#guaranteed monthly income plan

Text

Post Office Scheme: शादीशुदा लोगों के लिए सुनहरा मौका, अब हर महीने मिलेंगे 4950 रुपये

Post Office Scheme: शादीशुदा लोगों के लिए सुनहरा मौका, अब हर महीने मिलेंगे 4950 रुपये

Post Office Scheme : पोस्ट ऑफिस (Post Office) की मंथली इनकम स्कीम ( Monthly Income Scheme ) एक ऐसी सुपरहिट स्माल सेविंग्स स्कीम(Superhit Small Savings Scheme) है, जिसमें सिर्फ एकबार आपको पैसा लगाना पड़ता है।

Post Office Scheme

MIS अकाउंट का मैच्योरिटी पीरियड (maturity period) 5 साल का होता है। यानी, पांच साल बाद से आपको गारंटीड मंथली इनकम (guaranteed monthly income) होने लगेगी।

ज्वाइंट…

View On WordPress

#best monthly income scheme#big guaranteed monthly income program#et guaranteed income monthly#guaranteed income#guaranteed income plan#guaranteed monthly income plan#how to open bank mis account#how to open mis account in post office#how to open monthly income scheme#how to open post office monthly income scheme account online#how to open td account in post office#how to open td in finacle#how to open td in post office#india first guaranteed monthly income illustration#india first guaranteed monthly income plan review#indiafirst guaranteed monthly income policy#indiafirst guaranteed monthly income review#mis account open online#monthly income#monthly income plan#monthly income scheme#monthly income scheme benefits#monthly income scheme post office#new guaranteed monthly income program#open mis account in simple steps#post office#post office best saving scheme 2021#post office fd scheme#post office fixed deposit scheme#post office mis

0 notes

Text

hello hello! if youre usamerican with federal college debt thats about to start needing to be repaid, you should make sure youve gone to check out the new SAVE income based repayment plan the biden administration recently passed. this plan allows you to pay a monthly deposit that’s calculated based on your income. a few things make this different from the existing income based plans, including that your monthly repayment could be as low as $0 per month. if you pay the calculated amount, no further interest is accrued for the month, and if you keep up with these payments (which again, if youre like me and you dont make a lot of money might be ZERO dollars per month) then all your remaining debt will be forgiven after 12-25 years depending on your specific loans. the program application is very easy but processing takes about a month, so nows the time to get it in before repayment begins in november.

tldr: the SAVE federal aid plan can have you paying $0/month with no accruing interest on your student loans towards a guaranteed debt forgiveness after 12-25 years and you can read more about it and apply for it here!

#the plan doesnt apply to parent plus loans i believe but its still worth checking out the idr plans#kora.txt#got a letter today that im approved so yippeeeee

830 notes

·

View notes

Text

Major PSA: Patreon Changes & Discord Shutdown

Oh, I hate to be predictable lol.

What it comes down to is, I've lost the love in creating this story. (But this is NOT a "I'm not writing anymore of this story" post!)

I've put a lot of pressure on myself to put out bonus content on Patreon, and it and the Discord server hangs over my head - giving me that feeling like since I'm not constantly posting or growing an income around The Nameless, that I'm not doing enough or I'm not legit enough, etc.

I do want to stress that y'all are wonderful, and I'm honored that you've stuck around this long, and there has been absolutely NO pressure from you - it is self-inflicted guilt for sure.

The reality is that my day job workload is much more than it used to be with the new role I took earlier this summer - but it's work that I love. And I'm so thankful and pinching myself that I was able to find that.

In the end, I hope that will mean better things for you and the game - giving me the time and space to draw and write out of joy instead of guilt, getting to share a lot of content with everyone on tumblr again, and focusing my writing in on the game instead of trying to balance too much.

So, Patreon will be turning into a tip jar.

1. Currently, billing is paused. On September 2, the current tiers will be deleted and tiers will be added for (USD) $2, $5, and $7.

2. For current patrons, when a tier is deleted, your subscription IS NOT AUTOMATICALLY CANCELED. You must edit your pledge on your own to a lower tier if you don't want to be charged what you were before.

3. (EDITED) There will be no guaranteed bonus content, and the only difference in content will be that 18+ posts will be reserved for the $7 tier . I'm still planning to do the first meeting POVs and some art specials, it just may be slower and take a little while longer. I'm also hoping to at least post monthly progress reports, and will be figuring out how to open the current posts to the new tiers.

4. I will also be shutting down The Nameless Discord permanently today.

Thank you again for your patience with me, and I hope this will turn a new leaf and get me back in the head space for the actual game again.

Sending y'all much love, and thank you for everything. <3

Parker xoxo

174 notes

·

View notes

Text

I want to address a problem that seems to arise repeatedly in public discussions about green growth and degrowth. Some prominent commentators seem to assume that the debate here is primarily about the question of technology, with green growth promoting technological solutions to the ecological crisis while degrowth promotes only economic and social solutions (and in the most egregious misrepresentations is cast as “anti-technology”). This narrative is inaccurate, and even a cursory review of the literature is enough to make this clear. In fact, degrowth scholarship embraces technological change and efficiency improvements, to the extent (crucially) that these are empirically feasible, ecologically coherent, and socially just. But it also recognizes that this alone will not be enough: economic and social transformations are also necessary, including a transition out of capitalism. The debate is therefore not primarily about technology, but about science, justice, and the structure of the economic system.

[...]

Ecological economists point out that when we scale back our assumptions about technological change to levels that are, to quote the physicist and ecological economist Julia Steinberger, “non-insane,” and when we reject the idea that growth in rich countries should be maintained at the expense of the Global South, it becomes clear that relying on technological change is not enough, in and of itself, to solve the ecological crisis. Yes, we need fast renewable energy deployment, efficiency improvements, and dissemination of advanced technology (induction stoves, efficient appliances, heat pumps, electric trains, and so on). But we also need high-income countries dramatically to reduce aggregate energy and material use, at a speed faster than what efficiency improvements alone could possibly hope to deliver. To achieve this, high-income countries need to abandon growth as an objective and actively scale down less necessary forms of production, to reduce excess energy and material use directly.

[...]

Degrowth does not call for all forms of production to be reduced. Rather, it calls for reducing ecologically destructive and socially less necessary forms of production, like sport utility vehicles, private jets, mansions, fast fashion, arms, industrial beef, cruises, commercial air travel, etc., while cutting advertising, extending product lifespans (banning planned obsolescence and introducing mandatory long-term warranties and rights to repair), and dramatically reducing the purchasing power of the rich. In other words, it targets forms of production that are organized mostly around capital accumulation and elite consumption. In the middle of an ecological emergency, should we be producing sport utility vehicles and mansions? Should we be diverting energy to support the obscene consumption and accumulation of the ruling class? No. That is an irrationality that only capitalism can love.

At the same time, degrowth scholarship insists on strong social policy to secure human needs and well-being, with universal public services, living wages, a public job guarantee, working time reduction, economic democracy, and radically reduced inequality. These measures abolish unemployment and economic insecurity and ensure the material conditions for a universal decent living—again, basic socialist principles. This scholarship calls for efficiency improvements, yes, but also a transition toward sufficiency, equity, and a democratic postcapitalist economy, where production is organized around well-being for all, as Peter Kropotkin famously put it, rather than around capital accumulation.

The virtue of this approach should be immediately clear to socialists. Socialism insists on grounding its analysis in the material reality of the world economy. It insists on science and justice. Yes, socialism embraces technology—and credibly promises to manage technology better than capitalism—but socialist visions of technology should be empirically grounded, ecologically coherent, and socially just. They should emphatically not rely on speculation or magical thinking, much less the perpetuation of colonial inequalities. Green growth visions fall foul of these core socialist values.

94 notes

·

View notes

Note

As someone who is extremely new to using twitch but wants to support you, are bits better or is subbing better? Also I hope you're having a wonderful holiday!! ❤️🌻❤️🌻

It depends, they’re functionally very different!

Just as a quick answer before getting too in the weeds, GENERALLY I do prefer subs as long as it is something people are able and willing to do! Obviously no amount of financial support is ever necessary to be an appreciated member of the community, and bits are still generous simply by virtue of being opted into to help me out, but if subbing is an option for anyone it REALLY does go that little extra mile.

I say I prefer subs mainly due to the consistency of it. Subs are a majority of the time going to be a $5 monthly thing (though there are less-used higher tiers), and my cut of that is about 2.50. Assuming, say, 5 people begin a consistent monthly sub, that’s a guaranteed 12 bucks or so of income that I can reliable measure per month. If 3 of those 5 people mainly support with bits instead, I’m still getting support and it still contributes to the monthly payout, but there’s basically no way to predict how much it’ll show up in the total and plan accordingly. Could be like 50 extra bucks one time if people are feeling particularly generous, or it could amount to cents. One is consistent, the other is supplementary.

But again, both are appreciated! So really don’t fret too much either way. I always above all want to stress that continued support for my channels in ANY way you can afford, even if it’s just watching the YouTube highlights and sharing clips, makes a difference.

147 notes

·

View notes

Text

Two conservative groups say San Francisco and the state of California are racist for illegally giving away millions in tax money to three non-profits that exclude recipients based on race and gender identity.

The American Civil Rights Project and the Californians for Equal Rights Foundation say the city and state violate the law by picking who gets federal money based on skin color.

The suit names three guaranteed-income programs.

The Black Economic Equity Movement hands out $500 a month exclusively to young, Black Bay Area residents.

SAN FRANCISCO MAYOR PUSHES ADDICTION SCREENING FOR WELFARE RECIPIENTS

Guaranteed Income for Trans-people pays $1,200 a month to Black, Indigenous and Latino recipients, provided they are also transgender.

The Abundant Birth Project gives out $1,000 a month solely to pregnant Black and Pacific Islander women.

"We are asking for these programs to be halted until they are no longer discriminatory," says lawyer Dan Morenoff of the American Civil Rights Project.

"Each of these three programs qualifies and disqualifies individuals from participation and benefits based on their race."

San Francisco established the Abundant Birth Project in 2020 through its department of health. It provides $1,000 to $1,500 a month, for roughly nine months, solely to "Black and Pacific Islander women in San Francisco." Other races are not eligible for this "unconditional" income. Its annual budget is $1.8 million, but new $5 million in grants expand the program to four additional counties.

Advocates say that Black and Pacific Islander women need the help because of higher rates of premature birth. "This risk is primarily due to racism, both structural racism and racism that birthing people experience when they interact with physicians and other medical providers," says Dr. Zea Malawa of the San Francisco Department of Public Health.

True or not, the lawsuit claims, it remains illegal to exclude White and Latino women, especially those with higher risks of complication.

In November last year, San Francisco launched another guaranteed income program.

"To participate you must be Black, between the ages of 18 and 24, and live in certain areas within Oakland or San Francisco," according to BEEM guidelines. Those applying as 'White' on-line are told they are 'not eligible'.

The GIFT project provides $1,200 a month for 18 months to "Transgender, Non Binary, Gender Non-Conforming and Intersex" individuals provided they are "Black, Indigenous or People of Color." The program is run through the city's Office of Transgender Initiatives. Last week, the watchdog group Judicial Watch also sued San Francisco over the GIFT project.

The money in all three programs is provided with no strings attached, via a debit card replenished each month.

"Guaranteed Income is a temporary monthly payment made to people without any requirements or obligations," says BEEM. "It’s an approach to supporting people, so they have a little breathing room, can take care of immediate needs, and plan for the future."

Similarly, the GIFT project says, "the $1,200 stipend will be provided to participants so they may focus on their basic physical and mental health and wellness without worrying about income."

Fox News reached out to all three programs, but all declined an interview. Mayor London Breed's office said in a statement that the programs are legal and that it looks forward to addressing the charges in court.

16 notes

·

View notes

Text

A Whole New Chapter

In past blogs I’ve written every week or two. Here I am nearly 3 months into this current adventure and I finally sit down to write. I was really planning to give this up but I’ve endured a fair amount of grief from some of my readers, and with a hopefully blog-worthy event coming up (road trip!) Georgia has encouraged me to get back with the program.

Lots of catching up to do! But before I even get to the Philippines, I’ll take you back all the way to our previous trip. One day, as I was paying the bills necessary to maintain a home in the mountains of California, I thought about the monthly costs for electricity, propane, water, sewer, home & auto insurance, property taxes, etc. and wondered why we were paying so dearly for a home we only used half the time, and planned to use even less in the future. Georgia and I thought about it and talked and decided to downsize and relocate our base in the US, and spend most of our time over here – maybe 9-10 months a year.

And between May 2023 and our return here in March, that’s just what we did. We first found a small home on a ¾ acre lot, still under construction, in Fernley, Nevada. This promised much lower expenses than Graeagle, plus Nevada has no state income tax. As one example, our homeowner’s insurance is $328 per year, while we paid more than that every month for the house in Graeagle. Everything else has scaled accordingly, and though we’re not particularly in love with Fernley, it gives us what we need when we’re there, and we feel safe just locking up the house and leaving for 5-6 months at a time.

The new US Headquarters in Fernley

The house in Graeagle was put on the market in September, and in one day we had a buyer, with cash, and the deal was done! We stayed in the house until after Georgia’s son Matt was married (in Graeagle) then began the move to Fernley. By November 15 we were Nevada residents.

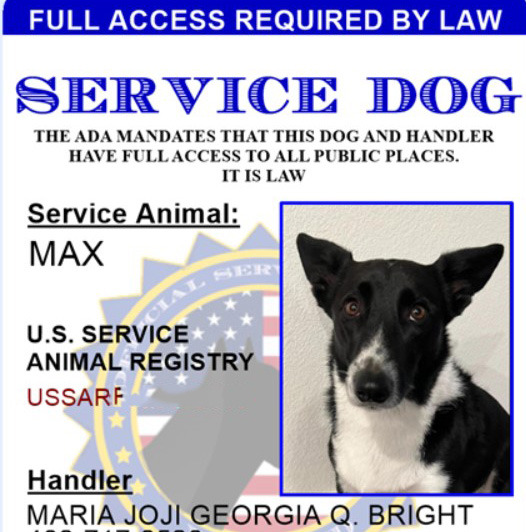

Max

Although Max was well taken care of while we were gone, by Georgia’s sister Dignah, we were the ones who suffered, missing him terribly. We decided to bring him with us, and leave him here during our short return trips to the US. Our caretakers love dogs so it should work out well.

I asked my nephew, who flies for a major airline, about the best way to fly a dog overseas. “Easy” he said, “he just needs to get registered as a medical service dog then he gets to fly in the cabin, for free.” Lucky for us, he’d done that for one of his own dogs and knew the ropes. Soon enough, Max was a “trained and certified” service dog, able to alert to Georgia’s condition. And no, ADA laws do not allow you to ask what that condition is.

Doesn't he look handsome on his ID card?

That was indeed the easy part, and only guaranteed Max a comfy seat on the plane. The path started with Max’s vet, who researched the health and vaccination requirements both for import to the Philippines and export from the US. Max got to know his vet well over the next few months but, as attested to by the lengthy USDA export form, he was perfectly healthy. A complete medical and vaccination history was provided to the Philippines Bureau of Animal Imports to receive an import clearance, and various US DOT forms had to be completed.

Thus armed with a large stack of paperwork, and a suitcase full of Wubbas and Chuckit balls, we set off for our flights from Reno to SFO, then SFO to Manila. The gate agent in Reno didn’t want to see any of the papers; she told us that it would be handled at SFO before the international flight. Nope, at SFO we just walked onto the plane and settled into our business class seats. Max had it pretty good for sure!

Surely we’ll have to provide paperwork to get Max through the airport in Manila, right? Well, again, no. Through Immigration, baggage claim, and Customs, Max just trotted along beside us. The whole trip and not once were we asked to provide any documentation. Welcome to the Philippines, Max!

The most amazing thing though, was Max’s bladder control. He used an animal relief area outside the Reno terminal before our first flight, wouldn’t go near the stinky in-terminal relief station in SFO, held it through both flights, then through the terminal in Manila, finally taking a potty break outside the terminal. Super-human!

Kawayan Cove

It was nice to get back to our home, after being back in the states for a very busy 10 months. Nice especially as the caretakers had done a good job maintaining both home and gardens. Ready to move in and relax!

After greeting everyone and making some instant friends, Max spotted the swimming pool. It was a hot day (and he soon found out that every day is hot here!) and in he went. A quick lesson on where the steps were so he can get in & out and now swimming is a daily activity. Usually when one of us is there to throw the Chuckit ball, but we’ve seen him go down by himself and sit on the bench with water up to his chest, just cooling off.

Mabini

Last trip, I wrote about our visit to nearby Mabini/Anilao, a famous dive spot in the Philippines. We noted that the second hotel we stayed in was dog-friendly so for Georgia’s birthday this year we decided to go back, taking Max this time. We all enjoyed relaxing, swimming (both pool and beach for Max), getting massages (sorry, not you, Max), and of course the bar and restaurant. We went diving one day and I got in a couple enjoyable dives, spotting lots of fish, octopus, nice corals and crinoids, turtles, and a number of colorful nudies (nudibranchs).

Where's Dad?

New Car

I had a plan for this trip to replace our Innova with a Toyota Fortuner SUV (a model not available in the US but similar to the Toyota Highlander). More luxurious, better ride and handling, but still retaining a lot of utility for hauling people and stuff around. Georgia had a better idea (as she's prone to have), to get a really small car mainly for use in and around town, something that will be easier to drive and park in the crowded markets.

We originally settled on a Toyota Wigo (again, no equivalent in the US), a very compact “city car” with a mighty 1.0L engine. Buying a new car here isn’t like in the US, where you practically have to shake salespeople off your legs. Even a test drive isn’t standard here; we actually had to go to 3 dealerships to get one. OK, one dealer did let us drive a Wigo, but only around the dealership parking lot! In the 3rd dealership though, we noticed a little bit larger mini-SUV called the Raize. About the same height and width as the Wigo, but somewhat longer and with lots more room inside. Comparison drives between the Wigo and Raize convinced us that the Raize’s even mightier 1.2L engine was worthwhile, plus it was more comfortable overall. A deal was struck and we’re now enjoying our new mini-SUV!

Georgia’s mom is also wanting a car for the Philippines, and it turns out that our Innova is exactly what she’s looking for. We’ve made a deal to sell it to her, so now we’re looking for its replacement. I may get my Fortuner after all!

Driver’s Licenses

Regarding the story above, I got to test drive the cars; Georgia didn’t. The salesperson noted that her license had expired the day before, which was her actual birthday. Mine didn't expire until July so I was good to go.

We’d been clued in to the existence of a Land Transportation Office (LTO) branch in a nearby shopping center that only handles driver’s license renewals, which was said to be very efficient compared to dealing with the full-service LTO. The requirements for renewal are basically passing a medical exam and a written test. We went to the medical office, conveniently next door to the LTO, for our exams. After filling out a short medical history, my exam consisted of getting weighed, height measured, and reading one line of inch-high letters on an eye chart. Every other result of the required “exam” was just filled in by the staff. And then, as I was waiting for my exam results to be registered, I was handed a certificate stating that I’d passed the written test with a score of 92%. VERY efficient indeed, considering that I’d never seen a test. I do wonder what questions I got wrong though…

In less than an hour overall, we both walked out with 10-year renewals on of driver’s licenses. I’ll be almost 80 when this one expires, hope I’m around to get it renewed!

And BTW, I’m mad because Georgia outscored me on the written test, getting a 96!

Billiards

Billiards is a popular activity in the Philippines, probably because it’s played indoors in air-conditioned rooms. I’ve played occasionally here with Herve, who has a table, but this year we’ve hooked up with Kawayan Cove neighbors Graham (of English garden fame) and Andy (a New Yorker who lives mostly in Singapore). Also in our group, from neighboring developments, are Jean (Belgian), and Robert (Canadian). We call our informal group the “Sandy Balls Billiards Club” and we play a “tournament” every weekend, each putting 100 Pesos (about $1.75) into a winner-take-all prize pool. I’ve won once, hoping to continue to improve my game.

L-R: Robert, Jean, Graham, me, Herve (Andy not pictured)

Road Trip!

We’ve been talking about a road trip to the far northern reaches of Luzon for some time; we finally decided to do it. And just like our road trip to Baguio and Sagada in 2018, we’re not driving or taking our car, rather hiring both. Reminds me of an old commercial…

Car rental = $40/day

Driver = $20/day

Food and Lodging for Driver = $10/day

Sitting in the back and enjoying the ride = Priceless!

Our itinerary will include La Union, Vigan, Pagudpud, Santa Teresita, Tuguegarao, and Baguio. Stay tuned!

Sunset(s)

We’re still enjoying our sunsets, nearly every evening. Since it’s been almost 3 months I’ll throw in some bonus photos!

From our home:

From Mabini:

All for now, take care everyone!

2 notes

·

View notes

Note

Although I decidedly do not need student loan forgiveness (my parents were able to pay for my entire college tuition so I didn’t have to take loans or even work during college, which should tell you all you need to know about my financial background) I stand in solidarity with y’all and I hope Biden comes through on this. I’d much rather my tax dollars go to loan forgiveness than blowing up people abroad.

In this case, it's not Biden we need to worry about; it is, and as ever, the fucking Supreme Court. If some asshole Republican AG sues the administration over this (which they will) and if it reaches the Supreme Court (which it might), then you can absolutely 100% guarantee that it will be struck down in a 6-3 decision along ideological lines. As I said before in all my other posts about this issue, that was the shortcoming with Biden doing this as an executive order (though I'm glad he did anyway). Of course the usual suspects are bitching and whining about how cancelling $10k outright ($20k for Pell Grant recipients, aka the poorest/low-income bracket of students) isn't enough and he should have just done it all, but the plan also contains major structural improvements that will have much longer-term ramifications apart from just outright cancellation, including:

As long as you're making payments (which can include $0 monthly payments if you're on an Income-Driven Repayment plan), NO INTEREST will be added to the principal balance of your loan. That is huge. I probably have at least 10K more in debt than I did when I graduated with my masters, because of the fucking interest. This is one of the things that make student loans so predatory: even if you pay the minimum amount, and if you pay it steadily, you just can't get out of debt because it keeps compounding and increasing. This means your balance will be frozen, and paying it down (even, again, if you don't actually pay anything!) will make a difference!

Full cancellation in 10 years if you've made qualifying payments (which again might be $0 if your income is low)! Also huge! People can spend DECADES paying, so capping it at only 10 years and then they're gone either way is major!

IDR plans are now capped at 5% of your discretionary monthly income, instead of 10%, which again goes a long way to making payments affordable.

If you made payments up/past March 2020 (the start of the first pandemic pause) you can actually get that money back!

Cancelling 20K in debt for the lowest earners/Pell Grantees is legitimately fucking game-changing, and will fully erase student debt for an estimated 20 million people, predominantly Black and Latino with no generational or family wealth to speak of. Even if I get 10k knocked off my student loans, I'll still have upward of 50K left over from my undergraduate/graduate degrees; I also have separate UK-based loans from my PhD which I have had to continue paying this whole time (even though Britain is literally on the verge of becoming a failed state due to economic collapse, but I digress). Of course I wish that I, personally, qualified for more forgiveness or that it would all go away. However, I absolutely recognize that this policy is going to help a lot of people who are considerably worse off than me (and I'm broke, so there you go).

Anyway, there's a lot of good stuff in this policy, and I expect further reform if the Democrats can hold/increase their Congressional majorities. But like I said, the problem isn't Biden; the problem is fucking SCOTUS. So let's see what happens.

75 notes

·

View notes

Text

Why The Gang Became Robbers

CW: Discussions of Poverty and Money

So, it’s somewhat theorized that the gang started stealing because of financial reasons. There’s actually some allusions to this in the movie itself, with them planning to stop stealing after the heist they were eventually caught for, them seeming to live in the shop, Johnny’s clothes seeming to be hand-me-downs (his dad’s jacket, a shirt that’s a few sizes too big with worn out sleeves, well worn-too large jeans), and mostly using walkie talkies instead of their phones (data is expensive). I started to wonder how deep in debt they actually were sooo... I did some calculations.

--------------------------

Disclaimer: All of these were based of the average costs of everything in the state of California (Calatonia is based on LA and San Francisco). There were some generosity here in debt calculations including giving them a good credit score when they applied for the loan and assuming they had only been in the states 7 years. Oh and that they had a bit money when they came to the US.

----------------------------------------------------

Debts

The Garage Itself

Building Price: $2,250,00

Down Payment (20%): $450,000

30-Year Fixed Loan Plan with Interest of 5.395%

Credit Score (I’m trying to help them out here): 729

Annual Property Tax: $28,125

Annual Home Insurance: $7,875

Monthly Payment: $13,102

Annual Total Building Payments: $193,224

Plus Other Expenses (calculated from average 2 person household costs)

Food, Water, Electricity: $24,475.8

Health Insurance: $0

Car Insurance: $0

----------------------------------------------------

Now, the total mortgage would be around 4.62708 million when calculating in 7 years of interest rates. And if we look at the average yearly income of a mechanic in California...

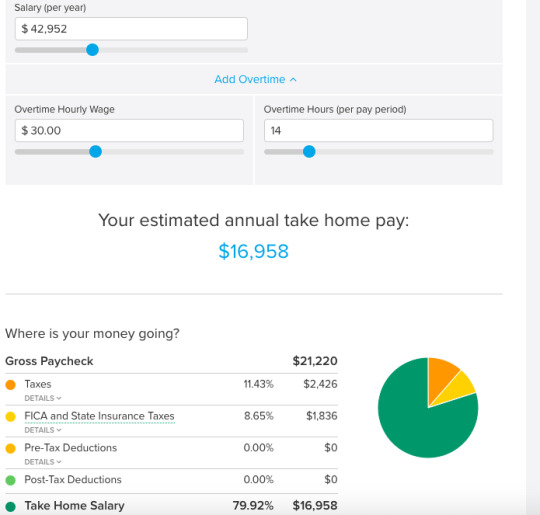

Yeah, Marcus is only taking home around $16,958 dollars per year, and that’s being generous with both rates and overtime. So, without even factoring in the debt, as well as assuming that Stan and Barry are not included in their household income, the Taylor family is almost $2,000 dollars below the Californian poverty line.

Now, let’s take a look at their plan here. We know that the gold shipment they were planning on stealing in Sing 1 was around 25 million dollars worth. Well, that would clearly pay off their entire mortgage, as well as probably help Stan and Barry with whatever financial issues they might be facing. It would also give them a good cushion for a few years going forward, preventing them from going into debt easily again.

With the seven years of payments totaling $599,844, and assuming that they have stolen at least $2.163,677 to pay towards the debt before, in Sing 1, they only owe a much more reasonable $1,863,559.

And while that is still a lot, if a rich person, say an old musical theatre star, wanted to guarantee that the performers at their old theatre troupe wouldn’t be falling onto a bad path, they could pay that off much easier than the full mortgage.

So, in conclusion, Johnny and his family, stolen money included in this, are still some of the poorest characters in all of Sing. They probably didn’t want to steal in the first place either, judging by how they were planning on stopping after the flubbed heist anyway. They were just desperate. they needed money, and clearly the garage plus whatever side jobs Johnny could have potentially had were not enough.

I believe that the main reason we don’t see them still stealing in Sing 2 is that their debts were paid off, more than likely by Nana Noodleman as she’s the only one with that amount of money lying around. This allowed them to begin working again without a immediate threat of debt, and with the money Johnny’s bringing in from the theatre, the family is probably in a bit better shape.

#sing#sing 2#sing johnny#sing marcus#sing stan (only mentioned)#sing barry (only mentioned)#sing nana noodleman (only mentioned)#this is a theory#you do not have to accept it as canon#i'm sorry if the math is off i tried#i was alway a reading and history kid#nana definitely helped buster johnny and ash out after the first movie#because theres literally no way the theatre could have turned that large of a profit that fast#this puts Johnny as the second poorest after Buster in sing 1 and the second after Nooshy in Sing 2#by my calculations at least

15 notes

·

View notes

Text

What Separates a 401(k) Plan from a Pension Plan

A 401(k) differs from a pension plan in that an employee can contribute to their retirement savings account through payroll deductions. Several employers also offer matching funds. On the other hand, pension plans are retirement accounts sponsored by employers and pay out a set sum of money when the employee retires. Your salary, number of years of service, and other factors will typically determine how much you receive.

It's crucial to comprehend the costs associated with a 401k or pension if you're considering getting one. The main causes of plan expenses are contributions, returns, and management fees. However, additional costs covered by the employer, such as administration and recordkeeping fees, can also impact the cost of a 401k. It would help if you asked for a fee schedule that lists all the costs related to your plan.

Asking about service fees, which vary by fund provider, is also a good idea. Some service providers charge fees for processing tax returns, moving assets between 401(k) plan providers, and other services. A typical pension has a cost advantage of 49% over a typical 401(k)-style retirement account, according to a recent National Institute on Retirement Security analysis. This cost advantage is primarily attributable to lower investment management fees, optimally balanced investment portfolios, and longevity risk pooling.

Employer-sponsored retirement savings vehicles include pensions and 401(k) plans, two distinct types. Even though they are both well-liked, one may be preferable to the other depending on your particular circumstances due to a few differences. A 401k and a pension are fundamentally different because a 401k allows you to choose how your money is invested. Several investment options are available, including stocks, bonds, and mutual funds.

As a defined-benefit plan, a traditional pension lets you know exactly how much money you'll receive each month when you retire. The sum is determined by years of service and past salaries. The benefit is typically paid out in lump sums when you reach a certain age, a process known as vesting, or in monthly payments. However, you won't get the entire sum if you quit your job before becoming vested.

Employees can make pretax contributions to a savings account through an employer-sponsored retirement plan known as a 401(k). Employees are allowed to contribute up to a certain amount each year, and occasionally, employers match the contributions. Unlike a pension funded by the company, a 401k is based on your contributions and investments and promises to pay you a set amount of money over time. The most common kind of tax-deferred retirement account in the US is this one, which is referred to as a "defined contribution" plan.

Similar to a 401(k), pension plans have rules governing how much of your pension is tax-deductible and how much is not. General Rule, which makes use of life expectancy tables, is used to calculate the taxable portion. The general Rule can be found in IRS Publication 939, or the Simplified Method can be applied to determine a more exact figure.

Both a 401k and a pension plan offer a range of investment options. Your financial objectives and current financial situation, among other things, will influence the type of investment that is best for your retirement needs.

Employees can save for retirement through a 401(k), a defined-contribution plan, and benefit from tax breaks on their contributions. Employers frequently match these contributions. A pension plan, however, is better suited for investors who want a lifetime income guarantee after retirement. Government regulations and expert fund managers oversee the management of these plans.

By investing in various asset classes, including stocks and bonds, pension funds seek to diversify their portfolios. Additionally, they can invest in derivatives and alternative investments, reducing the risk of losing money on a single investment.

2 notes

·

View notes

Text

Fitness Trainer Certification – An Overview

If you have a passion for fitness and love to help people lose body fat and become fit, you should consider a career as a Certified Fitness Personal Trainer after doing a Personal Trainer Course from a reputed Fitness Academy. This course will help you understand the human body better.

People have become very busy with work and have absolutely no time to dedicate to travel to a gym for their health & fitness. So many people who can afford the luxury of personal trainers have invested in “Home Gym” setups to help them achieve their weight loss goals (Actually Fat Loss goals), and maintain good fitness levels. If you ask most people, they will tell you that the money spent on a personal trainer is money well spent.

The Diploma in Personal Training (DPT) course is a relatively short course and you will be taught the basics of Anatomy, Physiology, Kinesiology, Nutrition and Supplementation, Flexibility Training, Weight Training, Exercise Programming, Cardiovascular Exercise, Health Screening & Evaluation, First Aid and Approach to Fat Loss.

Once you have done the Personal Trainers course, it is imperative that you increase your scope & money earning potential by doing The Certified Personal Trainer for Special Populations (CPT-SP) Course

In the advanced personal trainer course, you will be taught how to handle various clients with medical problems, ailments or injuries. This course teaches you Orthopedic Pathologies- joint wise, Cardiovascular & Respiratory Pathologies, Metabolic Disorders, Neurological Disorders, Kinesiology, Soft Tissue Injuries, Arthritis, Hernias and Fractures.

To further increase your result orientedness with your clients, you can also do an additional course in Sports Nutrition. (Being able to guide your clients in both exercise & Nutrition will help you almost guarantee results to your clients.

This is a great course to help nutritionists, personal trainers, gym instructors and group fitness instructors on how to recommend a good diet to gym members & Personal training clients the tenets of Sports nutrition will help you improve the performance of your clients (whether they are corporate Executives, Models, House Wives or competitive athletes).

This is a very upcoming career choice in India. The demand for Fitness solutions is increasing at an exponential rate & this will only get better. Every big brand of International Franchise chains of Health Clubs is investing in India in a big way with all of them having plans of 100-200 gyms per brand in India. All of these need qualified personnel & will not hire without a valid certification from a reputed Fitness Academy.

Whatever is your motivation to become a trainer, remember, you must be passionate about fitness and have a desire to really change people’s lives. A fitness trainer certification course will help you understand human anatomy better and you will be better equipped to train individuals.

It is one of the most rewarding fields & one of the few in which you get to see an incredible smile on your customers’ faces, when they tell you, “Thank you for changing my life”. Along with monthly incomes of INR 50k- 60k-, easily attainable through personal training. It also comes with a guarantee of incredible JOB SATISFACTION.

2 notes

·

View notes

Text

Proof that Short Term Cash Loans Is Exactly what You Need?

You are constantly looking for more money to deal with emergencies in your life. Here, we assist clients in choosing a suitable lender in the hopes of receiving additional funding while also understanding their loan needs. As a result, you don't travel far and wide before arriving at Classic Quid to submit an application for one of the best loan products based on your needs. Short term cash loans from direct lenders are a real option if you don't have a debit card in your wallet to serve as collateral for a loan. You don't have to wait to look for another loan because it enables you to address all of your urgent needs at once.

To make applying for a short term loans UK with us quick and simple, we especially developed our application process with the needs of our borrowers in mind. It will take you less than 5 minutes to finish our application because there isn't any documentation to submit or complicated questions to respond to.

Although the turnaround time for quick approval may vary, in most circumstances you should be able to get a short term loans UK direct lender decision on whether or not your application has been approved once you've completed it. This implies that you won't have to wait for hours or even days to find out if you've been accepted.

Find the Most Solid Momentary Advances Direct Loan specialists at classicquid.co.uk?

Classic Quid has focused on client insurance as a main concern as long as necessary. As the most legitimate direct moneylenders for short term loans UK direct lender in a spotted market, we have offered sensible and obliging reimbursement terms to our strength. We continually try to avoid potential risk to guarantee that the customer can manage the cost of the installments by doing exhaustive reasonableness checks. To guarantee that your funds won't put you in a tight monetary circumstance.

That's what it follows, you simply have to fill in the sum that you consider you can bear to pay the sum in each period of portion, in light of your income and money related financial plan. Soon in the wake of entering the advance charges as loan fees of the credit that you intend to take. The vital sum that you will be gave as advance would be screened.

Modest short term loans UK direct banks are extremely easy to utilize and will help you in covering the general installments. You can make use of the number cruncher to consider about the amount of you'll possess to save beside your month income for taking care of the advance. Further you can likewise get an undeniable thought with respect to how much a credit arrangement will cost you in minutes by making not many snaps.

Short Term Loans UK for Any Financial Need

Short term loans for bad credit are available. They are not available from all loan providers, but those that do usually charge a higher APR because you are deemed a higher risk. Personal loans for bad credit can help you improve your credit score if you manage your monthly payments properly. If you use your home or another valuable item as collateral, the lender can repossess your property to recoup their losses if you fail to make payments. This is a higher risk option that should be carefully considered. This is why we only provide short term loans UK applications.

https://classicquid.co.uk/

4 notes

·

View notes

Text

Best Mietkaution insurance in usa

Are Rent Guarantee Insurance Helpful?

When you’ve invested money into your business and rental properties, it makes sense to want to protect them. Landlord insurance makes it possible for you to protect your building from environmental damages while also protecting you

rself from liability; renters insurance allows tenants to protect their belongings at the unit. How does rent guarantee insurance help to protect your business? Though only seen internationally in the past, rent guarantee insurance is becoming more popular in America, and it’s easy to see why once you learn about it. This affordable insurance option just makes sense for many landlords are you missing out?

Expensive Is Rent Guarantee Insurance?

The cost of coverage is going to be a factor for many landlords like you when deciding whether or not adding this type of coverage makes sense. Unfortunately, the cost is going to vary widely depending on where you are and what the offerings in your area are.

Regardless, you may be able to balance the cost of adding this type of insurance Mietkaution into the base monthly rent depending on your area and profit margin. The insurance is a reasonable expense for your business if you consider the protection it adds, so factoring this cost into your rent calculation is something to think about. Many property management companies offer this type of insurance through a third-party with their services, so that is something to consider as well if you use or plan to use a property management company.

A tenant who cannot or refuses to pay rent is a landlord's worst nightmare. In most cases, individuals and companies who lease property have several policies to choose from, including the option to insure buildings and their contents as well as the legal expenses of getting a tenant evicted. Some of these policies might refer to something called "rental cover." However, that does not mean that they will be reimbursed if the tenant falls into arrears. Rent guarantee insurance, a relatively new import from the United Kingdom, is now being sold in the United States to fulfill those particular needs. These products are specifically designed to protect a landlord's income in the event that their tenant defaults on payments.

Rent Guarantee Insurance Payout?

In most cases, a claim can be filed as soon as the tenant has shown that they will not be paying rent or have not paid rent even after you send them an official notice. Most rent guarantee insurance plans do not cover the first month of unpaid rent, but they will cover up to six months starting from the second month.

Remember, however, that every insurance policy is a little bit different. This means that while the terms outlined above are a good representation of most policies, you should always check the terms of your specific policy for the most accurate details.

Benefits Of Rent Guarantee Insurance

Why do landlords choose to put more money into insurance through a rent guarantee policy on top of what they’re already spending on the mortgage, landlord insurance, and other costs?

What makes this type of insurance worth it?

There are a few primary things that may help this type of program worth the money:

Less Stress

If your tenant suddenly falls on hard times or leaves the property without notice, it is a very stressful time. With a guarantee in place, you can file a claim after as little as one month and be less stressed.

More Time To Find Good Tenants

When a tenancy ends suddenly, you may be tempted to fill the vacancy as quickly as possible with whoever applies. That can leave you with unchecked tenants who may repeat the process, which would just duplicate your stress. With the help of a guarantee program, you can do your complete screening process with less worry.

Beyond Physical Damages

Standard rent loss insurance policies are only focused on physical property damages that cause your income to be reduced, but that is not the case Mietkaution with a rent guarantee policy. YBuying rent guarantee insurance, like buying any other type of insurance, is about protecting your property and your investments. Any situation where you cannot collect rent becomes very stressful, so having insurance in place to reduce that burden can be a very smart move.

Remember how rent guarantee insurance can help you:

● Covers up to six months of rent due to renter nonpayment

● Can be taken out to cover specific rental policies

● Offers backup protection against sudden income loss

The world can be turbulent, and you can never predict what might happen.

2 notes

·

View notes

Text

Is Life Insurance An Investment?

At a meeting of financial advisors, I was recently asked, “do you actually think life insurance is an investment?” My inquisitor was making more of a statement than asking a question, so she was surprised by my answer: “I can tell you that life insurance was an investment for me; one that I’m benefiting from now.”

I explained to her that about 20 years ago, I started paying annual premiums into a whole life policy that was designed to have low loads and high cash values. Each March, right after receiving my annual bonus from work, I’d faithfully write a premium check to the insurance company. Nothing much happened with my policy during those 20 years other than the cash value account in the policy grew tax deferred.

Fast forward to last year when my family was grown, and I had transitioned from working in industry to working in academia. In other words, I didn’t need the death benefit anymore, and my taxes were lower. I made a tax-free exchange of my policy into an immediate payout annuity. Now my wife and I receive a monthly guaranteed amount that will pay us until the last of us die. And the taxes on the cash values that I experienced over the past 20 years are being prorated over our life expectancy. Keep in mind that I could have died during my pre-retirement years, and my wife would have received a substantial tax-free death benefit. But I didn’t die, and yet I made an approximate 6% after-tax internal rate of return on my premiums.

Life insurance as an investment in estate planning

To be clear, the vast majority of life insurance is purchased for risk management. The death benefit is a hedge that provides cash in the event of an unexpected death. It’s intended to pay off debt, provide a survivor income or otherwise generate liquidity for a premature death. Even in my case, I still own other life insurance policies intended to provide a death benefit.

But life insurance, largely because of its tax benefits, can also be used as an investment. And it’s not just because of the cash value associated with permanent insurance. Consider how the death benefit of a policy can generate millions in tax savings for a wealthy family. Rich families often use dynasty trusts to move their millions down through the generations. In this case, the family is the investor, not the individual. The challenge for these family dynasties are the three federal transfer taxes that charge a flat 40% rate on transfers: the gift, estate and generation skipping transfer taxes (GST). While these taxes can quickly deplete a wealthy estate, current law allows an exemption of $11.4 million before they apply. So, Generation 1 can set up a trust that uses $11.4 million to skip a generation, landing the wealth in the hands of Generation 3, transfer tax-free. Generation 2 doesn’t suffer for wealth because they live off the income in the trust. The question is what investment to use to maximize the efficiency of the $11.4 million exemption in moving money through the generations.

A popular solution in GST tax exemption planning is life insurance. This product has the advantage of paying exactly when needed, i.e. at the insured’s death, and it pays a benefit that is income tax-free. Let’s take an extreme example to demonstrate the leverage. A wealthy individual, Gen 1, uses her entire $11.4 million generation-skipping tax exemption to pay a one-time premium for life insurance. Assume the policy’s death benefit is $25 million and it resides in a dynasty trust. The trust is structured so that after Gen 1’s death, it collects the insurance proceeds income tax-free, and begins paying interest income to her children, Gen 2. The $25 million principal in the trust will eventually go to the grandchildren, Gen 3, after Gen 2’s death. Life insurance has maximized the leverage of this transaction. When Gen 1 died, the trust received $25 million income tax-free, and neither Gen 1 nor Gen 2 pay gift, estate or GST taxes on the death benefit. In the end, Gen 3 has $25 million in trust and the dynasty continues. Even accounting for inflation, the family experiences little, if any, diminution in the value of their wealth through three generations.

An added consideration is that the federal exemption is slated to return to a lower amount starting in 2026. This means that the exemption will revert to an inflation adjusted $5 million. So, the family that utilizes life insurance as an investment currently has the added advantage of leveraging the high exemption while it is available. The IRS has indicated it will not “claw back” this high exemption once it has been used. So, leveraging the exemption is a matter of “use it or lose it.”

Life insurance as an investment in retirement planning

The example I used above of my own policy is more typical of how life insurance can be used as an investment. In essence, I utilized the policy as a way to tax-efficiently supplement our monthly income. The policy first deferred taxes during my high-income earning years, and now spreads both the income and the income tax out over my lower earning years.

There are other ways to structure cash value life insurance to help supplement retirement income planning. It should be emphasized, however, that in all cases the insurance is first and foremost a means of providing a death benefit. Section 7702 of the U.S. Internal Revenue Code requires insurers to maintain a sufficient risk element in the policy to qualify the product as life insurance under the tax code. So, while the policy is in force, a death benefit is always in play.

That said, a popular life insurance retirement planning strategy involves directing as much premium as possible into cash value with the least amount allocated to the death benefit. This typically requires fiddling with two death benefit types and two premium tests — a function best handled by the insurance advisor or the insurance company. The idea is to structure ongoing premiums into the life insurance policy during one’s working years so as to stuff the product with tax deferred cash value. Then, at retirement, the policy turns into a source of income more than death benefit. Accumulation and risk protection during the working years switches to decumulation and retirement income.

Here’s how it works (using a Universal Life insurance policy as an example): first, at retirement, the owner stops paying premiums, thereby adding to cash flow. Next, working with the in-force cash values in the policy, the retiree determines an ongoing level income to take from the policy. The original source of that income is the owner’s tax basis in the contract. Life insurance has the advantage of first-in-first-out (FIFO) tax treatment, so the income coming out of the policy is initially treated as a return of premiums. Once the tax basis has been exhausted, the owner switches to making capitalized loans from the policy. In other words, the loan would be for the desired income plus the interest required for the loan itself. Since this income is a loan, no tax applies. The primary caution of this retirement income strategy is to not take out so much cash value as to have the policy lapse. If the insurance policy runs out of money, the owner incurs income tax without any corresponding cash to pay the tax.

This may all sound like a witches’ brew and more trouble than it’s worth. But some life insurance companies have become adept at making the process surprisingly easy. One noted company automates the entire income process so that the checks come monthly; the company knows when to switch from withdrawals of basis to loans, and then, when the values start to run out, the policy is essentially collapsed into a contract that won’t lapse. As far as the owner is concerned, he gets a level tax-free monthly income for several years in retirement. Conceptually, the transaction works like a Roth IRA. You use after tax dollars to accumulate a fund that pays out tax-free.

Financial professionals can, and do, argue over the merits of life insurance as an investment. Accusations occur over high loads, poor administration and unrealistic illustrations. Like any investment, the results of the transactions are highly dependent on the performance of the company that handles the contract. But it is hard to disagree with the tax advantages possible with life insurance as an investment. Simply put, it builds up cash values tax deferred and can pay them out tax free.

So, back to answering my inquisitor at the meeting. Yes, in the right situation and used correctly, life insurance can be considered an investment.

Credits: Steve Parrish

Date: Jul 9, 2019

Source: https://www.forbes.com/sites/steveparrish/2019/07/09/is-life-insurance-an-investment/?sh=3556843732b4

2 notes

·

View notes

Text

Energy price

How to smooth over the energy price shock

Prime Minister Boris Johnson is under pressure to act on soaring energy prices and household costs as a jump in capped bills looms in April.

The government has a trilemma over energy prices: how to solve the cost-of-living crisis, while being focused on net-zero, and unwilling to increase taxation or borrowing.

There may be no ideal solution, but a number of questions need clarification.

Who should be shielded from a 50% rise in energy prices and for how long?

Who should bear the burden - bill payers or taxpayers? Are we willing to take a hit on government debt?

And do we want to smooth this over 25 years or two or three years?

·Boris Johnson promises action over rising energy bills

·Energy prices: Government must show more urgency, says Ova boss

Imminent rises

The energy price rises that are coming in April and again in the autumn will reach well beyond the "hard-up" or "fuel poor", possibly sending inflation towards an incredible 7%.

This is something not seen in three decades, since well before the independence of the Bank of England.

Such is the scale of the increases in the pipeline - with typical bills heading to £165 a month - which the pressure will affect millions of lower-middle-income households as well as poorer ones.

Average households, which currently spend 4% of their disposable income on energy, will see that almost double many business listing.

A recent poll suggested that half of Britons would not be able to afford a rise in their monthly bills of £50 a month. That's the increase which is coming in a few weeks' time.

All of this means there are some fundamental flaws with the three main solutions currently being floated.

Discount expansion

An expansion of the £140 Warm Home Discount scheme is the current most-talked-about plan.

The current budget of this scheme is less than £500m a year.

It is not really designed for a situation where several million people might need support to fund a £20bn energy price shock.

The "core" element of the scheme distributes payments automatically to low-income elderly using pension credit data.

But there are now more people in the broader part of the scheme for working-age recipients of the discount.

This part of the scheme is run on a first-come-first-served basis, where recipients have to apply for the discount from a fixed pot of funds at each energy company and hope that the fund isn't exhausted.

There are some different criteria applicable at each energy company so claimants may not be eligible if they have switched.

The most significant factor, though, is that no funds come from the taxpayer.

It is all funded by the energy companies, or rather, funded from energy bills.

Redistributing half a billion for the fuel poor on to wealthier people's bills is one thing.

Adding several times that, on top of the record increases, starts to assume the character of a new tax.

Cuts to VAT and green levies

A cut in VAT saves 5% or £95 off a £1900 predicted bill. This might prove a helpful addition, but will not fundamentally alter the picture.

It also gives more cashback to those with the biggest bills, or the largest, least well-insulated mansions. And it also loses revenue to the Exchequer.

And then there is getting rid of the "green levies". These are a range of policies that add about £170 to bills business listings.

They reflect the funding for historical investments in green energy and a range of social obligations.

They would be required instead to be funded by the taxpayer.

A version of this idea was floated four years ago in Professor Dieter Helm's "Cost of energy" report to the government. He said that report had been "shelved".

Putting off costs

There is another solution that the government is looking at: what is being termed a "cost deferral mechanism".

Essentially some big banks, possibly backed by a Treasury guarantee, lend billions to energy companies, who then spread a £600 immediate hike, into, say an additional £120 premium every year for five years, or less over a decade.

It is possible to do this without Treasury backing, but some sort of adaptation of rules governing existing deferral arrangements such as the last resort supplier schemes would be needed.

Another version of this scheme being pushed in Whitehall could utilize the pandemic rescue architecture at the Bank of England by providing up-front funding.

This could prove rather controversial, but some argue that the scheme could help prevent inflation from getting to 7%.

Some version of the scheme, or "smoothing mechanism", has been gaining traction in the energy sector, in some government departments, and among MPs keen for a plan.

But it doesn't have universal backing in the energy industry.

In an interview with the BBC, earlier this week Centrica chief executive Chris O 'Sheaf referred to it as a "bailout" for energy companies.

That in turn has led to some skepticism at the Treasury about how it can work.

But I understand that plans along these lines are being worked up, with some observers seeing this scheme as the cornerstone of a Prime Ministerial relaunch in the coming weeks.

Short or long-term hike?

The judgment on whether this is a one-off shock, or whether, as Mr O'Shea suggested, it will last two years or more, is critical here.

There are reasons to believe it is the consequence of an exceptional set of circumstances.

Firstly, the post-pandemic bounce-back led to unprecedented demand, including for gas.

Secondly, the fact that due to a late, cold, and long winter last year, crucial stores of gas in Europe never got full in the first place going into this winter.

And lastly, there is the Nordstrom 2 pipeline from Russia which is finished, but has not been certified by Germany free business listings.

The prediction that wholesale gas prices stay high for a year or two is a reflection of what futures markets are saying.

All of that could change rather rapidly with a speech from Russian President Vladimir Putin, or when the global economy normalizes.

But we cannot be certain either way.

If a smoothing mechanism is put into operation, and wholesale prices remain high, then households might get prolonged chronic pain and a never-ending scheme.

Does the political cycle lend itself to such a spread of the burden with a general election expected in 2024?

All of this points to the traditional moment where Number 10's First Lord of the Treasury - one of the Prime Minister's official titles - overrules a fiscally cautious Chancellor.

But the political backdrop of "party gate" adds some uncertainty to what actually happens here.

The fundamentals are this though: Is this a one-off price shock? And for how long does the government want to spread the energy price pain?

For ordinary households, there couldn't be a more important consequence to the nation's currently delicate political balance.

Boris Johnson says he is talking to Chancellor Rishi Sunak over how the government could help people with soaring energy prices.

The prime minister is under pressure to act on rising household costs, ahead of further increases to capped bills due in April.

Some Tory MPs want cuts to green levies and VAT to help bring bills down.

Labour, which also wants VAT suspended, is also demanding higher taxes on oil and gas producers.

The party said it would use money from the hike to pay for more generous government payments to help poorer households with costs.

On Monday, Mr Johnson said ministers understood the difficulties people were facing, and "we're certainly looking at what we can do".

·Labour demands energy firm tax hike to cut bills

·How can the government solve the energy crisis?

·How much would a VAT cut on my energy bill save?

Trade body Energy UK predicts bills will surge by up to 50% in April, when the change to the price cap, due to be determined in February, kicks in.

There have been warnings that average households could pay about £700 more per year, amid surging prices for wholesale gas worldwide.

Speaking to reporters during a visit to a vaccination center, Mr Johnson said rises were driven by "general inflationary pressure" caused by the world economy "coming back from Covid".

But he added: "We've got to help people, particularly people in low incomes, we've got to help people with the cost of their fuel - and that's what we're going to do."

Asked if he would meet Mr Sunak this week, he replied: "I've been meeting the chancellor constantly. I met the chancellor last night to talk about it."

Mr Johnson is expected to hold his first formal discussions with Mr Sunak on Monday, although a decision on what to do is not expected imminently.

1 note

·

View note

Text

Life Insurance Coverage Settlement

When selecting this option, the beneficiary could have the aptitude to get a portion or the entire proceeds when wanted. However, pillar life settlement fund might be advantageous if your beneficiary has a particular cause to need more money or solely requires the earnings for a finite period. The major benefit of a life revenue settlement is that it provides your beneficiary with a lifelong income stream and prevents them from utilizing up the cash too fast. As the earnings is guaranteed, your beneficiary might end up receiving more than the dying benefit's value if they outlive the insurer's life expectancy estimate. Harbor Life will refer certified policy homeowners to a minimal of one or several licensed life settlement brokers or suppliers.

Life insurance coverage settlement choices are notoriously confusing, particularly if you try to evaluate them.

We could obtain compensation if you click on hyperlinks to those products or services.

In most circumstances the beneficiary can settle for the option the coverage owner chosen or change it to one that he/she feels fit his/her wants.

Consequently, it is usually a good suggestion to discuss which technique would work better with an expert within the life insurance area.

Payments obtained under an installment possibility are subject to earnings tax, however. It’s the curiosity on the payouts that's taxed as quickly as it's credited to the beneficiary. Although we are licensed as an insurance company, we don't concern insurance contracts or bind protection. In addition to getting the right kind of coverage, it’s essential that you just purchase enough insurance coverage for your family members.

Settlement Choices

If utilizing the joint and survivor life revenue annuity possibility, the beneficiary shall be permitted to annuitize the demise profit funds structured upon two or more individual lives. Using the curiosity income option, the life insurance company holds the funds and can pay a specified amount of interest on the funds. The interest can be disbursed on a monthly, quarterly, semi-annual, or annual schedule.

While lump sum life insurance coverage proceeds are usually earnings tax-free for the beneficiary, it’s necessary to note the exceptions. If the policy was bought by an worker benefit belief or certified retirement plan, proceeds are normally taxed as revenue to the beneficiary. Life insurance proceeds can be taxed if the proceeds are thought of compensation or dividends as a outcome of a company paid premiums.

Life Insurance Coverage Basics

There could also be circumstances attached that have to be met before beneficiaries obtain their demise benefits in some cases. An L bond, issued by GWG Holdings, was a bond that financed the acquisition of life insurance coverage policies on the secondary market. Being impartial, I symbolize many highly-rated insurance companies and, because I am not beholden to any one insurance company, my focus is to search out the proper company and policy for each particular person consumer. This would imply that the profit payments shall be depending on the amount of profit proceeds, in addition to the life expectancy of the named beneficiary who's anticipated to stay longer.

youtube

Under the interest solely settlement option, the insurance firm holds and invests the policy’s death benefit, and the growth is paid out to the beneficiary. This could be a useful method should you don’t need a big inflow of money now and wish to put it aside for retirement or a big future expense. As the name suggests, a lump sum payout allows the life insurance coverage beneficiary to receive the entire death profit at once. Term life insurance coverage is often essentially the most accessible kind of insurance coverage to buy.

Do Beneficiaries Pay Taxes On Life Insurance?

An insurance coverage belief is an irrevocable belief set up with a life insurance policy as the asset, allowing the grantor to exempt property from a taxable property. He is an independent life insurance coverage agent that works for his purchasers nationwide to secure affordable protection while making the method easy. In many circumstances, beneficiaries will choose the lump sum cost. This occurs when the general amount of the funds are settled at one time in a single payment. Proceeding with this selection can usually assist the beneficiary in selecting to repay massive obligations corresponding to funeral and burial bills, in addition to another final debts of the deceased. You have the proper to vary your mind about the life settlement transaction AFTER you obtain the proceeds of the life settlement.

#life settlements#life settlement broker#life settlement calculator#life settlement#life settlement companies#life settlement contract#best life settlement companies#life insurance settlement#life settlement services#viatical settlement companies#life settlement brokers#sell life insurance policy calculator#viatical companies#life settlement investments#coventry direct reviews#viatical settlement broker#what is a life settlement#life insurance settlement options#life settlement broker represents#settlement life insurance#can you cash in on a term life insurance policy?#viatical settlement#magna life#viatical investment#viatical settlement definition#companies that buy life insurance policies#life settlement contracts must be approved by which of the following#coventry direct#coventry direct scam#harbor life settlements reviews

2 notes

·

View notes