#Black Economy

Text

It’s easy to forget that people of African descent come from a rich legacy of community and wealth-building as the first kings and queens on the planet. In a world that stifles Black progress and seeks to recreate a Eurocentric world-view of history, the brilliance of Black business owners shines through like a diamond in the rough.

As communities of the African diaspora, from Historic Greenwood District to Cape Town, South Africa, seek to build generational wealth after decades and centuries of pillaging and persecution, a few exceptional entrepreneurs stand out. The 10 wealthiest people of African descent prove the potential that’s often locked away inside Black people everywhere.

Using data from Forbes, which tracks the net worth of the wealthiest human beings in the world, The Black Wall Street Times compiled a list of the top 10 wealthiest Black people. Out of the 10, four are American, and three are Nigerian. Additionally, two are women, and eight are men.

What lessons can we learn from their success? Let’s meet them.

10. Folorunsho Alakija — Nigerian businesswoman and philanthropist.

Alakija has an estimated net worth of $1 billion as of 2020. Alakija is the founder and executive vice chairman of Famfa Oil, one of Nigeria’s largest oil exploration companies. Entering the business world with a fashion label, Alakija rose to financial prestige by cultivating high-profile clients, including the wife of former Nigerian president Ibrahim Babangida. At 72 years old, Forbes ranks her as the 20th wealthiest person in Africa and the wealthiest woman on the continent.

I have faced many hurdles in my own life, but I have learned that with the right mindset, every challenge is a chance to create bigger and better opportunities. pic.twitter.com/KJDholX9tx— Folorunso Alakija (@alakijaofficial) March 20, 2023

9. Mohammed Ibrahim — British-Sudanese businessman and philanthropist.

Ibrahim has an estimated net worth of $1.2 billion as of 2023. Born in Sudan, he’s the founder and chairman of Celtel International, one of Africa’s largest mobile phone companies. He also established the Mo Ibrahim Foundation to support good governance in Africa. He sold Celtel International to Kuwait’s Mobile Telecommunications Company for a whopping $3.4 billion in 2005, pocketing $1.4 billion in the process.

— startupAFRICA (@startupafrimag) April 28, 2019

8. Michael Jordan — Former NBA player and American businessman.

The six-time NBA champion has stayed busy in his retirement years. He’s now a successful businessman with an estimated net worth of $2 billion as of 2023. Jordan is the majority owner of the Charlotte Hornets franchise and has several other investments in business ventures across the world.

7. Strive Masiyiwa — Zimbabwean businessman and philanthropist.

Masiyiwa has an estimated net worth of $2.1 billion as of 2023. In 1998, he overcame government opposition to launch the mobile phone network Econet Wireless Zimbabwe. He also owns stakes in fiber optic and fintech companies in several African countries. Together with his wife Tsitsi, he found HigherLife Foundation. The organization supports orphaned and low-income children in Zimbabwe, South Africa, Burundi and Lesotho.

I met Strive Masiyiwa’s Higher Life Foundation & Celebration Ministries International fact finding team that will help Joyce Banda Foundation International provide immediate & long term help to cyclone Freddy victims. Our people need urgent help. Looking forward to their support. pic.twitter.com/SvRuG7CSB0— H.E. Dr. Joyce Banda (@DrJoyceBanda) March 20, 2023

6. Oprah Winfrey — American media mogul and philanthropist.

Arguably one of the most famous Black American women, Winfrey has a net worth of $2.5 billion as of 2023. She is the founder and chairwoman of Harpo Productions, which produces television shows, films, and digital media for a variety of platforms. Beginning her career as a TV journalist, Winfrey transitioned her hit talk show into a media empire with the OWN network, reinvesting profits from movies into more ventures.

Top five

5. Patrice Motsepe — South African businessman.

In 2008, Motsepe became the first Black African billionaire and has an estimated net worth of $2.7 billion as of 2023. Motsepe is the chairman and founder of African Rainbow Minerals, a South African-based mining company. In 1997, he flippled low-producing mining shafts into a profitable enterprise. He is the owner of the Mamelodi Sundowns Football Club and was elected president of the Confederation of African Football in 2021.

This is Patrice Motsepe. He bought an unknown South African club to frustrate Orlando Pirates and Kaiser Chiefs. All the cups prize money is shared among the players. Today Mamelodi Sundows is the best football club in Africa pic.twitter.com/k2vhDRXtBo— Tolo (@021Nongwadla) March 28, 2023

4. David Steward — American businessman and philanthropist.

Steward has a net worth of $6 billion as of 2023, making him the fourth wealthiest Black person in the world. Steward is the founder and CEO of World Wide Technology, Inc., a privately held technology solutions provider. A man who once watched his car get repossessed has progressed past poverty to become owner of a company that boasts high-profile clients, such as: Citi, Verizon and the U.S. government. In 2018, Steward donated $1.3 million to the University of Missouri-St. Louis to establish the David and Thelma Steward Institute for Jazz Studies.

David Steward battled with obstacles like poverty and racism. David didn’t enjoy the best resources from his parents. However, he learnt lessons from his parents that gave him significant wealth. One such is “treating people right.”https://t.co/b1ntWaFeEX— Business Elites Africa (@ElitesAfrica) March 27, 2023

3. Mike Adenuga — Nigerian businessman and billionaire.

Adenuga has an estimated net worth of $6.1 billion as of 2023. He’s the founder and chairman of Globacom, one of Nigeria’s largest mobile phone networks. It’s the third largest operator in Nigeria, with 55 million subscribers. Adenuga also runs a profitable oil exploration company in the Niger delta. He supported himself as a college student earning an MBA in New York by moonlighting as a taxi driver. At age 26, he earned his first million dollars selling lace and soft drinks.

Mike Adenuga worked as a taxi driver to help fund his university education. A student in New York, USA, he drove a taxi to pay for his studies, even though his parents belonged to the upper middle class in Nigeria. He was born and raised in Ibadan, Oyo. pic.twitter.com/qs7CCk0CVh— Yorùbáness (@Yorubaness) March 17, 2023

2. Robert F. Smith — American businessman.

Smith a net worth of $8 billion as of 2023, making him the second wealthiest Black person in the world. He is the founder and CEO of Vista Equity Partners, a private equity firm that specializes in software, data, and technology companies. Vista is one of the most successful private equity firms, with $96 billion in assets. The persistent self-starter earned an internship at Bell Labs during college after calling the company every week for five months. As an engineer, he worked at Goodyear Tire and Kraft Foods before earning an MBA from Columbia University. In 2019, he vowed to pay the student debt for the entire graduating class of Morehouse College.

1. Aliko Dangote — Nigerian businessman.

Topping the list of the wealthiest Black person in the world with an estimated net worth of $13.7 billion as of 2023, is none other than Nigeria’s own Aliko Dangote. He’s founder and chairman of Dangote Cement, one of Africa’s leading cement producers and he’s Africa’s richest man. The company has operations in 10 countries across the Motherland, and he also boasts a newly created fertilizer company as of 2022. Once completed, Dangote Oil Refinery is expected to be one of the world’s largest, even as climate change continues to disrupt the planet.

Today we celebrate a polio-free Africa, the result of decades of vaccination, hard work, collaboration. Tomorrow we get back to work, to ensure wild polio does not come back. Together, we all can #EndPolio globally.— Aliko Dangote (@AlikoDangote) August 25, 2020

While Nigeria boasts the third and first richest Black people in the world, the list reflects a diverse array of personalities, backgrounds, and ingenuity across the African diaspora.

#Meet the Top 10 wealthiest Black people in the world in 2023#Black Entrepreneurs#Black Business#Black Money Makers#Black Economy

10 notes

·

View notes

Text

How the Freedman's Bank failure still impacts Black Americans

Pictured above, Housing and Urban Development Secretary Marcia Fudge at the Freedman’s Bank Forum held at the Treasury Department in 2022. Chip Somodevilla/Getty Images

The Freedman’s Savings and Trust Company, also known as the Freedman’s Bank, was established in March 1865 by white abolitionists, bankers and philanthropists. According to the Treasury Department, the bank was created to “help develop the newly freed African Americans as they endeavored to become financially stable.” Within the first few years, the bank flourished, with 37 established branches and more than 100,000 depositors in total.

However, the bank failed after less than a decade, due to a financial crash and mismanagement by an all-white board of trustees. More than 60,000 depositors, many of whom were Black, lost over $3 million (equivalent to $68.2 million today). Very few received a fraction of their money back after years of appeals to government officials. Many believe this bank’s failure created many Black Americans’ distrust of financial institutions.

Justene Hill Edwards is an associate professor of history at the University of Virginia and the author of the forthcoming book, “Savings and Trust: The Rise and Betrayal of the Freedman’s Bank.” Edwards told “Marketplace” host Kai Ryssdal that there is a “generational memory of the Freedman’s Bank and its failure” that dictates the strenuous relationship between Black Americans and financial institutions.

The following is an edited transcript of their conversation.

Kai Ryssdal: For those unfamiliar, could you give a 30-ish second precis of the Freedman’s Bank?

Justene Hill Edwards: Sure. Well, the Freedman’s Bank, also known as the Freedman’s Savings and Trust Company, was a savings bank founded in March of 1865. And it was founded by a group of white politicians and philanthropists for the financial benefit of recently freed slaves.

Ryssdal: As I was prepping to speak with you, it occurred to me that the phrase “well-meaning white philanthropists” should probably be appended here. Is that fair?

Edwards: That is absolutely true. The basic foundations of the Freedman’s Bank were created by white Northerners who, in some ways, really believed that they could economically help the nation’s almost four million freed African Americans. And so, they conceived of the bank as a vehicle to help them make the really dangerous transition from slavery to freedom, but in terms of their finances and economics.

Ryssdal: The reason this bank failed matters through, not just the history of that period, but up to today, right?

Edwards: It does. There was a financial crash, a financial crisis in the fall of 1873, and African Americans started to withdraw their money en masse. Frederick Douglass comes in, he becomes the bank’s president in March 1874. And he looks at the bank’s finances and realizes that the bank is overleveraged. The finance committee had approved of millions of dollars of bank loans that were not going to be repaid. And interestingly enough, the majority of those loans went to the white partners and businessmen who were affiliated with the bank’s trustees.

Ryssdal: We should point out here that was the Frederick Douglass.

Edwards: Yes. The one and only Frederick Douglass, the most photographed man of the 19th century, was the bank’s last president.

Ryssdal: Okay. Alright. So with all of that, as context, I want to do a little prologue here. Was the supposition by the people who started this bank that Black Americans had not had, not necessarily financial institutions, but financial know-how and financial practices before emancipation?

Edwards: Yes, that’s right. And in many ways, they really didn’t understand the financial knowledge that African Americans were bringing with them into freedom, African Americans who were enslaved were cultivating ideas of how to make and save money in the period of slavery. And so they were bringing with them very concrete ideas about saving and what they wanted to do with their money, which was to buy property and buy land.

Ryssdal: Well, that’s where I wanted to go next. Because, you know, one of the many, many, many tragedies of the Black American economic experience is the inability that Black Americans have had to build generational wealth, and in a way it kind of starts here. You relayed this story, either in an article I read or parts of your other writings, about during the Great Depression, a descendant of one of these people writing to FDR, saying, “It would be really great if I could get my hands on my grandmother’s deposit right now.”

Edwards: Exactly, and so we see that there is kind of a generational memory of the Freedman’s Bank and its failure. And I think in many ways, too, it’s dictated the oftentimes fraught relationship that we’ve seen between the financial services industry and African Americans in the 20th and 21st centuries.

Ryssdal: Well, say more about that, because this was 150-something years ago that this happened, and your theory of the case here is that it affects things today.

Edwards: Yes, I mean, we see, especially in the period after the bank ends, we see African Americans continue not to trust and engage with the financial services industry that becomes so important in building credit to be able to purchase homes to pass down generational wealth. And so, in some ways, it’s not surprising that the wealth gap is as staggering as it is today.

Ryssdal: As you have done the research for your forthcoming book on this subject, the title of which we’ll get to when we say goodbye here, I imagine there were so many instances as you were doing the research, where it was a ‘what if?’ moment. What if things had been different? What if they hadn’t expanded to white bankers? What if the loans had gone to some of the recently enslaved Black Americans? There must have been so many turning points where today it would have been so different.

Edwards: Sure. I mean, I have heard just in my own family the idea of saving money not in banks, but underneath the mattress. In many ways, I think that these kind of memories of the bank, even though we may not have the language to connect it to behaviors today, it’s there, which is why I think that the history of this bank is so important.

#How the Freedman's Bank failure still impacts Black Americans#Freedmens Bank#Freedmen#Black Money#Black Economy#Black Money Matters#Black Banks#Stolen Wealth#Banking by Theft#The Rise and Betrayal of the Freedman’s Bank

1 note

·

View note

Text

Race & Class Traitors by Diallo Kenyatta @DialloKenyatta #DialloKenyatta #BLKPWR

There is a segment of the BLK Community that believes that the BLK Masses are unworthy of loyalty from the BLK Elites, & that demanding Solidarity from the BLK Elites is begging. They refuse to, or too ignorant to understand that all BLK personal success is a byproduct of Collective Struggle & Sacrifice.

These individuals are both Race & Class Traitors. They have low Racial Esteem & project…

View On WordPress

#BLKPWR#art#Black Economy#black music#diallo kenyatta#Experiment#hip hop#hiphop#music#underground hip hop#video

1 note

·

View note

Text

ONCE UPON A TIME, THERE WAS A KNIGHT...

the visual inspiration for this was a combination of Frederic William Burton's Meeting on the Turret Stairs and also Bernardo Cavallino's The vision of St. Dominic receiving the Rosary from the Virgin

this was supposed to be just a one off illustration to get the thoughts out of my system, but then I started thinking about medieval politics and warfare and plagues and a castle and home as both a place of refuge, a prison, and a tomb, so perhaps they will end up as ex voto characters as well.

you may say, hey! that rosary looks like it has too many beads! it's a fifteen decade rosary, probably. dominicans are really into marian devotions. it works out.

also. spiral style stair cases. oh boy. it was that unexpectedly more difficult than I originally thought it would be to draw. the more I think about it, the less I understand them, even though I had a million photos of the stairs in front of me while I was drawing it.

⭐ I have a tip jar (ko-fi)!

⭐ and other places I’m at! bsky / pixiv / pillowfort /cohost / cara.app

#the economy and my bank account are in shambles and i ended up stress drawing this whole thing in one go#its so many lines. the next time i draw this. because i will be revisiting this composition. i want to use a different inking brush#i think. but the next time i draw this it will be with solid blacks on the stair case steps i think#hey here's a fun fact for those of you who aren't catholic. did you know that kissing the ring of the pope/a cardinal/etc#grants you an indulgence. cardinals also used to kiss the pope on the mouth. also foot and hand iirc. anyway#there are no cardinals in this drawing but im saying if you write medieval/renaissance smut about men of the cloth#you can really amp up the friction between holy and seductive with a lot of the (gestures vaguely) that.#actually another fun fact about cardinals. their fun sun hat (it's called a galero) has some fucking weird as hell fever dream (literally)#origin lore. so if seductive isn't your thing. the horror of a thing that you wear is also extremely fun#esp when you get into medieval gender performances of clothes and how they define a person etc#generic medieval tag#original tag

2K notes

·

View notes

Text

#capitalism#palestine#economy#imperialism#colonialism#israel#congo genocide#genocide#africa#marginalization#marginalizedcommunities#marginalized groups#marginalized people#black women#black voices#afrofuturism#melanin#afrocentric#afropessimism#afro surrealism#amplify#leftist#socialism#communism#anarchist#left wing#anti capitalism#white leftists#yt#uplifting

418 notes

·

View notes

Text

#Tex-ass#Texas republicans#republican assholes#maga morons#Cancun Cruz#Greg Abbott fails Texas everyday#Chip Roy insurrectionist#Ken Paxton career criminal#Dan Patrick sacrificed grandmas for the economy#John Cornyn black hole of corruption and greed#Goober Gohmert#Dan Crenshaw slanders female veterans#Tex-ass is the NRA homeworld

337 notes

·

View notes

Text

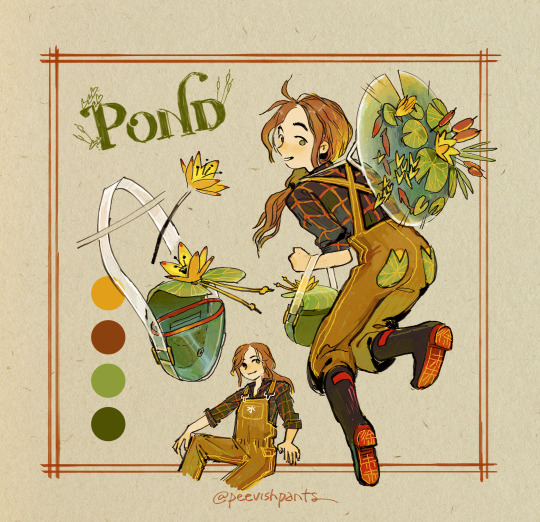

Rainy Day Outfit 3: Lilypads

Boots colour scheme inspired by louboutins! ... and north american leeches ^^"

#fashion#style#outfit#weiwei art#rainy day#pond#lilies#cottagecore#theres a leech in my friends cottage lake called Kobe i think#man i gotta use black shadows more its such a look#every time i see louboutins all i can think of are LEECHES#I think if u hav brown hair u would look awesome in brown overalls#Also nice overalls are SO EXPENSIVE?!??#I was lookin for one online cheapest ones i could find that didnt look made of thin material was like $80#Come on man thats like 2 weeks groceries#Well. Not anymore. Not in this economy.#Eggs r $8.29 for 30. Im goin broke bc i love eggs

3K notes

·

View notes

Text

If US politicians refuse to listen to our calls for ceasefire via letter, call, email, or petitions, then it's time to hit them where it hurts.

Don't buy anything during Black Friday or Cyber Monday. The American government cannot function without the funds of its people.

Free Palestine 🇵🇸

#free gaza#free palestine#gaza#palestine#from the river to the sea palestine will be free#israel#pray for palestine#ceasefire#america#usa#the united states of america#north america#black friday#cyber monday#amazon#shopping#online shoppping#economy#economics#boycott#boycott israel#politicians#politics#activism#share#thanksgiving#holiday#family#money

147 notes

·

View notes

Text

just because it could be significantly worse doesn't disregard the fact that it could also be a whole hell of a lot better

#there are so many things i could tag this as#lgbt#lgbtqia#trans#trans rights#economy#environment#fandom#politics#nature#autism awareness#palestine#black lives matter#education#etcetera

66 notes

·

View notes

Text

Alpha Kappa Alpha, the first collegiate sorority for Black women, is now the first to have its own credit union.

The sorority held a live stream on Thursday during the ribbon-cutting at its international headquarters in Chicago.

The commencement ceremony coincided with the organization’s annual leadership conference.

According to Chicago’s WLS – ABC 7, “For Members Only,” also known as FMO, is now the first digital financial institution in America that is Black-owned, women-led, and founded by a sorority.

“Everyone doesn’t understand the impact we make financially, so you have to start doing things so folks know we know how to control our money,” said Danette Anthony Reed, international president and CEO of AKA Sorority, in an interview with ABC7 Chicago.

The 115-year-old organization partnered with Aurora Advantage to provide digital banking services to members.

The idea for “FMO” was publically introduced in 2023 when the sorority introduced a new theme of “Soaring to Greater Heights of Service and Sisterhood.” Alpha Kappa Alpha Sorority’s members are committed to implementing key strategies to build personal, organizational, and community economic wealth.

The mission behind offering financial services is backed by their foundation pillar of being a “service to all mankind.”

“Every member will be an owner of the credit union,” FMO Federal Credit Union Executive Director Terri Bradford Eason told WLS.

The financial institution is open to active AKA members and their immediate families, staff and credit union employees.

FMO is a regulated and insured credit union that will reportedly offer savings accounts and loans.

Alpha Kappa Alpha Sorority Incorporated was founded on January 15, 1908, on the campus of Howard University. For over 115 years, the organization has upheld standards steeped in tradition and service. AKA has over 335,000 members worldwide, including prominent women such as Vice President Kamala Harris, author/activist Toni Morrison and journalist Star Jones.

#Alpha Kappa Alpha Sorority Inc. makes history with credit union#AKA#Black Credit Union#Black Money#Black Economy#Black Economic Growth#Sororitys#Divine Nine#FMO

2 notes

·

View notes

Text

Go to hell

#success#economy#finance#decor#marketing#skinnni#80s#black tumblr#kat dennings#beautiful model#adult model#anorexla#naomi campbell#aaliyah#girl interrupted#girl smoking#grunge#ai generated#girl in bed#tumblr girls#girlblogging#daddy's good girl#curvy girls#gisele bundchen#gorgeous#black beauty#black women#beauty#blondie#lana del ray aka lizzy grant

131 notes

·

View notes

Text

You know, David’s really good at making these certain faces

I don’t have a word to describe what they are but he’s good at it

#it’s literally black and white#why are his eyes still piercing through my skull 😭#❤️#steam powered giraffe#spg#the spine spg#SPG Pinterest economy is booming right now yall#my stuff

69 notes

·

View notes

Text

The Biden-Harris Administration Advances Equity and Opportunity for Black Americans

Growing Economic Opportunity for Black Families and Communities

Through the President’s legislative victories, including the American Rescue Plan (ARP), the Bipartisan Infrastructure Law (BIL), the CHIPS and Science Act, and the Inflation Reduction Act (IRA)—as well as the President’s historic executive orders on racial equity—the Biden-Harris Administration is ensuring that federal investments through the President’s landmark Investing in America agenda are equitably flowing to communities to address longstanding economic inequities that impact people’s economic security, health, and safety. And this vision is already delivering results. The Biden-Harris Administration has:

Powered a historic economic recovery that created 2.6 million jobs for Black workers—and achieved both the lowest Black unemployment rate on record and the lowest gap between Black and White unemployment on record.

Helped Black working families build wealth. Black wealth is up by 60% relative to pre-pandemic—the largest increase on record.

Cut in half the number of Black children living in poverty in 2021 through ARP’s Child Tax Credit expansion. This expansion provided breathing room to the families of over 9 million Black children.

Began reversing decades of infrastructure disinvestment, including with $4 billion to reconnect communities that were previously cut off from economic opportunities by building needed transportation infrastructure in underserved communities, including Black communities.

Connected an estimated 5.5 million Black households to affordable high-speed internet through the Affordable Connectivity Program, closing the digital divide for millions of Black families.

Helping Black-Owned Businesses Grow and Thrive

Since the President entered office, a record 16 million new business applications have been filed, and the share of Black households owning a business has more than doubled. Building on this momentum, the Biden-Harris Administration has:

Achieved the fastest creation rate of Black-owned businesses in more than 30 years—and more than doubled the share of Black business owners from 2019 to 2022.

Improved the Small Business Administration’s (SBA) flagship loan guarantee programs to expand the availability of capital to underserved communities. Since 2020, the number and dollar value of SBA-backed loans to Black-owned businesses have more than doubled.

Launched a whole-of-government effort to expand access to federal contracts for small businesses, awarding a record $69.9 billion to small disadvantaged businesses in 2022.

Through Treasury’s State Small Business Credit Initiative, invested $10 billion to expand access to capital and invest in early-stage businesses in all 50 states—including $2.5 billion in funding and incentive allocations dedicated to support the provision of capital to underserved businesses with $1 billion of these funds to be awarded to the jurisdictions that are most successful in reaching underserved businesses.

Helped more than 37,000 farmers and ranchers who were in financial distress, including Black farmers and ranchers, stay on their farms and keep farming, thanks to resources provided through IRA. The IRA allocated $3.1 billion for the Department of Agriculture (USDA) to provide relief for distressed borrowers with at-risk agricultural operations with outstanding direct or guaranteed Farm Service Agency loans. USDA has provided over $2 billion and counting in timely assistance.

Supported small and disadvantaged businesses through CHIPS Act funding by requiring funding applicants to develop a workforce plan to create equitable pathways for economically disadvantaged individuals in their region, as well as a plan to support procurement from small, minority-owned, veteran-owned, and women-owned businesses.

Created the $27 billion Greenhouse Gas Reduction Fund that will invest in clean energy projects in low-income and disadvantaged communities.

Increasing Access to Housing and Rooting Out Discrimination in the Housing Market for Black Communities

To increase access to housing and root out discrimination in the housing market, including for Black families and communities, the Biden-Harris Administration has:

Set up the first-ever national infrastructure to stop evictions, scaling up the ARP-funded Emergency Rental Assistance program in over 400 communities across the country, helping 8 million renters and their families stay in their homes. Over 40% of all renters helped are Black—and this support prevented millions of evictions, with the largest effects seen in majority-Black neighborhoods.

Published a proposed “Affirmatively Furthering Fair Housing” rule through the Department of Housing and Urban Development (HUD), which will help overcome patterns of segregation and hold states, localities, and public housing agencies that receive federal funds accountable for ensuring that underserved communities have equitable access to affordable housing opportunities.

Created the Interagency Task Force on Property Appraisal and Valuation Equity, or PAVE, a first-of-its-kind interagency effort to root out bias in the home appraisal process, which is taking sweeping action to advance equity and remove racial and ethnic bias in home valuations, including cracking down on algorithmic bias and empowering consumers to take action against misvaluation.

Taken additional steps through HUD to support wealth-generation activities for prospective and current homeowners by expanding access to credit by incorporating a borrower’s positive rental payment history into the mortgage underwriting process. HUD estimates this policy change will enable an additional 5,000 borrowers per year to qualify for an FHA-insured loan.

Ensuring Equitable Educational Opportunity for Black Students

To expand educational opportunity for the Black community in early childhood and beyond, the Biden-Harris Administration has:

Approved more than $136 billion in student loan debt cancellation for 3.7 million Americans through various actions and launched a new student loan repayment plan—the Saving on a Valuable Education (SAVE) plan—to help many students and families cut in half their total lifetime payments per dollar borrowed.

Championed the largest increase to Pell Grants in the last decade—a combined increase of $900 to the maximum award over the past two years, affecting the over 60% of Black undergraduates who rely on Pell grants.

Fixed the Public Service Loan Forgiveness (PSLF) program, so all qualified borrowers get the debt relief to which they are entitled. More than 790,000 public servants have received more than $56 billion in loan forgiveness since October 2021. Prior to these fixes, only 7,000 people had ever received forgiveness through PSLF.

Delivered a historic investment of over $7 billion to support HBCUs.

Reestablished the White House Initiative on Advancing Educational Equity, Excellence, and Economic Opportunity for Historically Black Colleges and Universities and the White House Initiative on Advancing Educational Equity, Excellence, and Economic Opportunity for Black Americans.

Through ARP, secured $130 billion—the largest investment in public education in history—to help students get back to school, recover academically in the wake of the COVID-19 pandemic, and address student mental health.

Secured a 30% increase in child care assistance funding last year. Black families comprise 38% of families benefiting from federal child care assistance. Additionally, the President secured an additional $1 billion for Head Start, a program where more than 28% of children and pregnant women who benefit identify as Black.

Improving Health Outcomes for Black Families and Communities

To improve health outcomes for the Black community, the Biden-Harris Administration has:

Increased Black enrollment in health care coverage through the Affordable Care Act by 49%—or by around 400,000—from 2020 to 2022, helping more Black families gain health insurance than ever before.

Through IRA, locked in lower monthly premiums for health insurance, capped the cost of insulin at $35 per covered insulin product for Medicare beneficiaries, and helped further close the gap in access to medication by improving prescription drug coverage and lowering drug costs in Medicare.

Through ARP, expanded postpartum coverage from 60 days to 12 months in 43 states and Washington, D.C., covering 700,000 more women in the year after childbirth. Medicaid covers approximately 65% of births for Black mothers, and this investment is a critical step to address maternal health disparities.

Financed projects that will replace hundreds of thousands of lead pipes, helping protect against lead poisoning that disproportionately affects Black communities.

Provided 264 grants with $1 billion in Bipartisan Safer Communities Act funds to more than 40 states to increase the supply of school-based mental health professionals in communities with high rates of poverty.

Launched An Unprecedented Whole-Of-Government Equity Agenda to Ensure the Promise of America for All Communities, including Black Communities

President Biden believes that advancing equity, civil rights, racial justice, and equal opportunity is the responsibility of the whole of our government, which will require sustained leadership and partnership with all communities. To make the promise of America real for every American, including for the Black Community, the President has:

Signed two Executive Orders directing the Federal Government to advance an ambitious whole-of-government equity agenda that matches the scale of the challenges we face as a country and the opportunities we have to build a more perfect union.

Nominated the first Black woman to serve on the Supreme Court and more Black women to federal circuit courts than every President combined.

Countered hateful attempts to rewrite history including: the signing of the Emmett Till Antilynching Act; establishing Juneteenth as a national holiday; and designating the Emmett Till and Mamie Till-Mobley National Monument in Mississippi and Illinois. The Department of the Interior has invested more than $295 million in infrastructure funding and historic preservation grants to protect and restore places significant to Black history.

Created the Justice40 Initiative, which is delivering 40% of the overall benefits of certain Federal investments in clean energy, affordable and sustainable housing, clean water, and other programs to disadvantaged communities that are marginalized by underinvestment and overburdened by pollution as part of the most ambitious climate, conservation, and environmental justice agenda in history.

Protecting the Sacred Right to Vote for Black Families and Communities

Since their first days in office, President Biden and Vice President Harris have prioritized strengthening our democracy and protecting the sacred right to vote in free, fair, and secure elections. To do so, the President has:

Signed an Executive Order to leverage the resources of the Federal Government to provide nonpartisan information about the election process and increase access to voter registration. Agencies across the Federal Government are taking action to respond to the President’s call for an all-of-government effort to enhance the ability of all eligible Americans to participate in our democracy.

Repeatedly and forcefully called on Congress to pass essential legislation, including the John R. Lewis Voting Rights Advancement Act and the Freedom to Vote Act, including calling for an exception to the filibuster to pass voting rights legislation.

Increased funding for the Department of Justice’s Civil Rights Division, which has more than doubled the number of voting rights enforcement attorneys. The Justice Department also created the Election Threats Task Force to assess allegations and reports of threats against election workers, and investigate and prosecute these matters where appropriate.

Signed into law the bipartisan Electoral Reform Count Act, which establishes clear guidelines for our system of certifying and counting electoral votes for President and Vice President, to preserve the will of the people and to protect against the type of attempts to overturn our elections that led to the January 6 insurrection.

Addressing the Crisis of Gun Violence in Black Communities

Gun violence has become the leading cause of death for all youth and Black men in America, as well as the second leading cause of death for Black women. To address this national crisis, the President has:

Launched the first-ever White House Office of Gun Violence Prevention, and taken more executive action on gun violence than any President in history, including investments in violence reduction strategies that address the root causes of gun violence and address emerging threats like ghost guns. In 2022, the Administration’s investments in evidence-based, lifesaving programs combined with aggressive action to stop the flow of illegal guns and hold shooters accountable yielded a 12.4% reduction in homicides across the United States.

Signed into the law the Bipartisan Safer Communities Act, the most significant gun violence reduction legislation enacted in nearly 30 years, including investments in violence reduction strategies and historic policy changes to enhance background checks for individuals under age 21, narrow the dating partner loophole in the gun background check system, and provide law enforcement with tools to crack down on gun trafficking.

Secured the first-ever dedicated federal funding stream for community violence intervention programs, which have been shown to reduce violence by as much as 60%. These programs are effective because they leverage trusted messengers who work directly with individuals most likely to commit gun violence, intervene in conflicts, and connect people to social, health and wellness, and economic services to reduce the likelihood of violence as an answer to conflict.

Enhancing Public Trust and Strengthening Public Safety for Black Communities

Our criminal justice system must protect the public and ensure fair and impartial justice for all. These are mutually reinforcing goals. To enhance equal justice and public safety for all communities, including the Black community, the President has:

Signed a historic Executive Order to put federal policing on the path to becoming the gold standard of effectiveness and accountability by requiring federal law enforcement agencies to ban chokeholds; restrict no-knock warrants; mandate the use of body-worn cameras; implement stronger use-of-force policies; provide de-escalation training; submit use-of-force data; submit officer misconduct records into a new national accountability database; and restrict the sale or transfer of military equipment to local law enforcement agencies, among other things.

Taken steps to right the wrongs stemming from our Nation’s failed approach to marijuana by directing the Departments of Health and Human Services and Justice to expeditiously review how marijuana is scheduled under federal law and in October 2022 issued categorical pardons of prior federal and D.C. offenses of simple possession of marijuana and in December 2023 pardoned additional offenses of simple possession and use of marijuana under federal and D.C. law. While white, Black, and brown people use marijuana at similar rates, Black and brown people have been arrested, prosecuted, and convicted at disproportionately higher rates.

Announced over 100 concrete policy actions as part of a White House evidence-informed, multi-year Alternatives, Rehabilitation, and Reentry Strategic Plan to safely reduce unnecessary criminal justice system interactions so police officers can focus on fighting crime; supporting rehabilitation during incarceration; and facilitating successful reentry.

FACT SHEET

#Joe Biden#Thanks Biden#Black History Month#black americans#african american#kamala harris#politics#US Politics#Economy#student loan debt#marijuana#criminal justice#gun violence#voting rights#from the White House#long post#because a lot has happened

68 notes

·

View notes

Text

When for an appointment in the morning and it ended early so I proceed to the nearby coffee shop to have my brunch at the Economy Rice (菜饭) stall. From the numerous dishes on display, I chose crispy prawn rolls (虾枣), chicken & black fungus and stewed potato slices to go with rice.

On the way to the MRT train, I spied on the gorgeous confections at Paris Baguette and couldn’t resist the temptation to not eat dessert. Gotten the Blueberry Yogurt Tart (S$9.50) which is topped with glazed blueberries and red chocolate pearls. The light purple yogurt mousse is tangy sweet with marbling of blueberry compote and the sponge cake gave it substance.

#Brunch#Economy Rice#菜饭#Prawn Roll#虾枣#Hei Zho#Chicken#Black Fungus#Stewed Potato#White Rice#Paris Baguette#Northpoint City#Cafe#Confection#Blueberry Yogurt Tart#Mousse#Sponge Cake#Pastry#Blueberry#Fruit#Tangy#Sweet#Dessert#Snack#Food#Buffetlicious

33 notes

·

View notes

Text

#black rose#black girl aesthetic#weed community#pisces#black girls of tumblr#black boys#fairy aesthetic#current events#black tumblr#black stoners#economy#bohovibes#bohostyle#boho#strwrsdaily#strawberry#stoner food#stoner#blunt#tobacco pipe#tie dye#crypto#gangster

133 notes

·

View notes