#funding rate crypto explained

Text

#funding rates#crypto funding rate#crypto#funding rate#funding rates crypto#funding rate explained#funding fee#funding rate binance#crypto trading#funding rate strategy#funding rates explained#what is funding rate#funding#funding rate crypto explained#crypto investing#binance futures funding#crypto funding rates explained#trading funding rate#how to check crypto funding rates#crypto market#trading crypto#funding rate binance futures in hindi#business#newblogflo#secretstime

0 notes

Text

Squeeth (oSQTH) Review: How To Make Squared (x²) Returns On Your ETH

Squeeth Review: How To Trade ETH For Exponential Profit

- What is Squeeth?

- How to trade ETH for higher profit

- How to generate regular yields with Squeeth.

@wadepros @opyn_ #options #Defi #ethereum #cryptocurrency #Obidatti2023

Today’s post is a review of Squeeth.

Squeeth is an Ethereum-based ERC-20 token for options trading.

It gives users high leverage and eliminates the need for strikes, liquidations, and more.

Squeeth was developed by the team at Opyn, the first DeFi protocol to allow users to trade partially collateralized options.

In this post, I did a full review of Squeeth and how to trade it.

Post…

View On WordPress

#How to buy Squeeth (oSQTH)#Opy#opyn#oSQTH#Squeeth Crab Strategy#Squeeth crypto explained#Squeeth funding rate#Squeeth price

0 notes

Text

This weekend’s episode of "Saturday Night Live" began with a skit poking fun at former President Donald Trump’s recently released, meme-worthy non-fungible token (NFT) collection.

“Seems like a scam and, in many ways, it is,” said James Austin Johnson, who played the 45th President in the show’s cold open.

While the mainstream media has eagerly picked up the story on the collection for its comedic value, the popularity of the Trump Digital Trading Cards has continued to climb since the collection dropped on Thursday, selling out within 24 hours.

According to data from OpenSea, the collection’s trading volume is 6,658 ether (ETH), or about $7.8 million at the time of publishing. Its floor price, which started at $99, has been hovering around 0.3 ETH, or $350.

The collection features 45,000 tokens in the style of baseball cards. In each collectible, Trump wears a different costume linked to rarity elements that allow users to enter a sweepstakes to win prizes like a zoom call with the former President or a cocktail hour at Mar-a-Lago.

In the wake of the project’s apparent success, internet sleuths have dug deep into the project and the parties behind the wallet addresses associated with Trump’s collectibles. Among the nuances and inconsistencies alleged on Twitter: the company that created the collectibles is hoarding a large amount of them; that the project poorly relies on stock imagery; and that most of the buyers opened new wallets without holding any cryptocurrency, sticking them with an NFT and no way to derive any future value from them.

THE STRANGE CASE OF 1,000 NFTS

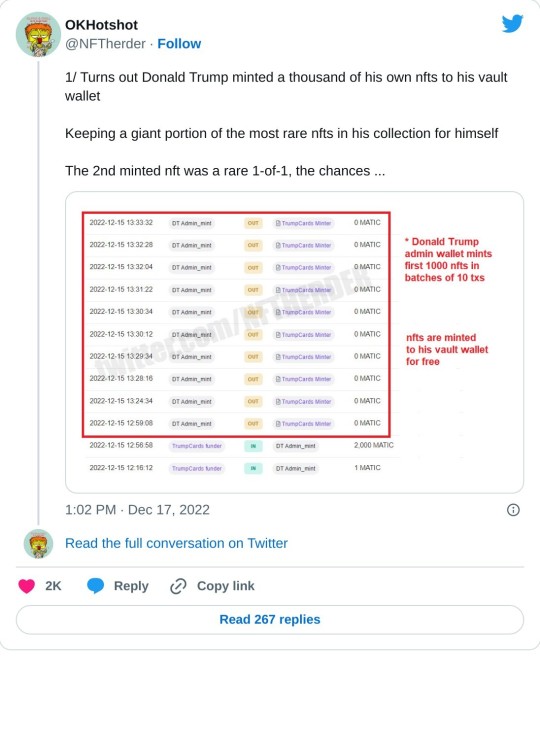

Over the weekend, Twitter user @NFTherder noticed something strange about a large number of the rarest NFTs in the collection. The user posted a thread explaining the nature of the transaction data of the contracts involved in the mint.

According to data from Polyscan, Polygon’s version of Etherscan, a “Donald Trump Admin” wallet minted 1,000 tokens to a Gnosis Safe Wallet, a multisignature smart contract wallet that requires a handful of users associated with the tokens to approve of any asset movement.

While the Collect Trump Cards site said that 44,000 of the 45,000 tokens created in the initial series would be available for users to mint, it did not specify what would happen to the remaining 1,000 tokens. Where another project might save those assets for a later date to revive demand, data suggests that the administrative wallet holds the remaining minted 1,000 tokens.

After the collapse of Three Arrows Capital, the crypto-hedge fund backed NFT collection “Starry Night” moved its tokens into a Gnosis Safe wallet, along with other valuable assets. It was likely done out of caution to hold the assets in one place to prevent any singular actor from moving these out of the wallet.

The Trump Trading Card site specified that there was a “strict limit of 100 Trump Digital Trading Cards per purchaser/household,” meaning that an individual or a group who did not have to abide by the rules for the general public was able to pick up a large swath of the NFT pool.

In addition, the mystery wallet isn’t full of second-rate NFTs. It minted 26% of the rarest 1-of-1 tokens and 28% of the autographed trading cards, according to NFTherder. These are the most valuable and expensive assets in the collection, respectively comprising 0.4% and 0.16% of the total tokens in the collection.

NFTherder told CoinDesk that not only do the wallet owners have the ability to inflate the price floor of the collection, but they also could have the ability to rig the sweepstakes and alter the competition.

“If this was a 10,000 unit collection about monkeys, the whole discord would be blowing up about how this is a rug and a scam and that the team is holding one fourth of the most rare supply,” said NFTHerder.

THE CURIOUS MARKS AND MAKER OF THE ART

While people have been digging into the wallet addresses and collection sweepstakes, other Twitter users were delving into pop culture digital artist Clark Mitchell and the artwork he created for the collection.

On-Chain TV founder Morgan Sarkissian tweeted an image of one of the collectibles featuring the 45th president in a space suit that seemed to still have a visible watermark from Shutterstock.

She also uncovered an Adobe watermark in another token listed in the collection.

Other Twitter users have found inconsistencies in the artwork, with some of the creative assets used to build the collection apparently taken from stock images or Amazon costumes.

While Mitchell has worked on other projects such as artwork for Disney, Hasbro and Marvel, this isn’t his first NFT project.

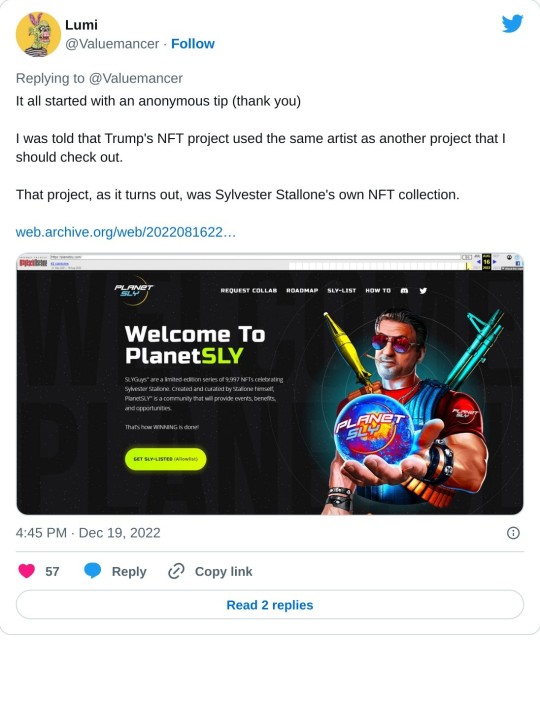

Web3 researcher and Twitter user @Valuemancer uncovered that Mitchell also did the artwork for Sylvester Stallone’s SlyGuy NFT collection that never launched, according to the digital collectibles website.

The collection included similar creative assets, such as drawings of the actor paired with exclusive access to events such as the Ultimate Stallone Experience, a dinner hosted by Stallone for token holders.

Mitchell, Sarkissian, @Valuemancer and the SlyGuy NFT collection did not respond to CoinDesk by press time.

THE SHINY NEW WALLETS WITH NO CRYPTO

While NFT collections often attract a wide range of buyers with various stake in the game, Trump’s NFT collection had a large number of buyers that appear to be new to digital collectibles.

According to data from Dune Analytics, of the nearly 12,900 users that minted Trump NFTs, about 9,300 did not hold any cryptocurrency in their wallet for gas fees – the fee all users pay for a transaction on the blockchain. If a holder has no balance of either MATIC or wETH, he is "No Gas" holder. That means he can't list his NFT for sale until he get some balance into his wallet, the Dune dashboard shows.

This means that 72% of buyers were likely purchasing NFTs for the first time.

The total number of tokens held by holders with no gas is 21,420, according to Dune Analytics, which one Twitter user pointed out may be stuck due to the more advanced nature of trading on Polygon.

“It's more like a 20,000 set than 45,000,” said Tyler Warner, staff writer at Lucky Trader on Twitter, citing the data as one of the reasons why the tokens skyrocketed in trading volume.

Warner did not respond to CoinDesk by press time.

In a harsh crypto winter where NFTs are already subject to market vulnerabilities, celebrities releasing successful NFT projects or funding Web3 ventures seems like a promising sign.

However, when the project is executed before fully working its kinks out, it does not serve as a vehicle for mass adoption. Instead, it can onboard a new user base that is not familiar with cryptocurrency or the steps needed to make a sound purchase, analyze blockchain data for irregularities and fund wallet transactions.

As projects like these continue to rise in popularity, it’s important to educate holders, dig into the details and look beyond the hype.

#us politics#news#coindesk#bitcoin#nfts#non fungible tokens#donald trump#Trump Digital Trading Cards#opensea#@NFTherder#twitter#Polyscan#Polygon#Etherscan#Gnosis Safe Wallet#Collect Trump Cards#Morgan Sarkissian#On-Chain TV#Clark Mitchell#copyright infringement#@Valuemancer#sylvester stallone#celebs#SlyGuy NFT#Dune Analytics#gas fees#Tyler Warner#blockchain#Lucky Trader#2022

30 notes

·

View notes

Text

“Also among Lane’s clients: FTX. Federal prosecutors are now examining Silvergate’s role in banking Sam Bankman-Fried’s fallen empire. The more pressing problem is that the collapse of FTX spooked other Silvergate customers, resulting in an $8.1 billion run on the bank: 60 percent of its deposits that walked out the door in just one quarter. (“Worse than that experienced by the average bank to close in the Great Depression,” The Wall Street Journal helpfully explained.)

In its earnings filing, we found out that Silvergate’s results last quarter were absolute dogshit, a $1 billion loss. Then, on March 1st, Silvergate entered a surprise regulatory filing. It says that, actually, the quarterly results were even worse, and it’s not clear the bank will be able to stay in business.

(…)

“If Silvergate goes out of business, it’s going to push funds and market makers further offshore,” Ava Labs president John Wu told Barron’s. The issue is how easy it is to get into actual cash dollars, which in finance-speak is called liquidity. Less liquidity makes transactions more difficult. Already there is a broader gap between the price at which a trade is expected to go through at and the actual price at which it executes, Wu said.

So Silvergate’s troubles are a problem for the entire crypto industry.”

“Within 48 hours, a panic induced by the very venture capital community that SVB had served and nurtured ended the bank's 40-year-run.

Regulators shuttered SVB Friday and seized its deposits in the largest U.S. banking failure since the 2008 financial crisis and the second-largest ever. The company's downward spiral began late Wednesday, when it surprised investors with news that it needed to raise $2.25 billion to shore up its balance sheet. What followed was the rapid collapse of a highly-respected bank that had grown alongside its technology clients.

(…)

"This was a hysteria-induced bank run caused by VCs," Ryan Falvey, a fintech investor at Restive Ventures, told CNBC. "This is going to go down as one of the ultimate cases of an industry cutting its nose off to spite its face."

(…)

The roots of SVB's collapse stem from dislocations spurred by higher rates. As startup clients withdrew deposits to keep their companies afloat in a chilly environment for IPOs and private fundraising, SVB found itself short on capital. It had been forced to sell all of its available-for-sale bonds at a $1.8 billion loss, the bank said late Wednesday.

(…)

All told, customers withdrew a staggering $42 billion of deposits by the end of Thursday, according to a California regulatory filing.

By the close of business that day, SVB had a negative cash balance of $958 million, according to the filing, and failed to scrounge enough collateral from other sources, the regulator said.

(…)

Now, thanks to the bank run that ended in SVB's seizure, those who remained with SVB face an uncertain timeline for retrieving their money. While insured deposits are expected to be available as early as Monday, the lion's share of deposits held by SVB were uninsured, and it's unclear when they will be freed up.”

“First Republic shares fell 52% in early trading before storming back to near the previous day's closing level, only to then finish the day down 15%. Investors expressed concerns about unrealized losses on assets at the bank as well as its heavy reliance on deposits that could turn out to be flighty.

(…)

First Republic's shares have lost 34% of their value in the past week.

(…)

In its annual report, First Republic said the fair-market value of its "real estate secured mortgages" was $117.5 billion as of Dec. 31, or $19.3 billion below their $136.8 billion balance-sheet value. The fair-value gap for that single asset category was larger than First Republic's $17.4 billion of total equity.

All told, the fair value of First Republic's financial assets was $26.9 billion less than their balance-sheet value. The financial assets included "other loans" with a fair value of $26.4 billion, or $2.9 billion below their $29.3 billion carrying amount. So-called held-to-maturity securities, consisting mostly of municipal bonds, had a fair value of $23.6 billion, or $4.8 billion less than their $28.3 billion carrying amount.

(…)

Total deposits at First Republic were $176.4 billion, or 90% of its total liabilities, as of Dec. 31. About 35% of its deposits were noninter-est-bearing. And $119.5 billion, or 68%, of its deposits were uninsured, meaning they exceeded Federal Deposit Insurance Corp. limits.”

“Signature becomes the third-largest bank to ever fail in the U.S., behind Silicon Valley Bank and Washington Mutual in 2008, if its assets haven't changed significantly since the end of 2022. Signature had $110 billion in assets as of Dec. 31, ranking 29th among U.S. banks. It had $88 billion in deposits as of that date, and approximately 89.7% were not insured by the Federal Deposit Insurance Corporation.

(…)

Signature served clients in the cryptocurrency world and had been trying to reduce its exposure. Like Silvergate Bank, another crypto-friendly bank that said last week it would voluntarily wind itself down, it suffered from a deposit outflow in the aftermath of the collapse of crypto exchange FTX. Deposits dropped 17% in the fourth quarter of 2022 as compared to the year-earlier period.

(…)

Now that Signature has been seized, Circle, issuer of the second largest stablecoin, "will not be able to process minting and redemption [for the stablecoin] through SigNet," and "will be relying on settlements through BNY Mellon,” CEO Jeremy Allaire said on Twitter Sunday evening.

Circle’s USD coin fell below its crucial $1 peg Friday after the company disclosed $3.3 billion in cash reserves held with the failed Silicon Valley Bank despite attempted withdrawals Thursday. After falling to 88 cents on Saturday, the company announced it planned to cover any shortfall from its SVB losses using “corporate resources.””

“Credit Suisse shares on Monday reached a new record low, falling as much as 15% as investors continued to hammer away at the stock of the Swiss banking giant after the collapse of banks in the U.S.

(…)

Credit Suisse CSGN CS has lost money for five straight quarters and says it’s expecting to post a loss before tax this year. It’s undergoing a big transformation after losing billions lending to the Archegos family office and having to freeze $10 billion worth of funds tied to Greensil Capital. Wealthy clients pulled out about $100 billion from Credit Suisse in the fourth quarter.”

#silvergate#silicon valley bank#svb#first republic bank#frb#signature bank#circle#bank#banks#crypto#currency#bank runs#credit suisse

5 notes

·

View notes

Text

In an exciting development for DeFi enthusiasts, a new Bitcoin-backed synthetic dollar is hitting the Market, promising users the opportunity to earn high yields on their investments. This innovative financial product aims to leverage the stability of Bitcoin while offering lucrative returns in the fast-paced world of decentralized finance. As it blends traditional asset security with cutting-edge DeFi strategies, this blend could potentially redefine how investors interact with digital currencies and yield-generating platforms. Stay tuned as we delve into how this synthetic dollar could be a game-changer for both novice and experienced DeFi users alike.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

In a groundbreaking development, Hermetica Labs is all set to revolutionize the Bitcoin DeFi (Decentralized Finance) world with the introduction of USDh, a pioneering Bitcoin-backed synthetic dollar. Promising an enticing yield of up to 25%, USDh aims to be a magnet for Bitcoin enthusiasts, offering them a way to earn on their dollar holdings without stepping away from the trusted Bitcoin network or depending on traditional banking systems.

Jakob Schillinger, the brain behind Hermetica, believes that USDh is going to change the game for Bitcoin DeFi. By enabling users to earn interest directly within the Bitcoin ecosystem, it caters specifically to those who prefer not to venture into other platforms for their financial growth. Built on the Stacks blockchain, USDh embarks on the mission to bring smart contract functionalities to Bitcoin, bolstering the Bitcoin DeFi movement, also known as BTCFi, which aims to mimic the success seen in Ethereum's DeFi space, but with a Bitcoin twist.

Despite the appealing high yields, there's a looming skepticism concerning the sustainability of USDh's returns. The crypto community is still wary from past incidents, like the fall of TerraUSD, which promised a 20% yield before its collapse. Hermetica, however, reassures the community by explaining that their method of generating yield through Bitcoin futures funding rates is sustainable. They've done their homework, showing that backtesting from January 2021 to March 2024 indicates an average annual yield of 11.71%, peaking at 26.11% during the bull Market of 2022.

Moreover, the launch of USDh arrives at a time when Bitcoin DeFi is on an upward trajectory, fueled by innovations like Ordinals, which allow data to be inscribed onto individual Satoshis. This development is seen by Schillinger as a game-changer that could potentially elevate Bitcoin DeFi to surpass its Ethereum counterpart in size within the next five years. With Ordinals generating more trading volume than Ethereum and Solana NFTs combined in certain months, and the unexplored capital within Bitcoin possibly exceeding $1 trillion, the potential for growth in the Bitcoin DeFi space is incredibly vast.

In essence, USDh by Hermetica Labs is not just another addition to the crypto world. It's a significant step forward in expanding the Bitcoin DeFi ecosystem, offering lucrative yields to Bitcoin holders

and paving the way for a future where Bitcoin's financial utilities are as compelling as those found on other platforms.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What is a Bitcoin-Backed Synthetic Dollar?

A Bitcoin-Backed Synthetic Dollar is like digital money that's made to be worth the same as a US dollar but is supported by Bitcoin. It's a way for people to use dollars in the digital finance world, but with Bitcoin as the safety net.

2. How does it promise high yields for DeFi users?

By using this synthetic dollar, DeFi (Decentralized Finance) users can earn more money on their investments. The high yields come from borrowing, lending, and trading activities within DeFi platforms, where the synthetic dollar acts as a stable and reliable form of currency.

3. Is using Bitcoin-Backed Synthetic Dollars safe?

While they offer higher returns, they also come with their risks. The safety depends on the stability of Bitcoin's value and the security of the DeFi platforms. However, many users find it a valuable way to earn more from their digital finances.

4. Can anyone use these synthetic dollars?

Yes, anyone who participates in DeFi and has Bitcoin can potentially use these synthetic dollars. You just need to have some understanding of how DeFi works and access to a DeFi platform that supports these synthetic dollars.

5. Why are they beneficial for DeFi users?

They're beneficial because they combine the stability of the dollar with the earning potential of DeFi. This means you can invest or trade without worrying too much about your money losing value because of volatile crypto prices, while still taking advantage of the lucrative opportunities in DeFi.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Text

What is total value locked (TVL) in crypto?

What is total value locked? It is the whole esteem of digital assets locked or staked in smart contracts in DeFi platforms or dApps. To explain things simply, let’s draw a parallel with the traditional financial system. People keep fiat money in bank deposits, using many different currencies. If we calculate the total amount of assets deposited in banks, it can serve as an analog to TVL in crypto.

Blog

This number can fluctuate for two main reasons. The first one is when people lock and stake more coins – or unlock and unstake them. The second one is asset price fluctuations. TVL is usually calculated with USD and not crypto because this value comprises the cost of many different cryptocurrencies. Let’s imagine that the amount of the staked coins doesn’t change – but the prices of some of them increase. Then, the TVL calculated in USD will increase accordingly.

Why Is TVL Important for DeFi?

Now that we’ve answered the question “What is the total value locked in DeFi?”, let’s analyze the importance of this metric.

The DeFi market functions thanks to the liquidity pool and the capital provided as collateral. TVL immediately impacts the operations of DeFi platforms and services. When this indicator is low, DeFi users can’t expect high returns and their trust in services will be undermined. A high TVL displays promising market perspectives and the potential for a decent income.

To increase their TVL, platform owners and managers can resort to various tricks. For instance, they can offer higher interest rates for their staking protocols to attract more users and funds.

Which Assets and Platforms Boast the Highest TVL?

The answer to this question can fluctuate over time. MakerDAO, Bend, Aave, Lido, and Curve, are among the assets that regularly demonstrate excellent results. The undisputed leader among the platforms is Ethereum, thanks to its huge user base and an extensive ecosystem of dApps developed on the basis of its blockchain. Solana tends to be the runner-up among the blockchain networks.

How to Get to Know the TVL?

You can rely on two sources of information about TVL:

Official information provided by the DeFi platforms. We’re talking about the platforms that let their users lock and stake tokens. The key drawback is that their teams might manipulate data to attract a wider audience and convince the market of their efficiency.

Analytics made by third-party platforms. In this case, we mean websites that don’t provide financial services. They leverage APIs and computing algorithms to evaluate the TVL of assets and service providers.

Sometimes, different sources of information can deliver different results when assessing the TVL of the same platform or asset. This can happen for two main reasons. The first one is the difference in the methods and algorithms used. The second one is the volatile nature of the market.

How Reliable Is TVL?

TVL is a handy metric for assessing the overall appeal of a DeFi project. However, you shouldn’t rely on it exclusively. Consider other important metrics too.

TVL locked can’t tell you anything about user activity on the platform. If the activity is low, it’s a bad sign.

The platform’s governance model and tokenomics are crucial as well. Invest time in exploring them and reading the documentation.

The team behind the platform largely determines its success. Find out about their previous experience in the crypto sector.

Hopefully, now you understand the TVL meaning crypto and its significance for the industry!

0 notes

Text

Notcoin price prediction

The minimum amount of Notcoin required to be changed into an NFT voucher is over 10 million coins. However, the next-sized coin is at 100 million coins. However, the vouchers are only suitable and active for people who have amassed up to 8 figures worth of coins in the telegram game.

It is important to note that vouchers can be used for exchange when the token is launched. When it is launched it will be treated as a convertible. This means that the Notcoin would only be exchanged between similar coins.

It would not be traded immediately on the platform. However, if traders are not interested in premarket trading they are not expected to participate in the platform. They are recommended to exchange their balance in the telegram game for not when the token is live.

How does Notcoin work?

Talking about Notcoin is a game found in telegram. Users can easily tap an image of a game in the game to get coins in the game. The owners of the game app hinted in a statement that they would make a coin to the game player base.

The player base of Notcoin consists of not more than 30 million people. It is targeted around late March or early April.

It is still uncertain what value the in-game token would be traded. However, user accumulates the NOT coin to stand a chance of getting value for their money. According to several reports, users would be allowed to speculate on the future value of the coin once it is launched.

On March 7, 2024, the NFT marketplace on the Open Market was $100,000,000 NOT which was valued at $2760 worth of Toncoin. The NFT vouchers possess a royalty charge. The royalty fee hoes for 20%. The profit will go into the funding of NOT liquidity.

Notcoin colleagues partook in a Twitter Space on Thursday where they illustrated the voucher framework, as well as covered the impending symbolic token burn. In the space, the group explained that each time somebody purchases a boost with their in-game coins, they are burning those tokens.

Furthermore, as reported last week, Notcoin is additionally step-by-step consuming in-game symbolic balances of players that have been dormant for 30 days or more. The engineers said Thursday that more than 5 billion in-game coins have proactively been burned over two days and that nonactive clients' balances will be burned at a rate of 5% each day until they play later.

During the Space, the group additionally referenced that the most active gamer allocation for the NOT token is 0.03% of the complete token supply. They said that users who had invited numerous players to join Notcoin were the ones probably going to get the highest token.

Upon send-off, Notcoin will be controlled by a DAO also called a decentralized autonomous association — which as of now has 158,000 individuals. While the group hasn't unveiled what the very DAO will be liable for, or what sort of proposal will be voted for, the designers referenced a "meta game" inside the Notcoin game where they delivered a sound clasp including morse code.

As indicated by the group, over 158,000 gamers understood the sound clasp was Morse code and tapped the code into their Notcoin application. Clients who did so were sent a baffling wire message by the Notcoin bot asking them, "Red or Blue Pill?" Clients who picked the red pill were diverted to NOT DAO where they could peruse the DAO declaration.

Notcoin Price Today

Notcoin value is $0, down 0.00% as of now, and the live market cap is nil. It has a circulating supply volume of 0 NOT coins and a maximum.

FAQ

Is Notcoin listed on Binance?

NOTCOIN has not been listed on Binance and nobody knows if NOTCOIN would ever be listed on Binance. They may be able to do this one day, but only with the Notcoin they have mined.

How do I cash out my Notcoin?

You can withdraw your Notcoin using the following steps.

Step 1: Use an exchange to sell crypto.

Step 2: Use your broker to sell Notcoin

Step 3: Use a P2P trade.

Step 4: Cash out at a Crypto ATM.

Step 5: Trade one crypto for another and then cash out

Is Notcoin real?

Despite its popularity on Telegram, Notcoin hasn't been listed. It has not had a value yet.

What is the value of Notcoin today?

Notcoin value is $0, down 0.00% as of now, and the live market cap is nil. It has a circulating supply volume of 0 NOT coins and a maximum. It has not been launched yet. However, it is been speculated that it is going to be launched anytime between late March and early April.

Who is the owner of the telegram?

The owners of the telegram are brothers. Pavel Durov and Nikolai Durov are brothers who founded Telegram back in 2013. They found a telegram when they were still in Russia. The current CEO is Vkontakte .

How does Notcoin work?

Talking about Notcoin is a game found in telegram. Users can easily tap an image game to get coins in the game. The owners of the game app hinted in a statement that they would make a coin to the game player base.

The player base of Notcoin consists of not more than 30 million people. It is targeted around late March or early April.

Conclusion

Notcoin price prediction has been speculated for months now. Nobody can tell the value of this coin. This is baffling as you are mining a coin you don't know the actual value. With

Notcoin, users can easily get to make millions when it finally launches. However, as of now the price of a Notcoin is not yet established. When it does launch, we will be the first to update you with the latest information regarding that.

Read the full article

0 notes

Text

Open A Gold Or Silver IRA Account

Before investing in any form of gold investment, it will be significant to analyze your wants. Up to now, there are about forty eight complaints which have been filed on Advantage Gold in BCA, where complaints are mainly as a consequence of unresolved issues and poor communication. To entry DeFi apps, and to use your property, you may connect your Nano S Plus to MetaMask. On Thursday, the Ministry of Economy and Finance of Peru predicted that copper costs might drop from $3.90/lb on common this year to $3.40/lb in 2023. Peru is the second largest copper producer on the earth. Register to obtain a free Retirement Technique Information for brand spanking new concepts on how to speculate in your retirement. Are we now getting smart to the rhetoric? Investing in gold or different valuable metals is a clever choice for diversifying your portfolio and avoiding danger. A super portfolio should embody a wide number of belongings so that you can meet your requirements in various situations.

You may also purchase crypto to your IRA the identical manner you'd other stocks. 2 On-line Advice and My Complete RetirementTM are a part of the Empower Advisory Services suite of companies supplied by Empower Advisory Group, LLC, a registered funding adviser. She says that if companies concentrate on specific use cases which can be related for their enterprise and place available in the market they'll be capable to resolve whether investing in blockchain expertise is smart. The purpose of the venture is to create a everlasting record of all meals-system knowledge that can make it easier and faster to hint produce from farm, to retailer. Whereas it’s not tough to start out investing in treasured metals, you want to verify you've gotten all the main points, like gold-backed IRA information, to adhere to rules and avoid penalties. Another choice is to go through a good site like eBay.

That is an IRS rule that isn't solely mandatory when one takes benefit of a silver IRA, but additionally a smart idea - the investor doesn’t have to worry about storing precious metals in a protected at dwelling. For example, if a person buys $a hundred worth of gold, he/she gets one hundred grams of gold with a price of $100. He explains how the value of silver and the paper dollar have separated. It can be tough to calculate the Unrelated Business Revenue Tax. Trading crypto tokens can earn you a profit, but it surely continues to be considered earnings. Furthermore, using the current UK CPI enhance of 9% for April 2022 the worth of an item would double in 8 years. gold-ira-review.com is much like a Roth IRA, besides that it requires workers to make extra contributions. Nevertheless, some buyers are now in search of different investment choices as inflation continues its spiral. Still stuck along with your old 401(ok), 403(b) or other investment account? One issue that might cut back central financial institution gold shopping for is a steep enhance in the price of gold. Can The Asset Also be Held In Standalone IRAs?

You wish to make investments in an asset class that rises with inflation. Equally, a 403(b) contract owner must calculate the RMD individually for every 403(b) contract they own, but can take the entire amount from a number of of the 403(b) contracts. If that is one thing that pursuits you, you should definitely do your research and get started right this moment! The euro and Chinese language renminbi have also declined against the dollar because the Fed started hiking interest rates in March. New residence gross sales within the US fell hard too, analyst anticipated a small decline however the number came in at an 8.6% Mom, which pushed the YoY number all the way down to 12.6% YoY.

0 notes

Text

#funding rates#crypto funding rate#crypto#funding rate#funding rates crypto#funding rate explained#funding fee#funding rate binance#crypto trading#funding rate strategy#funding rates explained#what is funding rate#funding#funding rate crypto explained#crypto investing#binance futures funding#crypto funding rates explained#trading funding rate#how to check crypto funding rates#crypto market#trading crypto#funding rate binance futures in hindi#secretstime#newblogflo

0 notes

Text

Bitcoin and Crypto Prices Surge as Biden Declares "Crypto Emergency"

Bitcoin and other cryptocurrencies like Ethereum, XRP, and Solana have experienced a sudden surge in price after the Biden administration declared a "crypto emergency." The price of Bitcoin reached approximately $45,000 per bitcoin, leading to an upward trend in other cryptocurrencies. Federal Reserve chair Jerome Powell's remarks about the crypto market also influenced this movement. Analysts have identified a signal that has historically been successful for bitcoin and crypto traders since 2015.

"We are three days away from the start of the Chinese New Year, and historically, when bitcoin was bought three days before and sold ten days after the Chinese New Year, the average return has been 11% for a two-week holding period," explained Markus Thielen, head of research at 10x Research. This pattern has been consistent, with deviations in 2019 and 2021 when bitcoin returns were 3% and 24% respectively. Thielen predicts that the bitcoin price will reach $52,000 by March and potentially surge to $70,000 by the end of the year. The rise in bitcoin's price is also attributed to various factors such as the expected Federal Reserve interest rate cut, the launch of US spot bitcoin exchange-traded funds (ETFs), an investment exodus from China, and the upcoming halving supply cut in April.

The cryptocurrency market is showing signs of growth once again. CoinLedger CEO David Kemmerer stated, "It's clear that the cryptocurrency market is growing once again... This latest rebound highlights the resilience of the industry." According to research, the average crypto investor made nearly $900 in 2023, compared to an average loss of $7,000 in 2022. The rebound follows the collapse of FTX, which resulted in a free fall of asset prices within the crypto ecosystem.

Read the original article on Forbes.

Hashtags: #bitcoin , #cryptocurrency , #ethereum , #bitcoinprice

0 notes

Text

Top 5 APPS to Sell Bitcoin in Nigeria 2024

Are you new to the crypto world or an old-time trader looking for a place to easily sell your bitcoins in Nigeria? This article is for you. Here, I will carefully explain how you can easily sell your bitcoins in Nigeria at the best rate.

When choosing the best app for selling your bitcoin in Nigeria, consider comparing them based on fees, withdrawal methods, and associated costs. Here are some platforms you can checkout right away, although we strongly recommend Koyn for easy cashout and maximum security of your funds:

Here are the Top 5 APPS to Sell Bitcoin in Nigeria 2024

Koyn: Koyn is one of the best apps in Nigeria where you can easily exchange your bitcoins for cash without any delay. Currently, it is the go-to app for anything bitcoin to naira in Nigeria. What is extraordinary about Koyn is that there are no fees and no additional charges. It is the number one choice for anyone that loves simplicity.

Binance: Everyone knows binance right? Binance is a globally recognized crypto exchange that offers P2P for Nigerians. You can also sell your bitcoins here if you know how to navigate the P2P platform.

Breet: This is an automated crypto-to-fiat mobile app that uses the OTC system, enabling you to convert your BTC to cash.

NairaEx App: NairaEx is a nice Bitcoin exchange platform, supporting various payment methods, including bank transfers and cash deposits. Its mobile app facilitates smooth transactions, allowing you to buy and sell Bitcoins with ease.

Paxful App: Paxful is a peer-to-peer Bitcoin marketplace that supports an extensive list of payment methods. With a user base of 200 million, Paxful’s app is a reliable choice for anyone looking to sell Bitcoins securely.

How to sell Bitcoin on Koyn

Selling bitcoin on Koyn is as easy as ABC. Here’s how you can get started:

1. Create a Koyn Account:

Quickly Download the Koyn app and create an account.

2. Add Your Bank Account Details:

To ensure a smooth transaction process, Quickly add your bank account details to your Koyn account. This step is essential for transferring the funds after your crypto sales.

3. Auto-Generated Wallet Addresses

Depending on the crypto you plan to sell, Koyn will automatically generate unique wallet addresses within your account. These addresses are where the digital assets you want to sell will be sent. Each cryptocurrency you plan to sell will have its specific auto-generated wallet address

4. Initiate the Transaction:

Send the cryptocurrency you wish to sell from your external wallet or exchange to the generated wallet address within Koyn. Wait for the network confirmation, which typically takes 15-30 minutes for three confirmations.

5. Automatic Conversion and Transfer:

Once the transaction is confirmed, your crypto will be automatically converted to naira at the best available rate. The equivalent Naira amount will be instantly transferred to your wallet for withdrawal.

Why you should sell your crypto on Koyn

User-Friendly Interface: Koyn is designed with simplicity in mind. Whether you’re new to cryptocurrencies or an experienced trader, you’ll find the interface intuitive and easy to navigate. This ensures a hassle-free experience for selling Bitcoin.

Top-Notch Security: Security is a paramount concern in the world of cryptocurrencies. We take security seriously and have robust measures in place to protect your money.

Prompt Transactions: Time is of the essence when it comes to cryptocurrency trading. We ensure that your Bitcoin transactions are processed swiftly, allowing you to access your funds when you need them.

Excellent Customer Support: Koyn’s dedicated customer support team is always ready to assist you with any queries or issues you may have. Our commitment to customer service sets us apart in the crypto space.

Conclusion

Koyn is the go-to app for selling Bitcoin in Nigeria. Its user-friendly interface, top-notch security, good rates, and excellent customer support make it the best choice for both beginners and experienced traders.

So, if you’re looking to sell your Bitcoins in Nigeria, koyn is your answer. It is the best app for Bitcoin trading in Nigeria.

Read the full article

0 notes

Text

Which crypto will grow? Predictions for 2024

There are now insights into the crypto market as it is a market that changes every day and not just annually. So, when looking at the performance of each crypto for 2024 there could be a different performance rate. In July 2023, there were over 420 million cryptocurrency users globally, and the total market valuation of all cryptocurrencies was $1.22 trillion (Team Stash, 2023). It is important to understand that the market trends impact the startup funding (www.equitymatch.co) gained by the crypto companies. Moreover, crypto enthusiasts are keeping an eye on the crypto fluctuations, so due to this reason, it is crucial to be aware of the crypto market for 2024. Many investors in platforms like EquityMatch are also keeping an eye on the blockchain market including crypto.

There are over 10,000 different cryptocurrencies available on the market, each with a particular purpose. Different global regulations have an impact on the adoption and market conditions of cryptocurrency, which is an important factor to consider while predicting crypto for 2024. The financial landscape is changing globally as a result of the constant evolution of cryptocurrencies, which has seen advancements in DeFi, NFTs, and scaling solutions. Understanding these facts explains the complicated and developing characteristics of this innovative financial landscape, which is critical for educated decisions in startup investments in the context of an increase in interest surrounding blockchain and crypto. Startups like Koryntia are using crypto and blockchain technology in their business model and are eyeing the crypto market for fluctuations.

The five main crypto that will grow next year

Bitcoin (BTC)

BTC, like the rest of the cryptocurrency market, is recognised for its capacity to overcome obstacles and make tremendous comebacks regardless of everyone writing it off. During the past eight years, several financial specialists have consistently predicted that the BTC bubble would pop "in the near future" each month. Regardless of this, the coin maintains its highest-level position, providing significant returns for BTC investors who are eagerly expecting another spectacular climb, an advantage for startup funding and investment opportunities. As of the 10th of November 2023, the value of a BTC was $36,535.77, with the market rank of first and a daily trading volume of $38,061,162,174. Some trading specialists believe that BTC prices will regain their lifetime top of around $69,000 by mid-2024 as they enter an "acceleration phase" defined by volatility and a strong rally (Malwa, 2023).

Ethereum

Ethereum and BTC are among the cryptocurrencies that have widespread recognition even beyond the cryptocurrency community. With its extensive feature set and interesting architecture, Ethereum is a well-deserved standout among blockchains. Ethereum is a fantastic investment opportunity for 2024 in addition to being an innovative technology. This cryptocurrency has the ability to expand significantly while carrying fewer crash risks than smaller altcoins that are more volatile. This means that investors could benefit significantly and have attractive chances for startup investment. As of November 10th, 2023, the value of one Ethereum was $2,114.83, with a market rank of second and a daily trading volume of $24,127,563,079. It is expected that by 2024, Ethereum will have risen to a peak value of $3,582 per coin, demonstrating its increasing demand.

Solana

Solana is not a new crypto for 2024, but it has just recently obtained traction and widespread recognition. Numerous investors have taken notice of its rapid elevation, which has assisted them in realising the project's outstanding functionality and high usability. Within the past month, the price of a Solana coin has climbed by 148.19%, adding a massive average of $87.50 to its current value of $56.53 as of November 10th, 2023, with the market rank being 7th and a daily trading volume of $2,820,906,034. The sudden increase in value suggests that if the coin's trajectory of development continues, it could position itself as a strong asset and draw a lot of interest for startup funding. It is anticipated that Solana will likely see a significant uptick by the year 2024, potentially peaking at $83.41 per coin, reflecting the growing interest in this cryptocurrency (Simrah, 2023).

Chainlink

Chainlink can be viewed as a cross between a decentralised network and a cryptocurrency. It is a fully decentralised oracle network with an established primary goal of connecting smart contracts with real-world data. With promising opportunities for startup investment, Chainlink has the potential to become a global phenomenon in 2024 that will have a significant impact on all industries in addition to the Bitcoin space. The value of Chainlink on November 10th, 2023 was $15.35, with a daily trading volume of $1,598,656,473 and a market rank being 12th. Based on the previous year's Chainlink values, it is expected that the coin will reach $22.59 by the beginning of 2024 (Daily, 2023).

Polygon (MATIC)

MATIC has attracted the attention of many crypto enthusiasts interested in Web 3.0. As more Web 3 applications become available over the coming years, it is anticipated that the currency MATIC will see significant demand in 2024. Recently, MATIC and Nike signed an agreement for all of Nike's Web 3 development to run on that platform. MATIC may lead the way when major organisations decide to use the new web. The value of a MATIC coin was $0.8486 on November 10th, 2023, with a market rank of 13th and a daily trading volume of $795,080,899. Given its increasing demand, it is projected that by 2024, MATIC will experience a significant increase, possibly reaching a peak value of $1.7560 per coin.

Conclusion

Crypto is a market that provides a lot of gains and losses; therefore, individuals should wisely make the decision. To make wise decisions, individuals should always observe the market trends in crypto, so, moving out with market trends of crypto for 2024 would be an ideal choice for investing in the future. Many startups in platforms like EquityMatch (www.equitymatch.co) that utilise blockchain technology are keeping an eye on the crypto market to succeed in their business goals and to gain startup funding.

0 notes

Text

DOGE; an Ideal Currency for Your Financial Future

In the exciting world of cryptocurrencies, DOGE stands out as one of the most attractive and fastest-growing digital currencies. At BT-Miners, we are pleased to introduce you to this unique cryptocurrency and explain how you can harness its benefits.

Dogecoin, often abbreviated as DOGE, was launched in 2013 as a friendly and fun cryptocurrency inspired by the popular Shiba Inu meme from which it takes its name. What began as a joke quickly turned into a serious and valuable digital currency with an active community behind it.

How Two Incredible Types of Cryptocurrencies Work

In today's digital age, cryptocurrencies have surged into the financial landscape, offering a completely new vision of how we conceive and use money. Among these digital currencies, two names stand out as favorites of the crypto community: Dogecoin and Litecoin.

At BT-Miners, we believe in providing you with essential knowledge so you can make informed decisions about your involvement in the exciting world of cryptocurrencies. Therefore, it's important to understand how these two types of cryptocurrencies, some of the most promising and resilient in the market, work.

How Do Litecoins Work?

Like Bitcoin, Litecoin uses blockchain technology to record and verify transactions. The blockchain is a decentralized public ledger that contains the history of all Litecoin transactions; each block in the chain contains a series of transactions connected to previous blocks to ensure the security and integrity of the network.

In the Litecoin network, a new block is created approximately every 2.5 minutes, allowing transactions of this cryptocurrency to be confirmed more quickly, making it the preferred choice for those looking to reduce processing time.

Litecoin offers a high level of security and privacy in transactions. Litecoin addresses are pseudonymous, meaning they are not directly associated with a user's identity. However, it's important to note that cryptocurrency transactions are public and can be traced on the blockchain.

How Do Dogecoins Work?

DOGE also relies on blockchain technology, which means that each block in the chain contains a series of transactions and links to previous blocks, ensuring the security and integrity of the network.

These types of cryptocurrencies use proof-of-work (PoW) consensus algorithms to verify and confirm transactions. Miners solve complex mathematical problems to add new blocks to the Dogecoin blockchain and, in return, receive rewards in the form of DOGE. This mining process is essential for the security and functioning of the network.

DOGE has become popular thanks to its online community and its use for donations and tips on platforms like Reddit and Twitter. It is also used to raise funds for charities and community projects. Its symbol, the Japanese Shiba Inu dog breed, is widely recognized and associated with the currency.

Features of the Equipment Available at BT-Miners

At BT-Miners, we are cryptocurrency mining experts and take pride in offering a range of powerful mining equipment. Mining is the key process for generating new digital currency and validating transactions on the DOGE blockchain network.

Our equipment is designed to help you optimize your mining capacity and maximize the potential of your Dogecoin. As cryptocurrencies continue to grow in value and popularity, DOGE mining has become an attractive option for cryptocurrency enthusiasts.

Is It Worth Mining with DOGE?

The profitability of Dogecoin mining is determined by several factors, including hardware computing power, electricity costs, and network difficulty. Due to the lack of supply limit and inflation, DOGE has not experienced as much value appreciation as Bitcoin. Therefore, profits may be lower compared to other virtual currencies.

The DOGE mining difficulty adjusts automatically to maintain a constant block generation rate. This means that difficulty increases, and profits may decrease as more miners compete for rewards.

Benefits of Mining with DOGE

DOGE has become a respected cryptocurrency, backed by an active and loyal community. But what are the inherent benefits of mining with DOGE?

As mentioned earlier, one of the main strengths of DOGE is its community. Enthusiasts of this cryptocurrency are known for their generous support and proactive actions. From online tips to charitable donations, the Dogecoin community is known for its friendly spirit and willingness to make a difference.

Relatively stable online acceptance suggests potential for further growth. Mining DOGE today could provide you with the opportunity to accumulate cryptocurrencies that could become even more valuable in the future.

It's also worth noting that compared to Bitcoin, DOGE is easier to mine due to its consensus algorithm. This means that expensive specialized mining equipment is not required; graphics cards (GPUs) and some older ASIC devices are suitable for mining Dogecoins, making it more accessible for amateur miners. However, better results can be achieved with the equipment we offer at BT-Miners.

Tips for Efficient DOGE Mining

Appropriate Hardware: Ensure that the hardware you choose is suitable for DOGE mining. While you don't need specialized equipment like in the case of Bitcoin, a powerful graphics card (GPU) is essential. High-end GPUs often perform better.

Join Our Mining Pool: Instead of solo mining, consider joining the DOGE mining pool we have at BT-Miners. This pool combines the computing power of multiple miners to increase the chances of solving blocks and receiving more regular rewards.

DOGE Wallet: Set up a wallet to store your DOGE. This is essential for receiving your mining rewards. You can choose from software wallets, hardware wallets, or online wallets based on your security preferences.

Consider Profitability: The profitability of DOGE mining can vary. It's advisable to track your costs and earnings to ensure that mining remains a viable investment.

Invest Effectively with the Help of BT-Miners

At BT-Miners, we are committed to providing you with the tools and knowledge you need to make the most of this journey.

If you want to get involved in DOGE mining and start your journey, we invite you to explore our powerful selection of mining equipment. Our products are designed for efficiency and long-term success.

Additionally, we also provide mining hosting services, so you don't have to worry about setup or maintenance. We'll take care of everything for you, so you can focus on making profits.

0 notes

Text

Ether (ETH), the cryptocurrency that powers the layer-1 smart-contract-enabled Ethereum blockchain, is rising in tandem with the broader crypto market on Monday and was last up around 3% over the past 24 hours, as per CoinGecko.

The cryptocurrency’s latest rally has seen it reclaim a market cap of $200 billion, with the ETH price last around $1,680, more than 10% up from earlier monthly lows.

Ether is the second most valuable cryptocurrency in the world next to Bitcoin (BTC), which has a market cap of nearly three times as much at just over $600 billion.

Ethereum remains by far the most widely used and trusted smart-contract-enabled blockchain in the crypto space.

Its dominance is emphasized by its 68% share of the total value of all cryptocurrency locked into smart contracts, or trade value locked (TVL), as per DeFi Llama.

Ether Has Been Lagging Bitcoin

While Ether has been rallying as of late in tandem with the broader market amid optimism about upcoming spot Bitcoin Exchange Traded Fund (ETF) approvals in the US, ETH remains a big relative underperformer when compared to Bitcoin, both this year and in recent weeks.

Where Bitcoin is up around 16% in the last 30 days and nearly 80% this year, Ether is up a more modest 6% in the past 30 days, and a much more conservative 34% this year.

This divergence in performance could partially be explained by Bitcoin-specific fundamentals, like optimism about upcoming spot Bitcoin ETFs, the fact that Bitcoin appears to be the safest cryptocurrency from regulatory risk (no major regulators are trying to claim it’s a security), and general safe-haven demand for Bitcoin.

Ether’s “Weak” Fundamentals

But some of Ether’s relative weakness can likely be explained by “weak” fundamentals relating to the cryptocurrency.

For instance, demand for the recently launched Ether futures ETFs in the US was very weak, suggesting limited institutional interest.

That shouldn’t come as much of a surprise given that spot Ether trading volumes on major cryptocurrency exchanges remain at around their weakest since late 2020 as per The Block, back when the Ether price was in the hundreds of dollars.

Meanwhile, as per data presented by Glassnode, in a sign of weak on-chain activity, gas fees have been falling as of late, meaning a lower ETH burn rate.

In recent weeks, the ETH burn rate has fallen below the cryptocurrency’s issuance rate, meaning that the Ether supply has at times become inflationary once again.

Since the end of August, the ETH supply has subsequently risen by just over 100,000 to just above 120 million, reducing the token’s scarcity and weighing on its value.

On-chain weakness, and the overall seemingly subdued demand for Ether, is further evident in the stagnation of the blockchain’s TVL.

As per DeFi Llama, Ethereum’s TVL has been in a downtrend since peaking in April at around $70 billion, and, at around $48 billion, remains well below its early 2022 all-time peak above $200 billion.

Rising interest rates on risk-free US government bonds probably explain this stagnation – why buy highly volatile staked Ether derivatives for a yield of less than 4% when you can get a yield of over 5% on risk-free US government bonds?

High US (and other) government bond yields will remain a key headwind to the health and growth of Ethereum’s DeFi ecosystem.

Price Prediction – What’s Next for Ether (ETH)?

All that being said, Ether price predictions could be about to take a substantial turn for the better if the cryptocurrency is able to break above key resistance at the $1,700 level.

ETH is currently facing headwinds in this area from a downtrend from the July highs and from the 100DMA.

But should Ether break above this level, a run higher towards the 200DMA just under $1,800 level is likely, with a break above this area opening the door to a run higher towards the summer highs just above $2,000.

Ether (ETH) Chart / Source: TradingView

With the

broader market rallying, led by Bitcoin, Ether will likely continue to pull higher in the weeks ahead.

Will it be able to outperform Bitcoin, however? Probably not.

Ether’s outperformance probably won’t become a major narrative again until its aforementioned weak fundamentals (on-chain activity, TVL) start seeing solid improvements.

Crypto Alternative to Consider - Bitcoin Minetrix ($BTCMTX)

The outlook for blue-chip crypto markets is good, but traders should always be on the lookout for diversification opportunities.

An exciting new decentralized Bitcoin mining protocol called Bitcoin Minetrix is generating a lot of hype, and has already raised over $2.1 million in funds from early investors into its $BTCMTX token presale.

$BTCMTX is the token that powers the protocol – investors who buy $BTCMTX can then stake their tokens to start earning non-transferable Bitcoin Minetrix mining credits.

These credits can then be burnt by their owners, and in exchange, they will get a share in Bitcoin Minetrix’s Bitcoin mining revenues.

$BTCMTX token holders will also earn $BTCMTX rewards, with a portion of the token supply already set aside to reward early stakers.

Bitcoin Minetrix’s protocol is governor by smart contracts built on top of the decentralized Ethereum blockchain, which is also where its token is issued.

The protocol thus offers better transparency and security versus other centralized cloud mining services.

1 note

·

View note

Text

Former BitMEX CEO Arthur Hayes has made a bullish prediction about Bitcoin's potential price. According to Hayes, Bitcoin could hit a value between $750,000 to $1 million by 2026, a figure that outpaces most current forecasts. The key reasons Hayes believes that the confluence of several key factors could propel Bitcoin to these unprecedented heights. First, he anticipates a financial crisis that could see rates dropping to zero, or a scenario where rates increase, but not as swiftly as governments' spending rates. In such a situation, Hayes suggests that Bitcoin could be valued at around $70,000 by the end of 2024, driven in part by the crypto halving event. He also foresees the launch of multiple exchange-traded funds by major asset managers in the U.S., Europe, and possibly Hong Kong. Hayes explains, "That's when the real bull market starts. He envisions not just Bitcoin but also other financial assets, including stock indices like NASDAQ and S&P, reaching record levels.China's stance on crypto Turning his attention to China, Hayes addressed the perceived crackdown on cryptocurrencies in the country. Contrary to the popular belief that China has completely banned cryptocurrencies, Hayes suggests that the reality is more nuanced. China has indeed made it challenging to trade crypto by ousting exchanges, but its citizens still own Bitcoin. The Chinese government's main concern, Hayes argues, is to maintain social stability. This concern was exacerbated by the potential for local disturbances due to mass speculation in volatile assets like crypto. Furthermore, the environmental impact of Bitcoin mining and its significant electricity consumption also played a role in China's stringent measures. Hayes has stressed the unique position of Hong Kong, which may serve as a pivotal player in the crypto space, given the geopolitical and technological considerations.

0 notes

Text

Bank of America Assesses Significance of Paypal’s USD Stablecoin and Fednow System

Bank of America on Paypal’s US Dollar Stablecoin

Bank of America published a Global Digital Asset Strategy report last week covering its view on Paypal’s U.S. dollar stablecoin and the Fednow payments system. The report was written by Alkesh Shah, head of global crypto and digital assets strategy at Bank of America Global Research, and Andrew Moss, the bank’s global digital asset strategist.

Paypal (Nasdaq: PYPL) is launching a U.S. dollar-denominated stablecoin, called Paypal USD (PYUSD), which will be available to U.S.-based Paypal customers. According to the payments giant, the stablecoin will be compatible with select third-party digital asset wallets and backed by traditional assets, including the U.S. dollar, short-term Treasuries, and cash equivalents.

Noting that Paypal, with 435 million users, is the first global company “to launch a stablecoin with regulatory approval,” Bank of America stated:

We expect PYPL’s PYUSD launch to drive payments efficiencies and an improved customer experience over time, but PYUSD adoption is unlikely to be significant in the near term, given lack of wallet compatibility, exchange trading pairs or new functionality.

“Over the longer term, we expect PYUSD to experience additional adoption headwinds as competition from CBDCs and yield-bearing stablecoins increases,” Bank of America continued. “Investors may have been fine holding non-yield-bearing stablecoins, such as USDT and USDC, when rates were close to zero, but yield-bearing stablecoins will likely become increasingly available and attractive with short-term rates above 5%.”

Regarding crypto regulations, Bank of America stressed:

We do not expect PYUSD’s launch to lead to accelerated regulatory clarity, given the stablecoin’s issuance does not alter systemic risk for traditional markets, but the stablecoin may face regulatory headwinds if non-banks are ultimately barred from stablecoin issuance.

Bank of America on Fednow

The Bank of America report also provides an analysis of the Fednow service, which went live on July 20 to “enable financial institutions, specifically banks and credit unions, to facilitate bank account-to-bank account transfers of customer funds in (near) real-time,” the bank described. Shah and Moss detailed:

We view Fednow as a needed and innovative solution to a problem – inefficient domestic payments and transfers – that other countries have already solved.

The analysts explained that Fednow’s infrastructure does not leverage blockchain technology, stating: “Instead, Fednow uses traditional payment rails to produce an interbank settlement system.”

They emphasized: “As the digital asset ecosystem evolves, we see the potential for stablecoins and, ultimately, CBDCs to provide an even better solution that would be faster and cheaper, especially for cross-border payments and transfers, which Fednow does not support … We note that the efficiencies Fednow enables are unlikely to be fully captured without financial institution adoption and resulting network effects, as well as development of end-user interfaces and applications.”

Do you agree with Bank of America on Paypal’s USD stablecoin and the Fednow system? Let us know in the comments section below.

Read the full article

0 notes