#Myths of stock market

Text

Unveiling the Myths in the Stock Market: Separating Fact from Fiction

Title: Unveiling the Myths in the Stock Market: Separating Fact from Fiction

Introduction:

The stock market is a complex and dynamic ecosystem that has fascinated and confounded investors for generations. As individuals navigate this financial realm, they often encounter a myriad of myths that can influence their decisions and perceptions. In this blog post, we aim to debunk some common myths…

View On WordPress

#commission-free trading#debunking myths#diversification#ETFs#financial decisions#financial education#financial goals#financial myths#fractional shares#informed investing.#investing myths#Investment Strategies#investor community#long-term investing#market timing#Market Trends#Market volatility#online trading#Risk Management#stock market#stock market misconceptions#stock market realities

0 notes

Text

Busting Myths and Fears of Stock Market Investment in India: A Comprehensive Guide

Introduction:

Investing in the stock market can seem intimidating, especially with the various myths and fears associated with it. However, understanding the realities and dispelling these misconceptions is crucial for those looking to grow their wealth and achieve financial goals. In this comprehensive guide, we will debunk common myths surrounding stock market investment in India. By providing…

View On WordPress

#Financial education#Individual investors#Investment myths#Long-term investing#Stock market investing

0 notes

Text

#StocksToBuy#stocks#StockMarket#finance#stock#krishafinance#broker#bestdemataccount#freedemataccount#India#stockbroker#myth#investment#fact#market#capital

0 notes

Text

What a lot of people don't understand about holistic and natural medicine is that it IS rooted in science. To say that ancestral knowledge passed down is not real because it doesn't have clinical studies run on it completes disregards the systems in which medicine is made. Modern medicine and the idea of something being "proven" to help or heal is based on what is studied and tested, which makes total sense, BUT what is overlooked is that what gets studied is completely dependent on what is funded. There are so many natural remedies passed down amongst all different cultures that utilize herbs and very accessible methods of medical intervention that are commonly seen us "myths" simply because people in power who choose what gets the proper clinical trials have their own agendas for what can be turned into financial gain and to say "there's no proof or study that this herb helps with this" is missing the bulk of information about how much capitalism and classism effects what is recognized given the necessary attention and resources in the scientific community.

I don't understand how so many people can consider themselves politically radicalized and anti capitalist but then flip flop when it comes to just this topic specifically as though knowledge on herbalism and techniques used for hundreds of years that aren't given medically funded backing are somehow just empty words and ignorant. Honestly, it's pretty transparently racist as well because so much of what is overlooked or shot down tends to be cultural knowledge and heritage passed down in oppressed groups and communities who's cultures in general get dehumanized in a lot of ways socially AND systemically!

They didn't even start doing clinical trials including studies on female bodies until extremely recently in the scope of how long modern medicine has been manufactured and yet people want to roll their eyes at the idea that natural medicine has existed for the people by the people for longer than any pharmaceutical can match up against.

So maybe instead of calling anyone who doesn't fully trust these large stock market companies with public health, people should consider the history of who gets an official say in what gets the money necessary for those clinical trials to take place that make that medicine "scientifically proven".

I did not understand the weight of this topic till I had my own diagnoses with a chronic condition that 99% of the time effects women and realized how drastically biased the medical systems care is and how directionless the care is for patients depending on who they are. And I really don't care if people with the privilege of not knowing that system intimately think it's not real till it's on Web MD.

142 notes

·

View notes

Text

Just a reminder that the "businesses are all closing down because of crime" is a Myth.

It is corporate PR by executives who get bit in the ass by COVID screwing with their gentrification projections. As an example:

Target just closed its location on 117th street "because of all the stealing."

Target at e 116th had about 201 crimes in 2022. Robberies, larcenies, shoplifting, all totaled 201 instances via NYPD crime data. The Target on 86th and 3rd had 380-ish incidents in 2022 and isn't being closed. Target is also opening up another location within a mile at 125th and Lenox.

That shopping plaza on e 117th actually has lower crime rates.

The National Retailer Federation even came out recently and said they're not seeing any data to show any substantive increase in theft loss.

CVS is decrying "losses from theft" while spending 10 billion on stock buybacks so executives would get massive bonuses. I wonder where all their money is going.

It's telling that these narratives only exist for cities in Democrat-aligned areas or states, like NYC or California while Republican-aligned cities and states have the most theft by a mile. Jacksonville Florida's property crime rate is 34.45% higher than NYC's. Memphis Tenneessee's property crime rate is 276.75% of NYC's.

It's literal corporate, right-wing propaganda that executives throw out there to excuse their own shitty business decisions and distract from how they're continuing to manipulate the stock market to make themselves richer.

#property crime#crime statistics#politics#propaganda#original content#right wing propaganda#republican#democrat

63 notes

·

View notes

Text

Forget 'Walking The Plank.' Pirate Portrayals—From Blackbeard to Captain Kidd—Are More Fantasy Than Fact.

How we think famous swashbucklers walked, talked, and dressed didn't come from the history books, so where did these pirate myths come from?

— By Jamie L. H. Goodall

An illustration from 19th-century artist Howard Pyle depicts a man being forced to walk the plank. Although there is no record of this type of punishment, it remains popular in pirate mythology. Photograph By Image Courtesy of Bridgeman Images

Say “pirate,” and people envision grizzled men with eye patches, parrots, and treasure maps. They picture buccaneers forcing their victims to walk the plank, and crying “Shiver me timbers” as they fly the Jolly Roger flag. It turns out, many of these stereotypes are not true. Pirates have been around for nearly as long as people have sailed the world’s waters, and, in fact, still exist. It’s just how they’ve been depicted that’s often misleading. So where did these misinterpretations come from?

A replica pirate ship cruising the Caribbean Sea near the Dominican Republic. Photograph By Thomas Grau, Alamy Stock Photo

Pirate Fashion

Pirates are commonly portrayed wearing colourful attire. He may sport as a loose-fitting shirt with a bandana around his head, a scarf around his waist, ripped pants, wearing tattered boots, like Captain Jack Sparrow from the Pirates of the Caribbean film series. Or he may appear a bit foppish, much like Stede Bonnet, the "gentleman pirate" in the 2022 series Our Flag Means Death.

Common pop culture depictions of pirate garb, as shown here in this early 20th century artwork, are often based on fanciful descriptions of their attire and language. Photograph By Image Courtesy of Bridgeman Images

Unfortunately, these looks are just not true. Much of this ostentation came from American artist Howard Pyle, who took his inspiration from Spanish bandits of the late 19th century. Sailors in the 18th century, pirates included, wore things such as loose pants cut off at the knee and thigh-length blouses.

Prosthetic limbs are another common pirate trait. It’s true some pirates had a wooden leg or hook hand, though it probably wasn’t the norm. More often than not, amputations at sea were likely a death sentence. While ships carried medicine chests, and medical care was often meted out by someone on the crew, infection and blood loss could lead to death. Even if a pirate survived an amputation, his ability to fight would be limited. But losing a limb didn’t mean one could not continue on the ship; the person might serve the crew, for instance, as a cook.

Many pirate clichés stem from the 1950 film 'Treasure Island,' featuring Robert Newton as the fictional pirate Long John Silver. Photograph By United Archives GMBH, Alamy Stock Photo

Pirate Talk

Common pirate phrases—such as Arrrrr me mateys!” and “Shiver me timbers!”—are common in pirate movies and pop culture. But they’re not legitimate things a pirate would actually have said. Robert Louis Stevenson imagined some of them for his 1883 novel Treasure Island, published more than 150 years after the “golden age” of piracy.

The trope of talking like a pirate is mostly a product of 20th-century Hollywood. In particular, British actor Robert Newton, who played both Blackbeard and Long John Silver. His portrayal of the fictional captain in the 1950s rendition of Treasure Island used an exaggeration of his own West Country accent and would define the sound of a pirate's accent. His portrayal also popularised many of the sayings associated with pirates today. In reality, pirates most probably spoke in a manner similar to all sailors of the time.

An artist imagines the often-willing markets pirates found throughout the Atlantic world for their stolen loot. Transatlantic trade was critical for the success of European colonies. Photograph By Gregory Manchess

Treasure, Buried or Otherwise

Captain Kidd may have buried his treasure, but that was a rare exception for most pirates. Typically, they spent their ill-gotten gains on women and alcohol at pirate-friendly ports as quickly as they could. Burying treasure would be dangerous due to shifting sands and tides, so one might easily lose their treasure. And there was a distinct lack of trust, not knowing if others might deceptively go back to dig up the treasure on their own.

Also, much of the loot pirates collected was not in the form of silver or gold. Such treasure would have been difficult to come by. The more common "booty" would have been whatever goods or commodities they could get their hands on, including timber, furs, silks, cotton, spices, and medical supplies. They also loaded up on items to perform necessary repairs on their ships, including cable, rigging, and sails.

Top Left: A gold bar and coins recovered from the Spanish galleon 'Las Maravillas' that wrecked in 1656 near the Bahamas. Photograph By Jeff Rotman, Nature Picture Library, Alamy Stock Photo Top Right: Prized Spanish coins, or pieces of eight, recovered from the wreck of the 'Whydah Gally'. Photograph By Zuma Press Inc., Alamy Stock Photo Bottom: Wooden treasure chests were typically studded with metal to reinforce them. Photograph By Andyroland, IStock, Getty Images

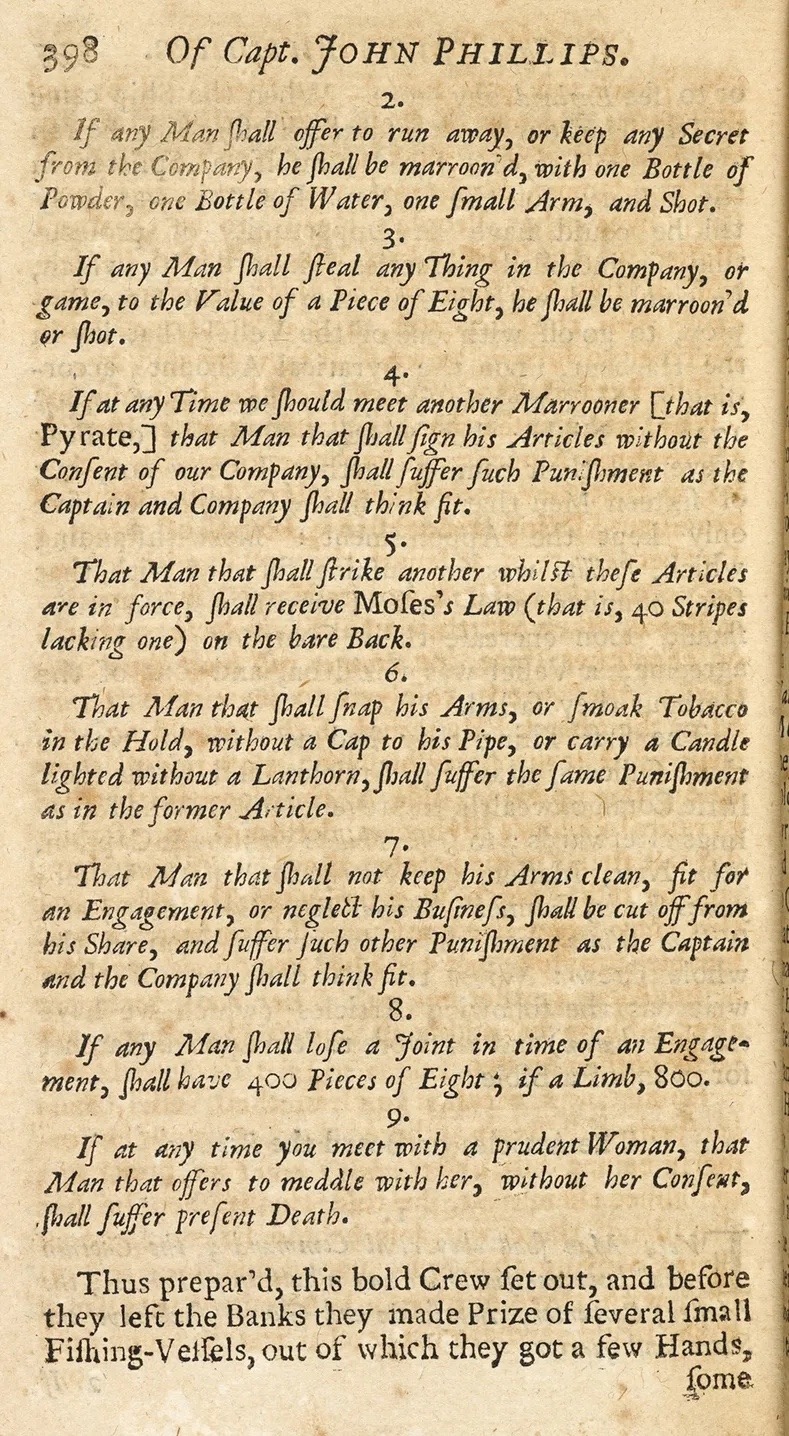

Pirate Codes

There is evidence that many pirate crews adopted a code of honour or articles of agreement, mostly to keep order on board the ship. These codes dealt with everything from how to divvy up loot, to what happened to pirates if they became injured in the line of duty, to how bad behaviour would be dealt with, to how prisoners would be treated. Some pirate articles have survived to this day, including the code of Englishman George Lowther and his crew, which, for example, compensated a person who lost a limb during a skirmish.

The 1724 articles of Captain John Phillips of the 'Revenge' discuss matters such as theft on board the ship and compensation for limbs lost during battle. Photograph By British Library Board. All Rights Reserved, Bridgeman Images

If a pirate violated the code, it is unlikely they were made to "walk the plank." Little to no historical evidence exists to support that practice, which was largely pulled from fiction, including Treasure Island. If victims were punished in some way, it was typically via keelhauling. Keelhauling was arguably a more hideous fate that involved an individual being tied to a rope and dragged under the ship. Victims of keelhauling either died by bleeding out from injuries inflicted by barnacles on the hull of the ship or by drowning. Other forms of punishment ranged from being thrown overboard to being lashed to being marooned on a desert isle.

Pirate Ships 🛳️ 🚢

Most pirates did not sail Spanish galleons, or even the frigates such as Captain Jack Sparrow’s Black Pearl. They favoured small, more manoeuvrable vessels, which allowed easy escape from larger warships that chased them. During the 16th and 17th centuries, sloops were the most common choice for pirates. They were quick and had a shallow draft, making easier escape into shallow waters. Schooners were another favourite of pirates. Similar to sloops, schooners were fast, simple to manoeuvre, and could easily hide in estuaries because of their shallow draft.

Top: A replica of the 17th-century Spanish galleon 'Neptune'. Photograph By Volodymyr Dvornyk, Shutterstock Middle: A crew raises the anchor from what is believed to be the remains of the pirate Blackbeard’s flagship, 'Queen Anne’s Revenge.' It was discovered in Beaufort Inlet, in Carteret County, North Carolina. Photograph By AP Photo, Robert Willett, The News & Observer

Bottom Left: The National Museum of the Royal Navy in Hampshire, England, displays a Jolly Roger that once belonged to Admiral Richard Curry, who seized it from pirates off the North African coast in 1790. Photograph By Andrew Matthews, Getty Images Bottom Right: Coves, such as this one near Bridgetown, Barbados, would have made perfect hideouts for pirates. Photograph By Fabio Mauri, Eyeem, Getty Images

And, despite popular myth, most pirates did not fly the famous Jolly Roger—a skull and crossbones symbol on a black flag. Some flew a black flag, which meant the pirate was willing to give quarter, while a red flag meant blood and certain death. Blackbeard’s flag showed a skeleton holding a spear pointing at a bleeding heart. Pirate crews also often held the flags of several different nations so they could raise a particular flag to signal being “friendly” to a passing ship, only to raise their pirate flag once they were in close enough range to attack said vessel.

Pirate Fights

One thing that most of the pop culture depictions of pirates got somewhat right is that they liked versatile weapons. Cutlasses, short swords with a slightly curved blade, could be used to effectively fight in the confined areas of a ship and could also be used to butcher meat.

Top: Bar shot were common tools for pirates, who used them at close range to destroy the rigging and sails of enemy ships. Due to the weights on either end of the bars, they would spin uncontrollably after being fired from a cannon. Bottom: This musket’s barrel and stock were cut down, likely so a pirate could more easily use it in close combat. Photographs By Kenneth Garrett

Pirates also enjoyed using a gun known as a blunderbuss. It had a distinct flared muzzle that sprayed small lead balls at intended victims. Cannons were also common onboard pirate ships. They could be loaded with chain shot (two cannonballs chained together), grapeshot (small cannonballs), or basic cannonballs. Their targets often didn’t stand a chance.

While books, movies, and popular culture may have taken liberty with descriptions of pirates through the ages, these pillagers have terrorised the seas for more than 2,000 years in one form or another, plundering victims and striking fear into their hearts. The most recent pirates work off the coasts of Somalia and Malaysia, looking far different from the “golden age” of piracy depictions. But one thing remains true: They are just as intimidating.

The 18th-century painting 'Anne Bonny, Female Pirate' by Fortunino Matania depicts Anne Bonny and an accomplice taking two sailors prisoner. Photograph By Image Courtesy of Historia, Shutterstock

#Culture | History#Pirate Portrayals#Blackbeard | Captain Kidd#Fantasy | Fact#Pirate Mythology#Pirate Ship 🛳️ 🚢#Pirate Garb#Fanciful | Descriptions#Attire Language#Treasure Island#Transatlantic Trade#European Colonies#Bahamas 🇧🇸

9 notes

·

View notes

Text

Meet The Character Monday

Only it's not Monday, it's Thursday. I've been skipping the past few Mondays, mainly because I forgot but also because of school.

Today, I bring you Victor Hans. A secondary protagonist in my black butler fic "Entrusted To You." (picrew brought to you by niseo who has wonderful art btw)

Victor has been alive for a long time. Records of his existence were lost centuries ago. Sired in 1346 to ensure his survival of the bubonic plague, he took his sire's family name and integrated with human society, weeding his way through the nobility. Physically, he's in his twenties, but he's actually 491 years old (not that old for a vampire) and is technically still a fledgling. Because he no longer controls blood circulation or temperature regulation of his body, he wears many black clothes that retain light and make him overheat, along with wearing scarves all year round. Considering he was brought back from the dead, his body temperature is lower than that of the average live person.

Vampire hunters started a myth that their blood could cure any ailment, thus leading people in search of them. Which birthed a market for supernatural trafficking. Werewolves fangs and fur for their strength, siren scales for their voice, ghost ectoplasm for vitality. You name it, apothecaries stocked up on it, feeding into the trade.

Years before he meets Sebastian, he is kidnapped, his fangs are ripped out, and he is harvested for his blood. The hunters didn't give him the mercy of killing him right then. Instead, they took him back to their caravan, where other supernatural creatures were kept in captivity. They were a traveling freakshow for humans to point, stare at, or even poke. He tried many times to escape but to no avail. He couldn't get past security. Two hulking gargoyles were watching; to the untrained eye, they were just statues.

In his grief, distraught by being the cause of Ciel's death, Sebastian finds a letter stating that this was the final job for him as the butler to the Queen's Guard Dog. Ciel had been keeping tabs on apothecaries throughout London thanks to the Undertaker because people were getting killed, and Scotland Yard wasn't sure why. Desperate and hoping that this could bring Ciel back, he complies with his final orders and hunts down how the apothecaries got their ingredients. Eventually, going undercover with Raziel and allowing himself to get "captured" by the vampire hunters. (Think how Sebastian and Ciel infiltrate the circus)

When Victor meets Sebastian, he hates him. He's coddled by the demon and treated as someone he isn't, all because Sebastian sees him as Ciel and sees him as a second chance to be his butler again. Victor refuses to talk to him or even stand in the same room as him, but he has to ensure his safety. His disobedience lands him on a trip to the boss's office, where he is beaten. The human forces him to fight, even going as far as to try and get new fangs to sprout. (They can't because vampire fangs aren't like human teeth) Which leads him to break Victor's jaw. Bloodied and on the floor, as a last resort, Victor calls out to Sebastian, pleading to get him out of there to save him. The demon comes running like a dog when they see a bone.

Sebastian is blinded by the similarities he thinks Victor and Ciel share, blinded by his own grief, and he cannot think straight. Their contract binding is loose and unspecified. It causes many problems because Sebastian isn't bound adequately to his contractee and, therefore, can do whatever he wants as there is no reason for him to stay. Victor doesn't want him around and does not need a demon butler. But Sebastian saves him in tricky situations, leading Victor to reevaluate his feelings about having a butler. He had spent his life as a butler to his sire. Having a butler of his own is a luxury.

Raziel hates him because undead humans are no better than live humans. Live humans serve him no purpose; undead humans are even more useless. As an angel, he believes it defies logic and throws off the balance between life and death. He and Grelle try to get Sebastian to see that there is no bringing back Ciel, as it will never happen.

#black butler#black butler oc#original character#male original character#vampire original character#kuroshitsuji#kuroshitsuji oc#kuro#kuro oc#vampire#victorian era

6 notes

·

View notes

Note

I wanted to tell someone else about this, and I feel like I haven't poked your ask box in a while. Hi Riot!

I am currently gnawing on a very juicy idea of Pharma as a Scavenger. Though it is unofficial at first.

Basically, his storyline has similar beats but changed. Still the opening with Tarn starting to blackmail him and the slow growth of demands he can at first meet with general stock and natural death. But Tarn escalates the numbers, and his terrible behavior and Pharma is caged in.

On the terrible day he is thinking of letting a patient slip away he hears his staff talking about black market organ market and Ambulon admitting yes, Swindle partook sometimes but Decepticons mainly got theirs from Scavenger teams and command turned the other way if the sold extra.

So Pharma goes looking and finds the Scavengers.

He starts paying them to provide tcogs, and they figure way not. Life is expensive, and they aren't being used. It takes them a while to realize their best client is an Autobot when Pharma is forced to meet in person and is very aggressive with them. But even if he is an ass and an Autobot, he pays good.

The first meeting is basically that meme of have a good day/fuck you/damn actually hope your day gets worse.

Pharma keeps meeting them coming more and more unhinged because Tarn is pushing in different ways when his stressball isn't breaking as expected and Pharma is having to adjust. Misfire makes the mistake of touching him at the wrong moment, and Pharma proceeds to have a very messy breakdown in the WAP because he feels scrubbed raw inside from secrets and having had a "house call" from Tarn the day before. Krok talks him down, and they Scavengers, who'd kind of assumed he was a transmute addict get the whole story out of him in between Pharma, throwing them hateful barbs.

Misfire, with perfect tact, says, "damn that's fragged up" which makes Pharma laugh wetly.

Krok, meanwhile, is furious at the "extracurricular entertainment," a phrase Tarn used, and Pharma spat out. Blackmailing someone to get supplies is one thing, but the more Pharma tells him about the interworkings of the DJD, which were a semi myth until now, the more disgusted Krok is.

The Scavengers make a point to be nicer to their doctor and check in on him during their deals, and Pharma softens a bit as they get to know him and offer comfort and a place he can share the burden. They are essentially saving his patients each time and Spinister gets very good at tcog extraction.

But this is hanging on by a thread, and all know something has to give. Crankcase is the one who finally says, "How would you kill him?" The Scavengers and Pharma start plotting to murder the DJD even if it half in jest because as they point out, Misfire gives them a target on their back.

Pharma has Red Rust ready as a late night musing with Spinister that leads Misfire to asking, "So, uh, are we going to kill the DJD...?" and no one knows what to say.

Eventually, though, they get delayed calling Pharma to tell him Misfire was taken by the Galactic Council. He uses his connections to assist so they find him faster, but they are still delayed. Pharma needs one more tcog. Pharma, after seven years of careful control, lets a patient slip away, and it breaks him.

He desperately uses the plague to escape and leave a trap for Tarn if he comes calling. Things go down the same-ish with him disassociated half the time. The only difference is while he is weeping rust he messages the Scavengers to warn them to not come he's dying and the plague is active. Spinister of course already made it too and innoculated them one day going through and stabbing everyone with no explanation so they book it. They get there in time to see Pharma get abducted and follow Tyrest back to the moon.

They proceed to stalk it out and get Fulcrum to sneak in as a spy joining Lockdown's gang to get info and learn about Pharma being used as a lab rat and the Kill Switch and plot save the CCs. Then, of course, the Lost Light shows up to ruin it. Krok activates the plan early, which makes things more chaotic as he smuggle Misfire and Spinister in to talk to Pharma, who is having a breakdown over Ratchet. They have a very emotional reunion, and Misfire hugs him and tells him he they've got new hands for him. Pharma has a breakdown crying because someone remembered him and came for him, and Misfire calls him their Autobot while Ratchet, who is a spine, watches confused. Pharma is considerably more stable and reluctantly tells Spinister to fix Ratchet. He does and keeps Pharma's hands and leaves Ratchet handless until he finds Ratchet’s hands in the Lost Light's medivay–for some reason I think Iremember the initial confrontation there and then them moving to the Luna-1 maybe I'm wrong–and casually fixes them before reattaching Ratchet's good as new hands and giving Pharma his back.

They go to destroy the Kill Switch, but Misfire has initiated hug protocol, so Pharma is being switched off from Scavenger to Scavenger seriously, so he's never not being hugged.

They find Krok and Rodimus arguing. Misfire shoves Pharma into Fulcrum's arms introducing him as the new guy, and Fulcrum awkwardly hugs him, which makes Pharma laugh as they make small talk. Pharma helps them disarm it without Rodimus dying refusing to make eye contact with the medics while Fulcrum awkwardly hold one hand as a compromise.

The Scavengers inform Pharma he is coming with them because he's one of them and he starts crying.

The Scavengers have a big group hug with Pharma crying into his–his–hands in the middle of a Decepticon plus Grimlock group hug. Minimus tries to make something of it, but the Scavengers all pull guns for their Autobot, and Rodimus makes the executive decision to let it go since they just saved the day together. Minimus and First Aid grumble and Pharma throws his Autobrand at them saying they can take this as his formal defection before Crankcase picks him up in a bear hig to prevent violence.

Ambulon insists on a goodbye and says he's sorry and thank you for Pharma trying to protect them. Misfire finally remembers his name which is the one before he was called Ambulon and goes "Wait, Thunderclash?!" Ambulon dies a littke because there was a reason he changed it. And the Scavengers exit stage left. Though Misfire shows that he might have pocketed something and it's half the Matrix which he presents to Pharma as compensation. Pharma laughs.

Oooooo???

Makes sense in another verse he'd resort to outside sources for his t-cogs, and ooo that they don't know he's an autobot until they finally meet him, which has gotta create crunchy first reactions

Makes sense the Scavs would be seeing Pharma's mental state worsen because Tarn being a bastard, and i like to think they have severe opinions on that (especially since it's the D-J-fucking-D we're talking about here)

Aaand yep they do, nice to see Krok kinda cares

"Are we going to kill the DJD?" One hell of a question because that's not easy to do

"Spinister no" "Spinister yes"

"Oh scrap, he's got our guy!" I feel like we as a fandom do not dwell on Pharma's time with Tyrest enough, like. Yes, Tarn & Delphi traumatized him pretty good. But so did Tyrest, and we as a fandom need to chew on the Tyrest arc more.

The LL and the WAP meeting a lot earlier than in canon has gotta have funny moments

Spinister would totally be able to fix Ratchet's hands

shsggd that's sooo sweet

He issss he isss a Scavenger now

Misfire pocketed what

#maccadam#transformers#mtmte scavengers#mtmte pharma#mtmte rodimus#decepticon justice division#mtmte minimus ambus#mtmte ambulon#mtmte tarn#mtmte first aid

18 notes

·

View notes

Text

Masterlist: Business and Economics

Navigation Post

Fun fact, tumblr allows 250 links on the old editor and 100 in the new. So. Network of masterlists.

Economics and Theory:

How rent should work

Ko-Fi prompt: Macroeconomics

Ko-Fi prompt: Some Basic Econ/Finance Terms

Ko-Fi prompt: A few tracts, primarily about the minimum wage

Ko-Fi prompt: Progressive Taxes

Ko-Fi prompt: The Myth of the Rational Actor

Ko-Fi prompt: Raising the Minimum Wage and Its Effects

Ko-Fi prompt: Stock Market Basics

Ko-Fi prompt: Stock Market Rant

Ko-Fi prompt: Why don’t Landlords have price wars? (demand inelasticity)

Ko-Fi prompt: Trickle-down economics

Ko-Fi prompt: Tariffs/VAT/Customs

How do we define a Healthy Economy?

The overlap and intersect of rent and commute costs against wages

- The effective demographic against which this argument works

When watching political ads, always ask: which taxes?

No income tax under [quantity]

Raising the Minimum Wage

Finance, and economics on the personal level:

Ko-Fi prompt: Anti-Inflation measures one can take with personal savings

Ko-Fi prompt: Green Stocks (are a marketing tactic and not a regulated term)

Being a business major who ended up a disillusioned leftist

Case Studies and Hypotheticals:

Ko-Fi prompt: Revenue and expenses for a sports stadium

Ko-Fi prompt: Going from shareholder-owned to employee-owned

Ko-Fi prompt: Thieves/Assassins Guilds

Ko-Fi prompt: Airline overbooking

Ko-Fi prompt: Car Dealerships

Ko-Fi prompt: Revenue and expenses for a concert venue

Raise Taxes on Golf

- I may have a reputation

Employee Stock Options

Did you know women couldn’t have credit cards in the US until 1974?

5 notes

·

View notes

Note

I saw your Greek Mythology masterpost, and wanted to hear your thoughts on an idea that's been swimming around in my head for awhile.

I've been inspired by Rick Riordan, because of course I have, and I like the idea of gods in the modern world.

The modern ideas of the gods are very different from the ancient interpretations, but that's kinda by design, no? Gods are fluid concepts that adapt with the culture that worships them, and our culture is very different from Ancient Greece.

I want to see the gods in a story where they're forced to basically "adapt or die." They need to adapt to the modern world or lose their importance.

Since it's low hanging fruit, I'll use Zeus as an example of what I mean. He's both the god of justice and very rapey, which contradict by our modern standards. In my concept, he either needs to adapt (stop being so rapey) or die (lose one of his most important deific domains).

This would reconcile the dissonance between the "original" gods and our modern interpretations, since that's basically the point of the story.

Also, to add more pressure on the gods, there's probably a younger generation of gods that could replace them if they fail to adapt. I struggle to believe that the gods stopped banging each other and having kids just because their worship fell out of fashion. There's definitely some newer gods running around. This could even connect to the myth/prophecy of Athena's younger brother.

So, this is basically the basic of my take on the Greek gods in the modern world. Thoughts?

Ps. Congrats on being my first ask ever

:3 Being someone's first ask is always such a cute honor. :3 You can't see it, but I'm blushing

Don't worry about someone accusing you of copying Rick Riordan by "placing gods in the modern world". Rick Riodan is just the last author in a long line. Neil Gaiman did it before with Sandman and American Gods. The Wonder Woman comics did it. Pratchett did it in Discworld ; Douglas Adam did it in The Long Dark Tea-Time of the Soul... And there's works about this idea dating back to the early 20th century.

However that being said, reading your outline strongly brings to mind American Gods by Neil Gaiman which is precisely about this - a generational conflict between older, traditional gods that are about to die from lack of worship, and a newer, younger generation of deities based on modern concepts (television, internet, cars, stock market...). So probably go check this novel to find more inspiration or see what was already done so that you can use the things that were not done.

For example I adore your idea that "The gods didn't stop banging" - having the ancient Greek gods give birth to new gods more adapted to the world or part of modernity is an absolutely cool idea that to my knowledge has never been done before (as outside of demigods and heroes, most works about Greek mythology in modern days just have the god stop having children with each other for some reason...)

Plus this is literaly what Greek mythology was about, generational conflict. It is filled with this. The Titans overthrew the primordial order of Ouranos. The Olympians destroyed the rule of the Titans. Zeus had to constantly fight not to get overthrown by his children. And even among mankind it is a constant struggle of younger ones overthrowing the old. I think you have something going on with this idea of a younger generation of gods. Why doesn't the Greek mythology simply continues in the modern world? A lot of potential here.

After that, when it comes to your example of Zeus and his "rapist" persona, I strongly suggest you go take a look at all the scholarly analysis and expert texts about Zeus to find the delightful implications of each of the gods traits. (And this is true for all the other gods). I made a post about Zeus and his immense lust and why it is not like people thought and why the Greek Zeus wasn't as much of a rapist as people painted him out to be (the real serial rapist was the Roman Jupiter, the Greek Zeus was much safer, though still a man-whore and a constant cheater). It is my "Why does Zeus has such a messy love life?" post, with a first part here and a second one here. (But maybe you saw them before since they were in my old masterpost)

And in them I reminded people of something that all analysis books and advanced manuals about Greek mythology explained (at least in France - I definitively need to translate on this website some excerpt from French texts about Greek mythology) - why is Zeus such a lustful guy who can't keep his d*ck in his pants? And it isn't just because he is lustful by nature - there is a deep religious reason behind this (just like behind all of the gods' characterization). Zeus title is "Father of Gods", "Father of Men", "Father of the World". Zeus isn't just a king - he is the archetypal father, the universal father. And this isn't just a fanciful title, it is one of his fundamental aspects, meaning it is in his nature to constantly "give birth" and find companions to spawn gods and men. The same way Ouranos gave birth to three different species in one go ; the same way Kronos had many children and couldn't stop having them despite the prophecy - in Greek mythology there is this topic that the king needs to procreate, as the ruler of the universe is also the fundamental procreation power that keeps giving birth to the other deities that will shape the universe ; and to the heroes that will save and civilize said universe. Zeus' role as a cosmic, endless father can even be pointed out in how he is one of the rare (if not the only) male god in Greek mythology that has the power to LITERALY give birth to children - to Athena through his head, to Dionysos through his thight, pointing out that his role and function WILL make him give birth to children even if women aren't around to do the job.

And once you consider this fact, the consequences and possibilities you brought forward become very deep, very fascinating and a true gold mine. In the post Me-too world, Zeus (Zeus/Jupiter if you decide to take the Greek and Roman deities as one, though myself I like to keep them separate) literaly is perceived and seen as the symbol of all those powerful tyrannical men of patriarchy who keep enforcing their lust onto women. Which is already a remnant of an ancient mindset from long-gone society (again in Greece women had no rights and no freedom) - but if Zeus needs to stop sleeping around... This actually doesn't just bother him because he is sex-driven. It will bother him or cause problems because his title is the one of the father, and he is a procreation/creation force. A sterile father is a useless father - like the Fisher King of the Arthurian legend. What does it mean? Does it mean he will have to find other ways to create gods and heroes? Does it mean he will need to retire? Does it mean his entire personality and attributes will change? Does it mean another "Father" will arise? Does it mean the male-led world of the Greek pantheon will be reversed as a cosmic "Mother" take the first role?

Of course it is for you to find out - but what I am trying to say here is that when exploring such an idea as yours, you have a full and open world of endless possibilities. If you ever feel restricted and limited don't be - because gods aren't just characters. They are poetic concepts, political implications, religious metaphors, sacred entities, with each of their attribute, each of their personality trait, each of their relationship being deeply symbolic of something. Do the gods in modern day adapt to the modern society and cultures? Do they still maintain their old views and symbols from Ancient Greece into the modern world? It is for the creator to decide - but if you need inspiration or to help build anything else, just consider how changing a god or goddess attribute actually touches them deeply into their very function and essence, and how it is all tied to a question of culture and religion. I think you'll find all character and plot development coming naturally to you in such a way.

Maybe it wasn't the answer you were expecting sorry about that X) But I am definitively looking forward for more of your project in the future, and if you want to chat more about this don't hesitate - I am always encouraging people to spin more and more stories about Greek mythology!

9 notes

·

View notes

Text

Amazon, Apple, Facebook, and Google are the four most influential companies on the planet. Just about everyone thinks they know how they got there. Just about everyone is wrong.

For all that's been written about the Four over the last two decades, no one has captured their power and staggering success as insightfully as Scott Galloway.

Instead of buying the myths these compa-nies broadcast, Galloway asks fundamental questions. How did the Four infiltrate our lives so completely that they're almost impossible to avoid (or boycott)? Why does the stock market forgive them for sins that would destroy other firms? And as they race to become the world's first trillion-dollar company, can anyone chal-lenge them?

In the same irreverent style that has made him one of the world's most celebrated business professors, Galloway deconstructs the strategies of the Four that lurk beneath their shiny veneers. He shows how they manipulate the fundamental emotional needs that have driven us since our ancestors lived in caves, at a speed and scope others can't match. And he reveals how you can apply the lessons of their ascent to your own business or career.

Whether you want to compete with them, do business with them, or simply live in the world they dominate, you need to understand the Four.

#book: the four#author: scott galloway#genre: non fiction#genre: business#genre: technology#year: 2010s

4 notes

·

View notes

Text

Master the Market: Proven Strategies to Beat the Stock Market and Build Wealth

Key Point:

Thanks to the internet, you don’t need to be an expert to invest your money smartly; all the necessary tools and stock data are online. By using these tools, some specific calculations and knowing how to spot a successful, profitable company, you will be in a prime position to make the right investment choices and steadily build your wealth.

For most of us, the stock market is basically a no-fly zone: it’s too complicated, and too dangerous. Let the experts handle it, we say.

But that’s a shame, because there is a way that anyone can make money in stocks. This post teaches you the key indicators for that right, wonderful business that could change your life.

Contrary to popular myths, you don’t have to be an expert to be a great investor, and it is possible to beat the market.

It’s common knowledge that you'd be remiss to invest without consulting a financial expert, right? Well, the notion that managing money demands both time and expertise isn’t exactly accurate.

You don't actually need to have depth of knowledge and all the tricks of a professional financial adviser. You just need a few good tactics.

Fortunately, today the internet has the tools and knowledge you need, at minimal costs. Information and tools such as stocks’ histories and statistic calculators can make a lot of the work easier for you. For instance, websites such as MSN Money, Yahoo! Finance and CNN Money have data on thousands of stocks and investment calculators.

Thanks to technology, these tools are actually far more accurate than anything experts had ten years ago. Aside from these tools, you also need to know that you really can beat the market. To do so, you must sell stocks for far more or buy for far less than their real market value.

Yet, according to the prominent Efficient Market Theory (EMT) you can’t do this, as everything that can be known about a company is already figured into the price. Thus, stock prices can’t be too high or low. But this is wrong.

Many of us recall the bubble in the nineties, where, contrary to EMT assumptions, prices were far above their real market worth for some years, only to plummet dramatically afterwards. Additionally, Warren Buffett showed that at least 20 investors were able to beat the market for over 20 years.

So cast aside the myths of expert help and an unbeatable market because, thanks to the internet and the strategies in this post you can make great investments yourself.

The popular strategy "diversify and hold" is not nearly as safe as it's cracked up to be.

You've heard the formula, “diversify and hold” a million times; it's supposedly the safest way to invest in the stock market. But it’s also problematic.

First, it would’ve failed for approximately more than half of the last century. Let's examine how a long-term, diversified portfolio would have performed between 1905 and 2005: it would’ve had a zero rate of return between 1905 and 1942, 1965 and 1983 and from 2000 to 2005. That's 60 out of 100 years!

What you should do instead of ‘diversify and hold’ is improve your security by keeping track of all your stocks — which you might not do if your portfolio is diversified, as it would take a lot of time and effort to monitor how all your stocks are doing. Also, it's unlikely that you would thoroughly comprehend the dynamics of all the businesses you're investing in. This would result in you not being able to react as quickly to save your portfolio from losses, as you would if you only invested in fields you understood.

Say you’re a pharmacist, and you receive a Red-Hand letter warning you about a drug’s serious, unexpected side-effects. You’ll know this letter will result in considerable losses for a pharmaceutical company and therefore sell your shares immediately. Whereas if you were clueless about pharmaceutical companies, you wouldn’t know about the pending losses until it’s too late.

The truth is, if you diversify, whatever happens to the market will happen to you. You should know that whenever a large amount of money is withdrawn from the market, mutual funds decline in value, investors withdraw even more money and values drop even faster. This could happen when all the baby boomers take out the money they invested for their retirement.

Only invest in a business you understand and you’d like to own.

If you were to buy a business, rather than stocks, would your criteria for doing so be any different? Shrewd investors only invest in a company they’d like to own in the long term, so thinking about buying stocks as if you were to buy the company will guide you towards investing carefully.

When you consider buying stocks, you probably think it’s easy to get out quickly if the company is doing poorly. You could therefore be tempted to opt for a risky business, pay too much attention to one promising growth-rate in an average business, or even lose money in a market bubble.

If you were to buy the whole company, however, you’d be far more cautious. You’d carefully weigh its performance, history and management against other companies and, in doing so, make far better decisions.

To make even better decisions on investments, it’s also wise to invest in a sector within your field of interest, as you’ll already be knowledgeable about it.

If you work in IT, for example, you’re in a far better position to invest there than someone who doesn’t. You’ll know about the different providers, their strategies, the quality of their products and so forth.

Also remember that investing in a business means you’re essentially voting for it to continue with its work.

Say you’re researching some highly profitable stocks to fund your child’s education. Would you purchase those stocks if the company is making a chunk of its profits by exploiting children in Bangladesh? As a smart investor, probably not.

Know that your investment will have an impact, and you’re making a statement of where you choose to invest.

There are good criteria for a company's ability to stand its ground.

Like moats around a castle, certain assets protect a company against competition and inflation. When investing, it’s a good bet to choose companies with one or more of these “moats.”

So what exactly do moats do? A moat enables a company to dominate a market, increase its prices to keep up with inflation and produce enough profit to expand.

There are many different kinds of moats. Some moats may be intangible competitive advantages, like a patent or a trade secret that makes direct competition really tough, or even illegal. For instance, Pfizer had a patent for its hugely successful Viagra, therefore other companies weren’t permitted to copy the product. As a result, Pfizer faced no real competition for sexual enhancers.

Another kind of moat could be a strong brand that customers identify with or are extremely loyal to. Coca Cola, for example is an incredibly stable and powerful brand and its customers will often choose its soft drinks over others.

A moat can also mean having products that are cheaper or easier to buy. For instance, Walmart is so immense that it’s in a powerful position to bargain with its suppliers. In doing so, it can sell goods at very competitive prices.

Another moat could be when the product itself isn’t really affordable, but switching to another is a real hassle. Take Windows, for example. Many people use it even though they hate Microsoft. But it’s easier to stick with it because so much software is exclusive to Windows and if they changed to another operating system, they’d have to change all their software, too.

Lastly, some companies’ moats entail exclusive governance over a market due to a legal privilege. For example, the utility PG&E has a legal monopoly to provide power in its area.

Steady businesses have competitive advantages.

We’ve now seen what moats are and how they can help businesses become extremely successful. But how can you know if a company has one? Well, you can be sure that a company has a moat if they score well on five specific indicators for a minimum of ten years.

The best indicator of a wide moat is return on investment capital (ROIC) over at least a ten year period. ROIC is the rate of return a company makes from the money it invests in itself in a year. For example, say you invested $20 in stamps and then later sold them for $30. Your profit would be $10. The ROIC is the profit divided by the total you invested, which in this case would be 50 percent.

Be aware that a company that generates high returns could draw so many competitors that a good position in the same market becomes difficult to secure and therefore none are able to make decent returns. Unless, however, the company has a wide moat.

Therefore, if a company can hold onto a ROIC of at least 10 percent for ten years, it’s likely beaten out its competitors, which now means it has an advantage.

Another good way to gauge a wide moat is by the growth of a company’s equity. Equity is the amount of money that would remain if a company sold all of its assets and cleared all of its debts.

If a company’s equity increases by 10 or more percent for at least ten years, it’s an indicator that it has enough money to invest into its expansion, which also puts the company in a solid, competitive position.

Some competitive advantages are easy to spot.

Let’s turn to three other ways to tell if a company has a moat, all of which are straightforward calculations.

The first calculation is figuring out if they’ve had at least a 10 percent increase in earnings per share (EPS) for approximately ten years.

Say three friends start a restaurant. Their EPS would be the restaurant’s net income divided by three. So if the store makes $60,000 net income, the EPS would be $20,000.

Then let’s say in 10 years, the EPS rises from $20,000 to $160,000. To calculate the restaurant’s EPS growth rate, first calculate how many times 20 needs to double in order to reach 160. So, 20 doubles to 40, then to 80 then to 160. So it doubles three times over the ten years, averaging around three years to double each time.

Now apply the Rule of 72. Divide 72 by the average number of years over which the figure doubles once. The restaurant’s ten-year-EPS growth rate would be 72 divided by three, which equals 24. Twenty-four percent would be the restaurant’s moat, and thus its competitive advantage.

You can also calculate when a sales growth rate consistently increases over ten percent. For example, Garmin’s sales rose from $100 million to approximately $800 million from 1995 to 2004, meaning it doubled three times over nine years, or once every three years. If we apply the rule of 72, we see that 72 divided by three equals a 24 percent sales growth rate. Clearly, Garmin had a wide moat.

The last calculation is the free cash flow growth rate. If this is consistently over 10 percent, this means profits turn into cash.

Free cash flow is operations cash minus capital expenditure, or the money that can be invested into expanding the company.

Garmin’s free cash flow grew from $40 million to $130 million in seven years, meaning it doubled just less than twice in seven years, or once every three and a half to four years. If you divide 72 by four, which equals an 18 percent sales rate, we see that Garmin was highly profitable.

For a smart investor, a company is only promising if the CEO is driven and owner-oriented.

When you’re considering which company to invest in, you can always refer to those Big Five criteria in the charts. But there’s something else that’s worth noting; how effective is the CEO you want to entrust your money to?

You need to opt for an owner-oriented CEO. They’ll make smart long-term decisions and inform the shareholders on what they need to know.

As a shareholder, you’ll need to know if there are any problems or you won’t be able to respond appropriately.

A good owner-orientated CEO will announce if it’s been a very bad year, and try to give a reasonable explanation. Likewise, an owner-oriented CEO will refrain from actions that temporarily increase the stock price but do harm to the company in the long term.

Picture an executive who owns a lot of shares trying to make the stock price rise so he can cash out. That executive doesn’t care about the business down the line, or about your shares.

You should also look for a CEO who is driven, as he’ll put in a lot of effort to ensure the company remains profitable. CEOs like this aim for big goals and they’ll remind their employees of those goals. A company with such a manager is well set to generate more and more company value, which is ideal for your investment.

For instance, when Darwin Smith bought out Kimberly-Clark, it was a mediocre company. But he pictured it as the best paper-products business in the world. He worked for 20 years toward this lofty goal, transforming and expanding the company. Twenty-five years after Smith took over, Kimberly-Clark was the world's number-one paper-based consumer-products company and had brands like Kleenex under its wing.

Knowing if a CEO is driven and honest equips you to make a sound estimate of a company's value.

Demand a big margin of safety.

Remember when we said that the Effective Market Theory is wrong? Here’s why: contrary to the theory, price and value aren’t the same thing, and the key is to buy when the difference gives you an advantage. A stock’s price is what you pay, whereas its value is based on the money a business generates over time.

Stock value can be a little tricky to gauge, as it’s based on a business’s future EPS and price/earnings ratio. However, there are tools and places to assess value online, such as Sticker Price Calculators.

Markets are inaccurate in the short term. For instance, at the close of the nineties, prices for gold, silver and copper dropped dramatically. Yet, the real value of metals wasn’t diminished; we’d need them eventually, so some savvy investors bought shares cheaply. Then, in the early 2000s, demand rose again, which increased share prices and those smart investors made a fortune.

What you should do is demand a large margin of safety. A margin of safety (MOS) is the value, minus the price.

A good margin of safety should be half the value of an investment. For example, in 2000, Dell’s value was estimated at $40/share, and so was its market price. That’s a fair price with no margin of safety.

As a smart investor, its price would need to be no higher than 50 percent of its real value, or $20, before you decide to buy.

Only a year later, Dell’s price fell to $20/share, while the stock’s value increased, so its MOS reached 50 percent. That would have been the right time to buy.

The MOS rule will provide you with great returns, and if there’s a bubble, it will prevent you from losing all your money.

A good MOS is not to be overlooked; in 2000, every NASDAQ stock that crashed had a stock price which was higher than its value.

Thanks to the internet, you don’t need to be an expert to invest your money smartly; all the necessary tools and stock data are online. By using these tools, some specific calculations and knowing how to spot a successful, profitable company, you will be in a prime position to make the right investment choices and steadily build your wealth.

Action plan: Be smart about checking the stock market.

Don’t work up a nervous sweat checking the market numerous times a day. The best time to check the market is when it’s closed, and, even better, at the same time each night. Doing so will give you the most consistent data.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

13 notes

·

View notes

Text

"Money (the blood) and economic growth (the body) constitute a defective myth because they can provide no expiation of guilt — in Buddhist terms, no resolution of lack. Our new holy of holies, the true temple of modern humanity, is the stock market, and our rite of worship is communing with the Dow Jones average. In return, we receive the kiss of profits and the promise of more to come, but there is no atonement in this. Of course, insofar as we have lost belief in sin, we no longer see anything to atone for, which means we end up unconsciously atoning in the only way we know how, working hard to acquire all those things that society tells us are important and will make us happy. Then we cannot understand why they do not make us happy, why they do not resolve our sense of lack. The reason can only be that we do not yet have enough. 'But the fact is that the human animal is distinctively characterized, as a species and from the start, by the drive to produce a surplus. There is something in the human psyche which commits man to nonenjoyment, to work.' Where are we all going so eagerly? 'Having no real aim, acquisitiveness, as Aristotle correctly said, has no limit.' Not to anywhere but from something, which is why there can be no end to it as long as that something is our own lack shadow. 'Economies, archaic and civilized, are ultimately driven by that flight from death which turns life into death-in-life.' Or by that flight from emptiness that makes life empty: by an intuition of nothingness that, when repressed, only deepens my sense that there is something very wrong with me.

In Buddhist terms, then, money symbolizes becoming real, but since we never quite become real we only make our sense of lack more real. We end up in infinite deferral, for those chips we have accumulated can never be cashed in. The moment we do so, the illusion that money can resolve lack is dispelled; we are left more empty and lack-ridden than before, being deprived of our fantasy for escaping lack. We unconsciously suspect and fear this; the only answer is to flee faster into the future. This points to the fundamental defect of any economic system that requires continual growth to survive: it is based not on needs but on fear, for it feeds on and feeds our sense of lack. In sum, our preoccupation with manipulating the purest symbol [money], which we suppose to be the means of solving the problem of life, turns out to be a symptom of the problem."

- David Loy, from "Buddhism and Money: The Repression of Emptiness Today." Buddhist Ethics and Modern Society: An International Symposium, edited by Charles Wei-hsun Fu and Sandra A. Wawrytko, 1991.

#david loy#quote#quotations#anthropology#psychology#psychoanalysis#buddhism#neoliberalism#capitalism#economic growth#economics#lack#consumerism

6 notes

·

View notes

Photo

Two books on the pathological optimism of mainstream American discourse.

Ehrenreich begins with her experience with breast cancer and the ubiquitous infantilizing teddy bears. One breast cancer foundation distributed gift totes that included rhinestone bracelets and a pink journal with a box of crayons. “Certainly men diagnosed with prostate cancer do not receive gifts of Matchbox cars.”

Bright-sided: How Positive Thinking is Undermining America

by Barbara Ehrenreich (2009)

A sharp-witted knockdown of America's love affair with positive thinking and an urgent call for a new commitment to realism.

Americans are a "positive" people -- cheerful, optimistic, and upbeat: This is our reputation as well as our self-image. But more than a temperament, being positive is the key to getting success and prosperity. Or so we are told.

In this utterly original debunking, Barbara Ehrenreich confronts the false promises of positive thinking and shows its reach into every corner of American life, from Evangelical megachurches to the medical establishment, and, worst of all, to the business community, where the refusal to consider negative outcomes--like mortgage defaults--contributed directly to the current economic disaster. With the myth-busting powers for which she is acclaimed, Ehrenreich exposes the downside of positive thinking: personal self-blame and national denial. This is Ehrenreich at her provocative best--poking holes in conventional wisdom and faux science and ending with a call for existential clarity and courage.

This reminder of how horribly wrong the economists were in the lead up to the 2008 mortgage/financial crisis from Ehrenreich.

Professional optimists dominated the world of economic commentary, with James Glassman, for example, a coauthor of the 1999 book Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market, winning a job as a Washington Post columnist and showing up as a frequent news show guest. Escalating housing prices were pumping up the entire economy by encouraging people to use their homes “like ATMs,” as the commentators always put it -- taking out home equity loans to finance surging consumption -- and housing prices were believed to be permanently resistant to gravity.

David Lereah, the chief economist of the National Association of Realtors, published a book in 2006 entitled Why the Real Estate Boom Will Not Bust and How You Can Profit From It and became “the most widely cited housing expert” at peak of housing bubble.

And how self-help culture nestles into Christian frames

As sociologist Micki McGee writes of the positive-thinking self-help literature, using language that harks back to its religious antecedents, “continuous and never-ending work on the self is offered not only as a road to success but also to a kind of secular salvation.” The self becomes an antagonist with which one wrestles endlessly, the Calvinist attacking it for sinful inclinations, the positive thinker for “negativity.”

Never Saw It Coming: Cultural Challenges to Envisioning the Worst

by Karen A. Cerulo (2006)

People—especially Americans—are by and large optimists. They’re much better at imagining best-case scenarios (I could win the lottery!) than worst-case scenarios (A hurricane could destroy my neighborhood!). This is true not just of their approach to imagining the future, but of their memories as well: people are better able to describe the best moments of their lives than they are the worst.

Though there are psychological reasons for this phenomenon, Karen A.Cerulo, in Never Saw It Coming, considers instead the role of society in fostering this attitude. What kinds of communities develop this pattern of thought, which do not, and what does that say about human ability to evaluate possible outcomes of decisions and events?

Cerulo takes readers to diverse realms of experience, including intimate family relationships, key transitions in our lives, the places we work and play, and the boardrooms of organizations and bureaucracies. Using interviews, surveys, artistic and fictional accounts, media reports, historical data, and official records, she illuminates one of the most common, yet least studied, of human traits—a blatant disregard for worst-case scenarios. Never Saw It Coming, therefore, will be crucial to anyone who wants to understand human attempts to picture or plan the future.

5 notes

·

View notes

Text

Passive Income for Beginners: How to Build a Sustainable Income Stream with Minimal Effort

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Definition of Passive Income

Passive income refers to earnings derived from ventures in which an individual plays a limited, hands-off role. Unlike active income, where one is compensated for time and effort, passive income allows for the accumulation of wealth with minimal ongoing involvement.

Growing Interest in Passive Income

In recent years, there has been a surge in interest surrounding passive income, driven by a desire for financial independence and a shift in the way people view work and wealth creation.

Importance of Building a Sustainable Income Stream

While the allure of passive income is undeniable, building a sustainable income stream requires careful consideration and strategic planning. This article aims to guide beginners through the process, offering insights into the different forms of passive income and the steps to take for long-term success.

Understanding Passive Income

Different Forms of Passive Income

1. Rental Income

One of the classic forms of passive income involves owning and renting out real estate. Property owners receive rental payments regularly, providing a steady income stream.

2. Dividend Income

Investing in dividend-paying stocks allows individuals to earn a share of the company’s profits regularly. This form of passive income is common in the stock market.

3. Interest Income

Putting money into interest-bearing accounts or bonds can generate interest income over time. It’s a less risky but often lower-yielding option.

4. Royalty Income

For those with creative talents, royalties from intellectual property such as books, music, or artwork can serve as a passive income source.

Pros and Cons of Passive Income

1. Advantages

Diversification: Passive income provides an opportunity to diversify income sources, reducing financial risk.

Flexibility: Unlike traditional jobs, passive income ventures often offer flexibility in terms of time and location.

Wealth Accumulation: Over time, passive income has the potential to accumulate substantial wealth.

2. Challenges

Initial Effort: Despite the term “passive,” many forms of passive income require significant upfront effort.

Market Risks: Investments come with inherent risks, and passive income is no exception.

Continuous Management: Even passive income streams need occasional monitoring and management.

Common Misconceptions

Myth: Passive Income Requires No Effort

One prevalent myth surrounding passive income is that it requires no effort. In reality, while the effort may be less intensive than in traditional employment, there is often a need for initial setup and ongoing management.

Reality Check: Initial Effort and Continuous Management

Whether it’s setting up a rental property, investing in stocks, or creating online content, the initial effort is crucial. Continuous management ensures the sustainability and growth of passive income.

Dispelling Other Misconceptions

Beyond the effort misconception, it’s essential to address other common myths, such as the notion that passive income is exclusively for the wealthy or that it guarantees instant financial success.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Building Blocks for Passive Income

Choosing the Right Income Stream

Before diving into passive income, it’s crucial to assess personal preferences, risk tolerance, and available resources. Choosing the right income stream sets the foundation for a successful venture.

Investment Strategies for Beginners

1. Real Estate Investments

Real estate offers tangible assets and the potential for appreciation. Beginners can start with rental properties or real estate investment trusts (REITs) for a more hands-off approach.

2. Stock Market Investments

Investing in stocks, particularly dividend-paying ones, is a common way to generate passive income. Researching and diversifying a stock portfolio is key to managing risks.

3. Peer-to-Peer Lending

For those interested in financial technology, peer-to-peer lending platforms provide opportunities to earn interest by lending money directly to individuals or small businesses.

Importance of Diversification

Diversifying passive income streams across different assets helps mitigate risks. Relying on a single source exposes individuals to the specific risks associated with that income stream.

Creating Passive Income Online

Blogging and Content Creation

In the digital age, creating and monetizing content through blogs, videos, or podcasts is a popular avenue for passive income. Quality content, coupled with strategic monetization, can lead to a consistent income stream.

Affiliate Marketing

By partnering with companies and promoting their products or services, individuals can earn commissions on sales generated through their referral links. Successful affiliate marketing requires understanding the target audience and building trust.

E-commerce Ventures

Setting up an online store and selling products or services can be a lucrative source of passive income. Automation in payment processing and order fulfillment contributes to the passive nature of this income stream.

Challenges and Tips for Success

While creating passive income online is accessible, it comes with its challenges. Saturated markets and changing algorithms can impact visibility. Consistent effort, adaptation, and staying informed about industry trends are crucial for success.

Automating Passive Income

Utilizing Technology for Automation

Advancements in technology offer tools and platforms to automate various aspects of passive income ventures. From scheduled posts to automated investment algorithms, technology streamlines processes.

Passive Income Apps and Tools

Numerous apps and tools cater specifically to passive income enthusiasts. These range from investment tracking apps to social media scheduling tools, simplifying management tasks.

Streamlining Processes for Efficiency

Efficiency is key to maintaining passive income with minimal effort. Streamlining processes, whether in content creation or investment management, allows individuals to focus on scaling their ventures.

Overcoming Challenges

Patience and Persistence

Building a sustainable passive income stream takes time. Patience is essential, and persistence in the face of challenges is crucial for long-term success.

Learning from Setbacks

Setbacks are inevitable, but they offer valuable lessons. Instead of viewing failures as roadblocks, consider them stepping stones toward refining strategies and improving outcomes.

Adjusting Strategies Based on Experience

As individuals gain experience, they may need to adjust their strategies. Market conditions change, and being adaptable is key to maintaining and growing passive income.

Case Studies

Success Stories of Passive Income

Highlighting real-life success stories provides inspiration and practical insights. Case studies can showcase diverse paths to achieving passive income, emphasizing the importance of individualized approaches.

Learning from Failures: What Went Wrong

Analyzing failures is equally instructive. Understanding where others went wrong can help beginners navigate potential pitfalls and make informed decisions.

Financial Planning for Passive Income

Budgeting and Saving

Managing passive income effectively requires sound financial planning. Budgeting and saving ensure that individuals can weather economic downturns and capitalize on investment opportunities.

Tax Implications of Passive Income

Understanding the tax implications of passive income is crucial. Different income streams may be taxed at varying rates, and tax planning is essential for maximizing profits.

Seeking Professional Financial Advice

For those unfamiliar with financial intricacies, seeking advice from professionals is advisable. Financial advisors can provide tailored guidance based on individual circumstances.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Tips for Beginners

Setting Realistic Goals

Beginners should set realistic and achievable goals. Whether aiming for a specific monthly income or diversifying income streams, clear goals provide direction.

Continuous Learning and Adaptation

The landscape of passive income is dynamic. Continuous learning, staying informed about industry trends, and adapting strategies are vital for sustained success.

Networking and Building Connections

Networking with like-minded individuals and building connections within chosen industries can open doors to collaboration, mentorship, and valuable insights.

Realizing Financial Freedom

The Link Between Passive Income and Financial Freedom

Passive income serves as a vehicle toward financial freedom. As income streams become more stable and diversified, individuals gain greater control over their financial destinies.

Achieving Long-Term Stability

Striving for long-term stability involves consistently reassessing and optimizing passive income strategies. By doing so, individuals can build a robust financial foundation that withstands economic fluctuations.

Conclusion

In conclusion, the path to financial independence through passive income is a journey worth embracing. By carefully selecting income streams, diversifying strategies, and staying resilient in the face of challenges, you pave the way to a stable and enduring financial future. Remember, each step you take toward passive income is a stride toward a life of financial freedom, where your money works for you, allowing you to enjoy the fruits of your labor effortlessly.

FAQs

Q. How much money do I need to start generating passive income?

The amount varies based on the chosen income stream. While some options require minimal investment, others may necessitate a more significant initial capital. It’s essential to assess individual financial circumstances and start within one’s means.

Q. Can passive income fully replace a traditional job?

While passive income has the potential to replace or supplement traditional employment, it’s crucial to recognize that success often requires time and effort. Complete replacement depends on factors such as income goals, chosen strategies, and market conditions.

Q. Are there risks associated with passive income?

Yes, like any investment, passive income carries inherent risks. Market fluctuations, economic downturns, and unforeseen challenges can impact earnings. Diversification and careful planning can help mitigate these risks.

Q. How long does it take to see significant returns from passive income?

The timeline for significant returns varies. Some passive income streams may yield quicker results, while others require a more extended period of growth. Patience and consistent effort are key to building a substantial income over time.

Q. Is passive income suitable for everyone?

Passive income is accessible to a broad audience, but its suitability depends on individual preferences, risk tolerance, and financial goals. Exploring various income streams and assessing personal circumstances can help determine the appropriateness of passive income pursuits.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Affiliate Disclaimer :

This article Contain may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

Source : Passive Income for Beginners: How to Build a Sustainable Income Stream with Minimal Effort

Thanks for reading my article on “Passive Income for Beginners: How to Build a Sustainable Income Stream with Minimal Effort“, hope it will help!

#FinancialFreedom#IncomeStream#FinancialIndependence#InvestmentStrategies#OnlineVentures#WealthBuilding#SmartFinance#howtomakemoneyonline#makemoneyonline#makemoneyonline2023#makemoneyonlinefromhome#makemoneyfast#affiliatemarketing#cpamarketing#blogging#dropshipping#ecommerce#passiveincome#makemoneytutorials#methodsandtutorials#internetmarketing#digitalmarketing#clickbankaffiliatemarketing#affiliatemarketingtraining#cpamarketingtraining#cpa#blog#makemoney#makemoneyonlineguide#freelancingtraining

3 notes

·

View notes