#free online bank account

Text

Things to learn regarding zero balance account opening with debit card access:

Zero balance accounts have become popular in today's banking environment as easily accessible options that provide financial inclusion to a larger group of people. These accounts have no minimum balance requirements, which makes them appealing choices for people who want banking services without having to keep a certain amount on hand. Debit cards further improve the usefulness of these accounts by facilitating simple access to money and a host of banking functions. This is a thorough post that will walk you through opening a debit card-accessible account with zero balance savings account online:

Look into your banking options:

Find out which banks offer debit card access and zero balance accounts. Compare the fees they charge for services, the features available for online banking, the availability of physical branches and ATMs, and any other benefits or rewards they may provide. Keep things like savings interest rates, transaction costs, and account management simplicity in mind. To guarantee a smooth financial experience with your debit card and zero balance account, look for companies recognized for their dependable customer support and user-friendly online banking systems.

Have the required documents:

Required documents include gathering valid identity, address evidence, and income-related documentation. Bring official identification, such as a passport, PAN card, or Aadhar card, to prove your identity. You should also have supporting documentation attesting to your address, including utility bills or rental agreements. Get income tax returns (ITR) or salary slips to document your income.

Choose The Account Type:

Once you have these documents together, evaluate each bank's account kinds. Consider straightforward savings accounts or more specialized choices based on your needs, including salary or student accounts. Consider account features that correspond with your financial objectives, such as interest rates, overdraft capabilities, and other benefits. Knowing the many account kinds makes it easier to choose the one that best meets your banking needs and provides the features and perks you want for your financial goals.

Application for Debit Cards

Apply for a debit card connected to the account after opening the zero balance account online. Fill out the bank's debit card application form, including all relevant documentation and personal information. Apply in person at the bank branch or online via the bank's mobile application or website. Following processing, the debit card will be issued by the bank. You may then activate it and use it for various purchases and transactions, taking advantage of the convenient cashless transactions and simple money access that comes with using a debit card.

Turn on and Utilize the Debit Card

Once you receive the debit card, activate it by following the steps provided by the bank, which usually require activating the card via an ATM or phone call. Establish a security PIN (personal identification number). Once activated, use the card for POS, contactless payments, internet purchases, and ATM withdrawals. Learn about the rules of overseas usage, spending caps, and security features. Look for any strange behavior with the card, and immediately notify the bank.

Wrapping It Up:

The above points give you crystal clear insights regarding zero balance account opening online with debit card. People can obtain necessary financial services and efficiently manage their finances by knowing the process and taking advantage of the available features.

#account online opening#application for joint account#bachat khata#bank account#bank account online#bank account open online#bank online account open#bank online account opening#bank open account online#bank saving account open#cibil score#create bank account online#credit card#digital bank app#free online bank account#internet banking

0 notes

Text

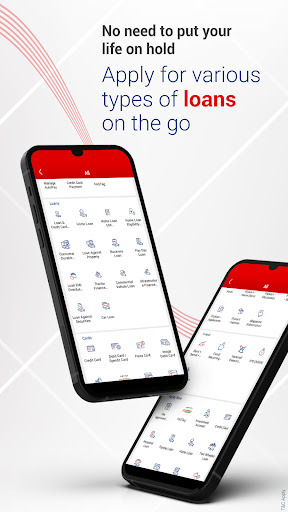

Kotak Mahindra Bank’s official mobile banking app for Android phones.

#best mobile banking app#banking app#mobile banking apps in india#free online bank account#account opening form online

1 note

·

View note

Text

If you sign up we both get $100!

Any of you looking for a free online bank account?

Let me refer you to my son's referral, affiliate link!

This is a completely free Debit card with no Monthly fees, or any other types of out if the ordinary Debit Card fees, that will give both you and me each $100, if you use my referral link to sign up for a free Chime Debit Card. It can be used like an online checking account too, and you can use it to get money through PayPal, or to get money when you sell items on eBay for example, and there are no fees. Thanks for checking it out.

https://www.chime.com/r/justinbryson15/?fbclid=IwAR1N5sp3XWqQsUoIS0rTusK574pSCKemEe-OV5pU5DVjNi49DYfrvqxWW_4

0 notes

Text

Help myself and you get $100

Sign up for a free online bank account via my affiliate referral link and we both get $100! Read below!

This is a completely free Debit card with no Monthly fees, or any other types of out if the ordinary Debit Card fees, that will give both you and me each $100, if you use my referral link to sign up for a free Chime Debit Card. It can be used like an online checking account too, and you can use it to get money through PayPal, or to get money when you sell items on eBay for example, and there are no fees. Thanks for checking it out.

This is a completely free Debit card with no Monthly fees, or any other types of out if the ordinary Debit Card fees, that will give both you and me each $100, if you use my referral link to sign up for a free Chime Debit Card. It can be used like an online checking account too, and you can use it to get money through PayPal, or to get money when you sell items on eBay for example, and there are no fees. Thanks for checking it out.

#online bank account#make $100#get rewarded#get reward#free online bank account#chime#online banking#online bank

1 note

·

View note

Note

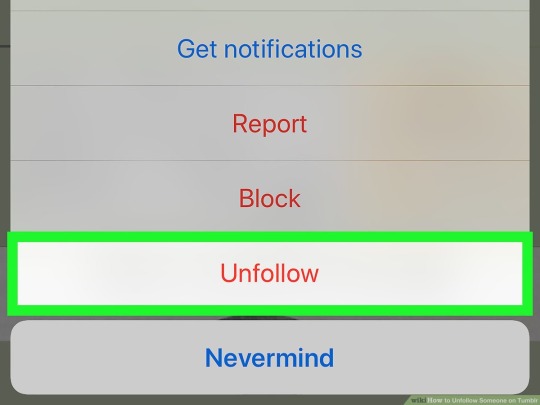

youre posts are so annoying can’t wait for you to get onto the next clout chasing fandom to shit their tags up with youre mediocre writing

hello anon, let me show you something

you see the unfollow button? there for a reason. see the block one? same!

#nat.txt#negative cw#discourse cw#Curate Your Experience Online: it’s free!!!#anon got me. i actually have no interest in genshin I’m clout chasing nobody look at my bank account or hours played

46 notes

·

View notes

Text

How to Choose the Best Free Online Bank

Online banking practices have made financial transactions more easier and secure than before. Considering that the majority of banks and other financial organizations now offer online banking, you may be asking how to find a reliable, cost-free option. Prior to settling on a bank, there are a number of considerations you should make; in this article, we'll go over a few of those. With this info, you will be able to create bank account online free and improve your financial position.

Hidden Charges: Some online bank accounts are “free” in name only and will be straddled with hidden charges like monthly maintenance fee. Such platforms are a red flag and you should do a thorough research before starting an account with any platform. Online banks also use misinformation tactics to get users to start a bank account. You have to be wary of such practices when making the decision to open a free online bank account.

Free ATM Service: Make sure you pick an online bank that lets you use ATMs for free. Some banks make you pay every time you use their machines. It would be ideal to avoid banks that charge you for using ATM services.

FDIC Insurance: FDIC insured banks are the real gold standard. Your money will be safe even if the bank fails. So always choose online banks that are insured by FDIC. This additional security will give you peace of mind.

A Strong Online Platform: The ease of use is the greatest advantage of online banks. This highlights the critical nature of user-friendly and reliable digital banking systems. You should also consider a bank's mobile app for easy account checking and payment processing while making your selection. You can compare the mobile banking apps of different platforms through simple search engine research.

Customer Service: Issues are bound to surface while using online banking services and you should always select a platform with excellent customer service. Since monetary transactions can become complicated from time to time, you should be able to depend on your service provider to resolve issues fast. You don’t want a service provider who does not offer 24/7 customer service.

Other Features: Today we have online banks that offer different services to clients. The option to integrate with investment platforms and money management tools is one of them. This feature will be extremely helpful to manage your finances in a more systematic manner. You will be able to access your spending data and make better decisions to save money with advanced features.

Conclusion:

In this day and age, having an online bank account is certainly a necessity. But when choosing one you have to be careful and study the services provided by a platform in detail. You can never be too careful while making decisions that will affect your financial security. Always ensure that there are no hidden fees, digital banking services are excellent and look for new features that will allow you to develop a holistic money management system when selecting a free online banking platform.

0 notes

Text

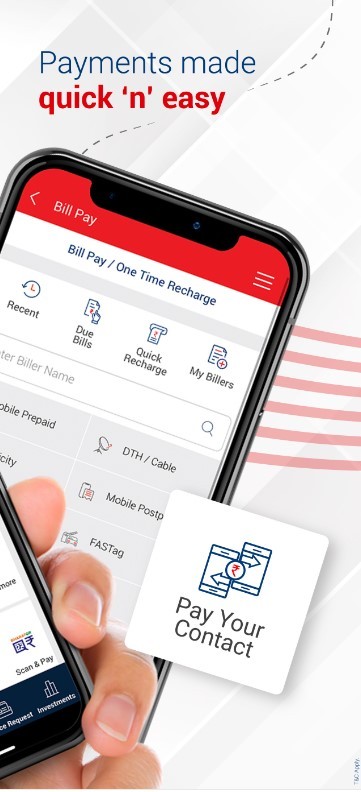

Kotak Mobile Banking app for iPhone

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://apps.apple.com/in/app/kotak-mobile-banking-app/id622363400

#online banking account opening#bank new account opening online#account opening online#create bank account online#apply for bank account online#free bank account opening online#apply online account opening#new bank account open app

1 note

·

View note

Text

Latest technologies used in the banking sector

Gaining a thorough understanding of operations can help you perform better. Technology integration in banking has shown a whole new range of capabilities. The global financial services ecosystem is changing quickly due to technological advancements. A thorough understanding of operations can help you perform better, as technology integration in banking has revealed a whole new spectrum of capabilities. Due to technological advancements today, many people apply online bank accounts and enjoy doing banking on their phones. Here you can see about technologies used in the banking sector:

Wearable technology

Imagine your bank is with you with just a simple gesture or touch. Wearable technology makes it conceivable now but a few years ago, it might not have been. By collecting data via technologies like sensors on smartwatches, fitness trackers, communication devices, and more, wearable technology is designed to give you an immersive experience. To assist in identifying users and prevent fraudulent transactions, these digital gadgets save consumers' payments and other crucial information. Customers can gain insights by interacting with other applications, too. Data is gathered and analyzed with the aid of servers, analytics engines, and decision support tools to assist businesses in making best choices for enhancing customer experiences.

Hyper-personalized banking

Personalized banking experiences increase customer loyalty. For this reason, banks today use a variety of tactics and tools, like omnichannel banking, purchase now pay later, and financial advice tools, to customize their products. For instance, omnichannel banking enables customers to communicate with banks through various channels while offering a uniform, customer-centric picture of their financial information. Personalized advice and investment guidelines are also provided through wealth management and financial advising tools, increasing investor and client satisfaction.

Banking of things

The banking sector is using IoT to collect data effectively. This automates data collecting for expediting banking procedures, including KYC and loans, to provide real-time event response. For instance, IoT-enabled smart, automated teller machines transmit alerts when there is insufficient cash or something wrong, ensuring prompt maintenance. Additionally, customers can make purchases using IoT-enabled digital wallets incorporated into their smartphones and wearables. Due to the real-time delivery of customer-specific data through linked devices, IoT in banking facilitates fraud detection, which reduces loss. Due to the advent of technology, many people fill out bank account online application and open digital bank accounts.

Artificial intelligence

The greater usage of artificial intelligence in banking is another one of the major banking technology trends that may be anticipated in 2023. Banks can lower financial crime risk and increase fraud detection with this technology. For instance, banking software and applications can use machine learning to monitor real-time transaction data and automatically send notifications or halt transactions if suspicious behavior is found. AI can also aid in the banking industry's process optimization. By cutting expenses and improving the effectiveness of their operations, banks can save time and resources by automating activities. Banks and other financial institutions can use AI to improve customer service and make more accurate choices.

Parting words Hopefully, you will learn about the technologies used in the banking sector. A fast-growing field, banking technology has a wealth of prospects for the financial industry. This technology development stimulates many people to open digital accounts by completing the bank account online application form.

#apply for bank account online#free bank account opening online#mobile banking app#online banking app#best mobile banking app

0 notes

Text

Open a zero balance savings account online in a few simple steps!

Welcome To Your Online Zero Balance Savings Account From Kotak!

Get an instant online bank account number & CRN (Customer Registration Number) so you can start banking immediately on the Kotak 811 app.

#account online opening#account opening#free bank account opening online#new bank account opening online#online account open#online bank accounts opening

1 note

·

View note

Text

Kotak Mobile Banking App

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank account opening app#apply online bank account#bank new account opening online#apply for bank account online#free bank account opening online#online banking app#mobile banking apps#online new account open

0 notes

Text

You get $100 and I get $100! I'll tell you how, read below! Thanks!

Anybody looking for an online bank account? I'm helping my son Justin promote his affiliate link for this to help our household meet living expenses.

Justin says "This is a completely free Debit card with no Monthly fees, or any other types of out of the ordinary Debit Card fees, that will give both you and me each $100, if you use my referral affiliate link to sign up for a free Chime Debit Card. It can be used like an online checking account too, and you can use it to get money through PayPal, or to get money when you sell items on eBay for example, and there are no fees. Thanks for checking it out.

Signing up takes only 2 minutes!"

1 note

·

View note

Text

OCBC Online Equities Account Review - Buy shares from OCBC's Digital Banking App! 0.05% commissions for SG, US and HK Markets!

Good news for OCBC customers!

You can now buy shares directly with your OCBC Digital Banking App via OCBC’s Online Equities Account (OEA).

This means you can bank and trade all on one app, so you don’t need to go through the hassle of accessing different accounts or apps.

Even better? You can fund your trades directly from your OCBC account, which is especially useful if you have a lot of foreign…

View On WordPress

#financial horse#financial horse blog#free amazon stock 2023#Investments#ocbc amazon stock promo 2023#ocbc app 2023#ocbc app review 2023#ocbc banking app 2023#ocbc banking review#ocbc online equities account promo#ocbc online equities account review#ocbc promo 2023#ocbc review#ocbc trading 2023#ocbc trading app#ocbc trading platform#ocbc trading stocks 2023#REITs#Singapore Stocks

0 notes

Text

Hate for you to miss out on cash back, join Rakuten w/ my invite & get $30 after you spend $30.

https://www.rakuten.com/r/DALEIG35?eeid=44747

#money#cash#refer and earn#referral#easy money#free cash#free money#make money from home#make money today#accounting#cash back#referral link#referral program#save money#cashback#money in the bank#moneymaking#moneymanagement#earn money online#savemoney#rewards#referral marketing#money back#money bags#cash balance plan#saving money#save more money#savings#online shoppping#shopping

0 notes

Text

im finding this really hard to articulate but it's absolutely infuriating to see the level of government power and pressure that can be applied against "antisemitism" when what "antisemitism" means is 'not approving of how the USA props up israel to further its military objectives in the middle east', while every year since 2015 in america has gotten scarier and more dangerous for the jews who actually live here and are citizens.

like it's been year after year of rising hate crimes, temples bombed and burned, women and men attacked on the streets, harassed online, and our elected officials mouth vague platitudes at hannukah about it. dozens of pundits make serious cash money saying that the holocaust never happened. conspiracy theories about child trafficking and one world bank are now just commonly accepted as fact. and we were told that there wasn't any more that anyone could actually do about any of this. because free speech. because freedom of religion. because everyone has a right to their opinions.

but for israel, for the IDF, suddenly the cops can start making arrests? the same cops that protected proud boys all this time at their rallies are hustling to shut down crowds protesting palestinian genocide. suddenly politicians are getting in real trouble and staffers are getting fired and online there's waves of accounts getting deleted. suddenly antisemitism is driving a whole lot of action!

but none of the machinery of empire was ever used to actually protect jews. none of it was for us at all. america has proved itself deeply and profoundly indifferent to our lives and our voices. the only thing that actually matters here is the material usefulness of israel as a proxy state.

there's your "antisemitism".

3K notes

·

View notes

Text

Tech how-to article written like a recipe. Is that anything? Fuck it.

Old-Fashioned Setting Up a Password Manager

For this project you will need:

One computer

One full-featured browser

One pre-made email account, not shared and logged-in

2-5 possible passwords

5-10 accounts to get started with storing passwords.

Before you begin pre-load your computer, logging in to your email account. You can save later prep time by having your primary social media accounts, banking information, email account, and online bills ready to hand.

Go to bitwarden.com and select "create account"; be sure to select "free account" - you can jazz it up later but we're learning the basics now.

Create the account using your primary email address as the login name and one long (but not complicated!) password that you are certain you can remember but is not widely shared online. This is a great way to use information about your favorite movies or songs, not a great place for your kid's or pet's names.

Set up your password hint with a good reminder; be sure to note any punctuation you added, for instance a comma to separate lines of a song or an exclamation point between words of a movie title.

Verify your email account with the password manager, then set up a new password for your email. You may need a phone or access to your extant 2FA tools for this step. Create a login in the password manager, add your email address, and generate a new password, then save the entry. Go to your email account, select "security" and "change password" - enter your old password to confirm then paste your new password manager generated password into the provided text boxes, and save. Log out of your email account, then log back in with your new password. You will need to do this on all of your devices, so make sure you're using a password manager that is accessible across platforms - Bitwarden is recommended for a reason, this is a place where you don't want to skimp when making substitutions!

Repeat the process of resetting passwords to taste; you don't need to do everything all at once, but it's best to start with a serving of 5-8 to get used to the process.

Time: 30min to 2hr DOE

Expense: Literally Free

Value: Priceless i never have to remember a fucking password again and now neither do you.

4K notes

·

View notes

Text

Choose to benefit from Bank Online Account Open

The joy that comes from opening an online banking account is what you need to expect when you have some decisions made. It is not everyone who is able to have these experiences of excitement. Most people have the thought that only the rich can be able to benefit from online banking is not true. The Bank Online Account Open process is for everyone who is interested in it. It is never for the rich alone. It is for you if you want a way to experience smooth methods of transactions and save money online as well. There are a lot of gains that comes with online savings opening. Despite the fact that with land based banks keep reducing their interest rates, you need to know that there is so much more with online banking.

Be sure the details are right

To ensure you do not forget your password or lose track of your login info, it is never bad to open an online savings account that will work for your benefit. One other main benefit or motive behind having these accounts have to do with being able to control your finances. A lot of people do not know how to benefit from this online gambling world which is wrong. No matter where you find yourself, always decide to tap into the unique benefits of online banking accounts. Deciding to move on to Open Online Bank Account App is definitely one thing that never goes wrong. With countless experiences taking over, you will be able to achieve the true value of what it needs to be as a banking system. Banking systems are designed for your benefit. They should be the safe haven where you can save money, make business progress, and more. With online banking, there are several changes you will love and that should be exciting for you to tap into. The apps used will definitely help you to find true fulfillment and excitement in using these apps.

Decide to take part in exciting banking

Your ability to sign up for or open an online savings account should be all you think about now. Nonetheless, it becomes very difficult if you cannot identify the right platforms and online banks to be a part of. It is clear to know that a lot of people today keep getting involved in Bank Online Account Open process through hasty decision making. That is not right. So, do not join in on that. When you decide to open online banking accounts, you need to think about the end results. Considering the end results is what you need to be interested in. this helps you to know for sure what needs to be done. This will keep you feeling good and focused as well. When you are able to consider all the pros and cons and realize that online banking accounts will work for you, the gains become clearer. That is always good.

Conclusion

You can choose to compare the different Open Online Bank Account App to ensure your every need is met. Also, decide to stick with apps that clearly work for your good. This will make your experience one of the best. There are so many people who regret the use of these apps because they chose the wrong online banking app. So, do your very best to ensure everything is able to work for you through quality research.

#kotak811#kotak#Account Opening Form Online#Instant Bank Account Opening Online#Free Bank Account Opening Online#New Bank Account Open Online#Upi Bank App#Zero Balance Account App#Manage Bank Account Online#Fast Mobile Banking#Online Bank Accounts Opening#Bank Account Open Online

1 note

·

View note