#cryptocurrency trading

Text

Hey everyine great news! My drop shiopping courses have been enough of a scusess tbat the

33 slurp juices remain. Your mission is to eliminate all of them before they can combine with an astro ape and mint a new astro ape

NFT game is back on! And there’s even better news!!!

Just ship a dead rat to 38.89679° N, 77.03601° W for a big surprise!!! Send me a pic of the surprise and you’ll even get a jared leto joker nft valued at 10 million billion dogecoin on us!!!

But hurry! This once in a lifetime opportunity is going away flr goot in just [function.timne+1]!!! Be sure to get in on the ground floor because forget the moon, we’re going all the way to freaking mars!!!

Did YOU seee the hiddem nessage??? Be sure to read the post thoroughly for any clues you might have missed!!!

#to the moon#nft#bitcoin#blockchain#crypto#cryptocurrency#web 3.0#binance#cryptocurreny trading#investment advice#retirement planning#stocks#stock market#cryptocurrency trading#cryptocurrency investment#might blaze this later idk

108 notes

·

View notes

Text

EVERY CRYPTOBRO IS A SON OF A BITCH GET FUCKED

#bitcoin#bitcoin prices#cryptocurrency prices#cryptocurrencies#cryptocurrency trading#btc#btc latest news#nftnews#nftcollectibles#nfts#nft crypto#bitcoin investment#cryptocurreny trading

61 notes

·

View notes

Text

Understanding How Cryptocurrency Trading Signals Work

Cryptocurrency trading is like a wild rollercoaster ride. Prices can shoot up or plummet in no time, leaving traders feeling lost and unsure about what to do. That's where trading signals come in. These signals are like helpful tips based on studying the market closely. They give traders advice on when to buy or sell cryptocurrency trading on cryptocurrency signals so they can make smart decisions and hopefully make some money.

Exploring the Different Types of Trading Signals

signals come in different flavors, customized to how different people like to trade. Here are the main types:

1] Technical Analysis Signals: These signals use fancy math and past price data to guess where prices might go next. They look at things like patterns on charts and indicators like moving averages or RSI to find trading chances.

2] Fundamental Analysis Signals: These signals look at the real value of a cryptocurrency, considering factors such as the technology behind it, its adoption rate, the expertise of its development team, and the current demand for it. They care more about what's under the hood than just the current prices of cryptocurrency.

3] Sentiment Analysis Signals: These signals check what people are saying on social media, news, and forums about cryptocurrency trading signals. By understanding how people feel, traders can get an idea of where prices might go, even if they're not looking at the current prices of cryptocurrency.

4] Hybrid Signals: Some signals mix it up, using both technical and fundamental analysis. This gives traders a wider view of what's happening in the market, hopefully helping them make better decisions.

The Benefits of Trading Signals

Using trading signals can help traders in many ways:

1] Making More Money: Following these signals, which are based on careful research, can increase the chances of making profitable trades and getting more money from investments.

2] Reducing Risks: Signals give insights into possible risks and where the market might be heading. This helps traders manage their risks better and avoid losing too much money.

3] Saving Time: Traders don't have to spend as much time analyzing the market because signals have already done that work for them. They can focus on actually making trades and managing their investments.

4] Learning: New traders can learn a lot from signals. They get to see how experts analyze the market and can pick up useful tips for their trading. Over time, they become better traders themselves.

Choosing the Right Trading Signal Provider

When picking a signal provider, it's important to think about a few things to make sure you're getting the right one:

1] Reputation and Trustworthiness: Look for providers that have a good reputation for being reliable and honest in trading on cryptocurrency. Check their track record to see if they've consistently given out accurate signals.

2] Accuracy: Check how often their signals have been right in the past in trading on cryptocurrency trading signals. You want signals that are good at predicting where prices will go.

3] Transparency: Make sure the provider is clear about how they come up with their signals and how well they've done in the past. You should be able to easily see how accurate their signals have been.

4] Cost: Think about how much it costs to use their service and whether it fits your budget. Make sure the price is worth it for the quality of signals you're getting.

Maximizing the Effectiveness of Cryptocurrency Trading Signals

To get the most out of signals, here are some easy tips to follow:

1] Know What's Going On: Keep up with what's happening in the market. Understand trends and how prices are changing so you can make smart decisions.

2] Use Signals Smartly: Think of signals as helpful tools, not the only thing you rely on. Do your research too, and use signals to confirm your ideas.

3] Get Signals from Different Places: Don't rely on just one signal provider. Subscribe to a few different ones to get different perspectives and make your decisions more reliable.

4] Stay Flexible: Keep an eye on what's happening and be ready to change your strategies. Markets can shift quickly, so be ready to adjust your plans accordingly.

Understanding the Risks Associated with Signals

While using cryptocurrency trading signals has its advantages, it's important to know the risks too:

1] Depending Too Much on Signals: If you rely too heavily on signals without really understanding how the market works, you might end up making bad decisions and losing money.

2] Getting Bad Signals: Sometimes, signals can be wrong or misleading. If you don't check them carefully, you could end up losing money. It's crucial to do your homework and make sure the signals are trustworthy.

3] Risk of Market Manipulation: Sometimes, people might give out false signals to trick traders into making certain trades. This could lead to losses if you're not careful. So, it's important to be cautious and not blindly follow every signal you see.

Exploring the Future of Trading Signals

The future of signals is set to see big changes, thanks to technology and rules getting better. Here are some important things to watch out for:

1] Smarter Signals with AI: As technology gets better, signals will become more accurate and helpful. Artificial intelligence and machine learning will help generate signals that give traders better insights, helping them make smarter decisions.

2] Trading Bots Working with Signals: Signals will work hand-in-hand with automated trading bots. This means trades can happen automatically based on signal recommendations. It'll make trading faster and easier, with less manual work.

3] Rules Getting Clearer: As the trading on cryptocurrency signals market grows, there will be more rules for signal providers. This will make sure they're transparent and accountable for the signals they give out, giving traders more confidence in using them.

FAQs

1. Are trading signals always accurate?

Ans : While signals can provide valuable insights, they are not infallible. Traders should exercise diligence and verify signals before acting on them.

2. Can I rely solely on signals for trading decisions?

Ans : It's not advisable to rely solely on signals for trading decisions. Traders should supplement signals with their own analysis and market research.

3. How often should I review my trading strategy based on signals?

Ans : Traders should regularly review and adjust their trading strategies based on the latest market developments and signal performance.

4. Are there free signal providers available?

Ans : Yes, some providers offer free cryptocurrency trading signals, but they may not always be as reliable or accurate as paid services.

5. What precautions should I take when using signals?

Ans : Traders should verify the credibility of signal providers, diversify signal sources, and be cautious of blindly following signals without understanding the underlying market conditions.

#cryptocurrency trading signals#current prices of cryptocurrency#trading on cryptocurrency#trading signals#cryptocurrency trading

2 notes

·

View notes

Text

Top 6 safe mobile crypto wallets

Know more:- www.bitlaxmi.co.in

#cryptocurrencies#cryptoworld#cryptocurrency trading#digital money#crypto update#crypto#blockchain#cryptodaily#bitlaxmitoken#digitalmarketing

8 notes

·

View notes

Text

#crypto currency#crypto news#crypto trading#crypto analysis#crypto#crypto trading tips#crypto technical analysis#kings charts#trading signals#cryptocurrency trading

2 notes

·

View notes

Text

Earning Money Online: How to Get Started with Cryptocurrency Trading

Cryptocurrency trading has become a popular way to earn money online. With the rise of digital currencies like Bitcoin, Ethereum, and Litecoin, more people are exploring the potential of trading cryptocurrencies for profit. If you're interested in getting started with cryptocurrency trading, here's what you need to know. Read more

#cryptocurreny trading#cryptocurrency#blockchain#Cryptocurrency investment advice#cryptocurrency trading#Bitcoin#Ethereum#Litecoin#decentralized currencies#trading strategy#cryptocurrency exchange#market trends#investment#cryptocurrency news#market movements#online income#digital currencies#blockchain technology.

2 notes

·

View notes

Text

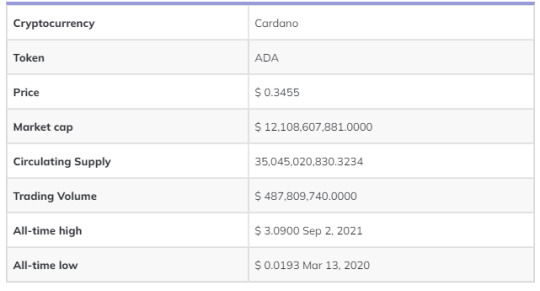

Cardano (ADA) Price Prediction 2022-2025: Will Cardano Price Rebound This Year?

The Cardano network is successfully crowned as one of the most scalable systems in the World Economic Forum. The network has been fast progressing to be the first peer-reviewed and impeccably scalable chain. The platform's native token ADA is in demand for its price.

Cardano is now establishing its reign in utility at an impeccable rate. Therefore, the quest to drive the price trajectories continues to grow louder. Dive in as we bring you the plausible Cardano Price Prediction for 2022 and beyond.

#cardano#crypto#Cryptocurrency trading#cryptocurrencies#coin#bitcoin latest news#cardano ada#cardano price prediction#cardano price analysis#Cardano price#crypto news#crypto news today#cryptocurrency news

2 notes

·

View notes

Link

Learn How Crypto Miners Make the World Greener?

2 notes

·

View notes

Text

Mastering the Triple Screen Trading Strategy: A Comprehensive Guide for Maximum Profits and Minimal Losses

Introduction

Introduction: In the world of trading, where uncertainty reigns supreme, having a robust strategy is crucial for success. One such strategy that has stood the test of time is the Triple Screen Trading System developed by Dr. Alexander Elder. This innovative approach combines the power of multiple screens to filter out the noise of the market and identify high-probability trading…

View On WordPress

#Confirmation Screen#cryptocurrency trading#Dr. Alexander Elder#Entry and exit points#Financial Markets#forex trading#learn technical analysis#Market Trends#Risk Management#Risk management in trading#stock trading#successful trading#technical analysis#Timing Screen#Trading Indicators#Trading Strategies#Trading Strategy#Trend Analysis#Trend Identification#Trend Screen#Triple Screen Trading System

0 notes

Text

Cryptocurrency Regulations Around the World

Various governments, including those in the United States, China, and other regions, struggle to regulate the rapidly expanding cryptocurrency market. This thorough guide can help us better understand how various countries address the complicated world of digital currencies by navigating their present regulatory frameworks and developments.

Understanding the regulatory environment is essential for anyone keen to study bitcoin trading and advance to the cryptocurrency expert or advisor position. Blockchain Council's cryptocurrency trading courses shine like a beacon, providing unmatched insights into digital assets and cryptocurrency trading as the need for knowledge in this industry rises.

United States

The United States, a prominent actor in the bitcoin market, has recently seen considerable regulatory changes. In 2022, a new framework that opened the door to more stringent regulation surfaced. Market authorities like the CFTC and the Securities and Exchange Commission (SEC) have acquired power in this changing environment.

Under Chairman Gary Gensler's direction, the SEC has moved aggressively toward regulation, as seen by the well-known legal action brought against Ripple. Gensler has highlighted the importance of safeguarding investors, characterizing the cryptocurrency markets as "a Wild West." The White House has also stated that it intends to deal with illicit cryptocurrency activity. It considers changing current laws and assessing the dangers of decentralized finance and non-fungible coins.

With the Biden administration acknowledging "significant benefits" in investigating a central bank digital currency (CBDC), the possibility of a digital dollar appears to be approaching. Chairman of the Federal Reserve Jerome Powell views a CBDC as a way to prevent the nation from using alternative currency.

China

For inheritance purposes, bitcoins are categorized as property in China. The People's Bank of China (PBOC) has banned Bitcoin mining and cryptocurrency exchanges due to worries about government funding and regulatory permission. Despite these constraints, China has been busily creating its digital yuan (e-CNY), and in 2022, it will formally launch the next stage of its CBDC pilot test program.

Canada

Canada proactively approaches cryptocurrency legislation. Even though they're not regarded as legal money, cryptocurrencies are liable to capital gains tax. The first Bitcoin exchange-traded fund (ETF) was authorized nationwide, and cryptocurrency trading platforms must register with regulatory bodies. As money service enterprises, all cryptocurrency investment firms must register with Canada's Financial Transactions and Reports Analysis Centre (FINTRAC).

United Kingdom

Trading cryptocurrencies are considered property in the UK, and exchanges must register with the Financial Conduct Authority (FCA). After the British Parliament's lower house recognized cryptocurrencies as regulated financial instruments and expanded the scope of existing legislation to include stablecoins, the regulatory environment became even more apparent.

Japan

Japan is progressive, recognizing cryptocurrency as legitimate property through the Payment Services Act (PSA). Cryptocurrency exchanges are required for anti-money laundering (AML), countering the financing of terrorism (CFT) regulations, and registering with the Financial Services Agency (FSA). The nation has been actively addressing regulatory issues, including taxation, and treats profits from cryptocurrency trading as supplemental income.

Australia

Australia taxes capital gains on cryptocurrencies because it considers them legal property. Exchanges must adhere to AML/CTF regulations and register with the Australian Transaction Reports and Analysis Centre (AUSTRAC). Prohibited trading of private coins and imposed restrictions on initial coin offerings (ICOs).

Singapore

Similar to the UK, Singapore considers cryptocurrencies to be property. Exchanges are licensed and governed by the Monetary Authority of Singapore (MAS) by the Payment Services Act (PSA). Because long-term capital gains are tax-free, Singapore is an excellent place for cryptocurrency-related business.

Korea

Exchanges of cryptocurrencies and suppliers of virtual asset services in South Korea must register with the Korea Financial Intelligence Unit (KFIU). The nation imposed a 20% tax on digital assets; it was initially scheduled to go into effect in 2022 but was postponed until 2025. A law known as the Digital Asset Basic Act is being worked on to control the learn crypto trading industry.

India

India's regulations regarding cryptocurrency still need to be clarified. Although a measure to prohibit private cryptocurrency is being circulated, it has yet to be approved. India levies a 1% tax deduction at source (TDS) on cryptocurrency trades and a 30% tax on cryptocurrency investments. In late 2022, the nation started a test program using tokenized rupees.

Brazil

Although Brazil has not declared Bitcoin legal cash, it did enact legislation acknowledging cryptocurrencies as legitimate means of payment. The regulatory framework, the "Legal Framework for Virtual Assets," assigns responsibility for overseeing cryptocurrency exchanges to the Brazilian Central Bank.

European Union

Most of the European Union allows cryptocurrency, while the individual member states govern exchanges. Taxation varies by country, ranging from 0% to 50%. New regulations like the Markets in Crypto-Assets Regulation (MiCA) seek to strengthen consumer safeguards and implement licensing specifications.

Current Worldwide Developments

Around the world, laws are still being developed as the bitcoin business develops. Many nations are working hard to create rules and regulations to deal with the particular difficulties that come with virtual currencies. Crypto exchanges are subject to restrictions in the United States, and legislation requiring crypto service providers to obtain an operating license will soon be introduced in the European Union. Regulating cryptocurrency is happening, but it's still complex and contentious.

In summary

Finally, crypto advisor classes are essential for individuals keen to learn about cryptocurrency trading, as cryptocurrencies require a detailed grasp of regulatory nuances. People who want to become cryptocurrency specialists or consultants must keep up with the latest developments as governments worldwide try to find a balance between regulation and innovation.

The cryptocurrency trading courses offered by Blockchain Council are a great approach to becoming an expert in this ever-evolving industry. They convey a comprehensive understanding of cryptocurrency trading and the leading cryptocurrencies. Blockchain Council's cryptocurrency trading courses offer the necessary resources to confidently and competently navigate the complex world of cryptocurrencies, regardless of your experience level.

1 note

·

View note

Text

MONEY WAS NEVER REAL CRYPTOCURRENCY DOUBLY SO

#bitcoin#bitcoin prices#cryptocurrencies#cryptocurrency trading#btc#btc latest news#nftnews#nftcollectibles#nfts#nft crypto#bitcoin investment#cryptocurreny trading#cryptocurrency prices

28 notes

·

View notes

Text

#crypto currency#crypto news#crypto trading#crypto analysis#crypto#crypto trading tips#trading signals#cryptocurrency trading#crypto technical analysis#kings charts

2 notes

·

View notes

Text

Top Cryptocurrency charting app

Ever wondered about those funky charts with green and red bars you see in the world of stocks and cryptocurrencies? They’re called “candlestick charts”, and they’re not as complicated as they look!

Imagine each bar, or “candlestick”, as a little story of a cryptocurrency’s journey in a specific time interval. Each candlestick tells us four things: the high, low, open, and close values of a cryptocurrency.

If our little candlestick ends its journey higher than where it started (the closing value is higher than the opening), it turns green. If it had a tough day and ended lower than it started (the closing value is lower than the opening), it turns red.

Just by glancing at the colors, you can get a sense of whether your shares or cryptocurrencies are having a good day (going up) or a bad day (coming down).

Now, if you’re a cryptocurrency investor, or just curious, you might want to track these values daily.

But how? Meet BitWallpaper, an open-source app that’s here to help. And no, despite the “wallpaper” in its name, it’s not about changing your desktop background!

BitWallpaper is available for Windows, and you can download it from its GitHub website or the Microsoft App Store. And don’t worry, the developer promises that this app doesn’t collect any information from its usage.

Once you open BitWallpaper, you’ll see cryptocurrency values displayed in Japanese Yen.

It supports a variety of cryptocurrencies, including the big names like Bitcoin, Litecoin, Ethereum, and 21 others.

In the BitWallpaper interface, you can pick your cryptocurrency of interest from the sidebar.

Voila! You’ll see the candlestick chart for that currency. You can even choose the chart intervals, from as short as 1 minute to as long as several months. If you’re into short-term investment, go for shorter intervals. If you’re in for the long haul, longer intervals are your friend.

#cryptocurrency mining#cryptocurrency exchange#cryptocurrency news#cryptonews#cryptocurrency trading

0 notes

Text

Bitcoin and its origin part - 2

Introduction:

In the previous part, we have learned the history of Bitcoin, its creation, and its mystery. But today we will go more deeper and understand all the remaining concepts during this session. So stay tuned with us throughout our journey to the Bitcoin and its origin.

Bitcoin and its rise:

As the Bitcoin concept became popular in the early years. Also, popularity comes in both training and practice. Cryptocurrency involves solving the problem of a cryptographic puzzle and adding the transaction to the blockchain network which includes validation.

During the initial stage, Bitcoin mining can be done by individuals using personal laptop, or computer.

But in the case of large-scale companies, massive warehouses, and full high-tech machines that are specifically designed for this work are required in these companies.

Main concept of Bitcoin and Blockchain technology:

Bitcoin is a digital currency that operates under open-source software with programming language. Its main purpose decentralise the network and to make it more secure and trustworthy. Here, we will learn more about the main concepts and blockchain technology so let's get ready for more deep detail on Bitcoin origin:-

The purpose behind programming language in Bitcoin:

Before we proceed to the next point let's recap what we have done till now. During the session, we learned how Bitcoin became popular and what things are required to set up for Cryptocurrency and so on. So let's talk about the topic we promise to discuss.

It includes a script that comes under the Bitcoin Programming language. The script is a unique and highly specialized language that enables transactions to be validated under certain conditions and it can be done before adding to Blockchain.

The Design is simple but powerful in contrast to handling complex transactional logic without affecting the security issue.

The script is based on stacked-based execution language which is related to Forth. In this operation is performed based on values that are put together. It is effective in memory usage and saving computation time.

It has the function of making smart contracts which makes the Bitcoin programming language the best. The smart contract here we refer to is a self-executing programme which comes with agreement terms that are written in the line of code.

Cryptocurrency was originally written in C++ language. During that time many different languages like Python, Java, and Go were introduced.

Generally, the Bitcoin programming language may seen overawe at first glimpse. It plays a crucial role in security support and ensures steamless Bitcoin transactions in the decentralized network.

Importance of Bitcoin Halving:

It is an event which takes place every four-year and it is necessary to understand the history of Bitcoin. This event helps in reducing the rate at which Bitcoin was created.

By adding an intentional feature to Bitcoin programming, it helps in the regular maintenance of deflationary tendencies.

Also during the early days, Bitcoin miners receive 50 Bitcoin per block. But after the two halvings, Cryptocurrency was reduced to 6.25 Bitcoin per block in May 2021. Due to this factor, Bitcoin's value decreased after every ten minutes of mining activity.

Moreover, after every halving there is a reduction in cryptocurrency at the inflation rate.

Development in Bitcoin as a peer-to-peer network:

Bitcoin's powerful impact can even affect the world of finance and technology industries. A few examples showing the impact of Bitcoin are the rise in the alternative cryptocurrency, the Increase in acceptance, and advanced blockchain technology.

Bitcoin's impact on Finance and technology:

During the creation of Bitcoin in 2009, the Finance and Technology industries were disrupted by Bitcoin. One of the Bitcoin impacts was back when the traditional finance system was operating without any intermediaries like banks and credit card companies. And the same goes for transactions that are smoothly done.

Furthermore, Bitcoin was introduced for e-commerce and online payment purposes. Also, they had a vision of making every merchant accept Cryptocurrency for transactions, which would reduce the conversion rate of currency all over the country.

Therefore, to make this vision true they must face regulatory hurdles and fluctuation in values.

Bitcoin alternative as Altcoin:

It sounds different but you may heard of the Bitcoin alternative. These alternative Bitcoins were created after the creation of the original Bitcoin. They also have unique characteristics such as faster payment, and more privacy.

But at that time Bitcoin was the only well-known digital currency that was accepted worldwide. The alternative currency provides different offers to the users.

Important note: not all Altcoins are equal, some of them have faced controversies such as scams and security issues.

Now, it is purely your decision whether to invest in an alternative currency, or not. Because there is risk and loss Torrence in Altcoins.

Bitcoin Acceptance and Adoption:

As Bitcoin's Popularity is growing so much that businesses started accepting Bitcoin for the payment of goods and services. A list of the big companies that have accepted Bitcoin are Microsoft, AT&T, and Expedia.

Furthermore, countries such as Japan and Australia have legalized cryptocurrency for exchange for goods and services.

Despite being developed, more problems are yet to be faced in the journey of Bitcoin.

Conclusion:

During our beautiful journey of Bitcoin, we have learned how Bitcoin rise and its popularity, the main concept of Bitcoin and its Blockchain technology, the development of Bitcoin's peer-to-peer network, and so many other things. Also, we will not stop our knowledge to upgrade even more. so, stay tuned with us with the coming new topics every week.

#cryptocurrency#cryptocurrency digital#cryptocurrency in india#cryptocurrency investment#cryptocurrency market#cryptocurrency news#cryptocurrency price#cryptocurrency trading#what is cryptocurrency

0 notes