#puttin

Text

[RIBS? LOOK AT HIM. HE'S NOT EVEN-- "JUST KEEP TALKIN', BUDDY. I'M GONNA EAT." AND SAILING OFF ON THE SHIPS TO NOWHERE. ALL WE'RE SIMPLY USING IS BLACK PEPPER AND SALT. PUTTIN' THESE LITTLE PIGGIES ON. WHAT DO YOU SMOKE WITH?]

#s01e05 local legends#guy fieri#guyfieri#diners drive-ins and dives#keep talkin#gonna eat#black pepper#little piggies#ribs#look#him.#ships#is#salt#puttin

5 notes

·

View notes

Text

Unveiling the Impact: Russian Ruble Plunges, Infuriating Putin's Inner Circle

Introduction to the Russian ruble plunge

The Russian ruble has these days skilled a full-size and alarming plunge, attaining a record low that has sent shockwaves through the global economic markets. This surprising decline in value has not most effectively raised worries approximately the steadiness of the Russian financial system. However, it has also profoundly impacted Vladimir Putin's inner circle. In this text, we can delve into the factors behind the Russian ruble's plunge and discover its implications for the political panorama and the regular lives of Russians.

Understanding the factors in the back of the Russian ruble plunge

To fully recognize the motives behind the Russian ruble's drastic decline, it's essential to consider several key factors. First and foremost, the economic sanctions imposed on Russia via Western international locations have played a good role. These sanctions, usually implemented in response to Russia's annexation of Crimea and involvement in the conflict in Ukraine, have severely limited Russia's entry into global markets and foreign investments. As a result, the Russian economic system has been under tremendous stress, leading to lower investor self-assurance and a subsequent devaluation of the ruble.

Furthermore, the plummeting oil expenses have additionally contributed to the ruble's downfall. Russia, being one of the international's largest oil manufacturers, is heavily based on oil exports as a vital source of revenue. However, the oversupply of oil in the global market and a decrease in demand because of the COVID-19 pandemic have led to a full-scale drop in oil prices. This has had a damaging impact on Russia's economy and the cost of the ruble.

The impact on Vladimir Putin's internal circle

The Russian ruble's plunge has sent shockwaves through Vladimir Putin's internal circle, infuriating those close ties to the Russian president. Many of Putin's allies and supporters, who have accumulated sizeable wealth and strength underneath his leadership, have seen their fortunes diminish swiftly due to the ruble's decline. This has no longer prompted financial distress but has also shaken their loyalty to Putin and his regime.

The economic downturn has also uncovered the vulnerability of Putin's monetary regulations. The Russian president has long relied on a device of crony capitalism, where the ones close to him are granted preferential remedy and get entry to resources. However, with the ruble's plunge, it has become evident that this machine could be more sustainable and may have excessive outcomes for folks who take advantage of it.

Political implications of the Russian ruble plunge

The Russian ruble's sharp decline includes massive political implications both regionally and across the world. Domestically, the financial hardships ordinary Russians face because of the ruble's devaluation may also lead to extended social unrest and dissatisfaction with Putin's authorities. The Russian president has built his popularity by promising balance and financial prosperity. However, the ruble's plunge has shattered this phantasm, leaving many Russians disenchanted and indignant.

On the global level, the Russian ruble's decline has similarly isolated Russia and weakened its influence. The ruble's devaluation reinforced the economic sanctions imposed by using Western international locations, making it hard for Russia to say its strength and pursue its geopolitical objectives. This has strained Russia's relations with the worldwide community and has exacerbated it's already aggravating relationship with the West.

Economic Effects on Russia

The monetary consequences of the Russian ruble's plunge are some distance-accomplishing and profound. The devaluation of the ruble has brought about a substantial boom in inflation, making it more excellent hard for average Russians to have the funds for basic requirements. The price of imported goods has skyrocketed, exacerbating the Russian population's financial burden.

Moreover, the devalued ruble has made it more demanding and challenging for Russian corporations to operate and increase. Many businesses, specifically those heavily reliant on imports or foreign investments, had been hit laborious employing the ruble's decline. This has resulted in extensive layoffs, bankruptcies, and a fashionable reduction in monetary pastime.

The reaction from the global network

The global community has carefully monitored the Russian ruble's plunge and has spoken back with a combination of concern and warning. Western countries, specifically those who have imposed financial sanctions on Russia, have seized the possibility to, in addition, isolate and weaken the Russian government. They have reiterated their dedication to retaining the sanctions regime till Russia adjusts its conduct and adheres to global norms.

However, other international locations, particularly people with close monetary ties to Russia, have feared the ruble's decline. The European Union, for example, has been careful in its response, as it fears that the monetary turmoil in Russia should spill over into its very own markets. Despite those concerns, the global network has typically remained company in its opposition to Russia, using the ruble's plunge to strain the Russian government.

Analyzing the function of sanctions within the ruble's decline

The monetary sanctions imposed on Russia have significantly affected the Russian ruble's decline. These sanctions have critically limited Russia's entry into global markets, making it difficult for the u. S . A . To attract foreign investments or acquire loans. As a result, Russia's economy has struggled, leading to a decrease in investor self-belief and a subsequent devaluation of the ruble.

However, it is vital to notice that the ruble's plunge can not be attributed to sanctions. Other factors, including the drop in oil fees and Russia's overreliance on oil exports, have also contributed to the ruble's decline. The mixture of these factors has created the perfect hurricane for the Russian ruble, causing it to hit a record low and inflict giant damage on the Russian economy.

Predictions and forecasts for the destiny of the Russian ruble

The future of the Russian ruble remains uncertain, with conflicting predictions and forecasts from economists and analysts. Some experts agree that the ruble will hold to depreciate, as the financial sanctions and coffee oil costs show no signs of abating. They argue that the ruble's decline may only persist with a sizable shift in Russia's monetary policies and a decision to continue conflicts.

On the other hand, some people expect healing for the ruble, albeit sluggish and gradual. They argue that as the worldwide financial system recovers from the effect of the pandemic and oil costs stabilize, Russia's financial prospects may improve, mainly to a strengthening of the ruble. However, these predictions come with the caveat that Russia needs to address its underlying economic challenges and reduce its dependence on oil exports.

How the ruble plunge affects regular Russians

The Russian ruble's plunge has had a profound effect on the ordinary lives of Russians. The ruble's devaluation has caused a large lower in buying strength, making it more challenging for ordinary Russians to pay for simple necessities. The growing inflation has eroded the value of their wages, leaving many suffering to make ends meet.

Moreover, the monetary downturn has resulted in considerable process losses and a decline in residing requirements. Many businesses were forced to downsize or close down altogether, leaving countless individuals unemployed and unsure about their future. The ruble's drop has created an atmosphere of economic instability and uncertainty, placing a heavy burden on the shoulders of regular Russians.

Conclusion

The Russian ruble's plunge has had implications for the Russian financial system and Vladimir Putin's inner circle. The combination of economic sanctions, low oil costs, and Russia's overreliance on oil exports has created a perfect typhoon that has severely devalued the ruble and caused sizeable monetary hardships for ordinary Russians. The ruble's decline has not most effectively infuriated Putin's internal circle however has also strained Russia's family members with the international network and raised questions about the sustainability of Putin's monetary rules. As the destiny of the ruble remains uncertain, it's far more critical for Russia to address its underlying economic demanding situations and diversify its financial system to mitigate the effect of future crises. Only then can Russia regain stability and repair the self-belief of its residents and the global network.

Frequently Asked Questions (FAQ) - Unveiling the Impact: Russian Ruble Plunges, Infuriating Putin's Inner Circle

Q1: What factors have contributed to the significant decline in the Russian ruble's value?

The Russian ruble's sharp decline can be attributed to various factors. Foremost among them are the economic sanctions imposed by Western nations on Russia. In response to Russia's actions in Crimea and Ukraine, these sanctions have limited Russia's access to global markets and foreign investments. Additionally, the drop in oil prices and Russia's heavy reliance on oil exports have further exacerbated the ruble's devaluation.

Q2: How has the ruble's plunge affected Vladimir Putin's inner circle?

The ruble's sharp decline has profoundly impacted those within Vladimir Putin's inner circle. Allies and supporters who have amassed significant wealth and influence under Putin's leadership have rapidly diminished their fortunes due to the rubble's depreciation. This has led to financial distress and a shake in their loyalty to Putin and his regime.

Q3: What are the political implications of the Russian ruble's decline?

The ruble's decline carries substantial political implications within Russia and globally. Domestically, the economic hardships stemming from the ruble's devaluation may lead to increased social unrest and dissatisfaction with Putin's government. Internationally, the ruble's decline has weakened Russia's global influence and strained its relations with other nations due to reinforced economic sanctions.

Q4: How has the Russian ruble's plunge impacted the everyday lives of Russians?

The ruble's devaluation has significantly affected the daily lives of ordinary Russians. It has decreased purchasing power, making it harder for them to afford necessities. Rising inflation has eroded the value of wages, leaving many struggling to make ends meet. The economic downturn has also caused widespread job losses and a decline in living standards.

Q5: What role have economic sanctions played in the ruble's decline?

Economic sanctions have played a substantial role in the Russian ruble's decline. These sanctions, imposed in response to various geopolitical events, have significantly restricted Russia's access to global markets, making it challenging for the country to attract foreign investments or secure loans. This economic pressure has strained Russia's economy and reduced investor confidence, contributing to the ruble's devaluation.

Q6: How have central banks and advisers responded to the ruble's decline?

Central banks and advisers have closely monitored the ruble's decline and its implications. For instance, Sergei Oreshkin, an academic and former economic adviser, has shared insights on the potential causes and consequences of the ruble's plunge. Central banks have often intervened to stabilize the currency and mitigate the impact of the devaluation on the country's economy.

Q7: How has the ruble's decline affected Russia's economic policy?

The ruble's decline has prompted Russia to reevaluate its economic policy. The weakening ruble has necessitated measures to counter inflation and support financial stability. Adjustments to fiscal policy, interest rates, and monetary measures have been considered to address the economic challenges of the ruble's depreciation.

Q8: What impact has news and media coverage had on the ruble's decline?

News and media coverage has played a role in shaping perceptions of the ruble's decline. The extensive range of the ruble's plunge and its economic implications can influence investor sentiment and public confidence. Media outlets often explore the potential causes of the decline and its ramifications for the country and its citizens.

Q9: How has the ruble's plunge affected academic discourse on Russia's economic policy?

The ruble's decline has sparked academic discussions about Russia's economic policy. Academics and experts in economics have analyzed the impact of various factors, such as sanctions and oil prices, on the ruble's value. These discussions contribute to a deeper understanding of Russia's economic vulnerabilities and potential policy responses.

Q10: How does the ruble's decline impact neighboring countries like Belarus?

While the article primarily focuses on the ruble's impact on Russia, neighboring countries like Belarus can also feel the effects due to economic ties and regional dynamics. Economic fluctuations in Russia, including the ruble's decline, can have ripple effects on neighboring economies, influencing trade, investments, and overall financial stability.

Q11: How have currency curbs affected the ruble's decline?

In response to the ruble's decline, measures such as currency curbs have been implemented to mitigate its impact. Currency curbs restrict currency transactions and movements to stabilize the exchange rate. These measures aim to prevent excessive volatility and restore stability to the ruble's value.

Q12: How have academic advisers like Maksim Oreshkin responded to the ruble's plunge?

Academic advisers like Maksim Oreshkin have provided insights and analysis regarding the ruble's plunge. Oreshkin, a notable academic and former economic adviser, has offered expertise on the factors contributing to the ruble's decline and its potential consequences. His insights contribute to a broader understanding of the economic dynamics at play.

Q13: What implications does the ruble's decline have for Russia's economic diversification efforts?

The ruble's decline underscores the importance of diversifying Russia's economy. Heavy reliance on sectors like oil exports makes the economy vulnerable to fluctuations in global commodity prices. The ruble's devaluation can incentivize efforts to diversify into other sectors, reducing the economy's susceptibility to external shocks.

Q14: How has the ruble's decline impacted Russia's relations with countries like Belarus?

While not explicitly covered in the article, the ruble's decline can affect Russia's relations with countries like Belarus. Economic ties between neighboring nations can lead to spillover effects, potentially impacting trade, investments, and economic cooperation. Belarus, a close regional partner, may experience indirect consequences from the ruble's devaluation.

Q15: What steps has Russia's central bank taken to address the ruble's decline?

Russia's central bank has taken measures to address the ruble's decline and stabilize the currency. Central banks often intervene in foreign exchange markets to influence the ruble's exchange rate. These interventions can include buying or selling foreign currency reserves to counter excessive volatility and stabilize the ruble's value.

Q16: How has the ruble's decline influenced academic discussions on economic policy?

The ruble's decline has prompted academic discussions on Russia's economic policy. Academics and economists delve into the impact of various factors on the ruble's trajectory, including sanctions, oil prices, and government measures. These discussions contribute to shaping informed policy recommendations to address the economic challenges.

Q17: What implications does the ruble's decline hold for the country's economic worth and stability?

The ruble's decline raises questions about Russia's economic worth and stability. A weakening currency can affect the country's international standing and investment attractiveness. Efforts to restore financial stability, bolster investor confidence, and diversify the economy can be imperative to enhance Russia's economic resilience in the face of such challenges.

Q18: How has the ruble's decline influenced Russia's policy towards neighboring countries like Belarus?

The article doesn't explicitly discuss Russia's policy towards neighboring countries like Belarus in the context of the ruble's decline. However, economic fluctuations, including the ruble's devaluation, can indirectly influence diplomatic and economic relations between neighboring nations. Economic challenges can prompt reevaluations of trade agreements, cooperation, and financial interactions.

Q19: How has the academic community responded to the ruble's decline in Russia?

The academic community in Russia and beyond has likely responded to the ruble's decline through research, analysis, and discussions. Academics specializing in economics, geopolitics, and international relations may explore the multifaceted impact of the ruble's devaluation and its implications for various aspects of the country's economy and global connections.

Q20: What long-term policy adjustments might Russia consider to address the ruble's vulnerability?

Russia might consider a range of long-term policy adjustments to address the ruble's vulnerability. These include diversifying the economy by investing in non-commodity sectors, implementing structural reforms to enhance economic resilience, and pursuing diplomatic efforts to ease economic tensions with trading partners. Such measures could mitigate the impact of future economic challenges.

#Russian Ruble#plunges#impact#infuriating#Putin's Inner Circle#blog post#russia#puttin#ruble#russian ruble#Blamed Ruble Plunge#Academic Analysis#Economic Policy#Central Bank Measures#Currency Curbs#Maksim Oreshkin Insights#Economic Stability#Ruble's Worth#Trade Impact#Belarus Relations#Global Economy#Financial Markets

0 notes

Text

rip acheron you wouldve loved the early 2000s

#honkai star rail#acheron hsr#myart#that bitch is [probably a spoiler] shes not spending 3hrs puttin on a gacha game outfit be serious

1K notes

·

View notes

Text

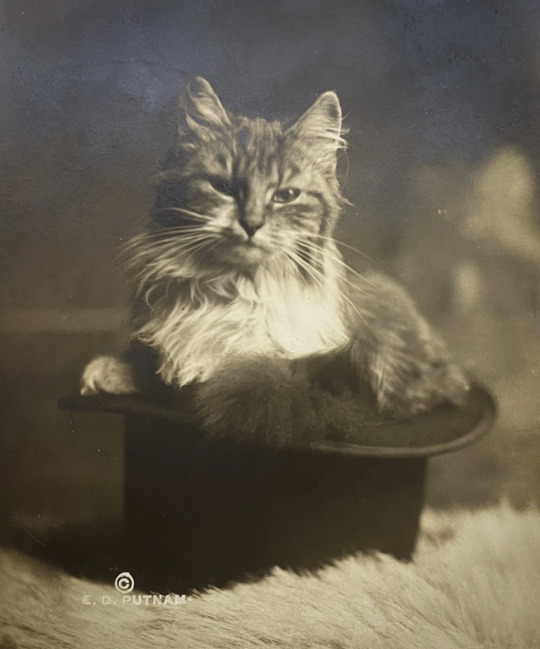

Look at this posh skrunkleton. Postcard from my collection, 1912.

2K notes

·

View notes

Text

Viv: Vaggies the best dancer in Hazbin.

Ummm r u fuckin sure babe cos…

1K notes

·

View notes

Text

Hilarious how pi day isn't even trending but the ides of March has been trending for the past week. Throw a pie in Julius Caesar's face, today only!

#ides of march#pi day#pie day#id like to think im funny#my ranblings#since this is getting notes im puttin this on here. by reblogging this you agree that trans rights are human rights#actually you agree with that by interacting with this post at all <3

7K notes

·

View notes

Text

Russia Reveals That Gas flows to Europe won’t resume until sanctions lifted

Russia Reveals That Gas flows to Europe won’t resume until sanctions lifted

View On WordPress

0 notes

Text

[AND IN BERKELEY, CALIFORNIA... FRESH, JUST MAGNIFICENT. EVIL WAS PREDICTABLE, ALWAYS PAINFULLY EXPECTED. PUTTIN' A SPIN ON PULLED PORK... PULLED PORK IN A COCONUT CURRY.]

#s10e11 sweet 'n savory#guy fieri#guyfieri#diners drive-ins and dives#just magnificent#pulled pork#coconut curry#berkeley#california#fresh#evil#puttin#spin

0 notes

Text

#just puttin on a coat#no biggie#stark#frieren#sousou no frieren#frieren at the funeral#frieren beyond journey's end#葬送のフリーレン#sailor arashi gifs#gif warning

1K notes

·

View notes

Text

if i ever reblog/like any fucking ai "art" i promise it is an accident and i want to be notified immediately to remove that stench from my blog, please and thank you

#just puttin that out there#unless we're screenshotting and discussing the thing ofc. that's not what i mean#im talking about like. a picture i may think is art but is actually ai. pls tell me so i can rid myself of it thanks

735 notes

·

View notes

Text

I love how they set taub’s biggest issue up to be the fact that he cheats on his wife. like that’s the only thing wrong with him really. and everybody dunks on him for it. meanwhile wilson has been causally dropping the fact that he’s a serial philanderer since season 1 and nobody bats an eye because there’s just so much else to unpack that it might be the most normal aspect of his personality

#house md#chris taub#love that clinically insane manwhore#james wilson#like yes he is proudly unfaithful and prone to affairs but the emotional cheating he be puttin those poor women through with house is much#much worse#I could tolerate my husband saying he’s slept with other women. like obviously horrible thing to do and I’d be mad. but it’s not outlandish.#if my husband called me up like ‘yeah I need to go take care of my manchild boybestie. he’s having legal issues and I need to#sacrafice my career for him. see ya later!’#I would kill him with my bare hands

517 notes

·

View notes

Text

You've heard of Sparky Sparky Boom Man

Now get read for Sparkle Sparkle Boom Boy

#bakudeku#bkdk#bakugou katsuki#bnha#bnha 405#mha 405#mha#mha bakugou#bnha bakugou#bnha spoilers#great explosion murder god dynamight#He's literally puttin of little sparkles#and hes just so happy#Im just slowly dying thanks#dkbkdk#avatar#avatar the last airbender#sparky sparky boom man#💥 💥 💥#also just look at that smile!#all might#yagi toshinori#the boy is so happy to get something named after himself from his hero#kacchan#kacchadeku#bnha leaks

581 notes

·

View notes

Text

fellas is it gay to suck your girl's dick? 🤔

#touhou project#tsukasa kudamaki#sanae kochiya#sanakasa#oil fire#pk.art#my art#yeah im puttin a community label on this cus i don't want to flash bang ppl#i think that means this won't show in tags but oh well#nsft#i spent so much time on the lineart (something i never do cus i just prefer cleaning the sketch) and i don't think it was worth it#too tired to color it properly but there's something at least#enjoy

671 notes

·

View notes