#start a business and make profit on amazon

Text

Amazon’s financial shell game let it create an “impossible” monopoly

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in TUCSON (Mar 9-10), then San Francisco (Mar 13), Anaheim, and more!

For the pro-monopoly crowd that absolutely dominated antitrust law from the Carter administration until 2020, Amazon presents a genuinely puzzling paradox: the company's monopoly power was never supposed to emerge, and if it did, it should have crumbled immediately.

Pro-monopoly economists embody Ely Devons's famous aphorism that "If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’":

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

Rather than using the way the world actually works as their starting point for how to think about it, they build elaborate models out of abstract principles like "rational actors." The resulting mathematical models are so abstractly elegant that it's easy to forget that they're just imaginative exercises, disconnected from reality:

https://pluralistic.net/2023/04/03/all-models-are-wrong/#some-are-useful

These models predicted that it would be impossible for Amazon to attain monopoly power. Even if they became a monopoly – in the sense of dominating sales of various kinds of goods – the company still wouldn't get monopoly power.

For example, if Amazon tried to take over a category by selling goods below cost ("predatory pricing"), then rivals could just wait until the company got tired of losing money and put prices back up, and then those rivals could go back to competing. And if Amazon tried to keep the loss-leader going indefinitely by "cross-subsidizing" the losses with high-margin profits from some other part of its business, rivals could sell those high margin goods at a lower margin, which would lure away Amazon customers and cut the supply lines for the price war it was fighting with its discounted products.

That's what the model predicted, but it's not what happened in the real world. In the real world, Amazon was able use its access to the capital markets to embark on scorched-earth predatory pricing campaigns. When diapers.com refused to sell out to Amazon, the company casually committed $100m to selling diapers below cost. Diapers.com went bust, Amazon bought it for pennies on the dollar and shut it down:

https://www.theverge.com/2019/5/13/18563379/amazon-predatory-pricing-antitrust-law

Investors got the message: don't compete with Amazon. They can remain predatory longer than you can remain solvent.

Now, not everyone shared the antitrust establishment's confidence that Amazon couldn't create a durable monopoly with market power. In 2017, Lina Khan – then a third year law student – published "Amazon's Antitrust Paradox," a landmark paper arguing that Amazon had all the tools it needed to amass monopoly power:

https://www.yalelawjournal.org/note/amazons-antitrust-paradox

Today, Khan is chair of the FTC, and has brought a case against Amazon that builds on some of the theories from that paper. One outcome of that suit is an unprecedented look at Amazon's internal operations. But, as the Institute for Local Self-Reliance's Stacy Mitchell describes in a piece for The Atlantic, key pieces of information have been totally redacted in the court exhibits:

https://www.theatlantic.com/ideas/archive/2024/02/amazon-profits-antitrust-ftc/677580/

The most important missing datum: how much money Amazon makes from each of its lines of business. Amazon's own story is that it basically breaks even on its retail operation, and keeps the whole business afloat with profits from its AWS cloud computing division. This is an important narrative, because if it's true, then Amazon can't be forcing up retail prices, which is the crux of the FTC's case against the company.

Here's what we know for sure about Amazon's retail business. First: merchants can't live without Amazon. The majority of US households have Prime, and 90% of Prime households start their ecommerce searches on Amazon; if they find what they're looking for, they buy it and stop. Thus, merchants who don't sell on Amazon just don't sell. This is called "monopsony power" and it's a lot easier to maintain than monopoly power. For most manufacturers, a 10% overnight drop in sales is a catastrophe, so a retailer that commands even a 10% market-share can extract huge concessions from its suppliers. Amazon's share of most categories of goods is a lot higher than 10%!

What kind of monopsony power does Amazon wield? Well, for one thing, it is able to levy a huge tax on its sellers. Add up all the junk-fees Amazon charges its platform sellers and it comes out to 45-51%:

https://pluralistic.net/2023/04/25/greedflation/#commissar-bezos

Competitive businesses just don't have 45% margins! No one can afford to kick that much back to Amazon. What is a merchant to do? Sell on Amazon and you lose money on every sale. Don't sell on Amazon and you don't get any business.

The only answer: raise prices on Amazon. After all, Prime customers – the majority of Amazon's retail business – don't shop for competitive prices. If Amazon wants a 45% vig, you can raise your Amazon prices by a third and just about break even.

But Amazon is wise to that: they have a "most favored nation" rule that punishes suppliers who sell goods more cheaply in rival stores, or even on their own site. The punishments vary, from banishing your products to page ten million of search-results to simply kicking you off the platform. With publishers, Amazon reserves the right to lower the prices they set when listing their books, to match the lowest price on the web, and paying publishers less for each sale.

That means that suppliers who sell on Amazon (which is anyone who wants to stay in business) have to dramatically hike their prices on Amazon, and when they do, they also have to hike their prices everywhere else (no wonder Prime customers don't bother to search elsewhere for a better deal!).

Now, Amazon says this is all wrong. That 45-51% vig they claim from business customers is barely enough to break even. The company's profits – they insist – come from selling AWS cloud service. The retail operation is just a public service they provide to us with cross-subsidy from those fat AWS margins.

This is a hell of a claim. Last year, Amazon raked in $130 billion in seller fees. In other words: they booked more revenue from junk fees than Bank of America made through its whole operation. Amazon's junk fees add up to more than all of Meta's revenues:

https://s2.q4cdn.com/299287126/files/doc_financials/2023/q4/AMZN-Q4-2023-Earnings-Release.pdf

Amazon claims that none of this is profit – it's just covering their operating expenses. According to Amazon, its non-AWS units combined have a one percent profit margin.

Now, this is an eye-popping claim indeed. Amazon is a public company, which means that it has to make thorough quarterly and annual financial disclosures breaking down its profit and loss. You'd think that somewhere in those disclosures, we'd find some details.

You'd think so, but you'd be wrong. Amazon's disclosures do not break out profits and losses by segment. SEC rules actually require the company to make these per-segment disclosures:

https://scholarship.law.stjohns.edu/cgi/viewcontent.cgi?article=3524&context=lawreview#:~:text=If%20a%20company%20has%20more,income%20taxes%20and%20extraordinary%20items.

That rule was enacted in 1966, out of concern that companies could use cross-subsidies to fund predatory pricing and other anticompetitive practices. But over the years, the SEC just…stopped enforcing the rule. Companies have "near total managerial discretion" to lump business units together and group their profits and losses in bloated, undifferentiated balance-sheet items:

https://www.ucl.ac.uk/bartlett/public-purpose/publications/2021/dec/crouching-tiger-hidden-dragons

As Mitchell points you, it's not just Amazon that flouts this rule. We don't know how much money Google makes on Youtube, or how much Apple makes from the App Store (Apple told a federal judge that this number doesn't exist). Warren Buffett – with significant interest in hundreds of companies across dozens of markets – only breaks out seven segments of profit-and-loss for Berkshire Hathaway.

Recall that there is one category of data from the FTC's antitrust case against Amazon that has been completely redacted. One guess which category that is! Yup, the profit-and-loss for its retail operation and other lines of business.

These redactions are the judge's fault, but the real fault lies with the SEC. Amazon is a public company. In exchange for access to the capital markets, it owes the public certain disclosures, which are set out in the SEC's rulebook. The SEC lets Amazon – and other gigantic companies – get away with a degree of secrecy that should disqualify it from offering stock to the public. As Mitchell says, SEC chairman Gary Gensler should adopt "new rules that more concretely define what qualifies as a segment and remove the discretion given to executives."

Amazon is the poster-child for monopoly run amok. As Yanis Varoufakis writes in Technofeudalism, Amazon has actually become a post-capitalist enterprise. Amazon doesn't make profits (money derived from selling goods); it makes rents (money charged to people who are seeking to make a profit):

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

Profits are the defining characteristic of a capitalist economy; rents are the defining characteristic of feudalism. Amazon looks like a bazaar where thousands of merchants offer goods for sale to the public, but look harder and you discover that all those stallholders are totally controlled by Amazon. Amazon decides what goods they can sell, how much they cost, and whether a customer ever sees them. And then Amazon takes $0.45-51 out of every dollar. Amazon's "marketplace" isn't like a flea market, it's more like the interconnected shops on Disneyland's Main Street, USA: the sign over the door might say "20th Century Music Company" or "Emporium," but they're all just one store, run by one company.

And because Amazon has so much control over its sellers, it is able to exercise power over its buyers. Amazon's search results push down the best deals on the platform and promote results from more expensive, lower-quality items whose sellers have paid a fortune for an "ad" (not really an ad, but rather the top spot in search listings):

https://pluralistic.net/2023/11/29/aethelred-the-unready/#not-one-penny-for-tribute

This is "Amazon's pricing paradox." Amazon can claim that it offers low-priced, high-quality goods on the platform, but it makes $38b/year pushing those good deals way, way down in its search results. The top result for your Amazon search averages 29% more expensive than the best deal Amazon offers. Buy something from those first four spots and you'll pay a 25% premium. On average, you need to pick the seventeenth item on the search results page to get the best deal:

https://scholarship.law.bu.edu/faculty_scholarship/3645/

For 40 years, pro-monopoly economists claimed that it would be impossible for Amazon to attain monopoly power over buyers and sellers. Today, Amazon exercises that power so thoroughly that its junk-fee revenues alone exceed the total revenues of Bank of America. Amazon's story – that these fees barely stretch to covering its costs – assumes a nearly inconceivable level of credulity in its audience. Regrettably – for the human race – there is a cohort of senior, highly respected economists who possess this degree of credulity and more.

Of course, there's an easy way to settle the argument: Amazon could just comply with SEC regs and break out its P&L for its e-commerce operation. I assure you, they're not hiding this data because they think you'll be pleasantly surprised when they do and they don't want to spoil the moment.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/01/managerial-discretion/#junk-fees

Image:

Doc Searls (modified)

https://www.flickr.com/photos/docsearls/4863121221/

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

#pluralistic#amazon#ilsr#institute for local self-reliance#amazon's antitrust paradox#antitrust#trustbusting#ftc#lina khan#aws#cross-subsidization#stacy mitchell#junk fees#most favored nation#sec#securities and exchange commission#segmenting#managerial discretion#ecommerce#technofeudalism

591 notes

·

View notes

Text

let me explain why i’m flooding your dash with posts about the harpercollins strike

As a bookseller, I want you to know that one of the worst things about our industry is the unsettlingly pervasive idea that we should financially suffer for working in it. There is a powerful idea in creative fields (as in many, many fields under late capitalism) that one should be willing to forego necessities of life -- namely, an adequate wage -- in order to have work that one resonates with emotionally.

In bookworld, I’d say that this is frequently aided and abetted by two factors. First, we often feel a strong sense of community with our coworkers and the book creation/promotion world at large and feel we should sacrifice personally for them; that to do so is right. Second, we have a sense that, due to a confluence of factors from Amazon monopolization to the rise of the Internet to the pandemic’s financial tolls, we work in a permanently struggling industry -- that we should be willing to take the hit, as it were, to help keep our business afloat.

Neither of those feelings is accurate in an independent bookstore. It doesn’t matter how narrow the profit margins are or how close you are with your coworkers. Your labor is labor, and it must be compensated. They are even less true in the context of a multi-billion-dollar publishing corporation, where the people at the top (including the parent company’s owner, who is literally Rupert Murdoch) benefit from growing monopolization while employees are unable to afford basic cost-of-living expenses. May I remind you that of HarperCollins’ thousands of employees, many are required to live in New York City -- one of the most expensive metropolitan areas in the world. While working long hours, HarperCollins staff making a starting salary (45,000/year) make $18,600 less than the average annual cost of living in New York City for a single person.

This is unacceptable. As one sign carried on the picket line read-- PASSION DOESN’T PAY THE RENT.

Fair wages do.

6K notes

·

View notes

Text

Tires cost a fortune. You can buy a car for $200, or at least you used to be able to, and easily spend double that on a set of rock-hard ditch-finders from the local tire shop. When I asked a tire company executive about it, they weasel-worded some mouth grease about tires being “expensive to ship.” Obviously, the only way I was going to get through this was to open a tire factory of my own.

This isn’t unusual. Tire factories used to dot this proud nation in a time before AliExpress and Amazon Secondus. Folks just like you and I would go to work and eke out a reasonable, middle-class existence – with a pension – putting high-quality tires under our neighbours’ cars, for cheap. Eventually, some spreadsheet said this was no longer cost-effective, and now we have to order our tires from another country.

I’m sure they have lots of good reasons for this. Tires are a lot better since the sixties and seventies: for instance, when it starts to snow, not everyone within a 50 mile radius of your car is instantly killed. You can brake harder into corners and also take them at greater speed, without them getting all greasy and knobbly as they heat up. You would expect this improved technology to cost more money, which means that the big tire executives needed to outsource it in order to make the final price more affordable.

Of course, this is patented bullshit. If you’re not interested in profit, you can make inexpensive, good tires all day long. Switch Tire Company, being technically a subsidiary of Switch Investment Corporation, is run entirely at a loss. We simply bet against ourselves every day, shorting our stock on the open market. People take the other side of it, maybe because we keep renaming our company to things like “Switch Blockchain Expressions” or “Switch Artificially Intelligent Hookerbots,” the sort of names that make the casual Wall Street Tier 1 investment bank think that we’re up-and-comers. Then we pour the money we made off their backs into running off a new set of race tires.

Sure, I could have used this kind of business acumen to do something other than lose money making tires for shit-box cars. How else was I going to be able to find 13-inch tires that are 10 inches wide?

207 notes

·

View notes

Text

Walking While Carefree & Black

Fetishized & dehumanized.

Daily misogynoir.

Harrassed on my daily walks for hugging a tree, picking a flower, laying on grass and stretching out my arms, twirling, smiling, being an unrushed unbothered carefree fierce ferocious unapologetic black woman who isnt on the way to somewhere, Im not going to 7-11 five minutes from my apartment, Im not rushing to work, Im not hurrying, Im not hustling, Im not bustling, Im not harried, Im not distratcted, Im not anxious, Im not impatient, Im not speedwalking, Im not in a car, Im not on a bike, Im walking on sidewalks, under bridges, near highways, busy intersections, busy traffic lights, near school buses, near angry white stay at home moms pushing their strollers, moms with toddlers shielding their eyes from me, white police men slowing their patrol cars when I am doing nothing but take a selfie under a bridge.

Why cant I be free?

Why cant I twirl?

Why cant I hug trees?

Why cant I treat a light pole as a stripper pole?

Is it a crime to joke around during the day when people are at school and work, jokingly twirl myself around the pole, pretend I am a pole dancer, and take a video selfie?

Will I be Sandra Bland'd?

Why cant I take pictures of a rose garden?

Why cant I take a selfie under a bridge? On a park bench?

Why cant I pick flowers near the sidewalk, smell them, place them behind my ear and skip down the sidewalk pavement?

Capitalism demands that I, a black woman, be a slave to their system but I left their system.

I left Amazon in a week with no job lined up.

I left Dow Jones with no job lined up.

I left Bank of America in 3 months with no job lined up.

I left Yale.

I quit my career coaching business after 3 years and over a hundred executive clients.

I permanently left corporate in 2019 and quit my business this year.

I am a permanent freeelancer now.

I am a podcaster now. We dont have sponsors yet so I dont currently generate income.

$55/hr at Amazon and after six months they were going to convert me with the coveted unrestricted stock aka golden handcuffs.

It was a cult. I left in a week.

I made -$7,000 last year as my business failed. I hated sales and referrals dried up.

Capitalism says I am a failure and a loser.

Capitalism says I, a nubian queen, Isis, an egyptian goddess, am only worth the revenue I generate.

I was the highest rated recruiter with the most hires at every Fortune 500 company I worked at.

I had over a hundred executive clients with my career coaching business that landed offers at Disney, Deloitte, Goldman Sachs, Amazon & Comcast with five figure salary increases.

I was a career advisor at Yale who coached graduate and postdoc STEM students.

Capitalism rolls its eyes and asks me, What have you done for me lately?

It demands I turn myself back into a machine to be deemed worthy.

But those days are over.

I will never work another 9 to 5 in any industry -- corporate, academic or non-profit.

I will never work a job that requires that I report into a supervisor.

I will never work another job with dictated shifts.

I will never sell anything to anyone ever again. I detest sales and I hate capitalism.

Capitalism is dehumanizing and it kills. It profits off of, relies on and thrives on energetic and psychic attacks that sends its adherents & acolytes to an early stress-induced death.

I was having GI issues and I healed myself.

No doctor, no gastroenterologist, no harmful laxatives, no chemical stimulants, no synthetic lab-made prescription medication that can all be addictive.

The smoothie takes 5 minutes and is just blending 1 cup pineapples, 1/2 cucumber, 1/4 grated ginger, 1 lemon, 1 orange, 2 tbs apple cider vinegar and 4 ice cubes & 1 cup of water in a mixer. Makes 2 servings, drink 1 cup in morning and 1 cup at night.

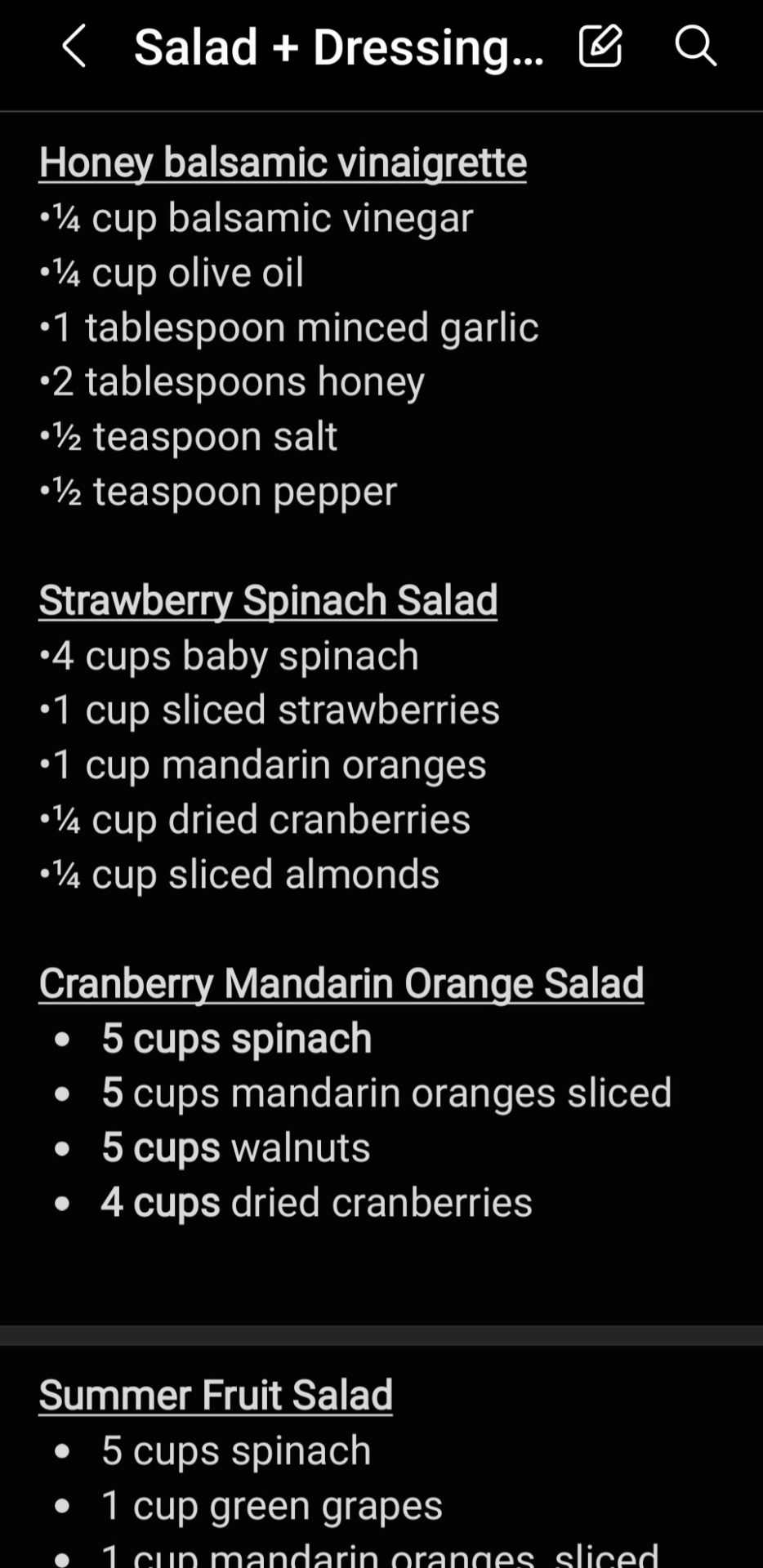

I just started walking outside in nature for an hour a day, not power walking, no step counting, no calorie counting, just being in nature, soaking up the sun, breathing the air, barefoot in grass, hugging trees, picking and smelling flowers, doing simple yoga exercises, abdominal massages, using a heating pad on my stomach, drinking 32 to 64 oz of water a day, eliminating coffe, not drinking soda during the week (used to drink 1 to 2 cans a day), fresh fruit & vegetable smoothie in the morning, oatmeal or grape nuts cereal with peppermint herbal tea no sugar or honey, homemade vegetarian salad & homemade vegetarian dressing (store bought dressing has a ton of fat, sugar amd calories) and mixed nuts as a snack Monday through Friday then I take a break and eat what I want on the weekend.

GI issues resolved themselves in a week, I am healthier, lighter, less sluggish, more fit, more in shape and more energetic. This is now my diet 75% of the time (5 days a week).

Decolonize your mind.

You have the ability to heal yourself. Stop running to doctors and quick fixes.

Change what you eat. Move more.

Get outside in nature! You are nature!

That is what heals. We come from nature and we are nature.

Trees, grass, sunlight, air, flowers, butterflies, streams, brooks, meadows, gardens, pumpkin patches, orchard farms, parks, nature trails.

Get outside.

Not to get in your car. Not to go somewhere.

Stop spending all your time penned inside like an animal and a prisoner.

Not to go to the mall, shopping, a restaurant, a salon, a spa, a movie theater, work, school, a grocery store, a laundromat, dry cleaners.

Not to run an errand.

Not to sit in traffic in a machine.

Not to burn calories.

Not to power walk.

Not to lose weight.

To reconnect with nature.

To reconnect your mind, soul, body, heart and spirit.

The west purposely severs this connection in service of capitalism.

Its up to you to restore it.

Walk. Breathe. Be. Skip. Twirl. Pose. Use the sidewalk as a catwalk. Take selfies. Take pictures.

Stop and smell the flowers.

Hug a literal tree.

Lay on the grass while cars roll past you with their windows down and stare at you like youre crazy.

Its 11 am on a Tuesday.

What the hell is she doing laying on the grass with her arms outstretched?

Why isnt she at work or at school?

Confuse people with your very presence.

I have a goth alt kawaii japanese street fashion aesthetic that includes boyshorts, leather garters, torn fishnets, leather chokers, hello kitty tiaras, six inch pink platform heels, black lipstick, mini cut out crop tops, extremely thick black eyeliner and hot pink eyeshadow.

For wearing this on Friday on my daily walk at 8:30 am which I then shared on TikTok, I was accused of being indecent, inappropriate for children to see going to school, people stared, rolled their windows down, honked at me, cars followed me, two men purposefully walked right into me bumping me (there was plenty of room on the sidewalk), an HVAC repairman leered at me outside of his van and literally just stared holes through me as I walked by.

Im 41. Im 5"1. Im 92 lbs. Im black and female.

I have a quirky style and aesthetic. I look young.

I also shaved my head bald a few weeks ago and have a bald fade.

People have since then called me a dyke, asked if I am trans, am I a boy or a girl, whats the deal.

Thats when I dont have a wig on.

I love different looks so I also wear long wigs.

The reaction is completely different when I wear a wig and people tell me how good I look, that people are slowing their cars down because I am attractive.

Bald fade, bony dyke who looks like a boy and might be trans.

Long wig, attractive girl, let me slow down and get a look.

Still black no matter the hair. Still followed.

Still harrassed.

A MAGA Proud Boy harrassed me with my bald fade while I was wearing an Eagles shirt and jeans. He stared at me as I took a selfie on a bench under a tree, when I got up to walk home, he started walking towards me and blocked my path in the small walkway we were both on and wouldnt let me pass.

Doesnt matter if its boy shorts and leather garters or an Eagles shirt and jeans.

I am harrassed for being a carefree black girl in capitalist Amerikkka.

#anti capitalism#green party#cornel west#socialism#environmetalists#tree huggers#nature lovers#heal yourself#plant medicine#herbal medicine#big pharma#gmos#abolish the police#black lives matter#blm#antiracism#lgbtq#transgender#feminism#feminist#patriarchy#third eye#ascension#self actualization#self expression#free spirit#be your true self#home remedies#black girl magic#limitless

80 notes

·

View notes

Text

We recently got into a discussion of producing audiobooks for small press, indy, and/or selfpub authors on another post, but we had strayed pretty far from the original post, and @genedoucette very kindly gave permission for me to slice his comment off the end of that post and put it into a new one.

genedoucette

I have been very, very lucky when it comes to audiobooks, so I'm hesitant to offer advice without adding a huge YMMV caveat at the top.

For most of my self-published novels, I used ACX and paid a narrator out-of-pocket (rather than 50-50 proceeds split), which just means I'm paying an agreed-upon X dollars per finished hour, prior to making any money off f the audio editon. Every book I did this with paid for itself, sometimes within the first two or three months, sometimes longer. (YMMV: I did a lot of this during what I would call the audiobook bubble, when demand was higher than supply.)

I had another novel series--Tandemstar--that I brought to an audiobook company, who brought it to their distributor, who agreed to pay for the production costs of the book and to pay me a (small) advance. To date, the royalties from that series have not made up the cost of the advance, but the good news was that none of the production costs came from my pocket and the advance meant I did make something out of the deal.

The rule-of-thumb I always heard was, don't expect books that haven't sold well to sell any better as audiobooks. But my experience, with ACX/Audible, is this: about 50% of my monthly earning come from audio sales.

How long is the book in question (word count), and what is the genre? Because it is absolutely possible to get a not-terrible narrator at a not-terrible cost on ACX. If it's a low word count book with a decent sales record, I'd 100% do it. If it's a high word count book with few sales, maybe not.

Thanks so much for this! I am admittedly always suspicious of Amazon writ large, but it's not like I've never partnered with them before, and often for indy authors they're one of a very few games in town.

50% of sales via audio impresses me a lot -- I'm not really in the industry so my sense of scale may be off but my eyebrows went up at that. And looking at ACX, a split-profits model would be appealing. I'm more interested in providing the reader with more options than I am with making royalties, so I don't mind low payout, but I also don't want to exploit a narrator if I can avoid it.

I doubt I'm selling near the level you are, but it's pretty consistent, at least -- for the last literary novel I published in 2021, and for the four genre romances published in the past year-and-change, it's generally 200-250 copies (epub and paperback) in the first 6 months, and about 40 per year after that. None of them are over 100K words -- the first of the romance novels, the one I'd be most likely to have done as an audiobook to trial, is around 50K, and the other books are all between 60K and 90K or so.

There's some fine print I'm not nuts about -- exclusivity to Amazon/Audible/iTunes for example -- but I can see why it's a necessary business model for them. There's not a ton of clarity on cost per hour for a book, but it looks like for a flat fee it starts around $250 per finished hour? So I'd probably be looking at minimum $1K out of pocket, which is probably roughly (I haven't done the math) royalties per book for a full year. It could be fun to give it a swing regardless, although reading the ACX site made me realize I'd actually have to give notes and feedback to a reader which sounds nervewracking.

It looks like the readers for ACX are repped by SAG-AFTRA, which means that for now I have time to consider while the strike is going on. (Obviously not all of them are union but if it's an entertainment format where the union is involved, I don't want to cross the picket.) And the ACX site is pretty comprehensive in terms of figuring out how it all works, so if I did want to source a narrator elsewhere and perhaps not distribute exclusively through ACX, I now have a grounding from which to research other options too.

Sorry, a lot of this is just me thinking aloud, but I truly do appreciate the info and also something to bounce off of in terms of considering it. And I appreciate the opportunity to share it with my readership too, thank you!

71 notes

·

View notes

Text

30 ways to make real; money from home

Making money online from the comfort of your home has become increasingly accessible with the growth of the internet and digital technologies. In 2023, there are numerous realistic ways to earn money online. Here are 30 ideas to get you started:

1. Freelance Writing: Offer your writing skills on platforms like Upwork or Freelancer to create blog posts, articles, or website content.

2. Content Creation: Start a YouTube channel, podcast, or blog to share your expertise or passion and monetize through ads, sponsorships, and affiliate marketing.

3. Online Surveys and Market Research: Participate in online surveys and market research studies with platforms like Swagbucks or Survey Junkie.

4. Remote Customer Service: Work as a remote customer service representative for companies like Amazon or Apple.

5. Online Tutoring: Teach subjects you're knowledgeable in on platforms like VIPKid or Chegg Tutors.

6. E-commerce: Start an online store using platforms like Shopify, Etsy, or eBay to sell products.

7. Affiliate Marketing: Promote products or services on your blog or social media and earn commissions for sales made through your referral links.

8. Online Courses: Create and sell online courses on platforms like Udemy or Teachable.

9. Remote Data Entry: Find remote data entry jobs on websites like Clickworker or Remote.co.

10. Virtual Assistance: Offer administrative support services to businesses as a virtual assistant.

11. Graphic Design: Use your graphic design skills to create logos, graphics, or websites for clients on platforms like Fiverr.

12. Stock Photography: Sell your photos on stock photography websites like Shutterstock or Adobe Stock.

13. App Development: Develop and sell mobile apps or offer app development services.

14. Social Media Management: Manage social media accounts for businesses looking to enhance their online presence.

15. Dropshipping: Start an e-commerce business without holding inventory by dropshipping products.

16. Online Consultations: Offer consulting services in your area of expertise through video calls.

17. Online Surplus Sales: Sell unused items or collectibles on platforms like eBay or Facebook Marketplace.

18. Online Fitness Coaching: Become an online fitness coach and offer workout plans and guidance.

19. Virtual Events: Host webinars, workshops, or conferences on topics you're knowledgeable about.

20. Podcast Production: Offer podcast editing, production, or consulting services.

21. Remote Transcription: Transcribe audio and video files for clients.

22. Online Translation: Offer translation services if you're proficient in multiple languages.

23. Affiliate Blogging: Create a niche blog with affiliate marketing as the primary revenue source.

24. Online Art Sales: Sell your artwork, crafts, or digital art on platforms like Etsy or Redbubble.

25. Remote Bookkeeping: Offer bookkeeping services for small businesses from home.

26. Digital Marketing: Provide digital marketing services like SEO, PPC, or social media management.

27. Online Gaming: Stream your gaming sessions on platforms like Twitch and monetize through ads and donations.

28. Virtual Assistant Coaching: If you have experience as a VA, offer coaching services to aspiring virtual assistants.

29. Online Research: Conduct research for businesses or individuals in need of specific information.

30. Online Real Estate: Invest in virtual real estate, such as domain names or digital properties, and sell them for a profit.

Remember that success in making money online often requires dedication, patience, and the ability to adapt to changing trends. It's essential to research and choose the opportunities that align with your skills, interests, and long-term goals.

#founder#accounting#ecommerce#copywriting#business#commercial#economy#branding#entrepreneur#finance#make money online#earn money online#make money from home#old money#i turn to these cute#disgraced youtuber ruby franke#my mum#money#claims shock report#says terrified brit#easy money

55 notes

·

View notes

Note

https://twitter.com/CineGeekNews/status/1735028345794855200

Warner Bros Discovery currently has an over 60% Probability of Bankruptcy.

I honestly am not sure if this is good or bad for the SPN revival. On the one hand, WB is NOT going to want to spend money on such a niche IP (that will really mostly only draw ppl who were already fans) if they are in such dire straits financially. On the other hand, they could bring in money by selling the IP to another studio who would obviously then want to actually do something with it since they spent money on it. But that also depends on another studio or streaming service wanting to do something with it which will be tougher. Netflix would make sense since they currently have SPN for streaming, except they will be losing their streaming rights at the end of 2025. A revival wouldn't even be released until then so why would Netflix want to put money into a revival of show that will, at that time, be streaming on a competitor (most likely Max since it will revert back to WB). Amazon is a possibility since both Jensen and Kripke are there (especially if they want to bring Kripke on for it) and Kripke seems to have some sway over there. But again, unless they buy the rights to SPN to stream on their platform, why would they want to make a show that will inadvertently benefit their competitor?

Thoughts?

https://www.macroaxis.com/invest/ratio/WBD/Probability-Of-Bankruptcy#google_vignette

[full disclosure, I sent this same ask to someone else as well, I'm not trying to spam people with it, I just wanted both your opinions!]

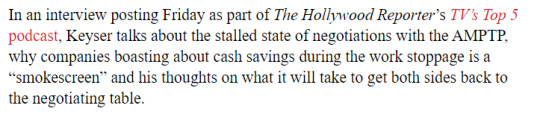

I went cross eyed reading the article, it looks like it was written by an A.I, which is not out of the realm of possibility given how many "journalists" are fired and Sports Illustrated was busted for using AI to write articles.

It really does not take much to avoid bankruptcy. Usually when a company is going to go under, the signs of it are obvious inaction for a long time and it inevitably dooms the business. The prime reason why WBD is not going broke is because they took immediate actions after the merger. What happens is the profitable parts of the business stays, while losses are either "turned around" or the business gets eliminated. Sometimes things like streaming subscribers will drop a quarter or two. Maybe a movie or two never gets released. But housecleaning is far more important than anything right now so that money is not wasted. The result is growing cash flow without losing much of the business.

Remember what I've said that cash flow is king? You can run a non-profitable company indefinitely with positive cash flow, but run a profitable company into the ground without cash flow. AT&T generated next to no cash flow. WBD exists for the very purpose of dismantling the legacy Time Warner conglomerate, that was the intention when AT&T sold it to Zaslav. It’s why they removed HBO from the name of Max. His job is to clean up its balance sheets, prepare its parts for sale, and pay himself handsomely in tune of $200 million last year. I begrudgingly admire Zaslav’s sticking with his controversial strategy, which saw other studios eventually following that same strategy.

By 2023, WBD paid off $12 billion in debt. That was a demonstration of faith by management in the turnaround efforts or else they would have kept the cash "just in case." The interest on the debt alone is eating $2 to $3 billion in free cash flow. Thats a lot of free growth in their bottom line when debt is paid down. Against all odds, WBD's streaming service HBO Max (and then just Max) is creating most of the cash flow improvement with $5 billion in cash flow. Advertising is growing in this segment at a robust pace. That said, the content decline for third-party licensing will have implications now that the strike is over and WBD has to start spending money on new contents on their prized IPs i.e. Lord of the Rings, Harry Potter, DC, etc.

For niche IPs like Supernatural, I see 50% chance of WBD still licensing it to Netflix because third-party licensing is the new king. WBD will also offload low-performing shows in the same bundle with higher-performing Supernatural because it will allow WBD to continue their 'creative accounting' to avoid paying residuals to low-tier actors. Then I can see Netflix doing what they did with Gilmore Girls and produce a revival limited series for Supernatural, which will increase viewership for the OG SPN and continue to help retain subscribers.

On the other hand, WBD is rebooting every niche IP under the sun and I'm pretty certain they will make the same attempt with Supernatural. The strike is over and WBD need to make new contents to attract back subscribers they lost over two quarters during the strike. When SPN goes back to Max in 2025, an announcement of a reboot/revival will mean free marketing from devoted fans and ensure continual interest and viewership of the OG SPN.

20 notes

·

View notes

Text

God, I'm probably going to rewatch the entirety of Hazbin for weeks, something I occasionally do with Helluva. Again, both mostly just passive interests away from my blog... until the actual show dropped and my absolute hyperfixation mode went haywire

Say what you want about the plot and designs themselves, I understand if it's not someone's cup of tea (Personally, I don't particularly like South Park, Family Guy, or Rick and Morty (anymore)), and the fact that it's pretty rushed, a fact I'll certainly agree with, but it is a fucking ACHIEVEMENT

I LOVE the busy designs and saturated colors, even if most are shades of red (If I had a show, it'd be mostly green and purple, lmao). I love the hand drawn and more cartoony style with fantastic VFX animation and backgrounds. I love the concept of Heaven vs Hell with demons and angels where angels can suck and demons can be good. I actually like that Adam was an entitled asshole because he didn't have to try for his wives, they were made FOR him

I don't go around looking for adult animation anymore because there's so many fucking Family Guy and Rick and Morty repetitive ass shows that use rigging and the same goddamn adult animation art style formula. Brickleberry, Paradise PD, American Dad, so on and so forth. Episodic drivel that KIND of teases a plot to keep you watching but it's the television equivalent of empty calories that you put on in the background. I stopped watching Rick and Morty after season 4 because it was just keeping the carrot on the stick way too far for me to care enough to keep watching (that and the whole Justin Roiland fiasco)

There's good adult shows, don't get me wrong, but almost nothing ANIMATED that's substantial and fun. There's a few, but it's smothered under Family Guy copycats and horribly stiff rigging that's cheap and bland by this point, and some are just downright depressing (Sorry Bojack and Tuca, I just couldn't handle you, I'm already sad half the time). To be honest, I almost didn't watch Inside Job because of the style, and even though it was mostly episodic it was fantastic!

Why can't I, for the decades of life I presumably still have past 18, have life in an animation made for adults? Charm? Pizzazz? Plot and color and FUN? Fucking anything more than the capitalistic weeds that choke the market just to turn a profit for the companies involved. I get it. Companies need to make a profit or they'll go in the red, lose money, yada, yada

But, in an already bleak fucking world where it's only getting bleaker and some corporations want to replace NINETY percent of an animated film/show process to AI eventually? I'm choked and burnout and everyday feels like there's no point in trying to make anything because the fucking programs will do it for us anyways, probably by stealing MORE from people who try. I don't need to see Meg from Family Guy get farted on or abused for no reason, or the Family Guy rip off equivalents that do it for shock value. I don't need copypaste stale material or IP revivals that beat over original ideas because they're safe and nostalgic, inevitably fucking up most of the time

Hazbin Hotel is far from perfect, but it got greenlit. It got picked up. It got to be written and MADE. I can almost guarantee you that Amazon only gave them eight episodes to start with, without certainty on whether or not it would be continued with them. I can almost guarantee you they had SOMEONE keep an eye on Helluva Boss's reception on YouTube to see if it would be profitable enough to continue Hazbin (After all, similar target demographic, right?) and the team wasn't informed until halfway through full production of season one that they'd get a second one. There may have even been the chance of them dropping Hazbin if Helluva's numbers didn't stay up

I love Hazbin and Helluva with so much of my heart because they're small oasis's in the corporate world that would prefer people work the warehouse and not the arts. Yes, I know Hazbin is on Amazon and 'Amazon bad', but if it's not encouraged by viewage (Which I'm sure it's doing well in right now) then original works will continue to be looked over in favor of shitty reboots or live action recreations

Ugh, anyways. I'm not sure how to end this. I just had to get my thoughts out

#cinntalks#unnecessary ramble#i love these two fucking shows#like way too much#cry happiness kind of love#didn't mean to talk this much again#long post#hazbin thoughts

13 notes

·

View notes

Text

The Re-Opening Of Handmade Hearts

It’s been an icy hot minute since I wrote a proper update, but I won’t complicate this one. The update series started with the presence of a workspace and the first shop opening; the second post was about the progress and success so far; the third was almost a year later because so much had happened, and I’d moved, and the store was on standby, and I was getting married, usw.

I’ve since not only moved countries, but I’ve also moved my main storefront from Ko-Fi to the Artisans Cooperative. (But you’ll still find patterns on Ko-Fi.) Like I have from the start, I do the math and show my work in the description of each item listing in a breakdown of the price: In bullet list form, I state the material costs, the platform fees, the time I’ve estimate I could most efficiently take to complete one of each item (which will almost always be less time than it actually took), and the wage per hour that I’m paying myself. If you add it all up, it’ll equal the price in the listing — minus a tax based on your area that the marketplace adds automatically.

There are six fixed shipping prices based on size and location, with the least expensive being within Germany and the most expensive being anywhere outside the EU. I’ve got two different sizes of box, but I really should get me some envelopes and offer a cheaper no-tracking alternative for certain (very small, mostly not-yet-existing) items.

Here are the listings so far!

(Photography by @ablondpanda)

I’ve done the math, and I have made just shy of 370€ in earnings in the time I’ve had Handmade Hearts open. I haven’t been able to work since 2019, so that’s 370€ in earnings within the last five years.

Ouch…

Ouch…?

Well, I have chronic depression, but I’ve managed to carve myself into an optimist; I’ve not had the chance to really grow yet as an indie seller, so having earned anything — not operated at a loss (at least within business expenses; general life expenses is another beast) — is a bright shining star to me.

My parter and I are waiting on job applications and government assistence. In the meantime, I’m hoping to gain more eyes and start making at least one sale every month in the middle and/or latter half of 2024.

I’ve yet to sell anything through the new storefront, so I’m trying to get more eyes on it. I’m considering opening a secondary storefront with Products With Love, a Germany-specific handmade marketplace, to get more eyes that won’t have to pay more than seven euros on shipping for any given thing.

Shipping is, unfortunately, not something I can do for free. To take a moment for personal politics: I really think mail should be one of those things governments work together to pay for and make free on the most basic level, like public infrustructure, roads and such. It shouldn’t cost $24 for me to send you a snake shaped neck pillow if you’re in the US.

That said, it does cost me 23€ (which is $24.53 as of writing this) to send you a snake shaped neck pillow right now. I want to emphasize that because it’s so common when shopping online to find something “underpriced” whose shipping is blown way up for profits, and I think sometimes it’s become habitual to assume that’s the case when shipping is over what Amazon would consider normal.

Another thing people do is including the shipping price within the price of the item to artificially remove shipping costs. That’s something I don’t do because A) I like transparency, and B) that would increase the platform fees you have to pay, increasing the overall price for no reason.

Ultimately, I hope that the way I do things helps people be more mindful of why things cost what they do.

To close out...

In preparation for posting this update, I’ve uploaded my tenth listing on the Artisans Cooperative marketplace. For my trans siblings, and for the pedants who have noticed that none of my wares have hearts on them:

#trans pride#actually autistic#ko-fi#artisans cooperative#crochetblr#crocheting#small business#shop small#disabled#disabled artisans#blog post

10 notes

·

View notes

Note

You seem like a good authority on the subject, so: what would your rec(s) be for a first tingler for someone looking to get in to Dr. Chuck’s work?

I would not call myself an authority since I stopped reading for fun in general sometime in 2018-2019 and am only getting back to it now, so I missed a lot of good stuff like the beginning of lesbian, bi and trans tinglers, and the classic literature tinglers I'm really looking forward to getting into. My knowledge is firmly in the early tinglers, BUT(T), here goes:

Chuck Tingle has a patreon, that's currently the best value financially AND isn't supporting Amazon, which is a nice bonus.

The patreon unfortunately doesn't have many of the older tinglers I'm currently talking about, bundles are also decent value, there's a whole bunch on the page linked below that you can peruse to see which ones are on a subject you're interested in. The only ones I don't recommend for general readers are the "pounded by politics" series since many of them deal with very specific events that were topical at the time.

Giving specifics to a tumblr asker is a little hard because when I recommend to friends I usually take their preferences into account. Speaking only for myself, I'm very partial to meta and living object tinglers, "The Analboros" and "Handsome Sentient Food Pounds My Butt And Turns Me Gay" are the 2 anthologies that I personally love enough that I own physical copies of them. I also HIGHLY recommend you read "Anally Yours, The Unicorn Sailor" before The Analboros.

If you like genre parodies, you'll probably like the longer novels at the bottom of this page: https://www.chucktingle.com/ebook.html , also "Butt Wars: Rogue Buns" and "Gaygent Brontosaurus: The Butt Is Not Enough"

For more straightforward Romance stories, Unicorn Tinglers Volume 1 is a good place to start.

If you like the shock value of the covers and are looking for ones that make you go "what the fuck just happened there" then "Happy Birthday Frankenstein, Now Pound My Butt" (which is one of the few older ones on patreon!) and "Living Inside My Own Butt For Eight Years, Starting A Business And Turning A Profit Through Common Sense Reinvestment And Strategic Targeted Marketing" are great ones to start with.

Hope that's helpful and you have fun reading tinglers!

9 notes

·

View notes

Text

The long, bloody lineage of private equity's looting

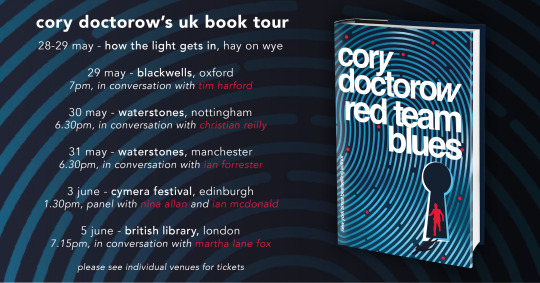

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”

The money to buy Samsonite — and many other businesses — came through a shadowy deal between Black and John Garamendi, then a California insurance commissioner, now a California congressman. Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money “from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc.”

Black ended up getting all kinds of favors from powerful politicians — including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to Jeffrey Epstein for reasons that remain opaque.

Black’s shady deals are a marked contrast with the exalted political circles he travels in. Despite private equity’s obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulance services to infrastructure from PE-owned companies, with disastrous results. Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder SteveS chwarzman declared, “It’s a war. It’s like when Hitler invaded Poland in 1939.”

Since we’re on the subject of Hitler, this is a good spot to bring up Monowitz, a private-sector satellite of Auschwitz operated by IG Farben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht. I’d never heard of Monowitz, but Tkacik’s description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slave laborers from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves down the 4.5m stretch of road to the facility. So the company bought 25,000 slaves — preferring children, who were cheaper — and installed them in a co-located death-camp called Monowitz:

https://www.commentary.org/articles/r-tannenbaum/the-devils-chemists-by-josiah-e-dubois-jr/

Monowitz was — incredibly — worse than Auschwitz. It was so bad, the SS guards who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork — Farben refused, citing the cost. The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben’s investors.

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp. And Farben’s subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz’s gas chambers.

Tkacik’s point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money — and they were even worse. The banality of evil gets even more banal when it’s done in service to maximizing shareholder value.

As Farben historian Joseph Borkin wrote, the company “reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted”:

https://www.scribd.com/document/517797736/The-Crime-and-Punishment-of-I-G-Farben

Farben’s connection to the Nazis was a the subject of Germany’s Master Plan: The Story of Industrial Offensive, a 1943 bestseller by Borkin, who was also an antitrust lawyer. It described how Farben had manipulated global commodities markets in order to create shortages that “guaranteed Hitler’s early victories.”

Master Plan became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

Seen in that light, the plunderers of today’s PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It’s a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can’t even close the carried interest tax loophole, how can we hope to do anything meaningful?

“Carried interest” comes up in every election cycle. Most of us assume it has something to do with “interest payments,” but that’s not true. The carried interest loophole relates to the “interest” that 16th-century sea captains had in their cargo. It’s a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it’s still on the books tells you everything you need to know about whether our political class wants to do anything about PE’s plundering.

Notwithstanding Tkacik’s (entirely justified) skepticism of the weaksauce remedies proposed in these books, there is some hope of meaningful action. Private equity’s rollups are only possible because they skate under the $101m threshold for merger scrutiny. However, there is good — but unenforced — law that allows antitrust enforcers to block these mergers. This is the “incipiency standard” — Sec 7 of the Clayton Act — the idea that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still act to block it if it creates an incipient monopoly.

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

The US has a new crop of aggressive — fearless — top antitrust enforcers and they’ve been systematically reviving these old laws to go after monopolies.

That’s long overdue. Markets are machines for eroding our moral values: “In comparison to non-market decisions, moral standards are significantly lower if people participate in markets.”

https://web.archive.org/web/20130607154129/https://www.uni-bonn.de/Press-releases/markets-erode-moral-values

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/02/plunderers/#farbenizers

[Image ID: An overgrown graveyard, rendered in silver nitrate monochrome. A green-tinted businessman with a moneybag in place of a head looms up from behind a gravestone. The right side of the image is spattered in blood.]

#pluralistic#kkr#lootersprivate equity#plunderers#books#reviews#monsters#nazis#godwin's law#godwins law#auschwitz#ig farben#pe#business#barbarians#united fruit#carried interest#corporate raiders#junk bonds#michael milliken#ensemble cast#carlyle group#monowitz#leon black

1K notes

·

View notes

Text

The Internet Was Made BY Porn

In the before time, in the long-long ago, if we wanted to communicate with someone out of ear shot, you had to go to your kitchen, and pick up a handset connected to the wall. This telephonic device allowed you to transfer sounds to distant locations, replacing the earlier telegraph. We even mastered a system that didn't require you to dial it.

youtube

Runtime: 2:49

Incidentally, this is where the term "Dial" and "Dial-up" comes from.

The US Advanced Research Project Agency (ARPA, which would later add a D for Defence and become DARPA), wanted a communication system that could survive nuclear war.

The idea was you set up an interconnected system of computer networks (spoilers). They had a flexible routing system that would basically search every path to find the shortes, and then send information along this path. If a path was cut, (by nuclear explosion), then a number of other paths will be available.

Well, the academics that designed this thought this was fantastic, and started connected their own computer networks together. The universities started giving locals access to these networks. The original form of e-mail didn't think that anyone would lie about their e-mail, and every network was set to automatically repeat any messages along that needed to get sent. I mean, that was literally how the network worked. Why would someone spoof a system who's primary purpose is complex mathematical calculations?

Eventually something thought that this would be fantastic for civilians. Every civilian could connect to a university, and do complex mathematical calculations!

Civilians entered the field, and started building major trunklines, offering service to wider and wider areas.

Now, the biggest profits can be made with new markets. This is how Telsa and Amazon made so much money. Everyone wanted to be the first to make money on this Internets thing, (that s isn't cute, as the internet is a series of interconnected networkS; the s was later dropped colloquially). Incredible amounts of financing poured into the tech startups. How did they make their money?

And that's what lead to the Dot Com Bubble.

So, it turns out the two main ways to make money on the internet are using it to arrange physical commerce, which is how Amazon made it's money, and to sell discrete amounts of data.

Now, what kind of data are people most willing to spend money on? Sing it with me now!

youtube

Runtime: 1:32

Movies? What about movies? It you wanted to spend 2 weeks of this.

youtube

Runtime: 0:28

Okay, yeah, you only have the dial-up noise when dialling up, but you still lose use of your telephone. How did you handle someone trying to call you while you were online?

Sadly, the answer is pretty banal. There's a busy signal, and you hope they call back later.

Even loading a site with a dozen pictures would take an hour. And people waited. And people paid for the privilege.

6 notes

·

View notes

Text

How to Publish a Book, pt 1

I told @tryxyhijinks I was gonna turn this into a shitpost, so here we go: how to publish an ebook in ten easy steps.

Write the book. This is, believe it or not, the fun part.

Edit the book. Slightly less easy, but you have to do this, no matter what anyone else has told you about "minimum viable product" or what have you. You can force your friends to read it, you can have a program read it aloud to you, you can read it backwards, you can hire someone to line edit your work, you can do some or most of the above, just get it edited. (Additional point: when hiring a professional, if you're happy with the plot, ask for line or copyediting; if you're not sure about plot points, ask for developmental editing; if you just need guidance, you may want to start with an editorial letter.)

Get a cover. You can make one yourself or pay someone to do it. You're going to want it to be about 1600x2500 pixels and 72 dpi. It's good to have a really nice cover, because covers sell books.

Typeset the book. I use Atticus to create an epub file. If you are also doing a print version or you are a control freak, I recommend it. Vellum and Reedsy are about the same, I think. If you have a lot of illustrations--big ones, I mean, not just an author photo--you should beg, borrow, or steal a copy of InDesign. You can use Calibre to compress your output epub file if you want to make sure you earn every available penny. However, my book is 6mb and it is about 8 cents to download. Also, if you're trying to do this on the cheap, you really can just do it in Word. The layout won't be as fancy, but you can do it. (Layout granularity, from least to most granular, is probably Word->Atticus->InDesign.)

If you want to publish under a press name that is not your name, you will need to start a business. Laws around taxes and registration may vary depending on where you are, but in general, you will want to register your name with your state or county registrar (for me, this cost $30 and I had to get a piece of paper notarized). Then you can get a business checking account (for me this part was free--I went through the bank I already have accounts with). In the US, sole proprietorships like this are taxed as pass-through entities, so you will pay personal income taxes on whatever money you make, but you don't have to pay corporate income taxes. If you are publishing books that could possibly get you sued (e.g., The Big Book of Welding While Juggling or Now You're Cooking with Napalm) you may want to form an LLC. Talk to a lawyer.

Open a KDP account. If you hate the Zon and want to only publish somewhere else (Apple Books, Kobo, Barnes and Noble, Smashwords, whatever), that's fine--the process is about the same. If you think you previously had a KDP account and then didn't use it, search your emails etc. to try to find out, because if they figure that out, they'll close both accounts and then you won't get paid.

Add your new title to the catalog (you will need to add metadata, like your name, series name if there is one, and a description of the book) and set the prices. Unless your book is super big, you'll probably earn more if you select the 70% option. For some reason, I changed a few of the prices. If you're planning to publish on several platforms, I don't recommend this--just set your price in one place and then let it convert those. Otherwise, you'll have to reinput everything over and over, because it's in the terms of service that you need to price things the same on Kobo as you do on Amazon (and so on).

Set the day of publication and tell people about it. Like your mom. Your weird aunt who's always so supportive. Your friend who has been listening to you bitch about how hard writing is for the past six months.

???

Profit.

Q: Hey, I want my book in several online stores, not just Amazon.

A: You have a few options. Draft2Digital/Smashwords and IngramSpark both distribute digitally to various places so you only have to set things up once. But they take a cut of the profit for this service. You can also set up independent accounts with each store and upload your stuff.

Q: What happens in step 9?

A: You know. Meet other indie writers and try to gain their trust. Read a lot. Work on the sequel. Get some sleep, because deadlines are exhausting, even self-imposed ones. Learn about advertising. That sort of thing.