#monthly income scheme at post office

Text

POMIS SCHEME - Post Office Monthly Income Scheme 2022

#pomisscheme #pomis_scheme #pomis #postofficesavings #savingscheme #bestsavingscheme #post_office_savings #saving_scheme #best_saving_scheme postoffice #pomisscheme #monthlyincomescheme #pomis #postofficescheme #சேமிப்புதிட்டம் #சேமிப்பு_திட்டம்

pomis scheme, pomis saving scheme, pomis scheme full details, pomis scheme latest update, pomis scheme interest, pomis scheme eligibility, pomis online account opening, best post office pomis scheme,pomis scheme 2022, pomis saving scheme 2022, pomis scheme full details 2022, pomis scheme 2022 latest update, pomis scheme 2022 interest, pomis scheme 2022 eligibility, 2022 pomis online account…

View On WordPress

#2022 pomis online account opening#best post office pomis scheme#best post office pomis scheme 2022#how post office monthly income scheme works#how to apply for post office monthly income scheme#mis in post office in tamil#money saving tips#monthly income post office schemes#Monthly income scheme#monthly income scheme at post office#onthly income scheme post office in tamil#p o m i s schemepost office scheme to double the money#pomis 2022#pomis online account opening#pomis saving scheme#pomis saving scheme 2022#pomis scheme#pomis scheme 2022#pomis scheme 2022 eligibility#pomis scheme 2022 interest#pomis scheme 2022 latest update#pomis scheme eligibility#pomis scheme full details#pomis scheme full details 2022#pomis scheme interest#pomis scheme interest rates#pomis scheme latest update#pomis scheme post office#post office fixed deposit scheme#post office mis interest rates in tamil

0 notes

Text

Post Office Scheme : पोस्ट ऑफिसची मस्त स्कीम, भरमसाठ व्याजासह दरमहा 9000 रुपये कमवा.

Post Office Scheme : पोस्ट ऑफिसच्या या आश्चर्यकारक योजनेत, फक्त पैसे सुरक्षित नाहीत तर व्याज देखील बँकांपेक्षा जास्त आहे. या योजनेत तुम्ही ५ वर्षांसाठी Single किंवा Join Account उघडू शकता.

प्रत्येकजण आपल्या कमाईतील काही भाग वाचवतो आणि तो अशा ठिकाणी गुंतवण्याची योजना बनवतो की भविष्यात केवळ मोठा निधी जमा होऊ शकत नाही, तर निवृत्तीनंतर नियमित उत्पन्नाचीही व्यवस्था करता येईल. या संदर्भात, Post…

View On WordPress

#post office#Post Office Monthly Income Scheme#Post Office New Scheme#Post office schemes in Marathi

0 notes

Text

Post Office Scheme: शादीशुदा लोगों के लिए सुनहरा मौका, अब हर महीने मिलेंगे 4950 रुपये

Post Office Scheme: शादीशुदा लोगों के लिए सुनहरा मौका, अब हर महीने मिलेंगे 4950 रुपये

Post Office Scheme : पोस्ट ऑफिस (Post Office) की मंथली इनकम स्कीम ( Monthly Income Scheme ) एक ऐसी सुपरहिट स्माल सेविंग्स स्कीम(Superhit Small Savings Scheme) है, जिसमें सिर्फ एकबार आपको पैसा लगाना पड़ता है।

Post Office Scheme

MIS अकाउंट का मैच्योरिटी पीरियड (maturity period) 5 साल का होता है। यानी, पांच साल बाद से आपको गारंटीड मंथली इनकम (guaranteed monthly income) होने लगेगी।

ज्वाइंट…

View On WordPress

#best monthly income scheme#big guaranteed monthly income program#et guaranteed income monthly#guaranteed income#guaranteed income plan#guaranteed monthly income plan#how to open bank mis account#how to open mis account in post office#how to open monthly income scheme#how to open post office monthly income scheme account online#how to open td account in post office#how to open td in finacle#how to open td in post office#india first guaranteed monthly income illustration#india first guaranteed monthly income plan review#indiafirst guaranteed monthly income policy#indiafirst guaranteed monthly income review#mis account open online#monthly income#monthly income plan#monthly income scheme#monthly income scheme benefits#monthly income scheme post office#new guaranteed monthly income program#open mis account in simple steps#post office#post office best saving scheme 2021#post office fd scheme#post office fixed deposit scheme#post office mis

0 notes

Text

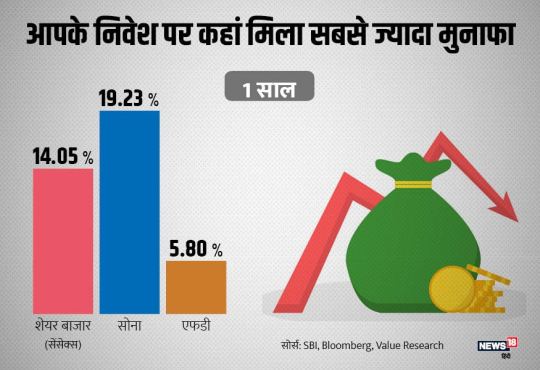

इस साल अमीर बनने के लिए अपनाए 7 अचूक नुस्खे! ज़िंदगी भर रहेंगे टेंशन फ्री

इस साल अमीर बनने के लिए अपनाए 7 अचूक नुस्खे! ज़िंदगी भर रहेंगे टेंशन फ्री

नई दिल्ली. अमीर बनने के लिए जरूरी नहीं है कि आपकी सैलरी बहुत ज्यादा हो या फिर आप हमेशा मुनाफे का बिजनेस करते हों. कम सैलरी और थोड़ी बचत के जरिए भी अमीर बना जा सकता है. इसके लिए जरूरी है कि आप सही जगह और सही समय पर पैसा लगाएं. हालांकि, ऐसे कुछ ही लोग होते हैं जो सही फाइनेंशियल प्लानिंग का रास्ता चूज कर पाते हैं. इसीलिए, नए साल में अच्छी फाइनेंशियल प्लानिंग के बारे में बता रहे हैं. देश के बड़े…

View On WordPress

#Business News In Hindi#FD#Financial Advisory#fixed deposit#gold etf#gold outlook 2020#Investment#investment tools#mutual fund#National Pension Scheme#nifty outlook 2020#Post office Monthly income#sensex outlook 2020#stock market outlook 2020#एफडी#कहां लगाएं पैसा#नए साल पर कैसे निवेश करें#नए साल पर निवेश की प्रक्रिया#नए साल पर निवेश के क्या तरीके हैं#नए साल पर मालामाल बनने का तरीका#निवेश#निवेश पोर्टफोलिया#नेशनल पेंशन स्कीम#पब्लिक प्रोविडेंट फंड#पैसा दो गुना करने के मौके#पोस्ट आफिस मंथली इनकम स्कीम#फिक्स्ड डिपॉजिट#म्यूचुअल फंड#यहां हैं निवेश का मौका#साल 2020 में सोने का भाव क्या होगा

1 note

·

View note

Text

Comparative Analysis: Estimating Returns from Post Office RD vs. EPF Investments

When it comes to secure investment options in India, both Post Office Recurring Deposits (RD) and the Employee Provident Fund (EPF) stand out as popular choices. Each investment avenue offers distinct advantages and suitability depending on the investor's profile and goals. By employing tools like the post office RD calculator, investors can easily forecast the returns on their monthly contributions to a Post Office RD, which is known for its stability and government backing.

On the other hand, the EPF, primarily designed for the salaried workforce, offers a retirement savings plan that not only helps in building a substantial retirement corpus but also provides tax benefits. To estimate the growth of their EPF contributions, investors can use an EPF calculator. This calculator takes into account variables such as the current EPF balance, employer’s contribution, employee’s contribution, and the current interest rate, which is revised annually by the government.

The key difference between these two investment options lies in their nature and the returns they offer. Post Office RDs allow for a fixed monthly deposit into an account, which earns interest at a rate determined by the prevailing government guidelines. The simplicity of the RD scheme makes it an attractive option for individuals with consistent but limited investing capacity. On the other hand, the EPF is not only a savings tool but also a vital component of India’s social security system, offering interest rates generally higher than those of RDs, which makes it highly beneficial for long-term growth.

Moreover, while the returns on RDs are taxed according to the individual's income tax slab, the interest earned and the maturity amount of the EPF are tax-free under certain conditions, making EPF a more tax-efficient investment in the long run. This distinction is crucial for investors when planning their tax liabilities.

For potential investors, understanding these nuances is vital. Using a post office Recurring Deposits calculator helps in setting realistic expectations on the returns from RDs, providing a clear picture of what the maturity amount will be at the end of the investment period. Similarly, the Employee Provident Fund calculator aids in comprehending how one's money grows over time with the added interest, especially with the compound interest feature that EPF offers.

When comparing both, it’s important to consider factors like investment tenure, risk appetite, liquidity needs, and tax implications. Post Office RDs are typically preferred by those who seek less risky avenues and may need to withdraw their investment relatively sooner. In contrast, EPF is ideal for individuals with a longer investment horizon, primarily due to its focus on retirement savings.

While both Post Office RD and EPF are solid investments, they serve different purposes and offer different benefits. The post office Recurring Deposits calculator and Employee Provident Fund calculator help investors make informed investment decisions that match their financial goals and retirement plans. By carefully analysing and comparing these options, investors can optimise their portfolios for long-term financial goals.

0 notes

Text

Development Channel Ponzi Scheme Director, Charles Lambert Re-arrested for Outstanding Debts

Charles Lambert, the 44-year-old British Nigerian, who is also the director of Development Channel, has once again been arrested and is in police custody once again on Tuesday as it’s not just about fraud or money laundering but allegations of accumulating debts exceeding UGx 200 million.

According to sources, the Development Channel has been running an elaborate scheme preying on unsuspecting victims throughout Uganda.

It is said that Police arrested Lambert for the second time in four months, citing his failure to settle debts and a trail of complaints from over 200 individuals who claimed to be victims of the elaborate Ponzi scheme.

The initial arrest in August followed complaints from transport companies, asserting that Lambert owed them Shs 127 million. Richard Kimuli Ssenoga, the head of transporters, revealed that Lambert had hired 63 PRADO SUVs promising daily income of Shs 150,000 to the vehicle owners.

Lambert paid Shs 17 million after the first arrest and pledged to clear the remaining balance in two months. However, he failed to honor his commitment, and the debt snowballed to Shs 213 million.

The creditors, desperate to recover their money, discovered that the Development Channel offices in Bukoto had been shuttered, and all properties liquidated. Sharon Nakkazi, a 24-year-old marketeer, shared her ordeal with the police, stating that she invested US$ 270 in a ‘No Drop Out’ tablet in January 2018, expecting a guaranteed monthly payment of US$ 100 for life. Unfortunately, she has not received any dividends for the past 10 months, prompting her to file a case against Lambert for obtaining money by false pretense.

In a cautionary statement, ASP Luke Owoyesigyire, the Kampala Metropolitan Police Spokesperson, urged the public to be vigilant against scams, noting that such investment chain companies often collapse when they run out of new recruits or fail to meet promised benefits. Development Channel targeted potential victims through strategic social media posts and infiltrated vulnerable spaces such as churches, schools, hospitals, and job seekers.

1 note

·

View note

Text

পোস্ট অফিসের এই স্কিম স্বামী-স্ত্রীর জন্য দুর্দান্ত অফার দিচ্ছে, অল্প সময়ে হবে আর্থিক উন্নতি।

0 notes

Text

Safe Investment Options in India: Securing Your Financial Future

In the ever-changing environment of financial markets, everyone prioritizes ensuring their financial future. For risk-averse investors, navigating the maze of financial possibilities can be difficult. In this tutorial, we'll look at secure investing possibilities in India, specifically for individuals who value stability and security.

Safe Investment Opportunities in India for Risk-Averse Investors

Fixed Deposits

Fixed deposits (FDs) are a traditional option for risk-averse investors. These are low-risk investments in which you deposit a lump sum with a bank or financial institution for a specified period of time and get a predetermined interest rate. FDs offer capital protection and consistent returns, making them a popular alternative for investors seeking a safe haven for their funds.

Mutual Funds

Mutual funds provide a diversified investing approach, making them ideal for risk-averse clients who want their assets managed professionally. With many types of mutual funds accessible, such as debt funds and hybrid funds, investors may select solutions that are appropriate for their risk level. Systematic Investment Plans (SIPs) reduce risks by spreading investments across time.

Post Office Savings Scheme

The Post Office Savings Scheme is a government-backed project that offers a variety of savings and investing opportunities. These programs include the Senior Citizens Savings Scheme (SCSS), Monthly Income Scheme (MIS), and Public Provident Fund (PPF). These programs are appealing to risk-averse investors because of the safety and reliability that comes with government support.

The National Pension Scheme (NPS)

NPS is a long-term retirement-focused investment scheme that encourages systematic savings. NPS offers a well-diversified portfolio that includes equity, term deposits, corporate bonds, liquid funds, and government funds. It provides not just financial stability in retirement but also tax breaks, making it an excellent alternative for risk-averse individuals.

Unit-Linked Insurance Plans (ULIPs)

ULIPs combine insurance coverage with investing potential. These plans provide flexibility by allowing investors to select among equities and debt funds based on their risk tolerance. ULIPs are becoming increasingly popular as a comprehensive financial product due to their ability to generate wealth and provide life insurance.

Public Provident Fund (PPF).

PPF is a long-term investment option that requires a 15-year lock-in period. This government-backed program offers competitive interest rates and tax breaks, making it a popular choice among conservative investors. The rigorous practice of paying yearly to the PPF assures consistent wealth building during the investing period.

Senior Citizens Saving Scheme (SCSS)

SCSS is a low-risk investment option for seniors that delivers regular income in the form of quarterly interest payments. With a five-year tenure, SCSS provides a consistent stream of income for retirees, making it a good choice for risk-averse persons in their golden years.

7.75% Government of India bonds.

Government bonds are regarded one of the most secure investment alternatives. The 7.75% Government of India Bonds, which have a fixed interest rate, provide both capital protection and regular returns. These bonds are a reliable option for risk-averse individuals looking for a safe haven for their assets.

Conclusion

In the search of financial security, selecting the correct investment option is critical. For risk-averse investors, the stated solutions offer a variety of possibilities, each with its own set of features and benefits. Whether you like the stability of fixed deposits, the diversification of mutual funds, or the broad coverage of ULIPs, there is an investing opportunity for everyone. Understanding your financial goals and risk tolerance allows you to develop a well-rounded investing strategy that protects your financial future. Explore the world of safe investments in India and begin your road to financial prosperity and peace of mind.

0 notes

Text

Exploring the Best Post Office Schemes for Students in India

I've been delving into the world of savings and investments recently, and I'm amazed at the plethora of options we have right at our doorstep - the Indian Post Office Schemes! 😊 From the Recurring Deposit (RD) that lets you save a little every month, to the Time Deposit Account (TD) that works like a fixed deposit, there's something for everyone. 💰

What caught my eye is the Monthly Income Scheme Account (MIS) - perfect for those who want a consistent cashflow. 💵 And let's not forget the Public Provident Fund Account (PPF) and National Savings Certificate (NSC) that offer tax savings and a nice return. 🙌

https://fresherblog.com/post-office-schemes/

For my friends with a rural connection or interest in agriculture, the Kisan Vikas Patra (KVP) is a gem. Your investment doubles in less than 10 years. 🚜

The best part? Even students can apply! Just fill out the form and submit it with your ID, address proof, and a snap. Oh, and you'll need some cash or a cheque for the first deposit. 📝

But remember, always read the fine print and make sure the scheme suits your needs and risk tolerance. Happy investing! 😊

#Investing101#PostOfficeSchemes#Savings#PersonalFinance#StudentLife#InvestmentTips#MoneyMatters#India#FinancialFreedom#students#fresherblog#college#college life#desiblr

0 notes

Text

Post Office Monthly Income Scheme|डाकघर मासिक आय योजना

How to Open MIS Post Office Monthly Income Scheme | MIS | Monthly Income Scheme | POMIS | Post Office Income Scheme | How to open Post office MIS account

अपने भविष्य को सुरक्षित करने के लिए सुरक्षित स्थान पर निवेश करना महत्वपूर्ण है। अगर आप ऐसा नहीं करते हैं तो जमा किया हुआ पैसा डूब सकता है। आज हम आपको एक ऐसी स्कीम के बारे में बताएंगे जहां निवेश करने से आपको अन्य विकल्पों के मुकाबले ज्यादा…

View On WordPress

0 notes

Text

post office monthly income scheme (పోస్ట్ ఆఫీస్ నెలసరి ఆదాయ పథకం)

0 notes

Text

Post Office Monthly Income Scheme In marathi (POMIS) : पोस्ट ऑफिस मासिक उत्पन्न योजना जाणून घ्या .

Post Office Monthly Income Scheme : भारत सरकारने सार्वजनिक क्षेत्रातील वित्तीय बँकांसह पोस्ट ऑफिस योजना सुरू केल्या आहेत. त्यापैकी पोस्ट ऑफिस मासिक उत्पन्न योजना (POMIS) ही अशी योजना आहे, जी तुम्हाला तुमच्या ठेवींच्या गुंतवणुकीवर खात्रीशीर परतावा देते. या योजनेचा लाभ कोणीही घेऊ शकतो.

भारतीय पोस्ट ऑफिस योजनांमध्ये अनेक प्रकारचे बचत खाते उघडण्याची सुविधा उपलब्ध आहे. तर यापैकी आपण पोस्ट ऑफिस मासिक…

View On WordPress

#breaking news#Government Scheme#Post Office Monthly Income Scheme#Post Office Monthly Income Scheme in marathi#post office scheme#Scheme#small business idea

0 notes

Text

Post office 2022: इन तीन योजनाओं में मिलेगा Guaranteed रिटर्न, कमाई का आसान तरीका

Post office 2022: इन तीन योजनाओं में मिलेगा Guaranteed रिटर्न, कमाई का आसान तरीका

Post office : पिछले कुछ दिनों से हम सभी देख रहे हैं कि शेयर बाजार में काफी उतार-चढ़ाव देखने को मिल रहा है। ऐसे में कई लोग जोखिम भरे इक्विटी मार्केट में निवेश करना पसंद नहीं कर रहे हैं। ऐसे लोगों के लिए डाकघर निवेश के बेहतरीन विकल्प लेकर आता रहता है। पोस्ट ऑफिस स्मॉल सेविंग्स स्कीम में निवेश करने से आपको लंबी अवधि में ज्यादा रिटर्न पाने में मदद मिलती है।

Post office : इन तीन योजनाओं में मिलेगा…

View On WordPress

#monthly income scheme post office#nsc details post office#office#Post Office#post office best investment plan 2022#post office best plan 2022#post office best scheme 2022#post office fd#post office fixed deposit scheme#post office interest rate#post office interest rate 2022#post office job#post office kisan vikas patra#post office latest interest rate#post office latest interest rate 2022#post office mis#post office mis interest rate 2022#post office mis scheme#post office monthly income scheme#post office nsc#post office nsc calculator#post office nsc interest rate#post office nsc rules#post office nsc sceme 2020#post office nsc scheme#post office rd#post office rd plan#post office rd scheme#post office recruitment 2022#Post Office Scheme

0 notes

Text

Post Office Monthly Income Scheme: हर महीने 2500 रुपये पाने के लिए एकमुश्त कितना जमा करें, चेक करें डिटेल्स

Post Office Monthly Income Scheme: हर महीने 2500 रुपये पाने के लिए एकमुश्त कितना जमा करें, चेक करें डिटेल्स

Post Office Monthly Income Scheme: बढ़ती आर्थिक असुरक्षा के चलते लोग ऐसी जगह निवेश करना चाह रहे हैं जो सुरक्षित भी हो और रिटर्न भी अच्छा हो. अगर आप भी ऐसे किसी निवेश विकल्प की तलाश में हैं तोपोस्ट ऑफिस की मंथली इनकम वाली स्कीम आपके लिए बेहतर विकल्प साबित हो सकती है. इसमें निवेश पर खतरा भी कम है और रिटर्न भी अच्छा है.

हम आपको बता रहे हैं पोस्ट ऑफिस मंथली इनकम स्कीम के बारे में. जैसा कि नाम से ही…

View On WordPress

#investment option#investment tips#post office#post office monthly income scheme#पोस्ट ऑफिस मंथली इनकम स्कीम

0 notes

Text

Diversifying Your Portfolio: Combining Nifty IT Investments with Post Office RD

Diversifying your investment portfolio is essential in today's volatile market. Combining growth-oriented investments like the Nifty IT index with stable, fixed-income assets like Post Office Recurring Deposits (RD) can provide security and growth. This balanced approach lets investors profit from India's growing IT sector and government-backed savings schemes while minimising risk.

This IT index comprises some of the most significant Indian companies in the information technology sector, listed on the National Stock Exchange (NSE). Investing in this index allows individuals to tap into the high-growth potential of the IT industry, which is renowned for its innovation, export earnings, and role in India's economic growth. As technology continues to evolve and integrate into every aspect of daily life and business operations, companies within this IT index are well-positioned for sustained growth. However, like all equity investments, they come with their share of volatility and risk, influenced by market conditions, global economic factors, and industry-specific trends.

On the flip side, the Post Office RD offers a contrast with its stability and government guarantee. Using a post office RD calculator, investors can easily forecast their returns from a recurring deposit. This tool helps in planning by providing exact figures on the maturity amount based on the monthly contributions and the tenure of the deposit. RDs are particularly appealing for risk-averse investors or those looking to balance their portfolios with a fixed-income investment. The interest rates on Post Office RDs are competitive, and the low minimum deposit requirements make it accessible to a broad audience. Additionally, the discipline of monthly deposits encourages a savings habit among investors, which is beneficial for long-term financial health.

Combining investments in this IT index with Post Office RDs offers a multifaceted approach to investing. Equity investments in the IT sector can provide significant returns but come with higher volatility and risk. Meanwhile, the RD offers a safe, predictable return, although lower than what might be achieved with equities. This blend allows investors to aim for growth through their Nifty IT investments, while the Post Office RD serves as a cushion, providing steady returns and reducing overall portfolio volatility.

Personal risk tolerance, investment horizon, and financial goals must be assessed before implementing this strategy. In the dynamic IT sector, equity investments should be long-term. Technology trends, global economic conditions, and currency fluctuations affect this IT index. Post Office RDs are good long-term savings instruments for emergency funds, educational savings, and other financial needs.

A diversified investment portfolio with Nifty IT and Post Office RDs can balance growth and stability. This strategy uses India's IT sector's high growth potential and a government-backed savings scheme's steady, guaranteed returns. As with all investment decisions, individuals should research or consult with financial advisors to tailor their investments to their financial situation and goals. This balanced approach can help navigate financial market complexities, offering security and growth.

0 notes