#crypto investing

Text

Cryptohubnews is your premier destination

Cryptohubnews is your premier destination for the latest and most insightful updates in the world of cryptocurrency. As a dynamic WordPress domain, we strive to provide a comprehensive and user-friendly platform where enthusiasts and investors alike can stay informed about market trends, technological advancements, and regulatory developments

http://www.cryptohubnews.liveblog365.com/?i=1

#crypto#crypto news#crypto market#crypto trading#crypto news today#crypto today#crypto banter#crypto update#solana crypto#trading crypto#crypto investing#latest crypto news#icp crypto#top crypto to buy now#best crypto#kaspa crypto#best crypto investment#banter crypto#crypto expert#best crypto investments#crypto updates#cardano crypto#crypto altcoins#more crypto news#crypto banter live#crypto prediction#crypto live trading

2 notes

·

View notes

Text

Coindcx is a popular cryptocurrency exchange that offers a referral program that allows users to earn a commission of up to 50% of their referral's trading feesCoindcx is a popular cryptocurrency exchange that offers a referral program that allows users to earn a commission of up to 50% of their referral's trading fees

Coindcx is a popular cryptocurrency exchange that offers a referral program that allows users to earn a commission of up to 50% of their referral's trading fees. The program is a great way to earn passive income by simply referring new users to the platform.

To participate in the referral program, users need to sign up for a Coindcx account and obtain their unique referral link. They can then share this link with friends, family, or followers on social media platforms. When someone clicks on the referral link and signs up for a Coindcx account, the user who referred them earns a commission on their trading fees.

The commission percentage earned by the referrer depends on the trading volume of the user they referred. Users can earn a commission of up to 50% of their referral's trading fees, which is among the highest in the industry.

The earned commission is credited to the referrer's Coindcx account and can be withdrawn or used for trading on the platform. Referral earnings can accumulate quickly, making it a great opportunity to earn passive income.

In conclusion, the Coindcx referral program is an excellent way to earn passive income by simply referring new users to the platform. With a commission of up to 50%, users can earn significant earnings by sharing their referral link with their network. However, it's important to remember that cryptocurrency trading comes with high volatility and risk, and users should only invest funds that they are willing to lose.

4 notes

·

View notes

Text

How To Get Rich With Bitcoin Even If

You Have No Clue About Technology

A cryptocurrency video course for beginners from an ex-Agora guru now publishing independently.

High quality content, great conversions and happy customers. Click here

#artists+on+tumblr#cryptocurrency#cryptocurreny trading#crypto#blockchain#digital currency#cryptotrading#crypto training#cryptocurrency training videos#learn cryptocurrency#de toekomst van cryptocurrency#crypto experts#crypto explainer#crypto ecosystem#crypto economy#digital economy#crypto course#crypto investing#crypto buy signals#crypto news#crypto exchange#crypto trading#crypto tips#crypto transactions#blockchain technology#blockchain stock#blockchain platform#blockchain solutions#blockchain explained#bitcoin

6 notes

·

View notes

Text

How to pass on your crypto when you die?

#artists+on+tumblr#cryptocurrency#cryptocurreny trading#crypto#blockchain#digital currency#cryptotrading#crypto training#cryptocurrency training videos#learn cryptocurrency#de toekomst van cryptocurrency#crypto experts#crypto explainer#crypto ecosystem#crypto economy#digital economy#crypto course#crypto investing#crypto buy signals#crypto news#crypto exchange#crypto trading#crypto tips#crypto transactions#blockchain technology#blockchain stock#blockchain platform#blockchain solutions#blockchain explained#bitcoin

4 notes

·

View notes

Text

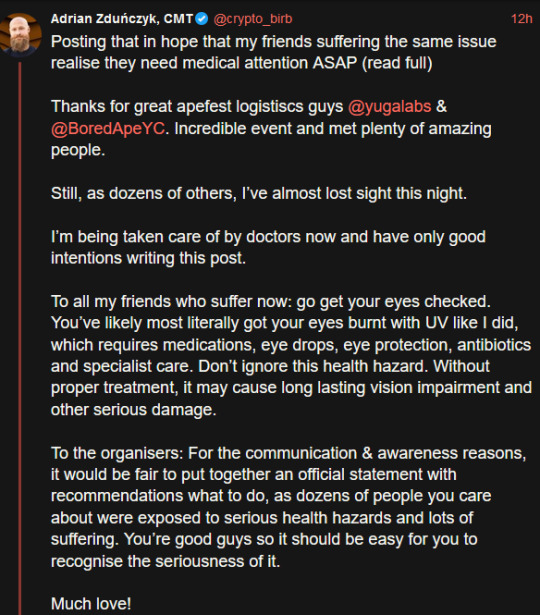

So... a bunch of NFT grifters threw a party in Hong Kong this weekend and reportedly a bunch of attendees are now at risk of permanent eyesight damage because the promoters used unsafe lighting, and people are going to the ER...

#jfc#I mean I know crypto is a fucking grift#but I kind of didn't think it would PHYSICALLY harm the idiots who invested in it#literally can't believe the last poster#like.... at what point DO you stop sucking these guys' dicks??!?#AFTER they blind you?!? WTF

30K notes

·

View notes

Text

10 Altcoins That Could Turn Your Crypto Portfolio from Blah to Brilliant Overnight!

Altcoins

Altcoins – When considering altcoin investments, it’s crucial to look beyond just the current trends and prices. Successful crypto investing often involves researching the project’s fundamentals, market potential, technological innovation, team, and community support.

Here are a few altcoins, outside of the very well-known ones like Ethereum and Bitcoin, that have been gaining…

View On WordPress

0 notes

Text

Join the 6th edition of Crypto Expo Dubai organized by HQmena for crypto traders, investors, and enthusiasts on Dubai 20-21 May 2024 at Dubai World Trade Centre.

0 notes

Text

US Cybersecurity Alert: Bitcoin Inscriptions Pose New Risks | ICODesk

In a recent cybersecurity alert, U.S. authorities have identified Bitcoin inscriptions as a potential risk to cybersecurity. The use of Bitcoin inscriptions, which involves embedding messages or data within Bitcoin transactions, has raised concerns among cybersecurity experts due to the potential for malicious activities and information dissemination.

Bitcoin inscriptions utilize the script language within Bitcoin transactions to embed additional information. While the primary purpose of Bitcoin transactions is to transfer value securely, the script language allows users to include data along with the transaction. This feature, although not widely used for legitimate purposes, has gained attention as a potential vector for cybersecurity threats.

Identified Cybersecurity Risks

Bitcoin inscriptions can be exploited to distribute malware. Malicious actors may embed executable code or links to malware within Bitcoin transactions, aiming to compromise the security of systems that process or interact with these transactions.

The use of Bitcoin inscriptions to embed messages can facilitate disinformation campaigns. Threat actors might use this method to spread false information or propaganda, leveraging the decentralized and immutable nature of the Bitcoin blockchain.

Large volumes of inscriptions can lead to blockchain bloat, impacting the efficiency and scalability of the Bitcoin network. Excessive data within transactions can strain the network, affecting transaction processing times and increasing fees.

Response and Mitigation Measures

In response to the identified risks associated with Bitcoin inscriptions, several mitigation measures are being considered:

Blockchain analytics tools are being employed to monitor Bitcoin transactions more effectively. Enhanced transaction monitoring aims to identify and flag transactions with suspicious inscriptions for further investigation.

Regulatory bodies are exploring ways to enhance oversight of cryptocurrency transactions. This includes collaborating with industry stakeholders to establish guidelines and best practices for preventing malicious use of Bitcoin inscriptions.

Educating users, businesses, and cryptocurrency service providers about the risks associated with Bitcoin inscriptions is crucial. Increased awareness can contribute to more informed decision-making and the adoption of security best practices

Blockchain Protocol Updates

Ongoing discussions within the cryptocurrency community involve potential updates to the Bitcoin protocol. These updates could address security concerns related to inscriptions and implement measures to mitigate associated risks.

While Bitcoin inscriptions have the potential to introduce new risks to cybersecurity, the cryptocurrency community and regulatory authorities are actively working to understand and address these challenges. As the landscape evolves, collaboration between stakeholders, ongoing research, and the implementation of effective cybersecurity measures will be essential to maintaining the integrity and security of the broader digital financial ecosystem.

For more updates

#bitcoin#bitcoin inscriptions#blockchain#cybersecurity#cybersecurity threats#cryptocurrency#crypto#crypto news#cryptocurrency prices#crypto price#ethereum#icodeskupdate#icodesknews#icodesk#crypto investing#crypto trading#cryptocurreny trading#cryptocurrencies#icodesknewsupdate

0 notes

Text

The Next Money Model: A Comprehensive Review of the Cryptocurrency VSL

Introduction: Cryptocurrencies have revolutionized the way we perceive and interact with money. As the digital currency market continues to evolve, new products and platforms emerge to cater to the growing demands of investors and enthusiasts. In this article, we will delve into "The Next Money Model" Cryptocurrency VSL, an affiliate product that aims to provide valuable insights and opportunities in the world of crypto.

Understanding "The Next Money Model" Cryptocurrency VSL: "The Next Money Model" Cryptocurrency VSL is an affiliate product that offers a comprehensive video sales letter (VSL) focused on cryptocurrency. It aims to educate users about the potential of cryptocurrencies, provide investment strategies, and guide them through the intricacies of the digital currency market.

Key Features and Benefits:

Educational Content: The VSL offers detailed information about cryptocurrencies, blockchain technology, and their impact on traditional financial systems. It covers topics such as Bitcoin, Ethereum, altcoins, decentralized finance (DeFi), and more.

Investment Strategies: "The Next Money Model" Cryptocurrency VSL provides insights into potential investment opportunities within the cryptocurrency market. It aims to empower users with knowledge to make informed decisions when it comes to investing in digital assets.

Expert Advice: The VSL features expert opinions and analysis from industry professionals who have experience and success in the crypto market. Their insights can help users navigate the complexities of cryptocurrency trading and investment.

Actionable Steps: The VSL guides users on how to get started with cryptocurrencies, including setting up wallets, choosing reliable exchanges, and implementing security measures to protect their investments.

Ongoing Updates: As the cryptocurrency market is constantly evolving, "The Next Money Model" Cryptocurrency VSL provides regular updates to ensure users stay up-to-date with the latest trends, news, and investment opportunities.

Target Audience: "The Next Money Model" Cryptocurrency VSL caters to both beginners and experienced individuals interested in cryptocurrency investments. It provides valuable guidance for those who want to understand the fundamentals of digital currencies and helps seasoned investors enhance their knowledge and strategies.

Is It Worth It? Determining the value of "The Next Money Model" Cryptocurrency VSL depends on individual needs and goals. If you are new to cryptocurrencies and wish to gain a comprehensive understanding of the market, this product can be a valuable resource. However, it's important to remember that investing in cryptocurrencies carries risks, and it's crucial to do thorough research and seek professional advice before making any investment decisions.

Conclusion: "The Next Money Model" Cryptocurrency VSL offers an educational and informative resource for individuals interested in exploring the world of cryptocurrencies. It aims to empower users with knowledge, investment strategies, and expert insights to navigate the digital currency market effectively. However, it is important to exercise caution, conduct independent research, and consult with professionals before making any financial decisions related to cryptocurrencies.

Buy this product through this Link:

https://www.digistore24.com/redir/397464/syauqibadri/

1 note

·

View note

Text

0 notes

Text

How To Multiply Your Net Worth

Over The Next 2 Years.

Introducing A Simple Strategy To Make Life-Changing Money

From The Fastest And Biggest Wealth Transfer In History.

Top ranked crypto investment newsletter

I started publishing my newsletter in 2018 and have turned many subscribers into millionaires. Click here

#artists+on+tumblr#cryptocurrency#cryptocurreny trading#crypto#blockchain#digital currency#cryptotrading#crypto training#cryptocurrency training videos#learn cryptocurrency#de toekomst van cryptocurrency#crypto experts#crypto explainer#crypto ecosystem#crypto economy#digital economy#crypto course#crypto investing#crypto buy signals#crypto news#crypto exchange#crypto trading#crypto tips#crypto transactions#blockchain technology#blockchain stock#blockchain platform#blockchain solutions#blockchain explained#bitcoin

5 notes

·

View notes

Text

Crypto investment analysis: Crypto market capital will reach $3 trillion by 2025, chart patterns stands positive

“Chart patterns of Crypto analysis give a significant outlook that Crypto market cap. will going to reach all time high at $3 trillion by 2025”

0 notes

Text

How to Spot Crypto Scams

Cryptocurrencies have gained significant popularity in recent years, attracting both seasoned investors and newcomers alike. While the crypto market holds immense potential for financial growth, it is also accompanied by its fair share of scams and fraudulent activities. In this article, we will explore the topic of spotting crypto scams and provide you with valuable insights on how to protect yourself from falling victim to fraudulent schemes.

Understanding the Risk Landscape of Crypto Scams

Cryptocurrencies offer decentralized and borderless financial opportunities, but they also attract scammers seeking to exploit unsuspecting individuals. It is crucial to familiarize yourself with the common tactics employed by crypto scammers and adopt preventive measures to safeguard your investments.

Research the Project and Development Team

Before investing in any cryptocurrency project, conduct thorough research on the project itself and the team behind it. Look for information about the team members, their qualifications, and their track record in the industry. A transparent and reputable team is more likely to deliver a legitimate project.

Analyze the Whitepaper and Roadmap

The whitepaper and roadmap provide insights into the project's goals, objectives, and the technology it aims to develop. Scrutinize these documents for clarity, feasibility, and innovation. Be cautious if the whitepaper lacks specific details or if the roadmap seems unrealistic or overly ambitious.

Evaluate the Token Economics

Understand the tokenomics of the cryptocurrency. Analyze factors such as the token's supply, distribution, and allocation. A well-designed token economy with a clear utility and purpose is indicative of a legitimate project.

Check for Community Engagement and Social Proof

A thriving community and active engagement on social media platforms can be positive indicators of a genuine project. Look for a strong and supportive community that actively participates in discussions and provides constructive feedback.

Assess the Project's Technology and Partnerships

Evaluate the underlying technology of the cryptocurrency project. Look for partnerships with reputable organizations or industry experts. A strong technological foundation and strategic collaborations can enhance the credibility of the project.

Scrutinize the Exchange Listings and Trading Volume

Examine the exchange listings and trading volume of the cryptocurrency. Legitimate projects are often listed on reputable exchanges with significant trading volume. Be cautious if the token is only available on obscure or unregulated exchanges.

Be Cautious of Promises of Guaranteed Returns

Beware of crypto investments that promise guaranteed high returns or unrealistic profit margins. Investments in cryptocurrencies are subject to market volatility, and there are no guarantees in the crypto space. Exercise caution and skepticism when encountering such claims.

Look for Red Flags in Social Media and Online Platforms

Scammers often utilize social media platforms and online forums to promote fraudulent schemes. Be wary of exaggerated claims, fake endorsements, and suspicious investment opportunities shared through these channels. Always verify information from multiple reliable sources.

Pay Attention to Unsolicited Investment Opportunities

Be cautious of unsolicited investment opportunities received via email, phone calls, or messaging platforms. Scammers may impersonate well-known individuals or organizations to gain your trust. Verify the authenticity of the investment opportunity independently before committing any funds.

Be Wary of Pump-and-Dump Schemes

Pump-and-dump schemes involve artificially inflating the price of a cryptocurrency through false information or hype, only to sell it at a profit, leaving unsuspecting investors with losses. Exercise caution when encountering sudden price surges or aggressive marketing tactics.

Utilize Trusted Sources for Information and Analysis

Rely on reputable sources for information and analysis of cryptocurrencies. Follow well-established news outlets, industry experts, and trustworthy influencers who provide reliable insights. Avoid relying solely on information from anonymous sources or unverified platforms.

Keep Your Private Keys and Wallet Secure

Protect your crypto assets by securing your private keys and wallet. Use reliable hardware wallets or secure software wallets with strong password protection. Enable two-factor authentication whenever possible and regularly update your wallet software.

Stay Updated on the Latest Security Practices

Stay informed about the latest security practices in the crypto industry. Keep track of common scams and evolving techniques used by scammers. Regularly educate yourself on best practices for securing your digital assets.

Conclusion

As the popularity of cryptocurrencies continues to rise, so does the risk of encountering scams. By being vigilant and adopting preventive measures, you can reduce the chances of falling victim to fraudulent schemes. Remember to conduct thorough research, stay informed, and exercise caution when investing in the crypto market.

1 note

·

View note

Text

#funding rates#crypto funding rate#crypto#funding rate#funding rates crypto#funding rate explained#funding fee#funding rate binance#crypto trading#funding rate strategy#funding rates explained#what is funding rate#funding#funding rate crypto explained#crypto investing#binance futures funding#crypto funding rates explained#trading funding rate#how to check crypto funding rates#crypto market#trading crypto#funding rate binance futures in hindi#business#newblogflo#secretstime

0 notes

Text

#crypto currency#crypto news#crypto trading#crypto analysis#crypto#crypto trading tips#crypto technical analysis#kings charts#trading signals#cryptocurrency trading#trading ideas#best cryptocurrency#crypto investing#crypto latest news#crypto trends#crypto world#crypto updates

0 notes

Text

Crypto Trading vs Investing: Which Path Fits You Best | ICODesk

The confusing but rewarding world of cryptocurrencies offers enthusiasts two distinct options: trading and investing. Both options involve strategies, timing, and risk levels. Understanding the nuances of crypto trading and investing is important to align your approach with your financial goals and risk tolerance.

Crypto Trading:

Time frame:

Short-term attention, minutes to a few weeks.

Exploiting fluctuations in currency prices to make quick profits.

Strategy:

Technical analysis and programs play an important role.

Taking advantage of market trends and short-term inflation.

Activity Section:

Strict monitoring and quick decisions are needed.

Day trading, swing trading, and some other short-term techniques.

Risk tolerance:

Increased risk due to market volatility.

A huge potential gain but also a huge loss.

Psychological factors:

Stress management and emotional discipline are essential.

A quick response to market changes is crucial.

Crypto Investments:

Time frame:

A long-term approach is often measured in terms of years.

Capitalizing on the potential growth of the cryptocurrency over time.

Strategy:

Primary research is key.

Assessment of technology, team, and long-term viability.

Activity Section:

Periodic rather than daily reviews are needed.

The ups and downs of the market are maintained over time.

Risk tolerance:

Low risk compared to trading.

Volatility is not an immediate concern.

Psychological factors:

Patience and a long-term perspective are needed.

Least affected by short-term market fluctuations.

Which Path Fits You Best?

Trading if:

They thrive in fast-paced environments. Enjoy exploring policies and market trends. It can handle an emotional roller coaster with rapid gains and losses.

Investment if:

You want a patient and long-lasting approach. Relief at the possibility of slow but steady growth and want to reduce the impact of short-term market fluctuations.

Conclusion:

The decision between crypto trading and investing ultimately depends on your personality, financial goals, and risk tolerance. Some find success in the adrenaline rush of trading, while others prefer a more stable approach to long-term investment.

For more updates

#cryptocurrency#crypto#blockchain#crypto price#bitcoin#crypto news#cryptocurrency prices#dogecoin price prediction#dogecoin#icodeskupdate#icodesknews#icodesk#ethereum#cryptocurrencies#cryptocurreny trading#investment strategies#crypto trading#crypto investing#cryptocurrency taxes#bitcoinnews#cryptonews#cryptotrading#bitcoinprice

0 notes