#IF and only IF i can get my monthly student loans to go lower

Text

I am literally crying. There are tears on my face.

This is the first time in my entire adult life I’ve felt like I wasn’t running away from an avalanche.

You’ve gotta read it, guys. The whole thing, not just the headline. (DailyKOS is free.) The ten grand in forgiveness is only the start. HE’S FREEZING INTEREST ACCRUAL. WHAT YOU OWE IS WHAT YOU OWE. The requirements for debt repayment are changing so more people are eligible for $0 monthly payments. There are some interest changes for current students that I admittedly kind of skimmed because I’m not a current student, but if you are or you work in education there’s some important stuff for you too.

AND PELL GRANT RECIPIENTS GET $20K IN FORGIVENESS. If you don’t know why that’s important: one of the criticisms of the original $10k plan was that a lot of Black students graduate with greater amounts of debt due to generational poverty and, probably, a dose of discrimination. THE MAJORITY OF PELL GRANTS GO TO BLACK RECIPIENTS. He can’t legally say “oh, and Black students get more,” but he can say “this program for people in dire need gets more, and because of the racial history of our country, most of the people in that program are Black.” And he did. It’s not a perfect solution, unfortunately I don’t think there is a perfect solution, but it’s pretty damn good. I’ll take “80% right” over “100% wrong.”

Also…he didn’t SAY anything about lowering college costs….but he sounds like it’s on his radar.

I now have $31k in student loans, thanks to Biden, and it’s not going to grow anymore. I would like my nieces to not need any—or at most, as the last generation used to say, “you can pay it off with a summer job.”

So let’s keep it on his radar. Until college is simply a step, not a pipe dream, for everyone.

7K notes

·

View notes

Video

youtube

The Biggest Economic Lies We’re Told

In America, it’s expensive just to be alive.

And with inflation being driven by price gouging corporations, it’s only getting more expensive for regular Americans who don’t have any more money to spend.

Just look at how Big Oil is raking it in while you pay through the nose at the pump.

That’s on top of the average price of a new non-luxury car — which is now over $44,000. Even accounting for inflation, this is way higher than the average cost when I bought my first car — it’s probably in a museum by now.

Even worse, the median price for a house is now over $440,000. Compare that to 1972, when it was under $200,000.

Work a full-time minimum wage job? You won’t be able to afford rent on a one-bedroom apartment just about anywhere in the U.S.

And when you get back after a long day of work, you’ll likely be met with bills up the wazoo for doctor visits, student loans, and utilities.

So what’s left of a paycheck after basic living expenses? Not much.

You can only reduce spending on food, housing, and other basic necessities so much. Want to try covering the rest of your monthly costs with a credit card? Well now that’s more expensive too, with the Fed continuing to hike interest rates.

All of this comes back to how we measure a successful economy.

What good are more jobs if those jobs barely pay enough to live on?

Over one-third of full time jobs don’t pay enough to cover a basic family budget.

And what good are lots of jobs if they cause so much stress and take up so much time that our lives are miserable?

And don’t tell me a good economy is measured by a roaring stock market if the richest 10 percent of Americans own more than 80 percent of it.

And what good is a large Gross Domestic Product if more and more of the total economy is going to the richest one-tenth of one percent?

What good is economic growth if the way we grow depends on fossil fuels that cause a climate crisis?

These standard measures – jobs, the stock market, the GDP – don’t show how our economy is really doing, who is doing well, or the quality of our lives.

People who sit at their kitchen tables at night wondering how they’re going to pay the bills don’t say to themselves

“Well, at least corporate profits are at record levels.”

In fact, corporations have record profits and CEOs are paid so much because they’re squeezing more output from workers but paying lower wages. Over the past 40 years, productivity has grown 3.5x as fast as hourly pay.

At the same time, corporations are driving up the costs of everyday items people need.

Because corporations are monopolizing their markets, they don’t have to worry about competitors. A few giant corporations can easily coordinate price hikes and enjoy bigger profits.

Just four firms control 85% of all beef, 66% of all pork, and 54% of all poultry production.

Firms like Tyson have seen their profit margins skyrocket as they jack up prices higher than their costs — forcing consumers who are already stretched thin to pay even more.

It’s not just meat. Weak antitrust enforcement has allowed companies to become powerful enough to raise their prices across the entire food industry.

It’s the same story with household goods. Giant companies like Procter & Gamble blame their price hikes on increased costs – but their profit margins have soared to 25%. Hello?

They care more about their bottom line than your bottom, that’s for sure.

Meanwhile, parents – and even grandparents like me – are STILL struggling to feed their babies because of a national formula shortage. Why? Largely because the three companies who control the entire formula industry would rather pump money into stock buybacks than quality control at their factories.

Traditionally, our economy’s health is measured by the unemployment rate. Job growth. The stock market. Overall economic growth. But these don’t reflect the everyday, “kitchen table economics” that affect our lives the most.

These measures don’t show the real economy.

Instead of looking just at the number of jobs, we need to look at the income earned from those jobs. And not the average income.

People at the top always bring up the average.

If Jeff Bezos walked into a bar with 140 other people, the average wealth of each person would be over a billion dollars.

No, look at the median income – half above, half below.

And make sure it accounts for inflation – real purchasing power.

Over the last few decades, the real median income has barely budged. This isn’t economic success.

It's economic failure, with a capital F.

And instead of looking at the stock market or the GDP we need to look at who owns what – where the wealth really is.

Over the last forty years, wealth has concentrated more and more at the very top. Look at this;

This is a problem, folks. Because with wealth comes political power.

Forget trickle-down economics. It’s trickle on.

And instead of looking just at economic growth, we also need to look at what that growth is costing us – subtract the costs of the climate crisis, the costs of bad health, the costs of no paid leave, and all the stresses on our lives that economic growth is demanding.

We need to look at the quality of our lives – all our lives. How many of us are adequately housed and clothed and fed. How many of our kids are getting a good education. How many of us live in safety – or in fear.

You want to measure economic success? Go to the kitchen tables of America.

404 notes

·

View notes

Note

Omfg your retarded! It’s obvious if you stepped outside. Minimum wage hasn’t been raised in years. Rent never stops increasing. Student loans are a death sentence. I just want to be able to afford to fucking live and not question being alive everyday of my life

I see where you're coming from and I understand why those conditions and challenges would make you feel the way you do. All of those in aggregate surely would feel like an impossible barrier to ever overcome.

You are absolutely correct that minimum wage has not been raised in years in most parts of the country and for most individuals, changes in legislation appear to be the only path to a higher income, but you underestimate how much control you truly have in obtaining a higher income. I do not know your journey thus far in life, but what I have observed in a lot of struggling individuals that express similar sentiments that you are mentioning is that they view success as an all-or-nothing pursuit. Now what I mean by this is that a lot of people have a vision of what they want their life to be and they are chasing the it as their next step in life, but instead they should be figuring out what are all the steps to get to their goal of success and viewing each step as an incremental win or success in itself.

e.g. If your goal is $100k and you're at $20k, then you don't need to feel stuck trying to go straight to $100k. You can make it a multi-step journey of progression from $20k -> $30k -> $40k ... $100k

Once gain you are absolutely correct about rent, but the key is that you consistently allow your income to increase too and yes, this is absolutely easier said than done, but you have potential to do it!

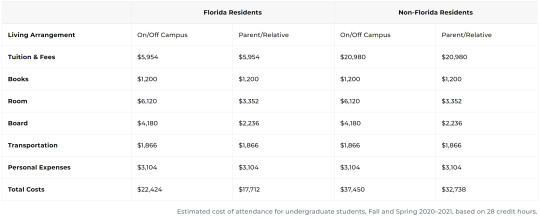

Now student loans can definitely be dangerous and relative to your current income, it seems astronomical to manage, but this is because it's meant to be relative to college graduate incomes and to be paid off over a decade. To put this into perspective, the median student loan balance for graduates is close to $35k, which is a little bit more than a new car and usually at a significant lower interest rate (~4.66%), which would equate to $365 monthly payment or $4380 per year. Meanwhile, median starting salary of college graduates upon graduating is the average starting salary for the graduating class of 2022 is $55,260. Even if you ignore raises, that still puts them at ~$51k (after paying student loans), so they generally have being standards of living than those with no student loans earning a significantly lower income.

Regardless of all that information and even if you want to ignore it, at the very least please don't ever question being alive!

21 notes

·

View notes

Text

What to consider before buying your first RV:

Let’s talk about the elephant in the room.. err.. RV..

Buying an RV is not that simple! As I mentioned in my first post where I shared the first five things I learned in the research stage, there is an insane amount of things to learn before you decide to take this leap.

Let’s start with 10 Basics things I’ve learned so far:

1.) If you are financing an RV, you need to have good credit. Getting a car is easier than being approved for an RV. They’re not considered to be in the same catagory. They’re a “luxury”. They’re a “toy”. My credit isn’t great. (Thanks student loans). I had a massive amount of help purchasing my RV and without that, I wouldn’t be doing this without changing to a traveling career first. Even then, I would still have a much higher monthly payment than I do now and the down payment would have been enormous.

2.) Don’t immediately go for the biggest and most fancy RV! Get a starter RV. I tried to get a brand new 2024 fifth wheel to start things off. Sure it was gorgeous. Exactly what I wanted. But it wasn’t the right one for a first time owner. And Calliope is more of my dream RV than my original dream RV! I have never towed anything behind a truck, granted they say the bigger the rv, the easier it is to tow. I would have needed a massive truck to bring that beast along with me in my travels. And that would have added another huge dent in my wallet. A new truck of that size is anywhere from $300-$1200 per month depending on your credit and down payment! Trust me, I looked! Not to mention, you want to try and live below your means so a lower monthly payment is always a good start!

3.) Don’t confuse your necessities with things that you want. Yes that new set of pots and pans is great, I love the brand new decor for the walls…buy a sewer hose to connect your black tank and a surge protector first! Some other necessities include a dehumidifier, a water filter, an emergency kit, polyurethane sealant for monthly seal replacements, etc. Speaking of necessities, you’ll also have an insurance policy. My policy is not yet equipped for full time living so it will increase when I move but right now it’s sitting at $170.32 per month. I definitely recommend getting an extended warranty! For that I put $800 down and I’m paying $175.00 per month for 18 months and the warranty lasts 7 years and will take care of anything in my RV that breaks. Fully covered! Which is great for someone who doesn’t know how to fix too many things. Although I did figure out how to take apart, rewire/recircuit, and put back together a ground unit AC so anything is possible!)

4.) Call around and ask RV parks about their bookings and whether or not they have space for something you’re looking at. Not all parks can accommodate larger RVs. Some of them have a 10 year rule meaning if your RV is more than 10 years old, you’re not renting from them. And the 55+ parks will be the end of me! I’m 31. Why can’t I rent from 3/4 of the parks around me? I’m not 55. (HUD says that parks can allow a percentage of their residents to be under 55, but that doesn’t mean they have to!) Ask about waiting lists. Ask about monthly prices. Ask if pets are allowed and what restrictions they may have. Ask all the questions!

5.) It’s very similar to renting an apartment. The monthly rent usually only includes water/sewer. So on top of rent you’re also paying for your typical bills. Electric, internet and cable, cell phone, etc. prices can range from $500 to $1600 per month. And the price can change depending on the season! There are deposits, some require background checks and added fees for pets. Most require an additional amount for an added person or a second vehicle, etc.

6.) Do. Your. Research. I cannot stress this enough. There are so many things I didn’t realize about RVs and full time living until I started researching. And I’m still asking all of the questions! What cleaning supplies should I use? Because bleach is safe for surfaces but you can’t put it down the sinks, the showers, or the toilets. But to sanitize your holding tank you can mix bleach into water with a specific ratio and run it through all the water lines (I’m still a little confused on this one myself—more research for me to do!). What do you mean I can’t use regular toilet paper?? Not in an RV. 1-ply only and lots of water to flush.

7.) No one likes to talk about it, but we’re gonna talk all about it. This is a safe space. How often do you need to empty your grey and black tanks? Depending on the size it can be as little as every 3 days. Maybe less. Thats just what my RV tech suggested for my trailer. A grey tank holds your dirty water from the shower and from sinks. The black tank is essentially your “septic system”. That is in quotations because RVs don’t actually have a septic system. You’ll also need special tank treatment in order to break down everything in the black tank and keep things smelling fresh! While we’re on the subject of 💩 keep your black tank closed! If it’s left open you can get the RV pyramid plug (EW!) and everything will be blocked! This is one of the major reasons 1-ply toilet paper and special treatments to liquify and break things down are a necessity. Not to mention if you leave it open while driving it can spill onto the road and then you can be fined for illegal dumping which carries a hefty fine and sometimes even jail time! No one wants that. One other piece of advice I got from the dealership when I did a walk through was to empty your black tank before you empty your grey tank. Black tank—human waste. Grey tank—shower and sink water. It cleans your sewer hose so to speak. It’s not really clean but you get the picture. And last but not least, the shower drain and the toilet pipe are not equal. No peeing in the shower! Lol

8.) I mentioned the heavy amount of upkeep and maintenance for an RV in my first post. It’s a lot of work! While researching I discovered most people recommend anywhere from 18-20% of the total cost of your RV for annual fees. Let’s say you purchase a $65,000 RV. So exciting! They shake your hand, you sign the papers, drive off the lot, and now you have this beautiful new Recreational Vehicle. 20% of that RV is $13,000. That means you could potentially be spending up to $1,083.33 per month for maintenance and upkeep, that is if you can’t do it yourself. There’s quite a few things that you can definitely do! But it’s still an important factor to keep in mind. Research your weekly, monthly, quarterly, and annual checklists of maintenance on an RV before you buy one!

9.) Storage space and traveling! I’m not a super materialistic person. I like things just like most people. But my likes tend to gravitate towards items like coffee mugs, cookware, matching soap dispensers, throw blankets, etc. I’m not a clothes shopper and I don’t own many shoes because honestly I hate wearing them. Lol I do like wallets… but I’ve been better about my wallet addiction. 😂 Back to the important information; DDO. Like I mentioned in my first post, Downsize, Declutter, Organize. The more things you put on your counters, the more things you have to move when you move. Of course there’s cool products like museum gel that you can use to hold things in place. But, I wouldn’t trust leaving a sharp knife set on the counter with museum gel on a travel day! A small plant, sure. Other storage spaces are small! The one issue I have run into with my RV is the kitchen drawers. I have 2. And neither one is big enough for a typical or a condensed utensil holder. I’m still working out how I want to fix that issue but I’ll get there. Some RVs have space for a washer and dryer with a hookup. I knew I really wanted that for my RV, especially if traveling. It’s not necessarily a need, it’s a want because laundromats exist. But I would give up my kitchen drawer space for a washer dryer closet any day.

10.) The final thing on this basics list is: Don’t Stress, Enjoy This Life. If you decide to jump on this bandwagon and buy an RV, the right one will come along at just the right time. You’ll learn from experience. You can ask other, more experienced RVer’s all your questions. One thing that stresses me out is finding a place to go. (Yes. Even though I’m telling you not to stress, you will still stress). It’s much more difficult than I imagined. Especially for long term living. There are Facebook groups and blogs and YouTube channels and websites and memberships and phone numbers, all to help you find a place to go even if only for a night. Cracker Barrel is usually on board with letting you stay one night. So is Walmart. Sometimes rest stops will allow you to stay for a night as well. Just be courteous and call to ask if you can stay first. Memberships to certain places can get you into parks for a certain amount of time for a lower cost but it is another monthly expense. Good Sam is one of the membership options, there is also thousand trails, and there are several more!

I’m starting this blog because as an inexperienced RVer there is so much that I don’t know and I’m sure that my experiences can help someone else! If not, maybe it’s at least free entertainment!

There is plenty more to come as I learn how to work the Full Time RV life. Follow along with me on this adventure!

#rv#rv life#rvadventures#travel#travel trailer#welcome home#cats#dogs#pets#advice#research#van life#maintenance#high maintenance#humidity#humidity control#learning#one day at a time

0 notes

Text

Student Loan Payments Resuming: Student loan borrowers in the United States have been enjoying a break from their monthly payments since March 2020 when the CARES Act was passed in response to the COVID-19 pandemic. However, this relief period is coming to an end, and it is important for borrowers to be aware of the changes that are coming. In this article, we will provide you with all the information you need to know about student loan payments resuming.

Understanding the CARES Act Suspension of Payments

When the CARES Act was passed in March 2020, it provided relief to student loan borrowers in the form of a suspension of payments until September 2020. Later, this suspension was extended until January 2021, and then again until September 2021. During this period, interest rates on federal student loans were also set to 0%, which meant that borrowers were not accruing any additional interest on their loans.

When Will Student Loan Payments Resume?

The latest extension of the suspension of payments is set to end on January 31, 2022. This means that borrowers will have to resume their monthly payments starting from February 2022.

What Should You Do If You Can't Afford to Resume Payments?

If you are unable to resume your student loan payments after the end of the relief period, there are several options available to you. One option is to apply for an income-driven repayment plan, which will allow you to make payments based on your income. Another option is to apply for deferment or forbearance, which will allow you to temporarily suspend your payments.

What Happens If You Don't Resume Your Payments?

If you do not resume your student loan payments after the end of the relief period and do not apply for any of the available options, your loan will go into default. This can have serious consequences, including damage to your credit score, wage garnishment, and even legal action.

What About Private Student Loans?

The CARES Act relief only applies to federal student loans. If you have private student loans, you should contact your loan servicer to discuss your options.

What Can You Do to Prepare for Resuming Payments?

If you are a student loan borrower, it is important to start preparing for the resumption of payments as early as possible. Some steps you can take include:

Reviewing your loan servicer information and making sure your contact information is up to date

Creating a budget and figuring out how much you can afford to pay each month

Considering enrolling in automatic payments to ensure that you don't miss any payments

How Can You Manage Your Student Loan Debt?

Managing student loan debt can be a challenging task, but there are several strategies that can help. Some of these strategies include:

Making extra payments when you can to pay off your loans faster

Consolidating your loans to simplify your payments

Refinancing your loans to get a lower interest rate

[wprpi title="Recent posts" by="category" post="3" icon="show"]

Conclusion

Student Loan Payments Resuming: Student loan borrowers in the United States will soon have to resume their monthly payments after a year and a half of relief. It is important to be aware of the changes that are coming and to prepare accordingly. By understanding your options and managing your debt effectively, you can make the most of this transition period and stay on top of your student loan payments.

FAQs

Can I apply for an income-driven repayment plan after my student loan payments resume?

Yes, you can apply for an income-driven repayment plan at any time, even after your payments resume.

Can I still make extra payments on my federal student loans?

Yes, you can still make extra payments on your federal student loans. This can help you pay off your loans faster and save money on interest.

Can I consolidate my federal student loans with my private student loans?

No, federal student loans and private student loans cannot be consolidated together.

However, you can consolidate your federal student loans through the Direct Consolidation Loan program.

Will interest rates on federal student loans change after the relief period ends?

It is possible that interest rates on federal student loans may change after the relief period ends. However, this will depend on various factors, including the state of the economy and federal policies.

What should I do if I have trouble making my payments after the relief period ends?

If you are having trouble making your student loan payments after the relief period ends, you should contact your loan servicer as soon as possible. They may be able to offer you different repayment options or assistance programs.

Reference

"Federal Student Loan Benefits and Repayment Options" - U.S. Department of Education: https://studentaid.gov/manage-loans/repayment/plans

"CARES Act: Relief for Federal Student Loan Borrowers" - Federal Student Aid: https://studentaid.gov/announcements-events/coronavirus

"5 Things to Know About Student Loan Relief in 2022" - Forbes: https://www.forbes.com/advisor/student-loans/student-loan-relief-2022/

"What to Do If You Can't Afford Your Student Loan Payments" - NerdWallet: https://www.nerdwallet.com/article/loans/student-loans/cant-afford-student-loan-payments

0 notes

Text

The Biggest Economic Lies We’re ToldIn America, it’s expensive...

New Post has been published on https://robertreich.org/post/710162153749004288

The Biggest Economic Lies We’re ToldIn America, it’s expensive...

youtube

The Biggest Economic Lies We’re Told

In America, it’s expensive just to be alive.

And with inflation being driven by price gouging corporations, it’s only getting more expensive for regular Americans who don’t have any more money to spend.

Just look at how Big Oil is raking it in while you pay through the nose at the pump.

That’s on top of the average price of a new non-luxury car — which is now over $44,000. Even accounting for inflation, this is way higher than the average cost when I bought my first car — it’s probably in a museum by now.

Even worse, the median price for a house is now over $440,000. Compare that to 1972, when it was under $200,000.

Work a full-time minimum wage job? You won’t be able to afford rent on a one-bedroom apartment just about anywhere in the U.S.

And when you get back after a long day of work, you’ll likely be met with bills up the wazoo for doctor visits, student loans, and utilities.

So what’s left of a paycheck after basic living expenses? Not much.

You can only reduce spending on food, housing, and other basic necessities so much. Want to try covering the rest of your monthly costs with a credit card? Well now that’s more expensive too, with the Fed continuing to hike interest rates.

All of this comes back to how we measure a successful economy.

What good are more jobs if those jobs barely pay enough to live on?

Over one-third of full time jobs don’t pay enough to cover a basic family budget.

And what good are lots of jobs if they cause so much stress and take up so much time that our lives are miserable?

And don’t tell me a good economy is measured by a roaring stock market if the richest 10 percent of Americans own more than 80 percent of it.

And what good is a large Gross Domestic Product if more and more of the total economy is going to the richest one-tenth of one percent?

What good is economic growth if the way we grow depends on fossil fuels that cause a climate crisis?

These standard measures – jobs, the stock market, the GDP – don’t show how our economy is really doing, who is doing well, or the quality of our lives.

People who sit at their kitchen tables at night wondering how they’re going to pay the bills don’t say to themselves

“Well, at least corporate profits are at record levels.”

In fact, corporations have record profits and CEOs are paid so much because they’re squeezing more output from workers but paying lower wages. Over the past 40 years, productivity has grown 3.5x as fast as hourly pay.

At the same time, corporations are driving up the costs of everyday items people need.

Because corporations are monopolizing their markets, they don’t have to worry about competitors. A few giant corporations can easily coordinate price hikes and enjoy bigger profits.

Just four firms control 85% of all beef, 66% of all pork, and 54% of all poultry production.

Firms like Tyson have seen their profit margins skyrocket as they jack up prices higher than their costs — forcing consumers who are already stretched thin to pay even more.

It’s not just meat. Weak antitrust enforcement has allowed companies to become powerful enough to raise their prices across the entire food industry.

It’s the same story with household goods. Giant companies like Procter & Gamble blame their price hikes on increased costs – but their profit margins have soared to 25%. Hello?

They care more about their bottom line than your bottom, that’s for sure.

Meanwhile, parents – and even grandparents like me – are STILL struggling to feed their babies because of a national formula shortage. Why? Largely because the three companies who control the entire formula industry would rather pump money into stock buybacks than quality control at their factories.

Traditionally, our economy’s health is measured by the unemployment rate. Job growth. The stock market. Overall economic growth. But these don’t reflect the everyday, “kitchen table economics” that affect our lives the most.

These measures don’t show the real economy.

Instead of looking just at the number of jobs, we need to look at the income earned from those jobs. And not the average income.

People at the top always bring up the average.

If Jeff Bezos walked into a bar with 140 other people, the average wealth of each person would be over a billion dollars.

No, look at the median income – half above, half below.

And make sure it accounts for inflation – real purchasing power.

Over the last few decades, the real median income has barely budged. This isn’t economic success.

It’s economic failure, with a capital F.

And instead of looking at the stock market or the GDP we need to look at who owns what – where the wealth really is.

Over the last forty years, wealth has concentrated more and more at the very top. Look at this;

This is a problem, folks. Because with wealth comes political power.

Forget trickle-down economics. It’s trickle on.

And instead of looking just at economic growth, we also need to look at what that growth is costing us – subtract the costs of the climate crisis, the costs of bad health, the costs of no paid leave, and all the stresses on our lives that economic growth is demanding.

We need to look at the quality of our lives – all our lives. How many of us are adequately housed and clothed and fed. How many of our kids are getting a good education. How many of us live in safety – or in fear.

You want to measure economic success? Go to the kitchen tables of America.

0 notes

Text

there's only 2 sticking points really which are : student loans and real estate

i'll say that a student loan that costs more than idk, 30% of your first real job's yearly income.....is stupid and not economically worthwhile. go to trade school or do community college + transfer and for fuck's sake, if money matters even a little to you don't pick an unemployable degree. you can learn those things on your own if you love them.

real estate is a different sticking point but what stops most americans is the down payment.... in switzerland i am limited both by my lack of downpayment cash and my 'insufficient' (to make banks feel secure) income. banks calculate your yearly running costs to be based on 5% mortgage rates (which is higher than reality) + 1% amortization yearly + an also overestimated % of property value in maintenance every year. so this means that despite most monthly running costs for a mortgaged home being LOWER than the typical rent for an equivalent (and usually inferior, too) home, banks expect a higher amount of income for safety purposes.

this means, that for a typical 2 bedroom apartment (prices are at about 1 Mio CHF for these) you need 200k cash for the down payment, 50k notary fees upon purchase.... AND to make 180-200k of income YEARLY (here this usually only happens in dual-income households, or else senior managers in lucrative fields. that's it. if you're solo you're shit out of luck and an economic underclass).

the only way to get past the income requirement is to bring more than 20% downpayment, which becomes even more tremendously challenging when average property prices for a small home are 1M.

#americans whine and whine and whine but in most of their country#the full price of a home is more like a swiss downpayment.#i could get into fiscality too.#swiss homeowners have to pay taxes on the 'virtual' rental income of a mortgaged homes EVEN IF THEY CURRENTLY LIVE IN THEM#this makes your tax rate climb deliriously as sums of 20k + are added to your total taxable income just bc you got a loan on your home

0 notes

Text

1 bedroom apartment with fireplace, allows pets, has a mini terrace in a great neighbourhood at <$300 per month ✓

#this would be amazing unbelievable perfection#IF and only IF i can get my monthly student loans to go lower#it'll take longer to pay them but at least i could live u know?#here's hoping i guess

1 note

·

View note

Text

i am not reblogging this post from OP (posted 2 days ago, with 4,400 notes and counting) because i know that often people are just making their own vent posts on their blogs and maybe don’t expect them to circulate widely outside of their small tumblr circle! and i don’t mean to like, jump on someone who is just commenting on something and then going on with their life. but i feel like i keep seeing versions of this sentiment on leftist twitter too and i really think it is a gross misrepresentation of the bill that passed earlier this month - which is due in part to social media’s intense focus on the “stimulus check” part of the bill. but the bill was not called “the stimulus check” act! it was called “The American Rescue Plan” and it was specifically geared towards providing desperately-needed relief to the American middle & working classes. the $1400 direct payments to individuals was just one small portion of the bill. here are the far more important parts:

in addition to receiving a $1400 direct payment themselves, individuals with children receive an additional $1400 check for each dependent

college students who are still listed as dependents on their parents’ tax forms (typically so they can retain health insurance benefits under the ACA) can more easily claim stimulus money - which is huge for college kids who may be helping to financially support immediate or extended family members

unemployment benefits have been extended from March 31, 2021 (their original expiration date) to September 6, 2021

unemployment benefits will be supplemented with a $300 weekly payment (ie $300 on top of what people are receiving from their state government)

unemployment benefits received in 2020-21 are tax-exempt (a retroactive change that means people who are unemployed won’t receive a surprise tax bill counting their unemployment money as “income”)

a substantial tax credit for employers who offer paid sick leave and paid family leave benefits (ie creating a direct incentive for employers to authorize emergency paid leave)

15% increase in food stamp benefits and extension of eligibility

child and family tax credit benefits!!!! this is the part that people are describing as one of the most significant anti-poverty initiatives in American history. families are eligible for a tax credit of $3600 for each child under the age of 6 and $3000 for each child between 6-18. people can also claim a child and dependent care credit with a maximum benefit of $4000 for one eligible dependent and up to $8000 for two or more. it also expands the earned income tax credit and lowers the age limit to 19. dems also pushed to get at least 50% of the tax credit money to people this year instead of making them wait for their 2021 tax return. this calculator allows you to calculate how much families will receive. if you make $50,000 a year and have four children, you will receive $13,200 through the child tax credit alone, paid out in monthly payments of $1,100 from July to December 2021 + an additional $6,600 lump-sum payment when you file your 2021 tax return early next year. there are also some additional dependent-related tax credits things that I don’t fully understand but that seem to indicate people are eligible for even more money.

forgiven student loan debt is made tax-free (a necessary prerequisite for future efforts to cancel/forgive student loan debt)

huge expansion of grant benefits to small businesses, including $28.6 billion specifically for bars and restaurants; $15 billion for low-interest, long-term replayment emergency disaster loans; and $7 billion more for the paycheck protection program (which can only be used on payroll expenses and makes it possible for small businesses to keep workers on payroll even if they are operating at lower capacity). you can describe this as “for the economy only” if you want, but I sure feel like it will alleviate a whole lot of human suffering by allowing people to keep their jobs & paychecks even if their workplaces remain partially shut down. my dad is a small business owner and has been able to keep his entire staff on payroll through the entire pandemic. the bill also includes billions for airlines and concert venues, which will again! means people won’t lose their jobs!! plus it allocates $175 million to fund a Community Navigator Program that reaches out to eligible businesses and helps guide them through the application process—ie making it possible for small businesses to actually take receive these benefits.

$350 billion to state, local, and tribal governments

$130 billion for K-12 schools to improve ventilation, reduce class sizes, purchase PPE for employees and students, and hire support staff; of this money, 20% must be dedicated to programs designed to counteract “learning loss” from students who missed school during the pandemic

$40 billion for colleges and universities, at least $20 billion of which must go to emergency grants to students (our university has been giving regular emergency grants throughout the pandemic to students to help cover rent, unexpected medical expenses, costs related to family emergencies or lost family income, tuition bills that they suddenly can’t pay, fees associated with wifi or purchasing tech equipment so they can learn virtually)

a HUGE amount of money four housing benefits!!!! i keep seeing people yelling about how $1400 won’t cover their rent but THAT’S WHAT THE RENTAL ASSISTANCE PROGRAMS ARE FOR. $21.6 billion in rent and utility assistance, paid directly to states and local governments so they can disburse it to eligible households!!! plus $5 billion to Section 8 housing (which “must go to those who are or were recently homeless, as well as individuals who are escaping from domestic violence, sexual assualt, or human trafficking”).

$5 billion to support state and local programs for homeless and at-risk individuals (can be used for rental assistance, homelessness prevention services, and counseling; can also be used to purchase properties that will be turned into permanent shelters or affordable housing for people who are homeless). plus an additional $120 for housing counseling.

$4.5 billion earmarked for a special assistance program that helps low-income households cover costs of heating and cooling and $500 million to cover water costs

$750 million in housing assistance for tribes and native Hawaiians (who are also eligible for other benefits through the rental assistance and direct tribal government grants described above)

and then BILLIONS of dollars to support FEMA, the Veterans Affairs’ healthcare system, the CDC, and state, local, and territorial public health departments for all things related to: COVID testing, contact tracing, vaccine production and distribution, vaccine outreach, PPE, and public health education. this includes (among many, MANY other things), $5.4 billion to the Indian Health Services (division of the Department of Health and Human Services that specifically provides health services to Native people and tribal territories), $200 million for nursing loan repayment programs, $80 million for mental health training, $3.5 billion in block grants specifically geared towards community mental health programs and substance abuse/prevention/treatment programs

$86 billion for a rescue package for pension funds (esp union-sponsored pension funds) that are on the verge of collapse - collectively covering 10.7 million workers.

billions of dollars for public transit programs (and sure, public transit is important to the economy, but access to regular, reliable, affordable, and safe public transit is HUGELY important to human health and well-being! it is how many people esp in urban areas access grocery stores, health care, their jobs, childcare facilities, etc.

$10.4 billion for agriculture, of which $5 billion is specifically earmarked for socially disadvantaged farmworkers. to quote wikipedia: “Experts identified the relief bill as the single most important piece of legislation for African-American framers since the Civil Rights Act of 1964.”

tons of money to fund 100% of premiums for COBRA (health insurance for people who have unexpectedly lost or had to leave their jobs) through October 2021. COBRA is hella expensive and experts estimate that 2.2 million people will need to enroll for COBRA benefits in 2021. there are also various provisions that expand Medicaid and the Children’s Health Insurance Program (a program targeted at uninsured children in families who don’t qualify for Medicaid but may not be able to afford adequate healthcare coverage. it also fixes some things with the ACA that could’ve led to people getting surprise bills due to fluctuating income or unexpected changes in employment status.

i am SO OVER the so-called ‘progressive’ rhetoric that no good can ever come from the government, or that all politicians (dems or republicans) are basically the same level of evil and incompetent, or that ~mutual aid~ (ie small payments made between individuals in a community) is the only thing we can count on or should count on in times of crisis. no!!!! fuck no!!!! like mutual aid is great but America is an INSANELY WEALTHY country and it is such bullshit to act like we can’t or shouldn’t expect our government to take care of the people who live here. and i am also just GRAHARRGHGHH at people who are completely disengaged from politics offering their jaded and hyper-cynical hot takes on things they don’t! actually! know! anything! about!!!!!!! and in the process making other people increasingly jaded and cynical about the possibility of electing a government that actually prioritizes the needs & well-being of its citizenry!!!

ugh i’m just TIRED of leftist political cynicism y’all especially when it comes from people who have absolutely no understanding of how much WORK it takes to make huge things like the American Rescue Act happen (work that includes not just the immediate negotiation of the bill but also the years of organizing & voter recruitment work it took to get a narrow democratic majority in the senate so that we could pass things like this!!!!). I’M DONE WITH BEING CYNICAL!!!! i feel, in a totally earnest and unjaded way, that it’s absolutely incredible that dems were able to write, negotiate, and pass this bill, and i feel so so so relieved to be currently living under an administration that is flawed in many ways but is at least actually and earnestly TRYING to reckon with unprecedented “suffering in an actual human scale” (to quote OP) and is even using this crisis as an opportunity to advance major anti-poverty initiatives that will have a LASTING IMPACT on actual human lives. as opposed to our previous administration, which was made up of thousands of people who woke up every single day and asked themselves “what can I do today to further dehumanize & inflict needless suffering upon millions of people?”

PHEW!!!! SORRY!!!! JUST HAVE A LOT OF FEELINGS I GUESS!!!!!!!!

#i went into this thinking i was going to be very measured and calm#but actually i'm pretty pissed off#people fire off their hot takes and thousands of people read them and it's so! fucking! infuriating!!!#no government is ever gonna be perfect! certainly ours still has a shit-ton of problems!!!!!#but i hate the 'only option is to fully disengage & say fuck it' attitude#esp when then thousands of people read it and accept it as truth#long post

30 notes

·

View notes

Note

hey mom can you educate me about money pls

Hey kid,

Very broad topic but here are a few ideas:

(Disclaimer: this is written by a European with free healthcare who never had to worry about credit score or student loans)

#1. Have a second bank account and transfer money there monthly:

It doesn’t have to be a huge amount, but make it one you won’t miss. No need to aim for 400€ if you have to transfer some of it back to pay bills.

Aim for twelve months worth of rent + bills + any monthly expense (pet food, therapist, gym, etc.): that is going to be your emergency money; medical, if you get sick, material, if something breaks, professional, if you lose your job. No “Oh I don’t have enough on Account #1 to pay for my Uber Eats delivery”.

Make sure you don’t pay more than you should: there are ways to lower your monthly charges; I recently halved my phone bill by sacrificing unlimited calls and 50 GB of data I didn’t need.

#2. Unless you’re in a place temporarily or a traveller at heart, invest in what you buy. Don’t purchase the same 10€ pair of H&M trainers over and over again: get a good sturdy pair of shoes that will be in your closet in fifteen years instead (and avoid trends, of course); then, take good care of them and go to the cobbler/tailor/etc. when needed. That logic works for:

anything that separates you from the ground (bed, car, etc.)

anything that you need regularly (fan, pans, hairdryer, etc.).

You don’t want that super useful thing to die after three weeks and 1/ having to buy it again, ergo spend more money and 2/ wait until it comes, i.e. be in a complicated situation in the meantime. Instead of buying Shitty Object A for 15€ and then Shitty Object B for 20 and hope for the best, make it a 50 now (after you researched its durability through customers reviews, of course).

Planned obsolescence is a real thing. My dad has a radio he bought in the seventies - it looks awful, but still works perfectly. If it were to fall on my foot, I would be the one getting damaged.

#3. Think about your long-term goals. Let’s say you want to buy a house or have four children: is it preferable to have dinner at a fancy restaurant with the girls tonight or invite them over and cook? You’ll enjoy food for twenty minutes and a house for a lifetime.

A friend of mine is currently dating a loaded guy and complained that, when grocery shopping together, he nitpicks and only wants to buy food that's on sale, whereas she doesn’t mind paying three extra pounds for fresh strawberries. But then, she concluded, that’s how he owns three apartments. Priorities!

Other little things:

Don’t fall into the trap of consumerism. No, you don’t need those shoes (you want them!); no, don’t buy gems for a game when you could wait three hours; no, secondhand things don’t look or smell bad. Death to retail therapy, see a doctor!

IF YOU CAN’T AFFORD IT TWICE, YOU CAN’T AFFORD IT.

Avoid as much as possible borrowing money from the bank, especially for something non-essential, as with debt comes interest; it can also put you in a bad position if you pass your deadline or need an urgent second loan for an actual emergency. Banks aren’t the Salvation Army.

Also, very specific but: hide 50€ somewhere in your house and 20 somewhere at work or at school. If something ever happens to your bank card, that will keep you out of trouble and hunger.

Don’t tell people how much you earn/saved. It’s a trap.

Between your well-being and money, choose yourself. If you are in an abusive relationship, leave; if you need medical help, go; you’ll always find a way to make things right later.

Love,

Mum

112 notes

·

View notes

Text

Brother Dearest Pt 61

“What the hell happened to him? He been faking that damn limp this whole time?” One of the Agents at SSR muttered to Chief Thompson who had just come from the lab Sousa’s team had shoved the irritated returned Chief from the shared lab between their floors. Already his own team was off sleuthing in Harlem for backup on the tip that Venom and Eddie had given them. With a huff through the passing group of Agents Sousa moved towards the elevator doors. And didn’t even make it halfway before Thompson stated with a smirk, “Few days near your sweetheart and you’re all upright, perfect example of bed rest to make a man out of a cripple again.”

Sousa simply pressed the button to call the elevator and tapped his cane against his fake shin that gave off an eye dropping metallic echo the men around him looked to. “New leg. Said in some time might be able to run on it. Just breaking it in.” The doors opened and before he could lower the cane the men watched with mouths opening to his unassisted step inside the lit up room. And when he turned he said, “Need it too, back up lab since you’ve been hogging ours has stairs.”

One of the guys asked, “Where the hell did you get a metal leg?”

While another asked, “How could you afford it?” As two more wondered on where the back up lab was that he’d never heard of before.

Sousa replied, “It was a gift.”

Thompson asked, “Let me guess, Peggy’s crime buddy ex squeeze Stark?”

“Baroness Bunny Pear Howlett.”

Thompson asked to their open mouthed stare, “Guess she’s trying to buy her way to the pearly gates before she kicks it. How’d you meet her?”

“I have a drive to get to the lab or I’d stick around chasing fiction and sit on my hands with you and your team.” He pressed the button and the doors closed cutting off the scoffs from the men who circled to talk more about the source of the new leg.

“Still say it’s a plot for points towards heaven. Heard she gained another ten pounds last week.”

Smirks spread and another in the group said to the stunned stare of one of the women on the floor passing notes to one of the Agent that came from another in a different department and floor. “I was her husband I’d have dumped her somewhere out of sight and mind instead of parading a whale around for clout in the papers.”

Down in the lobby Sousa strolled along all the way out to the lot where he climbed into his car and muttered, “Alright, let’s go follow a lead from an alien and his pregnant sister.” He shifted gears to the hum of the engine and pulled out of the lot to start the drive to the Hamptons where Stark’s mansion was located. Stretches of city were swapped for long patches of green with sprawling mansions that he sighed wondering how many years it would take him to save to afford one of these houses if he cared. And how many of these people actually owned these houses outright or had unimaginable mortgages on these marble accented wonders.

He couldn’t imagine a life in the city after his having grown up in a small town, but his sister did need him around. Sure it was just for weekly check ins and a monthly babysitting stop to let her and her husband have the night off. Always where he would be asked about his own future upon their return, now more than ever that his engagement had ended and he was back in town where he was just a floor away from the woman he hadn’t named to his sister that had caught on to his helpless pining. He had missed his sister and now that he had come back the townhouse he had been renting from his friend who had with the first offer stated one day he would be up to selling the place if he had gotten attached. It wasn’t much compared to the farmhouse he had grown up in but by chance if he could build up the nerve to take his chance and ask Peggy out just maybe she might like it for a family home of their own.

Stark’s drive however came into view and he sighed taking the turn and muttered, “Fingers crossed he’s in a helpful mood today.”

Off to the side of the front door he parked and spotted a curtain from above shift in notice of the company and out he climbed to make the walk to the door where he paused to fidget his hand on his cane before giving the front door a knock. Not two minutes later Jarvis was at the door that opened between them with a flinch of a smile, “Chief Sousa, how might I help you?”

“Mr Jarvis, I was wondering if I could talk to Howard actually.”

“Um,” he said to the faint sound of a one sided argument from a female and things being thrown and he stated, “Mr Stark is currently entertaining, however you are welcome to wait in the parlor.” Sousa nodded and stepped through the door that was shut behind them for the stroll through the echo filled mansion to the lushly decorated parlor where Jarvis asked, “Tea?”

“Sure,” Sousa answered and took a seat on the small couch closest to him.

For a few minutes he shook his head and bit back his ache to laugh at the insults fired at Stark until the faint sound of the kettle brought Jarvis back with a tea cart. Upon it with skillful ease he brought together a trio of cups while the tea steeped and asked, “If I may, are you here on official business, Chief Sousa?”

“Unofficially, yes,” that had Jarvis glance up at him, “Guys downstairs are hogging the lab and I was wondering if Stark might loan me use of his.”

That had Jarvis grin, “Oh, how exciting, new gadget?” A door slammed and he set down the napkin in his hand with a grin at him and said, “Pardon me a moment.”

Sousa nodded and watched him stroll out of the room adjusting his vest and tie to gather the belongings left by the door where around the still shouting woman he grinned in draping her wrap around her shoulders and offered her the handbag that had been left with it and stated, “Have a lovely day, Miss DeCoco.” Her thanks was soon followed by another shout to Stark who was now at the base of the stairs to watch her storm to the sports car she sped off in. Once the door was shut again Jarvis was heard to state, “Mr Stark,”

“Ya, I know, I’ll never learn my lesson. Time to go punish myself with a bubble bath.”

“Mr Stark,” Stark turned his head with brows raised and Jarvis continued, “Chief Sousa is here.”

“Oh, perhaps I should get dressed if I’m going to be arrested.”

“He stated he is here to borrow your lab actually.”

“Oh,” he said in a stunned tone and down the steps trotted in his untucked shirt and badly wrinkled pajama pants that lay over the top of his slippers. “Interesting.” To the door he went and strolled in with a grin and said, “Don’t get up, Daniel, how are you?” offering his hand to the man he approached who’d paused in his reach for his cane and shook the hand offered to him.

“Better than you it sounds like. Lovers quarrel?”

Stark shook his head with a grin at the release of hands stating, “Difference of opinions. I’ll send some scarves and a new purse and she’ll be more than happy to apologize.”

Sousa smirked, “So that’s what that was, denial, a lot quieter in my house growing up.”

Stark asked, “So what goodies did you bring to my doorstep? Jarvis says you asked to borrow my lab.”

After a reach into his jacket inner pocket he unfolded the sheet kept there while Jarvis poured the tea, “Part of my case I came back from LA to follow has some vanishing tech from a guy that came from Barbados. Well, I got a tip where to find him and the invisible ship he’s apparently been using to get around.”

“Vanishing tech, lot of people would love to get their hands on that.”

Sousa nodded, “Especially why we have to take him in and find out who else knows how to make it. However I got a tip on a compound to use to interfere with the tech. Pretty common ingredients, just couldn’t get it from her since she’s pregnant and all. Unsafe for the baby.”

Stark’s eyes flinched wider a moment and swept over the Chief asking, “Pregnant? Who gave you the compound?”

Sousa, “Oh, right, forgot to mention, Baroness Bunny Howlett.”

Stark’s face split into an amused grin, “How’d you get her roped into this case of yours?”

“Oh, her brother’s investigation mixed with mine and he caught some tips for me. Peggy knows them fairly well apparently, said they can be trusted and I mean it can’t hurt to try with what I’m up against.”

Stark accepted the sheet and chuckled saying, “Oh I gotta read this. Knew she was holding back on me.”

“Peggy?” Sousa asked accepting his cup of tea.

Stark nodded in response to his and replied, “Bunny. Babies, by the way.”

Sousa, “Must be twins by the size, no offense to her, and they all keep saying girls, as if they know for certain.”

Stark chuckled stating, “Triplets, actually,” parting the Chief’s lips. “She’s got a pretty good instinct on that from what I heard from the Brocks, can always tell a pregnancy before a blood test can by what they say.” Over the page his eyes shifted to the complex equations and diagrams of chemicals needed and reactions followed by one on how to fold the mixture into balloons. “This is way more complex than I would guess a second year student capable. Seems she’s been studying up on her own time. You must have shared a great deal on the tech with her for her to think up a way to counter it.”

“Venom did, apparently.”

Stark chuckled, “Come on Daniel, his name is Eddie. You can’t tell me you think Venom is real, some human eating monster brought on by a bite from a radioactive lizard. Bet it’d be amusing for them to hear you call him that.”

Sousa forced out a chuckle in curiosity if Stark had been let in on the secret, as obviously Peggy knew and only made him wonder why she hadn’t let him in on the fact that those comics were based on more fact than fiction. “Well apparently she’s been helping him to find a way to counter the tech from some diagrams in his own case which could be pretty deadly if they actually make it.” He took a sip and watched Stark read it again.

Jarvis asked after his own sip when he’d sat down, “How is she faring, Mrs Bunny? The papers, have not been particularly kind.”

Sousa caught his gaze answering, “She mentioned she was tired, she’s acting as Judge for some mock trials in school. Seemed to be a bit amused by some of the stories. Said they have a story planned when winter ends and she can’t hide the belly anymore.”

Jarvis said, “Perhaps we might drop in to make certain she is faring well.”

Stark said in a look up from the pages to say, “I’ve tried talking to the Times. Even been trying to stir up some bigger stories, but they are bent on chronicling Bunny’s health with every trash tip they claim to get. Today’s paper has a whole rehash of that frog dissection report and how that would equal a human’s autopsy if they had those results. Just trash, if anything that amount of metal in the body would leech moisture not allow a person to grow twice their usual size.” He lifted his cup and said to Jarvis’ glance his way, “She’s adorable pregnant, you know what I meant, she had to be what, 80 pounds wet, bound to be a reckoning when she puts that story out.”

A few sips later to the share of more plans Stark paused mid sentence at notice of the dark metal limb opposite the socked leg in view and said, “You um, that’s a new leg isn’t it?”

Sousa looked at him and said, “Oh, yes, the Baroness made it for me.”

Jarvis, “It was my impression she preferred not to be named by that title by friends.”

Stark, “She made you a leg? Out of what?”

“Metal, don’t know why gave it to me the second time I’d seen her. Fits shockingly comfortable. Said my old leg had lead in the securing brace that was leeching into my body and this one would be safer for me and help me to run again eventually when I’m used to it.”

Stark asked in a stunned tone, “Really?” Then glanced at his leg again and said, “Well, if you don’t mind I can watch you strut your stuff on the new leg down to our lab.”

“Nowhere near to strutting yet.” He said then joined the others on their feet to make the walk to the lab which gave Stark plenty of chance to steal glances at his eased stride after such little time with it. “So you have everything on the list, right?” His eyes having shifted away from Jarvis in his entrance of the code needed to unlock the lab.

Stark said, “Oh yes,” following Jarvis inside the room that lit up to the flick of a few switches that Sousa looked around while Stark gathered up a few things along the way to a bare station. Including a small device used to test metal contents, “fairly common ingredients by the look of it. Wouldn’t imagine they could do much of anything, but if Bunny says it should work then best to give it a try. No telling what she can pull out of her bag of tricks.”

He settled that helping of ingredients down Jarvis once he’d removed his jacket and folded up his sleeves got to arranging and finding the proper containers listed in your notes to prep and mix all of it in. Then paused at the final note, “Balloons?”

Sousa said, “She said that you have to keep it in latex, anything else it would eat through.”

Stark muttered to himself, “None of these are corrosive when mixed…” then looped around with more ingredients while Jarvis turned in a puzzled circle.

Jarvis, “We have latex gloves, no balloons.”

Stark said, “We have balloons,” pulling a package of grey balloons from a drawer in a desk along the way he added to the spread across the station and made a loop around Sousa to use the metal contents device on his leg. A single sweep of it and his confusion grew to the puzzling readings that there were no known metals in the known universe in it. “What metal did Bunny say she used?”

Sousa turned to see the device in his hand and answered, “She didn’t.”

Stark showed him the device, “Must have made a new one then, because this says there aren’t any metals in it.” After a pause they turned back to the task at hand and the Chief watched the duo work through the intricate directions that seemed to alter the known reactions of the ingredients. All entirely to puzzle the pair all the more on how you of all people had found them out and how this could react to the tech the Chief was up against.

Partway through the lift of a heated beaker underneath the fume hood as per instructions to be mixed into a cooled mixture in a silver bowl Sousa said, “I know you’re dying to ask more about the leg. Go on.”

Stark asked, “She just gave you a leg?”

Sousa said, “Said it’d help me keep up with Peggy. Seems like she just wants to help. Mentioned her relatives escaped a death camp,” that had Jarvis’ eyes on him, “And they’d seen a couple they were ordered to clear I guess and she was a Medic.” Jarvis looked away, “I mean she’s got that Medic rank maybe she wants to be a Doctor or work with the wounded.”

Jarvis asked, “You said Death Camps, her relatives escaped one?”

“Ya, Auschwitz, her aunt and cousin. Met them in France after they stormed Normandy Beach on D-Day. Haven’t met them yet, but if they’re anything like her and her brother should be a trip.”

Jarvis, “I believe Mrs Bunny has the best intentions for her education. And by your leg alone could change the lives of countless former soldiers at the very least.”

The final mixture came with a balloon to be folded over the fingers to pinch two knuckles worth of the creamy mixture that would upon the pinch of the balloon turned right side up to ease a tea spoon of the other mixture that almost had the men gag for the rancid grapefruit odor it gave off before each balloon was tied off and added to a bag for the Chief. “I’ll be damned,” Stark muttered to the sizzle of his having used the same spoon to scrape off the final creamy mixture than within moments ate the spoon he dropped into the mixture entirely. “She wasn’t kidding.”

Sousa peering over his shoulder muttered, “I don’t think she does that.”

Stark smirked, “Oh she has jokes, probably just missed some. She’s a master of subtlety is my guess with her humor.”

“One thing I cannot imagine her to be anything less than subtle. Title demands it no doubt.”

Stark smirked replying, “She married the title, grew up to barely a dime to her name. Could care less about that title so long as she got James out of the deal.”

Jarvis, “It is so pleasing to know she is so deep in love for all the hassle the press has given her since her retirement from the war.”

Sousa asked, “Where’d they even meet anyways, him being a Baron and all?” His eyes scanned between the duo and he asked to their shared disbelieving glance at each other, “What? What am I missing?”

Jarvis, “They met in the war.”

Stark, “Everyone knows this, it was in all the papers. Eddie had custody of her and he got drafted to the Canadian Forces. The hospital on the base Eddie got drafted to Bunny was a Nurse there then it got attacked.” This parted Sousa’s lips, “Eddie hacked off her hair and gave her a uniform, pack and gun and kept her with him while they were sent on their missions. Military counted her as a POW till a couple years later she ran into Victor and James’ platoon they mingled with. Not long after she got shot in the shoulder and was given a field promotion to Medic, E-4? I think. Then the world knew she was alive and safe out of Nazi hands. Somewhere in there they got sent on separate missions then met up at Normandy. That last year they stuck it out then got shipped straight to King George to be medaled and then out to Canada for her to get her GED and they met Truman somewhere in there and then she went on her University tour and settled on Barnard.”

“She got shot in the shoulder?”

Jarvis, “And the neck,” Only widening the Chief’s eyes more, “And there was mention of a facial grazing.”

Sousa, “She got shot three times above the ribs?!”

Stark, “Hard to imagine how badly she could have been hurt without that magnetic powered weapon she made that kept her men safe and was able to take out panzers and planes. Heard they got put on some harrowing details for their reputations.”

Sousa said, “I’m sorry, I can’t get past the she got shot in the face and neck part. I saw her, from several angles.”

Jarvis, “She was remarkably fortunate in her healing scar free from her injuries.”

Stark patted Sousa on the shoulder, “It’s alright Daniel, give it a few more visits and read up on her a bit, head down to The Blue Bonnet in lower Manhattan they’re playing a rerun of their wedding reel and the news clips they have on her in some sort of romantic retaliation for those headlines these days. Even some comics of theirs, helps to build up some socialization with the living mystery she is, well, the whole lot of them are.”

Sousa nodded and took hold of the bag, “Well, um, thank you for this. I have to get back and try to see if I can reach Eddie to plan a drop in tonight on my perp. Be a real thrill to catch my guy before Thompson catches his Weasel Bomber.”

Jarvis, “How have they not caught him yet?”

Sousa shrugged, “He’s got the whole floor except for Peggy on the case and all he’s won is a whole library of books and evidence that actually is from the case Eddie is searching on so they’ve been chasing an imaginary tail. Just ridiculous.”

Jarvis, “Could you not simply inform this Thompson that he is working on irrelevant evidence from an unrelated matter?”

Sousa smirked and said, “No, if the moron can’t figure his foot for a clue he shouldn’t have been given that promotion. But he’s too good at kissing ass than I could ever be to have been chosen against.”

Stark smirked back, “You got that promotion too old man.” Beginning to lead him off back to the front door.

Sousa rolled his eyes and replied, “They were desperate and I was the only one with enough time under my belt.”

Jarvis, “Sometimes necessity can be quite a virtue to have on your side. You have done more than earn the rank and now you have your own team here.”

“Who hate being stuck on my team. Rather be with the fun boys on Thompson’s floor.”

Jarvis, “Well then perhaps one might be traded for Peggy one day and you might have a worthy asset to your team.”

Sousa chuckled and answered, “Baroness has her way it would be best I wasn’t her superior.”

Stark smiled openly at him and clapped a hand on his back, “Well done, I’m hoping you mean in a matter of work positions, bout time we had another member on the team to know how happy you would make each other. And it’s nice to see Peggy gaining some strong women to back her outside of work. Hard to find someone on equal footing for her I would imagine. Plus Bunny has quite the mischievous streak in her. Hell of a pair.”

Sousa asked, “Have you guys seen that Lizard guy they’re putting up a billboard of over on the East Side?”

Jarvis, “Can’t say I have.”

Stark said, “I heard some big wigs have a big order from DC to post some new ‘official PR’ for one of their new show ponies.”

Sousa, “Why do they need a new show pony?”

Stark, “WW2 is over, Cold War is brewing though. Need someone’s face to slap on those posters now that Cap’s been bought out of their use.”

Sousa’s lips parted and Jarvis explained, “Mrs Bunny owns her brother’s image in and out of the uniform. Which the shield we hear is no longer in the Government vaults.”

Sousa, “Someone stole it?!”

Stark smirked and said, “Or someone took it home where it’d be looked after.”

Sousa muttered, “Home, you mean to his sister? What would she have need for that relic? Sledding with the kids?”

Stark chuckled and Jarvis stated in an amused tone, “That would be an amusing and handy use of the old hubcap.”

Stark more for himself than Sousa stated, “Well she certainly didn’t melt it down for that leg of yours. Vibranium would have been picked up by my scanner. No doubt if she’s got it nobody will see where she’s tucked it away. Just by chance he dropped it anyways, one of the last things he touched.”

They paused at the front door and Sousa said, “Victor said she has his pictures up in the library to honor their mother. To not pretend like he never existed. I can’t imagine, said he abandoned her for the war when she was a kid. Why would she have his picture up?”

Stark replied in a hinted solemn but steady tone, “Because she’s ‘not in the business of destroying little girl’s heroes’. What she told me. Why she shares about Bucky to his sisters and mom, he was all she had and he called her a monster. If you ask me, I think she saw him over there. Mentioned once how pitiful his shows were for the troops. If anyone could keep his memory from being trapped in that forever she would. Steve hated that damn show the minute he did it for the boys over there and not people back home who cheered and clapped.”

Sousa, “People who were out there dying, you mean.”

Stark answered, “Then he ran off on his own to news Bucky got taken prisoner. Had his boots on the ground after that till he took a nose dive in that plane.”

Jarvis, “I don’t imagine it would make much difference to put his photos away. He would still be there, all those years together, would still be there. Everything he said, and did, or lack thereof. Sometimes the silence and unanswered questions can be devastating enough.”

Sousa, “I just can’t seem to get a good read on her. I normally have a good radar for people. But her and her family, I don’t know about them.” The bag in his hand was lifted a little bit and he stated, “Thanks again. Let you know how it goes with the balloons.”

Stark said to his back, “Above all, have fun with it. My good balloons are involved.” The Chief chuckled on his way to his car to make the drive back.

*

Up against the wall you rested your hand in a moment’s pause once you’d hung up the phone after the call from the Blair House, where President Truman and his family were currently living to let the White House receive much needed repairs. He hadn’t asked again on progress of your pregnancy, yet shared he could have another word with the papers to ease up if they continued on like this when he was set for his next event. This call however came with news that out of respect for you they had found another mascot for their propaganda campaign for this new war on the hope front. Steve was at one time all you had and in that prior purchase of the comics Truman had enforced that ownership of everything Cap to sever that government owned tag from Steve’s ear to spare you pain of his face plastered everywhere once again. The big reveal would be at an event smack in the summer break when you would be in Canada and he said that once it did come out something might be done if you wished to show support publicly. But that would not be required.

Princess Elizabeth had responded to your latest letter in the trade off correspondence and even in her gleeful description of her enjoyment of the book you had gifted the couple for their vows the trunk hidden back in Canada kept popping back into your mind. It had been well over a year now since Truman had it sent to you personally that you had moved with you back there and buried like James and Vic had buried their own treasure hoards you had helped them to unearth and go through.

You had asked Peggy about a secret love child but somehow now thoughts of how his children would have grown up next to yours kept showing their faces like tiny prairie dogs you couldn’t shake while your date grew closer. But that tether had come to an end when the two hadn’t been physical, though not entirely fruitless as you learned by means of another Beserker on earth’s skilled studies that a sperm sample had been collected once from Steve and had been kept on ice in a facility. That upon the discovery to a more advanced facility had fallen prey to a freak accident and was leveled and the sample hidden away for when you might want use of it. Along with notes of the several failed tries of fertilization into volunteers by a group of scientists. By their inspection the sample was still viable and now under their care could last much longer and when the others would arrive there would be ample up to acting as surrogate for you.

But that would all be brushed away from your mind for now once again at the kick of your own girls who would send you back to the sketches you had been working up for the Manor finishing touches when you got back. Papers already had been bought before your trip back to Brooklyn and left there to install upon your return. Colored pencils helped to choose paint shades alongside paint swatches the guys had gathered and the duo helped to design some more furniture to go with what would be divided up to fill each of your wings by means of some books they flipped through. Every one of them secured answer that you were calming upon plans of the move. None more so than a mural of sketches on easels now set aside would be painted and hung when the basic paint smells didn’t make your stomach want to turn after the birth. The plans had been solidified nearly and on the page alone the Brocks who had come over the night prior had fallen in love with the changes to your new family home.

.

State vs Raslo, Tillinghast, Luckstrim

District Attorney Willie Abraham stood in front of the female student playing the 23 year old Christina Flanagan while she recounted her memory of the Defendant Jesse Rasslo on his way about the building in the process of stealing the information of ownership on each of the liquidated assets. “And you are certain it was Mr Rasslo? And not any chance it could have been anyone else?”

“I could point that hideous burnt orange and fuchsia leaf patterned fiasco of a vest he always wears out of a crowd. And if you mean his face I got a good look when he got into the elevator. It’s directly across from the store room I found a hole punch in to replace mine someone had run off with the week prior. Hard to get that ugly mug out of your mind after you see it with all of his tries at playing Casanova anytime he catches wind of a skirt nearby.”

The male student smirked and asked, “And when was the next time you saw Mr Rasslo?”

“Later on at the party. Came in far more gussied up than usual and made it a point to be social. Like he had to talk to everyone in the room. But then that’s when Miss Tillinghast began to try and put on a sort of one woman musical show and I excused myself to the other end of the room where I saw Mr Rasslo talking to Mr Virgil, who then left the room.”

“Did he seem angry?”

“No, determined, like he’d won something. Every time he won something he would get this one look on his face.” From the crowd now Jarvis, Stark and Peggy were added to the mix. All seemingly impressed of these cases they had caught up on with wonder on what two were next. “The same one Mr Gordon got a few minutes later when Mr Rasslo side stepped his way through the crowd to talk to him too. The brothers left and then it was like a switch flipped and Mr Rasslo joined Miss Tillinghast in her one woman show to keep all eyes on them. Only I couldn’t go hide in the toilet anymore as the lines for those grew and then by the time I’d found another for the catering staff in their office we heard the alarm sound and we all started to file out to wait for the cops to arrive to see what was wrong.”

Impressively a large board with the blueprints of a building to stand as example for the company was used by her and the DA in her show of where everyone was by use of markers and taped up sketches of ‘photographs’ taken from that evening by the team that was usually hired. This was what the Defense teams tried to attack and when they had failed in their tries to do so she flashed you a relieved smile in her being excused from the bench to exit the courtroom again now that her part was done.