#Property Tax Code

Text

Texas Property Tax Useful Information

Property taxes are a substantial expense for Texas homeowners, averaging about $3,600 annually. To reduce this expense, property owners should annually review and consider appealing property taxes. Visit @ https://www.poconnor.com/texas-property-tax-useful-information/

0 notes

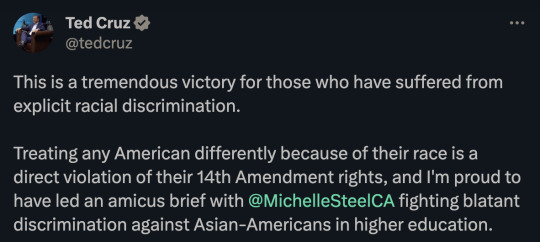

Photo

ENROLL TODAY In the Property Tax Protection Program

Benefits of enrolling in the Property Tax Protection Program™:

- Deadline alerts

- No flat fees

- Annual property tax protest

- Free support on homestead exemptions. Visit here to enroll now in the Property Tax Protection Program™ - https://www.poconnor.com/commercial-property-tax-protection-program/

#Property Tax Protection Program#property tax reduction#texas property tax code#Property tax appeal houston#houston property tax protest#o connor & associates

0 notes

Text

When I was a kid, I got chased by a cow for a little while. We were on a camping trip, I had wandered away from the campsite for some childlike reason, up towards the train tracks, and I got between the cow and her calf. Even after the two were reunited, the cow continued to chase me for about two kilometres, but at at a disinterested, low-speed kind of clip-clop fuming instead of actually mad. No doubt she was also bored. Eventually, I decided to jump over the train tracks and head back the long way, and the cow went back to her beefly business.

This memory is on my mind a lot lately, mostly because I've had to take up a job at the local dairy farm. Why? I need money. And the proprietor doesn't care if I use my real name on the government forms or not. Turns out that some guy in the graveyard down the highway is gonna owe a couple hundred bucks in back taxes this year, and I wish the revenuers every kind of luck in collecting from him.

Because the farm is so far from my house, and also because I can't return to my house right now until the police search team and TV news dissipates from the neighbourhood, I've been staying in the workhouse. It's not so bad. A little chicken-y, sure, but it's got a septic toilet and the other workers don't frown at me too much when it becomes obvious I don't know the first thing about how to milk a cow. What I do know how to do is fix broken-ass tractors, which I immediately set about doing when I realize that milking things is dull as hell.

Unfortunately for me, this sudden display of competence arouses the kindly farmer's interest. He immediately notices that it's not particularly normal for someone to be able to repair a cloudfallen "smart" John Deere using two pieces of copper wire, a nine-volt battery and a chunk of spray paint can that I found behind the shed. He begins to follow me, demanding that I fix everything else on the property. Panicking, I take off for the open road, but of course my decrepit Plymouth is not especially capable of doing thrilling stunts like "the speed limit." To the farmer's credit, he held on a lot longer than the cow before getting bored and going home: I got to jump two railroad trestles before his Dodge Ram threw a code.

187 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Jan. 6, 2024

"Billionaires attempting to influence politics from the shadows should not be rewarded with taxpayer subsidies," said Sen. Sheldon Whitehouse.

Legislation introduced Tuesday by a pair of Democratic lawmakers would close a loophole that lets billionaires donate assets to dark money organizations without paying any taxes.

The U.S. tax code allows write-offs when appreciated assets such as shares of stock are donated to a charity, but the tax break doesn't apply when the assets are given to political groups.

However, donations to 501(c)(4) organizations—which are allowed to engage in some political activity as long as it's not their primary purpose—are exempt from capital gains taxes, a loophole that Sen. Sheldon Whitehouse (D-R.I.) and Rep. Judy Chu (D-Calif.) are looking to shutter with their End Tax Breaks for Dark Money Act.

Whitehouse, a member of the Senate Judiciary Committee who has focused extensively on the corrupting effects of dark money, said the need for the bill was made clear by what ProPublica and The Lever described as "the largest known donation to a political advocacy group in U.S. history."

The investigative outlets reported in 2022 that billionaire manufacturing magnate Barre Seid donated his 100% ownership stake in Tripp Lite, a maker of electrical equipment, to Marble Freedom Trust, a group controlled by Federalist Society co-chairman Leonard Leo.

The donation, completed in 2021, was worth $1.6 billion. According to ProPublica and The Lever, the structure of the gift allowed Seid to avoid up to $400 million in taxes.

"It's a clear sign of a broken tax code when a single donor can transfer assets worth $1.6 billion to a dark money political group without paying a penny in taxes," Whitehouse said in a statement Tuesday. "Billionaires attempting to influence politics from the shadows should not be rewarded with taxpayer subsidies."

"We cannot allow millionaires and billionaires to run roughshod over our democracy and then reward them for it with a tax break."

If passed, the End Tax Breaks for Dark Money Act would ensure that donations of appreciated assets to 501(c)(4) organizations are subjected to the same rules as gifts to political action committees (PACs) and parties.

"Thanks to the far-right Supreme Court, billionaires already have outsized influence to decide our nation's politics; through a loophole in the tax code, they can even secure massive public subsidies for lobbying and campaigning when they secretly donate their wealth to certain nonprofits instead of traditional political organizations," said Chu. "We can decrease the impact the wealthy have on our politics by applying capital gains taxes to donations of appreciated property to nonprofits that engage in lobbying and political activity—the same way they are already treated when made to traditional political organizations like PACs."

The new bill comes amid an election season that is already flooded with outside spending.

The watchdog OpenSecrets reported last month that super PACs and other groups "have already poured nearly $318 million into spending on presidential and congressional races as of January 14—more than six times as much as had been spent at this point in 2020."

Thanks to the Supreme Court's 2010 Citizens United ruling, super PACs can raise and spend unlimited sums on federal elections—often without being fully transparent about their donors.

Morris Pearl, chairman of the Patriotic Millionaires, said Tuesday that "there is no justifiable reason why wealthy people like me should be allowed to dominate our political system by donating an entire $1.6 billion company to a dark money political group."

"But perhaps more egregious is the $400 million tax break that comes from doing so," said Pearl. "It's a perfect example of how this provision in the tax code is used by the ultrawealthy to manipulate the levers of government while simultaneously dodging their obligation to pay taxes. We cannot allow millionaires and billionaires to run roughshod over our democracy and then reward them for it with a tax break."

117 notes

·

View notes

Text

Storytime...

A long time ago there was this thing called redlining. White people didn't want Black people living in their neighborhood. So Black people were forced to live in the poorest areas with the lowest wages.

Yes, they banned redlining. But stopping something does not necessarily fix the damage that was done. It did not magically give Black folks higher wages so they could move into better areas. They were basically stuck. They were unable to build up generational wealth. So their children were also stuck in those poor areas with low wages.

Redlining created a cycle of poverty that still exists to this day.

Public schools are funded mostly by property taxes. If you live in an area with expensive property, there will be more money to fund local schools. If you live in an area with less expensive property, your local schools will not have the ability to properly fund themselves.

Poorer areas have more crime. They pay their teachers less. So they have a huge issue recruiting qualified teachers. They cannot provide students with all of the tools they need to succeed. No computers or current textbooks. Schools in warm areas will not have air conditioning. Some in cold areas will have inadequate or broken heating. The building infrastructure may be falling apart with leaky pipes and dysfunctional bathrooms.

Distraction after distraction makes it a difficult environment to learn.

Kids in poor areas are also more likely to be food insecure due to food deserts and sometimes they lack free school lunch programs. Hungry kids do much worse in school. It is hard to concentrate when you are hungry.

So in order for a Black student to succeed in an underfunded school they have to overcome the following variables... hunger, less qualified teachers, lack of school supplies, deteriorating facilities, outdated textbooks, lack of educational technologies, and they are poorly educated about sex and drugs. Many can easily fall victim to addiction and the consequences of sexual activity. They are also overpoliced and overdisciplined. Often getting suspensions and expulsions for the same behaviors as white students who only get warnings or detention. They get suspended 4 times as much.

Under those circumstances, even the brightest and most hardworking kids might struggle to reach their potential. Their grades will suffer. Their test scores will be lower.

On paper, they don't look like a good candidate for admission.

Affirmative action was a way to give those kids with potential a second chance at a good school. Recruiters could judge the students on other variables. They could take into account all of the educational obstacles. And they could admit people who probably would have thrived if they were born in a different zip code.

If someone goes to a good school and has good grades and test scores, they will find a place to get a higher education. Maybe not their first choice. Maybe not a fancy Ivy League school. But they will get a good college education *somewhere*.

If someone went to a bad school and had no chance at achievement... without affirmative action they might not get into any college at all.

If Republicans want to level the playing field, perhaps start with public school funding. (And stop voting against lunch programs for chrissake.)

Until that happens, ending affirmative action will make the cycle of poverty that much harder to break.

292 notes

·

View notes

Text

Fellah Cultivation Methods and Crops (1840-1914)

At the end of Ottoman rule, 75% of land was devoted to growing grains. A two-field system was common, with wheat and barley grown as winter crops on one half while the other half had a summer dew crop of sesame and Indian millet. The following season, the second half had the winter crop with the first half left fallow (Atran, 1986: 277). Other crops grown included dura, beans, fenugreek, and chickpeas, along with olives, grapes, cotton and oranges. Fallowing was widely used, allowing grazing cattle to feed on the fallow lands. The extensive system was not geared towards profit making but subsistence. The Ottoman government tried to outlaw fallowing by repossessing untilled land, but was largely unsuccessful (Atran, 1986: 278). Terracing was practiced in the hills with olive trees grown everywhere used as a source of oil and soap. By 1910 citrus groves covered 3,000 hectares. Vegetables were grown where irrigation was possible. The fellah [peasants] used homemade implements – a light nail plow, a sickle, a threshing board and two sieves [...].

Beginning with the 1858 Land Code, the Ottoman government, in an attempt to extract more taxes from the Fellaheen, tried to institute policies to transform land ownership. The goal was effectively to undermine «the system of collective holding and to institute an individual land-holding system» (Atran, 1986: 274). The code stipulated that a village could not communally own land and that titles should be given to each individual. Moreover, non-cultivated (Musha’a [collectively held]) land could not be the property of the fellah and would belong to the state. The 1876 Land Law decreed that Mulk [Sultan-granted] land held by notables who were not providing to services to the Sultan would be seized and could be sold to Europeans. One of the most notable purchasers was Baron Rothschild, who spent an estimated 10 million pounds sterling on land purchases, the construction of settlements, the establishment of plantations and manufacturing plants producing silk, glass, wine and water. He guaranteed the Jewish settlers who came to work on these plantations a minimum income (Aharoni, 1991: 57). At the same time the World Zionist Organization (WZO) was founded in 1897 and created the Keren Kayemet fund (JNF) for land purchases two years later. With their help, Jewish-owned land increased from 25,000 dunums [square kilometers] in 1882 to 1.6 million dunums by 1941.

Throughout these changes, the situation of the peasantry grew progressively worse as the tax burden increased. Often the fellah was forced to borrow money to make ends meet and many ended up selling the titles to their land, which they continued to work on, but with reduced benefits. By the turn of the century, six families in Palestine (the effendi) owned 23% per cent of all cultivated land, while 16, 910 families owned only 6% (Awartani, 1993).

The British Mandate (1914-1948)

Following the First World War, Palestine was designated as a mandated territory to Britain to rule the country until it become ready for independence. Along with this was the provision, first enshrined in the Balfour Declaration of 1917, to secure a national home for the Jewish people in Palestine. When the British received the Mandate for Palestine, the land issue was highly contentious. This is because the Mandate included the incompatible goals of «encouraging close settlement by Jews on the land» while at the same time «ensuring that the rights and position of other sections of the population are not prejudiced».

The British put into place policies that permitted the transfer of the land to the European settlers. The first being the transfer law of 1921, which granted individual holders the right to become the private owners of their land. Another law, the rural property tax, stipulated that land not cultivated for three years could be seized by the state and «be made use of in a more efficient way» (Zu’bi, 1981: 99). [...][D]espite new policies which tightened laws regarding Jewish land acquisition after 1929, the period of the mandatory government saw widespread expansion of Jewish agricultural settlements in Palestine (Table 1). For example, from 1900 to 1927, the area owned by the Jewish sector expanded from 42,060 to 90,300 ha: an average increase of under 2,000 ha a year. While from 1932 to 1941, after the riots, the area expanded from 105,850 ha to 160,480 ha – an average annual increase of 6,000 ha.

The quality of the soils of the land purchased is debated among scholars. According to Alon Tal, an Israeli environmental historian: «Though the real estate that Arab landlords were willing to sell was largely malaria infested swamps and wastelands, new agricultural settlements soon began to dot the map of Palestine» (Tal, 2006: 4). On the other hand, «The main areas appropriated by European investors were those concentrated in the maritime plain, the most fertile area in Palestine, specializing in citrus production» (Atran, 1989: 739).

Zu’bi (1981: 99) also writes, «Under British Colonization, the land appropriated by European (Jewish) settlers was the most densely populated areas. In 1921, the transfer of 240,000 dunums in the Beisan (Galilee) area to the European sector resulted in the dispossession of 8,730 families living from this land. By 1929 it was reported, 29.4% of peasant families’ land [that is, the land of 29.4% of peasant families] was expropriated as a result of the Zionist settlement».

– 2009. Leah Temper, “Creating Facts on the Ground: Agriculture in Israel and Palestine (1882-2000),” Historia Agraria 48, pp. 75-110.

101 notes

·

View notes

Text

Conditional financial clairvoyance was a difficult thing for the market to adapt to. How does one regulate a market that exists with a circular relationship to time? How does one regulate and punish fraud before it can be performed? How does the American legal system exercise power have across time as well as space? How can a market exist when the calculation of risk assessment seems to break physics itself?

The answer is deceptively simple: a state monopoly on violence. Little had to change.

The problem then becomes one of logistics. The efficient organization of legal resources, law enforcement, the tracking and investigation of crime. All of these state organs already struggled managing the flow of information from a single, stable, present. Attempting to manage a bureaucracy for a subfinite number of potential presents was thought to be impossible.

Enter, the hyperbureacracy.

Observation. This was the key. Observed particles behave differently than unobserved particles. The market works the same way. Through constant and specific observation of key market elements and a careful recording of these elements, the FTC is able to take the market singularity created by fully sub-transcendant plutophants, and quote "flatten it out like pizza dough" stretching out and pinning down the event horizon like the wings of a dead butterfly into what has been described as anything from an "event fog" to a "semi-permeable event manifold". This system of observation and recording a hyperchronological system forms what we now know as the Federal Trade Hyperbureacracy.

Few truly understand internal fiscal policy. FTH regulatory guidelines must be published in specific ciphers that blunt the texts transchronological properties. Attempting to interact with FTH regulatory guidelines without training can cause extreme psychoeconomic damage. As of 2011, the tax code eclipsed 144,000 pages. Few have read the Tax Codex in it's entirety, and those that do rarely survive.

Study is ongoing.

1K notes

·

View notes

Note

marriage of convenience and hair brushing/braiding for rexwalker, if you feel up to it?

Fanfiction Trope MASH-UP: Send me two (2) tropes from this list + a ship and I’ll describe how I’d combine them in the same story.

This ask meme is from over a year ago. Please don't send new prompts.

52. Marriage of Convenience

94. Hair Brushing/Braiding

Is it bad that my first thought is actually inspired by the Ob*kin fic Their fragrance came from you? There's a whole thing about Tatooine marriage braids that my mind immediately jumps to lmao

I think... let's say modern AU. Anakin is a single dad, has been for a few years. Padme died in childbirth, and while her will was made out in favor of Anakin and the kids, the executor of her will was her lawyer-mentor, Palpatine, who couldn't touch the trust funds set up for the twins (which are very large, and will become available when they turn 25, but can only be accessed for education costs before then), but did manage to somehow take almost all the liquid assets left for Anakin in bogus fees.

Anakin's still got the house, but as time passes, he's having more and more trouble with paying the property taxes. He's still managing, but the money Padme left for him is slowly dwindling, and the kids are going to start costing more as they get older, and he's already got Ahsoka living with him (she helps out with the kids so he can work, coding from home, since he's paying for her college tuition; she doesn't have to pay rent since she's a commuter student, and she's got a partial scholarship, but that's still a few thousand a year coming out of Anakin's pocket to put his little sister through underrad). Obi-Wan offered to help, but Obi-Wan lives on the other side of town and even tenured professors don't earn that much, compared to Coruscant's standard cost of living, especially since Obi-Wan adopted recently, a little girl called Reva, and--

Anakin's struggling financially, basically, which isn't a new circumstance, but he really doesn't want to lose Padme's house. Worst comes to worst, he can probably sell it back to Sola so it stays in the Naberrie family, and she'll let him keep living there, but... that's not a sure bet. The Naberries are comfortably wealthy, but it's still an entire house.

Rex, a college friend of Anakin's that went to the same aerospace program, comes back to town. He was on a military tour overseas, but got honorably discharged due to a head injury. Anakin offers to let hm sleep in the guest room, since Padme's house (it's still Padme's, in Anakin's mind), is a lot bigger than Cody's apartment, even if there are toddlers at large. Rex initially promises that he'll only stay long enough to find an apartment of his own, except he overhears Anakin on the phone with Obi-Wan about the finance stuff one day, and reaches out to a few people who have been in town more consistently for a better idea of what's going on without getting too deep into Anakin's business.

Rex manages to get a job locally; there's an airfield for hobbyists a few miles out of town, and the place is looking to hire a new engineer on staff to do repairs and checks on the small planes they keep on site. He starts making noises about moving out, and then, 'subtly,' suggests he just stay at Anakin's place and pay rent.

Anakin does not like the idea of Rex paying rent; friends don't do that! Anakin isn't going to make Rex pay rent in Anakin's home.

They don't talk about it for a few days, and then there's... IDK a night 'off,' where Obi-Wan or Sola or Aayla or Beru takes the twins for an evening, and Ahsoka goes out with friends, so Anakin can take some time off from being a Dad and just Relax.

He and Rex break out the wine, get tipsy not truly drunk, and Rex pokes at the 'just stay here' option again. The house is closer to the airfield than most apartments, and Rex can help take some of the weight off of Anakin and Ahsoka's shoulders with regards to childcare! Even if Anakin won't accept him paying rent!

Anakin argues this. Anakin's kids aren't Rex's responsibility, and Anakin doesn't need his charity (which is, of course, how he views Rex's suggestion). They go back and forth on the topic a few times, and then Rex throws out something about getting married 'for lower taxes' and 'it's not rent if it's my house too, right?' and it's. It's a joke.

Except they're both still thinking about it the next morning, with faint (but not faint enough) memories of a tipsy kiss before bed, and--

Months pass with the two of them circling around each other and Rex never quite moves out, and tax season rolls around, and Anakin is stretched so thin, even with all the cuts for children and covering a dependent's tuition and so on.

Rex quietly floats the idea of a convenience marriage again. It doesn't have to mean anything, if Anakin doesn't want it to. It's not an insult to Padme's memory, just a way of keeping her children in the house she chose for them. And it's not charity, because Rex will get tax cuts too, and better health insurance once Anakin can put him on the family plan he's got. It won't do anything for this year, but by the time the next year rolls around, Anakin will have less of a problem paying those taxes, even if that promotion he's been hoping for doesn't come through.

Anakin, eventually, agrees.

Just four months later, they tie the knot. It's a small ceremony, more than just a courthouse and a paper, just to... well, Anakin wants Rex to have this. Leia and Luke don't entirely understand what's going on, but Ahsoka told them that it means Rex is going to be staying for a lot longer than they originally planned, and they're pretty excited about that part. They're four, and 'Daddy's friend that we like a lot is staying' is pretty clear.

They don't have a 'traditional' wedding night, because they're still both looking at this as a platonic thing (it won't stay that way, but it still is for now). They do share a bed, because someone is sleeping in their guest room (IDK who, maybe a guest was too drunk post-wedding to get home and they just offered the room). Anakin's hair is long enough for an evening of people and, importantly, sticky toddler hands to have tangled it. He washes it out, comes to the bed, and looks so tired--because he had to wash the toddlers first--that Rex offers to brush it for him.

It's intimate. Gentlemanly, but intimate. They go to bed with warm cheeks and pounding hearts, and eventually, one of them rolls onto their side to cuddle.

Neither of them get much sleep that night.

#star wars#the clone wars#rexwalker#captain rex#anakin skywalker#ahsoka tano#skywalker twins#modern au#obi wan kenobi#phoenix answers memes

191 notes

·

View notes

Text

More on Transparency

If i had legislative power for 24 hours I think I would eliminate income tax privacy. Internal revenue code 6103 guarantees the privacy of tax returns, but this wasn't always the case and I think there's a strong argument that it is unhealthy for our democracy.

My definition of patriotism includes 'paying your fair share' near the top of the list and it's hard for the public to vote for equitable, much less progressive, tax policy if they can't see tangible examples of who pays what. Mark Cuban is a rare example of a billionaire who proudly shares what he pays. Wouldn't it be great if billionaires earned each other's esteem by bragging about the size of their tax bill rather than the size of their yacht?

The interesting thing is that property taxes aren't private. You can search any property, see the assessed value, the name of the owner and whether the property taxes have been paid. Why can't income taxes work the same way?

Second on my list would be the elimination of gerrymandered voting districts. I've read numerous articles conclusively demonstrating that gerrymandered districts drive polarity in each party as candidates no longer need to seek a centrist position in order to get elected.

Next would be reversal of Citizens United and implementation of new campaign funding laws.

I suppose healthcare would be on the list too, but I'm not sure where to begin with that one.

Serious question... what would be on your legislative list?

33 notes

·

View notes

Text

Transforming commercial property finances with cost segregation

Discover the power of cost segregation in transforming commercial property finances with our captivating case study, spotlighting remarkable improvements attainable via tax code optimization.

0 notes

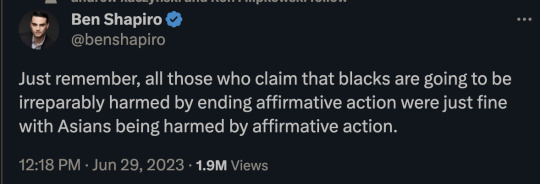

Photo

Do you overpay your property taxes?

There is no reason to overpay property taxes when we are here to assist you! To learn more visit https://www.poconnor.com/commercial-property-tax-protection-program/

#o connor & associates#texas property tax code#texas personal property tax Rate#Property tax appeal houston#houston property tax protest

0 notes

Text

If your city is a Brand, it’s already too late

Long post time. What is it that drives gentrification? Also, what is gentrification? Is it when a city gets blue hair and pronouns? No, it probably already had those.

Gentrification is the result of concentration of wealth in the hands of business owners, including landlords, over and above the hands of residents.

Let’s start with rent. Rent, like any good, is priced according to the laws of supply and demand. Supply of available rental housing is primarily determined by construction costs and estimated return on investment for new construction, and property management costs and estimated return on investment for existing units.

Breaking that down a bit, the higher construction costs get the higher the rent needs to be to break even on new construction. Construction costs include labor (which can always go down but you want it high for moral and practical reasons), materials (highly variable depending on the project) and bureaucratic costs. A bureaucratic cost is a cost that is based on how projects fit into the legal and practical environment, and are usually non-negotiable. Dig Safe, a program which requires three days of surveying local records before breaking ground, is an example where the function is to prevent crews from flattening a neighborhood by puncturing a gas main. Environmental Impact Statements, Fire Codes, Habitability Guidelines, and other regulations increase costs to projects. These programs are good and need to exist, but do stop smaller projects from happening at all because the capital investment required just to actually break ground on a new house might cost as much as the land and materials put together at which point you might as well build another 120$/sqft luxury midrise.

Property management costs for existing units are largely dependent on age and wear. A unit with no occupant is going to depreciate little, and may also appreciate in value. Depreciation and appreciation here are sort of unintuitive because they can happen at the same time. Imagine an old luxury sports car with a high resale price. Driving depreciates the value because it’s literal condition is poorer, even as the resale value goes up over time. The appreciation needs to beat both inflation and the value of depreciation for it to go up in real value. For companies with large capital holdings however, losses such as through the upkeep of empty apartment buildings are useful to a point because they reduce these organizations’s tax burdens. A company that makes a killing on the stock market only has to pay taxes if they keep it: if they buy houses they then don’t rent, they can claim they “lost” their stock market earnings with “bad investments” and then pay no tax while saving the real estate to rent later. Again, this favors the largest possible projects and the largest possible operators because small companies can be killed by an unprofitable quarter or 4 while large ones explicitly benefit from unprofitability in reducing their tax burden.

Expected ROI is the final piece of this, which affects both new and existing units. Every private developer and landlord wants to make as much money as they can, unless they are explicitly are renting as a service. An example of renting as a service would be families, who will rent to each other at favorable rates or for free, privileging people with large and/or wealthy families that are friendly with each other. Now, ROI is also subject to supply and demand. Everyone wants to build 120$/sqft luxury apartments but once everybody does nobody can sell/rent for those prices without setting a price floor and waiting for buyers to catch up. If you are a small developer, you can’t afford to do this. Your expenses will eat you alive. If you are a big developer, though, those expenses are offsetting the gains you make and serving to reduce you tax bill. Units at prices nobody can pay are effectively furloughed, meaning off the market, and, so long as they remain cheap to maintain, will remain that way, artificially restricting supply. It doesn’t matter if it’s for sale or not when it’s at a price you can’t afford. (Sidebar, anyone who tells you that the minimum wage depresses hiring because it artificially restricts demand is lying to you. It’s not strictly false, but like the above it’s a multi-variable equation and blanket statements about cost of labor are aimed at killing wages.)

What this alludes to also is a need for greater income equality. In order for rental to be a competitive option with furlough, not only does the price of furlough have to be increased, the real value of wages have to be increased in order to create opportunities for people to splurge. This is a twofold strategy, of both increasing the rewards of putting units on the market and increasing the costs of keeping them off. If real wages barely cover cost of living, or don’t cover cost of living, nobody can realistically spend more real wages on rent regardless of the percentage of their income it is. (Real wages here refers to the political power implied by dollar wages. A dollar is really worth whatever it can be exchanged for, whether that is a candy bar or a square inch of a 144$/sqft condo) The real value of everything except time and land are also constantly going down because of constant improvements in manufacturing. The cost in acres of land and hours of labor of a pound of beef, a bolt of cloth, or a pint of beer have dropped dramatically in the last century. Unfortunately, land is one of the few things that remains in marxist terms uncommodifiable, because it cannot be fully abstracted from the physical properties that make it valuable and we can’t make more of it just by making a better machine. This means that as the real value of things goes down because of supply and demand, the value of land only goes up because the supply is hard capped. If the value of everything under capitalism must go down because of increased production, while the value of capitalist assets must go up, or the system collapses, it makes sense that land would become a fixed point in that equation, the marxist speed of light observable from all reference points. The best approximation of land as commodity is, what else, apartments, which make available as living space the empty air above us. Because production never stops, the value of everything but land must go down. Therefore, as time passes, the price of land, and hence the price of housing, must tend upwards. Therefore, in order for housing to remain affordable, real wages must grow. This is the opposite of what is currently happening, as real wages have gone down for decades.

This income inequality which is one facet of capitalism is not new. For as long as people have lived in urban areas there have been issues between the abject class, the working class, the ruling class, and the professional class, a four part distinction I will seriously argue for in opposition to a lot of marxist theorists. The ruling and working classes ought to be familiar, or at least self explanatory. However, the other two classes I identify, the professionals and the abject, are useful to this analysis because they fill both a racial gap in the primarily marxist analysis I put forward and identify the two most likely groups to rent, which is to say the worker who works to produce but owns without governing and the professional who works to govern but does not own. The ruling class both governs and owns, but its court is full of courtiers who are there to push various agendas from within the rule of law without per se producing. Likewise, the working class pensioner exists in opposition to the abject who is denied the opportunity or the resources to be productive explicitly as a means to manufacture a threat against which inter-class solidarity between the workers and the rulers is developed. The textbook nazi conspiracy theory about “elites” doing a great racial replacement picks out perfectly what I mean by both the racial character of the professional and the abject and their utilization to foster solidarity between your plumber uncle and Elon Musk. This is relevant to both the broad theme of gentrification and the narrow theme of rent because gentrification is a wedge issue that divides the working class and the professional class far more than its impact on any other. The working class’ disidentification with doctors, lawyers, PMCs and other yuppie types, as well as the professional class’ disidentification with union politics, illegalism, and radicalism in general is brought to firecrackers in virtually any conversation about gentrification which seems in passing to be more about tapas bars than about real politics. Likewise, these groups shared distrust of and disdain for the abject, who are explicitly labeled by the state as constitutionally guilty, is the basis for the very broken windows policing strategy that empties neighborhoods of minorities regardless of class. The Rent is Too Damn High, and excluding homeless people from the “working” working class is a big part of how we got here specifically because the interests of small time owners and small time government functionaries, carried to their conclusions, are necessarily self defeating. These two groups eliminate the presence of the abject from their spaces at their own financial peril.

In addition to class, there is also a specific historical movement that is crucial to the understanding of gentrification as it exists, which is the movement of factories in search of cheap labor. The United States is not a good place to find cheap urban labor. You build a factory and suddenly everyone complains about air quality and labor violations and you can’t just kill them because everyone has lawyers. You kill one (us citizen) organizer and the NLRB is trying to get you in court for intimidation. What’s the country come to? But a shipping container costs a quarter cent per mile and the goods aren’t perishable so you go to Guangzhou or Cape Town where you can kill union bosses in peace. But for the American city, that’s a loss of what once made land prime real estate. What jobs can replace the insatiable demand for labor that a 24 hour paper mill once produced? Service labor, which crucially is site specific and therefore not outsourceable, is what the US has predominantly turned to. (and arms manufacturing which is not outsourced for very different reasons) However, service labor is only in demand if there is already a stable population that can be served, which requires a constant influx of capital holders in demand of service. This is why Airbnb exists and is hollowing out rental availability, why Boston as a college town is the way it is, and why there are in fact so many damn tapas bars. Fred Salveucci talked about being able to go north of the expressway in the 70s and being able to get a plate of mac and beans for half a buck. I went looking for a 5$ slice of pizza on my lunch break today around Government Center and found two places that were boarded up and ended up spending 20$ at Chilacates. Cities are being slowly turned into Cancun, complete with the fences to keep out the homeless.

What can be done about this? Obviously the factors we’ve discussed that favor consolidation of housing are mostly either contained within a gordion’s knot of tax policy or intrinsic to capitalism/goods as commodities. But, given that we narrow our objectives to making the rent lower, some obvious weaknesses jump out: increasing the cost of vacancy forces units out of furlough, because companies are no longer able to justify the losses, and increasing real wages increases the availability of capital for workers to spend on rent. These are the prongs I talked about earlier.

Legal means to pursue each prong exist. Both a minimum wage and a maximum wage, depending on their implementation, can potentially increase real wages, and vacancy taxes directly increase the costs of vacancy. The government can also ignore the market and directly mandate maximum rents within certain parameters. This tends to decrease the long term supply of housing for the reasons discussed at the outset, given that if the revenues from house building don’t cover the costs of building, less gets built. However, any political movement that exists exclusively within the white lines of the law fails to genuinely threaten change. Landlords, like bosses, break the law constantly with the impunity that a lawyer provides them against consequence. This is why a healthy dose of illegalism is an important part of any effective political movement. The most direct action one can take is property occupation, or squatting. Squatter’s rights are nearly non-existent in the United States. The most leeway that any state grants to any unknown persons occupying a dwelling is 60 days notice to vacate the property, and there are states that allow no notice evictions or lack statutes governing squatting at all. Every single state regards the occupation of owned property as trespassing, meaning most kinds of squatting are prosecutable offenses. However, squatting, even temporarily in ways that don’t expose the squatter to liability provided they don’t get caught, can seriously impact the value of properties. You have heard of rent lowering gunshots. This is the serious version of that. At the same time, illegal action needs legal defense, both in terms of non-compliance with police to protect those willing to take illegal actions from arrest and in terms of legal, 1st amendment protected disruption to keep focus on the issue. The most effective movements have a radical wing and a institutionalist wing who do not acknowledge each other but share the same tactics and objectives.

If you are housed, you need to be willing to protect and support homeless people because they are your front line. Start or join an Occupy movement, where they are your peers in occupying a public space illegally in a way that is too public to prosecute. Give to people on the street, and smash anti-homeless architecture if nobody is watching. Be willing to distract cops if you see someone doing something dodgy so they can get away. Remember that following the law is a tactic, and so is breaking it.

The case for this being on my transit blog is arguably weak, but I felt compelled after a particularly hateful experience looking at facebook memes about homeless people on the T. You should want those people there. You should want those people breaking down the doors of luxury apartments and setting up shop. You should want them keeping your city safe because the cops you hire to separate you from them will train their guns on you next.

And for gods sake, don’t let your city become a brand. Branding is marketing. Branding is clean, and bloodless, and a gloved hand around your throat that leaves no fingerprints.

23 notes

·

View notes

Text

This is a wonderful planet, and it is being completely destroyed by people who have too much money and power and no empathy. -Alice Walker

Spot the difference.

“Tory MP apologises for failing to report extra earnings on time.” Guardian: 19/10/15)

Tory MP failed to notice receiving £400,00 in outside earnings. (Financial Times: 04/02/16)

Boris Johnson apologises to Commons for failing to declare £52,000 earnings on time." sky news: 06/12/18)

“A Conservative MP has not been formally disciplined despite breaching rules on declaring interests after being lent £150,000 by a businessman for a rental property and then writing to a financial watchdog to praise the same person." (Guardian: 21/11/22)

“Nadhim Zahawi is under scrutiny over a multi-million pound tax dispute. The Conservative chairman says he made a “careless and not deliberate” error according to HM Revenue & Customs (HMRC), but he is now facing calls to resign." (4 news: 25/01/23)

“Rishi Sunak "inadvertently" broke the code of conduct for MPs by not correctly declaring his wife's financial interest in a childminding company set to benefit from government support” sky news: 24/08/23).

Did you spot the difference. No? Of course not, there isn’t any. All of the above failures to declare financial interests or income were all slips of memory and totally unintentional.

It must be really nice to have so much money that you cannot remember how much you have or where you last stashed it.

#uk politics#rishi sunak#boris johnson#nadhim zahawi#tory#mps#ethics#rules#breaking ministerial code

38 notes

·

View notes

Note

ML plot point: Minor thing, but an interesting one. Gabriel, Nathalie and Emilie used the Butterfly miraculous to remodel their home directly after it was built. This is why the Agreste manor has a lair and a catacomb. They also put a lot of secret passageways and traps/defenses both magical and mundane. The akuma they used is Domain, an akumatised Nathalie who basically has a mix of Overhaul's and Mimic's quirks so long as she's inside the property. They basically committed magical tax fraud.

Magical tax fraud!

Tbh I'm more concerned with the building codes. Get OSHA on that fucker.

But also this is the best explaination for the bullshit in the mansion.

21 notes

·

View notes

Text

Friday, Fuck It All.

I dropped off my taxes with my CPA. She was pleased to see how everything was neatly organized, with color coded tabs. I’m currently stewing over how much I’m going to pay this year, and I’m not in a good place about it.

Yesterday’s email about the other Texas project ruffled some feathers. So today I’m going to have a call and hopefully get everyone updated and calmed the fuck down. Still not certain if the property wants to spend the $5M + on this building.

Still no inkling about a “future work” call. So I’m rudderless in the water, without any wind. Drifting with the current. As you can imagine, I’m not in a good place about that.

Last night I had at least 5 stress dreams that woke me up. No death or sickness dreams. Just dreams about the stress involved with starting over, again. As in, I’m going to have to figure out the next path of my life, and quickly. 18, 24, 30, 35, 40, 47….Hell, what difference would 51 make? I should be used to starting over by now.

<holding space for No. 5> because it’s only 1:00PM, and something else is bound to fuck me over today

If only I could catch that break. Any takers on who or what is going to fuck me over this afternoon? I’m good for a hondo on a side bet.

12 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Jan. 9, 2024

"Almost nobody says we should have the richest pay the least. And yet when we look around the country, the vast majority of states have tax systems that do just that."

Nearly every state and local tax system in the U.S. is fueling the nation's inequality crisis by forcing lower- and middle-class families to contribute a larger share of their incomes than their rich counterparts, according to a new study published Tuesday.

Titled Who Pays?, the analysis by the Institute on Taxation and Economic Policy (ITEP) examines in detail the tax systems of all 50 U.S. states, including the rates paid by different income segments.

In 41 states, ITEP found, the richest 1% are taxed at a lower rate than any other income group. Forty-six states tax the top 1% at a lower rate than middle-income families.

"When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least," said ITEP research director Carl Davis. "And yet when we look around the country, the vast majority of states have tax systems that do just that."

"There's an alarming gap here between what the public wants and what state lawmakers have delivered," Davis added.

In recent years, dozens of states across the U.S. have launched what the Center on Budget and Policy Priorities recently called a "tax-cutting spree," permanently slashing tax rates for corporations and the wealthy during a pandemic that saw billionaire wealth skyrocket and company profits soar.

A report released last week, as Common Dreamsreported, showed ultra-rich Americans are currently sitting on $8.5 trillion in untaxed assets.

According to ITEP's new study, tax systems in just six states—California, Maine, Minnesota, New Jersey, New York, and Vermont—and the District of Columbia are progressive, helping to reduce the chasm between rich taxpayers and other residents.

Massachusetts, which has one of the more equitable tax systems in the nation, collected $1.5 billion in revenue last year thanks to its recently enacted millionaires tax, a measure that improved the state's ranking by 10 spots in ITEP's Tax Inequality Index. Minnesota has also ramped up its taxes on the rich over the past several years while expanding benefits for lower-income families, ITEP's study observes.

"The regressive state tax laws we see today are a policy choice, and it's clear there are better choices available to lawmakers."

But the full picture of U.S. state and local systems is grim. In 44 states, tax laws "worsen income inequality by making incomes more unequal after collecting state and local taxes," ITEP found.

Florida has the most regressive tax code in the U.S., with the richest 1% paying a mere 2.7% tax rate while the poorest 20% pay 13.2%.

Florida is among the U.S. states that don't have personal income taxes, which forces them to rely on consumption and property taxes that are "nearly always regressive," ITEP notes in the new analysis.

"Eight of the 10 most regressive tax systems—Florida, Washington, Tennessee, Nevada, South Dakota, Texas, Arkansas, and Louisiana—rely heavily on regressive sales and excise taxes," the study says. "As a group, these eight states derive 52% of their tax revenue from these taxes, compared to the national average of 34%."

Aidan Davis, ITEP's state policy director, said that "we've seen a lot of states shift their tax systems to become even more regressive in recent years by enacting deep tax cuts for the wealthiest."

The report points to Kentucky's adoption of a flat tax and repeated corporate tax cuts, which "delivered the largest windfall to families in the upper part of the income scale and have been paid for in part through new or higher sales and excise taxes on a long list of items such as car repairs, parking, moving services, bowling, gym memberships, tobacco, vaping, pet care, and ride-share rides."

Davis said that "we know it doesn't have to be like this," arguing there is a "clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off."

"The regressive state tax laws we see today are a policy choice," said Davis, "and it's clear there are better choices available to lawmakers."

#regressive tax code#progressive tax code#tax the rich#wealth inequality#income inequality#tax law#politics#itep#public policy

9 notes

·

View notes