you need to become a successful strategic advisor.

Client Relationship Management

If you rarely met with clients for compliance work, that will change with advisory. Long-term success in advisory requires connecting with clients and building trust. The businesses, finances, and potential growth of your clients are in your hands. You need to maintain trust by earning and reaffirming it regularly.

You must start the advisory relationship with a professional tone, because you don’t know your client yet. Then adjust how you work with them as you get to know them better. Emotional intelligence is an important skill in advisory.

For more information read our blog at https://pathquest.com/knowledge-center/blogs/the-skills-needed-to-be-a-strategic-financial-advisor/

0 notes

Text

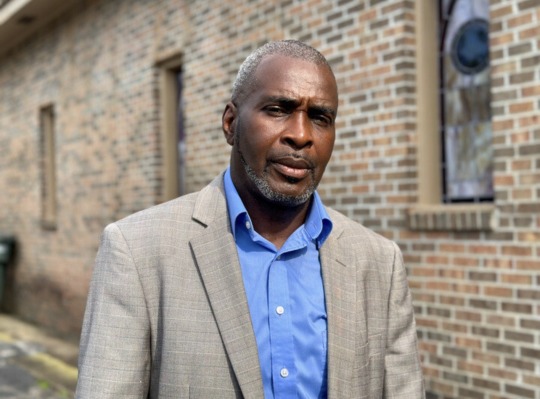

Patrick Braxton became the first Black mayor of Newbern, Alabama, when he was elected in 2020, but since then he has fought with the previous administration to actually serve in office. (Aallyah Wright/Capital B)

NEWBERN, Ala. — There’s a power struggle in Newbern, Alabama, and the rural town’s first Black mayor is at war with the previous administration who he says locked him out of Town Hall.

After years of racist harassment and intimidation, Patrick Braxton is fed up, and in a federal civil rights lawsuit he is accusing town officials of conspiring to deny his civil rights and his position because of his race.

“When I first became mayor, [a white woman told me] the town was not ready for a Black mayor,” Braxton recalls.

The town is 85% Black, and 29% of Black people here live below the poverty line.

“What did she mean by the town wasn’t ready for a Black mayor? They, meaning white people?” Capital B asked.

“Yes. No change,” Braxton says.

Decades removed from a seemingly Jim Crow South, white people continue to thwart Black political progress by refusing to allow them to govern themselves or participate in the country’s democracy, several residents told Capital B. While litigation may take months or years to resolve, Braxton and community members are working to organize voter education, registration, and transportation ahead of the 2024 general election.

But the tension has been brewing for years.

Two years ago, Braxton says he was the only volunteer firefighter in his department to respond to a tree fire near a Black person’s home in the town of 275 people. As Braxton, 57, actively worked to put out the fire, he says, one of his white colleagues tried to take the keys to his fire truck to keep him from using it.

In another incident, Braxton, who was off duty at the time, overheard an emergency dispatch call for a Black woman experiencing a heart attack. He drove to the fire station to retrieve the automated external defibrillator, or AED machine, but the locks were changed, so he couldn’t get into the facility. He raced back to his house, grabbed his personal machine, and drove over to the house, but he didn’t make it in time to save her. Braxton wasn’t able to gain access to the building or equipment until the Hale County Emergency Management Agency director intervened, the lawsuit said.

“I have been on several house fires by myself,” Braxton says. “They hear the radio and wouldn’t come. I know they hear it because I called dispatch, and dispatch set the tone call three or four times for Newbern because we got a certain tone.”

This has become the new norm for Braxton ever since he became the first Black mayor of his hometown in 2020. For the past three years, he’s been fighting to serve and hold on to the title of mayor, first reported by Lee Hedgepeth, a freelance journalist based in Alabama.

Incorporated in 1854, Newbern, Alabama, today has a population of 275 people — 85% of whom are Black. (Aallyah Wright/Capital B)

Not only has he been locked out of the town hall and fought fires alone, but he’s been followed by a drone and unable to retrieve the town’s mail and financial accounts, he says. Rather than concede, Haywood “Woody” Stokes III, the former white mayor, along with his council members, reappointed themselves to their positions after ordering a special election that no one knew about.

Braxton is suing them, the People’s Bank of Greensboro, and the postmaster at the U.S. Post Office.

For at least 60 years, there’s never been an election in the town. Instead, the mantle has been treated as a “hand me down” by the small percentage of white residents, according to several residents Capital B interviewed. After being the only one to submit qualifying paperwork and statement of economic interests, Braxton became the mayor.

(continue reading)

#politics#white supremacy#patrick braxton#woody stokes#republicans#alabama#sundown towns#racism#voter suppression

3K notes

·

View notes

Note

I'm writing a sci-fi story about a space freight hauler with a heavy focus on the economy.

Any tips for writing a complex fictional economy and all of it's intricacies and inner-workings?

Constructing a Fictional Economy

The economy is all about: How is the limited financial/natural/human resources distributed between various parties?

So, the most important question you should be able to answer are:

Who are the "have"s and "have-not"s?

What's "expensive" and what's "commonplace"?

What are the rules(laws, taxes, trade) of this game?

Building Blocks of the Economic System

Type of economic system. Even if your fictional economy is made up, it will need to be based on the existing systems: capitalism, socialism, mixed economies, feudalism, barter, etc.

Currency and monetary systems: the currency can be in various forms like gols, silver, digital, fiat, other commodity, etc. Estalish a central bank (or equivalent) responsible for monetary policy

Exchange rates

Inflation

Domestic and International trade: Trade policies and treaties. Transportation, communication infrastructure

Labour and employment: labor force trends, employment opportunities, workers rights. Consider the role of education, training and skill development in the labour market

The government's role: Fiscal policy(tax rate?), market regulation, social welfare, pension plans, etc.

Impact of Technology: Examine the role of tech in productivity, automation and job displacement. How does the digital economy and e-commerce shape the world?

Economic history: what are some historical events (like The Great Depresion and the 2008 Housing Crisis) that left lasting impacts on the psychologial workings of your economy?

For a comprehensive economic system, you'll need to consider ideally all of the above. However, depending on the characteristics of your country, you will need to concentrate on some more than others. i.e. a country heavily dependent on exports will care a lot more about the exchange rate and how to keep it stable.

For Fantasy Economies:

Social status: The haves and have-nots in fantasy world will be much more clear-cut, often with little room for movement up and down the socioeconoic ladder.

Scaricity. What is a resource that is hard to come by?

Geographical Characteristics: The setting will play a huge role in deciding what your country has and doesn't. Mountains and seas will determine time and cost of trade. Climatic conditions will determine shelf life of food items.

Impact of Magic: Magic can determine the cost of obtaining certain commodities. How does teleportation magic impact trade?

For Sci-Fi Economies Related to Space Exploration

Thankfully, space exploitation is slowly becoming a reality, we can now identify the factors we'll need to consider:

Economics of space waste: How large is the space waste problem? Is it recycled or resold? Any regulations about disposing of space wste?

New Energy: Is there any new clean energy? Is energy scarce?

Investors: Who/which country are the giants of space travel?

Ownership: Who "owns" space? How do you draw the borders between territories in space?

New class of workers: How are people working in space treated? Skilled or unskilled?

Relationship between space and Earth: Are resources mined in space and brought back to Earth, or is there a plan to live in space permanently?

What are some new professional niches?

What's the military implication of space exploitation? What new weapons, networks and spying techniques?

Also, consider:

Impact of space travel on food security, gender equality, racial equality

Impact of space travel on education.

Impact of space travel on the entertainment industry. Perhaps shooting monters in space isn't just a virtual thing anymore?

What are some indsutries that decline due to space travel?

I suggest reading up the Economic Impact Report from NASA, and futuristic reports from business consultants like McKinsey.

If space exploitation is a relatiely new technology that not everyone has access to, the workings of the economy will be skewed to benefit large investors and tech giants. As more regulations appear and prices go down, it will be further be integrated into the various industries, eventually becoming a new style of living.

#writing practice#writing#writers and poets#creative writing#writers on tumblr#creative writers#helping writers#poets and writers#writeblr#resources for writers#let's write#writing process#writing prompt#writing community#writing inspiration#writing tips#writing advice#on writing#writer#writerscommunity#writer on tumblr#writer stuff#writer things#writer problems#writer community#writblr#science fiction#fiction#novel#worldbuilding

250 notes

·

View notes

Text

Femme Fatale Guide: How To Master Your Money & Tips On Financial Literacy

Understanding and taking control of your finances improves your quality of life in many ways. Making strides toward better financial literacy can save you a lot of stress, unnecessary fees and helps you play a more active role in taking control over this aspect of adulthood. Once you understand the game of money, saving, and investing, it becomes infinitely simpler to devise a plan to set yourself up for a more financially-free future. Here are some practical tips to keep your finances streamlined, secure, and systemized to help you gain more financial literacy and win in this area of life.

Overview:

Track Your Income & Expenses

Set Financial Goals & Realistic Limitations

Invest Higher-Quality Items To Save Later

Educate Yourself On Different Types of Banking & Investment Accounts

Establish Credit, But Know Yourself

Create An Emergency Fund

Leverage Credit Card Benefits

Understand The Power of A Roth IRA (or Backdoor Roth IRA) & HSA

Automate Whenever Possible

Get Familiar With Taxes & Write-offs

Stay Informed About Employer Benefits

Purchase Seasonally & With Discount Codes (When Available)

Protect Yourself

Read Books

Seek Expert Advice

TIPS ON MASTERING FINANCIAL LITERACY:

Track Your Income & Expenses: Always have a record of all of the money going in and out of your accounts. Use the tool on your banking account app(s) to confirm your monthly income and expenses. Tools like Mint also are great to track your spending to see where every dollar is going all in one place. Aside from personal use, for small business owners, Quickbooks is my favorite invoicing and expense-tracking option.

Set Financial Goals & Realistic Limitations: Once you know your exact monthly income, budget your essentials, savings, investments, and fun money accordingly. Make sure necessities like rent, food, health insurance, electricity, WiFi, toiletries, etc. are accounted for before anything else. Depending on your financial situation, experts (not me – I try to educate myself as best as I can, but am no expert!) recommend trying to save and invest between 15-30% of your pre-tax income. Give yourself the liberty to spend the rest (say 15-20%) of your income, so you don’t feel deprived and stay on track with your goals.

Invest Higher-Quality Items To Save Later: Initially purchasing a higher-quality item often cuts your overall expenses in a certain area over the long run. (Ex: Well-made clothing, shoes, furniture, kitchen appliances, coffee maker, hair dryer, etc.). If you invest upfront on an item you regularly use, there’s a lower chance that it will deteriorate, rip, break, or otherwise become unusable for the next few years. When you opt for the cheaper option, this practice might save you a few bucks in the short term, but you will probably end up having to replace it a few times over time and spend more in the long run. This tip might seem counterintuitive to some, but it truly does save you a lot of money (and frustration). However, I will place a caveat here and say that this advice comes from a place of privilege. Never purchase something you can’t afford. If you have the means, spend a bit more upfront - it is better for your future wallet, allows you to indulge in a better quality of life, and helps you let go of any scarcity mindset/financial limiting beliefs.

Educate Yourself On The Different Types of Banking & Investment Accounts: Know the differences between and the use purpose of different accounts: Checking, Savings, CDs, 401K, Roth IRA, HSA, etc. Always opt for a high-yield savings account option to help preserve your money’s value over time with rising living costs and inflation.

Establish Credit, But Know Yourself: Your credit score is like your adult report card. It’s essential for so many aspects of life, like renting or buying a home, insurance, cell phone plans, etc., so it’s important to start building your credit as early as you can. However, if you know you’re the type of person to overspend with a credit card, look into secured credit card options (you deposit the money that acts as a credit limit, so it’s like a debit card with credit-building benefits).

Create An Emergency Fund: Pay yourself first. Have between 3-12 months of expenses available in a high-yield savings account at all times. If you have a family or are self-employed, aim for 6-12 months of necessary savings to stay sane. Saving this amount of money takes time. Be patient, and cut back on frivolous expenses if needed for the short term.

Leverage Credit Card Benefits: If you have enough self-control, always use a credit card instead of a debit card – but spend in the same way you would as though the money is coming directly out of your bank account. This gives you additional flight and other purchasing perks, such as cashback and exclusive discounts. Using a credit card provides additional security, too.

Understand The Power of A Roth IRA (or Backdoor Roth IRA, depending on your income) & HSA: Compound interest is your best friend financially. Depending on your income, invest as much as you can into a Roth IRA account or set up a backdoor Roth IRA through your brokerage firm (I use Vanguard!). HSA (Health Saving Accounts) accounts offer so many benefits – they can serve as a tax write-off, lower your overall healthcare costs, and be leveraged to use as an additional retirement investment account, too (I use Fidelity).

Automate Whenever Possible: Automate a portion of your paycheck to savings and your investments, so you never see this money. Pay yourself first before spending (on anything but necessities).

Get Familiar With Taxes & Write-offs: This mainly applies to anyone self-employed or a small business owner (been in the game for 5 years!). However, this point can also potentially be beneficial for students who can leverage an education credit for tax purposes. Explore all of your options to see what write-offs are available in your specific situation. Understand how your income and expenses influence your tax bracket. Investing in a CPA can save you a considerable amount of money and all of your sanity if you’re not a salaried employee. Look over the standardized section C document, and speak with a professional to help maximize your write-off potential (legally and honestly, of course). My CPA is my lifeline!

Stay Informed About Employer Benefits: Always maximize your 401K match (whatever percentage that is at your company), any wellness perks (like a gym membership or massage credit), or any meals and car services credits for late nights/work trips.

Purchase Seasonally & With Discount Codes (When Available): Try to purchase items off-season when you can (e.g. purchase classic winter closet staples in the summer when they’re on sale). Utilize plug-ins like Honey or Cently on your browser to have discount codes for any site readily available.

Protect Yourself: Stay on top of fraud alerts. Freeze your credit bureau accounts if necessary.

Read Books: Educate yourself on saving, investing, budgeting, building a business, etc. See the ‘Finance’ section of my Femme Fatale Booklist for some recommendations. I also love Graham Stephan’s Youtube channel – his videos are highly useful and practical for beginners in this life arena!

Seek Expert Advice: Use licensed professionals (CPAs, brokerage firms, your bank, etc.) as a resource, too, for your personal goals.

This is a lot to take in, so try to implement one action item (or a few) at a time, so you can work towards your goals without getting overwhelmed. Also, for reference, I’m in the United States, so all of these tips are focused on how the system works in my country - if you know of any international equivalents, feel free to drop them in the comments to guide others.

Hope this helps xx

#life advice#finance#adulting#femme fatale#dark femininity#dark feminine energy#it girl#hypergamy#high value woman#divine feminine#high value mindset#hypergamous#the feminine urge#success mindset#productivity#spending habits#entreprenuership#level up#self improvement#ideal self#female power#female excellence#personal growth#investing#girl advice#that girl#femmefatalevibe

1K notes

·

View notes

Text

Transform Your Finances: The Power of E-Accounting in the Digital Age

Introduction

In the ever-evolving landscape of financial management, businesses and individuals alike are continuously seeking more efficient, accurate, and convenient ways to handle their finances. With the advent of technology, particularly e-accounting, the possibilities for transforming how we manage our finances have expanded exponentially. In this blog post, we'll delve into the realm of e-accounting and explore how it revolutionizes financial management, offering real-time financial reporting and automated financial management solutions.

The Rise of E-Accounting

Gone are the days of traditional pen-and-paper bookkeeping or cumbersome spreadsheets. E-accounting, also known as online accounting or electronic accounting, leverages digital technology to streamline financial processes. It encompasses a range of software and platforms designed to automate tasks such as invoicing, expense tracking, payroll, and reporting.

Real-Time Financial Reporting

One of the most significant advantages of e-accounting is the ability to generate real-time financial reports. Unlike traditional accounting methods that require manual entry and reconciliation, e-accounting systems automatically update financial data as transactions occur. This means that businesses can access up-to-the-minute insights into their financial health, enabling better decision-making and strategic planning.

financial reporting provides stakeholders with a clear and accurate view of key metrics such as revenue, expenses, cash flow, and profitability. Whether it's monitoring sales performance, tracking expenses against budgets, or forecasting future growth, real-time reporting empowers businesses to stay agile and responsive in dynamic market conditions.

Automated Financial Management

Another compelling feature of e-accounting is automated financial management. With tasks such as invoice generation, bill payment, and payroll processing automated, businesses can save valuable time and resources. Automation reduces the risk of human error, ensures compliance with regulatory requirements, and improves overall efficiency.

Automated financial management also promotes better cash flow management. By streamlining invoicing and payment processes, businesses can accelerate the cash conversion cycle, optimizing working capital and liquidity. Moreover, automated alerts and notifications help businesses stay on top of overdue payments, minimizing the risk of late fees and disruptions to cash flow.

Harnessing the Power of E-Accounting

Embracing e-accounting isn't just about adopting new software—it's about embracing a mindset shift towards leveraging technology to drive financial success. Here are some key steps to harness the power of e-accounting effectively:

Evaluate Your Needs: Assess your current financial processes and identify areas where e-accounting solutions can add value. Whether it's simplifying invoicing, improving expense management, or enhancing reporting capabilities, prioritize solutions that address your specific requirements.

Choose the Right Software: With a plethora of e-accounting software available in the market, it's essential to select a solution that aligns with your business goals, scalability, and budget. Look for features such as real-time reporting, automation capabilities, user-friendly interface, and integration with other business systems.

Invest in Training: Implementing e-accounting software requires proper training for your team to maximize its benefits. Provide comprehensive training sessions to ensure that employees understand how to use the software effectively and efficiently.

Monitor Performance: Regularly monitor key performance indicators (KPIs) and metrics derived from your e-accounting system to track progress towards your financial goals. Use insights from real-time reporting to make data-driven decisions and adjust strategies as needed.

Stay Updated: The field of e-accounting is constantly evolving with new technologies and features being introduced regularly. Stay informed about industry trends and updates to ensure that your financial management processes remain optimized.

Conclusion

In today's fast-paced digital age, the power of e-accounting cannot be overstated. From real-time financial reporting to automated financial management, e-accounting solutions offer a plethora of benefits for businesses seeking to transform their finances. By embracing technology and adopting e-accounting practices, businesses can streamline processes, gain actionable insights, and drive sustainable growth in the digital era.

Suggested Blogs:

Financial e-Accounting Free tutorial

Excel data import techniques

Small business accounting

0 notes

Text

Russian disinformation campaigns aimed at undermining support for Ukraine in Europe have grown significantly in scope, skill, and stealth, reports the Financial Times.

Ralf Beste, head of the German Federal Foreign Office's culture and communication department, informed reporters that the Russian Federation is now combining greater sophistication and believability in its messages with automation to make information attacks more effective and harder to combat. Beste notes that "there's probably a lot going on that we don't even see."

"More and more conversations are taking place in private Telegram and WhatsApp channels. It is very difficult to understand what is happening there," the official says.

He added that in Germany, for example, the Russians target sensitive issues concerning the local population (such as the expansion of aid to Ukraine, the cessation of Russian gas supplies, doubts about further support from the United States within NATO, economic growth, etc.) and attempt to spread manipulative narratives on these topics.

This year, Beste's department uncovered one of the largest attempts to manipulate German public opinion on the X social network.

A network of over 50,000 fake accounts, posting up to 200,000 posts a day, sought to convince Germans that government aid to Ukraine undermined German prosperity and posed a threat of nuclear war. The network attempted to "launder" such statements by presenting them as if they had been published by Der Spiegel and Süddeutsche Zeitung.

Last week, the Czech government, in collaboration with other European states, exposed a network linked to oligarch Viktor Medvedchuk, which also disseminated pro-Russian and anti-Ukrainian narratives in Europe.

https://t.me/United24media/20328

24 notes

·

View notes