#digital account opening

Text

Features to look for when opening a digital savings account

It can be tricky to open a bank account for savings because many banks offer similar interest rates and features. Since most people use savings bank accounts for simple financial operations, most don't offer much more than essential banking services. It is the account that receives your monthly wage and is used to make regular payments for the majority of you.

But what happens if you want to open a digital savings account? It should provide a lot more benefits than a standard savings account. So, in this article, you can read about the benefits of a digital account opening compared to a regular savings account.

Easy to open and operate

Documentation and in-person trips to the bank are usually required when creating a savings bank account. The procedure can be laborious because you need to fill out paper paperwork and submit copies of your identity documents. Here's where an online savings account comes in handy.

Opening a modern digital savings account is simple when you make use of techniques like video-KYC and e-verification of electronic papers. If you have a smartphone and good internet access, opening an online savings account is very simple.

Quick activation of linked services

A digital savings account has significantly shorter service activation times than a traditional savings account. You don't have to wait to get a lot of features because you can do everything online.

Beyond purchases, the virtual debit card in a digital account app offers additional features. Furthermore, it enables you to promptly initiate Internet and mobile banking as soon as you receive the card. This means that as soon as you finish the account application, you can begin using more than 250 financial services.

Access to a wide range of digital services

A digital savings account should offer all of the banking services you need, be conveniently accessible from anywhere else, and be simple to set up and quickly activate.

You should be able to transfer money, pay bills, create statements, and more through services like Internet and mobile banking. Your personal finance needs should also be accessible through a single portal. This covers long-term savings, investments, and much more.

Added benefits and offers

Doing daily transactions isn't the only thing a modern digital savings account should be used for. Along with providing transaction benefits and reward points, it should compensate you for your usage. You should also be able to readily access all of the information whenever and whenever you want it.

For example, several banks offer you a variety of offers on the virtual debit card you receive right away after activating your digital savings account. They also offer cashback for online purchases for making specific purchases at a specific time. This feature in credit cards helps you enjoy offers while increasing your credit score.

Final thoughts

It could be time to switch to a new digital बचत खाता if your current savings account doesn't meet all of the requirements listed above. Not only is opening a digital savings account quick and easy, but it also moves you one step closer to the banking of the future.

#digital account opening app#online digital account opening#digital account opening#instant account opening bank#बचत खाता#bank khata kholna#best banking app#online bank account opening app#open bank account online app#bank online account#open online bank account

0 notes

Text

Best ways to get more returns from online savings accounts

For most people, a savings account is the first bank account they open. And in most banks, you can do certain things to yield a higher interest for the money you put into your savings account. Normally, savings money will yield different interest rates depending on the bank. But when you have an online open saving account, you get returns in a number of other ways. Even today, not many people can make full use of a savings account because they don’t know how to use one. So, here are some suggestions that help you earn higher returns from your savings account.

Choose an account with a high-interest rate.

The best method to get the most out of your savings account is to open one with a bank that gives more appealing interest rates. After all, you will always receive greater profits if the interest rate is higher.

Before selecting the best bank, compare savings rates online. You can enhance the interest you receive on the money you have saved over time by even a small rise in the savings account interest rate.

Make use of the rewards offered on bank debit cards

You can earn good if you have a savings account that is also linked to a debit card. Well-known banks provide debit cardholders with a profusion of incentives, bonuses, and other privileges.

For example, when you purchase items from co-brands or shop online, you might be able to take advantage of discounts. When you online open saving account, certain bank debit cards even offer free insurance coverage. So, over time, you will be able to save a huge sum of money with the help of all these perks and rewards.

Set saving goals

One of the main reasons most people find it difficult to reach their financial goals of saving money is a lack of discipline. So, how can someone develop the self-control to save money? Decide how much money you want to save and how long you want to save it for.

Do not forget to create short-term savings goals that are reasonable and should be neither extremely difficult nor extremely easy to attain. This also holds true for long-term money savings goals. This is because a goal that is too simple will encourage you to procrastinate, but a goal that is too hard will deter you from continuing.

Try to open two or more savings accounts.

Creating two or more savings accounts will enable you to handle your money more simply and to benefit from additional advantages. This is due to the possibility that managing just one savings account can make it difficult for you to prevent money from being wasted.

The majority of people have connected their primary savings accounts to their online wallets and use online payment apps to pay different expenses. So, it's beneficial to have a second savings account that you use to deposit any money that you don't end up spending each month.

Final thoughts

So, if you are ready, use your bank’s mobile banking app and online open saving bank account to enjoy the benefits of an online savings account and mobile banking.

#0 account opening bank#account online opening#bank online application#bank saving account open#digital account opening#digital savings account#free online bank account#instant account#instant saving account#instant account opening#online account opening#online bank accounts opening#online bank opening account#online banking account open

0 notes

Text

Top reasons to open a business bank account

Opening a business account can facilitate automated bookkeeping and help build your company's credit history. As a small business owner, you frequently deal with daily difficulties about the profits and expansion of your company. Opening a small business bank account is an essential step for any entrepreneur who wants to efficiently manage, control, and increase the revenue of their enterprise. Pay attention to more urgent and higher-priority problems by controlling your business' funds with a safe business checking or savings account. If you want to open a savings account, the first step is to apply for savings account. Stay here to know about the reasons to open a business bank account:

Make tax preparation easier

Your tax preparation can be automated with a bank account. Since you or your accountant may integrate the transactions in your company bank account with tax preparation software, it is considerably simpler if all of your business revenue and spending go via your bank account. This can save you numerous hours and heartache when attempting to sort through your finances at tax time, whether you hire a tax preparer or do it yourself.

You won't have to try to determine which expenses are personal and which can be attributed to your firm if you have a business bank account. As a result, taking deductions during tax season is almost enjoyable. You will have a clear audit trail if you or your company is ever under IRS examination, which lowers the risk of serious trouble.

Show the world you are a professional

Opening a business bank account helps show the public that you are a serious and capable business owner by allowing you to use a business account check to pay for supplies or services. When you conduct business using a business account, potential customers may feel more confident that your business is serious and not just a hobby. Managing your company's money effectively can assist in building credibility for your brand. When applying for savings account, you must complete a few procedures and submit some documents.

Build business credit

It is quite challenging to establish corporate credit through a personal account. You can manage expenses, payments, and invoices effectively if you have a separate company bank account. Your business credit score will be improved if you make payments on time, and it will be much simpler for you to maintain organization if personal money is not clogging your statements. Your business credit will be important when trying to get a loan or bargain a better deal with a vendor.

Protection of personal assets

To secure your assets, opening a company bank account is essential. Your assets could be at risk if you combine your personal and corporate funds. Unfortunately, businesses can suffer, incur legal issues, or fail in tough economic times without the owner's fault. As a business owner, you should not endanger your financial stability by pursuing your aspirations and passions. If something goes wrong with your business, you may protect your assets by separating your business and personal money.

Final thoughts

From the above-detailed information, you know about the reasons to open a business bank account. If you apply for savings account online, you can complete all your producers with your phone easily. A business bank account might help you organize your finances and save time on paying taxes and bookkeeping.

#bank open account online#bank saving account open#create online bank account#digital account opening

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Digital Savings account or an 811 digital bank account by visiting your nearest branch.

#digital savings account#online digital account opening#online digital bank account opening#digital account opening#digital banking india#digital banking#digital account

0 notes

Text

Guide to Save Money Using Credit Card

You know what? You will get an attractive rewards for using a credit card for money transactions. You are rewarded when you shop, make any utilities bill payment, or when you pay your bills with the card. Before using a credit card you need to know budgeting and smart spending to avoid the dangers of getting into debt or paying interest. In this post, you will learn how one should use a credit card to make money:

Choosing the right credit card

Choosing the right credit card is the initial step to save money. There are various types of credit cards available in the market. It is essential to select your card according to your spending patterns, such as lifestyle, shopping, travel, and premium credit cards. A lifestyle-based credit card will offer enhanced advantages in entertainment, dining, etc. Shopping-related credit cards offer benefits for shopping in both offline and online. You can enjoy complimentary lounge access, flyer miles, and privileges on hotel accommodations using travel oriented credit cards. A premium credit card provides excellent benefits for HNIs. Choose your credit card after evaluating your transactions.

Skip car rental insurance

The rental price can increase if you opt for a car rental agency’s insurance coverage. The extra insurance may be unnecessary if you are using a credit card. Instead, pay your rental payment using your credit card. This way, you will save a lot of money. Always read the terms and conditions to make sure the zero gaps in your car rental coverage.

Use welcome bonus

Many credit card issuers offer a welcome bonus in the form of additional reward points, coupons, gift vouchers, etc. You can utilize these bonuses to save money from spending on purchases. During the first year of purchasing the card you need to spend the specified amount that is mentioned in the instruction of credit cards.

Accumulate reward points as you spend

Already you know that credit card rewards exist. If not, how do you think that banks encourage you to have credit cards in the first place? The credit card apply app differs based on the type of credit card you use. You will quickly accumulate the reward points depending on the type of your credit card. You can check your reward points at the end of your monthly or yearly cycle.

Pay credit card bills on time

Yes, credit cards have high benefits, but they can be enjoyed only when you pay the interest charges within the due time. A credit card follows a billing cycle to generate the bills. A due date is mentioned to pay your credit card bills. When you pay your bills on time, you are safe from penalties. If you fail to pay the amount within the time, you may have to pay the interest amount based on the balance amount.

Bottom Line

Credit cards are considered as a great lifestyle enhancer, but it is essential to understand and to know how to use them wisely. In this way, you will get rewarded for the shopping or purchases. Use the credit card apply app for tracking the due time to pay your bills. So, make sure to use your credit card wisely and improve your savings.

#digital account#credit card apply app#mobile banking app indian bank#digital account opening#fast mobile banking#easy net banking app

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#0 bank account opening#apply for savings account#best online account opening#digital account opening#digital instant savings account#mobile banking account open

0 notes

Text

Is Instant Bank Account Opening Online very safe

The current age of online banking is what everyone is making noise about. With the high level of security in place with online banking platforms these days, it is not surprising that people choose to bank online more. You can decide to Open New Bank Account Online based on what works for you. Most people have benefited from these online accounts by linking them to their businesses. With these linking done, it seems everything is working accordingly. Benefiting from this world will definitely help you in pushing your business to the next level as you wish for it to be.

Visit your bank account from home

The PC at home, cybercafe, or work where transactions can be done. However, for your own safety restrict using devices that you alone have access to. If you do not do this, you will end up having to deal with breaches into your computer. This is because hackers who access those public computers will be able to access your account and that doesn’t help at all. When you do not consider these security precautions, it can become a problem. That is why you need to be very careful with the decisions you make. In choosing to move with an Instant Bank Account Opening Online, have this move made to ensure every decision is made to suit you. Even when you are at home, you can access your bank account from home. That is a good thing.

Your safety can be trusted

Ensure your computer is well secured. If you have an antivirus software installed onto your device, it helps to keep your device safe all round. Also, you need to ensure the internet connection you have is safe and strong. Online banks decide to take these things very seriously these days. They do not want to be in trouble with their customers. Also, they do not want to mess up their brand. That is why they do their best to keep their servers and apps safe. Naturally, online transactions can be trusted where safety is concerned. Deciding to Open New Bank Account Online via the wrong locations is what leads to problems. If you do not want to have issues of hacking into your account, you need to preserve your info and remain safe all the time. Some fraudsters try to create fake websites that are just like online banks. So, when you decide to link up with them or access them, they end up having access to your system which is bad.

Movement of money with extreme convenience

Choosing to have money moved or transferred from your online bank account to other accounts is simple. Since everything is done online, you do not lose a thing. Remember, when you decide to Open New Bank Account Online, you get to have that unique experience that counts and this is a great move. You can be lying down in your bed and be browsing through your financial statements. So, you get to know the right information about your finances without any form of pressure. One of the reasons people like to link these accounts to their businesses is due to their easy accessibility and their unique features that helps to move online businesses to the fore.

Conclusion

Deciding to go through with an Instant Bank Account Opening Online will keep you happy and fulfilled. Getting to know how these instant banking processes work is how to benefit from them. So, be ready to delve in.

#kotak811#kotak#Mobile App#Payment Bank#Upi Bank App#Money Transfer#E Banking#Digital Account Opening#Digital India Banking App#Digital Account App#Upi App Download#Net Banking App#Digital Account

1 note

·

View note

Text

Commission for @oneordinaryautumn (´▽ʃƪ)♡

#ekurea#anime commission#art#commissions open#art commissions#twisted wonderland#twisted oc#riddle rosehearts#twst wonderland#disney twst#twst oc#twst x reader#twst fanart#twisted love#twisted series#welcome to my twisted mind#twst#twst riddle#fan art#multifandom account#multifandom artist#multi fandom blog#drawing commisions#tumblr draw#drawingpeople#drawings#digital art#oc art#artoftheday#self ship community

306 notes

·

View notes

Text

welcome back

#oh cool a ragatha ask blog with lore i sure do hope when i open the account its last five posts doesn't punch me in the face#the amazing digital circus#tadc#ragatha tadc#tadc ragatha#ragatha#tadc jax#[ asks ]#don't tag as ship

521 notes

·

View notes

Text

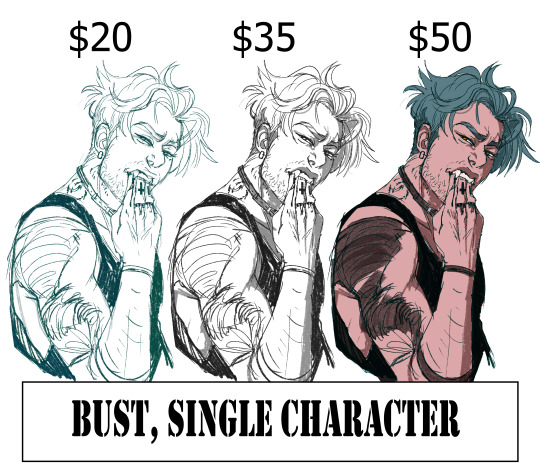

I'm opening commissions!

10 slots!!!

Bust shots - $100 USD per character

Half Body - $125 per character

Full Body - $150 per character

Simple BG included!

Examples of my art:

I also do Digital paintings, Animations, Comic pages, and Character design!

If you're interested, you can inquire for a quote

Feel free to DM me or email me at [email protected] with inquiries!

Thank you!

#commissions open#digital art#open commissions#art commissions#comms open#commission art#commissions#artists on tumblr#I'm so so so so so so so so SOOOO bad at making commission sheets..#BUT#it doesnt change. that my comms are open!!!#wahou#I need money LOL my poor bank account#taxes took like fucking 4k out my account and I havent been working so#grimace emoji#didnt think they would be that much#anyways#I'm also.#I have WAY too many things as options...#like.augh#I'm not specialized enough#cause my degree and work is basically 'doing anything'#like my job is to do the whole production pipeline myself#so if you wanna pay me to do any part of it I can do it all

190 notes

·

View notes

Text

online banking account open app

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#new savings account#neft bank transfer#credit card apply app#upi payment app#safe mobile banking#net banking#saving account opening#digital account opening

0 notes

Text

#kirby#swearing#sleepy-princess-craftery#daily kirby#my art#digital#hal laboratory#nintendo#that's the logo for my craft accounts :)#(@sleepy-princess-craftery here on tumblr)#finally opening my etsy store tomorrow#4 months later than intended.............#(I was Very Sick)#favorites

104 notes

·

View notes

Text

#art#illustration#drawing#painting#sketch#mypost#small art account#small art blog#small artist#digitalart#digital drawing#digital painting#digital art#trippy#trippy art#bunny rabbit#bunny#bunnies#rabbit#hare#watership down#El-ahrairah#el ahrairah#bunblr#bunny art#rabbit art#fanart#watership down art#comission#comissions open

76 notes

·

View notes

Text

Please do me a favor and cycle this around. I am a fulltime artist and it really helps me out. Thanks so much!

** NOW WITH A SIMPLE GOOGLE FORM or if you prefer: feel free to DM me with questions!!! **

My terms (Please read before commissioning)

Additional Characters:

Sketch $15, Lined $30, Rendered $50

Backgrounds:

*Varies based on the amount of detail required*

Simple $50-75, Complex $75-150

#commission work#art commissions#commission art#commissions#commission#digital artist#artist on tumblr#artist support#small art account#original art#art commissions open#commissions open#doods

97 notes

·

View notes

Text

#art#digital art#gaara fanart#sabaku no gaara#gaara#gaara of the desert#gaara of the sand#small artist#small art account#commissions open

124 notes

·

View notes

Photo

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

If you are an existing Kotak customer, you can use the 250+ features of the app to Bank, Pay bills, Invest, Shop and access services.

One of our recent additions to the 250+ features is our new Pay Your Contact feature, where you can now send money to anyone using just their mobile Number

• Bank on the go:

Manage all your financial transactions, send and receive money through NEFT, IMPS and RTGS & UPI, request for a cheque book and much more

• Shop at your fingertips:

Dive into KayMall and shop via Flipkart, Amazon, Bigbasket, book flights and hotel rooms via Goibibo and book train tickets (IRCTC Authorized Partner) and much more

• Pay your bills:

Pay your Mobile Recharge, DTH payments and other bills with the online BillPay feature. Also, use the AutoPay feature to remember your monthly bills and pay them automatically from your account. Never miss a deadline again

#kotak811#Bank Online Account#Zero Balance Account#Money Transfer#Online Banking#Account Opening Online#Online Open Saving Account#E Banking#Bank Account Online#Bank Account Check#Digital Account Opening#Online Savings Account#Open Savings Account

1 note

·

View note