#post office latest interest rate 2022

Text

Post office 2022: इन तीन योजनाओं में मिलेगा Guaranteed रिटर्न, कमाई का आसान तरीका

Post office 2022: इन तीन योजनाओं में मिलेगा Guaranteed रिटर्न, कमाई का आसान तरीका

Post office : पिछले कुछ दिनों से हम सभी देख रहे हैं कि शेयर बाजार में काफी उतार-चढ़ाव देखने को मिल रहा है। ऐसे में कई लोग जोखिम भरे इक्विटी मार्केट में निवेश करना पसंद नहीं कर रहे हैं। ऐसे लोगों के लिए डाकघर निवेश के बेहतरीन विकल्प लेकर आता रहता है। पोस्ट ऑफिस स्मॉल सेविंग्स स्कीम में निवेश करने से आपको लंबी अवधि में ज्यादा रिटर्न पाने में मदद मिलती है।

Post office : इन तीन योजनाओं में मिलेगा…

View On WordPress

#monthly income scheme post office#nsc details post office#office#Post Office#post office best investment plan 2022#post office best plan 2022#post office best scheme 2022#post office fd#post office fixed deposit scheme#post office interest rate#post office interest rate 2022#post office job#post office kisan vikas patra#post office latest interest rate#post office latest interest rate 2022#post office mis#post office mis interest rate 2022#post office mis scheme#post office monthly income scheme#post office nsc#post office nsc calculator#post office nsc interest rate#post office nsc rules#post office nsc sceme 2020#post office nsc scheme#post office rd#post office rd plan#post office rd scheme#post office recruitment 2022#Post Office Scheme

0 notes

Text

1.'This exploitation cannot continue': EU urged to ban unpaid internships

In 2023, nearly half of interns (45%) were unpaid and 67% didn't have full access to social protection, according to the latest data. Unions are now pushing for a law banning unpaid internships across the EU, before the upcoming elections "shake everything up again". Read more.

2. Farmer protests: Several key roads, including to Brussels, still blocked by tractors

Farmers' protests continued on Tuesday, with tractors blocking major roads up and down the country, which is disrupting another morning rush hour. Read more.

3. Belgium records higher rate of medical mistakes during hospital stays

French-speaking Belgians are significantly more likely to experience a negative incident during a hospital stay than patients in 15 other countries surveyed under the same OECD model. Read more.

4. ‘Utterly appalling’: Belgian prisons reach record number of inmates

The number of people detained in Belgian prisons reached 12,012 on Monday, a new record. Trade unionist Eddy De Smedt (VSOA) says overcrowded conditions are "utterly appalling" for inmates and staff alike. Read more.

5. Paris less popular among Belgians for summer break due to Olympic Games

The French capital is usually a top destination among Belgians booking a short trip, but due to the high costs of hotels as a result of the Olympic Games, their interest has shifted to other cities. Read more.

6. Dutch confectioner Tony's Chocolonely posts record sales

Dutch confectioner Tony's Chocolonely saw a record turnover of €150 million for the financial year 2022-2023, nearly a quarter higher than the previous year 23.2%. Read more.

7. Hidden Belgium: La Grande Poste

The central post office in Liège was a sad sight for 20 years. Known as La Grande Poste, the Neo-Gothic building was completed at a time when Liège was one of the world’s great industrial cities. Read more.

2 notes

·

View notes

Text

President Biden's decision to impose new tariffs on China shows that he has learned from past mistakes. This move reflects a strategic approach to trade relations, aiming to protect American businesses and workers. Biden's focus on fair and equitable trade practices signifies a shift in US-China policy. Stay tuned for updates on the impact of these new tariffs.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

A sweeping White House action to raise tariffs on China as early as next week "reflects lessons learned" about the behavior of the country, according to a former official who helped lead the government's review of what duties should be imposed.

The White House announcement expected Tuesday is the culmination of a two-year investigation and reflects economic damage that China already inflicts on the US, says Greta Peisch, who until recently was general counsel in the office of the US Trade Representative.

She cited unfair trading practices in areas like solar panels and electric vehicles.

"We've seen the impact of China's industrial policy and excess capacity in a number of sectors," she added.

The Biden government review began in 2022 and is focused on duties that were first imposed in the Trump administration. Its apparent conclusion next week could impact tariffs on a range of industries from electric vehicles to batteries to solar power to critical minerals.

Bloomberg was the first to report the administration's plan to announce the results of this long-awaited review.

The announcement will also reportedly quadruple tariffs on EVs from China, according to a Wall Street Journal report. That move could raise the tariff rate to roughly 100% from its current level of 25%.

During a press conference Friday, China's Foreign Ministry responded to the reports by charging that "the US continues to politicize trade issues, abuse the so-called review process of Section 301 tariffs and plan tariff hikes."

"China will take all necessary measures to defend its rights and interests," the spokesperson added.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What are the new tariffs on China that Biden is implementing?

Biden is implementing new tariffs on certain goods imported from China as a way to address unfair trade practices.

2. Why is Biden imposing these tariffs?

Biden believes that these tariffs will help to protect American businesses and workers from unfair competition and strengthen the U.S. economy.

3. Will these tariffs affect consumers?

There is a possibility that these tariffs may lead to higher prices for certain goods, which could ultimately impact consumers.

4. Are these tariffs permanent?

The duration of these tariffs is not specified, but they are meant to address current issues and may be adjusted or lifted based on future developments.

5. What lessons have been learned from previous tariffs on China?

Biden's administration has learned from past tariff strategies and aims to apply a more targeted and strategic approach to ensure effectiveness and minimize negative consequences.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Text

As the federal Parliament returned this week, there’s been a renewed debate about the Trudeau government’s economic record and the state of Canada’s economy relative to its peers. A comprehensive evaluation—including key metrics such as investment, income growth, and living standards—demonstrates an overall record of economic stagnation.

Recall that the Trudeau government was first elected in 2015 based in part on a new approach to government policy, which promised to boost Canada’s economy through a combination of temporary borrowing to finance a limited increase in government spending, lower taxes for most Canadians (except higher-income earners), and a more active approach to economic development. After eight years in office, the government has not only failed to live up to its promises to reduce taxes and limit borrowing, but its overall mix of policies has contributed to the country’s poor economic outcomes.

Start with program spending. Since taking office, the Trudeau government has greatly increased federal spending (excluding interest costs) from $256.3 billion in 2014-15 (the year before it took office) to $448.2 billion in 2022-23—an increase of 74.9 percent. After adjusting for inflation, the Trudeau government has recorded the five highest years of federal spending per person in Canadian history. Put differently, it has spent significantly more than past governments did during the Second World War, the 2008 financial crisis, or other emergencies in the country’s history. Post-COVID levels of spending have still not returned to pre-COVID levels.

Most of this spending growth has been deficit-financed. The government has recorded eight consecutive deficits and its latest fiscal projections anticipate more deficits for at least the next six years. This deficit spending has come with a big cost. Not only has it led to the accumulation of nearly $1 trillion in new federal debt, but it’s come with rising interest payments that are paid through tax dollars. Federal debt servicing payments currently stand at $46.5 billion in 2023-24 which amounts to more than one in every ten dollars of federal revenue. For perspective, federal interest payments now represent more than total spending on childcare benefits (Canada Child Benefit and $10-a-day daycare) and almost the same amount as Ottawa provides the provinces through the Canada Health Transfer (figure 1).

Tax increases have also been used to finance growing federal spending. In 2016, the federal government increased the top personal income tax from 29 percent to 33 percent which now means that the combined top personal income tax rate (federal and provincial) exceeds 50 percent in eight provinces (with the remaining provinces only slightly below 50 percent). In 2022, Canada had the fifth highest top tax rate out of 38 OECD countries. And while the Trudeau government reduced the second lowest personal income tax rate, it has also eliminated several tax credits that have offset the tax savings. According to our estimates, the net effect is that 86 percent of middle-income families are paying higher personal income taxes than they did before.

Lower-income families have also seen an increase in their tax bills. Specifically, 60 percent of families who are in the bottom 20 percent of earners are paying more in personal income taxes following the changes made by the current government.

The political debate cited earlier is fundamentally at its core about whether the Trudeau government’s policy agenda has produced positive or negative outcomes. The evidence is pretty clear: it has led to stagnation rather than greater prosperity for Canadians. The broadest measure of living standards is GDP per person (adjusted for inflation over time), which calculates the total value of all goods and services produced in the economy in a given year on a per-person basis. In the pre-pandemic period between 2016 and 2019, growth in per-person GDP (inflation-adjusted) was an anemic 0.9 percent. One study in fact found that Canada’s per-person GDP growth from 2013 to 2022 (0.8 percent) was the weakest on record since the 1930s (figure 2).

Since the Trudeau government was first elected there’s been 32 quarters with data on per-person GDP growth (up to the third quarter of 2023). For thirteen of those quarters, Canada experienced negative per-person GDP growth adjusted for inflation, including before and after the pandemic. Moreover, the latest numbers show that we haven’t recovered to peak pre-pandemic levels—inflation-adjusted per person GDP in 2023 was still 2.2 percent below the levels in the second quarter of 2019. Overall, inflation-adjusted GDP per person has only grown by 1.9 percent since 2015. The United States, by contrast, grew by 14.7 percent during the same timeframe.

Prospects for the future, given current policies, are not encouraging. Not only are we falling behind our most important trading partner, but the Organization for Economic Cooperation and Development (OECD) projects that Canada will record the lowest rate of per-person GDP growth among 32 advanced economies from 2020 to 2030 and from 2030 to 2060. Countries such as Estonia, South Korea, and New Zealand are expected to vault past Canada and achieve higher living standards by 2060. A key source of this disappointing performance on living standards is our declining business investment. Business investment (inflation-adjusted), excluding residential construction, declined by 16.3 percent between 2014 and 2022, or by 1.9 percent on average annually.

One way to think about the consequences of declining business investment is to compare investment per worker between Canada and the U.S. According to a 2023 study, between 2014 and 2021, business investment per worker (inflation-adjusted, excluding residential construction) decreased by $3,676 (to $14,687) in Canada compared to growth of $3,418 (to $26,751) in the U.S. (Figure 3). To put it differently, in 2014, Canadian businesses invested 79 cents per worker for every dollar invested in the United States. By 2021, that level of investment had declined to just 55 cents per worker.

The flow of funds into Canada by foreigners compared to the outflow of investment by Canadians to other countries tells a similar story. In 2008, the two levels were roughly comparable—$65.7 billion in foreign direct investment in Canada versus $84.6 billion in investment by Canadians outside of the country. A big shift started in 2015 (Figure 4), and by 2022, foreign direct investment in Canada ($64.6 billion) was significantly lower than Canadian investment abroad ($102.3 billion).

There are various explanations for the decline in business investment. Some may reflect broader global developments, but many stem from government policy itself. Since 2015, the federal government has implemented a series of policies that have cumulatively harmed the country’s investment environment, particularly in the energy sector. Bill C-69, which instituted a complex and burdensome assessment process for major infrastructure projects, and Bill C-48, which prohibits producers from shipping oil or natural gas from British Columbia’s northern coast, are two examples.

These policy choices have had tangible negative effects on projects such as the Northern Gateway pipeline, the Energy East pipeline, the Mackenzie Valley pipeline, Teck Resources’ proposed Frontier oilsands mine in Alberta, and Kinder Morgan’s Trans Mountain pipeline. It’s no surprise, therefore, that investment in the Canadian oil and gas sector fell from $95.5 billion in 2014 to $35.1 billion in 2023 (adjusted for inflation)—a drop of 63.2 percent. More recent policy proposals, including forthcoming regulations on electricity production, clean-fuel standards, single-use plastics, and a hard cap on GHG emissions in the oil and gas sector, will only further weaken investment in Canada. While there are many contributing factors behind energy investment, Canada’s unattractive policy environment must be understood as a major deterrent.

In the “Canada-US Energy Sector Competitiveness Survey 2023,” senior executives in Canada’s petroleum industry pointed to uncertainty regarding environmental regulations, as well as duplicative and inconsistent regulations, as deterrents to investment. Indeed, 68 percent of respondents in Canada are deterred by the uncertainty concerning environmental regulations, and 54 percent of respondents are discouraged by regulatory duplication and inconsistencies. Less than half of American respondents were deterred by those same factors in their jurisdictions. As for Canada’s labor market, the top-line numbers hide some concerning trends. For example, between February 2020 (when the pandemic began) and June 2023, private-sector job creation (net) was fairly weak at 3.3 percent compared to 11.8 percent job growth in the government sector (Figure 5).

Another concern is that the labor force participation rate is declining because of the country’s aging population. Since 2014, Canada’s labor force participation rate has decreased from 66.3 percent to 65.6 percent. As the population ages, Canada’s labor force will continue to shrink, causing the unemployment rate to be lower than it otherwise would be with stable participation rates. For perspective, there are 3.0 million Canadians aged 15 to 24 in the labor force compared to 3.5 million Canadians aged 55 to 64, which represents a ratio of 0.87—down from 0.97 in 2014. Declining participation rates, rising government sector employment, and weak private sector job growth do not equate to strong labor market performance, including the conditions for sustainable, market-driven income gains.

As an example, median total income (inflation-adjusted) for couples with children grew at a compound annual rate of 1.3 percent between 2015 and 2021 (the latest year of available data). But if one backs out transfers from the government, income gains in the form of employment-based wages and salaries are much weaker. In 2014, government transfers accounted for 6.7 percent of total income for couples with children. In 2021, they represented 11.8 percent of their total income (Figure 6).

It must be remembered that an increase in government transfers has been financed by government debt. It leads to basic questions about its sustainability since, presumably, the resulting public debt increases will need to be paid for through future tax increases or spending reductions at a later date.

A better measure of income growth for Canadian families is therefore to look at the income of households before taxes and government transfers, referred to as market income. As shown in the table below, the median market income for couples with children has grown by a meager compound annual rate of 0.6 percent between 2015 and 2021. For perspective, the growth rate in median market income from 2005 to 2014 was almost triple (1.7 percent). As another point of comparison, government transfers for couples with children have grown at a compound annual rate of 13.6 percent during the Trudeau government’s time in office.

Median employment incomes for individuals in Canada trail our American counterparts by a significant margin. In an analysis that compares 141 metropolitan areas in Canada and the U.S., the authors found only two Canadian cities in the top half of the overall rankings. The performance of Toronto is particularly concerning, as the median employment income in Canada’s most populous metropolitan area ranked 127th among the 141 jurisdictions analyzed. Vancouver and Montreal ranked 131st and 134th, respectively.

Median employment income for Torontonians and Montrealers is nearly $20,000 below that of individuals in the New York/New Jersey metropolitan area, whereas Vancouverites trail Seattle residents by nearly $24,000. The upshot of all of these facts and figures is that Canada’s economy across a wide range of metrics—including GDP growth, business investment, and incomes—is stagnant or even declining and that government policy has played a key role in these disappointing outcomes.

The first step in solving any problem is to admit that there is a problem. The evidence is clear: it’s time for federal policymakers to quit pretending we’re on the right track.

0 notes

Text

On September 18, 2023, Monday, for the first time in history, the U.S. national debt reached $33 Trillion and created a milestone. The national debt can be simplified as what any country owes its creditors. The Treasury Department published the following information in its latest data update on Monday. Notably, the U.S. national debt crossed the critical milestone when government spending was already under scrutiny.

U.S. National Debt Marks Historic Milestone

According to the latest data update, just four decades ago, the national debt hovered at nearly $907 Billion which has now gone up in trillions. Maya MacGuineas, the president of the Committee for a Responsible Federal Budget, talked about the historic milestone.

According to MacGuineas, “The United States has hit a new milestone that no one will be proud of: our gross national debt just surpassed $33 trillion. Debt held by the public, meanwhile, recently surpassed $26 trillion. We are becoming numb to these huge numbers, but it doesn’t make them any less dangerous.”

Notably, the historic debt level comes as Congress races to avert a government shutdown at the end of this month.

As per a recent report by Fox Business, an American media company, “House Republicans unveiled a short-term plan late Sunday that would temporarily fund the government through October 31.”

Michael Peterson, CEO of the Peter G. Peterson Foundation, further said “As lawmakers drift from one short-term fiscal crisis to the next, our national debt just keeps piling up, trillion after trillion. After the debt ceiling showdown in June, we crossed the $32 trillion debt milestone. Now, as we stare down a potential government shutdown just three months later, we have raced past $33 trillion in red ink.”

About National Debt Update

The latest findings from the Congressional Budget Office show that the national debt will almost double in size over the upcoming three decades. Late in 2022, the national debt grew to nearly 97% of gross domestic product. Under current law, the figure is expected to grow rapidly to 181% at the end of 2053.

The grave matter of concern here is the spike in interest rates in the past year and a half has made the cost of servicing the national debt “more expensive.” This is because as interest rates rise, the U.S. government’s borrowing costs on its debt will also increase.

The Committee for a Responsible Federal Budget (CRFB), also noted in its recent X (formerly Twitter) post, that “The gross national debt of the United States is now more than $33 trillion, having added $1 trillion to the debt in just three months.”

💰 The gross #nationaldebt of the United States is now more than $33 trillion, having added $1 trillion to the debt in just three months. #DebtFacts pic.twitter.com/qSgP37bzXm— CRFB.org (@BudgetHawks) September 18, 2023

Source

0 notes

Text

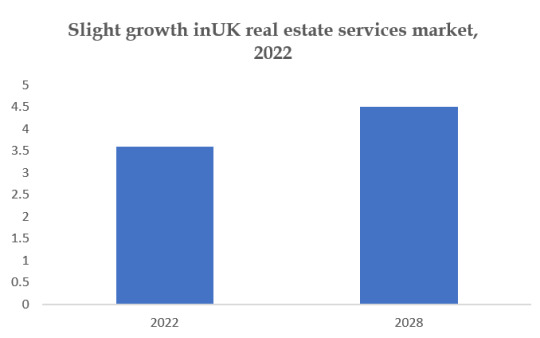

What does it mean for UK’s Real Estate Services Market to be Impacted by Interest Rates and Investor Sentiments?: Ken Research

Buy Now

Story Outline

UK commercial real estate has seen a sharp correction in prices over the last nine months. Capital values began to fall last summer and are now 21% below their peak in June 2022. That is the sharpest correction since the period immediately following Lehman Brothers failure in 2008.

The UK real estate market is experiencing a resurgence of interest from international investors. According to the latest INREV intentions survey in January, the UK ranks second in popularity among Asian, Middle Eastern, and North American investors targeting Europe, and third among European investors.

1. Implications for real estate – a year of two halves?

To learn more about this report Download a Free Sample Report

If the consensus on inflation and interest rates is correct, then there is a strong possibility that capital values will find a floor over the summer, 25-30% below their peak in June 2022.We expect that rental values will be broadly flat at the all-property level through 2023-2024. This year’s recession is forecast to be relatively mild and there is little risk of an over-supply of new space hitting the market at the wrong time. For example, the total amount of office space in central London will only grow by 1-2% between 2022-2024. This compares with 5% during the global financial crisis (GFC) and 13% during the recession of the early 1990s.

2. What is the biggest opportunity for growth in the Property Management Services industry in the UK?

Visit this Link: – Request for custom report

The industry relies on rented residential properties in the UK, as a large bulk of revenue is associated with residential rental property management services. Demand from rented residential properties trends opposite the number of residential property transactions. A rise in residential property transactions typically indicates more first-time buyers getting on the property ladder and ramps up home ownership, hitting demand for residential management services. The number of residential property transactions is falling in 2022-23, providing a potential opportunity for property managers.

By embracing digital innovations, automation, and advanced analytics, property management companies can enhance operational efficiency, deliver better customer experiences, and make informed strategic decisions. Embracing technology will enable them to streamline processes, optimize maintenance operations, and offer personalized services, ultimately attracting more clients and gaining a competitive edge in the market.

Several factors are aligning to support a recovery in investor demand for UK real estate. Bond yields have stabilized post-pandemic, the UK real estate market has re-priced faster than others, and the currency (sterling) has become more stable. History has shown that previous recessions were followed by robust real estate performance. If UK inflation continues to decrease and the recession remains mild, investors are advised to consider deploying capital later this year.

0 notes

Text

New Post has been published on All about business online

New Post has been published on https://yaroreviews.info/2023/08/rail-fares-in-england-to-rise-below-inflation-again-in-2024

Rail fares in England to rise below inflation again in 2024

Getty Images

Regulated train fares in England will again rise below the rate of inflation next year, the government has said.

The move is meant to help people with the soaring cost of living and follows a similar intervention in 2023.

Any rises will once more be delayed until March 2024, rather than kicking in in January as was normal pre-Covid.

However, one campaign group said fares should be frozen “in recognition of the burden high fares place on rail passengers”.

Regulated fares cover about 45% of fares, including season tickets on most commuter journeys, some off-peak return tickets on long-distance journeys and anytime tickets around major cities.

Before the Covid pandemic, they were increased in January each year, based on the Retail Prices Index (RPI) measure of inflation from the previous July. The normal formula is RPI plus 1%.

RPI in June was 10.7% and is expected to be around 9% in July, with the figure due to be published this Wednesday.

It is not known what next year’s increase will be, but this year the government increased national rail fares by 5.9%, which was well below July 2022’s RPI figure of 12.3%.

That increase was still the largest since 2012, according to regulator the Office of Rail and Road.

At the time Labour called the rise a “sick joke for millions reliant on crumbling services”.

The government’s latest intervention comes as UK inflation – the rate at which prices rise – remains high although is starting to ease.

Millions are still struggling with higher prices for food and services at time when interest rates are also rising to tackle the problem, making it more expensive to borrow money.

A Department for Transport (DfT) spokesman said the government would “continue to protect passengers from cost of living pressures”.

‘Patchy performance’

Anthony Smith, chief executive of watchdog Transport Focus, which represents passengers, said: “Nobody likes their fare going up, but after a year where many journeys have been blighted by disruption due to industrial action and patchy performance, passengers will be relieved to hear that fares will be capped below the Retail Prices Index and any increases will be delayed until March next year.”

But Paul Tuohy, boss of pressure group Campaign for Better Transport, said the government should “freeze rail fares – as they have done with fuel duty – until the long-promised ticketing reform takes place”.

The DfT promised in 2021 to simplify the entire ticketing system, reducing the vast number of fares available which can make it difficult for travellers to decide which is best for them.

Reforms so far have included a trial of “single leg pricing” and the introduction of flexi-season tickets. But the pressure group says overhauling the ticketing system has yet to take place.

Since last summer rail passengers have faced disruption due to a wave of strikes, with further industrial action planned on Saturday 26 August and Saturday 2 September.

Workers are demanding pay rises that reflect the soaring cost of living, while also trying to stop job cuts and changes to working conditions.

The Scottish and Welsh governments have not announced their policies regarding rail fare rises next year.

Related Topics

Companies

Department for Transport

More on this story

When are the next train strikes?

1 day ago

Rail fares in England to rise by up to 5.9%

22 December 2022

0 notes

Text

Philippines car rental market is in the growing stage, driven by the increase in disposable income and the rising demand from tourist activities: Ken Research

Buy Now

With the Covid’19 pandemic getting over and removal of travel restrictions, the market is again picking up and is expected to continue growing in the coming years as renting a car for travel is faster and more convenient than public transport or other means to get around the city.

Covid Impact on Market: Before the pandemic, between 2017 and 2019, the market was surging at a steady rate as the service was becoming more popular among users due to its affordability and convenience and higher internet penetration. Post pandemic, the market demand was highly impacted and negatively affected. The long duration of lockdowns forced companies to lay off the vehicles to reduce their loss and hence, the fleet size decreased.

Interested to Know More about this Report, Request for a sample report

Demand from Tourist Activities: With the travel restrictions and safety concerns, the tourist movement completely stopped. Along with that, offices were operating remotely, hence there was not much demand in the market. With the removal of travel restrictions, the market is again picking up and is expected to continue growing in the coming years.

Increase in Disposable Income: With an increase in disposable income of people from the previous year, the paying capacity of people have increased. With this people has been spending more than earlier on renting cars.

Analysts at Ken Research in their latest publication “Philippines Car Rental Market Outlook to 2027F - Driven by the increase in tourism and business activities along with deeper internet penetration and adoption of digital services.” observed that the Philippines car sharing market is expected to showcase considerable growth in the coming five years. In the upcoming years, it is predicted to expand more rapidly due to increased internet penetration and the adoption of smartphones. The Philippines Car Rental Market is expected to grow at robust CAGR over the forecasted period 2022P -2027F.

Key Segments Covered in the report

Philippines car Rental Market

By Type of Booking

Online market

Offline market

By Type of Car

Small Cars(PHP 3500-7500 / Per trip)

Medium(PHP 3500-7500 / Per trip)

Luxury(PHP 7500+)

By Purpose

Leisure

Business

Philippines Car Leasing Market

By Type of Region

Manila

Luzon

Visayas

Mindanao

By Time Duration

1 year

2 year

3 year

4 or more year

By Vehicle Price Range

Sedan(PHP 20000-35000

SUV(PHP 35000-50000)

Premium(PHP 50000+)

By Type of End User

Corporate

Retail Individuals

Philippines Ride Hailing Market

By Type of Region

Metropolitan

Non Metropolitan

Visit this Link :- Request for custom report

Philippines Ride Sharing Market

By Point of Service

Rest Area

At Airport

By Type of Car

Sedan

SUV

By Type of Distance

Short distance

Long distance

Philippines Self-Drive Car Rental Market

By Type of Region

Metro cities

Non metro cities

By Type of Booking Channel

Online

Offline

By Usage

Intercity

Intracity

By Time Period

1-2 days

A week

A month

By Type of Car

Standard (PHP 1500 + / per hour)

Luxury (PHP 1000-4000/24hours)

By Type of Booking Period

Weekend

Weekdays

By Segment of Car

Standard

luxury

By Status of Ownership

Owned

Leased

By Point of Service

At Airport

Rest area

Key Target Audience

Car Rental Service Providers

Car Rental Companies aiming to establish in the Philippines

Philippines Automotive Industries

Government Bodies & Regulating Authorities

Venture Capitalist targeting the car rental market

Automotive industry association

Car Manufacturers

Existing Car Rental Companies

OEM Dealerships

New Market Entrants

Investors

Car Rental Associations

Time Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2027

Companies Covered:

Car Rental

Diamond Rent-a-Car

Luxicar

Voyg

Rent a Car ECLPI

Avis

Hertz

SafeRide

Self-Drive

Europcar

Thrifty

Juzzr Car Rental

Hertz

Voyg

SafeRide

VPI

Ride Hailing

Grab

JoyRide

Hirna

Maxim

Ride Sharing

Grab

Hirna

Car Leasing

Orix

Avis

Diamond Rent-a-Car

Europcar

Herts

ECLPI Rent a Car

Key Topics Covered in the Report

Overview and Genesis of Car Rental Market in Philippines

Ecosystem of Philippines Car Rental Market

Business Cycle of Philippines Car Rental Market

Timeline of Major Players of Philippines Car Rental Market

Value Chain Analysis of Philippines Car Rental Market

Philippines Car Rental Market Sizing, 2017- 2022

Market Segmentations of Car Rental Market in Philippines

Snapshots on different Car Rental Markets in Philippines

Industrial Analysis of Car Rental Market in Philippines

Competitive Analysis of Car Rental Market in Philippines

Future Outlook and Projections of Car Rental Market in Philippines

For More Insights On Market Intelligence, Refer to the Link Below: –

Philippines Car Rental Market Outlook to 2027

Related Reports by Ken Research: –

Vietnam Car Rental Market Outlook to 2027F

Belgium Car Rental Market Outlook 2027F

#Philippines Car Rental Market#Philippines Car leasing sector#Philippines Car leasing Industry#Philippines vehicle rental industry portfolio#Philippines Passenger Car market size#Philippines Automotive Market Passenger Car sector#Philippines Car Sharing Market size#Philippines Cab Aggregator Market#Philippines Self-Driven Market#Philippines Car Pooling/Ride-Sharing Market#Philippines Car Rental Market Vehicle type#Philippines Car Rental Market Booking mode#Philippines Car Rental Market Pick-up market share#Philippines Regional Car Rental Market share#Philippines Car Rental market Trends#Challenges Car Leasing Philippines#Opportunities Car rent Philippines#Car Rental and Leasing Service Providers Philippines#Philippines Car Leasing Lenders#Leading Players in Philippines Car Sharing Market#Competitors in Philippines Car Rental Market#Emerging Players in Philippines hire car Market#Major players in Philippines Vehicle Rental Market#Vehicle rental Companies in Philippines#Top Captive players in Philippines Car-Hire Industry#e-platform players Philippines Car rental Market#Philippines Car Rental Market Average rental duration#Philippines Car Rental Market Future Market Sizing Analysis#Philippines car rental services market#Tourism vehicle rental market size

0 notes

Text

SAM HSN: A VISIONARY ENTREPRENEUR TURNING BANKRUPT COMPANIES INTO SUCCESS STORIES

Hassan Sameh, also called Sam Hsn, is an Egypt-conceived finance manager presently living in Egypt and Monaco. Enthusiastically for assuming command over bankrupt organizations and changing them into productive endeavors, Sam Hsn is an amazing powerhouse in the business world. Drawing motivation from Will Smith and Bruce Wayne (Batman), he is driven by the longing to impart trust, trust, and flexibility in others, empowering them to safeguard, battle for, and have faith in their fantasies.

A Business visionary with a Different Portfolio

Sam Hsn has been engaged with various critical tasks throughout the long term, exhibiting his abilities as a business visionary and business tactician. A portion of his most outstanding endeavors include:

Significant Level Games Picture The executives Organization: Sam Hsn laid out this office to give proficient administration and backing to world class competitors, lifting their professions and public picture.

Confidential Airplane Organization (2018): Perceiving the interest for customized air travel, Sam Hsn established a confidential airplane organization that takes care of clients looking for extravagance and comfort.

Extravagance Vehicle Organization (2018): Extending his inclinations in the transportation area, Sam Hsn made an organization spend significant time in top of the line cars, guaranteeing unmatched quality and style for knowing clients.

Nautical Organization (2018): Under the name OLMETA LOC, Sam Hsn wandered into the universe of sea administrations, giving first rate nautical encounters and administrations.

Business Center (2020): OLMETA DOM, a cutting edge business place, was created to offer proficient office spaces and backing administrations for developing organizations.

Extravagance Land Office (2022): Sam Hsn's latest endeavor, OLMETA IMMOBILIER, has some expertise in extravagance land, taking special care of clients looking for lavish properties and extraordinary help.

The Olmeta Gathering and Its Enthusiasm for Music Creation

Notwithstanding his different business portfolio, Sam Hsn is likewise the main impetus behind the Olmeta Gathering. This combination is made out of the accompanying organizations: Olmeta Loc, Olmet Dom, Olmeta Land, and 360 degrees. The 360 degrees organization is committed to music creation and ability advancement, finding new craftsmen and offering extensive help all through their vocations.

Stay informed and up-to-date with the latest breaking news, in-depth reporting, and insightful analysis on Fox Daily Post. Visit us now and never miss a beat.

0 notes

Text

Health care, housing and leadership top issues as P.E.I. heads toward April 3 vote

Prince Edward Island Premier Dennis King called a provincial election for April 3 on Monday night, and political experts say the top issues on the campaign trail are expected to be health care, housing and leadership.

King's majority Progressive Conservative government is seeking a second term in office following four years marked by the COVID-19 pandemic, two major post-tropical storms and an ongoing struggle to repair a deteriorating health-care system.

At dissolution, the Conservatives held 15 of the legislature's 27 seats. The Green Party, led by Peter Bevan-Baker, had eight seats, and the Liberals under Sharon Cameron held four.

The vote in 2019 saw P.E.I. become the first province in Canada in which the Green Party formed the official Opposition.

Political observers say the electorate does not seem to be in the mood to change the government, but the campaign could prove pivotal because there are plenty of hot-button issues.

HEALTH CARE

Like other provinces in Canada, P.E.I. is facing its own health-care crisis. A growing number of Islanders are complaining about a lack of family doctors and long wait times for treatment.

During the 2019 election campaign, which brought the Progressive Conservatives to power, the incumbent Wade MacLaughlan faced withering criticism about the Liberal party's failure to deal with the doctor shortage.

Since then, the number of residents looking for a family doctor has continued to climb, leaving the ruling party vulnerable to opposition criticism.

But King's government is sure to draw voters' attention to the federal government's recent decision to give the province $966 million over the next 10 years for health-care funding, including more than $288 million in new money.

HOUSING SHORTAGES

The Island's rapidly growing population has led to a shortage of housing, but the problem is not new. P.E.I.'s vacancy rate hit a record low in 2018, and the problem has persisted; it was 0.8 per cent last year.

King has responded by offering developers low-interest loans to increase the housing supply, but the latest data suggests development is actually slowing down.

The Green Party has focused on this issue, pointing out in January that as the government was tearing down a tent encampment in Charlottetown, the Canadian Mortgage and Housing Corporation was reporting that P.E.I. had one of the worst rental markets in the country.

"It doesn't matter if it's housing, health care or any other issue that matters to Islanders," Bevan-Baker said in January. "The bottom line is this. The King Conservatives are failing to meet the challenges of the day and the expectations of the public. And the quality of life on P.E.I. is declining because of it."

LEADERSHIP

King's government has come under scrutiny for how it has handled a number of major challenges, including post-tropical storms in 2019 and 2022 that caused widespread damage.

At one point, Bevan-Baker called for a public inquiry to investigate the government's response to post-tropical storm Fiona in September 2022, but King's government rejected the request.

Questions have also been raised about the government's handling of the potato industry's struggle with the potato wart fungus, which resulted in trade bans that cost the province about $50 million in lost revenue.

And much of the government's first term in office was defined by its response to the COVID-19 pandemic, which was declared after King had served as premier for just under a year.

"I don't know of any government in recent history that has had to deal with so many crises in their first term," says Don Desserud, political science professor at the University of Prince Edward Island.

Meanwhile, King's straight-talking, folksy style seems to have connected with the electorate. But Bevan-Baker has also proven to be an effective communicator.

As for the Liberals, leader Sharon Cameron is virtually unknown, having led the party for less than four months.

MOOD OF THE ELECTORATE

Peter McKenna, a professor in the political science department at the University of Prince Edward Island, says Islanders don't appear to be in the mood for a change in government.

He says there is no sense of fatigue or disillusionment with the party in power, despite the state of health care and the rising cost of living.

As well, he says the opposition Greens and Liberals don't seem to have any momentum as the campaign gets started.

The Greens appear to be "in a holding pattern," McKenna said. As for the Liberals, the professor says the party is practically a non-entity.

"The Liberal party has sort of faded from the political scene here," he said in a recent interview. "It's no longer a major political force on Prince Edward Island."

This report by The Canadian Press was first published March 7, 2023.

By Hina Alam in Fredericton and Michael MacDonald in Halifax

from CTV News - Atlantic https://ift.tt/XQ0UkCx

0 notes

Text

In unprecedented world chip droop SK Hynix to halve funding as recession looms By Reuters

2/2

© Reuters. FILE PHOTO: Reminiscence chips by South Korean semiconductor provider SK Hynix are seen on a circuit board of a pc on this illustration image taken February 25, 2022. REUTERS/Florence Lo/Illustration

2/2

By Joyce Lee and Heekyong Yang

SEOUL (Reuters) -South Korea’s SK Hynix Inc warned on Wednesday of an “unprecedented deterioration” in reminiscence chip demand, deepening fears of worldwide recession, and mentioned it might slash funding after quarterly revenue tumbled 60%.

The world’s second-largest reminiscence chipmaker, whose shoppers embrace Apple Inc (NASDAQ:), mentioned its funding in 2023 will likely be lower by greater than 50% – an echo of cuts the reminiscence chip business endured within the 2008-09 monetary disaster that gives a stark portrait of the depth of a worldwide slowdown in tech demand.

Chipmakers had loved a powerful post-pandemic demand surge till early this yr. However demand has turned sharply weaker in latest months as hovering inflation, rising rates of interest and gloomy financial outlook have led customers and companies to tighten spending.

“We hope that the market will stabilise to some extent by second half of subsequent yr, however we aren’t ruling out the opportunity of an extended downturn,” Kevin Noh, Chief Advertising Officer at SK Hynix, informed analysts.

Buyers regarded past the grim outlook to welcome the aggressive funding lower, sending SK Hynix shares 1.7% greater in a guess the size of the motion would assist management chip oversupply and prop up chip costs.

SK Hynix’s dire projections add to a flurry of warnings from U.S. tech giants this week of faltering development prospects. Microsoft Corp (NASDAQ:) on Tuesday projected quarterly income beneath Wall Avenue targets throughout its enterprise items, together with its cloud enterprise and PC unit.

SK Hynix mentioned its working revenue fell to 1.66 trillion gained ($1.16 billion) within the July-September quarter, from 4.2 trillion gained a yr earlier. The outcome was beneath analysts’ expectations of a 1.87 trillion gained revenue, based on Refinitiv SmartEstimate.

“Provide will proceed to exceed demand in the interim,” SK Hynix mentioned in a press release, pointing to a fall in pocket book and smartphone shipments.

Reminiscence chip costs plunged by 20% as demand fell throughout all functions within the third quarter, SK Hynix mentioned, citing dropping PC and smartphone shipments whereas knowledge centres prioritised utilizing up current chip stock.

NO TURNAROUND TILL LATE 2023?

SK Hynix mentioned its 2022 funding is predicted to be on the “higher vary of 10-20 trillion gained ($7-14 billion)”, which means 2023 investments may fall beneath 10 trillion gained.

“The capex lower was larger than I anticipated,” mentioned Wi Minbok, analyst at Daishin Securities.

“Even when SK Hynix reduces investments, it is going to take round six months till precise output is affected … We do not anticipate market circumstances to show round earlier than the third quarter of 2023.”

Different chipmakers have additionally begun curbing provide and funding. U.S. agency Micron Expertise (NASDAQ:) plans to chop investments by greater than 30% subsequent yr, whereas Taiwanese big TSMC has additionally lower its 2022 funding plan.

The spending cuts come as the worldwide smartphone market, a key income supply for the chip business, contracted 9% on-year in July-September, marking the worst third-quarter since 2014, based on evaluation supplier Canalys.

SK Hynix additionally warned of uncertainties involving its chip vegetation in China on account of U.S. export restrictions on superior chip gear to China geared toward slowing Beijing’s technological advances.

The corporate obtained a one-year waiver on the restrictions for its chip vegetation in China, however mentioned it might be tough to function its Wuxi plant within the nation if the waiver was not prolonged, and should have to think about promoting the plant or bringing gear to South Korea.

($1 = 1,426.6500 gained)

Originally published at Irvine News HQ

0 notes

Text

Bank of England warns of fresh interest rate hike

New Post has been published on https://interestrate.co.uk/bank-of-england-warns-of-fresh-interest-rate-hike/

Bank of England warns of fresh interest rate hike

Andrew Bailey, the governor of the Bank of England, has warned markets that rates may need to rise more than previously expected. Addressing an audience in Washington, he highlighted inflationary pressures and a more aggressive approach to interest rates in the coming months. This comes amidst the political turmoil sweeping through the UK, which saw Jeremy Hunt installed as the new Chancellor of the Exchequer.

Meeting of minds

While we are not privy to the discussions between the Chancellor and the governor of the Bank of England, Andrew Bailey described this as a “meeting of minds”. Amidst concerns of mixed signals, it seems as though the Bank of England will refrain from any market interventions until the government’s tax and spending plans are announced on 31 October. This appears to be at odds with a recent statement suggesting that the bank would act as and when appropriate. Describing this as the “correct sequence” of actions, does this leave the pound at the beck and call of markets until 31 October?

Interest rate rises

On 22 September, the Bank of England increased base rates by 0.5%; they now stand at 2.25%. Before the recent statement in Washington, markets were split between a 0.75% and 1% increase in November and the same again in December. However, in light of the update from Andrew Bailey, there are concerns the next interest rate rise could be even more aggressive.

A few weeks ago, the consensus was that UK base rates would hit 3% by the end of 2023. However, the latest analysis suggests that base rates could be as high as 6% by the end of next year. Indeed, they could be more than 4.25% at the end of 2022 if the Bank of England decides to take a more aggressive approach than the markets expected.

Fiscal sustainability

As the fallout from the government’s mini-budget continues, the previous Chancellor’s refusal to let the Office of Budget Responsibility (OBR) review his budget before publication is now notorious. In a subtle dig at Kwasi Kwarteng, Bailey suggested that “flying blind is not a way to achieve sustainability”. Consequently, Hunt and Bailey appear to be singing from the same hymn sheet, while Liz Truss may now be Prime Minister in name only.

Further U-turns to come?

Again, in direct conflict with recent comments by Truss, Hunt has readied the markets for a potential increase in taxes and a reduction in public spending. We know there is still a multi-billion pound hole in the budget, and difficult decisions will need to be made in the short term.

Markets holding their breath

Hunt’s appointment was seen by many as a “safe pair of hands” to steady the ship. However, even in the early days, he seems to be leading the way, with the Prime Minister following. With the Bank of England unlikely to intervene in markets until 31 October, when the government will set out its new tax and spending plans, could sterling be at the beck and call of the markets again?

0 notes

Text

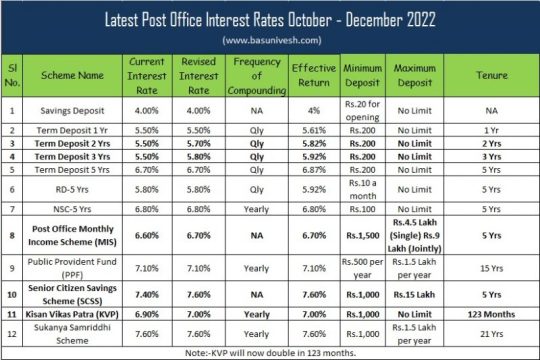

Latest Post Office Interest Rates October - December 2022

Latest Post Office Interest Rates October – December 2022

Latest Post Office Interest Rates October – December 2022 – What are the Post Office Small Savings Interest Rates for October to December 2022? What are the latest Post Office interest rates on FDs, MIS, SCSS, NSC, KVP, PPF and SSY Schemes?

Because of higher inflation, many banks started increasing their FD rates. Hence, many thought that this time Government will increase the interest rates of…

View On WordPress

0 notes

Text

President Biden's decision to impose new tariffs on China shows that he has learned from past mistakes. This move reflects a strategic approach to trade relations, aiming to protect American businesses and workers. Biden's focus on fair and equitable trade practices signifies a shift in US-China policy. Stay tuned for updates on the impact of these new tariffs.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

A sweeping White House action to raise tariffs on China as early as next week "reflects lessons learned" about the behavior of the country, according to a former official who helped lead the government's review of what duties should be imposed.

The White House announcement expected Tuesday is the culmination of a two-year investigation and reflects economic damage that China already inflicts on the US, says Greta Peisch, who until recently was general counsel in the office of the US Trade Representative.

She cited unfair trading practices in areas like solar panels and electric vehicles.

"We've seen the impact of China's industrial policy and excess capacity in a number of sectors," she added.

The Biden government review began in 2022 and is focused on duties that were first imposed in the Trump administration. Its apparent conclusion next week could impact tariffs on a range of industries from electric vehicles to batteries to solar power to critical minerals.

Bloomberg was the first to report the administration's plan to announce the results of this long-awaited review.

The announcement will also reportedly quadruple tariffs on EVs from China, according to a Wall Street Journal report. That move could raise the tariff rate to roughly 100% from its current level of 25%.

During a press conference Friday, China's Foreign Ministry responded to the reports by charging that "the US continues to politicize trade issues, abuse the so-called review process of Section 301 tariffs and plan tariff hikes."

"China will take all necessary measures to defend its rights and interests," the spokesperson added.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What are the new tariffs on China that Biden is implementing?

Biden is implementing new tariffs on certain goods imported from China as a way to address unfair trade practices.

2. Why is Biden imposing these tariffs?

Biden believes that these tariffs will help to protect American businesses and workers from unfair competition and strengthen the U.S. economy.

3. Will these tariffs affect consumers?

There is a possibility that these tariffs may lead to higher prices for certain goods, which could ultimately impact consumers.

4. Are these tariffs permanent?

The duration of these tariffs is not specified, but they are meant to address current issues and may be adjusted or lifted based on future developments.

5. What lessons have been learned from previous tariffs on China?

Biden's administration has learned from past tariff strategies and aims to apply a more targeted and strategic approach to ensure effectiveness and minimize negative consequences.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Link

0 notes

Link

Latest and Revised Post Office Interest Rates applicable for October, November and December, 2022 and post office scheme details

0 notes